Business

Inside Business Africa Nigeria: Wilo Group: a technology-driven company

Inside Business Africa

Nigeria: Wilo Group: a technology-driven company.

Interview with Mr. Oscartin Idemudia, Director, Pump Nigeria Limited.

He speaks on the company’s growth and Innovativeness in water management technology over the years.

Can you provide a brief overview of your company’s history and its core values?

The Wilo Group is a multinational technology group and one of the world’s leading premium suppliers of pumps and pump systems for building services, water management and the industrial sector. The last decade has seen us move from a hidden to a visible and connected champion. Wilo currently employs more than people around the globe. With innovative solutions, smart products, and individual services, we make water move using intelligent, efficient, and eco-friendly techniques. We are already digital pioneers in the industry with our products and solutions, processes, and business models.

Wilo Pumps Nigeria Limited was founded as a subsidiary in 2016 to better address the dynamically growing market in pre-sales, sales, and after-sales support. Wilo in Nigeria now has a skilled local technical team of professionals with years of experience in all steps along the water cycle.

What sets your company apart from competitors in the pump manufacturing industry?

As the digital pioneer in the industry, our innovative solutions, smart products, and individual services move water in an intelligent, efficient, and climate-friendly manner. We are also making an important contribution to climate protection with our sustainability strategy and in conjunction with our partners. This has earned us various Sustainability awards. For example, we were awarded the platinum rating by EcoVadis in 2022. This independent rating agency has assessed 90,000 companies – but has awarded the platinum rating to just one percent of them. After receiving a silver medal in 2019 and 2020 and a gold medal in 2021, we have now been awarded the highest EcoVadis rating for the first time. This development is testament to our ambition to constantly become more sustainable.

Our pioneering spirit also led to the quite recent implementation of a hydrogen Powerplant at our headquarters in Dortmund, the H2POWEPLANT, which enables us to store surplus energy from our PV- system and reconvert it into energy again when needed. Apart from the reduction of our own energy consumption and our dependence on external supply, this also gives us the opportunity to establish ourselves as a player along the value chain of hydrogen, the energy source of the future. First customer orders are already being negotiated.

What types of pumps does your company specialize in manufacturing?

Wilo manufactures pumps and pump systems for building services, water management and industry market segments. Some of our pump applications include Water Supply, Raw Water extraction, Wastewater transportation, HVAC, Fire Fighting, Pressure Boosting, Irrigation/Agriculture, sanitation, and special applications to mention a few.

Wilo is known as a pioneer in high-efficiency pump technology in many different fields of application. Thanks to state-of-the-art motor technology and a variety of control possibilities, our products enable energy savings of up to 80%* (*depending on the application) compared to outdated, uncontrolled pumps. Proactive change has advantages for all sides. You save energy and costs, improve the sustainability balance of your buildings and installations by up to 90%, and bring your technology up to date at the same time.

With Wilo-Energy Solutions therefore we point out possible energy savings and take responsibility for future generations and the fight against climate change.

How do you ensure the quality and reliability of your products?

Wilo has a Quality Control Department whose role is key in the day-to-day production activities of the Group as a whole. This team ensures that all the necessary guidelines are adhered to according to the ISO standards. To this end, Wilo is ISO 9001, 14001 and 18001 certified and our pump solutions are environment friendly.

Wilo intends to continue establishing itself as the digital pioneer of the pump industry and set new standards as an innovation leader. Research and development are therefore traditionally a top priority at Wilo. Research and development expenses amounted to € 71.0 million or 4.3 percent of net sales in 2021.

Furthermore, we invested in our capacities to increase the Circulatory capability of our products.

Are there any new products or innovations in development?

Yes, Wilo is always on the move to develop innovative solutions, smart products, and individual services. Thanks to these, Wilo therefore continues to set standards.

Who are your primary customers and which industries do they belong to? How do you stay competitive in terms of pricing and product offerings?

Wilo has a wide customer base in all the respective market segments we operate in: Building Services Residential, Building Services Commercial, OEM (Original Equipment Manufacturers), Water Management and Industry. Our products, system solutions and services are therefore systematically tailored to the specific needs of customers in the respective market segments.

In our three-stage sales model, we collaborate with consultants, private and public contractors, wholesalers and at times, end users.

