Business

Unmasking the Maltese Cross of Corruption* By Arnold Owie

*Unmasking the Maltese Cross of Corruption*

By Arnold Owie

A national scandal has unfolded with the revelation of substandard petroleum products being imported into Nigeria, linked to a shadowy oil blending plant in Malta. Leaked documents and interviews expose a complex web of corruption involving NNPC personnel, oil traders, and terminal operators. Matrix Energy, owned by Abdulkabir Adisa Aliu, a member of the Presidential Economic Coordination Council (PECC), is at the center of this scandal. The company has been importing low-grade petroleum products from Russia, blending them in Malta, and selling them in Nigeria.

Aliu’s actions demonstrate a disregard for the Nigerian people’s welfare. Matrix Energy’s logistical infrastructure suggests a deliberate attempt to undermine local refinery efforts, ensuring continued importation of inferior fuel products. The allegations against Aliu are severe, including securing preferential access to crude oil cargoes and trading them through a UAE-based entity.

The Malta saga is a damning indictment of the entire system, with Farouk Ahmed and Mele Kyari facing scrutiny for their alleged complicity. The NNPC’s failure to curb substandard fuel imports is a testament to its incompetence or complicity, betraying public trust and national pride.

The exposé’s severity is heightened by Russia’s expulsion from the SWIFT global banking network, making oil and gas dealings between Nigerian entities and Russian refineries illicit. Shipping data reveals a disturbing trend: 15,000 tons of petroleum products were transloaded onto the ‘Matrix Triumph’ vessel on June 16 and discharged at Matrix Jetty in Warri on June 21 without rectification, implying toxic diesel is being sold to unsuspecting Nigerian consumers.

The House of Representatives’ visit to the Dangote Refinery on July 20, 2024, confirmed Matrix Energy’s importation of subpar diesel. Diesel samples from Matrix filling stations had a sulphur content exceeding 2,653ppm, far surpassing the 50ppm requirement. Aliko Dangote presented findings from an exhaustive analysis of diesel samples, revealing alarming sulphur content levels. The testing, conducted at Dangote Refinery’s state-of-the-art laboratories, employed precise protocols to measure total sulfur content in petroleum products.

Dangote revealed that the diesel samples were purchased in the presence of lawmakers, ensuring transparency and accountability. The test results showed that his refinery’s diesel boasted an exemplary quality, with a sulfur content of 600-650 ppm initially, and a remarkable 87 ppm currently. In stark contrast, the samples from TotalEnergies and Matrix Retail exhibited alarmingly high sulfur concentrations of 1,829ppm and 2,653ppm, respectively.

These findings corroborate the disturbing fact that certain companies have been peddling diesel with sulfur levels exceeding 2,000 parts per million, indicative of off-spec, adulterated products sourced from Russian refineries and purportedly “corrected” at blending plants in Malta and Lome. However, instead of rectifying the subpar fuel, a large-scale adulteration scheme was perpetrated, thereby posing grave dangers to the lives of consumers.

A report by Stakeholder Democracy Network (SDN), a non-governmental not-for-profit organization, said it appears to be easy for sub-standard fuel imports to enter Nigeria. “So it is probable that large volumes of fuel consumed are of poor quality, causing significant damage to public health, engines, and the environment. “This contributes to air quality levels that cut life expectancy by 4.7 years in the Niger Delta, the worst hit area across the African continent,” SDN said in its report.

The diesel produced locally in Nigeria is of a significantly higher quality than the fuel blended in Malta. This fact alone underscores the criminal nature of this operation. By importing inferior fuel, these unscrupulous individuals are not only defrauding the Nigerian government but also endangering the lives of millions of Nigerians. The long-term damage to vehicles and other machinery caused by these substandard products is incalculable.

In contrast to the greed and avarice displayed by those involved in the Malta saga, the figure of Alhaji Aliko Dangote stands tall as a beacon of patriotism and entrepreneurial spirit. Dangote’s strong commitment to building a world-class refinery in Nigeria is a testament to his belief in the potential of his country. Despite facing numerous obstacles and setbacks, he has persevered in his efforts to create jobs and generate wealth for the Nigerian people. Dangote’s refinery represents a tangible solution to the perennial fuel crisis and a catalyst for economic growth.

It is no coincidence that those involved in the Malta saga are vehemently opposed to Dangote’s refinery project. Their business model relies on the continued importation of substandard fuel, a practice that would be rendered obsolete by the existence of a local refinery. The Maltese cross of corruption is a formidable obstacle, but Dangote’s determination, coupled with the support of the Nigerian people, can overcome it.

This despicable scandal necessitates a prompt and resolute response from the government, entailing a comprehensive and unbiased investigation to hold accountable those responsible for these reprehensible actions. A radical overhaul and restructuring of the NNPC is imperative to prevent the recurrence of such abuses of power and ensure transparency. Moreover, the government must foster a conducive environment, conducive to the growth and prosperity of local refineries, thereby safeguarding our economy from the pernicious influence of saboteurs and revitalizing our oil and gas sectors with utmost haste.

Consequently, Male Kyari must be forthwith stripped of his position, while Adisa Aliu must be subjected to a meticulous and thorough investigation regarding his involvement in these sham dealings. The Nigerian populace deserves a government firmly committed to their welfare, and a petroleum sector distinguished by transparency, efficiency, and accountability.

The laxity in regulating fuel quality poses a grave and formidable health risk to the citizens of Nigeria, underscoring the imperative for a government that prioritizes their well-being. The Malta saga serves as a stark reminder of the formidable challenges confronting Nigeria, yet simultaneously presents an opportunity for transformative change. By unmasking the entrenched corruption and collusion that has long plagued the oil and gas sector, this scandal can catalyze a paradigm shift, heralding a new era of reform and accountability.

The Maltese saga Is a dark chapter in Nigeria’s history, but it can also be a turning point. By exposing the corruption and greed that have plagued the oil and gas sector, this scandal offers an opportunity to build a better future. A future where the nation’s resources are used for the benefit of its people, not the enrichment of a few.

Only by taking these steps can Nigeria hope to break free from the stranglehold of corruption and build a brighter future for its citizens.

Owie is an oil and gas expert writing from the United Kingdom.

