Business

Discover the New Property Hotspots: Why More Buyers are Choosing Adron Homes

Discover the New Property Hotspots: Why More Buyers are Choosing Adron Homes

In recent years, a significant shift in where people choose to call home has been quietly reshaping the property market. From bustling cities to serene suburban towns, the narrative of homeownership is being rewritten as more individuals and families seek out new environments that offer a better quality of life, more space, and a stronger sense of community. At the forefront of this transformation is Adron Homes, a real estate company that has not only recognized these emerging trends but has positioned itself as the premier choice for discerning buyers.

The idea of “home” has evolved, especially in the wake of global events that have made people reevaluate their priorities. The shift toward remote work, the desire for more personal space, and a renewed focus on wellness have led to a surge in demand for properties in areas that were once considered off the beaten path. Suburban towns, smaller cities, and even rural locales are experiencing a renaissance, with people flocking to these areas for a variety of reasons:

1. Space and Affordability: As property prices in major cities continue to soar, buyers are increasingly looking for alternatives that offer more bang for their buck. Suburban and rural areas often provide larger homes at a fraction of the cost, allowing families to enjoy more space without compromising on quality.

2. Quality of Life: The hustle and bustle of city life, once a draw for many, is now being traded for the peace and tranquility of quieter neighborhoods. With less traffic, lower crime rates, and a closer connection to nature, these areas offer a slower pace of life that appeals to those looking to escape the stress of urban living.

3. Community and Connection: In these new property hotspots, there is often a stronger sense of community. Neighbors know each other, local businesses thrive, and there’s a shared commitment to preserving the character of the area. This sense of belonging is a significant draw for those looking to put down roots.

4. Remote Work Flexibility: The rise of remote work has untethered many workers from the office, giving them the freedom to live wherever they choose. This newfound flexibility has opened up a world of possibilities, with many opting to live in areas that offer a better work-life balance.

As the property market shifts and new hotspots emerge, one name consistently stands out as the go-to option for buyers: Adron Homes. With a reputation for excellence, innovation, and customer satisfaction, Adron Homes is more than just a real estate company; it’s a partner in your journey to finding the perfect home.

1. Diverse Portfolio: Adron Homes offers a wide range of properties in the most sought-after locations, from serene suburban communities to vibrant small towns. Whether you’re looking for a spacious family home, a modern apartment, or a serene getaway, Adron Homes has something to suit every taste and budget.

2. Commitment to Quality: Every Adron Homes property is built to the highest standards, with a focus on durability, design, and functionality. The company’s commitment to quality ensures that your home is not just a place to live, but an investment in your future.

3. Customer-Centric Approach: At Adron Homes, the customer always comes first. The company’s dedicated team of professionals is there to guide you every step of the way, from choosing the right property to navigating the buying process. With Adron Homes, you’re never just a client; you’re part of the family.

4. Affordability and Flexibility: Understanding that buying a home is one of the most significant financial decisions you’ll ever make, Adron Homes offers flexible payment plans and financing options that make homeownership more accessible. The company’s goal is to make your dream home a reality without the stress of financial strain.

5. Sustainability and Innovation: Adron Homes is committed to building sustainable communities that are not only good for their residents but also for the environment. From energy-efficient homes to green spaces and community amenities, Adron Homes is leading the way in creating living spaces that are as environmentally friendly as they are beautiful.

As more people discover the benefits of living in these new property hotspots, the demand for quality homes will continue to rise. Adron Homes, with its unwavering commitment to excellence, is perfectly positioned to meet this demand and help buyers find their ideal home in these thriving communities.

Whether you’re looking to escape the chaos of city life, find more space for your growing family, or simply invest in a community that aligns with your values, Adron Homes is your best choice. With their diverse portfolio, commitment to quality, and customer-focused approach, Adron Homes is not just helping people find houses; they’re helping them find homes where they can build their futures.

