Business

The Profitable Venture of Building Warehouses on Land Property in Nigeria by Dennis Isong

Published

8 months agoon

The Profitable Venture of Building Warehouses on Land Property in Nigeria by Dennis Isong

Investing in real estate has always been a reliable pathway to wealth generation, particularly in Nigeria, where the demand for land and property consistently rises due to rapid population growth. Among the various forms of real estate investments, building a warehouse on your land property stands out as a highly profitable venture.

A warehouse is a large building or structure primarily used for storing goods, merchandise, and materials. Warehouses serve as key nodes in the supply chain, where goods are received from suppliers, stored, and then distributed to retailers or customers. They can range from small storage spaces to massive complexes covering thousands of square meters. The design of a warehouse is typically utilitarian, focusing on functionality, safety, and efficiency, with features like high ceilings, loading docks, and climate control systems to protect perishable items.

Uses of a Warehouse

1. Storage of Goods: The primary function of a warehouse is to store goods, ranging from raw materials to finished products. This storage capability helps businesses manage their inventory and meet customer demands without the risk of stockouts.

2. Distribution Hub: Warehouses often serve as distribution centers, where goods are received from various suppliers and then dispatched to retail stores, customers, or other warehouses.

3. Order Fulfillment: In e-commerce, warehouses play a crucial role in order fulfillment, where products are picked, packed, and shipped to customers after an online purchase.

4. Cross-Docking: This is a process where products from a supplier or manufacturing plant are distributed directly to customers or retail chains with minimal handling or storage time, reducing the need for warehouse space and speeding up delivery times.

5. Product Consolidation: Warehouses can consolidate smaller shipments from different suppliers into a larger, single shipment, reducing transportation costs and increasing efficiency.

6. Seasonal Storage: Businesses often need additional storage space for seasonal products. A warehouse provides the necessary space to store these goods until they are needed, such as holiday decorations or seasonal clothing.

7. Inventory Management: Modern warehouses are equipped with inventory management systems that track the movement of goods, manage stock levels, and ensure efficient operations.

8. Buffer Storage: Warehouses act as a buffer between production and consumption, allowing businesses to store excess inventory during times of low demand and release it when demand spikes.

9. Packaging and Labeling: Many warehouses offer packaging and labeling services, where goods are repackaged, labeled, or customized before being shipped to their final destination.

10. Product Testing and Inspection: Some warehouses are equipped with facilities for testing, inspecting, and even repairing products before they are shipped out to ensure quality and customer satisfaction.

Benefits of Warehouse Property Investment in Nigeria

1. High Demand for Storage Space: Nigeria’s booming population and growing economy have led to an increase in the production and consumption of goods. This, in turn, has driven the demand for storage facilities, making warehouses a sought-after commodity. Companies in industries such as manufacturing, agriculture, retail, and e-commerce all require warehouse space to store their products and manage their supply chains effectively.

2. Steady Rental Income: One of the primary benefits of building a warehouse on your land property is the potential for steady rental income. Companies are willing to pay premium prices to lease well-located and well-maintained warehouses. This provides property owners with a reliable and consistent source of income, often with long-term lease agreements that offer financial stability.

3. Appreciation of Property Value: Investing in warehouse property not only generates rental income but also contributes to the appreciation of the property’s value over time. As urban areas expand and industrial zones develop, the value of land with functional warehouses increases. This makes it a lucrative investment for the future.

4. Low Vacancy Rates: Warehouses, especially those located in strategic areas like Lagos, Abuja, and Port Harcourt, tend to have low vacancy rates. The consistent demand for storage space ensures that warehouse properties are rarely left unoccupied, reducing the risk for investors.

5. Diverse Tenant Base: Warehouses attract a wide range of tenants from various industries, including logistics, manufacturing, retail, and e-commerce. This diversity reduces the risk of dependency on a single tenant or industry, providing a more stable investment.

6. Scalability: Unlike residential or commercial properties, warehouses offer scalability. As your business grows, you can expand the warehouse space by acquiring adjacent land or optimizing the existing layout. This flexibility allows you to cater to larger tenants or store more goods, increasing your income potential.

7. Tax Incentives: The Nigerian government, recognizing the importance of infrastructure and storage facilities, offers various tax incentives for warehouse construction and operation. These incentives can significantly reduce the overall cost of investment and increase profitability.

8. Inflation Hedge: Real estate, including warehouse properties, is considered an effective hedge against inflation. As inflation rises, the value of the property and rental income tends to increase as well, preserving the purchasing power of your investment.

9. Strategic Location Advantages: Warehouses strategically located near ports, airports, major highways, or industrial zones have a significant advantage. These locations reduce transportation costs and improve logistics efficiency for tenants, making such warehouses highly desirable.

10. Potential for Conversion: Warehouses offer the potential for future conversion to other uses, such as retail spaces, offices, or residential units. This versatility adds to the long-term value of the investment.

How Warehouse Investment is Profitable for Nigerians in the Diaspora

For Nigerians in the diaspora, investing in warehouse property in Nigeria presents a unique opportunity to build wealth and maintain a connection to their homeland. Here’s how this investment can be particularly profitable:

1. Currency Exchange Benefits:

Diaspora investors often have access to foreign currencies, which are stronger than the Nigerian Naira. Investing in warehouse properties allows them to take advantage of favorable exchange rates, reducing the overall investment cost while earning rental income in Naira.

2. Passive Income:

For Nigerians living abroad, managing day-to-day operations in Nigeria can be challenging. Warehouse investment offers a low-maintenance option to generate passive income. Once a warehouse is leased to a reliable tenant, it requires minimal oversight, allowing diaspora investors to enjoy steady income with limited involvement.

3. Portfolio Diversification:

Many Nigerians in the diaspora invest in real estate as a way to diversify their portfolios. Warehouse properties provide a unique asset class that offers both income generation and capital appreciation, helping to balance investment risk.

4. Leverage Local Knowledge and Networks: Diaspora investors can leverage local knowledge and networks to identify prime warehouse locations and negotiate favorable deals. Collaborating with local real estate experts ensures that they make informed decisions and maximize their returns.

5. Contributing to Nigeria’s Economic Growth: By investing in warehouse properties, Nigerians in the diaspora contribute to the development of the country’s infrastructure. This investment helps create jobs, support businesses, and stimulate economic growth, which in turn, enhances the stability and value of their investments.

6. Legacy Building:

Investing in warehouse property is a long-term venture that can be passed down to future generations. Diaspora investors can build a legacy for their families by acquiring valuable assets in Nigeria that will continue to generate income and appreciate in value over time.

7. Remote Management Solutions:

Advances in technology have made it easier for diaspora investors to manage their properties remotely. From digital lease agreements to online rent collection and property management platforms, investors can efficiently oversee their warehouse investments from anywhere in the world.

8. Tax Efficiency:

Nigerian tax laws offer various incentives and deductions for real estate investments, including warehouse properties. Diaspora investors can take advantage of these tax benefits to reduce their tax liabilities and increase their net returns.

9. Risk Mitigation through Property Management Companies:

For those concerned about managing properties from abroad, hiring a reputable property management company in Nigeria can mitigate risks. These companies handle tenant relations, maintenance, rent collection, and legal compliance, ensuring that the investment remains profitable without the investor’s constant involvement.

10. Potential for High Returns:

Given the high demand for warehouse space in Nigeria, especially in urban and industrial areas, the potential for high returns is significant. Diaspora investors can capitalize on this demand by investing in well-located warehouses, securing long-term tenants, and enjoying substantial rental income and property appreciation.

For personalized assistance with your property needs, contact Dennis Isong, a top Lagos realtor specializing in helping Nigerians in the diaspora own property stress-free.

Contact: +2348164741041

Related

Sahara weekly online is published by First Sahara weekly international. contact saharaweekly@yahoo.com

Business

NYCN Governor, Idahosa Urges Diaspora Youths to Seize Global Market Opportunities …Pledges to Collaborate with The Global Clusters

Published

10 hours agoon

April 15, 2025

NYCN Governor, Idahosa Urges Diaspora Youths to Seize Global Market Opportunities

…Pledges to Collaborate with The Global Clusters

Ambassador Collins Idahosa, Governor of the National Youth Council of Nigeria (NYCN), European Chapter, has urged Nigerian youths in the diaspora to transcend limitations and seize the abundant opportunities available in global markets through innovation and entrepreneurship.

He highlighted that such initiatives would facilitate international networking, enabling young Nigerians to establish businesses, create jobs, and forge partnerships that stimulate economic growth and technological advancement in Nigeria.

In his address titled “Rise Up, Nigerian Youths,” Idahosa asserted that the future of Nigeria lies in the hands of its youth, both at home and abroad.

Speaking at a youth forum on Monday, themed “Innovation and Entrepreneurship Opportunities for Nigerian Youth in the Diaspora,” he urged Nigerian youths overseas to capitalise on global opportunities to reshape both their nation and the wider community.

“Innovation and entrepreneurship offer limitless prospects for Nigerian youths in the diaspora to contribute significantly to their home country and the global arena.

