Business

Sujimoto Pens An Open Letter To President Tinubu

Published

9 months agoon

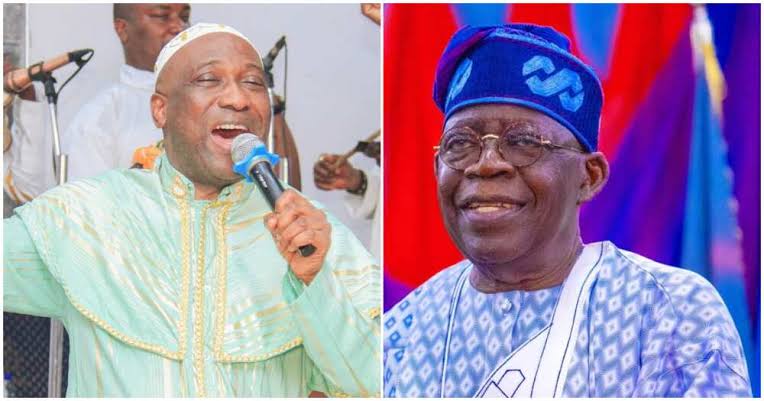

“Government Has No Obligation To Support Businesses” – Sujimoto’s Open Letter To Mr President

Dear Mr. President,

In 1978, Steve Jobs raised over a million dollars from the garage of his house through the use of his intellectual collateral, not a property, to develop the largest technology company and the biggest firm in the world today by market capitalization.

The multi-trillion-dollar vision with a backbone of public research funding from the U.S. government was achieved based on the national importance of driving innovation and as a sign that government’s investment and its initial leg into great companies do not only present tax benefits but also profit the entire ecosystem.

Government creates greatness. In fact, renowned industrialists like John D. Rockefeller, Cornelius Vanderbilt, and Sakichi Toyoda, among a host of other business magnates who received firm governmental support, have today created empires that provide jobs for millions of people globally.

Your excellency, there’s no greater and more fascinating story than a flourishing economy that thrives on innovative businesses. Thus, intentional support for subsidising businesses and dreams is a strategic and intelligent thing to do as a nation.

In Nigeria today, no start-up or entrepreneur can raise one naira in pre-seed funding without having to provide an arm and a leg. A demand for physical collateral that cripples revolutionary ideas and quenches the visionary flames of entrepreneurship.

With over 200 million citizens and a pregnant economy that must be delivered through the surgical needle of proper restructuring, the Nigerian business landscape must recover from its 77 percent year-on-year funding decline, a sharp fall from the $2 billion that the startup ecosystem attracted between July 2021 and June 2022 to $470 million in the last year (July 2022 to June 2023).

Asiwaju, as the economy continues to find its feet, the hikes in food prices and transportation are slowly eating deep into the moral fabric of society. Uncommon entrepreneurs are forced to explore new terrains with the Jakpa syndrome, where countless of Nigeria’s brightest minds seek opportunities elsewhere, away from their homeland.

Even companies with over 100 employees are being forced out of business or in debt due to a series of negative funding. An employee who earns N200,000 as a monthly salary today still struggles with the skyrocketing cost of living, which takes up more than 70 percent of the income. This influences the decision of such staff to seek alternative ways of surviving while living in debt, even before salaries are paid (if paid on time or even ever paid after 3 months).

Father, Nigeria’s current economic situation is like a mosquito sitting on one’s scrotum; the slightest amount of anger or irritation will lead to excruciating social and economic unrest.

Although all hopes are not dashed, in fact, new ones are being created as businesses gradually move from brick-and-mortar into the digital space. In today’s fast-paced society, the criteria for support should shift from tangible to intellectual assets, where vision can be invested in with funding and monitoring timelines and milestones, creating an enabling environment where competence and integrity prevail over connections and deceit.

As it stands today, no Nigerian bank is able to give any entrepreneur, visionary businessman, or woman one naira without a property asset or fixed asset to be held as collateral.

Amidst innovative thinking, financial engineering has crippled the growth of radical entrepreneurs, who have no problem with the presence of vision but lack everything in the acquisition of tangible collateral.

For Nigeria to reclaim its position as the Jewel of Africa and maintain her stance as the economic heart of Africa, it is crucial to urgently take into consideration this:

7 Pillars to tackle economic deprivation in Nigeria:

Funding Opportunities: One of the biggest challenges facing entrepreneurs is access to capital. Funding remains the engine that propels innovation, generates new businesses, and brings fresh products and services to the market. As such, government has to encourage financial institutions to create an intellectual and creative collateral system for businesses with no alternative for physical collateral such as lands or properties.