Business

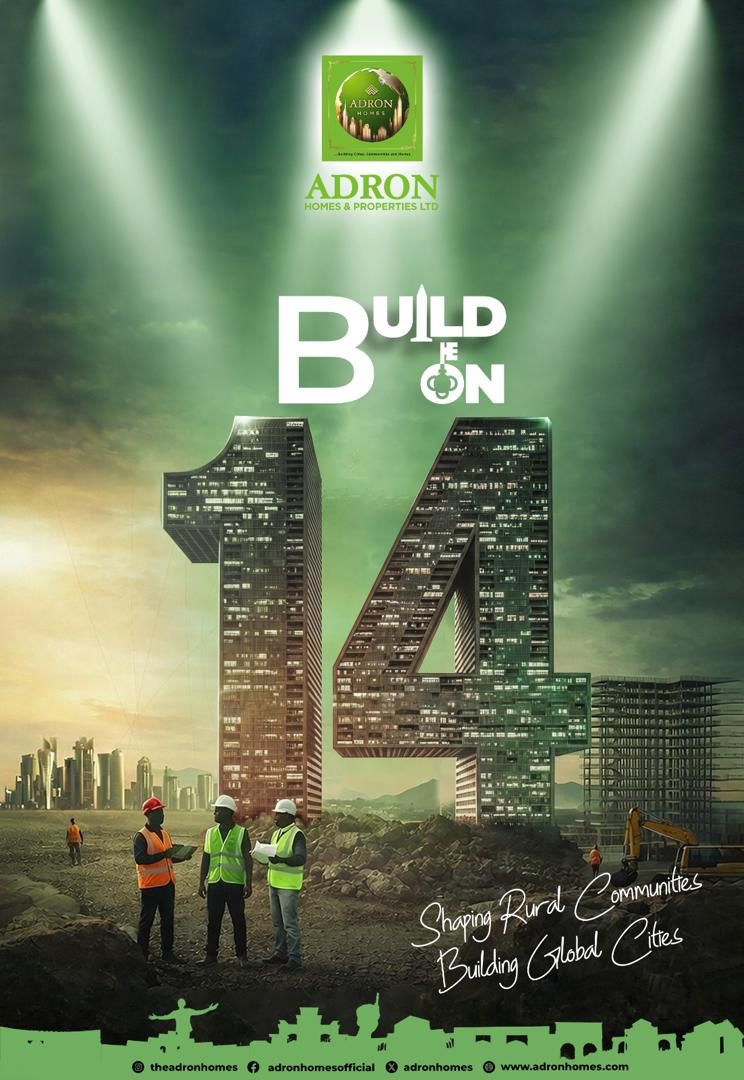

Adron Homes at 14: From Shimawa to Over 60 Livable Communities, Building Cities Beyond Estates

Adron Homes at 14: From Shimawa to Over 60 Livable Communities, Building Cities Beyond Estates