Wilo provides both series solution (which gives maximum production) and customized solutions (products with special technical requirements) to cater to individual pump needs thereby making our prices competitive. However, we ensure that we are a part of projects from the design stage to the project commissioning stage. We also offer after-sales support through our Wilo Care Packages which further gives our customers all-round support.

What strategies are in place to expand your customer base and enter new markets?

Wilo has a Go-to-Market Approach for various market segments which ensures that at every point we continue to cover white spots while our global and local marketing team is tasked with continuously promoting brand visibility, enhancing stakeholder engagement, promoting collaboration with partners, and organizing customer loyalty programs.

Can you provide insights into your manufacturing process and facilities?

Within our region-for-region approach, we try to source, produce, and assemble as close to the end customer as possible. Wilo has 17 main production sites across the world in Germany, France, India, South Korea, USA, Turkey and Russia, Italy, UAE and China. We are also present in over 80 countries with assembly, service and sales sites.

In Sub-Saharan-Africa specifically, Wilo has established assembly plants in South Africa and Kenya, as well as a subsidiary in Nigeria. We have a sales office in Ethiopia and Country Sales Managers for 15 other countries in Africa.

Our worldwide presence ensures that we can respond to reach new markets and meet the rising demand for high-performance technologies at all times.

How do you ensure efficiency and sustainability in your manufacturing operations?

We consider ourselves to be a climate protection company above and beyond our product and solutions portfolio. We express this identity through our commitment to the Sustainable Development Goals (SDGs).

The production at our headquarters in Dortmund (Germany) as well as our plants in Aubigny (France) and Bari (Italy) proceeds climate-neutral. The carbon footprint of all Wilo plants in Europe is thus neutral. Moreover, we have reduced our Scope 1 and Scope 2 emissions by another 17 percent. Set against the benchmark year of 2018, the reduction amounts to a grand total of 36 percent. We have made further investments in generating electricity ourselves. We successfully installed new solar photovoltaic plants at our sites in Hof (Germany), Kesurdi (India) and Cedarburg (USA). Adding the existing plants in Dortmund (Germany) and Kolhapur (India), five of Wilo’s primary production sites now have sustainable technology.

The above mentioned H2POWERPLANT at the Wilopark not only operates as an energy storage but further allows us to lower our energy consumption by using the waste heat to regulate the temperature in our factory.

We have made further important steps along the path to an integrated circular economy approach. We are now deriving additional potential for improvements from the ecological footprints that have been calculated for our products during their entire life cycle. These are aimed at the use of more sustainable materials as well as enhancements relating to repairability and recyclability.

Are there any challenges or bottlenecks in your production process that you’re actively addressing?

Wilo has developed an explicit sustainability strategy based on its Ambition 2025 corporate strategy and the identification of key issues. The central tenet of this strategy is to provide more people with clean water while simultaneously reducing the ecological footprint. A total of 18 goals have been formulated within four action areas.

For example, on Material and Waste, our strategic goal is to consume 250 tonnes less material resources by 2025. We will achieve this by increasing the number of reused components in our products to at least 30,000 per year, keeping materials in circulation, increasing the materials efficiency of our products by at least 12 tonnes per year. Now, we are primarily looking at copper, cast and aluminum casting, which make up most of the weight of our products. New technologies will drastically reduce material requirements.

We are reducing packaging materials. As a first step, we are focusing on increasing the use of reusable packaging in the inbound segment, where we are aiming for a share of 100 percent by 2025.

We will increase the recycling rate at Wilo’s sites. By separating materials, increasing the sourcing of recyclable materials, and adopting reuse systems, we are planning to achieve a rate of at least 90 percent by 2025.

8. What role does research and development play in your company’s growth strategy?

R & D has played and still plays a major role within our entrepreneurial identity. Thanks to our continual research and development, we can now offer a broad portfolio of smart products and systems. Smartification is not a trend but is now a standard that customers are asking for ever more frequently.

One of the reasons why we outperformed the targeted sales growth compared with the previous year is because the Wilo-Stratos MAXO established itself on the market as a smart pump. Another is that the launch of sales of the three smart pumps Wilo-Stratos GIGA2.0, Wilo-Yonos GIGA2.0 and Wilo- Stratos PICO/-Z had an impact. The new generation of the Wilo-Stratos PICO/-Z offers maximum energy efficiency through the combination of EC motor technology, Dynamic Adapt plus and precision setting options. A universal interface additionally offers an optional Bluetooth retrofitting option for digital applications using the Wilo-Smart Connect module BT.