“With their exposure to diverse cultures, advanced technologies, and innovative business models, diasporan youths are uniquely positioned to drive innovation across various sectors,” he stated.

He emphasised the importance of the diaspora, describing it as an extraordinary asset. In 2023 alone, Nigerian remittances surpassed $20 billion.

“By harnessing their international networks, they can establish businesses, create jobs, and foster partnerships that promote economic growth and technological progress in Nigeria,” he added.

He further pointed out that the growing availability of digital platforms and the rise of global collaboration facilitate the ability of Nigerian youths abroad to provide innovative solutions to local challenges, particularly in technology, healthcare, agriculture, and education.

“By tapping into global markets and leveraging their acquired skills and knowledge, they can play a pivotal role in transforming Nigeria’s economy. Additionally, by fostering innovation and creating sustainable business models, diaspora youths can actively contribute to their states’ development agendas.”

He reiterated his call for the establishment of State Diaspora Agencies to create formal frameworks for engagement between states and their citizens abroad.

He said states such as Edo and Kwara have already made progress with dedicated agencies, and he urged others to build upon these efforts for sustainable diaspora engagement that ensures continuity, maximises investments, and drives development.

Idahosa expressed his honour at being invited to the prestigious World Youth Summit 2025 in Thailand, scheduled for July 14–18, 2025, at the United Nations venue in Bangkok.

He pledged to continue advocating for Nigerian youth worldwide, with the support of Ambassador Dr. Adekunle Badmus, Global President of The Global Clusters.

He noted that The Global Clusters is a groundbreaking international network committed to youth development, innovation, and global impact, making it a strategic ally in shaping the future of African youths both at home and abroad.

Notably, Dr. Badmus also serves as Nigeria’s ambassador to the National Youth Council of Nigeria in Turkey. Idahosa aims to leverage this opportunity to further champion the values and goals of the National Youth Council of Nigeria.

Related

Business

Al Humphrey Onyanabo Launches The Best of Nigeria Magazine: A Digital Celebration of Icons, Innovators, and Nation Builders

Published

2 days agoon

April 14, 2025

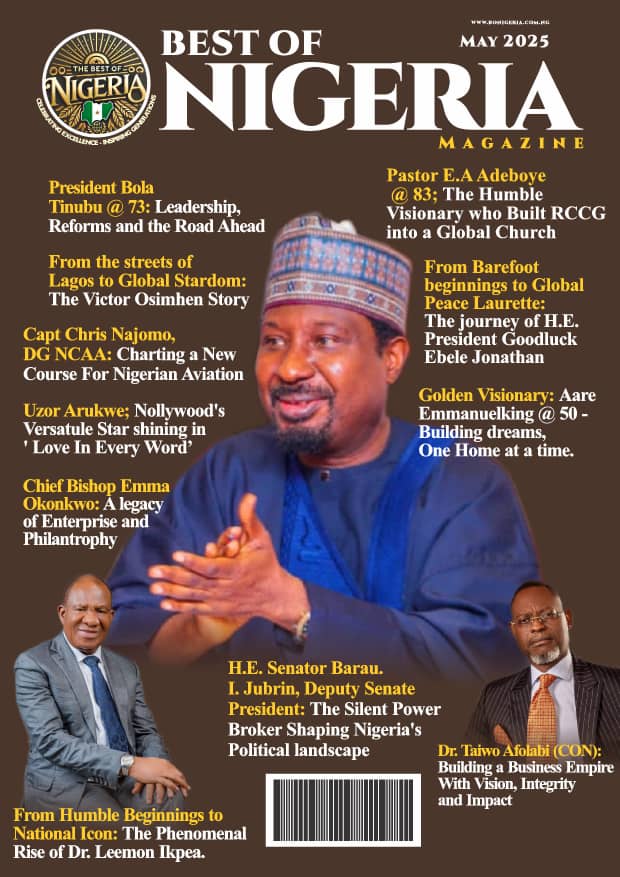

Al Humphrey Onyanabo Launches The Best of Nigeria Magazine: A Digital Celebration of Icons, Innovators, and Nation Builders

Veteran society writer Al Humphrey Onyanabo has launched a powerful new publication — The Best of Nigeria magazine — a bold, digital-first magazine dedicated to celebrating the individuals driving Nigeria’s progress across politics, business, faith, sports, entertainment, and philanthropy.