Business

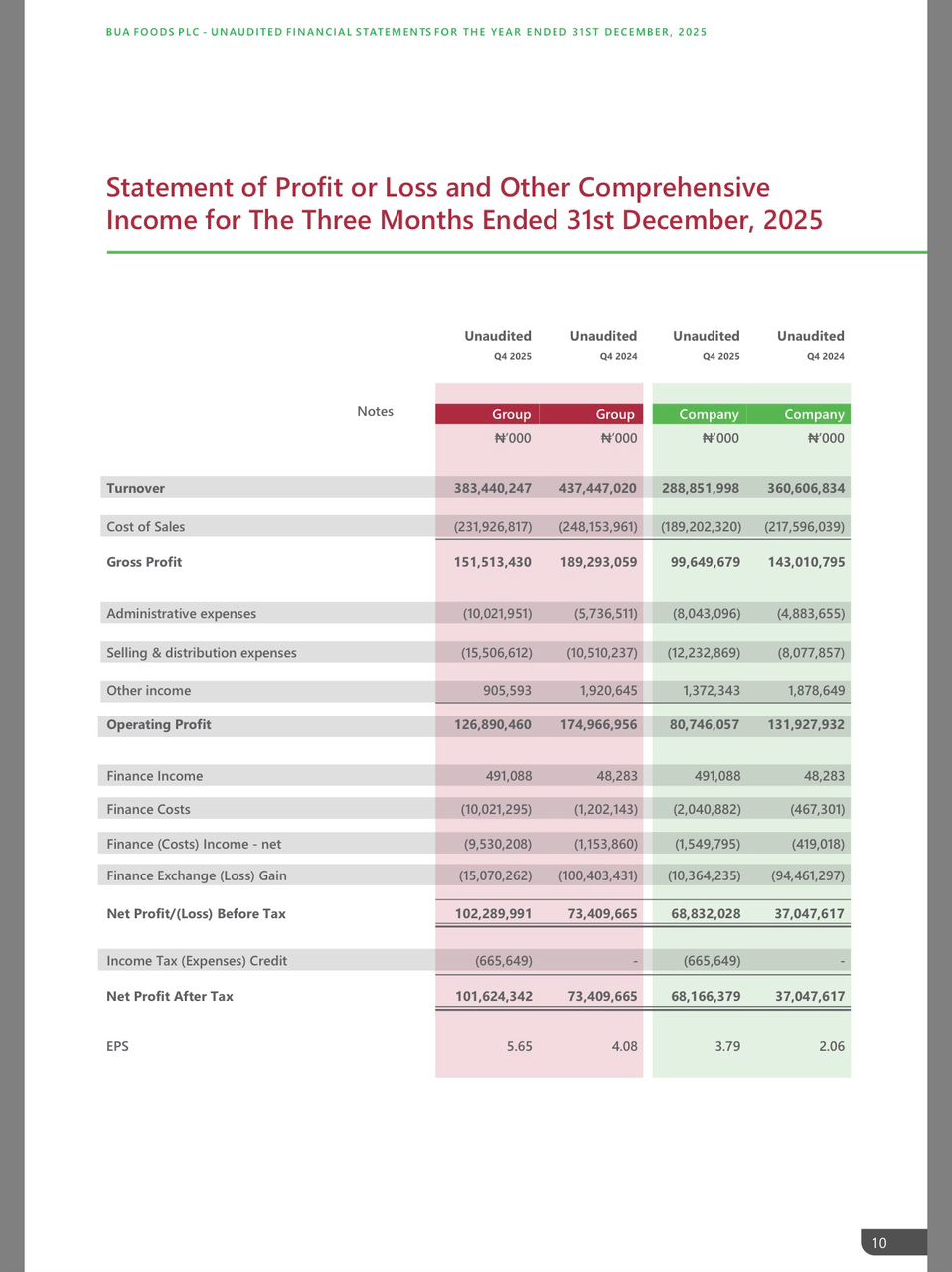

BUA Foods Records 91% Surge in Profit After Tax, Hits ₦508bn in 2025

BUA Foods Records 91% Surge in Profit After Tax, Hits ₦508bn in 2025

By femi Oyewale

Business

Adron Homes Unveils “Love for Love” Valentine Promo with Exciting Discounts, Luxury Gifts, and Travel Rewards

Adron Homes Unveils “Love for Love” Valentine Promo with Exciting Discounts, Luxury Gifts, and Travel Rewards

In celebration of the season of love, Adron Homes and Properties has announced the launch of its special Valentine campaign, “Love for Love” Promo, a customer-centric initiative designed to reward Nigerians who choose to express love through smart, lasting real estate investments.

The Love for Love Promo offers clients attractive discounts, flexible payment options, and an array of exclusive gift items, reinforcing Adron Homes’ commitment to making property ownership both rewarding and accessible. The campaign runs throughout the Valentine season and applies to the company’s wide portfolio of estates and housing projects strategically located across Nigeria.

Speaking on the promo, the company’s Managing Director, Mrs Adenike Ajobo, stated that the initiative is aimed at encouraging individuals and families to move beyond conventional Valentine gifts by investing in assets that secure their future. According to the company, love is best demonstrated through stability, legacy, and long-term value—principles that real estate ownership represents.

Under the promo structure, clients who make a payment of ₦100,000 receive cake, chocolates, and a bottle of wine, while those who pay ₦200,000 are rewarded with a Love Hamper. Payments of ₦500,000 attract a Love Hamper plus cake, and clients who pay ₦1,000,000 enjoy a choice of a Samsung phone or a Love Hamper with cake.

The rewards become increasingly premium as commitment grows. Clients who pay ₦5,000,000 receive either an iPad or an all-expenses-paid romantic getaway for a couple at one of Nigeria’s finest hotels, which includes two nights’ accommodation, special treats, and a Love Hamper. A payment of ₦10,000,000 comes with a choice of a Samsung Z Fold 7, three nights at a top-tier resort in Nigeria, or a full solar power installation.

For high-value investors, the Love for Love Promo delivers exceptional lifestyle experiences. Clients who pay ₦30,000,000 on land are rewarded with a three-night couple’s trip to Doha, Qatar, or South Africa, while purchasers of any Adron Homes house valued at ₦50,000,000 receive a double-door refrigerator.

The promo covers Adron Homes’ estates located in Lagos, Shimawa, Sagamu, Atan–Ota, Papalanto, Abeokuta, Ibadan, Osun, Ekiti, Abuja, Nasarawa, and Niger States, offering clients the opportunity to invest in fast-growing, strategically positioned communities nationwide.

Adron Homes reiterated that beyond the incentives, the campaign underscores the company’s strong reputation for secure land titles, affordable pricing, strategic locations, and a proven legacy in real estate development.

As Valentine’s Day approaches, Adron Homes encourages Nigerians at home and in the diaspora to take advantage of the Love for Love Promo to enjoy exceptional value, exclusive rewards, and the opportunity to build a future rooted in love, security, and prosperity.

Business

Why Nigeria’s Banks Still on Shaky Ground with Big Profits, Weak Capital

*Why Nigeria’s Banks Still on Shaky Ground with Big Profits, Weak Capital*

*BY BLAISE UDUNZE*

Despite the fragile 2024 economy grappling with inflation, currency volatility, and weak growth, Nigeria’s banking industry was widely portrayed as successful and strong amid triumphal headlines. The figures appeared to signal strength, resilience, and superior management as the Tier-1 banks such as Access Bank, Zenith Bank, GTBank, UBA, and First Bank of Nigeria, collectively reported profits approaching, and in some cases exceeding, N1 trillion. Surprisingly, a year later, these same banks touted as sound and solid are locked in a frenetic race to the capital markets, issuing rights offers and public placements back-to-back to meet the Central Bank of Nigeria’s N500 billion recapitalisation thresholds.

The contradiction is glaring. If Nigeria’s biggest banks are so profitable, why are they unable to internally fund their new capital requirements? Why have no fewer than 27 banks tapped the capital market in quick succession despite repeated assurances of balance-sheet robustness? And more fundamentally, what do these record profits actually say about the real health of the banking system?

The recapitalisation directive announced by the CBN in 2024 was ambitious by design. Banks with international licences were required to raise minimum capital to N500 billion by March 2026, while national and regional banks faced lower but still substantial thresholds ranging from N200 billion to N50 billion, respectively. Looking at the policy, it was sold as a modern reform meant to make banks stronger, more resilient in tough times, and better able to support major long-term economic development. In theory, strong banks should welcome such reforms. In practice, the scramble that followed has exposed uncomfortable truths about the structure of bank profitability in Nigeria.

At the heart of the inconsistency is a fundamental misunderstanding often encouraged by the banks themselves between profits and capital. Unknown to many, profitability, no matter how impressive, does not automatically translate into regulatory capital. Primarily, the CBN’s recapitalisation framework actually focuses on money paid in by shareholders when buying shares, fresh equity injected by investors over retained earnings or profits that exist mainly on paper.

This distinction matters because much of the profit surge recorded in 2024 and early 2025 was neither cash-generative nor sustainably repeatable. A significant portion of those headline banks’ profits reported actually came from foreign exchange revaluation gains following the sharp fall of the naira after exchange-rate unification. The industry witnessed that banks’ holding dollar-denominated assets their books showed bigger numbers as their balance sheets swell in naira terms, creating enormous paper profits without a corresponding improvement in underlying operational strength. These gains inflated income statements but did little to strengthen core capital, especially after the CBN barred banks from using FX revaluation gains for dividends or routine operations. In effect, banks looked richer without becoming stronger.

Beyond FX effects, Nigerian banks have increasingly relied on non-interest income fees, charges, and transaction levies to drive profitability. While this model is lucrative, it does not necessarily deepen financial intermediation or expand productive lending. High profits built on customer charges rather than loan growth offer limited support for long-term balance-sheet expansion. They also leave banks vulnerable when macroeconomic conditions shift, as is now happening.

Indeed, the recapitalisation exercise coincides with a turning point in the monetary cycle. The extraordinary conditions that supported bank earnings in 2024 and 2025 are beginning to unwind. Analysts now warn that Nigerian banks are approaching earnings reset, as net interest margins the backbone of traditional banking profitability, come under sustained pressure.

Renaissance Capital, in a January note, projects that major banks including Zenith, GTCO, Access Holdings, and UBA will struggle to deliver earnings growth in 2026 comparable to recent performance.

In a real sense, the CBN is expected to lower interest rates by 400 to 500 basis points because inflation is slowing down, and this means that banks will earn less on loans and government bonds, but they may not be able to quickly lower the interest they pay on deposits or other debts. The cash reserve requirements are still elevated, which does not earn interest; banks can’t easily increase or expand lending investments to make up for lower returns. The implications are significant. Net interest margin, the difference between what banks earn on loans and investments and what they pay on deposits, is poised to contract. Deposit competition is intensifying as lenders fight to shore up liquidity ahead of recapitalisation deadlines, pushing up funding costs. At the same time, yields on treasury bills and bonds, long a safe and lucrative haven for banks are expected to soften in a lower-rate environment. The result is a narrowing profit cushion just as banks are being asked to carry far larger equity bases.

Compounding this challenge is the fading of FX revaluation windfalls. With the naira relatively more stable in early 2026, the non-cash gains that once flattered bank earnings have largely evaporated. What remains is the less glamorous reality of core banking operations: credit risk management, cost efficiency, and genuine loan growth in a sluggish economy. In this new environment, maintaining headline profits will be far harder, even before accounting for the dilutive impact of recapitalisation.

That dilution is another underappreciated consequence of the capital rush. Massive share issuances mean that even if banks manage to sustain absolute profit levels, earnings per share and return on equity are likely to decline. Zenith, Access, UBA, and others are dramatically increasing their share counts. The same earnings pie is now being divided among many more shareholders, making individual returns leaner than during the pre-recapitalisation boom. For investors, the optics of strong profits may soon give way to the reality of weaker per-share performance.

Yet banks have pressed ahead, not only out of regulatory necessity but also strategic calculation.

During this period of recapitalization, investors are interested in the stock market with optimism, especially about bank shares, as banks are raising fresh capital, and this makes it easier to attract investments. This has become a season for the management teams to seize the moment to raise funds at relatively attractive valuations, strengthen ownership positions, and position themselves for post-recapitalisation dominance. In several cases, major shareholders and insiders have increased their stakes, as projected in the media, signalling confidence in long-term prospects even as near-term returns face pressure.

There is also a broader structural ambition at play. Well-capitalised banks can take on larger single obligor exposures, finance infrastructure projects, expand regionally, and compete more credibly with pan-African and global peers. From this perspective, recapitalisation is not merely about compliance but about reshaping the competitive hierarchy of Nigerian banking. What will be witnessed in the industry is that those who succeed will emerge larger, fewer, and more powerful. Those that fail will be forced into consolidation, retreat, or irrelevance.

For the wider economy, the outcome is ambiguous. Stronger banks with deeper capital buffers could improve systemic stability and enhance Nigeria’s ability to fund long-term development. The point is that while merging or consolidating banks may make them safer, it can also harm the market and the economy because it will reduce competition, let a few banks dominate, and encourage them to earn easy money from bonds and fees instead of funding real businesses. The truth be told, injecting more capital into the banks without complementary reforms in credit infrastructure, risk-sharing mechanisms, and fiscal discipline, isn’t enough as the aforementioned reforms are also needed.

The rush as exposed in this period, is that the moment Nigerian banks started raising new capital, the glaring reality behind their reported profits became clearer, that profits weren’t purely from good management, while the financial industry is not as sound and strong as its headline figures. The fact that trillion-naira profit banks must return repeatedly to shareholders for fresh capital is not a sign of excess strength, but of structural imbalance.

With the deadline for banks to raise new capital coming soon, by 31 March 2026, the focus has shifted from just raising N500 billion. N200 billion or N50 billion to think about the future shape and quality of Nigeria’s financial industry, or what it will actually look like afterward. Will recapitalisation mark a turning point toward deeper intermediation, lower dependence on speculative gains, and stronger support for economic growth? Or will it simply reset the numbers while leaving underlying incentives unchanged?

The answer will define the next chapter of Nigerian banking long after the capital market roadshows have ended and the profit headlines have faded.

Blaise, a journalist and PR professional, writes from Lagos and can be reached via: [email protected]

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

Business6 months ago

Business6 months agoBatsumi Travel CEO Lisa Sebogodi Wins Prestigious Africa Travel 100 Women Award

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING