Enlightment

Fuel scarcity looms as FG owes oil marketers $1.7bn

The country may be plunged into another round of excruciating fuel scarcity in the next couple of weeks, as oil marketers disclosed that they are running out of patience over the Federal Government’s refusal to pay its $1.7 billion debt owed oil marketers since May 2015. One of the oil marketers, who spoke to Vanguard in Abuja under the condition anonymity, disclosed that the seeming sanity in petroleum products distribution and sales across the country can be likened to the, “peace of the graveyard,’ as he noted that marketers are only ensuring that they are not seen as individuals seeking to sabotage the efforts of government. He stated that the marketers had written series of letters over their predicaments to the Presidency and that the Presidency had agreed to grant them audience, while he warned, however, that if nothing is done to address the issue of the debts owed them, they would be forced to take drastic measures that might lead to the return of another fuel crisis. He explained that the amount owed the marketers was for foreign exchange differentials owed both major oil marketers, independent oil marketers and other petroleum marketers. He said the amount was the balance from the payments made by the Goodluck Jonathan administration, before handing over to President Muhammadu Buhari, while the rest was incurred in May 2016, when the Federal Government devalued the naira. According to the source, major oil marketers are owed about $500 million, while independents, depot and petroleum products marketers were owed about $1.2 billion. The source also confirmed that some of the oil marketers are indebted to the government, stating, however, that their indebtedness pales in comparison to the huge debt the Federal Government owes the oil marketers. He further stated that the oil marketers’ indebtedness to the country was more recent, while the Federal Government’s debts dated back to May 2015. “Irrespective of the fact that our own debt is recent, very small and insignificant, compared to the amount the Federal Government owes us, the government is asking us to pay, while nothing is said about their own debt which is huge and dates back to 2015,” he said. He noted that as a result of the huge debts, majority of the oil marketers had sacked a large number of their staff, as many of them are finding it extremely difficult to pay staff salaries and even sustain their operations, as a result of the unfavourable operating environment. He added that the oil marketers are currently at loggerheads with a subsidiary of the NNPC, the Pipeline and Products Marketing Company, PPMC, over the introduction of obnoxious rules that are detrimental to existing contractual obligations, without proper consultations with oil marketers and other stakeholders. He also disclosed that majority of the oil marketers had since stopped the importation of Premium Motor Spirit, PMS, also known as petrol, while he confirmed that the NNPC is currently the major importer and has enough stocks of the commodity on ground to guarantee several months of supply. However, he said, “While I can tell you that the NNPC has adequate quantity of the product to last the country for months, we the oil marketers have agreed that we cannot continue to allow the NNPC to supply its products to Nigerians through our facilities, both depots and retail outlets, while nothing is done to address the debts owed us. “We might be forced to stop the NNPC from using our facilities; then let us see how the NNPC can supply its millions of litres of PMS to the public. It is a known fact that the NNPC cannot supply its products to the public without using the facilities of oil marketers. Confirming the development, the NNPC, in its latest Monthly Financial and Operational Report for September 2016 released recently, disclosed that as regards downstream sector, NNPC remains the major importer of petroleum sector. This, according to the NNPC, was despite the liberalized price regime due to inaccessibility of foreign exchange (FOREX). However, it stated that the “FOREX intervention by the international oil companies (IOCs) cushions the effect. Also, the ongoing Turn around Maintenance (TAM) is promising to entirely change the anemic outlook of the country’s refineries.”

Enlightment

Understanding Property Titles and Documents in Nigeria by Dennis Isong

Understanding Property Titles and Documents in Nigeria by Dennis Isong

Sahara Weekly Reports That Being a property owner in Nigeria is a big accomplishment and a wise investment. But managing the complexity of property ownership necessitates a thorough comprehension of papers and property titles. These records are vital for preserving property rights since they act as official proof of ownership. This article explores the several kinds of property titles and documents that are available in Nigeria, their significance, and the ways in which they support safe real estate transactions.

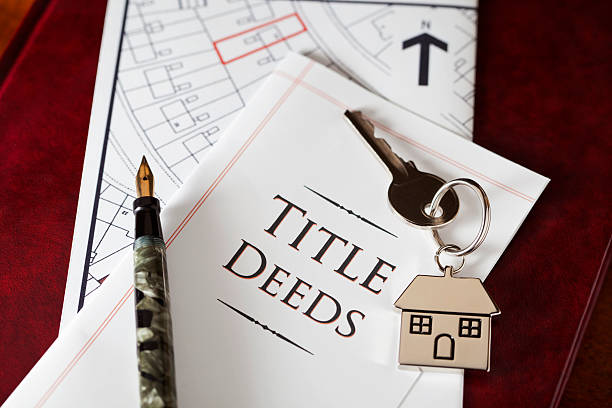

1. Certificate of Occupancy (C of O):

A Certificate of Occupancy is perhaps the most crucial document when it comes to land ownership in Nigeria. It is issued by the state government and serves as proof of ownership and the right to use the land for a specific purpose. The process of obtaining a C of O involves the applicant submitting an application to the state government, which then conducts due diligence to verify the legitimacy of the claim to the land. Once issued, the C of O grants the holder exclusive rights to use and develop the land.

