Business

Dangote beats MTN, Globacom, Banks to emerge Most Valuable Brand in Nigeria for 6th Consecutive Year

Dangote beats MTN, Globacom, Banks to emerge Most Valuable Brand in Nigeria for 6th Consecutive Year

Dangote Industries Limited has emerged as Nigeria’s most valuable brand for the sixth consecutive year. This achievement was confirmed by the brand and marketing firm, TOP 50 BRANDS NIGERIA, as part of its comprehensive 2023 Top Brands perception assessment.

Winning the award for a record 6th time confirms the foremost African indigenous Conglomerate’s unwavering dominance of the domestic brand space.

TOP 50 BRANDS NIGERIA, is a qualitative, non-financial evaluation of top corporate brands in the country. The annual top brands league table which has become like a report card, with which top corporate brands have a feel of their ranking in the market is done with a special purpose model, the Brand Strength Measurement (BSM Index).

The rating firm in a statement said that Dangote got an impressive aggregate score of 86.2 on the Brand Strength Measurement (BSM) index, reinforcing its position at the forefront. The score reflects the consistent excellence of the brand.

MTN remains a strong contender, securing a close second place with an 85 BSM index score. This year’s third and fourth positions are secured by Airtel Nigeria and Globacom, both with BSM index scores of 77.9 and 77 respectively. Interestingly, this reaffirms the prominence of telecom brands, with three out of the top four hailing from this sector. Among the Top 10 brands are Access Bank, Zenith Bank, Coca-Cola, GTCO, and First Bank, Globacom was adjudged the Most Popular Brand following the outcome of a Top of Mind (TOM) Survey, where respondents mentioned 10 brands that came to their mind or that they could easily recall.

This year’s survey had as respondents Chief Marketing Officers and Head of Corporate Communications of major companies across the land.

TOP 50 BRANDS NIGERIA announcing the ratings said, “this annual top brand evaluation provides a qualitative, non-financial assessment of the value of leading corporate brands in the country. It gauges consumers’ perceptions of brands and their impact on overall brand strength, using the Brand Strength Measurement (BSM) index—a model designed to assess a brand’s ability to deliver on its promises from the consumer’s perspective.”

In today’s market, brands have woven themselves into the fabric of our daily lives, from dawn to dusk and even in every consumer choice. This phenomenon is amplified by the rise of concepts like consumer awareness, differentiation, and the dynamics of the global economy, making brands pivotal actors.

Chief Executive Officer of TOP 50 BRANDS NIGERIA Taiwo Oluboyede, speaking on the outcome of this year’s evaluation, likened brand to a person. He said,“A brand is like a person with all the traits that define his/her personality to the audience. When you hear someone’s name, you are likely not just going to remember their faces or apparel, but who they really are and what they mean to you.”

“Someone may claim to be the best man in the world, and could even go as far as doing paid advertising to attract attention. However, the real description of the person to you is your experience. Perception about a person could change from like to dislike or the other way round, the same is also true for a brand. That is why promoters go the extra length consistently remain in the target audience like-list” he added.

He elaborated that the onus lies with brand owners and promoters to uphold compelling propositions and consistently deliver on promises. “It’s not just about making pledges anyway; it’s about steadfastly living up to them—a commitment that separates the top brands from the rest,” he stated.

A breakdown of the 2023 evaluation report indicated that Nigerian-owned brands continued to shine among the top 10, with 10 brands. These are Dangote, Globacom, Access Bank, Zenith Bank, GTCO, and First Bank.

Five of the top ten brands are Banks, while three are Telecoms. Impressively, 9 of the 10 were among the top 10 last year, while 4 maintained their previous position. Airtel Nigeria made a remarkable ascent to third place. Also, six brands have consistently maintained top 10 positions for a remarkable 7 years in a row.

Overall, 26 or 52% of the 50 brands are multinational, while 24 or 48% are Nigerian brands.

Rite Foods Limited stands out as the highest gainer this year, leaping 14 places from 46th to 30th. Notably, Wema Bank makes a noteworthy debut in the annual brand ranking. Furthermore, nine brands maintained their 2022 positions, they are Dangote, MTN Nigeria, GTCO, First Bank, Multichoice, Fidelity, Toyota Nigeria, FMNPLC, and AXA Mansard.

A breakdown of the report indicatedthat Banking Services, as usual, had the largest entries with 12 entrants, representing 24% of the total. Access Bank topped the category. This is followed by Consumer Goods with 9 brands, that is 18%, with Dufil Prima Foods leading the charge.

The Conglomerates category has 6 brands, making up 12%, with Dangote Group on top. The Oil and gas, Beverages, and Telecom sectors each contribute 4 brands, with Oando, Coca-Cola, and MTN leading their respective categories.

The Insurance sector has 3 brands, with AIICO at the forefront. Meanwhile, the Building & Construction Services, Media, and Electronics categories had 2 brands each, featuring Julius Berger, Multichoice, and Tecno Nigeria leading their respective categories.

Automobile, Agricultural, and Aviation/Logistics sectors had 1 brand each —Toyota Nigeria, Olam International, and Air Peace.

Business

Time is of the essence,” the group stressed. “Every delay compounds the hardship and weakens faith in the system.”

Trapped Funds, Fading Trust: Heritage Bank Depositors Demand Urgent CBN Bailout

By Ifeoma Ikem

Nearly two years after the collapse of Heritage Bank, thousands of depositors say they are still living with the financial and emotional aftershocks of a liquidation they insist was never meant to end this way. What began as regulatory reassurances has, in their view, spiralled into prolonged uncertainty, partial payments, and mounting hardship, thus prompting a fresh and urgent appeal to President Bola Tinubu and the Governor of the Central Bank of Nigeria, Olayemi Cardoso, to intervene decisively.

In a strongly-worded statement issued in Lagos, the depositors framed their demand not simply as a financial request but as a test of the country’s commitment to safeguarding public trust in its banking system. They are asking the Central Bank to provide immediate bailout funds to the Nigeria Deposit Insurance Corporation (NDIC) to enable full reimbursement of all affected customers, arguing that the pace of recovery so far has been painfully slow and grossly inadequate.

According to them, while insured deposits up to ₦5 million were covered under statutory provisions, payments beyond that threshold (known as liquidation dividends) have amounted to just 14.2 percent of their total balances in nearly two years. The first tranche of 9.2 percent was paid in April 2024. A second installment of 5 percent followed recently. For many, that has been the extent of relief.

At this rate, they argue, the mathematics simply does not inspire confidence.

“These are not abstract figures,” one depositor said. “They represent school fees, retirement savings, working capital for small businesses, cooperative funds, and life savings built over decades.” Among those affected, they say, are civil servants, retirees, entrepreneurs, and families whose livelihoods have been upended by the prolonged wait.

What deepens their frustration, they contend, is the memory of official assurances given before the bank’s collapse. When signs of distress first emerged, depositors recall that the Central Bank publicly and privately reassured customers that their funds were safe and that the institution remained sound. Those assurances, they say, influenced their decision not to withdraw their savings at the time.

The eventual liquidation therefore came as a shock, both financially and psychologically. “We trusted the regulator,” the group noted. “Between the Central Bank and the NDIC, we were told our funds would be repaid 100 percent.”

It is that promise, they argue, that must now be honored in full.

While acknowledging that the NDIC has begun verification and payment processes, the depositors insist that the agency lacks the financial capacity to conclude the exercise within a reasonable timeframe. They point to the scale of total deposits — estimated at about ₦650 billion — and the fact that only around ₦54 billion has been paid out in 18 months. In their view, that ratio raises serious questions about whether the liquidation process, left solely to asset recovery, can realistically guarantee timely reimbursement.

The group also referenced previous instances in which the Central Bank stepped in to stabilize distressed institutions, arguing that regulatory precedent supports intervention. They cited the reported ₦460 billion facility linked to Heritage Bank before its collapse, as well as substantial financial support extended to other banks to facilitate mergers or recapitalization. In one example, they noted, a ₦700 billion support package reportedly enabled a struggling bank to qualify for a merger, with favorable repayment terms that included a five-year moratorium and extended repayment window at below-market interest rates. They also referenced regulatory intervention in Keystone Bank as evidence that decisive action is possible when systemic stability is at stake.

Given that history, they say, it is difficult to understand why a direct bailout to protect depositors is not being prioritized.

Beyond financial restitution, the depositors are also calling for accountability. They demanded a thorough investigation and immediate prosecution of any individuals or entities found culpable of asset diversion, mismanagement, or actions that may have contributed to the bank’s collapse. To them, justice is as important as compensation.

They argue that without visible consequences, public confidence in the banking system could erode further. “The integrity of the financial sector rests not only on liquidity, but on accountability,” one stakeholder said. “If people believe that funds can disappear without consequences, trust collapses.”

The broader concern, they warn, is systemic. Nigeria has not witnessed a full commercial bank liquidation in over two decades, as troubled institutions have typically been resolved through mergers, acquisitions, or regulatory restructuring. Many depositors therefore assumed that a similar pathway would apply in this case. Instead, they say, liquidation has exposed gaps in depositor protection mechanisms.

They also question the broader insurance framework, noting that banks have paid premiums to the NDIC for years precisely to safeguard depositors. If recovery remains this limited, they argue, the protective purpose of that insurance scheme comes under scrutiny.

For small business owners, the implications have been severe. Some report shutting down operations due to frozen capital. Others speak of properties sold under distress or retirement plans abruptly altered. The social cost, they insist, is real and growing.

At the heart of their appeal is a request for clarity. They want a clear, binding timeline for completion of the liquidation process and a transparent roadmap outlining how and when full repayment will occur. Without that, they fear that partial dividends will continue indefinitely, eroded by inflation and the time value of money.

They have also urged the Presidency and the National Assembly to step in, arguing that the matter transcends a single bank and touches on Nigeria’s financial credibility before the global community. Prolonged uncertainty, they warn, risks signaling regulatory inconsistency at a time when the country seeks to attract investment and deepen financial inclusion.

For the depositors, the issue is no longer simply about numbers on a ledger. It is about confidence in regulators, in institutions, and in the promise that money kept within the formal banking system is secure.

They believe the Central Bank must now assume full responsibility for resolving what they describe as a crisis of trust. Whether through direct financial support to the NDIC, accelerated asset recovery, or a hybrid intervention model, they insist that swift action is essential.

“Time is of the essence,” the group stressed. “Every delay compounds the hardship and weakens faith in the system.”

In a nation striving to strengthen its financial architecture and restore economic stability, the resolution of the Heritage Bank liquidation may well become a defining test — not only of regulatory capacity, but of the enduring covenant between citizens and the institutions entrusted with their savings.

Business

Aig-Imoukhuede Foundation opens applications for 6th Cohort Programme

Aig-Imoukhuede Foundation opens applications for 6th Cohort Programme

The Aig-Imoukhuede Foundation is pleased to announce that applications are now open for the sixth cohort of its transformative AIG Public Leaders Programme (AIG PLP).

This flagship six-month executive education initiative, delivered by the University of Oxford’s Blavatnik School of Government, is designed to empower high-potential public sector leaders across Africa with the tools, networks, and strategic insight required to deliver meaningful reform across African public institutions.

Applications are now open to qualified public servants from all English-speaking African countries and will close on Sunday, April 12, 2026. The programme commences in October 2026.

Since its inception in 2021, the AIG PLP has built a formidable reputation for creating tangible impact.

Alumni from the programme have gone on to design and implement more than 230 reform projects within their ministries, departments, and agencies across Africa.

An impact survey revealed that 62% of alumni have earned promotions or assumed expanded leadership roles post-training, demonstrating the programme’s direct effect on career advancement and institutional influence.

“Across Africa, the complexity of public sector challenges demands more than good intentions. It requires reformers who understand systems, can navigate institutional realities, and are equipped to implement sustainable change.

The AIG PLP is designed to meet this need,” said Ofovwe Aig-Imoukhuede, Executive Vice-Chair of the Aig-Imoukhuede Foundation.

As part of the programme, a PLP alumna, Titilola Vivour-Adeniyi, Executive Secretary of Lagos State DSVA, launched a secure self-reporting tool that allows survivors of domestic and sexual abuse safely document incidents and preserve evidence.

Survivors are already accessing support, and the tool ensures that crucial proof is protected until justice can be sought. This is one of over 230 impactful reform projects being implemented across sectors as diverse as healthcare, finance, agriculture, and education.

We are seeing proof every day that investing in the capacity and leadership potential of people, delivers the kind of transformation that policy alone cannot achieve.”

The AIG PLP is a blended learning experience that combines online sessions with an intensive residential module.

It is offered at no cost to selected participants, with the Foundation covering all costs of the programme including accommodation and feeding during the residential weeks.

Participants gain direct access to world-class faculty from the University of Oxford, and learn to tackle core public sector challenges such as: Negotiating in the public interest. Harnessing digital technology for governance.

Strengthening public organisations.

Upholding integrity in public life.

The curriculum culminates in a capstone reform project, where participants apply their new skills to a real-world challenge within their institution.

This practical component ensures that learning translates directly into actionable solutions.

Interested candidates are encouraged to apply early. For more details on the application process and to apply, please visit the Aig-Imoukhuede Foundation website.

Business

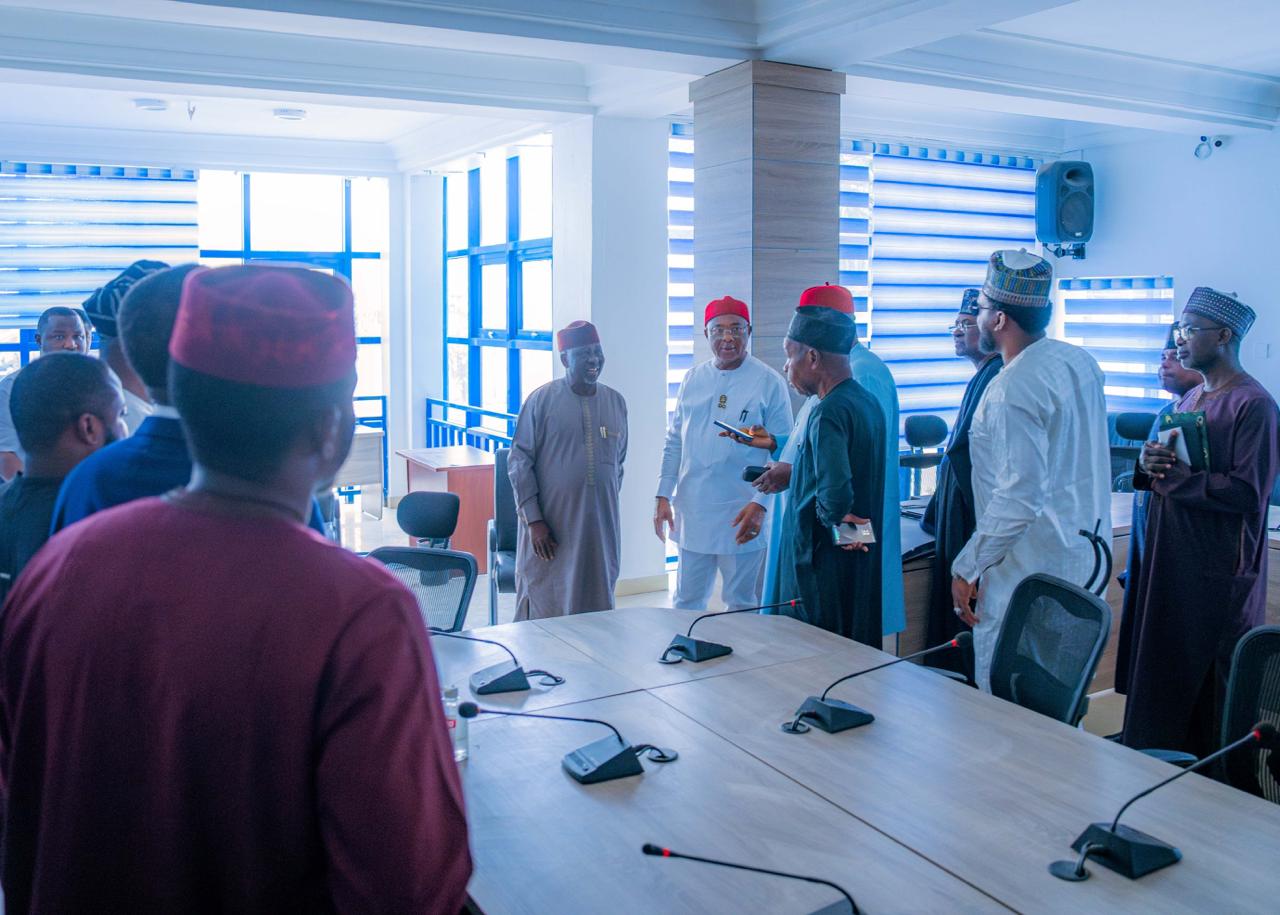

Renewed Hope Ambassadors Inspect RHA Secretariat

Renewed Hope Ambassadors Inspect RHA Secretariat

Renewed Hope Ambassadors, led by its Director-General and the Governor of Imo State, Hope Uzodinma, alongside Zonal Coordinators (NW, NC, SE), the Media & Publicity Directorate, and other key stakeholders, inspected the RHA Secretariat two days after President Bola Tinubu unveiled the Renewed Hope Ambassadors grassroots engagement drive in Abuja.

-

celebrity radar - gossips7 months ago

celebrity radar - gossips7 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

society7 months ago

society7 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

news3 months ago

news3 months agoWHO REALLY OWNS MONIEPOINT? The $290 Million Deal That Sold Nigeria’s Top Fintech to Foreign Interests