society

From Boom to Burden: Nigeria’s Public Debt Skyrockets to ₦152.39 Trillion; The Fiscal Timebomb No One Can Afford to Ignore

From Boom to Burden: Nigeria’s Public Debt Skyrockets to ₦152.39 Trillion; The Fiscal Timebomb No One Can Afford to Ignore.

By George Omagbemi Sylvester, published on saharaweeklyng.com

“A deep dive into the National Bureau of Statistics’ Q2 2025 debt report, the drivers of the surge, its human and macroeconomic costs and urgent remedies the country must adopt.”

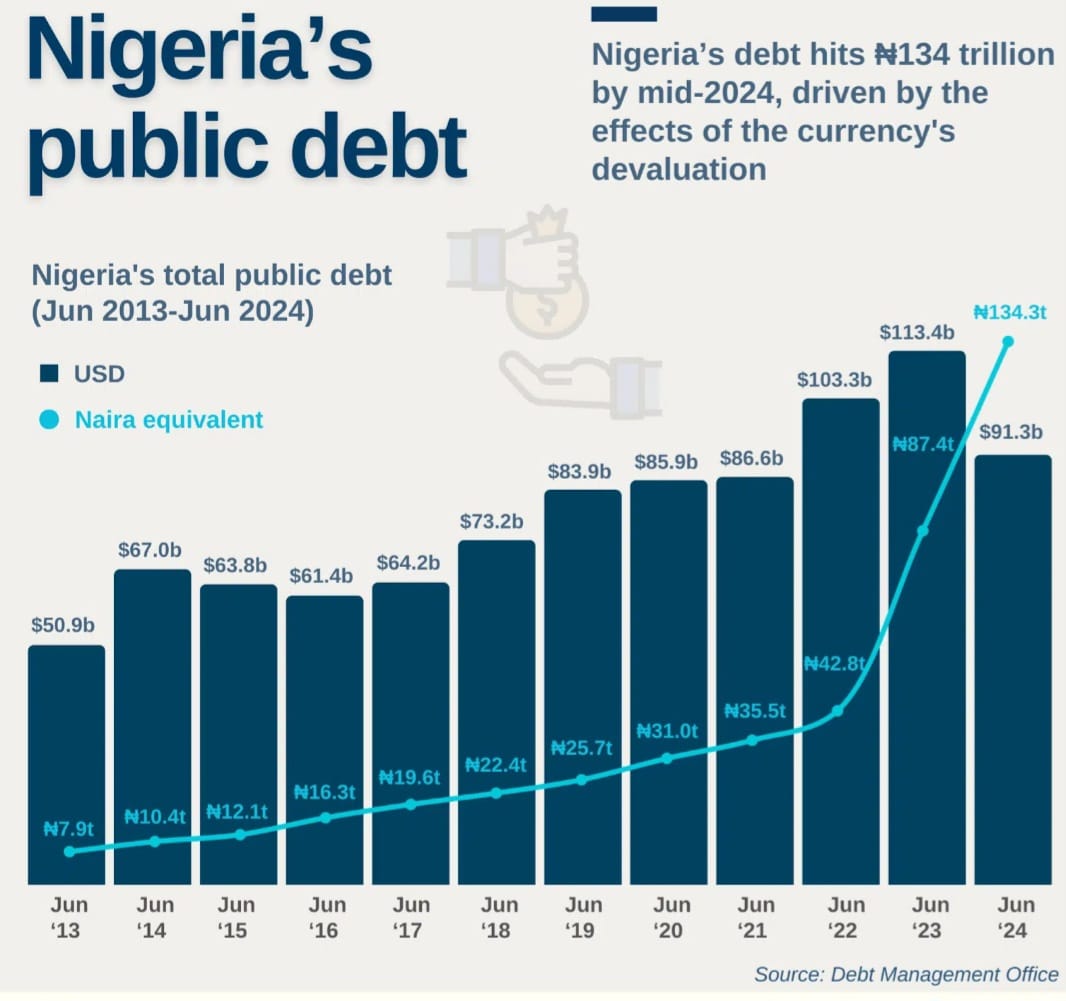

Nigeria’s public debt stock climbed to ₦152.39 trillion in the second quarter of 2025, a number so large it should break the complacency of every policymaker, investor and citizen. The National Bureau of Statistics (NBS) disclosed the figure in its Nigerian Domestic and Foreign Debt Report for Q2 2025, noting that the total represents an increase from ₦149.38 trillion in Q1 2025 and an eye-watering year-on-year rise of about ₦18.09 trillion from Q2 2024.

This is not arithmetic on a spreadsheet. It is a health check on the nation’s financial body and the diagnosis is troubling. The report shows that external debt stood at ₦71.84 trillion (about US$46.98 billion) while domestic debt reached ₦80.55 trillion (about US$52.67 billion), meaning domestic borrowing now accounts for just over half of the stock and is driving much of the recent rise.

What the numbers mean and why they are dangerous. A 2.01% quarter-on-quarter rise to ₦152.39 trillion may look modest in percentage terms, but the absolute jump and its composition carry several threats:

Debt service crowding-out. Debt servicing already consumes a growing share of government revenues. In the first quarter of 2025, public debt servicing ran into the trillions of naira monthly, a drain on funds that would otherwise finance hospitals, schools, roads and social safety nets. When more revenue goes to pay creditors, less remains for capital expenditure that lifts living standards.

Exchange rate and currency risk. A large external component exposes Nigeria to exchange rate volatility. When the naira weakens, the naira-equivalent cost of external obligations rises, inflating the debt stock in naira terms even when dollar liabilities are unchanged. This mechanism has pushed Nigeria’s debt figures higher in recent quarters.

Shift toward domestic borrowing. The tilt to domestic markets can temporarily shield Nigeria from forex swings but it is not benign: domestic borrowing competes with the private sector for savings, can raise interest rates and risks “crowding out” private investment. The NBS data show domestic debt now represents roughly 52.9% of the total stock which is a structural shift with consequences for growth.

Fiscal sustainability and bond market appetite. Investors will demand higher yields if they sense fiscal slippage or that borrowing is financing consumption rather than productive investment. Higher yields increase future debt service costs and can precipitate a vicious cycle of borrowing and servicing. International lenders and rating agencies watch these trends closely.

Voices of alarm; experts weigh in. This is not just a numbers story. Economists and fiscal watchdogs have repeatedly warned that Nigeria’s rising debt service burden risks displacing essential public investment. Muda Yusuf, CEO of the Centre for the Promotion of Private Enterprise, has stressed that the country’s growing debt-service obligations are already outpacing capital expenditure and that if left unchecked the trend will “CROWD OUT ESSENTIAL GOVERNMENT FUNCTIONS.” His warning is a sober reminder that borrowing without a credible plan for revenue growth and efficiency is a recipe for stagnation.

From the policy side, Finance Minister Olawale (Wale) Edun has defended ongoing reforms while acknowledging the fiscal pressures they aim to correct; his public commentary has emphasized the need to balance reform momentum with debt sustainability. But words must be matched with concrete measures and revenue reform, expenditure prioritization and transparent use of loan proceeds.

BudgIT and other civil-society monitors have also cautioned that fresh borrowing plans risk breaching prudential thresholds unless accompanied by aggressive fiscal consolidation and transparency. The public deserves clear accounting of what loans are for and how they translate into jobs, services and growth.

Who owes what? – sub-national contributions and the Lagos effect. The NBS report flagged that several sub-national governments (states and local councils) account for a material portion of liabilities. Lagos State, Africa’s commercial powerhouse, tops the list of state debtors, reflecting a mix of infrastructure projects and financing strategies used by its government. This raises questions about the sustainability of state borrowing and coordination with federal debt strategy.

State borrowing is not inherently wrong: cities and states need capital for roads, water and urban services. But the danger comes when short-term revenue mismatches finance long-term projects, or when guarantees and contingent liabilities are not transparently recorded in public accounts, risks that compound national exposure.

The human cost; AUSTERITY by another name. Debt is not an abstract macro variable; it is translated into policy choices that affect ordinary Nigerians. When debt servicing eats into the budget, governments face stark options: cut capital projects, raise taxes, reduce subsidies or borrow more. Each option hits households. Higher taxes and reduced services fall hardest on the poor; heavier borrowing sows the seeds of future austerity. The recent rounds of subsidy reform and tariff adjustments illustrate how fiscal tightening quickly becomes a matter of daily survival for vulnerable families.

Practical policy prescriptions; what must happen now. Nigeria needs a coherent, aggressive and transparent strategy to arrest unsustainable debt dynamics. Key policy measures should include:

Fiscal consolidation anchored on revenue growth, not just austerity. Close tax gaps, widen the tax base, modernize collection and rationalize exemptions. Without credible revenue mobilization, debt reduction will be cosmetic.

Prioritize productive borrowing. New loans must be costed against expected economic returns. Borrow for infrastructure that catalyzes private investment and jobs; avoid borrowing to fund recurrent consumption.

Strengthen debt transparency and sub-national coordination. Publish timely, disaggregated debt data (federal, state, guaranteed, contingent liabilities) and enforce borrowing rules for states. Citizens must be able to see what is owed and for what purpose.

Protect capital expenditure. Ring-fence a minimum share of spending for capital projects; prioritize those with measurable social returns. Debt that finances growth pays for itself; debt that finances consumption destroys fiscal space.

Engage creditors for smarter terms. Where appropriate, renegotiate maturities, explore concessional windows, and pursue blended finance with private partners to reduce direct government exposure.

A closing warning and a call to action. Nigeria’s rise to ₦152.39 trillion in public debt is not destiny; it is a consequence of choices. The challenge for leaders is to choose policies that restore fiscal balance, revive growth and protect the poorest. As Muda Yusuf cautioned, the country cannot allow debt servicing to outpace capital spending or to become the tail that wags the dog.

If policymakers fail to act decisively, the result will be slow growth, higher costs of living and a future generation saddled with the obligation to repay a debt that did not translate into durable prosperity. The NBS report is a clarion call and EVERY RESPONSIBLE NIGERIAN, from the PRESIDENCY to the STREET, must treat it as such.

society

Zamfara State Launches Landmark IDP Policy and Action Plan as UNDP, Northwest Forum Pledge Support

Zamfara State Launches Landmark IDP Policy and Action Plan as UNDP, Northwest Forum Pledge Support

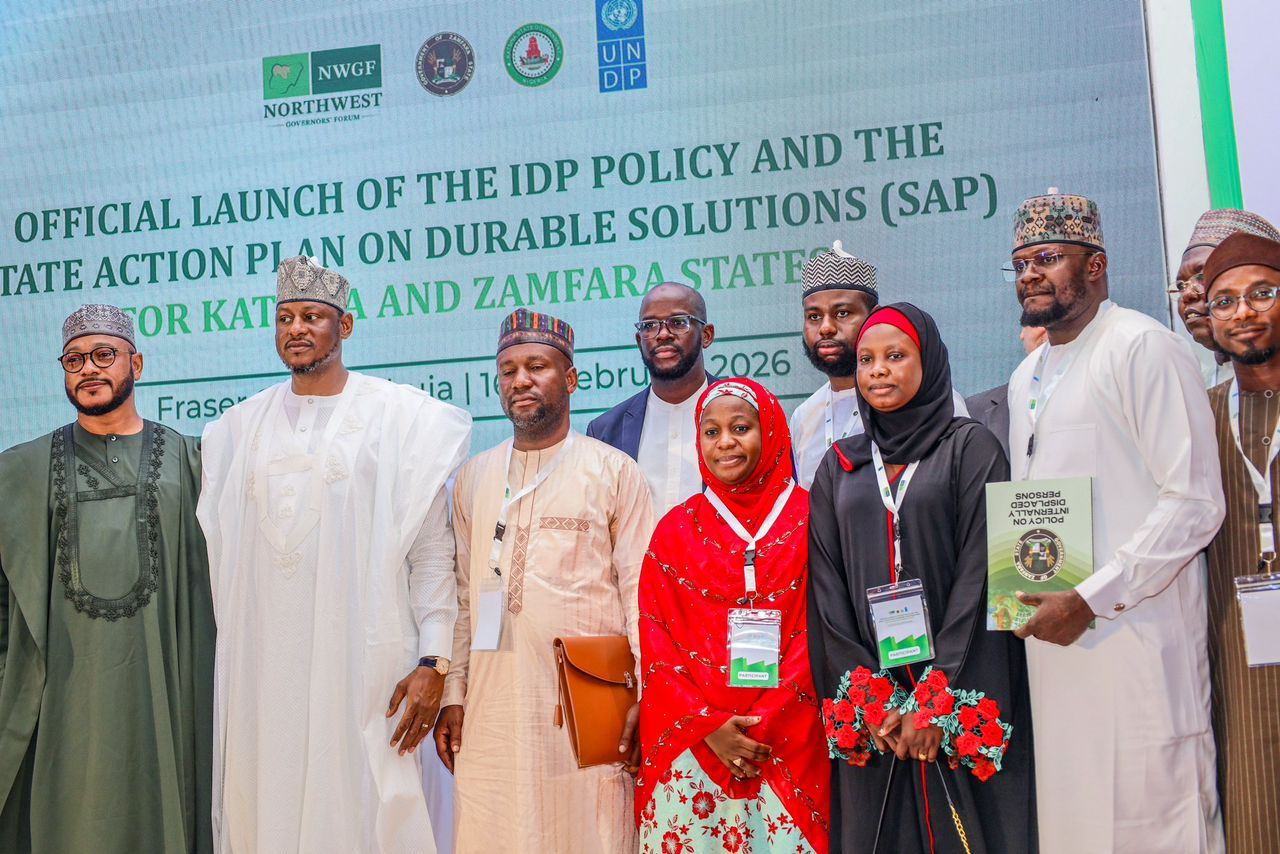

In a significant move to address the humanitarian crisis wrought by banditry and internal displacement, the Executive Governor of Zamfara State, His Excellency Dr. Dauda Lawal, has officially launched a comprehensive policy framework and action plan aimed at delivering durable solutions for internally displaced persons (IDPs) in the state.

The Governor attended the joint launch ceremony for the IDP Policy and the State Action Plan on Durable Solutions, an initiative simultaneously rolled out for both Katsina and Zamfara States in the nations capital Abuja today Feburary 16, 2026. The event marks a pivotal moment in the region’s approach to managing displacement, shifting from emergency response to long-term, sustainable recovery.

The ambitious programme is the product of a strategic collaboration between the Northwest Governors Forum and the United Nations Development Programme (UNDP). This partnership underscores a unified, regional acknowledgment that the challenges of displacement require coordinated, multi-state solutions that address root causes and build lasting resilience.

For Zamfara State, which has borne the brunt of years of insecurity, the new policy is being hailed not merely as a bureaucratic formality, but as a binding social contract with its most vulnerable citizens. It establishes a clear roadmap for restoring the dignity of displaced families, with a laser focus on rebuilding shattered communities and creating viable pathways for safe return, peaceful resettlement, and sustainable reintegration.

The framework goes beyond temporary relief, outlining concrete strategies to help displaced populations not just survive, but ultimately thrive in safety. It seeks to transform the lives of those who have lost their homes and livelihoods by ensuring they are active participants in the state’s recovery.

Speaking at the launch, Governor Lawal reaffirmed the administration’s unwavering commitment to translating the policy document into tangible, measurable impact on the ground. “Under my leadership, we remain committed to ensuring that this framework translates into measurable impact for our people.”

The launch signals a new chapter for Zamfara, one focused on healing and forward momentum. By anchoring the response in a durable solutions framework, the state government aims to build systemic resilience, strengthen the capacity of local institutions to manage future crises, and ultimately, shape a more secure, stable, and inclusive future for all residents of Zamfara State.

society

Bright Brain Community Initiative, TMRI Host International Women’s Conference on Gender-Based Violence

Bright Brain Community Initiative, TMRI Host International Women’s Conference on Gender-Based Violence

society

A LEGACY OF EXCELLENCE: Wisdom Benson Celebrates 44 Years of Entrepreneurial Triumph

A LEGACY OF EXCELLENCE: Wisdom Benson Celebrates 44 Years of Entrepreneurial Triumph.

Wisdom Benson, the visionary CEO of Wisic Services, is celebrating a major milestone – his 44th birthday on 18th February! A seasoned entrepreneur, accomplished networker, and dedicated leader, Wisdom has spent over 20 years driving business growth, empowering individuals, and shaping the future of entrepreneurship in Nigeria and beyond.

As the helm of Wisic Services, Wisdom has demonstrated exceptional leadership, guiding his team with vision, resilience, and courage. His entrepreneurial journey is a testament to the power of consistency, integrity, and strategic thinking. Under his leadership, Wisic Services has become a beacon of innovation and excellence, making a lasting impact in the industry.

Wisdom’s commitment to mentoring young entrepreneurs and promoting businesses has inspired countless individuals. He has been a driving force behind the success of many startups and SMEs, providing them with the necessary tools and guidance to thrive.

“Every year is not just an addition of time, but an addition of wisdom, strength, and purpose. The journey continues,” Wisdom said ahead of his birthday. “I am grateful for the opportunity to make a difference in the lives of others, and I look forward to continuing to inspire and empower the next generation of entrepreneurs.”

As we celebrate Wisdom Benson’s 44th birthday on 18th February, we honor a man whose story inspires determination, excellence, and forward thinking. His legacy is a testament to the power of hard work, dedication, and passion.

“We are thrilled to celebrate Wisdom’s milestone birthday and acknowledge his contributions to the business community,” said a spokesperson for Wisic Services. “His vision, leadership, and commitment to excellence are an inspiration to us all, and we look forward to many more years of success and impact.”

Here’s to many more years of expanded territories, deeper impact, and greater accomplishments!

*About Wisdom Benson*

Wisdom Benson is a seasoned entrepreneur, accomplished networker, and the visionary CEO of Wisic Services. With over 20 years of experience, he has established himself as a leader in the business community, driving growth, empowering individuals, and shaping the future of entrepreneurship in Nigeria and beyond.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING

-

Business6 months ago

Business6 months agoBatsumi Travel CEO Lisa Sebogodi Wins Prestigious Africa Travel 100 Women Award