2. Deed of Assignment:

A Deed of Assignment is a legal document that transfers ownership of property from one party to another. It typically outlines the details of the transfer, including the names of the parties involved, a description of the property, and any conditions or considerations attached to the transfer. This document is crucial for formalizing the sale or transfer of property rights and should be duly executed and registered with the appropriate government authority to ensure its validity.

3. Deed of Conveyance:

Similar to a Deed of Assignment, a Deed of Conveyance is used to transfer ownership of property. However, unlike the Deed of Assignment, which is commonly used for the transfer of leasehold interests, the Deed of Conveyance is used for the transfer of freehold interests. It is typically executed between the seller (grantor) and the buyer (grantee) and includes details such as the purchase price, description of the property, and any covenants or warranties.

4. Survey Plan:

A Survey Plan is a document that shows the accurate boundaries and measurements of a piece of land. It is prepared by a licensed surveyor and is essential for verifying the exact location and dimensions of a property. A Survey Plan is often required during the process of obtaining a C of O or when transferring property ownership to ensure that there are no boundary disputes or encroachments.

5. Power of Attorney:

A Power of Attorney is a legal document that grants someone else the authority to act on behalf of the property owner. It is commonly used in situations where the property owner is unable to handle their affairs due to illness, absence, or other reasons. A Power of Attorney can be limited or general in scope, depending on the specific powers granted to the attorney-in-fact.

The Significance of Property Titles: Safeguarding Your Investment

Legal Ownership:

Property titles serve as incontrovertible evidence of legal ownership. They establish the rightful owner of the property and delineate the boundaries of their ownership rights. Without a valid title, one cannot claim ownership of a property, leaving them vulnerable to disputes and challenges regarding ownership.

Protection of Property Rights:

Property titles provide protection against encroachments and unauthorized claims to the property. They offer a legal shield against potential disputes, ensuring that the owner’s rights are recognized and respected by others. With a clear title, property owners can confidently assert their ownership rights and defend against any attempts to infringe upon them.

Facilitation of Transactions:

Clear and valid property titles facilitate smooth and efficient real estate transactions. When buying or selling property, a clean title provides assurance to both parties that the transaction is legitimate and free from any encumbrances or defects. It instills confidence in buyers and lenders, making it easier to secure financing and close the deal.

Legal Certainty:

Property titles provide legal certainty by establishing a chain of ownership that can be traced back through time. They document the history of the property, including previous transfers of ownership, mortgages, liens, and other encumbrances. This historical record ensures transparency and clarity regarding the property’s status, enabling informed decision-making by prospective buyers and lenders.

Access to Legal Remedies:

In the event of a dispute or legal challenge regarding property ownership, a valid title provides the basis for seeking legal remedies and resolution. Property owners with clear titles can avail themselves of legal avenues to defend their rights and rectify any discrepancies or irregularities affecting their ownership. This access to legal recourse is essential for protecting investments and preserving property rights.

Peace of Mind:

Perhaps most importantly, property titles offer peace of mind to owners, knowing that their investment is secure and their ownership rights are legally recognized. With a clear title in hand, property owners can confidently enjoy the benefits of homeownership, such as occupancy, development, and transferability, without fear of adverse claims or challenges.

The Implications of Not Acquiring Property Titles in Nigeria: Risks and Consequences

Lack of Legal Ownership:

One of the most significant implications of not acquiring property titles is the lack of legal ownership. Without proper documentation, individuals cannot assert their ownership rights over the property, leaving them vulnerable to claims by other parties. This lack of legal ownership can lead to disputes, litigation, and the loss of investment in the property.

Insecurity of Tenure:

Property titles provide security of tenure, guaranteeing the owner’s right to occupy and use the property without fear of eviction or interference. Without proper titles, individuals face uncertainty regarding their tenure, making them susceptible to arbitrary eviction or displacement by third parties claiming ownership rights. This insecurity of tenure can disrupt lives, businesses, and communities, leading to social and economic instability.

Difficulty in Transacting:

Acquiring property titles is essential for facilitating real estate transactions, such as buying, selling, or leasing property. Without clear titles, individuals encounter difficulties in transacting, as potential buyers or lenders may be reluctant to engage in deals involving properties with uncertain ownership status. This can impede economic development and hinder investment in the real estate sector.

Limited Access to Credit:

Property titles serve as collateral for obtaining loans and credit from financial institutions. Without proper titles, individuals have limited access to credit, as lenders are unwilling to accept properties with unclear ownership as collateral. This lack of access to credit hampers economic growth and development, as it constrains individuals’ ability to invest in property development and other productive ventures.

Vulnerability to Fraud and Exploitation:

In the absence of property titles, individuals are vulnerable to fraud and exploitation by unscrupulous actors seeking to exploit their lack of legal protection. Fraudulent schemes such as land grabbing, forgery of documents, and illegal sales thrive in environments where property titles are not properly established. This exposes unsuspecting individuals to financial loss and legal entanglements.

Legal and Regulatory Risks:

Failure to acquire property titles exposes individuals to legal and regulatory risks, as they may be in violation of laws and regulations governing property ownership and transactions. Government authorities may take enforcement actions against individuals occupying or developing property without proper titles, leading to fines, penalties, or even demolition of structures.

Dennis Isong is a TOP REALTOR IN LAGOS.He Helps Nigerians in Diaspora to Own Property In Lagos Nigeria STRESS-FREE. For Questions WhatsApp/Call 2348164741041

Enlightment

HOW TO MAKE MONEY FROM THE INSUFFICIENT HOUSING DEVELOPMENT IN NIGERIA

HOW TO MAKE MONEY FROM THE INSUFFICIENT HOUSING DEVELOPMENT IN NIGERIA

BY DENNNIS ISONG

SHELTER which is housing is an indicator of being successful in Nigeria whether built or rented. However, a built one with your money is the height of success that appeals to people’s mentality. The shelter cannot be brushed aside as it is part of how we survive. As such, it’s a crucial and basic human need alongside food and clothing.

Housing is an important sector that must be given rapt attention as it typically improves the economic growth of a country.

However, Nigeria has been lagging in providing an affordable housing plan to a majority of Nigerians. It’s quite difficult for the middle class to afford to buy/build a house. However, they are still trying to do something. Unfortunately, it’s a hopeless journey for the lower class.

Nigeria, a highly-populated country in Africa with over 48% of its people living in the urban centers has less than 10% of available land areas to live in.

Yearly, about 4% of the population migrate to towns and cities to struggle for a better life. What does this mean? There’s a continual need for housing, I mean, where would these people call shelter?

The housing deficit in Nigeria has caused the available ones to skyrocket rent prices up to 60% of annual income, meanwhile, the United Nations recommended 20-30%.

However, this issue can be eradicated. Nigeria isn’t the only country suffering from this, developed countries are affected likewise.

WHY DO WE HAVE THESE PROBLEMS?

So many factors are responsible for the housing deficit in Nigeria.

They are;

1.Poverty

Poverty is a disease eating up the country. People can either afford to do something or not. There is barely a middle ground. Affordability is relative. Houses considered affordable may be extremely expensive to some. It’s quite difficult coming to the middle ground in a country where poverty has eaten deep into.

2. Limited access to finance

Not everyone has the finance for housing in Nigeria. A vast population of Nigerians is just trying to make it work with their limited income. That’s why you see abandoned projects almost everywhere. Some people give it a try but end up losing interest when it becomes overwhelming and there’s no feasible way out in sight.

3. Overpopulation in urban centers caused by rural-urban migration

Especially in the urban centers, this might be hard to deal with considering the continuous increase in people migrating day in, and day out. In this kind of situation, the need for housing is paramount and no matter how many available houses are, it can’t be enough. I want to believe this is a good business for anyone interested in the real estate business and who has the money. You already have a field day.

4. High cost of building materials

Incessant inflation and the rise in the dollar keep affecting the cost of building materials. Quotations hardly work now because there’s always going to be an increase in the labor market.

This is quite discouraging, especially for Nigerians who are still trying to put together money from their income to consider housing projects.

Cement prices in Nigeria are also reportedly about 30-40% higher compared to neighboring countries or the world market prices.

How then is it possible to have a great housing scheme in a country like Nigeria?

5. Inadequate or absence of infrastructural facilities

Infrastructural facilities such as electricity, water, good roads, and good drainage systems are heavily lacking or inadequate. This is not encouraging for the private sector to want to dive into housing provision.

Although, times are changing, most especially, in the urban centers. At least, there’s a level of infrastructural facilities there. Rural areas are so much at the receiving end because of this absolute lack of infrastructural facilities, so, whatever private sectors want to do stays within the urban areas.

With all these, if you are considering focusing on providing housing as your real estate business, then you have the floor. Nigeria is lacking in the aspect of housing development meanwhile, the population keeps rising each day.

The main agenda is urbanization which has made thousands of people focus on towns and cities they believe can benefit them. This massive migration has put a stall on the availability of houses. So, it’s a great idea if you can get this on board.

There may be affordability problems, however, people are doing all they can to have a roof over their heads. Please note, that this is a business that requires a lot of money to get together.

My Name is Dennis Isong and I am a Real Estate Professional.I have a GIFT for YOU. Before you buy any property in Nigeria read this Real Estate Guide.CLICK THE LINK BELOW TO DOWNLOAD FOR FREE https://landproperty.ng/free

Enlightment

WHY YOU SHOULD FOCUS ON BUYING A HOME

WHY YOU SHOULD FOCUS ON BUYING A HOME

BY DENNIS ISONG

Martins had lived in rented apartments at different times before making up his mind to own a home.

All his experiences weren’t pleasant. He had lived with lousy people, dirty people, criminals, etc. the last straw that broke the Camel’s back was when he had a fight with the landlord due to prepaid meter payment.

He had bought a freezer then, so the landlord said he dared not use it because they always had to buy light. Mind you, the landlord had every form of home appliance you could think of, yet, he insisted that Martins must do away with the freezer.

Initially, Martins thought it was a joke until the landlord began to make life a living hell for him. It got to a point where Martins had to get him arrested.

At the end of the day, Martins bought a home out of frustration which he paid by installment.

Buying or renting a home has so many diverse views from people. Each person’s opinion of it largely depends on experience. Both options are not bad, however, owning a home saves you a lot of problems. Forget the soothing idea that you are now a landlord/lady, many benefits come with it.

Renting is an agreement where a payment is made to the owner of the house (landlord) to reside for an agreed period. Some people consider renting a waste of money which is untrue.

Before you buy a home, you have somewhere to shelter in the meantime. It becomes a waste of money if you have the finances to buy a home, yet, you are not giving it some consideration.

Renting has its advantages and downsides. A few of the downsides are unexpected increases, living with toxic people or homeowners, and having to live with unpleasant instances. That’s why you need to consider buying a home. These things are avoidable only if you are in your home.

It’s a great financial decision. There are so many benefits that come with it such as security, peace of mind, fewer worries about co-tenants, privacy, you have your space without having to share, etc.

WHY YOU SHOULD CONSIDER BUYING A HOME

1. Buying a home is a long-term investment

Renting a home requires continuous payment to maintain the place either monthly or yearly. You are at the risk of an exorbitant increase that leaves your incoshookken which you can’t avoid than pay if you still want to live in the house.

Homeownership is a permanent asset that doesn’t require being scared of any increase coming from anyone. Meanwhile, it appreciates over time.

2. Rent continues to increase

The fear of rent increase is the beginning of wisdom. Rent increase is a common thing in Nigeria, unfortunately, it’s not an event you can fight. It’s either you pay or move out so that someone that can pay can move in. With your home, this can’t happen. All you need to do is maintain it.

3. You feel secured

There’s worthwhile security with homeownership. Unlike a rented apartment, the Landlord might just wake up one day and serve everyone quit notice unprovoked or sell the house. And when this happens, you would start trying to look for a way to find another house. Owning a home takes away the fear of being evicted unexpectedly.

4. It’s your home, you call the shots

There’s a level to what you can do in a rented home and whatever alteration you want to do needs to be permitted by the landlord first before you can do anything. It’s his house, he has the exclusive rights to it. You can’t change a particular thing (major adjustments) without asking for a go-ahead from him/her.

5. Homeownership comes with sustainability

Having a home helps in sustaining your financial gains and income. You can easily plan how /where to divert your income unlike when a large chunk of it used to go for rent which you even have to be careful of spending because you are expecting an increase. Apart from rent, other unforeseen circumstances need to be considered. Renting a home eats deeper into your income than having your home. If you feel it isn’t, pick a pen and paper and calculate all you have had to spend on your rental home since the beginning of the year.

Meanwhile, we consider that not everyone can afford to buy a home at once, that’s why installment plans are common with property vendors these days. There’s nothing that’s not possible. Even with your income, owning a home is doable. Just try to focus on planning!

My Name is Dennis Isong and I am a Real Estate Professional.I have a GIFT for YOU. Before you buy any property in Nigeria read this Real Estate Guide.CLICK THE LINK BELOW TO DOWNLOAD FOR FREE https://landproperty.ng/free

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING

You must be logged in to post a comment Login