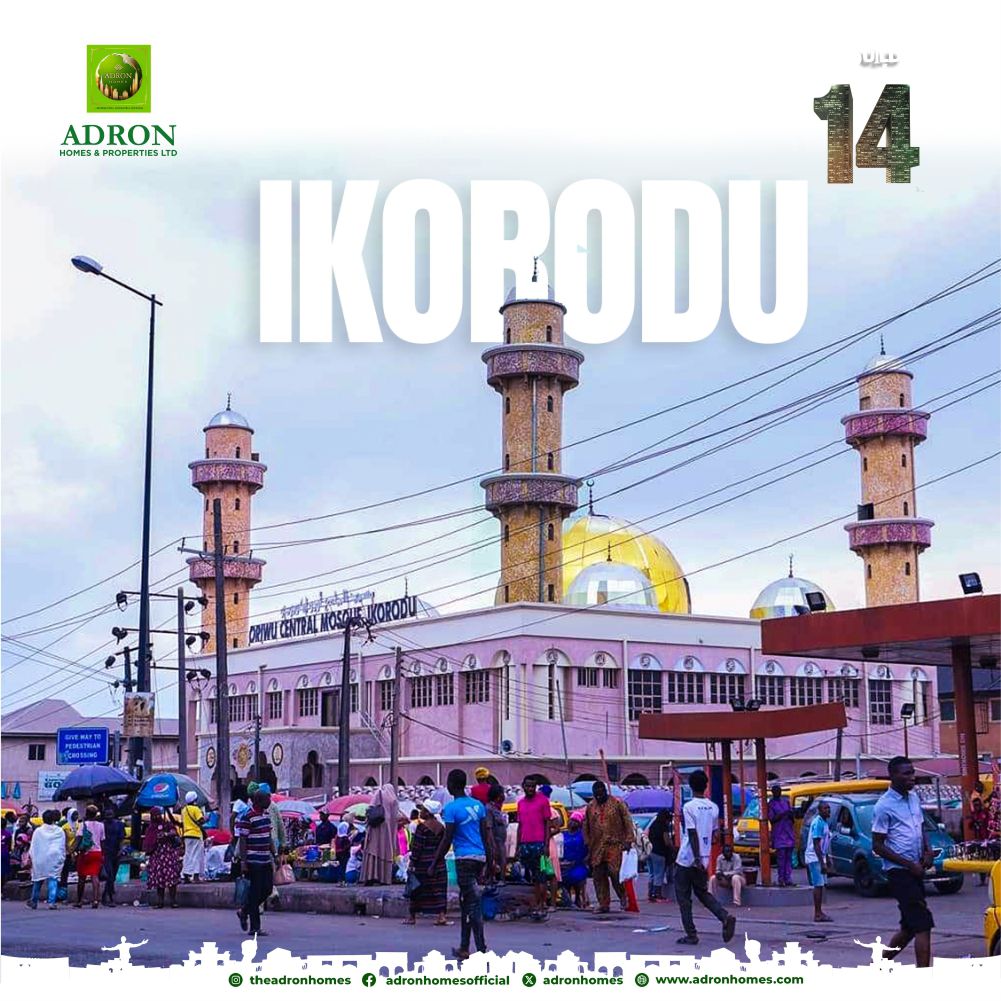

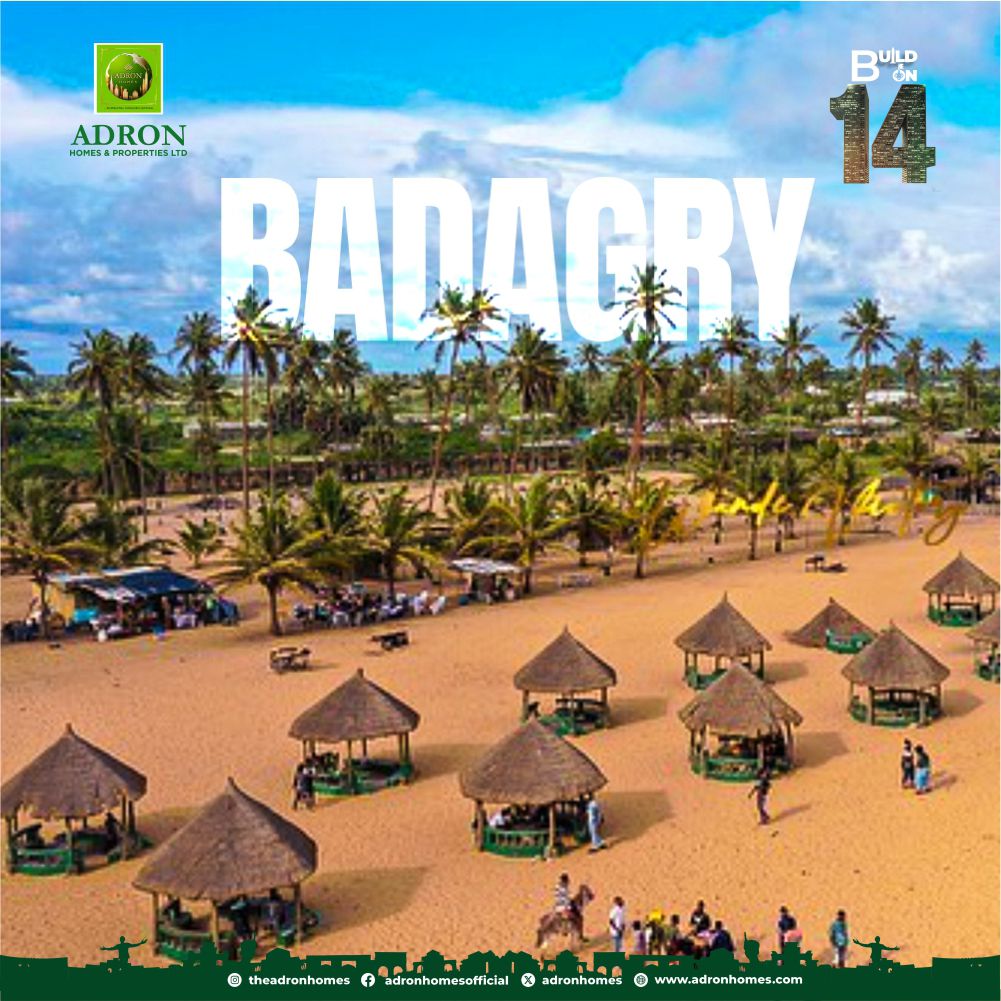

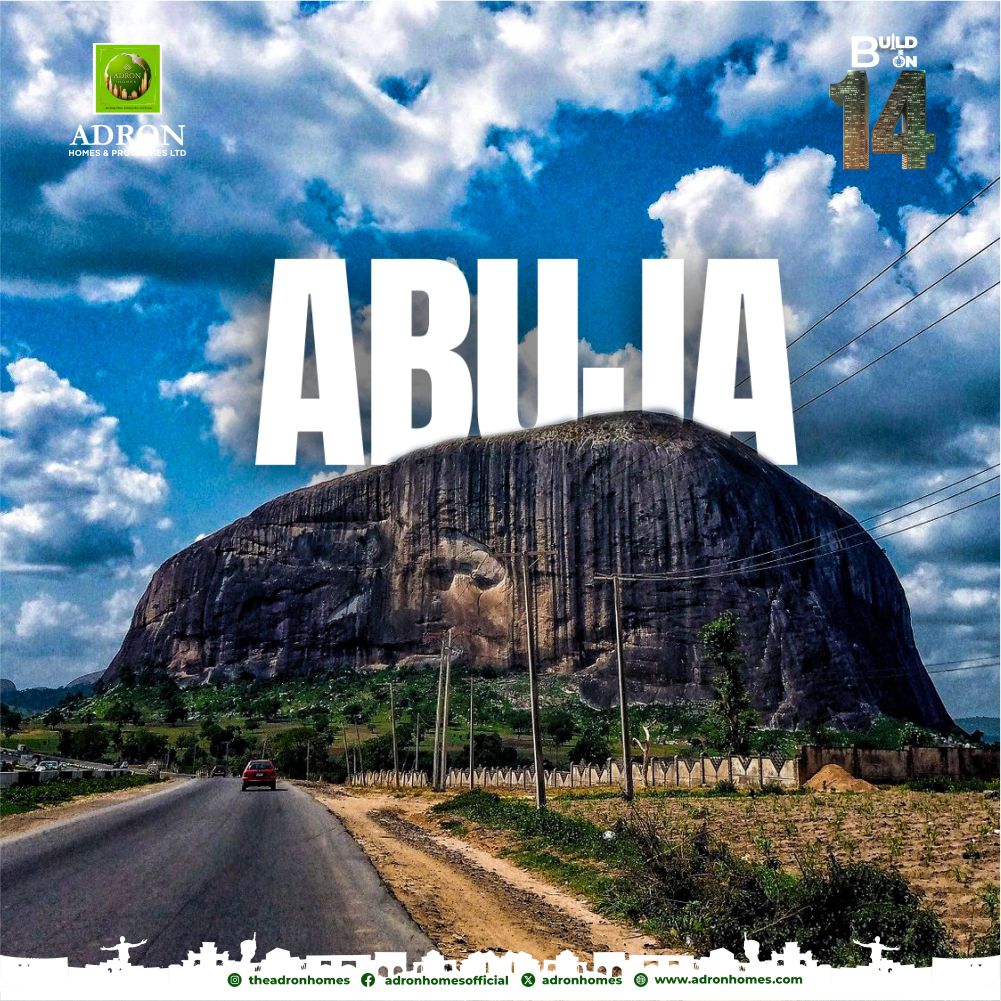

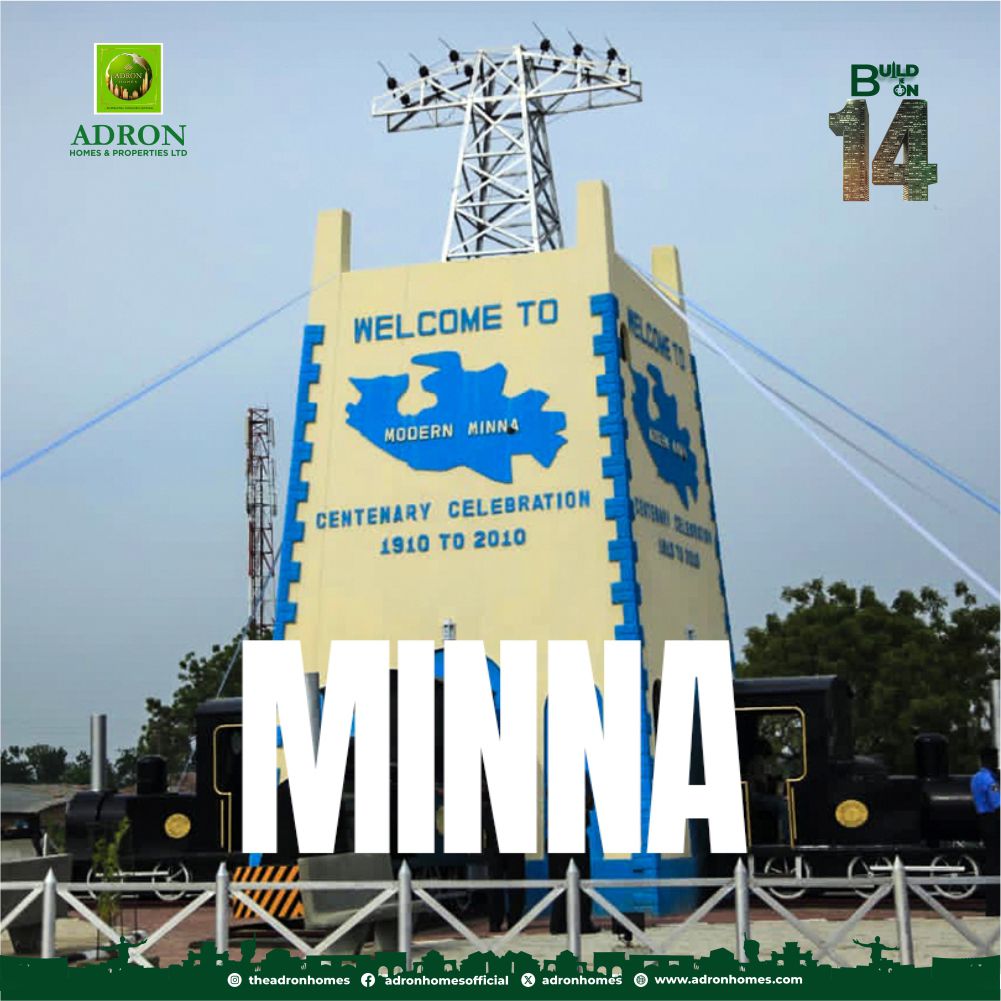

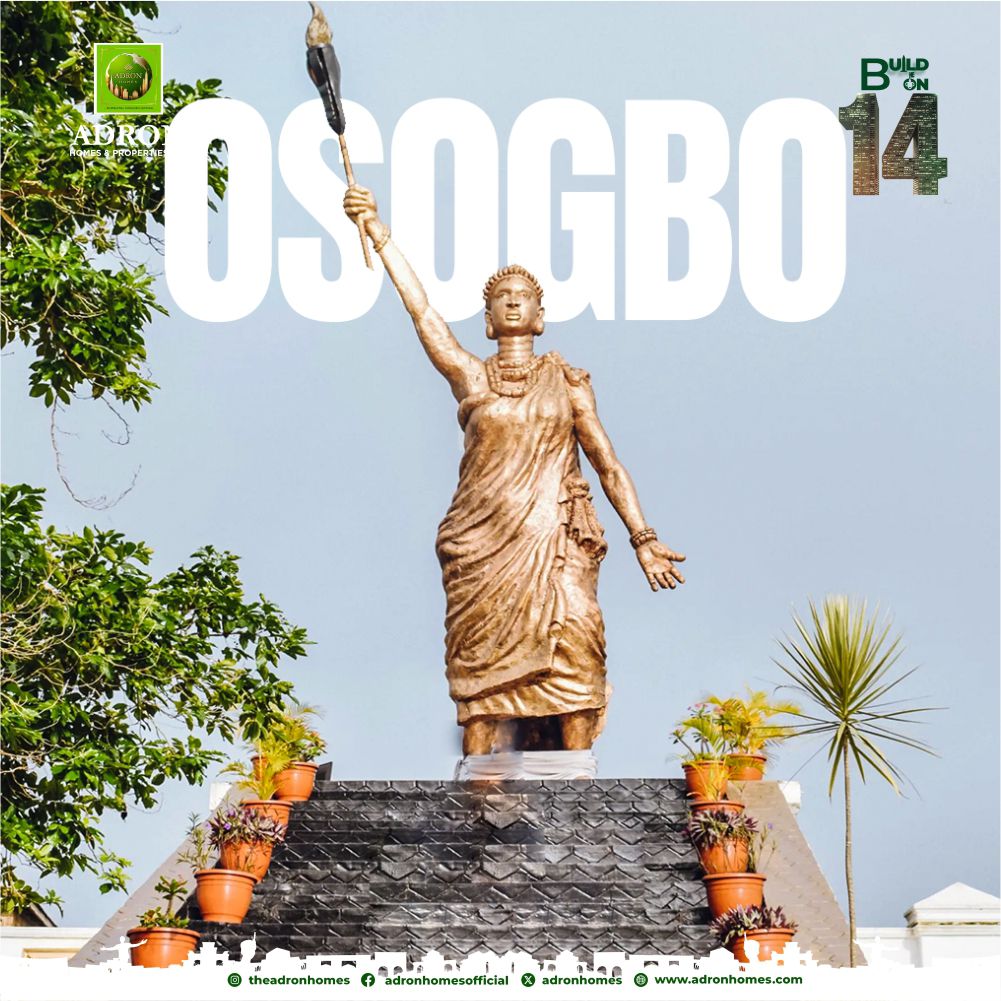

Fourteen years ago, what began as a visionary real estate development effort in Shimawa, Ogun State, has evolved into one of Nigeria’s most recognizable housing success stories. Today, Adron Homes & Properties stands as a major force in structured urban development, with over 60 livable communities and estate dwellings spread across key regions of the country. Its journey reflects a deliberate mission that is not just to sell land, but to build functional cities where Nigerians can live with dignity, security, and a strong sense of community.

At a time when Nigeria faces rapid urbanization and an ever-growing housing deficit, Adron Homes has embraced an approach rooted in planning and affordability. From its earliest developments, the company adopted a city-building model that integrates structured layouts, accessible infrastructure, and community-focused design. Roads, drainage systems, green areas, and designated social spaces are incorporated into estate planning, transforming empty land into organized residential hubs.

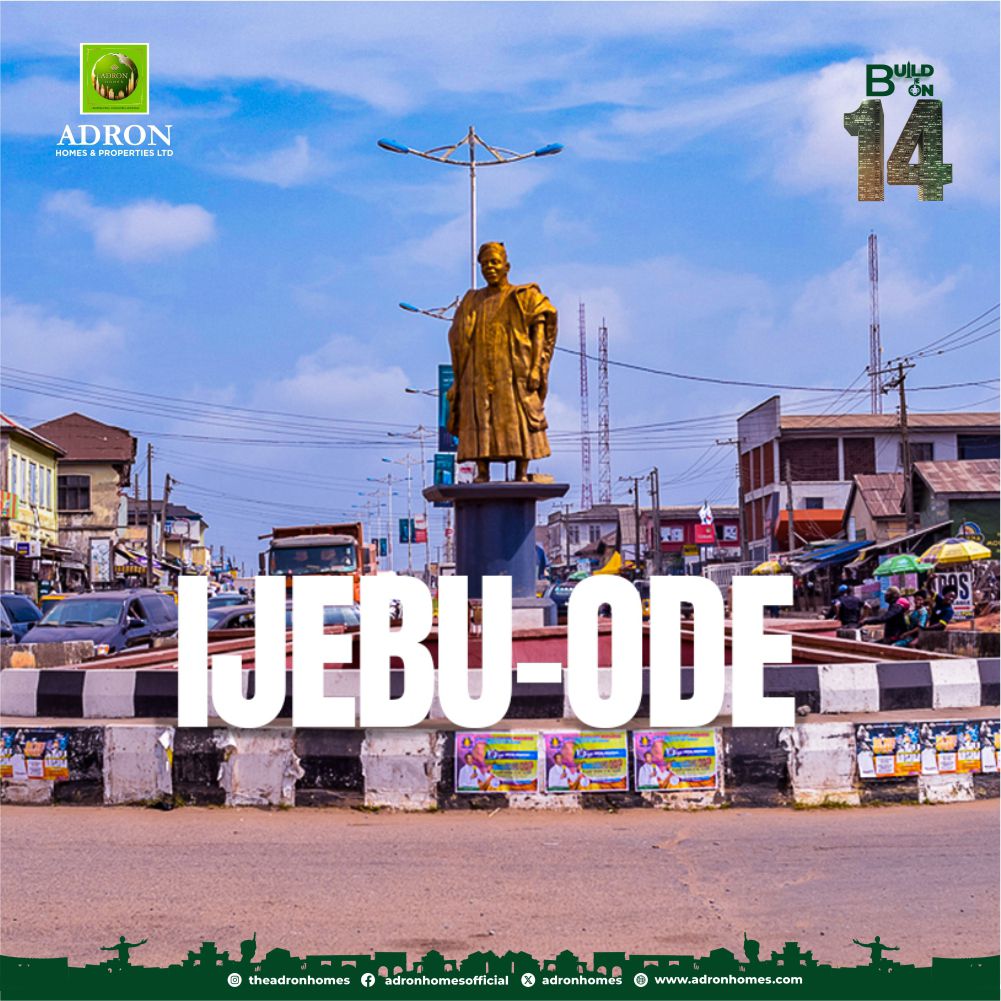

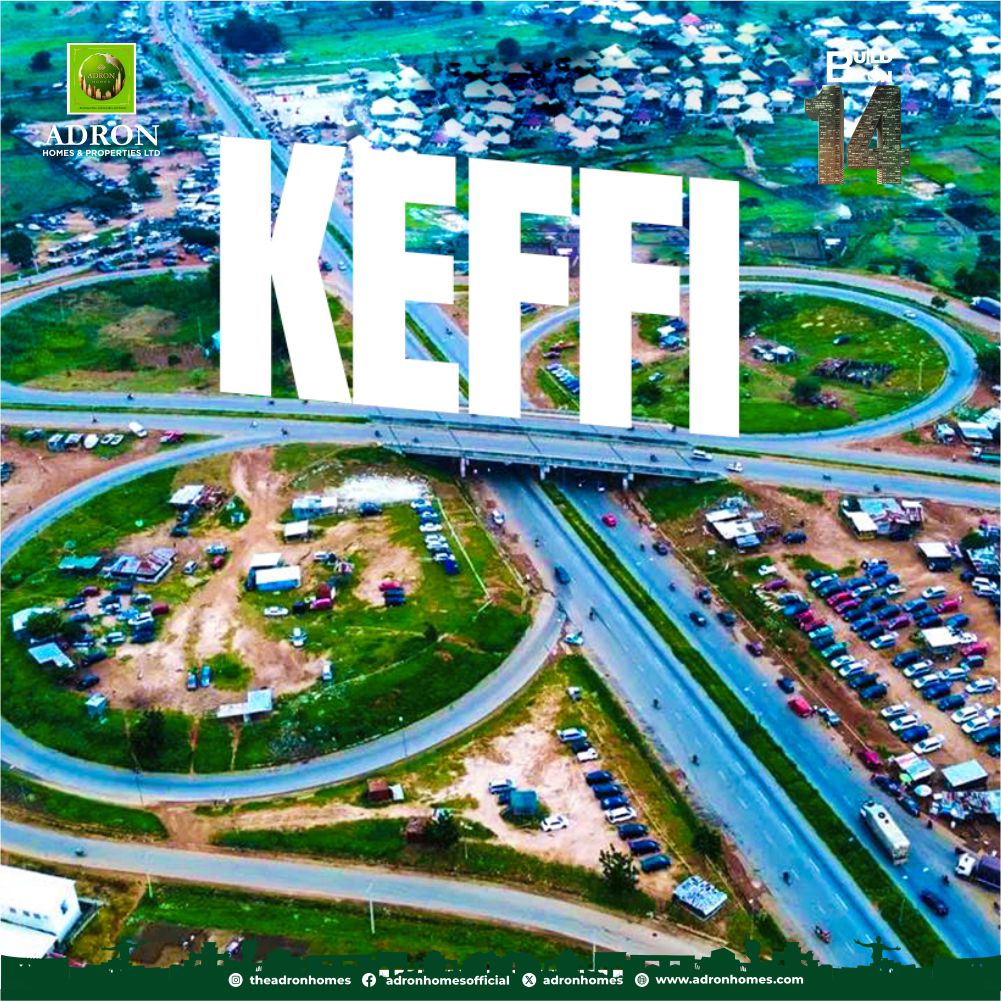

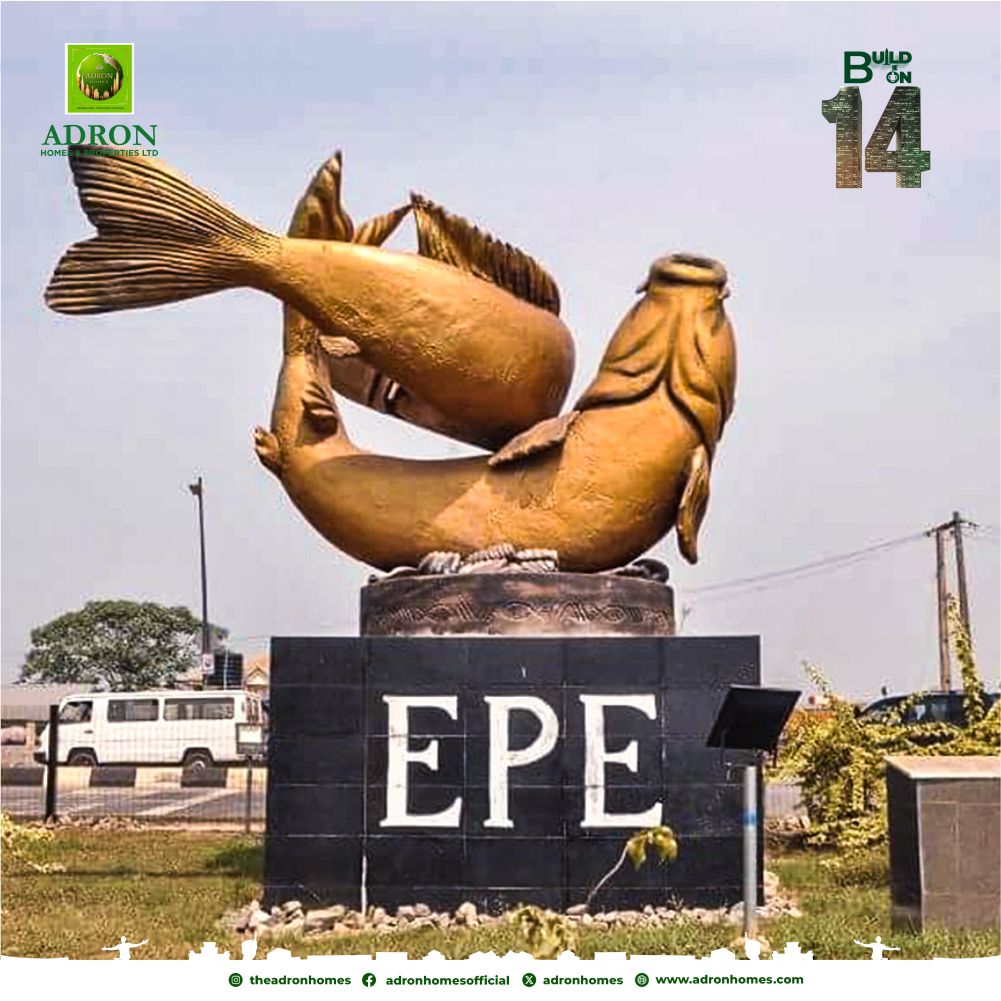

The story of Adron’s growth mirrors Nigeria’s evolving urban landscape. Beginning in Shimawa, the company strategically expanded into major growth corridors, including Lagos, Ogun, Oyo, Osun, Ekiti, Abuja, Nasarawa, Niger, and beyond. Its estates have not only provided shelter but have also influenced the emergence of new residential districts, encouraging organized expansion and helping to reduce the challenges associated with unplanned settlements.

Central to the company’s success is its commitment to affordability. Through flexible payment structures and innovative housing initiatives, Adron Homes has opened the door to homeownership for thousands of Nigerians who previously considered property ownership out of reach. This democratization of housing has empowered families, strengthened communities, and supported economic growth through increased property investment and local business opportunities within estates.

Beyond physical structures, Adron Homes prioritizes community building. Estates are designed as living ecosystems where families interact, children grow in secure environments, and entrepreneurs find opportunities to thrive. The emphasis on social cohesion has helped transform residential spaces into vibrant neighborhoods, reinforcing the idea that housing development should nurture human connection as much as physical infrastructure.

As Nigeria continues to urbanize, Adron Homes’ model demonstrates that real estate development can be both commercially viable and socially impactful. Its projects serve as reference points for emerging residential corridors, attracting further investment and setting standards for organized development across multiple regions.

Celebrating fourteen years of growth and innovation, Adron Homes remains committed to shaping Nigeria’s urban future through sustainable planning, inclusive housing solutions, and community-driven development. From its humble beginnings in Shimawa to a nationwide network of livable communities, the company’s journey stands as a testament to the power of vision, resilience, and a steadfast belief that cities are built not just with structures, but with people at their heart.

Business

14 Years of Democratizing Landownership: How Adron Homes Is Redefining Mass Housing in Nigeria

14 Years of Democratizing Landownership: How Adron Homes Is Redefining Mass Housing in Nigeria

For decades, homeownership in Nigeria remained an elusive dream for millions, restricted by rising rents, unstable housing markets, and mortgage systems beyond the reach of the average citizen. Fourteen years ago, Adron Homes and Properties Limited set out to challenge this reality with a bold and disruptive vision: to make land and homeownership affordable, accessible, and achievable for everyday Nigerians.

Founded on the principle that housing should be a right and not a privilege, Adron Homes has steadily emerged as one of Nigeria’s most influential mass housing developers. At the heart of its success is an affordability-driven model that prioritizes inclusion without compromising quality. Through flexible payment plans, low initial deposits, and extended installment options, the company has broken long-standing financial barriers that once excluded civil servants, young professionals, artisans, traders, and Nigerians in the diaspora from owning property.

Fourteen years on, this vision has translated into tangible impact across over 60 estates nationwide, strategically located in major and emerging growth corridors including Ibeju-Lekki, Lekki–Epe, Badagry, Shimawa, Papalanto, Sagamu, Abeokuta, Ibadan, Osun, Ekiti, Abuja, Nasarawa, and Niger State. Each estate represents more than infrastructure, it reflects Adron Homes’ commitment to decentralizing development and expanding access to property ownership beyond traditional urban centers.

Through this mass housing initiative, thousands of Nigerians have successfully transitioned from tenants to landlords, many achieving property ownership for the first time. Unlike conventional real estate models that emphasize exclusivity and luxury, Adron Homes has consistently aligned its offerings with the real income realities of the Nigerian population, ensuring that housing solutions remain practical, inclusive, and sustainable.

Beyond affordability, trust has remained a defining pillar of the Adron Homes brand. The company places strong emphasis on secure land titles, transparent documentation, and regulatory compliance, protecting subscribers from land disputes and fraudulent transactions. This focus on integrity has strengthened customer confidence and positioned Adron Homes as a dependable gateway to long-term wealth creation through real estate.

As Adron Homes marks its 14th anniversary, its mass housing journey stands as more than a corporate achievement but a national intervention. By restoring dignity, promoting financial security, and transforming thousands of property ownership dreams into reality, Adron Homes continues to play a vital role in shaping Nigeria’s housing landscape and building a future where more citizens can truly call a place their own.

Business

Deadline of Compliance: Nigeria’s Urgent Call for Tax Return Filing

Deadline of Compliance: Nigeria’s Urgent Call for Tax Return Filing

By George Omagbemi Sylvester | Published by SaharaWeeklyNG.com

“Shift or Structural Demand? A Declaration of Civic Duty in a Nation at a Fiscal Crossroads.”

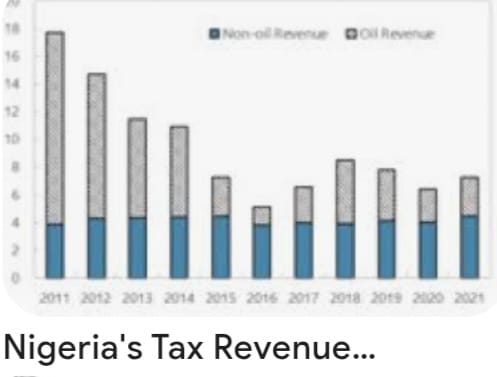

In the unfolding narrative of national development and economic reform, few instruments are as defining as tax compliance. For Nigeria, a nation perpetually grappling with revenue shortfalls, structural dependency on a single export commodity, and entrenched informal economic behaviour, the Federal Government’s recent clarification on tax return deadlines is not mere bureaucratic noise. It is a deliberate and inescapable declaration: the social contract between citizen and state must be honoured through transparent, lawful and timely tax reporting.

At its core, the government’s pronouncement is stark in its simplicity and radical in its implications. Federal authorities, speaking through the Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, have made it unequivocally clear that every Nigerian, whether employer or individual taxpayer, must file annual tax returns under the law. This encompasses self-assessment filings by individuals that too many assumed ended once employers deducted pay-as-you-earn taxes from their salaries.

This is not an optional civic suggestion, it is mandatory, backed by statute, and tied to a broader vision of national fiscal responsibility. Citizens can no longer hide behind ignorance, apathy, or false assumptions. “Many people assume that if their employer deducts tax from their salaries, their obligations end there. That is wrong,” Oyedele warned, emphasizing that the obligation to file remains with the individual under both existing and newly reformed tax laws.