How do you foster innovation within your organization?

Wilo Group has an annual innovation award for employees, the award recognizes the best ideas out of a pool of ideas shared on an innovation platform. In 2022, a concept by an employee won because it offered an excellent strategic fit in the areas of water hygiene and sustainability and allows Wilo to open new market opportunities: Wilo-SiFresh, a system solution for circulating cold water guarantees compliance with the strict drinking water standards. If a circulation line is added to a potable water installation, the circulator integrated in Wilo-SiFresh can keep the water in permanent circulation, monitor the temperature and thus prevent stagnation. If one of the monitored parameters gets close to a critical limit value, Wilo-SiFresh automatically reacts by flushing, reducing the water temperature and guaranteeing the prescribed water exchange. The hygiene regulations for cold drinking water are monitored and complied with in a smarter way, while water consumption is additionally reduced to a minimum.

Wilo also promotes local capacity development to empower people to sustainably shape their own development and invests in the development and advancement of employees.

9. Are there any recent technological advancements or R&D projects worth high lighting?

Wilo has recognized how important digital technologies and automation are for intelligent, efficient, and sustainable management of pumps in operation. This is why Wilo is investing an annual growth rate of at least 15% into the development of smart products. Thanks to our continual research and development, we can now offer a broad portfolio of smart products and systems.

One of the technological advancements is the Wilo-Smart Connect module BT that serves to add a Bluetooth interface to Wilo products. This applies to all products equipped with a Wilo connectivity interface. The Wilo-Smart Connect module BT enables mobile devices such as smartphones and tablets to be connected. Using the Wilo Smart Connect function in the Wilo-Assistant app, the pump can be operated and adjusted, while data such as energy consumption can be displayed in real time.

The Smart Balance tool, another technological advancement in the Wilo-Assistant app makes it easier than ever to carry out hydronic balancing. After the installed heating surfaces have been entered, the app calculates how to optimize the volume flows and the feed temperature. The results provide the basis for calculating the preset values of the most common thermostatic valves. Using the display of the volume flow, the optimal setpoint of the pump can be identified. Hydronic balancing can reduce energy costs by up to 20%.

What measures does your company take to minimize its environmental footprint?

Wilo is a climate protection company. As the winner of the German Sustainability Award in the “Climate” category and as one of 50 Sustainability and Climate Leaders worldwide, we see it as our obligation to make an active contribution to achieving the global climate goals. Our aim is to achieve carbon-neutral operations at our 15 production sites around the world by 2025 and to cut emissions group-wide by at least 60 percent from the benchmark year of 2018.

All locations purchase electricity from renewable energy sources; we offset the emissions from heating energy by using projects that are certified to the gold standard. Wilo has thus earned the “climate-neutral company” mark of conformity for the relevant locations and made an important step forward in the implementation of its climate strategy.

Energy consumption at the Wilo production sites throughout the Group totaled 64,446 MWh, a reduction of 11% from the previous year. Key influencing factors included lower heating requirements as a result of weather conditions and the measures taken to save gas.

Increasing energy efficiency is an important determining factor when it comes to climate neutrality. Wilo has set itself the goal of implementing energy efficiency projects every year that produce energy savings of at least 1% on the previous year’s consumption. The projects initiated in the past year are showing results that go far beyond the targets that have been set energy savings amount to 2,911 MWh, which is equivalent to around 4% of consumption in 2021.

At our location in Dortmund, for example, we have further optimized the building management system, producing savings of over 2,500 megawatt-hours in gas and electricity consumption. We have installed a new air compressor (savings of 70 megawatt-hours) in Laval (France), modernized the lighting systems and heating (15 megawatt- hours) in Busan (Korea) and converted the office building in Beijing (China) to LED technology (30 megawatt-hours).

10. Are there any sustainability initiatives or goals your company is currently pursuing?

At Wilo, sustainability management is seen as a function that cuts across all areas. Supplying more people with clean water while also reducing our environmental footprint is at the heart of our sustainability strategy. Within the four areas in which we take an active role – Water, Energy & emissions, Materials and waste, and Employees and society – we have drawn up a total of 18 ambitious goals.

The Executive Board of the Wilo Group already signed the UN Global Compact in 2018, thereby strengthening our own commitments. In line with our business activities, Wilo exerts a particular influence on achieving SDG goals 6, 8, 9, 11, 12, 13 and 17.

How do you incorporate sustainability into product design and manufacturing processes?

Our goal is to reuse at least 30,000 products and components from unused returned products per year. By extending it to the whole of the Wilo Group and by optimizing the processes. Thanks to our recycling-friendly product design, the potential recycling rate for a Wilo pump is almost 100%. The environment benefits from the lower consumption of raw materials.

Another key sustainability approach is also to reduce the use of raw materials in the manufacturing process and, in particular, not to use materials that are harmful to the environment. An indicator that we focus on especially here is copper savings. Thanks to advances in the technology, the use of copper per pump has been steadily reduced over the years. Our goal is annual savings of 12 tons compared to the respective previous models. In parallel with this, we are also looking at reducing the use of other materials such as iron and aluminum.

The increasing volume of packaging waste is also a growing problem for the environment. Optimizing packaging solutions with the aim of minimizing material deployment as far as possible is a key component of a circular economy. Our long-term goal is to steadily increase the share of reusable packaging and to further reduce the use of raw materials and environmentally critical materials.

11. What are your short-term and long-term goals for the company? How do you plan to achieve growth and maintain profitability in the coming years?

In these geopolitically challenging times, it is more important than ever to build economic, political, and personal bridges. We want to remain a reliable partner to our stakeholders, invest in our markets, strengthen our supply chains and keep on diversifying.

Our focus is on ways to increase our market share in the emerging markets such as Africa, South-East Asia (ASEAN), Central Asia etc. whilst we also consider ways to foster business development in the fields on sustainable water supply, water treatment/recycling and Hydrogen which is an essential storage medium of the future when it comes to achieving climate neutrality.

12. Are there any potential challenges or opportunities on the horizon that you’re preparing for?

As a leading supplier for critical infrastructure, Wilo is able to contribute to the solution of some of our world’s most pressing challenges and thus turn challenges into opportunities.

Water scarcity

Water is the basis for all life and an indispensable part of every society. Globally, however, there are big differences in terms of the available resources and the proportion of people with access to clean fresh water. Wilo moves water – reliably, efficiently and sustainably. Our innovative products and holistic solutions improve the quality of the water supply while protecting valuable resources.

Energy scarcity

Wilo helps to secure energy supply. 246 terawatt hours of energy could be saved every year by installing high-efficiency pumps for heating, cooling and air conditioning. For example, the Biogas Plant in Darsin Poland which is safe and has a climate-friendly heat generation.

Food Scarcity

The war in Ukraine and the and the increasingly noticeable consequences of climate change brought the risks to the security of the food supply into sharp focus in 2022. By improving the water supply in agriculture with its expertise, tailored products, and reliable technology, Wilo is making a substantial contribution to safeguarding the supply of food.

In the prestigious Toshka project, a quite recent reference of ours, more than 300 high-efficiency Wilo split case pumps have been installed to irrigate semiarid regions in the Egyptian dessert so they can be reclaimed for agricultural use.

How would you describe the leadership style and culture within your company?

Navigating a multinational company through turbulent times requires functional yet adaptable structures and processes. Wilo therefore operates a multifunctional matrix organization. When it comes to the individual employees, Wilo empowers them to take over responsibility so that they can help shape the future with initiative, passion, and courage.

It is our culture therefore to act responsibly towards employees and society and promote effective development programmes to ensure that 70% of managers are developed internally. Wilo also continuously strengthens the culture of diversity so that 20% of management positions are filled by women.

Thanks to good talent management and a wide range of training and professional development measures, we were able to fill 80% of Wilo vacancies in middle and upper management with talented employees from within the company last year.

13. What are the key trends shaping the pump manufacturing industry today?

Five megatrends relevant for the company have been defined in the context of long-term strategic planning. Globalisation, urbanisation, energy shortage, climate change and water shortage will significantly influence the Wilo Group’s business in the future and are already having a visible impact on the company’s current development. An important megatrend in its own right, digital transformation will play a central role when it comes to managing the various challenges the aforementioned megatrends will entail for the company and for society, business and politics, as well as helping to support the targeted and efficient implementation of solutions.

How is your company adapting to changes in technology, regulations, and market demands?

As a premium provider, Wilo therefore continuously aims to develop leading technology and intelligent solutions that make people’s everyday lives noticeably easier. Hence, we can adapt to change because we are a solution provider. We thereby adapt to changes in:

Technology

Use of a technology radar – a systematic supervision of technology trends in the relevant technical fields of the company.

Establishment of a worldwide patent monitoring system with focus on relevant technology fields and competitors.

Regular technology studies in upcoming technology trends.

Regulations

Installation of a Technical Advocacy Team with the target to monitor, report and influence all kind of upcoming regulations and standards worldwide. This team organizes many internal colleagues who actively participate in all relevant associations and standardization bodies.

Strong cooperation with a second team for Government & Public Affairs.

Implementation of new regulatory requirements and standards by a team for Product Compliance.

Market Demands

Installation of a trend monitor system.

Establishment of a team for market intelligence.

Setting up a Corporate Product and Sustainability Strategy to ensure systematic approaches to new market demands and requirements.

General

Setting up an Innovation Management approach since 2013 with the target to strengthen the innovation ability and culture of the company.

The Innovation Management enables a systematic approach to innovate and involves all important internal and external stakeholders, like all employees, customers, suppliers, strategic partners, etc.

14. How do you gather and utilize customer feedback to improve products and services?

As a responsible organization, not only our global Sales, Marketing and Service Team, but each employee ensures that customer feedback is taken and treated with fairness. Our passion for best quality and highly efficient pump solutions allows us to integrate such feedback for improved products and service delivery.

What measures are in place to ensure customer satisfaction and retention?

As a client-centric organization, our customer tailored product offerings and after-sales support to enhances customer satisfaction and retention.

With Wilo as your partner, a customer is sure of choosing high-quality product solutions, but also of benefiting from a comprehensive, worry-free package of well-thought-out services.

Our tailor-made service solutions cover the entire life cycle of your Wilo products – including what comes after the customer’s purchase. We are represented locally in over 60 countries and worldwide with more than 3,300 professional Wilo service technicians. We collaborate to develop a service concept to meet our customer’s individual needs; with our expertise and personal consultancy, we make sure that the operation of your systems is as energy-efficient, reliable, and economical as possible. All the while our competent Wilo service technicians are ready to assist you with fast, reliable, and on-time support.

We also keep our customers informed about the very latest technologies and trends and support them through all project phases from design and configuration to commissioning and maintenance. Even with complex pump and system technology we offer our customers well thought-out service solutions and make sure that our services are continuously adapted to their needs.

Read the original article on Inside Business Africa Nigeria

Business

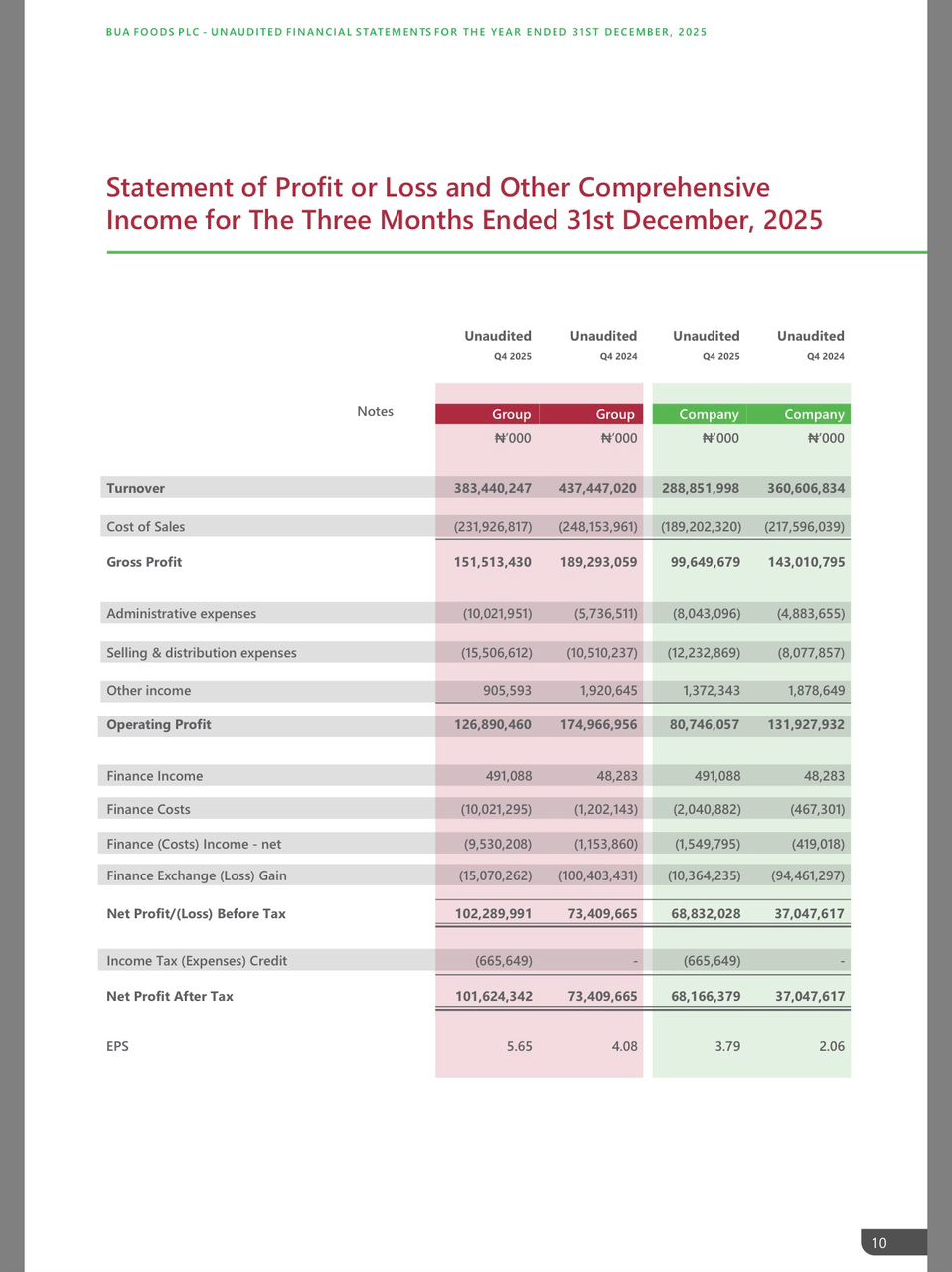

BUA Foods Records 91% Surge in Profit After Tax, Hits ₦508bn in 2025

BUA Foods Records 91% Surge in Profit After Tax, Hits ₦508bn in 2025

By femi Oyewale

Business

Adron Homes Unveils “Love for Love” Valentine Promo with Exciting Discounts, Luxury Gifts, and Travel Rewards

Adron Homes Unveils “Love for Love” Valentine Promo with Exciting Discounts, Luxury Gifts, and Travel Rewards

In celebration of the season of love, Adron Homes and Properties has announced the launch of its special Valentine campaign, “Love for Love” Promo, a customer-centric initiative designed to reward Nigerians who choose to express love through smart, lasting real estate investments.

The Love for Love Promo offers clients attractive discounts, flexible payment options, and an array of exclusive gift items, reinforcing Adron Homes’ commitment to making property ownership both rewarding and accessible. The campaign runs throughout the Valentine season and applies to the company’s wide portfolio of estates and housing projects strategically located across Nigeria.

Speaking on the promo, the company’s Managing Director, Mrs Adenike Ajobo, stated that the initiative is aimed at encouraging individuals and families to move beyond conventional Valentine gifts by investing in assets that secure their future. According to the company, love is best demonstrated through stability, legacy, and long-term value—principles that real estate ownership represents.

Under the promo structure, clients who make a payment of ₦100,000 receive cake, chocolates, and a bottle of wine, while those who pay ₦200,000 are rewarded with a Love Hamper. Payments of ₦500,000 attract a Love Hamper plus cake, and clients who pay ₦1,000,000 enjoy a choice of a Samsung phone or a Love Hamper with cake.

The rewards become increasingly premium as commitment grows. Clients who pay ₦5,000,000 receive either an iPad or an all-expenses-paid romantic getaway for a couple at one of Nigeria’s finest hotels, which includes two nights’ accommodation, special treats, and a Love Hamper. A payment of ₦10,000,000 comes with a choice of a Samsung Z Fold 7, three nights at a top-tier resort in Nigeria, or a full solar power installation.

