society

Nigeria’s Wealth Must Not Be Buried in a Family’s Account

Nigeria’s Wealth Must Not Be Buried in a Family’s Account.

By George Omagbemi Sylvester — published by SaharaWeeklyNG.com

“Stop the looting; start the lifting; our oil, our schools, our future.”

Nigeria sits on a treasure trove – OIL, GAS, ARABLE LAND, MINERALS and a HUMAN CAPITAL POOL BRIMMING with TALENT. Yet year after year, decade after decade, those riches vanish into a narrow CUL-DE-SAC: private bank accounts, shell companies, luxury mansions and politically-protected empires. This is not accident. It is deliberate. It is theft dressed in law, in contracts and in the cloak of impunity. Make no mistake: when a nation’s wealth is siphoned into a few family accounts, the country dies a little more each day; its hospitals crumble, its children go hungry, its schools rot and its future is mortgaged to foreign lenders.

The scale of the damage is not rhetorical. Nearly half of Nigerians (an estimated 45–47 percent) live in poverty today, a backslide from gains made in previous decades. This is not HAPPENSTANCE; it tracks directly with a failure to translate national resources into public goods and inclusive growth. When resource rents are privatized, the social contract ruptures. The numbers come from the World Bank and national poverty assessments: tens of millions of Nigerians count themselves among the dispossessed while national treasure is diverted.

Corruption in Nigeria is structural and systemic, not episodic. Transparency International ranks Nigeria among the countries with the lowest public-sector integrity scores, placing it deep in the lower third of the global table. That ranking is not just a badge; it is a diagnostic: weak institutions, opaque procurement, entrenched patronage networks and a justice system that is slow or selective. When you have that ecosystem, state wealth becomes private wealth.

We must be precise about who benefits and who loses. In the past years, Nigeria’s anti-graft bodies reported significant recoveries (nearly half a billion dollars in one year) a sign both of the scale of grand corruption and the capacity of law enforcement when political will aligns with teeth. Yet recoveries are only part of the picture: they point to an enormous stock of looted assets and a flow of stolen revenues that have already damaged infrastructure, education and health for generations. Recoveries are APPLAUSE-WORTHY only if followed by institutional reform that prevents RE-LOOTING. Otherwise, they read like mopping the floor while the tap remains open.

Why does this matter? National wealth is the fuel for public services. When royalties, taxes and export receipts are diverted to private coffers, the obvious consequences follow: SCHOOLS lack TEACHERS, HOSPITALS lack MEDICATION/TABLETS, ROADS remain UNBUILT and SECURITY FORCES are UNDER-RESOURCED. The International Monetary Fund and World Bank have repeatedly warned that revenue leakages and weak governance constrict fiscal space for development and leave ordinary citizens exposed to austerity that benefits no one but the already wealthy. The IMF’s policy teams have documented how mismanagement and corruption eat into budgets that should be used for human development.

This is not a problem without solutions. Though solutions demand ferocity; legal, institutional and civic. First: transparency. Every contract, every licence, every major procurement in extractive sectors must be published, audited and put in the public domain. Citizens have a right to know how much was earned, how much was spent and who benefited. The Extractive Industries Transparency Initiative and similar frameworks exist for a reason: sunlight is the antiseptic that kills many corrupt arrangements. Countries that have enforced publishing and independent audit have seen substantial reductions in leakages and higher public trust. Lack of transparency is the first oxygen upon which looting breathes.

Second: strengthen legal institutions and make enforcement impartial. It is not enough to recover stolen assets when prosecutions are rare, sentences light and legal processes drag on. The EFCC and other bodies must be independent, funded and legally insulated from political interference. Fast-track courts for corruption cases, asset-freezing orders that take effect immediately and international cooperation to follow illicit flows must be scaled up. The recent record of asset recovery shows capability; but capability must be matched with consistency and due process.

Third: redesign public finance to minimize single-point vulnerabilities. RESOURCE-DEPENDENT economies must create sovereign wealth vehicles with strict governance rules; independent boards, multi-year budgeting rules and mandatory social spending floors that cannot be altered by one executive’s whim. A WELL-GOVERNED sovereign fund transforms resource volatility into predictable investment in education, healthcare and infrastructure. When properly governed, resource wealth becomes a buffer, not a temptation. The IMF and World Bank have repeatedly endorsed these mechanisms.

Fourth: rebuild civic culture and elite responsibility. No law can substitute a society that tolerates theft. As economist and global thinker Dambisa Moyo warns about dependency and poor governance, SUSTAINABLE GROWTH REQUIRES ACCOUNTABILITY and ELITE COMMITMENT to NATIONAL WELLBEING; not personal accumulation masquerading as public service. And as a salient voice in Nigerian public life, Ngozi Okonjo-Iweala has long reminded us that fighting corruption requires citizens at every level; there are no bystanders in a functional democratic fight against kleptocracy. These are not empty slogans: they are the moral spine of reform.

There will be pushback. Those who have enjoyed privatized state wealth will invoke NATIONALISM, BUREAUCRATIC COMPLEXITY, or “POLITICAL WITCH-HUNTS.” Ignore him. This is not about revenge; it is about recovery, fairness and survival. It is about replacing patronage with performance, secrecy with scrutiny and capture with competence.

Let us be blunt: ACCOUNTABILITY IS NOT A COSMETIC EXERCISE. It will require targeting HIGH-LEVEL ENABLERS; accountants, lawyers, bankers and foreign intermediaries who design and conceal schemes. It will require cooperation from international financial centers, tougher ANTI-MONEY-LAUNDERING ENFORCEMENT and a refusal to treat recovered assets as political bargaining chips. When the law is crisp and the will is fixed, stolen wealth returns to public use to build SCHOOLS, to widen CLINICS, to make POWER available for factories and farms.

Finally, Nigerians must demand a different social bargain. Vote, protest, litigate and monitor. Civil society must be endowed, not harassed. Journalists must be free and protected to follow stories that lead to offshore accounts and private islands. Citizens must refuse the bargain where family enrichment substitutes for national stewardship. The country’s wealth must be a NATIONAL INHERITANCE and not a FAMILY HEIRLOOM buried in an invisible account.

To paraphrase the blunt truth of our times: wealth hidden in a family account is wealth wasted for a nation. Every naira that disappears from public books is a teacher who will not be hired, a clinic that will remain without medication/tablets, a road that will never be paved. If we do not act, we consign our children to inherit a nation of truncated promise.

This is not pessimism. It is a call to arms. Nigeria’s riches are not fated to enrich only a few. With transparency, legal rigor, institutional redesign, international cooperation and civic insistence, we can finally ensure that what belongs to Nigeria benefits Nigerians. We must refuse the theft of tomorrow’s opportunities to pay for today’s ostentation.

“STOP BURYING OUR WEALTH IN PRIVATE GRAVES” should be more than a slogan; it should be a NATIONAL DEMAND. The time to speak it aloud, loudly and collectively is NOW.

society

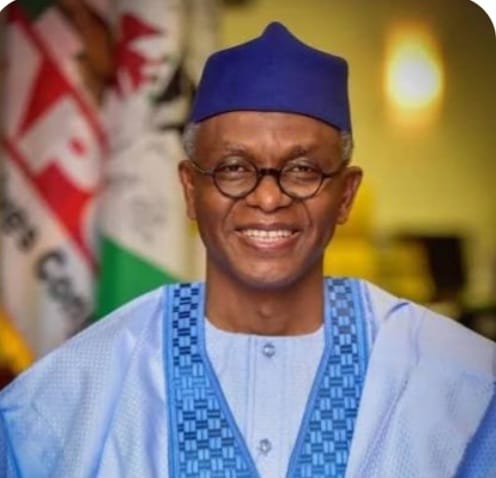

El-Rufai Turns 66 in EFCC Custody

El-Rufai Turns 66 in EFCC Custody

By George Omagbemi Sylvester | Published by SaharaWeeklyNG

“Former Kaduna governor questioned over ₦432 billion corruption probe as cybercrime charges loom.”

Former Kaduna State governor Nasir El-Rufai spent his 66th birthday in the custody of Nigeria’s anti-graft agency, the Economic and Financial Crimes Commission (EFCC), after hours of interrogation over an alleged multibillion-naira corruption probe tied to his eight-year tenure in office.

The development, which unfolded in Abuja on Monday, February 17, 2026, marks one of the most dramatic political moments in recent Nigerian history, as a former federal minister and influential northern political figure now finds himself at the centre of parallel corruption and cybercrime investigations.

According to multiple reports, El-Rufai arrived at the EFCC headquarters in the Jabi district of Abuja around 10 a.m. in response to an official invitation issued by the commission. After hours of questioning, he was detained overnight as investigators sought more time to interrogate him over alleged financial misconduct amounting to about ₦432 billion.

The probe stems primarily from a 2024 report by the Kaduna State House of Assembly, which accused his administration of mismanaging public loans, violating due process in contract awards and leaving the state with a heavy debt burden.

Investigators are said to be focusing on alleged diversion of funds, money laundering, and the accumulation of debts considered unjustified by lawmakers.

An EFCC source indicated that the former governor was grilled for about eight hours before the agency obtained a court order to keep him in custody for further questioning.

His media aide, Muyiwa Adekeye, confirmed the detention, stating that El-Rufai honoured the invitation and remained with investigators after what he described as a “frank and fruitful interaction” with officials.

The central institutions in the unfolding case are the EFCC, which is investigating alleged financial crimes, and the Department of State Services (DSS), which has filed separate criminal charges.

The EFCC investigation was triggered by petitions and the Kaduna Assembly’s findings, which alleged that loans obtained during El-Rufai’s tenure between 2015 and 2023 were either misapplied or executed without due process.

The anti-graft agency subsequently invited the former governor in December 2025 as part of the ongoing probe.

Parallel to the corruption investigation, the DSS filed a three-count cybercrime charge at the Federal High Court in Abuja, alleging that El-Rufai unlawfully intercepted the private communications of National Security Adviser Nuhu Ribadu.

The charge reportedly arose from statements the former governor made during a television interview in which he claimed that the NSA’s phone had been bugged.

Authorities argue that such an act, if proven, would constitute a serious breach of Nigeria’s cybercrime and communications laws and a threat to national security.

The timing of the detention, coinciding with El-Rufai’s birthday, triggered strong political reactions across Nigeria. Former Vice President Atiku Abubakar publicly congratulated him, describing him as “a man of courage and intellect” amid what he called political persecution.

Supporters also gathered around the EFCC headquarters, with reports of protests and clashes with security personnel.

Meanwhile, his son, Bello El-Rufai, a member of the House of Representatives, praised his father’s record as a reformist administrator, framing the detention as a test of character rather than a stain on his legacy.

Available accounts suggest a sequence of events beginning with an EFCC invitation, followed by his appearance at the commission’s headquarters, prolonged interrogation and eventual detention pending further investigations or possible arraignment.

Sources indicate the probe has been ongoing for about a year before the former governor was summoned.

The case is being closely watched for its potential impact on Nigeria’s anti-corruption drive and political stability. El-Rufai is not only a former governor but also a former Minister of the Federal Capital Territory and a key figure in northern political circles.

Anti-corruption scholars have long argued that the credibility of any anti-graft campaign rests on its impartiality. As Nigerian political economist Pat Utomi once observed, “The true test of a nation’s integrity is whether the law applies equally to the powerful and the powerless.”

Similarly, former World Bank president James Wolfensohn famously warned that corruption “diverts resources from the poor to the rich, increases the cost of running businesses, and distorts public expenditures.”

Those principles now frame the public debate around the El-Rufai case: whether the investigation represents genuine accountability or a politically charged confrontation.

As of the time of reporting, El-Rufai remains in EFCC custody, with investigators expected to decide whether to file formal charges in court. The outcome could set a major precedent for how Nigeria handles corruption allegations against former state governors.

For now, the image of a once-powerful political figure marking his birthday inside an anti-graft detention facility underscores the unpredictable nature of power in Nigeria’s evolving political landscape and the enduring question of whether accountability will truly become a national norm.

society

Carry‑On Chaos: Travelers Clash Over Tightened Size Rules in 2026

Carry‑On Chaos: Travelers Clash Over Tightened Size Rules in 2026

By George Omagbemi Sylvester | Published by SaharaWeeklyNG

“As airlines worldwide strictly enforce carry‑on dimensions, social media erupts, passengers incur surprise fees, and industry experts warn that confusion and inconsistent policies are straining the travel ecosystem.”

A growing storm of discontent has erupted across social media platforms, particularly on TikTok, as air travelers from the United States to Europe and beyond grapple with the tightening of carry‑on luggage size enforcement in 2026. What began as a viral video warning about changing baggage measurements has ballooned into a widespread debate over airline policies that many passengers say are opaque, inconsistent and financially punitive.

The spark was a clip shared by TikTok user karenschaler, a screenwriter and travel enthusiast, urging fellow flyers to reexamine their carry‑on bags before their next trip. She insisted that “so many carry‑on bags that used to get through fine are now getting pulled, gate checked and you are being charged,” especially if those suitcases have hard shells, bulky wheels, or extended handles that make them technically oversize.

What most passengers didn’t realize until recently is that this isn’t a new rule implemented by governments, there’s no global treaty or international regulator that set new carry‑on dimensions for 2026. Rather, what’s changed is the degree of enforcement by airlines and how they interpret their own size restrictions, which often include wheels and handles in the measurement.

At the centre of the controversy is the 22 x 14 x 9 inches limit (56 x 36 x 23 cm), a standard carried by many U.S. carriers, including American Airlines and others. Under these policies, the size limit now explicitly counts everything on the bag not just the main compartment, but also the wheels and pull handle. Bags exceeding this, even by fractions of an inch, are being flagged at gates and subjected to surprise “gate‑check” fees that can range from around $35 to $65 or more.

A particularly viral incident that fuelled the debate involved an NHS doctor denied boarding on an easyJet flight because her carry‑on (though marketed as compliant) was deemed too large when measured by airline staff at the gate. That moment, widely shared and criticized online, has given tangible form to passenger frustration.

Experts point to multiple forces behind this shift. Airlines are under growing pressure to reduce boarding times and streamline turnaround operations. Flight delays often are caused by bottlenecks at boarding gates when oversized bags are discovered last‑minute. Stricter enforcement, carriers say, helps ensure that baggage physically fits into overhead compartments and that flights depart on schedule.

Dr. Sarah Rodrigues, an aviation policy expert at the Global Transport Institute, explains: “Airlines are trying to balance operational efficiency with passenger convenience. When policies lack clarity and consistency, you inevitably get confusion and frustration and especially when their interpretation varies from one airport or carrier to another.”

Some carriers, like American Airlines, have even removed rigid bag sizers from gate areas, instead training agents to use discretion when assessing bags, with instructions to “err on the side of the customer” for borderline cases. But that discretion itself is part of the confusion, with travelers unsure what will be accepted at one airport and rejected at another.

On TikTok and Reddit threads, travelers have shared anecdotes of bags that flew without issue in 2025 now being denied in 2026. Common complaints include unclear advertising by luggage manufacturers and many still label products as “carry‑on approved” without noting that airline measurements must account for wheels and handles.

One frequent commenter lamented, “We bought a new bag last year to fit requirements now it’s suddenly not good. This is the biggest scam. Every year the airlines seem to change rules for carry‑ons.” Another quipped, “Did the overhead bins shrink?” encapsulating a sentiment that the rules are arbitrary rather than grounded in real capacity needs.

Travel consumer advocate Mark Jenkins, director of the Airline Passenger Rights Foundation, warns: “When airlines tighten enforcement without clear, unified communication, you disenfranchise passengers. Clarity, not ambiguity, should be the lodestar of airline policy.”

Part of the frustration stems from the sheer lack of global standardization. In the U.S., many carriers still adhere to the 22 x 14 x 9 standard, while some, like Southwest Airlines, maintain slightly larger allowances for now. Other parts of the world feature entirely different rules; some European proposals even aim to mandate free hand luggage for passengers, another layer of policy that can run counter to carriers’ current practices.

The result is confusion among passengers who might (without a global regulatory baseline) find their luggage acceptable on one flight and penalized on the next.

Consumer groups advise that travelers measure their luggage carefully (including wheels and handles) and check airline‑specific policies before booking. In an era where ancillary fees contribute significantly to airline revenue, passengers increasingly find themselves navigating a labyrinth of hidden charges.

Dr. Elizabeth Moreno, a transportation economist, notes: “Air travel is no longer just about the ticket price. It’s the sum of every fee (checked bags, carry‑ons, seat selection) and when airlines alter enforcement without uniform messaging, it erodes consumer trust.”

The carry‑on debate of 2026 reflects broader tensions in modern air travel: operational efficiency versus passenger rights, profitability versus transparency, efficiency versus customer experience. As travelers share their frustrations online and industry policies continue to evolve, one thing remains clear, the skies may be busy, but the policies on the ground need greater clarity, cohesion, and fairness if passengers and airlines are to move forward together peacefully.

society

BREAKING NEWS* UKA Shakes Global Digital Finance Space with É-ATC Gold Coins Launch

*BREAKING NEWS*

UKA Shakes Global Digital Finance Space with É-ATC Gold Coins Launch

In a groundbreaking move, the United Kingdom of Atlantis (UKA) has officially launched its É-ATC Gold Coin, backed by a staggering $10 billion gold reserve. This revolutionary cryptocurrency is set to disrupt the global digital finance landscape, boasting a starting market capitalization of $10 billion and a token price of $20.

The launch of the É-ATC Gold Coin marks a significant milestone for UKA, demonstrating its unwavering commitment to innovation, financial stability, and progress. The organization apologizes for recent digital inconsistencies and assures stakeholders that corrective measures are in place to ensure a seamless experience.

Emperor Dr Ugochukwu Christian Esemonu. Emperor incharge of Africa Region, Emperor incharge of Santorini Empire. Also Emperor incharge of Admin to the Global Throne. A man who is standing stronger and stronger inspite of distraction, expressed heartfelt gratitude to the Almighty God, Jehovah, and acknowledged the visionary leadership of Nobilis Solomon Winning, the Father of the Kingdom. The message also recognized the invaluable contributions of esteemed stakeholders, including the Global Emperor Admin of Atlantis, the Head of Government, and the Secretary General to Government.

The É-ATC Gold Coin is designed to rival leading global digital solutions, offering a secure, reliable, and transparent means of financial transaction. UKA citizens and global stakeholders are encouraged to complete their KYC processes and participate in acquiring the coins, becoming part of this historic moment in digital finance history.

“Today, we mark a new chapter in UKA’s journey, one of innovation, growth, and prosperity,” said Emperor Dr. Ugochukwu Christian Esemonu. “We are committed to delivering excellence and driving progress for our citizens and stakeholders.”

UKA’s leadership has called on citizens to unite, move forward in discipline, and peaceful coexistence, as they expand their platforms for business, trade, investment, and exchangeability. The organization is poised to surprise its critics and rise stronger, with a focus on delivering tangible results and driving growth.

The Reigning Monarch Emperor Solomon Winning’s unwavering faith, courage, and tenacity have brought UKA this powerful new beginning. His steadfast leadership has kept the vision alive, even in challenging moments, and has proven to be a beacon of hope for the people of UKA.

The É-ATC Gold Coin is now among the top 12 most powerful market capitalization in the world, a testament to UKA’s commitment to excellence and innovation.

*Key Highlights:*

– É-ATC Gold Coin launched with $10 billion gold backing

– Starting market capitalization: $10 billion

– Token price: $20

– Crypto version designed to compete with leading global digital solutions

– UKA citizens and stakeholders encouraged to participate in acquiring coins

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING

-

Business6 months ago

Business6 months agoBatsumi Travel CEO Lisa Sebogodi Wins Prestigious Africa Travel 100 Women Award