Business

Nigeria’s Captured State: How MultiChoice Weaponized Laws to Protect Its Empire

THE CAPTURED BENCH: HOW MULTICHOICE AND ITS ELITE LAWYERS WEAPONIZED NIGERIA’S COURTS TO CRIPPLE DEMOCRACY, DEFY REGULATIONS AND EXPLOIT THE NATION

Price hikes and silenced watchdogs

In March 2025, Nigerians woke up to find that DStv and GOtv subscription prices had shot up by 20-25%. The Federal Competition and Consumer Protection Commission (FCCPC) immediately announced plans to investigate. Consumer advocacy groups were hopeful. Finally, someone would check whether Multichoice was abusing its market power, But once again, the courts stepped in. Multichoice’s lawyers, led by Moyosore Onibanjo, rushed to file an ex parte motion, claiming the FCCPC had no right to regulate pricing in a “free market.” Justice Omotosho issued an order that stopped the FCCPC from even looking into the matter. No debate. No hearing. Just a swift injunction.

For many Nigerians, this was the final straw. Complaints poured in on social media: “Why can’t our regulators do anything?” and “Is DStv above the law?” People couldn’t help noticing that every time an agency tried to act, a new court order appeared.

Corporate Leviathan

In Nigeria’s rapidly evolving media landscape, Multichoice Nigeria Limited, operators of DStv and GOtv, has long positioned itself as a market leader. However, recent revelations from the National Security Advisor’s office paint a starkly different picture: one of a corporate giant systematically deploying legal warfare to evade accountability, undermine regulatory bodies, and render agencies like the National Broadcasting Commission (NBC), the Federal Competition and Consumer Protection Commission (FCCPC) and the Economic and Financial Crimes Commission (EFCC) powerless. Over the past decade, Multichoice has weaponized Nigeria’s judicial system, securing a litany of court orders to stall investigations, invalidate regulations, and shield itself from sanctions. This report unravels the company’s calculated strategy to transform regulators and security agencies into “toothless bulldogs,” highlighting key cases, complicit judicial actors, and the broader implications for Nigeria’s regulatory framework.

In Nigeria, where media freedom once thrived, Multichoice Nigeria (owners of DStv and GOtv) have used legal tricks to dodge regulators and crush competition. What started as a success story turned into a corporate takeover of Nigeria’s broadcast industry. Multichoice’s legal team weaponized court technicalities to weaken government agencies, turning oversight into a joke.

The 2021 Default Judgment Debacle (FHC/ABJ/CS/1386/2021) Incorporated Trustees of Media Rights Vs. NBC

It was a brisk morning in Abuja when news of Justice James Omotosho’s decision sent shockwaves through Nigeria’s broadcasting circles. In a case that had once promised to empower the National Broadcasting Commission (NBC), the judge instead dealt a stunning blow to the commission’s authority—one that many believe would change the fate of broadcast regulation in the country.

The Incorporated Trustees of Media Rights took the NBC to court. They contended that the commission’s sanctions were not only heavy-handed but also a violation of natural justice. Justice Omotosho had already handed down a sweeping judgment—a permanent injunction that barred the NBC from levying any fines on broadcast stations.

In a bid to overturn the ruling, the NBC filed a motion that the earlier judgment was reached without due process. The NBC had sought to sanction Multichoice for breaching broadcast codes. Justice Omotosho dismissed their plea, and critics argue this set a dangerous precedent: regulators could now be punished for procedural oversights while corporations enjoyed judicial leniency.

This case set a precedent for regulators’ procedural missteps being exploited to entrench corporate impunity. By framing the NBC as negligent, Multichoice and allied entities secured judicial cover to bypass accountability. The significance of the ruling in this case, is to the effect that a regulator does not have the powers to impose sanctions for a breach of a defined law or regulation, which is an anomaly.

The 2024 AGI Heist (FHC/ABJ/CS/652/2024) Multichoice Nigeria Ltd. & Details Nigeria Ltd. v. NBC)

In a sweeping 2024 judgment, Justice Omotosho again ruled in favor of Multichoice, declaring Section 2(10)(b) of the NBC Code ultra vires for mandating 2.5% of broadcasters’ gross income as Annual Gross Income (AGI). The court redefined “annual income” as revenue minus production costs, slashing Multichoice’s liability. It also upheld a disputed 2020 waiver agreement, binding the NBC to accept fixed payments far below statutory rates. The ruling not only invalidated critical NBC regulations but also rewarded Multichoice for years of underpayment, costing the federal government an estimated N32.5 billion in lost revenue. The pattern again was to invoke functus officio to block regulatory appeals and framing Multichoice as the “vigilant” victim against “indolent” agencies.

The Price Hike That Sparked a Legal Firestorm

FCCPC vs. MultiChoice: A Legal Battle Over Price Hike

On March 1, 2025, MultiChoice raised DStv and GOtv subscription fees by 20-25%, citing rising costs. The move, barely a year after the last increase, triggered public outrage, with many accusing the company of exploiting its market dominance.

However, the Federal Competition and Consumer Protection Commission (FCCPC) had summoned MultiChoice and its CEO on February 27, to appear for an investigative hearing to explain its decision to increase rates starting on March 1. The commission expressed concerns about frequent price hikes, potential abuse of market leadership, and anti-competitive practices. However, instead of complying, MultiChoice filed an ex parte motion at the Federal High Court in Abuja on March 3, seeking to block FCCPC’s intervention.

On March 12, Justice James Omotosho known for his pro-corporate rulings, granted Multichoice’s request. In his decision, he restrained the FCCPC from taking any “administrative steps” against the company pending the determination of the case. The ruling effectively shields Multichoice from regulatory scrutiny, allowing it to proceed with the price hike while the FCCPC remains powerless to act. Critics have slammed the decision as a blow to consumer rights and a victory for corporate impunity.

The 2025 Ex Parte Order: EFCC and NBC Gagged

In a recent court order granted in March 2025 and filed under Suit No: FHC/L/CS/179/25 (Multichoice & Details Nigeria Vs. EFCC, NBC & Anor) reveals Multichoice’s desperation to avoid scrutiny. The EFCC had launched an investigation into the company’s alleged underpayment of Annual Gross Income (AGI) and refusal to submit financial records dating back to 2014. Instead of complying, Multichoice accused the EFCC and NBC of “harassment” and violating its “fundamental rights.”

Justice Omotosho, without hearing the regulators’ side, issued a sweeping injunction:

a. Blocked Arrests: Barred the EFCC from inviting or detaining Multichoice staff.

b. Froze Investigations: Halted demands for financial documents, including evidence of AGI remittances.

The ruling effectively halts Nigeria’s anti-graft agency from probing (a) ₦32.5 billion in unpaid levies (as established in the 2024 AGI case) and alleged tax evasion tied to creative accounting of “programming costs.”

The Legal Playbook: How Courts Became Corporate Tools

Multichoice’s tactics follow a ruthless blueprint:

1. Forum Shopping: Multichoice repeatedly filed cases in the Abuja Division of the Federal High Court, where judges like Omotosho became reliable allies. Legal experts accuse the company of “judicial engineering”—handpicking courts to secure favourable rulings that redefine regulatory authority.

2. Killing Competition: When the NBC amended its code in 2022 to break Multichoice’s stranglehold on exclusive content (like Premier League rights), the company sued. Justice A. Lewis-Allagoa sided with Multichoice, declaring that “private contracts trump over public interest.” The decision cemented Multichoice’s monopoly, leaving smaller rivals unable to compete.

3. Redefining the Rules: In 2024, Multichoice challenged the NBC’s Annual Gross Income (AGI), arguing that its 2.5% fee should apply to profits, not gross revenue. Justice Omotosho agreed, slashing Multichoice’s contributions by billions of naira. The ruling starved the NBC of funds meant to support local broadcasters, widening the gap between corporate giants and struggling independents.

4. Pre-emptive Strikes: At the first hint of regulatory action, Multichoice files lawsuits to paralyze investigations. In 2025, when the Federal Competition and Consumer

5. Protection Commission (FCCPC) probed sudden price hikes for DStv subscriptions, Multichoice secured an exparte order from Justice Omotosho—blocking the inquiry before regulators could present their case. Critics called it a “judicial coup.”

Consequently, Nigeria’s judiciary stands accused of enabling corporate impunity. Justice

James Kolawole Omotosho of the Federal High Court, Abuja, emerges as the central figure in Multichoice’s legal fortress. Between 2021 and 2025, he presided over at least seven high stakes cases involving the company, each time ruling in its favour with near-scripted consistency.

The Fallout: Toothless Bulldogs and a Captured State

The cumulative effect of these rulings is a regulatory landscape where:

* NBC is financially crippled, unable to collect lawful levies or enforce content rules.

* FCCPC is barred from investigating blatant consumer exploitation.

* Judicial Complicity: Courts prioritize corporate rights over public interest, with certain judges becoming repeat enablers.

The lawyers behind the scenes

Behind all of Multichoice’s courtroom triumphs are two powerful Senior Advocates of Nigeria (SANs): M.J. Onigbanjo and Moyosore Onibanjo. Their tactics are legendary among legal circles in Abuja.

a. Onigbanjo the Codebreaker: Known for pre-emptive strikes, he files lawsuits against regulators just before they finalize audits or announce sanctions. By flipping the script, he forces agencies to defend themselves rather than go on the offensive.

b. Onibanjo the Ex Parte Maestro: Skilled at obtaining secretive court orders, he convinces judges that immediate action is needed—often without the regulators being present. Critics have called this “judicial malpractice.”

Their Playbook:

1. Judicial Engineering: Handpick courts and judges.

2. Weaponize Rights: Frame investigations as “rights violations.”

3. Delay Tactics: Adjourn cases for years (e.g., the EFCC suit is stalled until May 2025).

The Global Playbook – How Multichoice Replicated Its Nigerian Model and the Pushback

While Nigeria’s anti-graft agencies and courts remain paralyzed by legal maneuvers favouring Multichoice Nigeria, other African nations are mounting fierce resistance against the South African media giant’s monopolistic tactics. From Malawi’s bold expulsion of the company to South Africa’s billion-dollar fines, a pattern of defiance is emerging across the continent—one that starkly contrasts with Nigeria’s capitulation to corporate impunity.

Malawi’s Stand: “Follow the Rules or Leave”

In August 2023, Malawi became a beacon of regulatory courage. When Multichoice attempted to hike DStv subscription prices without approval, the Malawi Communications Regulatory Authority (MACRA) secured a court injunction to block the increase. Multichoice retaliated by halting new subscriptions and threatening to exit the country. “We don’t negotiate with bullies,” declared MACRA Director General Daud Suleman. By September 2023, Multichoice withdrew entirely, abandoning 200,000 subscribers. “Malawi’s laws protect its people, not foreign profits,” Suleman added.

Sierra Leone: Slapped with a “Profiteering” Fine

Sierra Leone’s National Telecommunication Commission (NATCOM) took a similarly hardline stance in 2023, fining Multichoice R968,000 (Le250 million) for “unfairly profiteering” after the company blamed currency fluctuations for price hikes. NATCOM Chair Momoh Conteh accused Multichoice of “exploiting our people under the guise of exchange rates.” The regulator threatened to shut down DStv operations unless the fine was paid within a week—a move hailed by consumer groups.

Kenya’s Football Revolution: Breaking the Monopoly

In 2017, Kenya’s Competition Authority (CAK) ordered Multichoice to share exclusive English Premier League rights with rivals like Zuku TV, declaring the company’s monopoly “anticompetitive and destructive.” After a two-year legal battle, CAK Director Wang’ombe Kariuki announced: “No single entity can hoard content that belongs to the people.” The ruling opened Kenya’s airwaves to fair competition, a model now praised across East Africa.

South Africa’s $3.7 Billion Reckoning

In its home country, Multichoice faced its toughest blow yet. In 2017, South Africa’s

Competition Commission found the company guilty of anti-competitive practices, including hoarding sports rights to crush rivals. The penalty? A staggering 10% of annual revenue—$3.7 billion.

“No corporation is above the law here,” said Commissioner Tembinkosi Bonakele. By 2022, the South African Revenue Service (SARS) had clawed back another $500 million from Multichoice after uncovering years of profit under-declarations.

Nigeria: The Captured Market

While its neighbours fight back, Nigeria remains a glaring exception. In 2023, the Federal Inland Revenue Service (FIRS) settled a N1.8tn ($1.27bn) tax claim for the Multichoice Nigeria operation and a $342m claim for value-added tax dispute with Multichoice for just N35.4bn ($37.3m) —a colossal and unjustified discount.

Breaking the stranglehold

In hushed conversations across government offices and civil society groups, there’s a growing belief that Nigeria must reclaim its regulatory powers—or risk sinking deeper into a state of corporate capture. Some propose that the National Judicial Council (NJC) investigate the repeated pattern of rulings in Multichoice’s favor. Others call for a new Broadcast Industry Reform Act that would strengthen the NBC’s authority. Also, the National Security Adviser must probe the question whether judges collude with Multichoice’s legal team and whether there is economic sabotage whereby preemptive lawsuits have been used to stifle Nigeria’s broadcast sector regarding the Multichoice’s ₦32.5 billion levy evasion.

Nigerians are frustrated by skyrocketing subscription fees and a sense of helplessness. Yet without coordinated action from the courts, lawmakers, and the executive branch, these calls for justice may remain just that—calls.

For now, Multichoice continues to operate in Nigeria with near-impunity, while the rest of the continent moves toward stricter enforcement. The central question remains: “Will Nigeria’s institutions stand up for the public interest, or will the nation remain a haven for corporate giants who know how to work the system”?

Until something changes, the courts will keep issuing orders, regulators will keep hitting walls, and ordinary Nigerians will keep wondering why the rules seem to favour the powerful over the people. The stage is set for a showdown—one that could either reaffirm Nigeria’s commitment to fair governance or cement its status as a captured state under the gavel of judges and unconscionable practices of members of the Bar.

Business

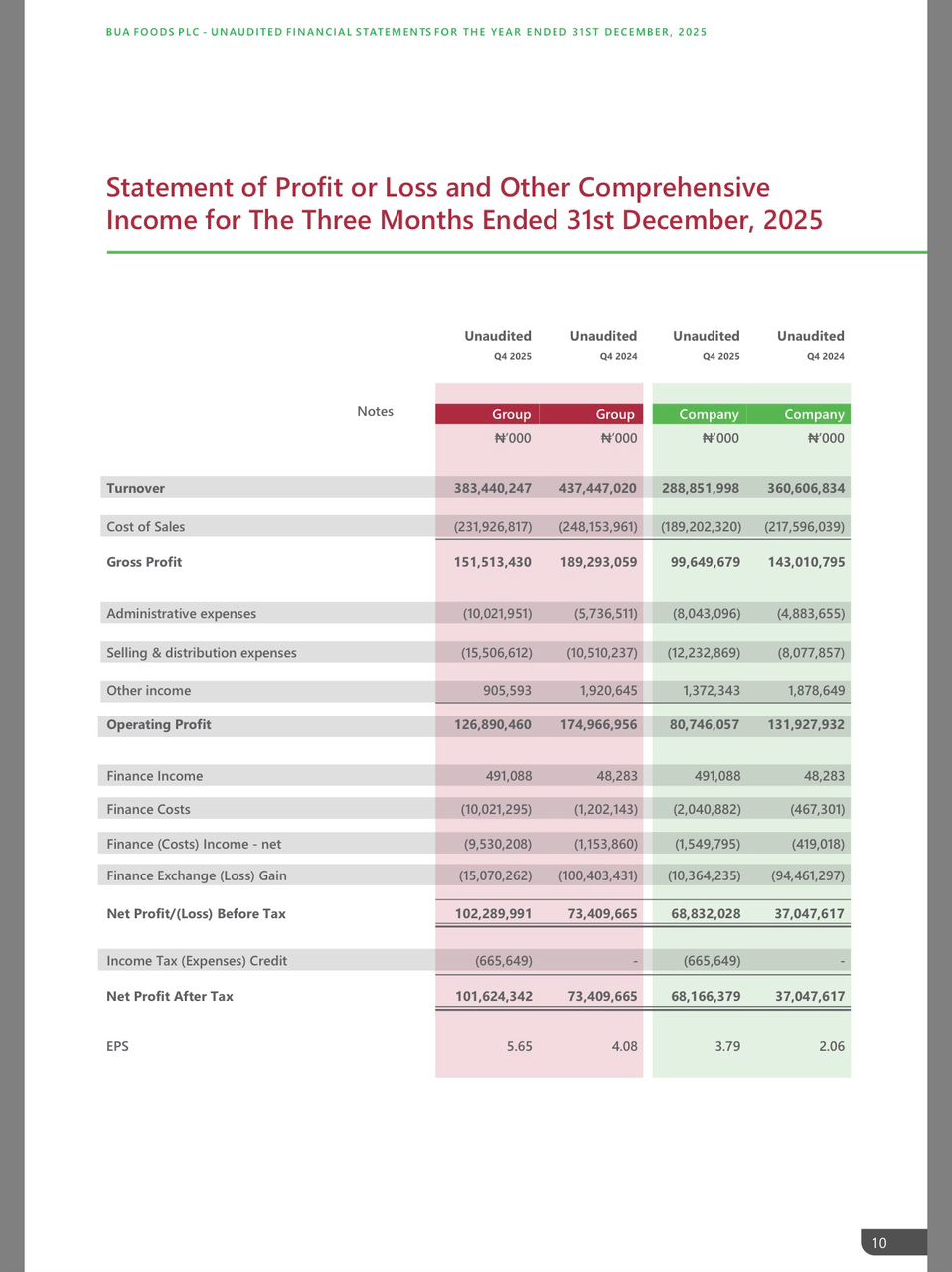

BUA Foods Records 91% Surge in Profit After Tax, Hits ₦508bn in 2025

BUA Foods Records 91% Surge in Profit After Tax, Hits ₦508bn in 2025

By femi Oyewale

Business

Adron Homes Unveils “Love for Love” Valentine Promo with Exciting Discounts, Luxury Gifts, and Travel Rewards

Adron Homes Unveils “Love for Love” Valentine Promo with Exciting Discounts, Luxury Gifts, and Travel Rewards

In celebration of the season of love, Adron Homes and Properties has announced the launch of its special Valentine campaign, “Love for Love” Promo, a customer-centric initiative designed to reward Nigerians who choose to express love through smart, lasting real estate investments.

The Love for Love Promo offers clients attractive discounts, flexible payment options, and an array of exclusive gift items, reinforcing Adron Homes’ commitment to making property ownership both rewarding and accessible. The campaign runs throughout the Valentine season and applies to the company’s wide portfolio of estates and housing projects strategically located across Nigeria.

Speaking on the promo, the company’s Managing Director, Mrs Adenike Ajobo, stated that the initiative is aimed at encouraging individuals and families to move beyond conventional Valentine gifts by investing in assets that secure their future. According to the company, love is best demonstrated through stability, legacy, and long-term value—principles that real estate ownership represents.

Under the promo structure, clients who make a payment of ₦100,000 receive cake, chocolates, and a bottle of wine, while those who pay ₦200,000 are rewarded with a Love Hamper. Payments of ₦500,000 attract a Love Hamper plus cake, and clients who pay ₦1,000,000 enjoy a choice of a Samsung phone or a Love Hamper with cake.

The rewards become increasingly premium as commitment grows. Clients who pay ₦5,000,000 receive either an iPad or an all-expenses-paid romantic getaway for a couple at one of Nigeria’s finest hotels, which includes two nights’ accommodation, special treats, and a Love Hamper. A payment of ₦10,000,000 comes with a choice of a Samsung Z Fold 7, three nights at a top-tier resort in Nigeria, or a full solar power installation.

For high-value investors, the Love for Love Promo delivers exceptional lifestyle experiences. Clients who pay ₦30,000,000 on land are rewarded with a three-night couple’s trip to Doha, Qatar, or South Africa, while purchasers of any Adron Homes house valued at ₦50,000,000 receive a double-door refrigerator.

The promo covers Adron Homes’ estates located in Lagos, Shimawa, Sagamu, Atan–Ota, Papalanto, Abeokuta, Ibadan, Osun, Ekiti, Abuja, Nasarawa, and Niger States, offering clients the opportunity to invest in fast-growing, strategically positioned communities nationwide.

Adron Homes reiterated that beyond the incentives, the campaign underscores the company’s strong reputation for secure land titles, affordable pricing, strategic locations, and a proven legacy in real estate development.

As Valentine’s Day approaches, Adron Homes encourages Nigerians at home and in the diaspora to take advantage of the Love for Love Promo to enjoy exceptional value, exclusive rewards, and the opportunity to build a future rooted in love, security, and prosperity.

Business

Why Nigeria’s Banks Still on Shaky Ground with Big Profits, Weak Capital

*Why Nigeria’s Banks Still on Shaky Ground with Big Profits, Weak Capital*

*BY BLAISE UDUNZE*

Despite the fragile 2024 economy grappling with inflation, currency volatility, and weak growth, Nigeria’s banking industry was widely portrayed as successful and strong amid triumphal headlines. The figures appeared to signal strength, resilience, and superior management as the Tier-1 banks such as Access Bank, Zenith Bank, GTBank, UBA, and First Bank of Nigeria, collectively reported profits approaching, and in some cases exceeding, N1 trillion. Surprisingly, a year later, these same banks touted as sound and solid are locked in a frenetic race to the capital markets, issuing rights offers and public placements back-to-back to meet the Central Bank of Nigeria’s N500 billion recapitalisation thresholds.

The contradiction is glaring. If Nigeria’s biggest banks are so profitable, why are they unable to internally fund their new capital requirements? Why have no fewer than 27 banks tapped the capital market in quick succession despite repeated assurances of balance-sheet robustness? And more fundamentally, what do these record profits actually say about the real health of the banking system?

The recapitalisation directive announced by the CBN in 2024 was ambitious by design. Banks with international licences were required to raise minimum capital to N500 billion by March 2026, while national and regional banks faced lower but still substantial thresholds ranging from N200 billion to N50 billion, respectively. Looking at the policy, it was sold as a modern reform meant to make banks stronger, more resilient in tough times, and better able to support major long-term economic development. In theory, strong banks should welcome such reforms. In practice, the scramble that followed has exposed uncomfortable truths about the structure of bank profitability in Nigeria.

At the heart of the inconsistency is a fundamental misunderstanding often encouraged by the banks themselves between profits and capital. Unknown to many, profitability, no matter how impressive, does not automatically translate into regulatory capital. Primarily, the CBN’s recapitalisation framework actually focuses on money paid in by shareholders when buying shares, fresh equity injected by investors over retained earnings or profits that exist mainly on paper.

This distinction matters because much of the profit surge recorded in 2024 and early 2025 was neither cash-generative nor sustainably repeatable. A significant portion of those headline banks’ profits reported actually came from foreign exchange revaluation gains following the sharp fall of the naira after exchange-rate unification. The industry witnessed that banks’ holding dollar-denominated assets their books showed bigger numbers as their balance sheets swell in naira terms, creating enormous paper profits without a corresponding improvement in underlying operational strength. These gains inflated income statements but did little to strengthen core capital, especially after the CBN barred banks from using FX revaluation gains for dividends or routine operations. In effect, banks looked richer without becoming stronger.

Beyond FX effects, Nigerian banks have increasingly relied on non-interest income fees, charges, and transaction levies to drive profitability. While this model is lucrative, it does not necessarily deepen financial intermediation or expand productive lending. High profits built on customer charges rather than loan growth offer limited support for long-term balance-sheet expansion. They also leave banks vulnerable when macroeconomic conditions shift, as is now happening.

Indeed, the recapitalisation exercise coincides with a turning point in the monetary cycle. The extraordinary conditions that supported bank earnings in 2024 and 2025 are beginning to unwind. Analysts now warn that Nigerian banks are approaching earnings reset, as net interest margins the backbone of traditional banking profitability, come under sustained pressure.

Renaissance Capital, in a January note, projects that major banks including Zenith, GTCO, Access Holdings, and UBA will struggle to deliver earnings growth in 2026 comparable to recent performance.