A seasoned chronicler of Nigeria’s elite and cultural vanguards, Onyanabo( he is also publisher of the news platform,(www.nigeria360.com.ng) brings his signature storytelling style to this exciting platform, presenting compelling narratives of excellence, legacy, and resilience. The publication seeks to inform, inspire, and elevate the national conversation by spotlighting those who are shaping the soul and future of Nigeria.

Leading with Leadership: H.E. Senator Barau I. Jubrin

Front and center in the maiden May edition is a powerful profile of H.E. Senator Barau I. Jubrin, Deputy Senate President — described as “the silent power broker” — whose strategic influence is quietly shaping Nigeria’s political architecture. This feature explores his disciplined leadership style, legislative impact, and national relevance.

A Vision Rooted in National Pride

According to Onyanabo, “The Best of Nigeria isn’t just a magazine — it’s a platform of pride and purpose. We are shining a light on those who reflect the strength, brilliance, and ambition of our people, at home and abroad.”

Now available in digital format, the magazine will soon transition into print editions, allowing for broader circulation and deeper engagement with readers across Nigeria and the diaspora.

Inside the May Edition,

The second edition is packed with thought-provoking features and powerful tributes, including:

Dr. Leemon Ikpea, Chief executive officer of The Lee Engineering Group: From humble beginnings to 35 years of excellence in oil and gas.

President Bola Ahmed Tinubu @ 73: A close look at leadership, reforms, and the future.

Dr. Taiwo Afolabi, (CON), CEO, SIFAX GROUP: Building a business empire on vision and integrity

Capt. Chris Najomo: Piloting a new chapter for Nigerian aviation

Pastor E.A. Adeboye @ 83: The humble visionary behind RCCG’s global expansion

Chief Bishop Emma Okonkwo: A celebrated legacy of enterprise and philanthropy

H.E. Goodluck Jonathan: From barefoot boy to global peace laureate

Victor Osimhen: From the streets of Lagos to global football stardom

Uzor Arukwe: Nollywood’s versatile star shining in Love In Every Word

Mr. Jim Ovia: A tribute to the godfather of modern Nigerian banking and founder of Zenith Bank

Mr. Pascal Dozie: Honoring the legacy of the visionary founder of Diamond Bank

And many more inspiring stories of Nigerians breaking boundaries around the world.

With each edition, The Best of Nigeria will continue to uncover and celebrate the champions of our society — the quiet heroes, the headline-makers, and the legacy-builders.

Beyond celebrating outstanding individuals, The Best of Nigeria magazine is also committed to showcasing the rich tapestry of Nigeria’s tourism, culture, and creative economy to a global audience. From breathtaking destinations like the Obudu Mountain Resort and Erin Ijesha Waterfalls to historical gems like the Benin Bronzes and the Nok Terracotta, the magazine will highlight the beauty, diversity, and heritage that make Nigeria a top destination for cultural exploration and adventure.

In addition, The Best of Nigeria will serve as a gateway to the country’s thriving creative and economic sectors — spotlighting Nollywood’s global rise, the infectious pulse of Afrobeats, the elegance of Nigerian fashion, and the power of local art. It will also promote viable investment opportunities across real estate, agriculture, tech, and tourism, positioning Nigeria not only as a cultural powerhouse but as a land of innovation, enterprise, and limitless potential.

The journey to tell Nigeria’s most inspiring stories has begun. And this is only the beginning.

Related

Business

VANGUARD AWARDS OLAKUNLE WILLIAMS THE ENERGY ICON OF THE YEAR: CELEBRATING THE TIGER OF THE ENERGY SECTOR IN AFRICA

Published

5 days agoon

April 11, 2025

VANGUARD AWARDS OLAKUNLE WILLIAMS THE ENERGY ICON OF THE YEAR: CELEBRATING THE TIGER OF THE ENERGY SECTOR IN AFRICA

BY CHINEDU NSOFOR

Olakunle Williams, the Chief Executive Officer of Tetracore Energy Group, has been honored with the prestigious Vanguard Energy Icon Award 2025. This accolade recognizes his outstanding contributions to the African energy sector and his visionary leadership in driving innovation and sustainable growth.

A Visionary Leader Transforming Africa’s Energy Landscape

Under Williams’ guidance, Tetracore Energy has emerged as a leading energy solution provider, boasting a natural gas portfolio exceeding 75 million standard cubic feet per day (MMScfd) for industrial use and energizing over 300 megawatts (MW) of power generation in Nigeria. His strategic focus on clean and cost-effective energy solutions aligns with Africa’s aspirations for a sustainable future, positioning him as a pivotal figure in the continent’s energy narrative.

Pioneering Gas Innovation and Strategic Collaborations

Williams’ commitment to innovation is exemplified by Tetracore’s recent collaboration with Dangote Cement to supply up to 400,000 standard cubic meters per day of Auto Compressed Natural Gas (Auto-CNG) for its logistics operations. This partnership marks a significant step towards achieving the goals of President Bola Ahmed Tinubu’s Presidential CNG Initiative (Pi-CNG), highlighting Williams’ role in advancing Nigeria’s energy transition.

Accolades Reflecting Excellence

Olakunle Williams’ remarkable leadership, visionary drive, and consistent dedication to transforming Africa’s energy landscape have earned him several prestigious accolades both locally and internationally. In 2022, he was honoured with the Nigeria Domestic Gas Ambassador Award by the Nigeria Gas Association in recognition of Tetracore’s outstanding commitment to deepening domestic gas utilization across Nigeria. This was closely followed in 2023 by the Innovative Gas Company of the Year Award presented by the Nigeria Gas Investment Forum, celebrating Tetracore’s pioneering contributions to innovation within the gas industry. His transformative leadership qualities were further acknowledged in 2021 when he received the Energy Personality Leadership Prize for African Leadership Excellence, highlighting his role in reshaping the African energy sector. Williams’ growing influence was also solidified when the African Energy Chamber listed him among the 25 Energy Personalities to Watch in 2022, positioning him as one of the most dynamic leaders shaping Africa’s energy future. In 2023, The Guardian Nigeria further amplified his reputation by featuring him among Nigeria’s 50 Most Inspiring and Definitive Top CEOs in its Annual CEO Series. His exceptional contributions to leadership and corporate governance earned him the Professional Doctorate and Corporate Leadership Excellence Award in 2025, conferred by the Chartered Institute of Public Resources Management and Politics (Ghana). In the same year, he bagged the Innovative Sustainable Energy Provider of the Year Award at the Nigerian Business Leadership Awards (NBLA), organised by BusinessDay, for his strategic and sustainable energy solutions. Notably, Williams’ continental impact was recognized with the CHOISEUL 100 Africa’s Economic Leaders Award, celebrating his outstanding role in shaping Africa’s economic and energy landscape and affirming his position as a key figure in Africa’s development story.

An Illustrious Career Dedicated to Energy Advancement

With over 16 years of experience across the natural gas and power value chains, Williams’ career includes roles such as Consultant on the Energy desk at Deloitte Nigeria and leading Commercial Advisor at the Nigerian Gas Company Limited. His academic credentials include a Master of Business Administration from the University of Bradford School of Management (UK), and he is a Project Management Professional, Chartered Management Accountant, and Fellow of the Institute of Management Consultants. Williams is also a member of several professional bodies, including the International Bar Association (IBA), Chartered Institute of Taxation (CITN), and the Institute of Arbitrators (UK).

Driving Sustainable Energy Solutions

Tetracore Energy, under Williams’ leadership, has significantly expanded its natural gas portfolio in alignment with Nigeria’s ‘Decade of Gas’ initiative and the country’s Energy Transition Plan (ETP). The company’s focus on projects that impact industrialization and energy access includes a long-term contract to supply up to 40 MMScf/d of gas to the Rongtai Industrial Park in Edo State and 60 MMScf/d of natural gas to the Niger Delta Power Holding Company (NDPHC), supporting 34% of electricity generation to the Nigerian grid.

A Legacy of Excellence

Olakunle Williams’ recognition as the Vanguard Energy Icon 2025 is a testament to his unwavering dedication to excellence, innovation, and sustainable development in Africa’s energy sector. His recognition as a CHOISEUL 100 Africa’s Economic Leader and BusinessDay’s Innovative Sustainable Energy Provider of the Year further solidify his position as one of Africa’s most influential figures in the sector. Williams’ leadership continues to inspire and drive progress, earning him a reputation as the “Tiger of the Energy Sector” in Africa. The Vanguard Recognition/Vanguard Award further solidifies his legacy as a transformative and visionary force in shaping Africa’s energy future.

Related

Trending

-

Business6 months ago

Business6 months agoComprehensive Media Audit Shows Flutterwave, MTN Nigeria, and Bolt Outpacing Competitors in Media Engagement

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoHow Deji Adeyanju Secured The Release Of Speed Darlington

-

Politics6 months ago

Politics6 months agoMy best is yet to come’ As Ambassador Adesina ‘Lanre Ogunsola affirmed at the APC APEX body, Obafemi Owode Local Government

-

Entertainment4 months ago

Entertainment4 months agoAliu Gafar delivers stellar performance as Esusu in Femi Adebayo’s Seven Doors