news

TINUBU SIGNS LANDMARK TAX REFORMS INTO LAW, SETS NIGERIA ON THE PATH TO A $1 TRILLION ECONOMY

By Prince Adeyemi Aseperi-Shonibare

Public Analyst and APC Member

In a bold and defining move poised to reshape Nigeria’s economic trajectory, President Bola Ahmed Tinubu has signed into law four far-reaching tax bills passed by the National Assembly. The reforms mark the most ambitious overhaul of Nigeria’s tax system in over half a century, aimed squarely at strengthening government revenue, stimulating private sector growth, and positioning Africa’s largest economy to achieve its target of becoming a $1 trillion economy by 2030.

At a formal signing ceremony held at the State House on Thursday, the President declared that the new laws signal a new lease of life for the country’s economy and its people. “We are in transit; we have changed the roads. We have changed some of the misgivings. We have opened the doors to a new economy and new opportunities,” Tinubu said.

The four tax laws are:

1. Nigeria Tax Bill (Ease of Doing Business)

2. Nigeria Tax Administration Bill

3. Nigeria Revenue Service (Establishment) Bill

4. Joint Revenue Board (Establishment) Bill

The reform package is the culmination of intense policy work led by the Presidential Committee on Fiscal Policy and Tax Reforms, chaired by renowned fiscal expert Mr. Taiwo Oyedele. The initiative aims to eliminate redundant taxes, unify tax administration across all levels of government, digitalize collection systems, and promote equity through progressive tax structures.

WHAT THE NEW TAX LAWS ENTAIL

The Nigeria Tax Bill consolidates all fragmented and conflicting tax statutes into a harmonized code. It retains the current 7.5% VAT rate, introduces progressive personal income tax brackets (0% for minimum-wage earners, up to 25% for ultra-high-income earners), and eliminates tax burdens on NGOs, compensation for injury, and low-earning digital entrepreneurs. A 4% development levy on corporate profits will fund student loans and infrastructure through the Nigeria Education Loan Fund.

The Nigeria Tax Administration Bill standardizes tax operations at federal, state, and local government levels. It mandates joint audits, integrated taxpayer databases, and digital monthly filings for high-risk sectors like international shipping and aviation. Penalties are now streamlined to reduce arbitrariness and corruption.

The Nigeria Revenue Service (Establishment) Bill replaces the Federal Inland Revenue Service (FIRS) with the Nigeria Revenue Service (NRS)—a fully autonomous national revenue authority with enhanced powers to manage all public revenues including taxes, oil royalties, and levies from over 100 agencies. The new agency is performance-based and digitally driven.

The Joint Revenue Board Bill institutionalizes federal-state-local government collaboration. It enables shared infrastructure, technology, and dispute resolution frameworks. A national Tax Appeal Tribunal and Tax Ombudsman will be established to ensure fairness and justice for taxpayers.

WIN ,WIN ,SITUATION FOR ALL

For state governments, these reforms are a game changer. States will now retain 30% of VAT generated within their jurisdiction, receive 50% equal-share distribution, and 20% based on population. With streamlined processes and digital tax integration, states are now empowered to grow their internally generated revenue (IGR) sustainably and reduce reliance on federal allocation.

For the federal government, the reforms boost non-oil revenue, cut wasteful duplication among MDAs, and raise Nigeria’s tax-to-GDP ratio from a low 10.8% toward the continental benchmark of 18%. This reduces the fiscal deficit and strengthens Nigeria’s standing in global capital markets.

For corporate organizations and SMEs, the reforms bring clarity and predictability. Businesses with under ₦50 million turnover will enjoy 0% corporate tax. VAT input claims are now standardized, compliance processes are digital, and there are tax reliefs for investments in education, infrastructure, and agriculture.

For citizens, especially low-income earners, the progressive income tax brackets mean more disposable income. Compensation for injury or trauma under ₦50 million is now tax-exempt. Digital access to tax filing, reduced harassment, and better service delivery are built into the new tax ecosystem.

For international investors and development partners, the unified tax framework offers legal certainty, ease of compliance, and compatibility with global standards. The reforms also align Nigeria with the OECD’s global minimum tax requirements for multinational corporations.

IMPACT ON ECONOMIC DEVELOPMENT AND THE $1 TRILLION GDP AMBITION

According to the World Bank’s 2024 Nigeria Development Update, Nigeria’s path to a $1 trillion economy by 2030 hinges on structural reforms, public investment, and fiscal discipline. These tax laws directly address those imperatives.

“Revenues are surging… The ultimate purpose here is jobs and opportunities,” said Alex Sienaert, the World Bank’s lead economist for Nigeria. The World Bank estimates that with effective reform implementation, Nigeria’s GDP could double over the next five years, fueled by non-oil growth in agriculture, services, and manufacturing.

The IMF also praised Nigeria’s fiscal efforts. IMF Managing Director Kristalina Georgieva noted, “It’s been really good to see the government taking these head on… expanding social protection to target the most vulnerable.” This fiscal consolidation—combined with subsidy removal, FX reforms, and targeted social programs—has significantly improved Nigeria’s credit outlook.

International confidence is rising. Nigeria is in talks to rejoin JPMorgan’s Emerging Market Government Bond Index, signalling renewed foreign investor interest. Morgan Stanley analysts predict that Tinubu’s policy reforms “could fuel economic growth and the rise of a mass consumer market.”

Brazil’s recent $1 billion agricultural agreement with Nigeria is another strong vote of confidence. With new revenue, the government can expand infrastructure, digitize public services, and fund large-scale investments in power, transport, and education.

ECONOMIC ANALYSIS OF THE REFORMS

Dr. Bismarck Rewane described the reforms as “the first serious attempt in over 30 years to treat taxation as a tool for national development, rather than merely a channel for revenue collection.”

Dr. Sarah Alade observed: “The harmonization under this bill will reduce friction and stimulate business growth, especially in the SME space.”

Professor Ode Ojowu emphasized that “progressive taxation reflects redistributive justice. That is good economics and better politics.”

Ifueko Omoigui Okauru stated: “Establishing a performance-based NRS is long overdue. Autonomy breeds accountability.”

Professor Akpan Ekpo said: “This bill introduces structure and predictability, which are critical for investor confidence.”

Dr. Andrew Nevin noted: “Joint audits and unified data are powerful tools to expand the tax net without raising rates.”

Eze Onyekpere called the Joint Revenue Board “the administrative glue that binds the reform.”

Alex Sienaert concluded: “If implemented with discipline, these reforms could raise Nigeria’s tax-to-GDP ratio by five to seven percentage points.”

Kristalina Georgieva added: “This is comprehensive, courageous, and overdue.”

A PRESIDENTIAL LEGACY IN THE MAKING

Taiwo Oyedele remarked: “History will remember you for good for transforming our country.”

Dr. Zacch Adedeji described the signing as “the happiest day of my professional life.”

Senate President Godswill Akpabio said: “You have birthed a tax system that will last for generations.”

CONCLUSION

President Tinubu’s tax reforms are not just fiscal adjustments—they are a foundational blueprint for Nigeria’s economic rebirth. By prioritizing fairness, efficiency, and inclusivity, these laws aim to build trust in government, empower states, attract global capital, and enable Nigeria to take its rightful place as an emerging economic powerhouse.

However, these reforms must not remain locked away in government files or limited to elite policy circles. The federal and state governments must commit to sustained public sensitization—through town halls, multilingual roadshows, traditional and social media, and engagement with business associations, community leaders, religious institutions, and market unions. Citizens need to understand what has changed, how it affects them, and how to comply. Only through nationwide enlightenment can the spirit of these reforms be translated into real progress.

If implementation stays consistent and inclusive communication follows, Nigeria’s dream of a $1 trillion economy by 2030 will not only be possible, but inevitable.

news

Buratai Pays Tribute to Ihejirika at 70, Hails Mentorship and Legacy of Leadership

Buratai Pays Tribute to Ihejirika at 70, Hails Mentorship and Legacy of Leadership

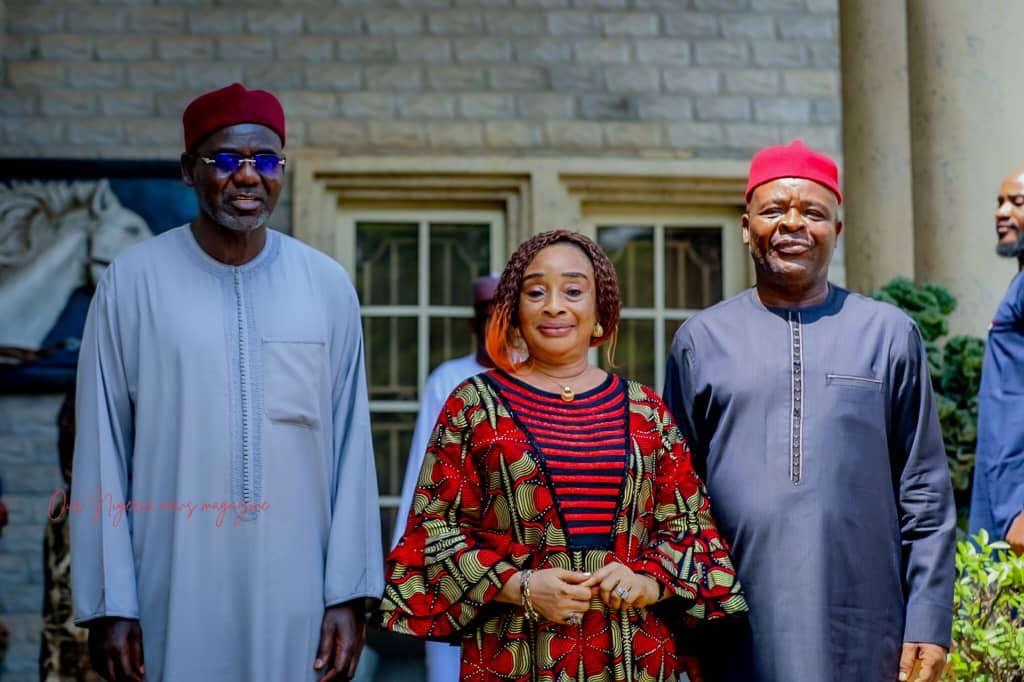

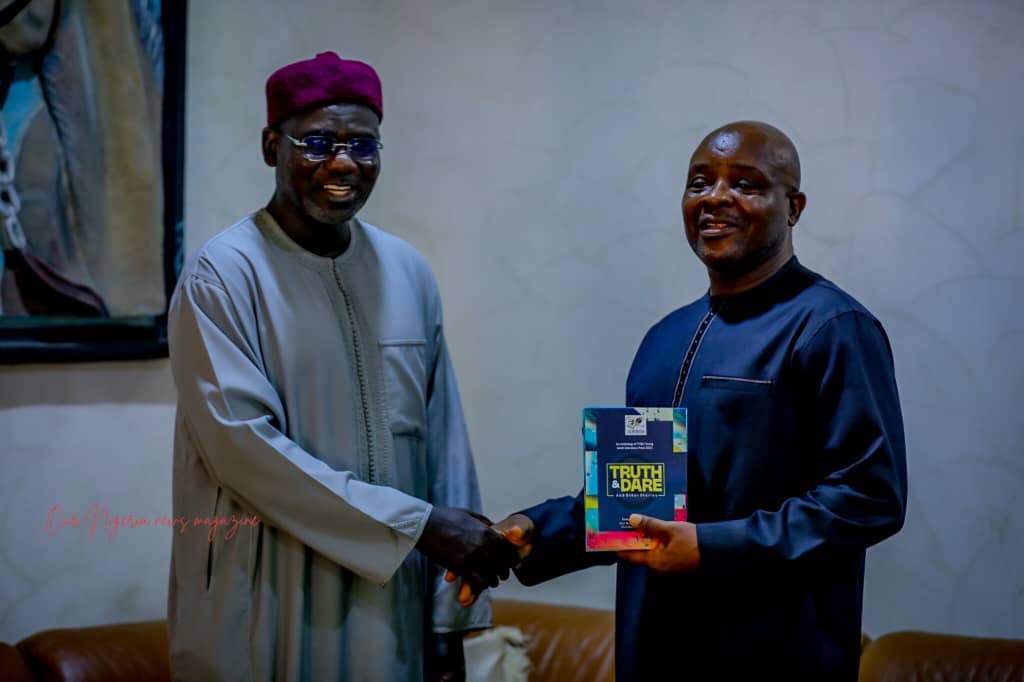

Former Chief of Army Staff and Nigeria’s immediate past Ambassador to the Republic of Benin, Lt. Gen. (Rtd) Tukur Yusuf Buratai, has paid a glowing tribute to his predecessor, Lt. Gen. OA Ihejirika, as the retired General marks his 70th birthday.

In a heartfelt message released in Abuja on Friday, Buratai described Ihejirika as not only a distinguished soldier and statesman, but also a commander, mentor, and “architect of leadership” whose influence shaped a generation of senior military officers.

Buratai recalled that his professional rise within the Nigerian Army was significantly moulded under Ihejirika’s command, citing key appointments that defined his career trajectory.

According to him, the trust reposed in him through early command responsibilities, including his first command posting at Headquarters 2 Brigade and later as Commandant of the Nigerian Army School of Infantry, laid a solid foundation for his future leadership roles.

“These opportunities were not mere appointments; they were strategic investments in leadership,” Buratai noted, adding that such exposure prepared him for higher national responsibilities.

He further acknowledged that the mentorship and professional grounding he received under Ihejirika’s leadership were instrumental in his eventual appointment as Chief of Army Staff and later as Nigeria’s Ambassador to the Republic of Benin.

Buratai praised Ihejirika’s command philosophy, describing it as professional, pragmatic, and mission-driven. He said the former Army Chief led by example, combining firm strategic direction with a clear blueprint for excellence that continues to influence military leadership practices.

“At seventy, General Ihejirika has earned the right to reflect on a legacy secured,” Buratai stated, praying for good health, peace, and enduring joy for the retired General as he enters a new decade.

He concluded by expressing profound gratitude for the leadership, mentorship, and lasting example provided by Ihejirika over the years.

The tribute was signed by Lt. Gen. Tukur Yusuf Buratai, who described himself as a grateful mentee and successor, underscoring the enduring bonds of mentorship within the Nigerian Army’s top leadership.

news

Sagamu Plantation Row: Igimisoje-Anoko Family Challenges LG Claim

news

Sagamu Communities Exonerate Sir Kay Oluwo, Accuse Teriba of Land Invasions, Violence

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING

-

Business6 months ago

Business6 months agoBatsumi Travel CEO Lisa Sebogodi Wins Prestigious Africa Travel 100 Women Award