In a real sense, the CBN is expected to lower interest rates by 400 to 500 basis points because inflation is slowing down, and this means that banks will earn less on loans and government bonds, but they may not be able to quickly lower the interest they pay on deposits or other debts. The cash reserve requirements are still elevated, which does not earn interest; banks can’t easily increase or expand lending investments to make up for lower returns. The implications are significant. Net interest margin, the difference between what banks earn on loans and investments and what they pay on deposits, is poised to contract. Deposit competition is intensifying as lenders fight to shore up liquidity ahead of recapitalisation deadlines, pushing up funding costs. At the same time, yields on treasury bills and bonds, long a safe and lucrative haven for banks are expected to soften in a lower-rate environment. The result is a narrowing profit cushion just as banks are being asked to carry far larger equity bases.

Compounding this challenge is the fading of FX revaluation windfalls. With the naira relatively more stable in early 2026, the non-cash gains that once flattered bank earnings have largely evaporated. What remains is the less glamorous reality of core banking operations: credit risk management, cost efficiency, and genuine loan growth in a sluggish economy. In this new environment, maintaining headline profits will be far harder, even before accounting for the dilutive impact of recapitalisation.

That dilution is another underappreciated consequence of the capital rush. Massive share issuances mean that even if banks manage to sustain absolute profit levels, earnings per share and return on equity are likely to decline. Zenith, Access, UBA, and others are dramatically increasing their share counts. The same earnings pie is now being divided among many more shareholders, making individual returns leaner than during the pre-recapitalisation boom. For investors, the optics of strong profits may soon give way to the reality of weaker per-share performance.

Yet banks have pressed ahead, not only out of regulatory necessity but also strategic calculation.

During this period of recapitalization, investors are interested in the stock market with optimism, especially about bank shares, as banks are raising fresh capital, and this makes it easier to attract investments. This has become a season for the management teams to seize the moment to raise funds at relatively attractive valuations, strengthen ownership positions, and position themselves for post-recapitalisation dominance. In several cases, major shareholders and insiders have increased their stakes, as projected in the media, signalling confidence in long-term prospects even as near-term returns face pressure.

There is also a broader structural ambition at play. Well-capitalised banks can take on larger single obligor exposures, finance infrastructure projects, expand regionally, and compete more credibly with pan-African and global peers. From this perspective, recapitalisation is not merely about compliance but about reshaping the competitive hierarchy of Nigerian banking. What will be witnessed in the industry is that those who succeed will emerge larger, fewer, and more powerful. Those that fail will be forced into consolidation, retreat, or irrelevance.

For the wider economy, the outcome is ambiguous. Stronger banks with deeper capital buffers could improve systemic stability and enhance Nigeria’s ability to fund long-term development. The point is that while merging or consolidating banks may make them safer, it can also harm the market and the economy because it will reduce competition, let a few banks dominate, and encourage them to earn easy money from bonds and fees instead of funding real businesses. The truth be told, injecting more capital into the banks without complementary reforms in credit infrastructure, risk-sharing mechanisms, and fiscal discipline, isn’t enough as the aforementioned reforms are also needed.

The rush as exposed in this period, is that the moment Nigerian banks started raising new capital, the glaring reality behind their reported profits became clearer, that profits weren’t purely from good management, while the financial industry is not as sound and strong as its headline figures. The fact that trillion-naira profit banks must return repeatedly to shareholders for fresh capital is not a sign of excess strength, but of structural imbalance.

With the deadline for banks to raise new capital coming soon, by 31 March 2026, the focus has shifted from just raising N500 billion. N200 billion or N50 billion to think about the future shape and quality of Nigeria’s financial industry, or what it will actually look like afterward. Will recapitalisation mark a turning point toward deeper intermediation, lower dependence on speculative gains, and stronger support for economic growth? Or will it simply reset the numbers while leaving underlying incentives unchanged?

The answer will define the next chapter of Nigerian banking long after the capital market roadshows have ended and the profit headlines have faded.

Blaise, a journalist and PR professional, writes from Lagos and can be reached via: [email protected]

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society5 months ago

society5 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

Business6 months ago

Business6 months agoBatsumi Travel CEO Lisa Sebogodi Wins Prestigious Africa Travel 100 Women Award

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING