Bank

FIDELITY BANK BEGINS INTERNATIONAL EXPANSION DRIVE

FIDELITY BANK BEGINS INTERNATIONAL EXPANSION DRIVE

With its half-year 2022 results showing a 20.7 per cent rise in profit after tax year-on-year, Fidelity Bank Plc, which last week announced the planned acquisition of Union Bank UK, is leaving no one in doubt with its readiness to avail itself of the tremendous gains of international presence.

In response to their peculiar needs and ever-changing business environment, commercial banks in Nigeria have continued to raise their scale through deliberate acquisitions and business combinations.

This is because, unlike in the past when the Central Bank of Nigeria (CBN) had to raise the capital threshold, forcing banks to either opt for public offers to raise additional funds or merge with operators with similar visions, it is the competition for the sphere of influence that is driving most mergers and acquisition these days.

Analysts attribute the development to the shrinkage of business opportunities amid the current global economic challenges.

Banking industry watchers said with the keen competition by fintech companies and the rising appetite of consumers of banking products for innovations and risks, there are pressures on banks to leave their comfort zones and respond to these growing needs.

Consequently, banks decided to go for options that are best suited for them including the option of a holding company where they bring their non-banking operations under one umbrella. Others decided to go for acquisitions to create a niche for themselves.

It is under the latter category that Fidelity Bank Plc falls as it announced a business combination with a United Kingdom bank last week.

The bank disclosed that it has entered into a binding agreement for the acquisition of a 100% equity stake in Union Bank UK Plc for which the central bank has issued a letter of no objection.

The move is seen as an opportunity for Fidelity Bank to optimise its international banking licence and take advantage of the planned business combination with Union Bank UK, which has been offering competitive banking services including personal banking, trades finance, treasury management, and structured trade and community finance, which offers to individual and corporate clients for as far back as 1983.

Although the transaction is subject to the approval of the Prudential Regulatory Authority of the United Kingdom, Fidelity Bank officials said they hope to leverage the gains of the acquisition to improve the bank’s returns to its shareholders and to add value to its current and prospective customers.

Improved Half-Year Result

The news of the planned acquisition came the same week that Fidelity Bank’s half-year result for 2022 made its way to the public domain.

Analysts said with the impressive results, Fidelity Bank has demonstrated the capacity to be competitive in the Nigerian banking industry.

According to the unaudited half-year results, the bank posted a profit after tax of N23.307 billion for its 2022 half-year results, representing a growth of 20.72% year-on-year.

In the financials submitted to the Nigeria Exchange Group Limited (NGX), the bank also made significant improvements across key performance indicators.

The results indicate that the bank’s gross earnings rose by 37.87% to N154.843 billion from N112.304 billion reported in 2021, driven by a 50% growth in net interest income.

Profit before tax stood at N25.079 billion from N20.628 billion posted in 2021, representing a growth of 21.57%.

Interest and similar income using the effective interest rate method rose by 48.45% from N85.090 billion recorded in the first quarter (Q1) of 2021 to N126.348 billion in the period under review.

Based on the result the Board of Directors under the powers vested in it by Section 426 of the Companies and Allied Matters Act (CAMA 2020), proposed an interim dividend of 10 Kobo per share amounting to N2,896,258,569.20 from Retained Earnings as of 30 June 2022.

The Register of Shareholders will be closed on September 13, 2022. The qualification date is September 12, 2022.

On September 20, 2022 dividends will be paid electronically to shareholders whose names appear on the Register of Members as of September 12, 2022, and who have completed the e-dividend registration and mandated the Registrar to pay their dividends directly into their bank accounts.

The planned acquisition of Union Bank UK signposts the final transition of the former Union Bank of Nigeria Plc to new separate owners. In December 2021, Union Bank’s core investors – Union Global Partners Limited and Atlas Mara –reached a Share Sale and Purchase Agreement (SSPA) with Titan Trust Bank (TTB) for the sale of 89.39 percent of Union Bank’s issued share capital.

The agreement came a decade after the initial investment by the core investors in 2012.

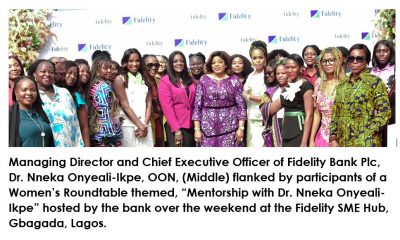

Commenting on the bank’s performance in March, the MD/CEO, Fidelity Bank Plc, Nneka Onyeali-Ikpe, said: “Digital Banking gained further traction driven by new initiatives in our retail business and the enhancement of existing digital banking products.