Reducing the regulatory burden on entrepreneurs: To further promote the entrepreneurship culture, especially among youths, the current political dispensation has to reduce the bureaucratic red tape by simplifying and streamlining the process of starting and running a business. For example, the World Bank’s Ease of Doing Business Index ranks countries like Singapore and the United Arab Emirates at the top of the list due to their business-friendly policies, while Nigeria is not even among the first one hundred.

Agricultural Exploits for Food Security: If you travel through the Lagos to Ibadan expressway, or the Kano-Zaria road, spans of land remain uncultivated, creating backlogs of agricultural deficits that won’t only tackle food scarcity if properly utilised but also create jobs for potential farm entrepreneurs while drastically reducing crime rates.

Nigeria is blessed with over 34 million hectares of arable land, a farming sector that has the potential to contribute above 23% to the nation’s GDP.

As a symbol of hope, Suji Farm Estate, a subsidiary of the esteemed Sujimoto Group, is taking on the mantle with a firm plan to allocate over 20,000–1,000,000 hectares before 2030, spreading across all geopolitical zones and all 36 states, for localised food production and mass employment opportunities designed to provide job security for over 10,000–200,000 citizens nationwide. With a clear plan for setting up a team of young, independent, and outstanding youth to supervise work, live, and play on the farm.

Suji Farm Estate will be built on an advanced farm estate system that incorporates housing, farm hospitals, hotels, and markets within an ecosystem, creating opportunities for agro-tourism and affordable housing.

In tackling food security, aside from creating thousands of farm entrepreneurs, the government must seek out innovative people—not only Sujimoto Farms but also numerous young agro-entrepreneurs across all 37 states—who have exceptional reputations, passion and technical know-how, encourage them, and fund them. It is in the government’s interest to intentionally fund businesses and projects with strong potential to impact our dare economy, which will eventually drive taxes and many other benefits for the nation.

An idle hand is the devil’s workshop: Nigeria currently sits on a keg of gun powder as the unemployment rate remains on the rise. The youth of the nation is our biggest asset, and it is alarming that over 42% of her population is out of work, a silent time bomb and a destructive tool vulnerable to use by terrorists, banditry, and other related vices. It is urgent that the youth start putting their expertise into farming and other lucrative ventures.

Government supports innovative enterprise: Yes, not all governments have the obligation to support businesses, but governments have a moral duty and obligation to partner with businesses because a thriving business is a thriving nation.

Great nations like Egypt and Singapore are intentionally encouraging localised production and promoting local enterprises. It is high time for the Nigerian government to create stimulus packages for businesses and local entrepreneurs to help them achieve their goals, promote job opportunities, and drastically improve foreign exchange. This should not come in the form of grants but in affordable and accessible loan packages for specified durations.

Sectoral Research and Development: If Elon Musk was in Lagos, he probably would have ended up in computer villages selling mobile devices, with his innovative ideas frustrated due to lack of funding. Steve Jobs also may have been a genius entrepreneur—he certainly had an eye for design—but his most successful product would not exist if it weren’t for the billions of dollars that the US government spends every year on research and development.

Just like SpaceX, although it is not yet in the full stage of generating revenue, the American government has also maintained a great share in funding the technological corporation because of its economic relevance and research impact on global society.

Nigeria can’t afford to think small. As the giant of Africa and the biggest nation in Africa with the biggest problem, the government needs to go out there and identify 10,000–50,000 outstanding entrepreneurs from all 36 states who have the capacity and reputation to do things differently, empower them beyond physical collateral, invest in their intellectual property,and create an enabling environment where competence and integrity prevail over connections and deceit.

Localised Production, Global Distribution: As of today, a 50-KG bag of rice costs N42,000 from the mills and about N52,000 from supermarkets, whereas the same bag of rice is worth N22,000 at Seme Border, Republic of Benin. The secret to reducing the price is by growing the paddy locally and setting up rice mills in individual states, drastically reducing the cost of rice and food.

This is what Suji Farms Estate aims to achieve in the next 24 months, where we will be able to grow our paddy, mill the paddy, and distribute it directly to supermarkets across the nation, drastically reducing the cost of a bag from N52,000 to N35,000. This will further improve our nation’s human capital development and deliberately improve the nation’s food security, but we are only one company, and we believe the government can partner with other innovative agro-entrepreneurs, providing them with accessible, affordable, and non-stressful capital.

With a clear blueprint to develop affordable housing, improve the agricultural sector, and foster job opportunities within the retail space, Sujimoto Group has over the years built a solid reputation in the luxury real estate sector and is positioning itself to drastically reduce the housing deficit and bridge the unemployment gap in the next 5 years with the 1,000,000-hectare Sujimoto Farm Estate nationwide project.

To achieve this feat in an environment where funding is almost impossible and access to land is difficult, the present-day government must stretch its hand of collaboration, fund astounding projects, and tie performance bonds to them while monitoring project milestones and timelines. On the other hand, the funding isn’t for free, as government will also generate income through payback, business taxes, and employer income taxes.

“My dear President, I know that you have created a solid road map and a fantastic blueprint for the next 8 years, for I believe that the feat of achievement you attained in Lagos State and the successful entrepreneurs you’ve created between 1999 and 2007can be replicated again on a national scale.”

Thank you, your distinguished excellency.

Dr. Sijibomi Ogundele is the Managing Director of Sujimoto Group, the Czar of Luxury Real Estate Development, and the mastermind developer behind the renowned Giuliano. Our other audacious projects, such as the most sophisticated building in Banana Island, LucreziaBySujimoto, the grandiose Sujimoto Twin Tower, the tallest twin towers in Africa; the regal Queen Amina by Sujimoto, a monument to royal affluence; the magnificent high-rise LeonardoBySujimoto; Nigeria’s No. 1 most affordable luxury housing, Ìlú Titun, and Africa’s most exclusive waterfront townhouses, GiovanniBySujimoto, some of which have etched an indelible imprint on Nigeria’s skylines, a testament to their unrivalled mastery of modern day engineering.

Related

Sahara weekly online is published by First Sahara weekly international. contact saharaweekly@yahoo.com

You may like

-

Tinubu-Shettima supporters vow to expose appointees plotting against President’s 2027 interests

-

More Taxes, Economic Hardship Fulfills Primate Ayodele’s Prophecy On Tinubu’s Government

-

Rivers Crisis: Yoruba Youths Berate Wike For Disrespecting Tinubu …say FCT Minister never respected Abuja peace accord

Business

ASR AFRICA BEGINS THE CONSTRUCTION OF THE ABDUL SAMAD RABIU CLASSROOM BLOCKS FOR THE UNIVERSITY OF UYO UNDER ITS TERTIARY EDUCATION GRANTS SCHEME

Published

7 hours agoon

May 9, 2024

ASR AFRICA BEGINS THE CONSTRUCTION OF THE ABDUL SAMAD RABIU CLASSROOM BLOCKS FOR THE UNIVERSITY OF UYO UNDER ITS TERTIARY EDUCATION GRANTS SCHEME

Uyo, May 9th, 2024

Sahara Weekly Reports That The Abdul Samad Rabiu Africa Initiative (ASR Africa) has commenced the construction of four classroom blocks for the University of Uyo in Akwa Ibom State with a groundbreaking held on the university campus today. This donation forms part of a grant given to the University of Uyo through the ASR Africa Tertiary Education Grants Scheme, which was drawn from ASR Africa’s US$100 million Fund for Social Development and Renewal.

The Vice Chancellor of the University, Prof. Nyaudoh U. Ndaeyo, expressed his gratitude to ASR Africa for considering the University of Uyo as a worthy beneficiary of the Tertiary Education Grant Scheme. He emphasised that constructing these classroom blocks was a top priority for the university and requested that the project be completed quickly so that the institution could start using it. He also appreciated the Chairman of ASR Africa, Abdul Samad Rabiu, for his various interventions in tertiary institutions in the country.

Dr. Ubon Udoh, MD CEO of ASR Africa, whilst giving his remarks, applauded the management of the University of Uyo for their support project so far. He also reiterated the commitment of the founder and Chairman of ASR Africa, Abdul Samad Rabiu, to supporting quality education within the tertiary education system in Nigeria and Africa. He further urged the students to make good use of the new facility when it is completed.

So far, over 27 public and private Nigerian universities and institutions of higher learning have benefitted from the ASR Africa Tertiary Education Grants, including the University of Maiduguri, Ahmadu Bello University Zaria, the University of Ilorin, the University of Benin, and the University of Ibadan; Adamawa State University, University of Jos, Federal University of Technology, Minna amongst others.

About ASR Africa

ASR Africa is the brainchild of the African Industrialist, Philanthropist, and Chairman of BUA Group, Abdul Samad Rabiu. The Abdul Samad Rabiu Africa Initiative (ASR Africa) was established in 2021 to provide sustainable, impact-based, homegrown solutions to developmental issues affecting Health, Education and Social Development within Africa.

Related

Business

More Taxes, Economic Hardship Fulfills Primate Ayodele’s Prophecy On Tinubu’s Government

Published

14 hours agoon

May 9, 2024

*More Taxes, Economic Hardship Fulfills Primate Ayodele’s Prophecy On Tinubu’s Government

For almost one year, Nigerians have been made to go through palpable mayhem in the sectors that should drive the nation into bountifulness. Most especially, the economy and security sectors have maintained a constant downtime, leading to an unprecedented perilous season for the citizens of the once-lively nation.

The predicament of the country cannot be separated from the current leadership; the President Bola Ahmed Tinubu-led administration cannot be exonerated from the country’s current state because the policies of the government are the major factors responsible for hardship.

Although President Tinubu’s mantra was ‘Renewed hope’ , many quarters of the country have simply exuded hopelessness in the last one year; an administration that raised the hopes of its citizens and promised to make life enjoyable didn’t waste time before inflicting pains on innocent electorates.

The beginning of Nigeria’s renewed woes was the first declaration of President Bola Ahmed Tinubu at his swearing-in ceremony that ‘Subsidy is gone’. Barely 24 hours after the President’s statement, the price of petrol increased from N189/Litre to N557, the highest in the history of Africa’s largest oil producer.

While many couldn’t see more to President Bola Ahmed Tinubu than meets the eye during the campaigns, a distinguished Nigerian prophet, Primate Ayodele already X-rayed through his prophetic lens what would become of the APC government if Nigerians voted for the party.

Several Nigerians banked on the renewed hope mantra of President Tinubu but Primate Ayodele was that fearless voice warning Nigerians against voting for Tinubu or the All Progressive Congress (APC) because it would be a government of hardship for the country.

Some of his warnings were hinged on the state of Nigeria’s economy and security. In viral videos, he was heard saying voting for President Tinubu would lead Nigeria into a dungeon. In follow-up prophecies, He prophesied that Dollar will be sold for N1,500, fuel will be sold for N800/Litre, a bag of rice will be sold for N6500, to mention a few.

‘’ I’m not saying anyone should not insult me, I am not scared of any human being. If Nigeria votes APC in 2023, things will be tougher. We will see human beings and want to eat them like food. This is how God told me. I am not saying you should not criticize me or say anything against me even as an APC member, I warned you in 2015 too. You want to vote for lies in 2023, if you vote for the party that has a broom as their symbol, I pity churches. I am not against anybody and I don’t vote, Nigeria will be tough. If you vote and Tinubu enters, there will be serious problems.’’

‘’If Nigerians vote for APC in 2023, the country will sink, we will swim in poverty, and the economy will be in shambles. If APC wins, Nigeria will suffer extraordinarily. We have not yet seen hardship; if APC wins, the real hardship will come. The economy will be sick.’’

As the cleric foretold, citizens are swimming in serious poverty, food items have become unaffordable for the common man, the Nigerian economy has been struggling to breathe for one year without any significant headway and in short, Nigeria has been thrown into an endless dungeon.

Moreover, suffice to say that the President Bola Ahmed Tinubu-led administration, just as Primate Ayodele foretold, is one that is bent on making Nigerians suffer extraordinarily. The government through the Central Bank of Nigeria (CBN) just recently introduced some taxes despite the current hardship faced by those who will still be required to pay the newly imposed taxes.

In a memo, the Central Bank of Nigeria (CBN) ordered all commercial banks to impose a 0.5% levy on some electronic transactions. The fund is supposed to be transmitted to the Office of the National Security Adviser for the purpose of cyber security. The levy is imposed on the initiator of the transaction and not the receiver.

There is the stamp duty, the Nigerian Inter-Bank Settlement System (NIBSS) charge, and the Value Added Tax. This is apart from the charges imposed by banks like the maintenance fee and the SMS charges.

Meanwhile, the introduction and increment of some of these taxes were all foretold by Primate Ayodele who warned the citizens against voting for another APC government.

In his 2024 prophecies which were released in December 2023, the cleric revealed that there will be an increase in tariffs and more taxes would be introduced for Nigerians in the coming year.

‘’I foresee there will be a high cost of living as tariffs on goods and Services will be raised and taxes will be too high despite the fact that the goods are not contrabands. The spirit of God says the economy will still be very difficult to manage. The government needs to do something good for the people and seek the face of the Lord for divine direction.’’

In another video, he asserted that the government would increase stamp duty and Value added Tax (VAT).

‘’I am seeing an increase in stamp duties. The bank stamp duty will not be friendly to the people…it’s going to be a new thing that will come out. Also, increment in VAT will shut down the economy. The government must not try to increase it because it will make the economy tougher’’

@primateayodele #centralbank #cardoso #olayemicardoso #cbn #centralbankofnigeria #banking #duties #charge #stampduties #primateayodele #iescworldwide

The prophecies of Primate Elijah Ayodele and their manifestation further explain the negligent attitude of people especially when it comes to divine revelations from the almighty God. There are no questions about Primate Ayodele’s credibility; there are proven records of over 15,000 fulfilled prophecies credited to him but the ears of the electorate have simply been deafened towards divine warnings.

Well, 2027 is by the corner and hopefully, they listen; maybe Nigeria will become a better nation that exudes hopefulness, liveliness, and wellness.

Related

*Jumbo Emerges Rivers Assembly Speaker

Rt. Hon. Oko Jumbo representing Bonny Constituency has emerged as the Speaker of the Rivers State House of Assembly.

Oko becomes the third Speaker under the current administration after Edison Ehie and Martin Amaewhule.

Details later…

Related

Cover Of The Week

- Eritrea: Seminars Highlight 33rd Independence Day Anniversary May 9, 2024

- Kenya: Mediation Key to South Sudan Peace Process, President Ruto May 9, 2024

- Following directives of the United Arab Emirates President, the UAE allocates USD 15 million in relief aid to flood victims in Kenya May 9, 2024

- Abidjan hosts the first Edition of the West African Festival of Arts and Culture (ECOFEST) May 9, 2024

- The Vice-President of The Economic Community of West African States (ECOWAS) Commission H.E. Mrs Damtien L. Tchintchibidja Advocates Pooling Efforts to speed up the Implementation of the ECOWAS Human Capital Development (HCD) Strategy May 9, 2024

- Pan-African Legal Group CLG Opens Office in Congo’s Oil & Gas City Pointe Noire May 9, 2024

- President El-Sisi Offers Condolences over the Passing of Sheikh Hazza bin Sultan bin Zayed Al-Nahyan May 9, 2024

- President El-Sisi Meets Jordan's Prime Minister and Minister of Defense May 9, 2024

- African Union, International Committee of the Red Cross (ICRC) Roundtable Seeks Innovative Tech Solutions for Landmine Clearance in Africa May 9, 2024

- Brazilian Association of Piped Gas Distributing Companies (ABEGÀS) to Lead Brazilian Delegation to Angola Oil & Gas (AOG) 2024 May 9, 2024

- Eritrea: Seminars Highlight 33rd Independence Day Anniversary May 9, 2024

- Kenya: Mediation Key to South Sudan Peace Process, President Ruto May 9, 2024

- Following directives of the United Arab Emirates President, the UAE allocates USD 15 million in relief aid to flood victims in Kenya May 9, 2024

- Abidjan hosts the first Edition of the West African Festival of Arts and Culture (ECOFEST) May 9, 2024

- The Vice-President of The Economic Community of West African States (ECOWAS) Commission H.E. Mrs Damtien L. Tchintchibidja Advocates Pooling Efforts to speed up the Implementation of the ECOWAS Human Capital Development (HCD) Strategy May 9, 2024

- Pan-African Legal Group CLG Opens Office in Congo’s Oil & Gas City Pointe Noire May 9, 2024

- President El-Sisi Offers Condolences over the Passing of Sheikh Hazza bin Sultan bin Zayed Al-Nahyan May 9, 2024

Trending

-

celebrity radar - gossips5 months ago

celebrity radar - gossips5 months agoTripple Celebration, As AAS CEO, Jesam Micheal Emerges Fintech Expert of The Year, Launches Lounge

-

celebrity radar - gossips5 months ago

celebrity radar - gossips5 months agoJesam Micheal the philanthropist, Clears the Hospital Bills of UGEP Patients, Put Smiles On Faces Of Orphanages, Police (video)

-

Business3 months ago

Business3 months agoFintech Guru, Jesam Micheal Opens Biggest Apple Store In Africa, Reveals Why

-

Business4 months ago

Business4 months agoFintech Guru, Jesam Micheal Opens Biggest Apple Store In Lagos On Saturday (Video)