The Deadlines and the Reality They Reveal.

Across the federation, state and federal revenue authorities have reaffirmed statutory deadlines in pursuit of compliance. The Lagos State Internal Revenue Service, for instance, moved to extend its filing date for employer returns by a narrow window, reflecting the reality that compliance often lags behind legal timelines. The extension was intended not as leniency, but as a pragmatic effort to allow accurate and complete submissions, underscoring that true compliance rises above mere mechanical ticking of a box.

At the federal level, Oyedele’s intervention was even more fundamental. He reminded Nigerians that annual tax returns for the preceding year must be filed in good faith, with integrity and in respect of the law. This applies regardless of income level including low-income earners who have historically believed that they are outside the tax net. “All of us must file our returns, including those earning low income,” he stated.

Herein lies one of the most challenging truths of contemporary Nigerian governance: widespread tax non-compliance is not just a technical breach of law, it is a deep cultural and structural issue that reflects decades of mistrust between citizens and the state.

The Root of the Problem: Non-Compliance as a Symptom.

Nigeria’s tax culture has long been under scrutiny. Public discourse and economic analysis consistently show that a significant majority of eligible taxpayers do not file annual returns. Oyedele highlighted that even in states widely regarded as tax administration leaders, compliance remains strikingly low, often below five percent.

This widespread non-compliance stems from multiple sources:

A long history of weak tax administration systems, where enforcement was inconsistent and penalties were rarely applied.

A perception that public services do not reflect the taxes collected, eroding the citizenry’s belief in reciprocity.

An informal economy where income often goes unrecorded, making filing seem irrelevant or impossible to many.

Lack of awareness, with many Nigerians genuinely believing that tax liability ends with employer deductions.

The government’s renewed push for compliance directly challenges these perceptions. It signals a shift from voluntary or lax compliance to structured accountability, a stance that aligns with best practices in modern public finance.

Why This Matters: Beyond Deadlines.

At its most profound level, the insistence on tax return filings is about nation-building and shared responsibility.

Scholars of public finance universally agree that a robust tax system is the backbone of sustainable development. As the eminent economist Dr. Joseph E. Stiglitz has observed, “A society that cannot mobilize its own resources through fair taxation undermines both its government’s legitimacy and its capacity to provide for its people.” Filing tax returns is not a mere administrative task, it is a declaration of participation in the collective project of national advancement.

In Nigeria’s context, this declaration carries weight. With the enactment of comprehensive tax reforms in recent years (including unified frameworks for tax administration and enforcement) authorities now possess broader statutory tools to ensure compliance and accountability. These measures, which include electronic filing platforms and stronger enforcement powers, have been framed as fair and equitable, targeting efficiency rather than arbitrariness.

Yet the success of these reforms depends heavily on citizens embracing their civic duties with sincerity. And this depends on mutual trust, the belief that paying taxes yields tangible benefits in infrastructure, education, healthcare, security and social services.

Voices From Experts: Fiscal Responsibility as a Public Ethic.

Tax law experts and economists, reflecting on the compliance push, have underscored a universal theme: taxation without transparency is inequity, but taxation with accountability is empowerment. When managed with fairness, a functional tax system can reduce dependency on volatile revenue sources, stabilise national budgets, and support long-term investment in human capital.

Professor Aisha Bello, a respected authority in fiscal policy, notes that “Tax compliance is not a burden; it is the foundation upon which social contracts are built. A citizen who honours tax obligations affirms the legitimacy of governance and demands better performance in return.”

Similarly, a leading tax scholar, Dr. Emeka Okon, argues that “The era when Nigerians could evade broader tax responsibilities simply because automatic deductions occur at source must end. For a modern economy, every eligible citizen must be part of the formal tax fold not as victims, but as stakeholders.”

These authoritative voices point to an unassailable truth: filing tax returns is both a legal requirement and a moral responsibility, an expression of citizenship in its fullest sense.

Challenges on the Ground: Compliance and Capacity.

While the rhetoric of compliance is compelling, the reality on the ground demands nuanced understanding. Many taxpayers (especially in the informal sector) lack meaningful access to digital platforms and resources for filing returns. For others, the fear of bureaucratic complexity and perceived punitive enforcement deters participation.

The government, for its part, has responded by promoting online systems and pledging greater taxpayer support. Tax authorities are increasingly engaging stakeholders to demystify filing processes, explain requirements and offer assistance. This mix of enforcement and facilitation is essential. As one seasoned revenue specialist observed: “The state cannot compel compliance through force alone; it must earn it through education, simplicity and fairness.”

The Broader Implication: A New Social Compact.

Ultimately, Nigeria’s renewed emphasis on tax return filing transcends administrative deadlines. It is an unequivocal declaration that national development is a shared responsibility, that citizens and state must engage in a transparent, accountable, and reciprocal relationship.

Tax compliance, therefore, becomes far more than a legal act; it becomes a moral claim on the nation’s future.

When citizens file their returns honestly, they affirm their stake in the nation’s destiny. When the government collects taxes transparently and deploys them effectively, it strengthens not only public services but civic trust itself.

In this sense, the deadlines proclaimed by Nigeria’s fiscal authorities mark not an end but a beginning; the beginning of a civic epoch in which accountability replaces apathy, participation replaces indifference and national purpose triumphs over fragmentation.

The road ahead will not be easy. But in demanding compliance, Nigeria is demanding more than tax returns. It is demanding commitment and that, ultimately, is the foundation on which nations are built.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

Business6 months ago

Business6 months agoBatsumi Travel CEO Lisa Sebogodi Wins Prestigious Africa Travel 100 Women Award

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING