Business

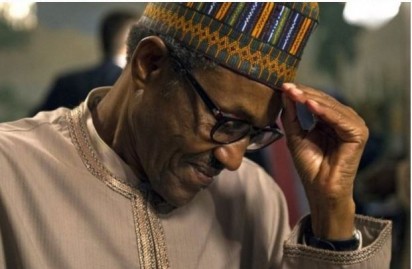

‘Power situation in Nigeria is no longer a laughing matter’ – Pres. Buhari

President Mohammadu Buhari on Monday woke up to the realities of epileptic power supply in Nigeria, saying that the situation was no longer funny. Should the situation persists; the president said it would seriously affect the change agenda of the present administration. The president said his administration must do everything necessary to increase power generation and distribution from its present status of about 1,500 to 3,500 megawatts with additional 2,000 before the end of the year as a way of halting the ripple effects on the economy. But giving high hopes on the power sector, the president stated that before his government winds up in 2019, he would achieve a historic 10,000 megawatts of electricity. The promise was contained in a keynote address which he presented at the opening ceremony of a two day summit of the National Economic Council, NEC, in Abuja. The president who noted the theme of the summit: Nigerian States: Multiple Centers of Prosperity was apt, had identified five key areas such agriculture, power, manufacturing, housing and healthcare as challenges the Council must prioritize. President Buhari also expressed misgivings over the privatization of the power sector in the country, saying that the process was more profit oriented than a thing of public interest. He stated that the sector was yet to show the gains of the privatization Programme as quality of service was still in a sorry state. But being an ongoing process, the president said that it must be completed. He said: “Nigerians’ favourite talking point and butt of jokes is the power situation in our country. But, ladies and gentlemen, it is no longer a laughing matter. We must and by the grace of God we will put things right. In the three years left for this administration we have given ourselves the target of ten thousand megawatts distributable power. In 2016 alone, we intend to add two thousand megawatts to the national grid. “This sector has been privatized but has yet to show any improvement in the quality of service. Common public complaints are: Constant power cuts destroying economic activity and affecting quality of life, High electricity bills despite power cuts, Low supply of gas to power plants due to vandalization by terrorists, Obsolete power distribution equipment such as transformers, Power fluctuations, which damage manufacturing equipment and household appliances, Low voltage which cannot run industrial machinery. “These are some of the problems, which defied successive governments. In our determination to change we must and will, insha Allah, put a stop to power shortages. “Key points to look at here are: Privatization. We are facing the classic dilemma of privatization: Public interest Vs Profit Motive. Having started, we must complete the process. But National Electricity Regulatory Commission (NERC), the regulatory authority, has a vital job to ensure consumers get value for money and over-all public interest is safe-guarded. “Government to fast-track completion of pipelines from Gas points to power stations and provide more security to protect gas and oil pipelines. “Power companies should be encouraged to replace obsolete equipment and improve the quality of service and technicians.” On agriculture, president noted with dismay the high cost of food items, saying that government must play active role in achieving food production and self sufficiency. He also observed that the commercial banks had no meaningful credit facilities for the agriculture sector, asking them to increase their lending to the sector. He said “On Agriculture today, both the peasant and the mechanized farmers agree with the general public that food production and self-sufficiency require urgent government action. For too long government policies on agriculture have been half-hearted, suffering from inconsistencies and discontinuities. “Yet our real wealth is in farming, livestock, hatcheries, fishery, horticulture and forestry. From the information available to me the issues worrying the public today are: Rising food prices, such as maize, corn, rice and gari, Lack of visible impact of government presence on agriculture, Lack of agricultural inputs at affordable prices. Cost of fertilizers, pesticide and labour compound the problems of farming. Extension services are virtually absent in several states. “Imports of subsidized food products such as rice and poultry discourage the growth of domestic agriculture. “Wastage of locally grown foods, notably fruit and vegetables which go bad due to lack of even moderate scale agro-processing factories and lack of feeder roads. “These problems I have enumerated are by no means exhaustive and some of the solutions I am putting forward are not necessarily the final word on our agricultural reform objectives: “First, we need to carry the public with us for new initiatives. Accordingly the Federal Ministry of Agriculture in collaboration with the States should convene early meetings of stakeholders and identify issues with a view to addressing them. “Inform the public in all print and electronic media on government efforts to increase local food production to dampen escalating food prices. “Banks should be leaned upon to substantially increase their lending to the agricultural sector. Central Bank of Nigeria (CBN) should bear part of the risk of such loans as a matter of national policy. “States should increase their financial support through community groups. The appropriate approach should be through leaders of community groups such as farmers cooperatives. “Provision of feeder roads by state governments to enable more effective evacuation of produce to markets and processing factories.” Speaking on manufacturing, president Buhari felt grieved that many industries were having the challenges of accessing foreign exchange to buy their raw materials. Noting that the situation was a phase however, he also identified Inadequate infrastructure such as Power, Roads, Security, high cost of borrowing money, lack of long term funding as factors militating against manufacturing in Nigeria. As a way of surmounting the problems, president Buhari made some recommendations. “The infrastructure Development Fund should be fast-tracked to unlock resources so that infrastructural deficiencies can be addressed. “There should be more fiscal incentives for Small and Medium Enterprises (SMEs), which prove themselves capable of manufacturing quality products good enough for export. “Central Bank of Nigeria (CBN) should create more incentives and ease credit terms for lending to manufacturers. “A fresh campaign to patronize Made-in-Nigeria goods should be launched. Example: all uniforms in government-sponsored institutions should be sourced from local factories”, he said. On housing, president Buhari said that there was housing deficit in Nigeria. According to him, the plan by his party, the All progressives Congress, APC to build 250 housing units might not be realized. He said: “Some estimates put Nigeria’s housing deficit at about sixteen million units. In our successful campaign to win the general elections last year our party, the APC, promised to build a million housing units a year. This will turn out to be a very tall order unless: “The Federal Government builds two hundred and fifty thousand units. The 22 APC States together manage another two hundred and fifty thousand units. “We invite foreign investors together with local domiciled big construction companies to enter into commercial housing building to pick up the rest.” The president also noted that “Severe shortage of housing, High rents, Unaffordable prices for prospective buyers especially middle and low-income earners”, in addition to “red tape, corruption and plain public service inefficiency lead to long delays in obtaining ownership of title documents”, amongst others were the huddles faced in actualizing meaningful housing scheme for all. President Buhari while speaking health as prerequisite for economic development, revealed that a whooping sum of $1 billion was been spent by Nigerians for medical treatment abroad on Healy basis. He said “In my inauguration speech last May, I remarked that the whole field of Medicare in our country needed government attention. Dirty hospitals! (Few sights are more upsetting than a dirty hospital), inadequate equipment, poorly trained nursing staff, overcrowding. The litany of shortcomings is almost endless. “Sound health system is part of the prerequisites for economic development. Nigerians travel abroad, spending an estimated One Billion US Dollars annually to get medical treatment. Despite huge oil revenues the nation’s health sector remains undeveloped”. In attacking the challenges of the sector, the president stated that there should be more funding for health centres to improve service delivery. According to him, the “World Bank and World Health Organization (WHO) could be persuaded to increase their assistance”. He also stated that a public health propaganda should be strengthened on Environmental sanitation, smoking, Better dieting, Exercising”. This was even as he charged the National Agency for Food, Drug, Administration and Control, NAFDAC, to intensify campaign against fake drugs. “NAFDAC should intensify efforts on reducing or stopping circulation of fake drugs in Nigeria. Ministry of Health should work closely with the Nigerian Medical Association to ensure that unqualified people are not allowed to practice”, he said Meanwhile, the Vice President Yemi Osinabjo who chaired the summit and the chairman of Nigerian Governors forum and governor of Zamfara state, Abdulazz Yari who also spoke at the opening ceremony underscored the need for prioritization in the light of dwindling oil prices in the international market. The summit had all the serving ministers as well as the 36 Nigerian State governors as participants.

Business

Nigeria’s Inflation Drops to 15.10% as NBS Reports Deflationary Trend

Nigeria’s headline inflation rate declined to 15.10 per cent in January 2026, marking a significant drop from 27.61 per cent recorded in January 2025, according to the latest Consumer Price Index (CPI) report released by the National Bureau of Statistics.

The report also showed that month-on-month inflation recorded a deflationary trend of –2.88 per cent, representing a 3.42 percentage-point decrease compared to December 2025. Analysts say the development signals easing price pressures across key sectors of the economy.

Food inflation stood at 8.89 per cent year-on-year, down from 29.63 per cent in January 2025. On a month-on-month basis, food prices declined by 6.02 per cent, reflecting lower costs in several staple commodities.

The data suggests a sustained downward trajectory in inflation over the past 12 months, pointing to improving macroeconomic stability.

The administration of President Bola Ahmed Tinubu has consistently attributed recent economic adjustments to ongoing fiscal and monetary reforms aimed at stabilising prices, boosting agricultural output, and strengthening domestic supply chains.

Economic analysts note that while the latest figures indicate progress, sustaining the downward trend will depend on continued policy discipline, exchange rate stability, and improvements in food production and distribution.

The January report provides one of the clearest indications yet that inflationary pressures, which surged in early 2025, may be moderating.

Bank

Alpha Morgan to Host 19th Economic Review Webinar

Alpha Morgan to Host 19th Economic Review Webinar

In an economy shaped by constant shifts, the edge often belongs to those with the right information.

On Wednesday, February 25, 2026, Alpha Morgan Bank will host the 19th edition of its Economic Review Webinar, a high-level thought leadership session designed to equip businesses, investors, and individuals with timely financial and economic insight.

The session, which will hold live on Zoom at 10:00am WAT and will feature economist Bismarck Rewane, who will examine the key signals influencing Nigeria’s economic direction in 2026, including policy trends, market movements, and global developments shaping the local landscape.

With a consistent track record of delivering clarity in uncertain times, the Alpha Morgan Economic Review continues to provide practical context for decision-making in a dynamic environment.

Registration for the 19th Alpha Morgan Economic Review is free and can be completed via https://bit.ly/registeramerseries19

It is a bi-monthly platform that is open to the public and is held virtually.

Visit www.alphamorganbank to know more.

Business

GTBank Launches Quick Airtime Loan at 2.95%

GTBank Launches Quick Airtime Loan at 2.95%

Guaranty Trust Bank Ltd (GTBank), the flagship banking franchise of GTCO Plc, Africa’s leading financial services group, today announced the launch of Quick Airtime Loan, an innovative digital solution that gives customers instant access to airtime when they run out of call credit and have limited funds in their bank accounts, ensuring customers can stay connected when it matters most.

In today’s always-on world, running out of airtime is more than a minor inconvenience. It can mean missed opportunities, disrupted plans, and lost connections, often at the very moment when funds are tight, and options are limited. Quick Airtime Loan was created to solve this problem, offering customers instant access to airtime on credit, directly from their bank. With Quick Airtime Loan, eligible GTBank customers can access from ₦100 and up to ₦10,000 by dialing *737*90#. Available across all major mobile networks in Nigeria, the service will soon expand to include data loans, further strengthening its proposition as a reliable on-demand platform.

For years, the airtime credit market has been dominated by Telcos, where charges for this service are at 15%. GTBank is now changing the narrative by offering a customer-centric, bank-led digital alternative priced at 2.95%. Built on transparency, convenience and affordability, Quick Airtime Loan has the potential to broaden access to airtime, deliver meaningful cost savings for millions of Nigerians, and redefine how financial services show up in everyday life, not just in banking moments.

Commenting on the product launch, Miriam Olusanya, Managing Director of Guaranty Trust Bank Ltd, said: “Quick Airtime Loan reflects GTBank’s continued focus on delivering digital solutions that are relevant, accessible, and built around real customer needs. The solution underscores the power of a connected financial ecosystem, combining GTBank’s digital reach and lending expertise with the capabilities of HabariPay to deliver a smooth, end-to-end experience. By leveraging unique strengths across the Group, we are able to accelerate innovation, strengthen execution, and deliver a more integrated customer experience across all our service channels.”

Importantly, Quick Airtime Loan highlights GTCO’s evolution as a fully diversified financial services group. Leveraging HabariPay’s Squad, the solution reinforces the Group’s ecosystem proposition by bringing together banking, payment technology, and digital channels to deliver intuitive, one-stop experiences for customers.

With this new product launch, Guaranty Trust Bank is extending its legacy of pioneering digital-first solutions that have redefined customer access to financial services across the industry, building on the proven strength of its widely adopted QuickCredit offering and the convenience of the Bank’s iconic *737# USSD Banking platform.

About Guaranty Trust Bank

Guaranty Trust Bank (GTBank) is the flagship banking franchise of GTCO Plc, a leading financial services group with a strong presence across Africa and the United Kingdom. The Bank is widely recognized for its leadership in digital banking, customer experience, and innovative financial solutions that deliver value to individuals, businesses, and communities.

About HabariPay

HabariPay is the payments fintech subsidiary of GTCO Plc, focused on enabling fast, secure, and accessible digital payments for individuals and businesses. By integrating payments and digital technology, HabariPay supports innovative services that make everyday financial interactions simpler and more seamless.

Enquiries:

GTCO

Group Corporate Communication

[email protected]

+234-1-2715227

www.gtcoplc.com

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING

You must be logged in to post a comment Login