For high-value investors, the Love for Love Promo delivers exceptional lifestyle experiences. Clients who pay ₦30,000,000 on land are rewarded with a three-night couple’s trip to Doha, Qatar, or South Africa, while purchasers of any Adron Homes house valued at ₦50,000,000 receive a double-door refrigerator.

The promo covers Adron Homes’ estates located in Lagos, Shimawa, Sagamu, Atan–Ota, Papalanto, Abeokuta, Ibadan, Osun, Ekiti, Abuja, Nasarawa, and Niger States, offering clients the opportunity to invest in fast-growing, strategically positioned communities nationwide.

Adron Homes reiterated that beyond the incentives, the campaign underscores the company’s strong reputation for secure land titles, affordable pricing, strategic locations, and a proven legacy in real estate development.

As Valentine’s Day approaches, Adron Homes encourages Nigerians at home and in the diaspora to take advantage of the Love for Love Promo to enjoy exceptional value, exclusive rewards, and the opportunity to build a future rooted in love, security, and prosperity.

Business

Why Nigeria’s Banks Still on Shaky Ground with Big Profits, Weak Capital

*Why Nigeria’s Banks Still on Shaky Ground with Big Profits, Weak Capital*

*BY BLAISE UDUNZE*

Despite the fragile 2024 economy grappling with inflation, currency volatility, and weak growth, Nigeria’s banking industry was widely portrayed as successful and strong amid triumphal headlines. The figures appeared to signal strength, resilience, and superior management as the Tier-1 banks such as Access Bank, Zenith Bank, GTBank, UBA, and First Bank of Nigeria, collectively reported profits approaching, and in some cases exceeding, N1 trillion. Surprisingly, a year later, these same banks touted as sound and solid are locked in a frenetic race to the capital markets, issuing rights offers and public placements back-to-back to meet the Central Bank of Nigeria’s N500 billion recapitalisation thresholds.

The contradiction is glaring. If Nigeria’s biggest banks are so profitable, why are they unable to internally fund their new capital requirements? Why have no fewer than 27 banks tapped the capital market in quick succession despite repeated assurances of balance-sheet robustness? And more fundamentally, what do these record profits actually say about the real health of the banking system?

The recapitalisation directive announced by the CBN in 2024 was ambitious by design. Banks with international licences were required to raise minimum capital to N500 billion by March 2026, while national and regional banks faced lower but still substantial thresholds ranging from N200 billion to N50 billion, respectively. Looking at the policy, it was sold as a modern reform meant to make banks stronger, more resilient in tough times, and better able to support major long-term economic development. In theory, strong banks should welcome such reforms. In practice, the scramble that followed has exposed uncomfortable truths about the structure of bank profitability in Nigeria.

At the heart of the inconsistency is a fundamental misunderstanding often encouraged by the banks themselves between profits and capital. Unknown to many, profitability, no matter how impressive, does not automatically translate into regulatory capital. Primarily, the CBN’s recapitalisation framework actually focuses on money paid in by shareholders when buying shares, fresh equity injected by investors over retained earnings or profits that exist mainly on paper.

This distinction matters because much of the profit surge recorded in 2024 and early 2025 was neither cash-generative nor sustainably repeatable. A significant portion of those headline banks’ profits reported actually came from foreign exchange revaluation gains following the sharp fall of the naira after exchange-rate unification. The industry witnessed that banks’ holding dollar-denominated assets their books showed bigger numbers as their balance sheets swell in naira terms, creating enormous paper profits without a corresponding improvement in underlying operational strength. These gains inflated income statements but did little to strengthen core capital, especially after the CBN barred banks from using FX revaluation gains for dividends or routine operations. In effect, banks looked richer without becoming stronger.

Beyond FX effects, Nigerian banks have increasingly relied on non-interest income fees, charges, and transaction levies to drive profitability. While this model is lucrative, it does not necessarily deepen financial intermediation or expand productive lending. High profits built on customer charges rather than loan growth offer limited support for long-term balance-sheet expansion. They also leave banks vulnerable when macroeconomic conditions shift, as is now happening.

Indeed, the recapitalisation exercise coincides with a turning point in the monetary cycle. The extraordinary conditions that supported bank earnings in 2024 and 2025 are beginning to unwind. Analysts now warn that Nigerian banks are approaching earnings reset, as net interest margins the backbone of traditional banking profitability, come under sustained pressure.

