Business

Professor Alexia Thomas Genius In The Myth

Prof. Alexia Thomas was born on the 2nd of March 1973. She is a Philosopher, a Musician, a Humanitarian, a Politician, a Writer, a Curator, a Political Advocate, an Idealist, a Socialist, a Counsellor, a Teacher, a Human Rights Advocate, a Legal Practitioner, an Activist, a Realist and a Bureaucrat.

A British fiery Human Rights Activist who is the Chairman, The Commonwealth Liberation Party, a registered political party in United Kingdom (UK) and President, Independent Diplomat Commission (IDC), and Chieftain, Commonwealth Alliance Treaty Commission in United Kingdom. Fondly called ‘Royal Mother’,she has been at the fore-front of fighting against the acts of slavery, injustice and dehumanization of United Kingdom Border Agency, UKBA against Commonwealth citizens.

NOBLE QUOTES BY PROF ALEXIA THOMAS:

“Human race has the power to enact love energy to accept different race with oneness and love”

“We cannot drive the wagon into the future without retrogressing to the past”

“No man has the right to deny another man his free will liberty to be free”

“All government of the world and leaders of the world should observe protocol against human oppression”

“Law of magna carta is broken and the consequences of retribution must be averted as the dice has been cast and denial is not an option for the threat of karma not to hunt great Britain and her territories”

Prof. Thomas was born in Nigeria to Mr. Thomas Anofojie Ihenyen and late Mrs Bridjet Okhen Itua both from Esan Central, Edo State – Nigeria.

Prof. Thomas at birth was named Elizabeth Ihenyen.

• At age 4, her mother separated from her father and she her three siblings were taken to the village in Oghabgo-Ekpomo by her mother to live with their grandmother.

• At age 8, her father fought hard to bring them back to Lagos where they lived and grew up with their step mother.

• At age 17 she realised her talent in singing with the aid of her mother’s advice, she abbreviated Elizabeth to be Lizzy and Ihenyen to be Henz and became known as Lizzy Henz, which became her artistic name.

• At age 18, she lost her mother to a mysterious death at age 35. Having had a mother who was the prettiest woman she ever knew, who spoilt her with rich gifts. She felt the death of her mother is a strive to achieve greatness not wanting to be consoled by the lost. Her father’s words of encouragement kept her going “Forget your mother’s wealth, strive to achieve yours”. Reasons being that Prof. Thomas mother was married to another man and this denied her access to her mother’s wealth. Ever since, her courage is not to value Gold and Silver but wake her conscious knowledge to develop life ethical wisdom.

• At age 29 she got married to Mr. Lennox Igoche Ikwue and then adopted the name Lizzy Ikwue-Henz.

• At age 35 she separated from her husband due to his infidelity in the marriage and she relinquished the use of her name Lizzy Ikwue-Henz and officially and formally adopted the name Alexia Thomas through deed poll change of name.

• Prof. Thomas is a woman who believes in the dignity of labour. She is born to a family of four. She has a younger sister Loveth born 1975 lives in Canada, a younger brother Alex born 1976 lives in Nigeria and another brother Victor born 1978 lives in America.

• At age 17, a lady by name Miss Uche and her male associate in Festac Town, Lagos approached Prof. Thomas then known as Lizzy by name in a conversation and told her she is beautiful, look like a model and that she should take up music as a career. Yes this was the beginning of new dream.

• Prof. Thomas mum and dad refused to support her but she refused giving up her career and pushed her inspiration. She got herself a company to sponsor her album by name Diya Fatimelehin and Co. They invested in her demo and requested she travels to America for realisation of her dream. Prof. Thomas parents stopped the ambition to travel to America, because she was a minor as her mum went to her sponsor’s office to threaten him. Nevertheless, a turbulent Nigerian economy, Prof. Thomas resulted to make her first album production locally. Though she failed to meet up with her sponsor’s expectation and she lost the financial support to further her career.

• At age 19, she gained admission to Federal University of Technology Minna Niger State to study Mathematics and Computer Science.

• She met her first love Mr. Kayode Agbetusin, got pregnant with her first son Torpy Agbetusin as refusing to abort the pregnancy left her a young mother and the birth of her son in 1994. She left University at 200 levels to live with her mother-inlaw for support care of her son. Within 9 months after Torpy’s birth her relationship fell apart with Mr. Agbetusin because she refused to give up her career as a musical artiste. She could not return back to school in the North of Nigeria as Torpy was still too small for her to take the risk. She had a transfer to University of Lagos and repeated 200 levels again and later the school noticed the transfer was not properly officiated by her previous University. Prof. Thomas refusal to return to the Northern Nigeria to continue her education made her give course of study and was able to focus fully on her musical career alongside mother hood.

• At age 22, she realised her first break through of a duo album with her partner Isaiah Okoro titled Evidence.

THE GENIUS

• Prof. Thomas Mind Archaeology was born, like a fairy too fake to be real, she had dream in August 1995, late Bob Marley with wife Rita and their children paid her a visit in her one room apartment in Ilogbo, Okokomaiko-Lagos. In her dream, she questioned the fact why the dead were paying her a visit. In her dream she was sleeping while her guest arrived as she woke up in her dream sleep to receive her guest, she woke up in reality and realised it was a dream. Ever since that night, her generic being as a genius was born. She has powers to do everything through her mind apart from waking up the dead. For the first time in 1995 her School of Taught was born “The Mind Science Regression”. Her ability to travel back to time using the focus of Natural Mystic, as a result, her pen has been her sword. She writes the write, craft the craft, draft the draft and as an idealist her redemption is a world free of Human Torture and Life Equality between the rich and poor.

• At age 25, she released her solo album called Woske. It was difficult for Prof. Thomas to achieve her dream as an artiste as she had no support from musical label since she refused to flirt with musical boss and their promoters so she went ahead to release both of her albums on her musical label called Lizalex Records.

• At age 26, Prof. Thomas phenomenon gift of mind science healing began. She realised she could heal the sick from mysterious sickness. She could heal stroke patients. Her gift advanced to Hybrid Psychic.

She sees you deeper than a mere two eyes. She could see individual beings in the spirit and in the physical. She performed numerous healings. In 1995 she was confronted with a major task of delivering a female diagnosed with HIV. She delivered the female using her mystical doctrine but sadly in payback she lost her two months pregnancy because of her failure to comply with the doctrine ethics hence non compliance practise. She delivered her chairman Dr. Ola Oki from his stroke in the year 2000 which paralysed his entire body. Prof. Thomas finally abandoned her mind science healing till she is 57 years old in 2040, but on special invitation by close friends and associates, she still exercise the use of her gift of mind science healing.

BRITISH LIFE

She later left the shores of Nigeria as a music diva in 2004 and relocated to London. In the past 17 years in United Kingdom, UK, her fame has soared all over the Queen’s enclave for a different vocation but music. It all stems from her boldness, profound ideology in litigation philanthropy and various forms of human right crusades which has brought freedom and hope to hundreds of Commonwealth citizens that were earlier facing arduous and diverse British immigration problems.

POLITICS

PROF Alexia is the Chairman, The Commonwealth Liberation Party (TCLP), an opposition government in United Kingdom, Chairman, Commonwealth Alliance Treaty Commission and President, Independent Diplomat Commission (IDC), British Naturalized citizen whose face is very familiar in most homes in United Kingdom (UK) through her regular legal assistance to hundreds of Commonwealth citizens entering UK having various Immigration issues or court representation through her sound litigation attorneys who offers several assistance to citizens of Commonwealth inside UK that are having challenges with either the British police, Immigration or Home Office over illegal arrests or detention.

Alexia, highly revered for her political stance, economic acumen, human rights concepts amidst Commonwealth communities for her rich and deep knowledge repertoire all over Europe and UK revealed that she renounced her Nigerian nationality officially January 12, 2015 due to spiritual ideology of Queen Elizabeth 1 living in her which led to her belief, “I have renounced my Nigerian nationality on January 12, 2015 for British citizenship. I still retain my Nigerian heritage with ancestry rights. My skin may be black, but my mentality is that of a white person due to my deep spiritual inclination with Queen Elizabeth 1 of England, Her Majesty described in Hall of Fame as royal monarch whose name was epochal in world history for her sense of duty, preserving English peace and stability at a personal cost.”

“Since Queen Elizabeth 1 lives in me, I strongly believe Countries of Commonwealth nations deserve total freedom through enforcement of free trade, travel and currency. We are to enforce Nations of Commonwealth in prompt obedience to upholding Articles 9, 13,15, 22 and 26 of Universal Declaration of Human Rights (UDHR) 1948 United Nations Members State Bonded Oath of Allegiance. I am in the know that based on my work as an Independent Diplomat, I’m a Citizen of the World.”

ACTIVISM

In her quest to lead the ‘Movement of Liberation’ and ‘Prepare Men and Women for the Battle of Armageddon an ‘Enforcement of the Manifesto Mandate 21st Century of 2021, for a ‘Face of Change, ‘She Faced Challenges And Trials’, ‘She Faced Death’, ‘She Got Oppressed’, ‘She Was Imprisoned’, ‘The System Humiliated and Manipulated Her’, ‘She Wrote Free Nobles Of Consciousness Of Man’s Will For Government’, ‘Her Reforms were passed in to Law’, ‘Her Ideas Were Stolen’ And ‘She Was Denied Recognition’. To understand the Myth of Her Knowledgeable Professor Alexia Thomas in finding a lasting solution of the problems of the Countries of the World and healing the pains with her Clinic of the Orthodox School of Thoughts, to treat the psychological torture Men, Women and Children have suffered for years from generations to generations, ‘Her Actions, World, Command, Authority and Power Can Be Interpreted For Man To Understand That Her ‘MISSION’ in the World is AN ORCHESTRATION OF A SYMBOLIC SUPERNATURAL BEING THROUGH THE FILM TITLED ‘THE CLASH OF THE TITANS’.

In one of her quest for fighting slavery, injustice and dehumanization of united kingdom border agency, ukba against commonwealth citizens happen to hit rock as the strides she has made in nearly two decades seem not to be going well with some people at the united kingdom border agency (ukba).

In some of her moves, she wrote letter to commissioner of police, metropolitan police, new scotland yard

Titled: “ukba personnel plot, decoy to assassinate me and eliminate my family”- 24th July 2008 ,

She narrated that her life was threatened daily by some personnel of ukba, especially from oakington and collinbrook detention centers, because i fight against the injustice orchestrated on commonwealth citizens.”

She exhibited strong political will as such in local election In United Kingdom (UK)( 5th May 2016), ‘Britain Must Leave European Union, Commonwealth Citizens Don’t Cast your Vote for Britain in EU’

She stood by to agree that European Union (EU) Treaty must be abolished and the European Union must be dissolved. She quoted: “You Cannot Push the Wagon into the Future without Retrogressing into the Past.”

In the coming UK election, Britain Must Leave European Union or else they must be ready to kill Her Monarchy and destroy The Commonwealth. Commonwealth Citizens are advised not to vote Britain in EU.”

She maintained that there are Secret Plot of EU Agenda and Hunt for Judaism Exposed and Uk making unending profit through Royalties for Commonwealth Nations.

Prof Thomas informatively backed her party statement of Britain Must Leave European Union, Commonwealth Citizens Don’t Cast your Vote for Britain in EU

by exposing the relationship that exist between EU and Chinese Government, according to her: “The EU are busy occupying the Agenda of Great Britain, so also the Chinese Government are busy occupying the Agenda of Commonwealth Nations. What do both the EU and the Chinese Government intend to achieve by plotting Great Britain and Commonwealth Nations? The God of Men should watch out as the Dragon of Hell is being controlled in the body of Man to destroy the World.”To clam it all, European Union Treaty is a Criminal Act

As an activist, the rights activist also accused the police in the country of illegally detaining people in their cells against their rights. She named the British Immigration and other such law enforcement agencies as culpable in the silent killing of citizens from Commonwealth. These killed citizens, according to her, are buried in unmarked graves.

The rights activist also accused the police in the country of illegally detaining people in their cells against their rights.

In a petition she wrote and copied all top officials of government as well as the office of the Queen, Professor Thomas said Sir Bernard Hogan-Howe, the Commissioner of Police, New Scotland Yard could be stripped off his honour for allowing injustice on the citizens of the nations of Commonwealth.

“Mr. Commissioner, your office cannot be in denial of the death toll of Commonwealth citizens. The British Immigration officers have been destructive as their views of the Commonwealth citizens are human bugs…” She said.

She wrote the British Police Commissioner a letter dated 26 February, 2016 over rights abuse and queried Why Commissioner of Police must open up on historical & current cases of homicide and copied Copied Queen Elizabeth II, Prince of Wales, Prime Minister, Buckingham Police Dept, Parliament; House of Commons, Foreign & Commonwealth Office

In a letter also copied to Queen Elizabeth II, Prince of Wales, Prime Minister, Buckingham Police Dept, Parliament; House of Commons, Foreign and Commonwealth Office in a bid to bring to their attention all salient issues raised, Professor Thomas said: “The police should stop the immigration officers commissioned as Cameron’s stormtroopers to stop killing the Commonwealth citizens and to stop destroying their values as they are not the British peoples’ problem but instead the British are their own muggers because they cannot survive without the Commonwealth countries.

“Sir Bernard Hogan-Howe, as a law graduate, I would have expected that you challenge the obscenity of Cameron’s government, rather you will see it has nothing to do with you and you refuse to expose the atrocities committed against the citizens of Commonwealth. Your officers must check themselves, they have failed their strangers unequivocally and your land, their settlement.

“The whole British Police Force needs serious overhauling of their institution as their criminality has brought dis-reputation to law integrity. You have soaked yourself in political mud of corruption. The British Police as a Force now confraternized and using deceit diplomacy to imprison people .

Why Commissioner of Police must open up on historical & current cases of homicide

For the purpose of truth, justice, fairness and posterity, Professor Thomas brings to the attention of Sir Bernard Hogan-Howe the need to open historical and current cases of homicides. She said: “Mr. Commissioner, your office must open historical and current cases of homicide as judgement must prevail; hence no man is above the law.

“Failure to open these investigations becomes evidential race superiority complex is a sicken trait, therefore Britain rather be an Island of its own, so Commonwealth nations must not be cheated in a white man’s deceit to steal their Gold and give them rubbles.

“Evidence proving that immigration officers killed unlawfully is in a letter on our server which in its re-investigation is a cold case as justice is required for the unlawful death of the Commonwealth citizens and ignorance of duties is death of service.

RELIGION

Prof Alexia believes in Saintism, Saintism’ as a religion which protects the human race, she strongly holds that Saintists are human guardian angels.

Saintism Practise is the religion that appreciates the beauty of human creation. The Movement of the Independent Diplomat Commission (IDC) gave birth to the Saintism Practise. Saintism Religion is about using the powers of Natural Mystic to regress to the Orthodox Teachings, perceiving Nature Equilibrium where Humans agree to accept other breeds by emanating energy from Mystic of Nature Philosophizing today man purported as Illusion Imagination.

Newest Saintism religion could impact lives of millionaires, billionaires and people that are exposed to all the atrocities being perpetuated by religious leaders in exploiting the black race, amongst other issues. Saintism religion protects human race

POSITION.

Professor Alexia Thomas Founded Independent Diplomat Commission on the 6th May 2007 and later became the Company Secretary of Independent Diplomat Commission in July 16, 2010

She founded The Commonwealth Liberation Party (Political Party In Britain) and she is the Party Leader and Nominating Officer of The Commonwealth Liberation Party which was registered on 25th March 2015

She is the President And Chairman of Independent Diplomat Commission (IDC) till date

She became the Company Director of Independent Diplomat Commission in August 13, 2009

Business

Deadline of Compliance: Nigeria’s Urgent Call for Tax Return Filing

Deadline of Compliance: Nigeria’s Urgent Call for Tax Return Filing

By George Omagbemi Sylvester | Published by SaharaWeeklyNG.com

“Shift or Structural Demand? A Declaration of Civic Duty in a Nation at a Fiscal Crossroads.”

In the unfolding narrative of national development and economic reform, few instruments are as defining as tax compliance. For Nigeria, a nation perpetually grappling with revenue shortfalls, structural dependency on a single export commodity, and entrenched informal economic behaviour, the Federal Government’s recent clarification on tax return deadlines is not mere bureaucratic noise. It is a deliberate and inescapable declaration: the social contract between citizen and state must be honoured through transparent, lawful and timely tax reporting.

At its core, the government’s pronouncement is stark in its simplicity and radical in its implications. Federal authorities, speaking through the Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, have made it unequivocally clear that every Nigerian, whether employer or individual taxpayer, must file annual tax returns under the law. This encompasses self-assessment filings by individuals that too many assumed ended once employers deducted pay-as-you-earn taxes from their salaries.

This is not an optional civic suggestion, it is mandatory, backed by statute, and tied to a broader vision of national fiscal responsibility. Citizens can no longer hide behind ignorance, apathy, or false assumptions. “Many people assume that if their employer deducts tax from their salaries, their obligations end there. That is wrong,” Oyedele warned, emphasizing that the obligation to file remains with the individual under both existing and newly reformed tax laws.

The Deadlines and the Reality They Reveal.

Across the federation, state and federal revenue authorities have reaffirmed statutory deadlines in pursuit of compliance. The Lagos State Internal Revenue Service, for instance, moved to extend its filing date for employer returns by a narrow window, reflecting the reality that compliance often lags behind legal timelines. The extension was intended not as leniency, but as a pragmatic effort to allow accurate and complete submissions, underscoring that true compliance rises above mere mechanical ticking of a box.

At the federal level, Oyedele’s intervention was even more fundamental. He reminded Nigerians that annual tax returns for the preceding year must be filed in good faith, with integrity and in respect of the law. This applies regardless of income level including low-income earners who have historically believed that they are outside the tax net. “All of us must file our returns, including those earning low income,” he stated.

Herein lies one of the most challenging truths of contemporary Nigerian governance: widespread tax non-compliance is not just a technical breach of law, it is a deep cultural and structural issue that reflects decades of mistrust between citizens and the state.

The Root of the Problem: Non-Compliance as a Symptom.

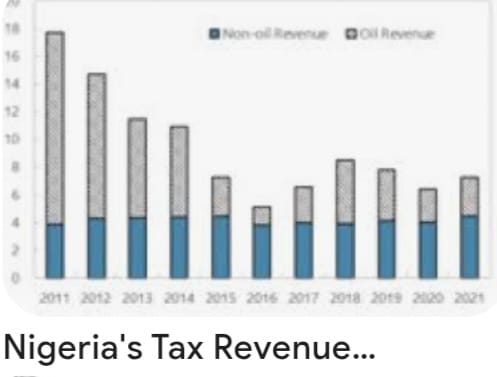

Nigeria’s tax culture has long been under scrutiny. Public discourse and economic analysis consistently show that a significant majority of eligible taxpayers do not file annual returns. Oyedele highlighted that even in states widely regarded as tax administration leaders, compliance remains strikingly low, often below five percent.

This widespread non-compliance stems from multiple sources:

A long history of weak tax administration systems, where enforcement was inconsistent and penalties were rarely applied.

A perception that public services do not reflect the taxes collected, eroding the citizenry’s belief in reciprocity.

An informal economy where income often goes unrecorded, making filing seem irrelevant or impossible to many.

Lack of awareness, with many Nigerians genuinely believing that tax liability ends with employer deductions.

The government’s renewed push for compliance directly challenges these perceptions. It signals a shift from voluntary or lax compliance to structured accountability, a stance that aligns with best practices in modern public finance.

Why This Matters: Beyond Deadlines.

At its most profound level, the insistence on tax return filings is about nation-building and shared responsibility.

Scholars of public finance universally agree that a robust tax system is the backbone of sustainable development. As the eminent economist Dr. Joseph E. Stiglitz has observed, “A society that cannot mobilize its own resources through fair taxation undermines both its government’s legitimacy and its capacity to provide for its people.” Filing tax returns is not a mere administrative task, it is a declaration of participation in the collective project of national advancement.

In Nigeria’s context, this declaration carries weight. With the enactment of comprehensive tax reforms in recent years (including unified frameworks for tax administration and enforcement) authorities now possess broader statutory tools to ensure compliance and accountability. These measures, which include electronic filing platforms and stronger enforcement powers, have been framed as fair and equitable, targeting efficiency rather than arbitrariness.

Yet the success of these reforms depends heavily on citizens embracing their civic duties with sincerity. And this depends on mutual trust, the belief that paying taxes yields tangible benefits in infrastructure, education, healthcare, security and social services.

Voices From Experts: Fiscal Responsibility as a Public Ethic.

Tax law experts and economists, reflecting on the compliance push, have underscored a universal theme: taxation without transparency is inequity, but taxation with accountability is empowerment. When managed with fairness, a functional tax system can reduce dependency on volatile revenue sources, stabilise national budgets, and support long-term investment in human capital.

Professor Aisha Bello, a respected authority in fiscal policy, notes that “Tax compliance is not a burden; it is the foundation upon which social contracts are built. A citizen who honours tax obligations affirms the legitimacy of governance and demands better performance in return.”

Similarly, a leading tax scholar, Dr. Emeka Okon, argues that “The era when Nigerians could evade broader tax responsibilities simply because automatic deductions occur at source must end. For a modern economy, every eligible citizen must be part of the formal tax fold not as victims, but as stakeholders.”

These authoritative voices point to an unassailable truth: filing tax returns is both a legal requirement and a moral responsibility, an expression of citizenship in its fullest sense.

Challenges on the Ground: Compliance and Capacity.

While the rhetoric of compliance is compelling, the reality on the ground demands nuanced understanding. Many taxpayers (especially in the informal sector) lack meaningful access to digital platforms and resources for filing returns. For others, the fear of bureaucratic complexity and perceived punitive enforcement deters participation.

The government, for its part, has responded by promoting online systems and pledging greater taxpayer support. Tax authorities are increasingly engaging stakeholders to demystify filing processes, explain requirements and offer assistance. This mix of enforcement and facilitation is essential. As one seasoned revenue specialist observed: “The state cannot compel compliance through force alone; it must earn it through education, simplicity and fairness.”

The Broader Implication: A New Social Compact.

Ultimately, Nigeria’s renewed emphasis on tax return filing transcends administrative deadlines. It is an unequivocal declaration that national development is a shared responsibility, that citizens and state must engage in a transparent, accountable, and reciprocal relationship.

Tax compliance, therefore, becomes far more than a legal act; it becomes a moral claim on the nation’s future.

When citizens file their returns honestly, they affirm their stake in the nation’s destiny. When the government collects taxes transparently and deploys them effectively, it strengthens not only public services but civic trust itself.

In this sense, the deadlines proclaimed by Nigeria’s fiscal authorities mark not an end but a beginning; the beginning of a civic epoch in which accountability replaces apathy, participation replaces indifference and national purpose triumphs over fragmentation.

The road ahead will not be easy. But in demanding compliance, Nigeria is demanding more than tax returns. It is demanding commitment and that, ultimately, is the foundation on which nations are built.

Business

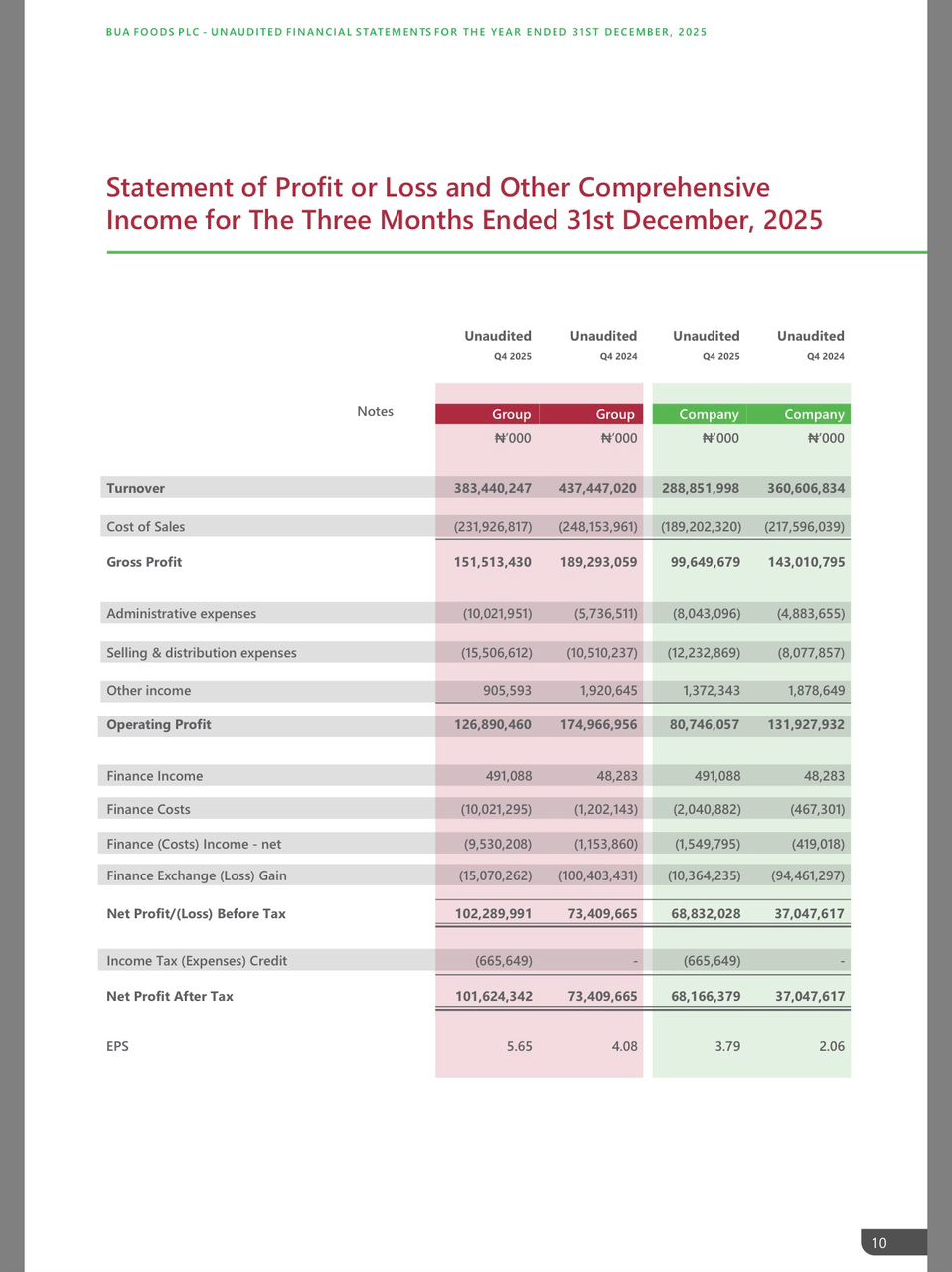

BUA Foods Records 91% Surge in Profit After Tax, Hits ₦508bn in 2025

BUA Foods Records 91% Surge in Profit After Tax, Hits ₦508bn in 2025

By femi Oyewale

Business

Adron Homes Unveils “Love for Love” Valentine Promo with Exciting Discounts, Luxury Gifts, and Travel Rewards

Adron Homes Unveils “Love for Love” Valentine Promo with Exciting Discounts, Luxury Gifts, and Travel Rewards

In celebration of the season of love, Adron Homes and Properties has announced the launch of its special Valentine campaign, “Love for Love” Promo, a customer-centric initiative designed to reward Nigerians who choose to express love through smart, lasting real estate investments.

The Love for Love Promo offers clients attractive discounts, flexible payment options, and an array of exclusive gift items, reinforcing Adron Homes’ commitment to making property ownership both rewarding and accessible. The campaign runs throughout the Valentine season and applies to the company’s wide portfolio of estates and housing projects strategically located across Nigeria.

Speaking on the promo, the company’s Managing Director, Mrs Adenike Ajobo, stated that the initiative is aimed at encouraging individuals and families to move beyond conventional Valentine gifts by investing in assets that secure their future. According to the company, love is best demonstrated through stability, legacy, and long-term value—principles that real estate ownership represents.

Under the promo structure, clients who make a payment of ₦100,000 receive cake, chocolates, and a bottle of wine, while those who pay ₦200,000 are rewarded with a Love Hamper. Payments of ₦500,000 attract a Love Hamper plus cake, and clients who pay ₦1,000,000 enjoy a choice of a Samsung phone or a Love Hamper with cake.

The rewards become increasingly premium as commitment grows. Clients who pay ₦5,000,000 receive either an iPad or an all-expenses-paid romantic getaway for a couple at one of Nigeria’s finest hotels, which includes two nights’ accommodation, special treats, and a Love Hamper. A payment of ₦10,000,000 comes with a choice of a Samsung Z Fold 7, three nights at a top-tier resort in Nigeria, or a full solar power installation.

For high-value investors, the Love for Love Promo delivers exceptional lifestyle experiences. Clients who pay ₦30,000,000 on land are rewarded with a three-night couple’s trip to Doha, Qatar, or South Africa, while purchasers of any Adron Homes house valued at ₦50,000,000 receive a double-door refrigerator.

The promo covers Adron Homes’ estates located in Lagos, Shimawa, Sagamu, Atan–Ota, Papalanto, Abeokuta, Ibadan, Osun, Ekiti, Abuja, Nasarawa, and Niger States, offering clients the opportunity to invest in fast-growing, strategically positioned communities nationwide.

Adron Homes reiterated that beyond the incentives, the campaign underscores the company’s strong reputation for secure land titles, affordable pricing, strategic locations, and a proven legacy in real estate development.

As Valentine’s Day approaches, Adron Homes encourages Nigerians at home and in the diaspora to take advantage of the Love for Love Promo to enjoy exceptional value, exclusive rewards, and the opportunity to build a future rooted in love, security, and prosperity.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

Business6 months ago

Business6 months agoBatsumi Travel CEO Lisa Sebogodi Wins Prestigious Africa Travel 100 Women Award

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING

You must be logged in to post a comment Login