We now have 56.0% of our customers enrolled on the mobile/internet banking products and 90.0% of total customer-induced transactions done on digital platforms with digital banking business contributing 27.6% to net fee income.”

Fidelity Bank is described as a highly capitalised bank with a Capital Adequacy Ratio (CAR) of 19.8% in H1 2022. It successfully acquired and integrated two operating commercial banks (FSB and Manny Bank).

The bank boasts of a strong trade and export business with a diversified portfolio across sectors and market segments. It also has a wide distribution network serving over seven million customers. Today, Fidelity Bank is the only bank of its size in Nigeria with no business operation outside the shores of Nigeria.

Value Addition

At an interactive session with some financial journalists in Lagos last week, the bank’s Executive Director in charge of Operations and Information, Mr. Stanley Amuchie, explained that the acquisition aligns with the bank’s short to medium-term aspirations and international expansion drive.

Interestingly, UBUK’s competitive range of banking services includes Personal Banking, Trade Finance, Treasury Management, Structured Trade, and Commodity Finance which it offers to individual and corporate clients.

Listing the attraction in the UBUK, Amuchie said the bank offers a robust range of banking services to customers doing business from and into Africa, including trade finance, personal banking, business banking, treasury services, and commercial lending.

It is going to be a plus for Fidelity Bank to combine business with the UBK which provides extensive trade financing to businesses or individuals, that includes secure tracking of physical risks and events in the chain between importers and exporters.

Amuchie explained that up till now, what Fidelity Bank does when it needs to satisfy the demand of its Nigerian customers with banking needs in the UK is to work with other banks.

However, with the ongoing acquisition, the bank will not only meet the needs of its customers with ease, but it will also be able to conserve fees that it would have paid to another bank.

“Union Bank UK provides extensive trade financing to businesses or individuals that includes secure tracking of physical risks and events in the chain between importers and exporters,” he stated, adding that the bank provides transaction and liquidity management services to individuals and businesses, helping clients trade across borders and ensuring timely delivery and collection of payments.

Enhanced Product Offering

According to him, a significant captive business opportunity exists in Fidelity books as well as enhanced product offerings, bundled services, and cross-selling.

Other low-hanging fruits from the acquisitions include the offer of international banking service support, especially for HNIs in Nigeria, trade finance, and a corresponding banking relationship with Fidelity Bank.

In terms of operation, there is the prospect of cross-border collaboration in sales and client services, while the possibility of shared services will be considered.

Amuchie also talked about workforce transformation and integration of performance culture by the time the acquisition is fully consummated.

The acquisition also raises the prospect of significant captive business opportunities for UBUK from Fidelity Bank’s existing foreign currency transactions in Nigeria.

Fidelity Bank is also looking at the possibility of revenue and cost optimisation through cross-selling and shared services.

It is also believed that complementary business operations will enable strong value creation for shareholders and clear benefits for customers, staff, and other key stakeholders.

Throwing more light on the expectations from the acquisition, Amuchie pointed out that “UBUK will service other subsidiaries of Fidelity Bank under the proposed Holdco structure.

He added that there is potential for stronger customer loyalty and stickiness through integrated financial services and bundled products for diaspora customers and corporate banking clients, etc.

The bank was recently recognised as the Best SME Bank Nigeria 2022 by the Global Banking & Finance Awards. It has also won awards for the ‘Fastest Growing Bank’ and ‘MSME & Entrepreneurship Financing Bank of the Year’ at the 2021 BusinessDay Banks and Other Financial Institutions (BAFI) Awards.

Commenting on the agreement, Onyeali-Ikpe said: “This transaction aligns with our strategic plan of expanding our services touchpoints beyond the Nigerian market and providing straight-through services that meet and exceed the needs of our growing clients.

The diverse bouquet and business model of Union Bank UK offer a compelling synergy and we hope to build on the existing capacity to create a scalable and more sustaining service franchise that will support the wider ecosystem of our trade businesses and diaspora banking service

Bank

Alpha Morgan Bank Deepens Presence in Abuja with New Branch in Utako

Alpha Morgan Bank Deepens Presence in Abuja with New Branch in Utako

Marking another milestone in its expansion drive, Alpha Morgan Bank has opened a new branch in Utako, Abuja, reinforcing its strategy of building closer institutional ties within key business communities and bringing its financial expertise closer to individuals, and enterprises driving the city’s growth.

The new branch, located at Plot 1121 Obafemi Awolowo Way, Utako, Abuja is strategically positioned to serve individuals, entrepreneurs, and corporate clients within Utako and surrounding districts.

The expansion follows the Bank’s recently concluded Economic Review Webinar held in February 2026, as the bank continues to position as a thought-leader in the financial services industry.

Speaking on the opening, Ade Buraimo, Managing Director of Alpha Morgan Bank, said the move underscores the Bank’s commitment to accessibility and service excellence.

“Proximity matters in banking. As communities grow and commercial activity expands, financial institutions also evolve to meet customers where they are. The Utako Branch allows us to deliver our services to people in that community efficiently while maintaining the high standards our customers expect,”

The Utako location will provide a full suite of retail and corporate banking services, including account opening, deposits, transfers, business banking solutions, and financial advisory support.

Customers and members of the public are invited to visit the new Utako Branch to experience the Bank’s approach to satisfying banking.

Bank

Alpha Morgan to Host 19th Economic Review Webinar

Alpha Morgan to Host 19th Economic Review Webinar

In an economy shaped by constant shifts, the edge often belongs to those with the right information.

On Wednesday, February 25, 2026, Alpha Morgan Bank will host the 19th edition of its Economic Review Webinar, a high-level thought leadership session designed to equip businesses, investors, and individuals with timely financial and economic insight.

The session, which will hold live on Zoom at 10:00am WAT and will feature economist Bismarck Rewane, who will examine the key signals influencing Nigeria’s economic direction in 2026, including policy trends, market movements, and global developments shaping the local landscape.

With a consistent track record of delivering clarity in uncertain times, the Alpha Morgan Economic Review continues to provide practical context for decision-making in a dynamic environment.

Registration for the 19th Alpha Morgan Economic Review is free and can be completed via https://bit.ly/registeramerseries19

It is a bi-monthly platform that is open to the public and is held virtually.

Visit www.alphamorganbank to know more.

Bank

Separating Fact from Confusion: What Nigerians Need to Know About the 7.5% VAT on Banking Service Fees

In recent weeks, digital-banking customers and social media, especially on Twitter have raised concerns about deductions labelled as “VAT” on transfers and other charges.

Some dangerously false narratives, which when you take a critical look, you’ll clearly see that they have been orchestrated and sponsored by malicious elements, have given the impression that the 7.5% Value Added Tax (VAT) is a new or arbitrary charge introduced by fintechs, or that it applies to the amounts customers send. These claims are misleading and deserve careful clarification which is the purpose of this piece.

First, it’s important to understand how VAT works in Nigeria’s financial sector today. VAT on fees and charges for financial services has long been part of Nigeria’s tax system. The then Federal Inland Revenue Service (FIRS) had issued information circulars on March 31, 2021 where it stated that VAT on Financial Services (Circular No. 2021/04) that most fees, commissions, and charges by financial institutions (banks, insurance companies, brokers) are subject to 7.5% VAT.

This justifies a recent advertorial the Nigeria Revenue Service (NRS) which stated unequivocally that VAT was not newly introduced on banking service charges by recent tax reforms, and that it did not impose a new tax obligation on customers in that regard.

However what was left unsaid in that publication was that on the 12th of December, the tax agency had written to all financial institutions and payment gateways based on past meetings with operators that following from the new Tax Act, they were reminded of their mandatory obligations to collect, deduct and remit VAT at the prescribed rate.

The Agency then gave an 18- day grace period to all players to configure and align their systems while directing full compliance with the directive with effect from January 19, 2026. And so, some fintechs sent messages to their customers in the spirit of clarity and transparency.

It must be said that what has changed is that in a bid to widen the tax net, microfinance banks and fintechs who were not obligated to deduct and remit said VAT before now, have now become compelled to do so. The enforcement and standardised collection of VAT across banks and fintech platforms including mobile transfers, USSD transaction fees, and card issuance fees with compliance deadlines issued by tax authorities. So why anyone would vilify any financial institution obeying the laws of the land beats my imagination.

For those who have raised questions around transparency and wrongly suggesting that fintechs are suddenly imposing new, unexplained costs on users – as it has been explained above, this is a matter of regulatory compliance, not a lack of transparency or customer exploitation. These VAT deductions are not new fees created by the companies themselves, and providers are not arbitrarily raising their prices.

In closing, two things that everyone must bear in mind as we move forward in this new tax climate – all stakeholders including fintech platforms and regulators must communicate better and clearly. Nigerians must refrain from peddling unsubstantiated claims and malicious narratives, it has no benefits for anyone and erodes trust in systems.

-

society6 months ago

society6 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

news3 months ago

news3 months agoWHO REALLY OWNS MONIEPOINT? The $290 Million Deal That Sold Nigeria’s Top Fintech to Foreign Interests

-

Business6 months ago

Business6 months agoGTCO increases GTBank’s Paid-Up Capital to ₦504 Billion

-

society6 months ago

society6 months ago“You Are Never Without Help” – Pastor Gebhardt Berndt Inspires Hope Through Empower Church (Video)