Renaissance Capital, in a January note, projects that major banks including Zenith, GTCO, Access Holdings, and UBA will struggle to deliver earnings growth in 2026 comparable to recent performance.

In a real sense, the CBN is expected to lower interest rates by 400 to 500 basis points because inflation is slowing down, and this means that banks will earn less on loans and government bonds, but they may not be able to quickly lower the interest they pay on deposits or other debts. The cash reserve requirements are still elevated, which does not earn interest; banks can’t easily increase or expand lending investments to make up for lower returns. The implications are significant. Net interest margin, the difference between what banks earn on loans and investments and what they pay on deposits, is poised to contract. Deposit competition is intensifying as lenders fight to shore up liquidity ahead of recapitalisation deadlines, pushing up funding costs. At the same time, yields on treasury bills and bonds, long a safe and lucrative haven for banks are expected to soften in a lower-rate environment. The result is a narrowing profit cushion just as banks are being asked to carry far larger equity bases.

Compounding this challenge is the fading of FX revaluation windfalls. With the naira relatively more stable in early 2026, the non-cash gains that once flattered bank earnings have largely evaporated. What remains is the less glamorous reality of core banking operations: credit risk management, cost efficiency, and genuine loan growth in a sluggish economy. In this new environment, maintaining headline profits will be far harder, even before accounting for the dilutive impact of recapitalisation.

That dilution is another underappreciated consequence of the capital rush. Massive share issuances mean that even if banks manage to sustain absolute profit levels, earnings per share and return on equity are likely to decline. Zenith, Access, UBA, and others are dramatically increasing their share counts. The same earnings pie is now being divided among many more shareholders, making individual returns leaner than during the pre-recapitalisation boom. For investors, the optics of strong profits may soon give way to the reality of weaker per-share performance.

Yet banks have pressed ahead, not only out of regulatory necessity but also strategic calculation.

During this period of recapitalization, investors are interested in the stock market with optimism, especially about bank shares, as banks are raising fresh capital, and this makes it easier to attract investments. This has become a season for the management teams to seize the moment to raise funds at relatively attractive valuations, strengthen ownership positions, and position themselves for post-recapitalisation dominance. In several cases, major shareholders and insiders have increased their stakes, as projected in the media, signalling confidence in long-term prospects even as near-term returns face pressure.

There is also a broader structural ambition at play. Well-capitalised banks can take on larger single obligor exposures, finance infrastructure projects, expand regionally, and compete more credibly with pan-African and global peers. From this perspective, recapitalisation is not merely about compliance but about reshaping the competitive hierarchy of Nigerian banking. What will be witnessed in the industry is that those who succeed will emerge larger, fewer, and more powerful. Those that fail will be forced into consolidation, retreat, or irrelevance.

For the wider economy, the outcome is ambiguous. Stronger banks with deeper capital buffers could improve systemic stability and enhance Nigeria’s ability to fund long-term development. The point is that while merging or consolidating banks may make them safer, it can also harm the market and the economy because it will reduce competition, let a few banks dominate, and encourage them to earn easy money from bonds and fees instead of funding real businesses. The truth be told, injecting more capital into the banks without complementary reforms in credit infrastructure, risk-sharing mechanisms, and fiscal discipline, isn’t enough as the aforementioned reforms are also needed.

The rush as exposed in this period, is that the moment Nigerian banks started raising new capital, the glaring reality behind their reported profits became clearer, that profits weren’t purely from good management, while the financial industry is not as sound and strong as its headline figures. The fact that trillion-naira profit banks must return repeatedly to shareholders for fresh capital is not a sign of excess strength, but of structural imbalance.

With the deadline for banks to raise new capital coming soon, by 31 March 2026, the focus has shifted from just raising N500 billion. N200 billion or N50 billion to think about the future shape and quality of Nigeria’s financial industry, or what it will actually look like afterward. Will recapitalisation mark a turning point toward deeper intermediation, lower dependence on speculative gains, and stronger support for economic growth? Or will it simply reset the numbers while leaving underlying incentives unchanged?

The answer will define the next chapter of Nigerian banking long after the capital market roadshows have ended and the profit headlines have faded.

Blaise, a journalist and PR professional, writes from Lagos and can be reached via: [email protected]

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society5 months ago

society5 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

Business6 months ago

Business6 months agoBatsumi Travel CEO Lisa Sebogodi Wins Prestigious Africa Travel 100 Women Award

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING