Business

PROF. ALEXIA THOMAS, CHAIRMAN, TCLP UK – THE ORACLE THAT SPOKE ABOUT DAVID CAMERON’S EXIT AS BRITISH PRIME MINSTER

Consequent upon Professor Alexia Thomas’ announcement on 6th of January 2016 and officially released to the Media Press 12th January 2016 as a proclamation that Britain’s Prime Minister, David Cameron’ government would be aborted, many received the awakening news with different perceptions but the fierce Chairman of Britain’s opposition party, The Commonwealth Liberation Party (TCLP) stood her ground maintaining Cameron will definitely be booted out of office on or about April 24.

After warning Cameron’s government of stealing through taxation of income Tax/VAT among other consequential allegations, Prof. Thomas stressed the government lost its bid of representing the People by practicing Terror Justice and Tyranny against Members of the Commonwealth Nations.

Not only that, a stern warning was similarly sent out to the People of England when the TCLP Chairman adjudicated and pronounced that Britain must leave European Union, during which she implored Commonwealth Citizens not to cast their votes for Britain to remain in EU.

As the various campaigns for and against the referendum heightened, Prof. Thomas reiterated in an interview with SAFARI NEWS, saying Cameron knew his time was up because the Oracle had spoken. He had made up his mind top leave since April 24 but it was all a game for him to have remained to witness the voting yesterday”.

At the early hours of today however, the World woke up with the News that Britain had claimed back its birthright by leaving the EU, a confirmation of Prof. Alexia Thomas’ April 6 proclamation and indeed, not only did Britain voted itself out of the EU, Prime Minster David Cameron at the break of the elections results, swiftly bowed out when he announced his immediate resignation as the PM.

Speaking with SAFARI NEWS immediately after the pronouncement of Cameron’s resignation, the Royal Mother as she’s fondly referred to asserted that, “the World hasn’t seen anything yet, my revelations are out to open Peoples’ eyes and for Cameron, he knew his time was up. For Britain leaving the EU, it was something that must happen because Britain needed to take back its place to save its Monarchy from being quashed, the same way the UE had done to their domains”.

Another shocker as Prof. Alexia Thomas handed down is, “Those that have been married to EU Citizens as a result of the EU Club arrangements are in for a surprise. Such marriages will sure be revoked by the time I continue to open up the consequences of the Confraternity”.

Here, we produce excerpts of Prof. Thomas’ pronouncement of abolishment of Cameron’s government on 24th April 2016.

“WHERE Justice Is Denied, Where Poverty Is Enforced, Where Ignorance Prevails, And Where One Class Is Made To Feel That Society Is An Organized Conspiracy To Oppress, Rob And Degrade Them, Neither Persons Nor Property Will Be Safe”, Postulates Frederick Douglass.

It is an open-secret that the present Conservative style of Governance being led by David Cameron, British Prime Minister is built on Injustice, Evil, Oppression, Enslavement Mentality of the Coloured People with the sole intentions to practicing Terror and Tyranny against the People of Commonwealth Citizens. Certainly, this secretive group Cameron belongsis an organized conspiracy to oppress, rob and degrade the Coloured people.

Professor Alexia Thomas, Chairman, The Commonwealth Liberation Party, TCLP, UK flays the wickedness on-going in British Government under the watchful eyes of Cameron and why his government would be abolished on or before 24thApril. Her press statement in London reads: “Your Policies are very contagious and destructive to Human Race, certainly denial is not an option. My Press statement dated 22/11/2015 clearly defined Constitution of Democratic System of Government Principles and practice as taught by the founding fathers headship Thomas Jefferson, the 3rd President of United States. Your Party has been a very destructive one-killing the Welfare and Wellbeing of the Coloured People and you will agree with me it is fair to ask the Queen Elizabeth II to use her Monarchical Powers to abolish your leadership or alter it by simply transferring powers to Labour Party headship.

“Monarchical Throneship of Queen Elizabeth II has Powers to abolish your Leadership as this may not have been used before or such Redress of Government Abolishment has not been used since the 16th Century after the beheading of the King Charles I, though his death gave Rights to Ordinary Men like yourself the privileges to come to Power through enacting the Bill of Rights 1689.

As the Chairman of The Commonwealth Liberation Party (TCLP) and the Chieftain of Commonwealth Treaty Alliance Commission, I tell you today such Powers to abort your Government will be executed on or before the 24th of April 2016, if you and your Cabinets Ministers fail to behave yourselves. Mr. David Cameron, know your Government could be pardoned from Penalty of Guilt as your Ignorance of lack of Political Mythology could eliminate your accountability to the Destructive values brought upon the People of the Commonwealth.

On Cameron’s Government stealing from the citizens through tax exploitation, Professor Thomas said: “Your Government is Power intoxicated as through the Peoples’ votes you have Audaciously run United Kingdom Nation as an Outlaw Bandit, exploiting the Taxation System of Income Tax and VAT Tax at 20%, very unreasonable as this is stealing from the Citizens. Mr. Cameron how dare you Slander the Citizens of the Commonwealth Nations with Immigration Law, a Sham Legislation knowingfully well Britain never had Permittal to make 53 Commonwealth Nations their Colonies but instead forced Mastered them through Fierce and Death. We should be fair as a Race to the Cores Values of Commonwealth Nations who Britain bothered their Isolation and forcefully coerced them to accept the British Heritage in 15th Century ago.

Unlimited Travel access to Commonwealth Citizens

In hurtful tones, her letter reads: “Mr. Cameron, know it today United Kingdom is indebted to the Commonwealth Nations and their Citizens. Until the 51 Countries of African and Asia Continents realise Full Civilization, their Citizens must continue to have Unlimited access to Travel to the United Kingdom and the Immigration Confraternity Laws debarring their Rights must be abolished without Deliberation or Compromise. To this End, all Immigration Detention Centers in the United Kingdom must be demolished and all the German Investors having Shares in the Immigration Business and Services of Border Control and Technological Facilities should be paid back their Investment as they must now find other Trade to make their gains because the Commonwealth Citizens Detention is not a Sector for Investment. Simply do not Say no Money to pay them. The process is simple, just Print more money and pay them as Money is a Piece of Paper meant to fool the Governed because Politics is a Ghostly Operations.

“United Kingdom found Riches and Greatness in the 15th Century from the Commonwealth Countries and their Citizens and till date, your Government is still in continual receipt of Royalties from these Poor Slaved Continents of Africa and Asia, yet your Conscience fears no Retribution, because God created them to be of less Values to the White Race. This should not be a bias reason because Humans has bigger Brains, so the Conscience of Guilt should supersede Conscience of Destruction of the Human Race and for this reason Slavery as a Business was abolished in United Kingdom and America.

David Cameron’s Govt to Disband from Office

Standing on truth, Professor Thomas dares British Prime Minister when she explained: “Mr. Cameron, I say unto you Verily, Verily, Verily, your Government will be Disband and Disgraced out of Number 10 Downing Street. Know very well as I said this Words to you, we are Equal in Powers of Governance and the difference is your Vote gives you access to Print Money and control UK Money Supply and the Economy. The only reason you may gullibly assumed you are more Superior than myself is because the Police, Army, Navy, Immigration and Crown Servants are paid by your Government. Mr. Cameron I am your Competitor and as an Opposition Government, we “The Commonwealth Liberation Party (TCLP)”, are not readily bothered about who Rules.

What matters is who Rules the People of United Kingdom must have the Knowledge, the Principles, the Respect, the Compassion, the Protection, the Appreciation and the Values to the People with Rights of Sovereignty.

“Any Ruling Government must respect Human Values, Integrity and Dignity of Human Substance. If you read ‘TCLP’ Teachings and Doctrines, you will see our generosity over view in a Reflection, as I will expect you this year to get some serious Education and your Cabinet Ministers should equally go for Mind Development Training on Humanity Courses or else they could possibly go to Jail ‘En masse’ in the next 15years because of the ‘Enormous and Ferocious Atrocities’ they have committed in the Term of your Government. Money is simply irrelevant as you know the Tricks in Government since Headship. Money is a Piece of Paper. The fact your Conservative Party has made it more important than Human Lives and values, the need of changing School Syllabus is essential. The Amendment of School Syllabus and Curriculum Vitae is Mandatory; So Students will be taught Humanity and Human Values as a Course and the Consciousness of Resistance to refuse Cash, among others.

However, following the much-publicised campaigns and lobbying for Britain’s remaining in the European Union, Her Knowlegeable Prof. Alexia Thomas on April 20 send strong warnings to the British people not to allow the “EU Club” to kill its Monarchy by taking to remaining in the EU.

Here’s the excerpts from her April 20 warnings which actually came to pass earlier today;

“In her published article- ‘The Secret Plot of the EU and the Hunt for Judaism’, her Mythological teachings illustrated the fierce Wars of the EU Criminal Masterminded plot, rivalry fierce battle between the British Empire and the German Nation dates back to the era of 18th Century when Queen Victoria, the Great Grand Mother of the current Queen Elizabeth II was on the Throneship. The propensity of the dispute leading to the War and the Marriage between the British Kingdom, the German Nation and all Countries in the EU started in 1914 of the First World War and 1939 of the Second World War.

Queen Victoria sent her grandson Prince Leopold Charles Edward George, Duke of Albany, Duke of Saxe-Coburg to Germany to rule her Empire. Prince Leopold Charles Edward, second Duke of Albany, Earl of Clarence and Baron Arklow, was born at Claremont House in Surrey (1884). He was Queen Victoria’s favourite grandson.

He got married to a German woman Viktoria Adelheild, Princess of Schleswig Holstein Sonderburg Gluckburg on 11thOctober 1905 in Glucksburg Castle, Gluckstadt, Slesvig-Holstein, Prussia. They had five children namely: Johann Leopold-Hereditary of Saxe Coburg Gotha, Sibylla-Princess of Saxe Coburg Gotha, Hubertus Dietmar Friedrich Wilhelm- Prince of Saxe Coburg Gotha, Caroline Mathilde-Princess of Saxe Coburg Gotha and Friedrish Josias Carl Eduard-Prince of Saxe Coburg Gotha.

Queen Victoria died and in that era the German Nation fought the British Kingdom in the First World War and Prince Leopold Charles Edward joined the German to fight against his own Country. The German lost the First World War and the Royal family of The Duke in England believes the act of The Duke to take sides with German was Traitorship. He was stripped off his Royal Peerages.

In 1918, Prince Leopold Charles Edward George was forced to abdicate his ducal throne after he joined the German Empire during World War I to fight against Britain. He was never forgiven by his cousins, as he was seen as a traitor for the role he played in First World War 1. He was banished from England. He was denied his birthright by the ruling British Empire, deprived of his British rights,denied his title of Prince and Royal Highness in British honours in 1919.

He joined the German Nazi Party and served in a number of positions in Nazi Germany, and in 1930s to 1940s was President of the German Red Cross. He was the maternal grandfather of Carl XVI Gustaf of Sweden and the younger brother of Princess Alice, Countess of Athlone. This royal Prince born in Buckingham Palace, London created Earl of Clarence, and Baron Arklow. The Germans called him Karl Eduard.

Professor Thomas Chieftain Commonwealth Treaty Alliance Commission unveiled the truth that the animosity and fierce rivalry amongst the Royal descendants of UK Monarchy and exiled descendants of the late Duke of Saxe-Coburg and Gotha settled in Germany and other countries of the EU will see the Commonwealth Nations destroyed. In that revenge of the Duke is to destroy the Commonwealth Nations which automatically end the Sovereignty of the UK and Her Monarchy.

Professor Thomas explained: “In this coming UK election, Britain Must Leave European Union or else they must be ready to kill Her Monarchy and destroy The Commonwealth. Commonwealth Citizens are advised not to vote Britain in EU.”

In a-20 pages article report titled ‘The Secret Plot of EU Agenda and the Hunt for Judaism’, her educative messages have brought huge enlightenment to Members of the Commonwealth Nations in her Mythological teaching, she states “Judaism Theory is the demolition of Commonwealth Nations through the Power of the Occultic Unions of the EU Treaty.”

For Judaism Sacred, she raised a few posers that “Since the ‘Whom’ and the ‘Whose’ from Commonwealth Countries Are Clones From The British Empire, The Nations Of Commonwealth Shall Be Marked Down To be Use As The Sacred Lamb For Sacrification; To Be Burnt, Dehumanized And Killed with Provisions To Wipe Their Generations. The Aim of the European Union Treaty is A Criminal Plot To Enact Superiority in Their Quest To Claim The British Kingdom.”

Secret Plot of EU Agenda and Hunt for Judaism Exposed

Regarding the First Apocalypse of Judaism, she said “EU Treaty is the spirit of the Hitler and Nazis transferred in Men nurtured to finish the failed struggle of their cruel ambitions to rule the World at the expense of killing the Jews the Sons of God whom they felt the race were not pure enough to live in the Face of the Earth.

She dug deep into the springing well of divinity by explaining the intricacies surrounding the Second Apocalypse of Judaism, “The plan that led to Second World War to invade Britain by Nazis to rule the World is not yet over. The tears of the grandson of Queen Victoria, Prince Charles Edward of the United Kingdom, Duke of Albany (Leopold Charles Edward George) Duke of Saxe-Coburg And Gotha from 19th July 1884 – 28th March 1954 sent to Germany by Queen Victoria to Rule her empire and whose empire was later rejected and demolished by the revolution of Germans also he was denied his birth right by the ruling Monarch in Britain because his Cousins felt, his act as traitor within the First World War was not justified.

“The EU Treaty is powered by the Criminal Mastermind as revenge from his children whose main adopted Nationality is Germany since that is the second home owned to them by their mother. The quest to revenge the denials of their father the Duke of Saxe-Coburg and Gotha is powered by their quest to destroy the British Empire.”

In the article, Prof Thomas gave insights into how Commonwealth Countries are used as sacrificial lambs and prey for sacrification in the Second Apocalypse of Judaism. Her words: “The Faith Of The Jews Massacred By The Nazis Is Beginning To Unfold For The Citizens From Commonwealth Nations, As Gradually They Are Being Haunted For Their Vulnerability, Charged For Offences Not Committed By Them, Sentence To Prison For An Unjust Penalty, Killed Silently For The Offences Of The Children Of Anomalies, Made To Work Tirelessly, Made To Work With No Hope Of Ever Claiming Their Benefits, Made Redundant In A Country They Only Visited As Labourers As With No Option Of Passport Or A Pass Issued To Them, They Have No Hope Of Ever Seeing Their Beloved Country.”

She talks about Affirmation of Judaism Sacred by saying “To prove preparation to destroy the future of the Commonwealth Countries Citizens is unfolding; The British Government has been made the Scapegoat. They have been set up by the EU Cult to use their hands to ruin their Clones amidst the ‘Whom’ and the ‘Whose’ of the Commonwealth Countries.

“More prisons have been planned and constructed, as the current ones that houses the Commonwealth Citizens Captive are full. The Children of Commonwealth Nations are rusting in the Prisons and various Detention Centres awaiting their faith for the Sacred of Judaism while most are there for more than two years. The British Government are too busy to understand the Propaganda and allegation of the false information set up to keep Commonwealth Citizens captives in Prisons and Detention Centres for no offence or wrong doing, they have done to deserve such a horrible fate.”

This Human Rights Advocate listed various phases in which the layers of sacred of Judaism are mapped out. She analyzed the methodology as: “Those With No Papers Are Returned To Their Countries, Those With Papers Are Not Allowed To Renew Their Visas, Those With Residence Status, Their Papers Are Revoked, The Plot For Mass Deportation, The Plot To Set Up Bigger Camps To House Them, The Plot To Kill Them Silently If They Show Resistance and The Plot To Wipe Out All Their Generations.”

Prof Thomas named other ‘Current Prisons for Judaism Sacred’ to include: “Dover Removal Centre, Collinbrook Removal Centre, Oakington Removal Centre; Hamasworth Removal Centre, Dungavel Removal Centre, Masefield Removal Centre, Lindholam Removal Centre, Yarl’s Wood Removal Centre, Haslar Removal Centre Tinsley House Removal Centre and . Her Majesty Prisons.” Just as the names are illustrated, it is obvious proof that all Detention Centers in UK are named in German dialect, simply means the Germans are at War with the Nations of the Commonwealth with intentions to destroy their citizens for that reason they build concentration centers in UK.

On how dreadful the reality of Judaism is, she further explained the process as “To demolish Commonwealth Nations by virtue of their vulnerability as a Continent less powerful, To displace them through means of Mass Deportation and to revoke their Right to enjoy the immunity promised them by the British Government prior to their Independent.”

She gave three definitions on the ‘Deceit of Judaism’ which she described, First Definition: “A Premeditated Attempt By The Union Of EU To Get The British In Alliance To Build Structures That Will Accommodate Their Children Within The Territory Of The British Kingdom.

Second Definition: “The Distraction Of Great Britain Made Incapacitated Of Their Vision For Themselves And Their Great Nation.

Third Definition: “A Decoy To Lure Great Britain To Work Tirelessly To Generate Funds For The Union Of EU At The Expenses Of Feeding Their Children Of Anomalies Who Are Bastards And Traitors To The British Empire.”

EU and Chinese Govt. Unity

Prof Thomas informative statement exposed the relationship that exist between EU and Chinese Government, according to her: “The EU are busy occupying the Agenda of Great Britain, so also the Chinese Government are busy occupying the Agenda of Commonwealth Nations. What do both the EU and the Chinese Government intend to achieve by plotting Great Britain and Commonwealth Nations? The God of Men should watch out as the Dragon of Hell is being controlled in the body of Man to destroy the World.”

As an Oracle, Prof Thomas has predicted that in ‘The Apocalypse of Judaism’, the EU in the formation of 28 countries fused in a tyrannical mission with main sole purpose to rule the World by ‘Force’ or by ‘Death’.

The EU plot the eradication and the displacement of Citizens of Commonwealth by means of Mass Deportation. The EU quest is to remove Citizens of Commonwealth from all European Countries thereby making the British Kingdom infiltrated with the Children of Anomalies who are trained to be a Sons of Adoption by Birth or Migration. The EU motives are to wage ‘War’ against a Nation in a rebirth to achieve the goals of their forefathers to topple the British Monarchy. The EU rebellion is to bring down the British Monarchy, giving them the chance of motivation to claim the land that belongs to the God of Men.

“If they fail the target of their evil plot which is inevitable, the consequences is they have nothing to lose. They Will Persistently Aim Their Target At Destroying Great Britain By Virtue Imagination Of Their Propaganda To Fume War. You cannot avert their plot because they live amidst the God of Men through their different colours of rainbow, decoyed like chameleons, shaded in different colours, for they see you and you cannot see them and when they plot they succeed before you can put a fight back.

“The Death Of God Of Men Cannot Be Averted Because They Have Foolishly Accepted The Children Of Anomalies Who Have Traded Their Deceit In Pretense For Passion As They Came Like Strangers Into Your Territory For No Good, But To Reap Your Goodies And Deny You The Merit Of Your Profit.

Under ‘The Plague of Revenge’, Prof Thomas noted that “The Adoption of Children of Anomalies through the EU Treaty is a Threat to Great Britain, as the Spirit of the Fathers of the Children of Anomalies is to persistently quest for the failure of their defeat through Revenge.”

Entering deeper into divinity, Prof Thomas statement elucidates on ‘Voices from the British Empire’, which the reason she said “The only solution is to keep the purity of Great Britain whose faith has suffered many Battles of Invasion from Century after Century, through the Ascension of the future Kings to the Throne and their Heirs. Britain are to stand against the invaders and the Children of Anomalies.”

European Union Treaty is a Criminal Act

Prof Thomas exposed ‘EU Treaty Criminal Mastermind’ as: “The Birth of the EU is formed on the foundation of Hitler and Nazis failed premeditated plot to Rule the World, the foundation of a molten boiling Tyrant, a Criminal Mastermind plotted to make The EU a World Power. The EU feared that the United States of America might be the next most powerful Nation while Objectives of the EU are hidden and mastermind as a Secret to aid their uprising Agenda.”

The article expressed analytical education into the reality of Judaism when it asked some questions and made revelations into how the ‘EU Treaty is a Threat’ as it reads: “If EU was founded on a positive intention, then why did it marginalized Africa, Asia and Caribbean? Within the EU Countries, the poorest Countries also formed part of the EU Government, then why are the benefits of Trade and Travel not enjoyed by the marginalised Continents such As Africa, Asia, Caribbean and Middle East?

“It is obvious the EU Referendum is not formed with genuine objectives, rather on the basis to up rise a Movement that will threaten all other Continents .The EU forming a Treaty with a controlled Unitarian Government is a decoy to emancipate power.

“EU TREATY IS A THREAT: All Countries Should Be Made To Build Their Own Sustainable Government Through Education Given To Their People By Defining How Well They Sustain A Democratic Governance Free Of Corruption To Suit The Needs Of Their Citizens.

“If Great Britain is wise enough they should refuse the EU Treaty And All Countries Should Lead Themselves With Their Own Goals And Objectives To Suit Their Citizens According To Their Culture And Heritage. EU Referendum Should Be Abolish And A Referendum Of Friendship For Neighbouring Territory (FFNT) Be Consented And Not EU Treaty.”

Prof Thomas gave deep insights to inner-working of ‘EU Uprise Plot’ when she explained that “United Kingdom is the only Country in the World with a strong Monarch, All EU Countries have no Monarch and if they do, their Monarch is neither strong nor active compared to the Great Monarch in Britain and Many of the EU Countries have ruined their own Monarch because of their foolishness of assuming a Monarchy is formed by privilege of Nature.”

How about the unseen consequences of every action so far taken regarding the EU? This cerebral woman stated that “The Criminal mastermind, whose hidden objectives gave birth to EU is a decoy to conquer the World in pretence, fuming from an alliance with a Government of her own.

“EU has successfully emancipated 28 Countries within the EU states to sign the EU Treaty . These countries are: Austral, Portugal Luxemburg, Cyprus, Slovenia, Netherlands; Denmark, Sweden Poland, Finland, Belgium, Slovakia, Germany, Czech Republic, Spain, Hungary, Estonia, Switzerland; Irish Republic, France, Liechtenstein, Latvia, Greece, Norway, Lithuania, Iceland, Malta and Italy.”

The over-ambition of EU Government to ensure superiority over all other countries in the world comes under ‘EU Treaty Decoy’, whose aim Prof Thomas said: “To make the EU Government superior over all other Government in the World, To make Britain and other Countries second class, To be dictators having Power over directives to control the Union of Countries within the EU Cult, To contest their strength with United States of America whose Power, Energy and Strength emancipated from Great Britain; To be stronger through Union of EU To challenge The only Monarch in Great Britain, To use their Union through Treaty in pretence to undermine the existence on why the Monarch in Great Britain should not be allowed to exist; To enforce Nations by Acts of Tyrannical Dictatorship through Trade, Currency, Economy, Power and Crude Oil, To secure an EU Army through a premeditated Criminal plan, if successful after 50 years of existence, this can lead to third World War.”

To proffer a lasting solution in solving the plethora of problems facing countries in the world, Professor Thomas in healing the peoples’ pain with her Clinic of the Orthodox School of Thoughts enumerated: “To Heal The Wound And Pains Of The Oppress Which Is Now Enforceable And Appraisals must be consented and payment duly awarded to the Citizens of the Commonwealth Countries who are the Children of Grace because ‘THE WILL OF MAGNA CARTA HAS BEEN BROKEN AND MAGNA CARTA THE LAW OF MAN’S FREE WILL LIBERTY TO BE FREE HAS BEEN BREACHED’, THE GOD’S OF THE WORLD MUST BE APPEASE TO FORGIVE HIS SONS OF RULERSHIP to breed the Sanity to live and their Souls be allowed eternal life for rebirth. Therefore to Appease the Vengeance of Magna Carta which is the ‘HUNT’ Of The GHOST OF KING JOHN (1166 – 1216) And The Spirit Of QUEEN ELIZABETH I (1558 – 1603)’ then Appraisal must be consented and sacrifice of dues to be paid to Man is a must mandate.”

Business

Deadline of Compliance: Nigeria’s Urgent Call for Tax Return Filing

Deadline of Compliance: Nigeria’s Urgent Call for Tax Return Filing

By George Omagbemi Sylvester | Published by SaharaWeeklyNG.com

“Shift or Structural Demand? A Declaration of Civic Duty in a Nation at a Fiscal Crossroads.”

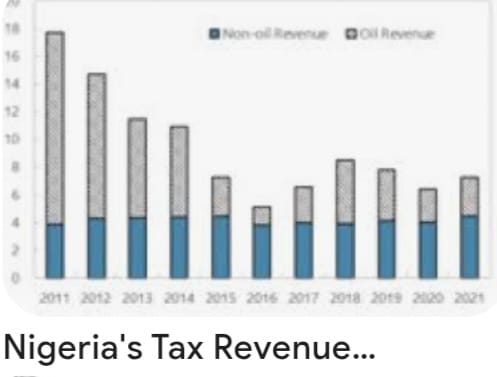

In the unfolding narrative of national development and economic reform, few instruments are as defining as tax compliance. For Nigeria, a nation perpetually grappling with revenue shortfalls, structural dependency on a single export commodity, and entrenched informal economic behaviour, the Federal Government’s recent clarification on tax return deadlines is not mere bureaucratic noise. It is a deliberate and inescapable declaration: the social contract between citizen and state must be honoured through transparent, lawful and timely tax reporting.

At its core, the government’s pronouncement is stark in its simplicity and radical in its implications. Federal authorities, speaking through the Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, have made it unequivocally clear that every Nigerian, whether employer or individual taxpayer, must file annual tax returns under the law. This encompasses self-assessment filings by individuals that too many assumed ended once employers deducted pay-as-you-earn taxes from their salaries.

This is not an optional civic suggestion, it is mandatory, backed by statute, and tied to a broader vision of national fiscal responsibility. Citizens can no longer hide behind ignorance, apathy, or false assumptions. “Many people assume that if their employer deducts tax from their salaries, their obligations end there. That is wrong,” Oyedele warned, emphasizing that the obligation to file remains with the individual under both existing and newly reformed tax laws.

The Deadlines and the Reality They Reveal.

Across the federation, state and federal revenue authorities have reaffirmed statutory deadlines in pursuit of compliance. The Lagos State Internal Revenue Service, for instance, moved to extend its filing date for employer returns by a narrow window, reflecting the reality that compliance often lags behind legal timelines. The extension was intended not as leniency, but as a pragmatic effort to allow accurate and complete submissions, underscoring that true compliance rises above mere mechanical ticking of a box.

At the federal level, Oyedele’s intervention was even more fundamental. He reminded Nigerians that annual tax returns for the preceding year must be filed in good faith, with integrity and in respect of the law. This applies regardless of income level including low-income earners who have historically believed that they are outside the tax net. “All of us must file our returns, including those earning low income,” he stated.

Herein lies one of the most challenging truths of contemporary Nigerian governance: widespread tax non-compliance is not just a technical breach of law, it is a deep cultural and structural issue that reflects decades of mistrust between citizens and the state.

The Root of the Problem: Non-Compliance as a Symptom.

Nigeria’s tax culture has long been under scrutiny. Public discourse and economic analysis consistently show that a significant majority of eligible taxpayers do not file annual returns. Oyedele highlighted that even in states widely regarded as tax administration leaders, compliance remains strikingly low, often below five percent.

This widespread non-compliance stems from multiple sources:

A long history of weak tax administration systems, where enforcement was inconsistent and penalties were rarely applied.

A perception that public services do not reflect the taxes collected, eroding the citizenry’s belief in reciprocity.

An informal economy where income often goes unrecorded, making filing seem irrelevant or impossible to many.

Lack of awareness, with many Nigerians genuinely believing that tax liability ends with employer deductions.

The government’s renewed push for compliance directly challenges these perceptions. It signals a shift from voluntary or lax compliance to structured accountability, a stance that aligns with best practices in modern public finance.

Why This Matters: Beyond Deadlines.

At its most profound level, the insistence on tax return filings is about nation-building and shared responsibility.

Scholars of public finance universally agree that a robust tax system is the backbone of sustainable development. As the eminent economist Dr. Joseph E. Stiglitz has observed, “A society that cannot mobilize its own resources through fair taxation undermines both its government’s legitimacy and its capacity to provide for its people.” Filing tax returns is not a mere administrative task, it is a declaration of participation in the collective project of national advancement.

In Nigeria’s context, this declaration carries weight. With the enactment of comprehensive tax reforms in recent years (including unified frameworks for tax administration and enforcement) authorities now possess broader statutory tools to ensure compliance and accountability. These measures, which include electronic filing platforms and stronger enforcement powers, have been framed as fair and equitable, targeting efficiency rather than arbitrariness.

Yet the success of these reforms depends heavily on citizens embracing their civic duties with sincerity. And this depends on mutual trust, the belief that paying taxes yields tangible benefits in infrastructure, education, healthcare, security and social services.

Voices From Experts: Fiscal Responsibility as a Public Ethic.

Tax law experts and economists, reflecting on the compliance push, have underscored a universal theme: taxation without transparency is inequity, but taxation with accountability is empowerment. When managed with fairness, a functional tax system can reduce dependency on volatile revenue sources, stabilise national budgets, and support long-term investment in human capital.

Professor Aisha Bello, a respected authority in fiscal policy, notes that “Tax compliance is not a burden; it is the foundation upon which social contracts are built. A citizen who honours tax obligations affirms the legitimacy of governance and demands better performance in return.”

Similarly, a leading tax scholar, Dr. Emeka Okon, argues that “The era when Nigerians could evade broader tax responsibilities simply because automatic deductions occur at source must end. For a modern economy, every eligible citizen must be part of the formal tax fold not as victims, but as stakeholders.”

These authoritative voices point to an unassailable truth: filing tax returns is both a legal requirement and a moral responsibility, an expression of citizenship in its fullest sense.

Challenges on the Ground: Compliance and Capacity.

While the rhetoric of compliance is compelling, the reality on the ground demands nuanced understanding. Many taxpayers (especially in the informal sector) lack meaningful access to digital platforms and resources for filing returns. For others, the fear of bureaucratic complexity and perceived punitive enforcement deters participation.

The government, for its part, has responded by promoting online systems and pledging greater taxpayer support. Tax authorities are increasingly engaging stakeholders to demystify filing processes, explain requirements and offer assistance. This mix of enforcement and facilitation is essential. As one seasoned revenue specialist observed: “The state cannot compel compliance through force alone; it must earn it through education, simplicity and fairness.”

The Broader Implication: A New Social Compact.

Ultimately, Nigeria’s renewed emphasis on tax return filing transcends administrative deadlines. It is an unequivocal declaration that national development is a shared responsibility, that citizens and state must engage in a transparent, accountable, and reciprocal relationship.

Tax compliance, therefore, becomes far more than a legal act; it becomes a moral claim on the nation’s future.

When citizens file their returns honestly, they affirm their stake in the nation’s destiny. When the government collects taxes transparently and deploys them effectively, it strengthens not only public services but civic trust itself.

In this sense, the deadlines proclaimed by Nigeria’s fiscal authorities mark not an end but a beginning; the beginning of a civic epoch in which accountability replaces apathy, participation replaces indifference and national purpose triumphs over fragmentation.

The road ahead will not be easy. But in demanding compliance, Nigeria is demanding more than tax returns. It is demanding commitment and that, ultimately, is the foundation on which nations are built.

Business

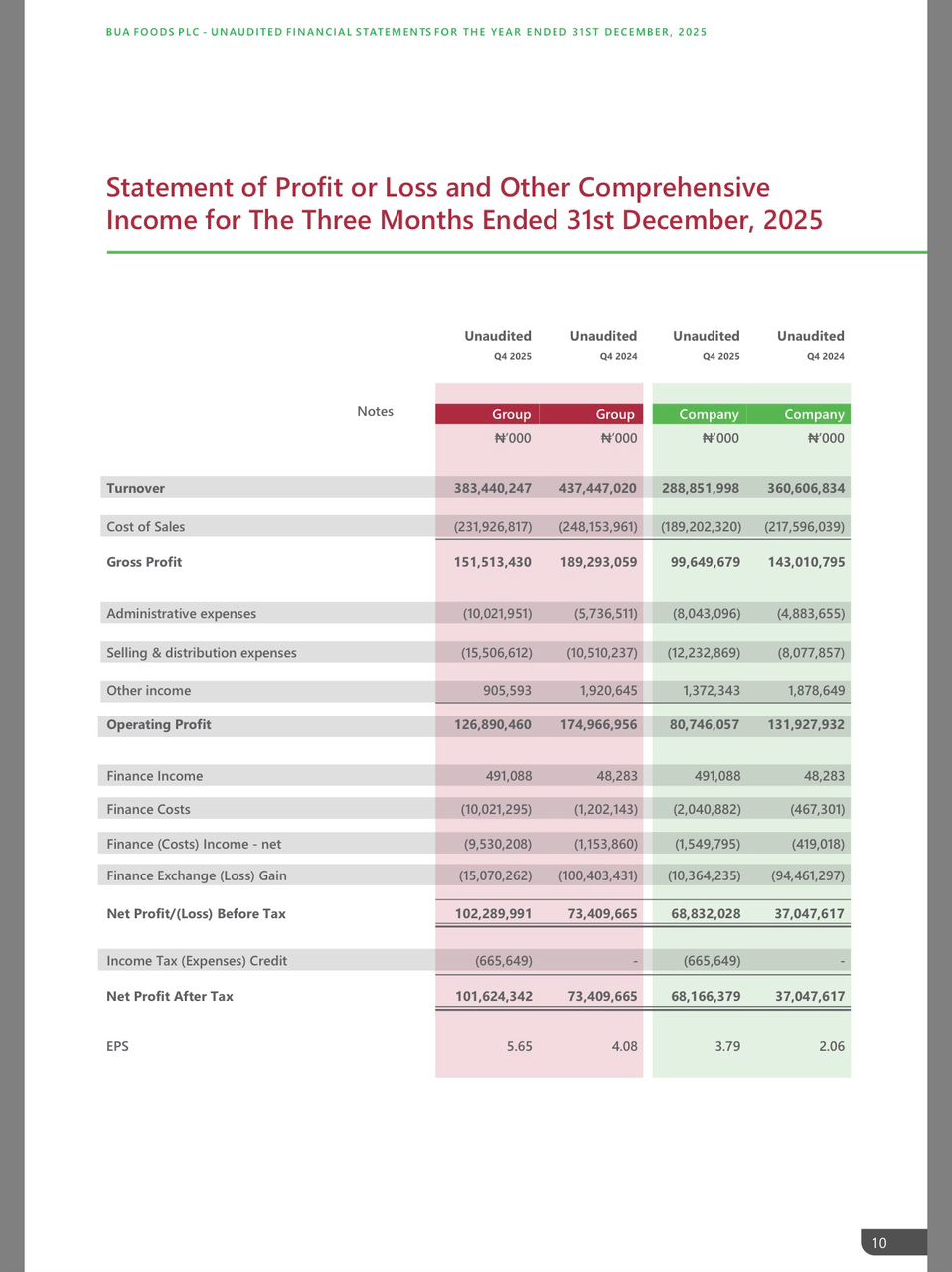

BUA Foods Records 91% Surge in Profit After Tax, Hits ₦508bn in 2025

BUA Foods Records 91% Surge in Profit After Tax, Hits ₦508bn in 2025

By femi Oyewale

Business

Adron Homes Unveils “Love for Love” Valentine Promo with Exciting Discounts, Luxury Gifts, and Travel Rewards

Adron Homes Unveils “Love for Love” Valentine Promo with Exciting Discounts, Luxury Gifts, and Travel Rewards

In celebration of the season of love, Adron Homes and Properties has announced the launch of its special Valentine campaign, “Love for Love” Promo, a customer-centric initiative designed to reward Nigerians who choose to express love through smart, lasting real estate investments.

The Love for Love Promo offers clients attractive discounts, flexible payment options, and an array of exclusive gift items, reinforcing Adron Homes’ commitment to making property ownership both rewarding and accessible. The campaign runs throughout the Valentine season and applies to the company’s wide portfolio of estates and housing projects strategically located across Nigeria.

Speaking on the promo, the company’s Managing Director, Mrs Adenike Ajobo, stated that the initiative is aimed at encouraging individuals and families to move beyond conventional Valentine gifts by investing in assets that secure their future. According to the company, love is best demonstrated through stability, legacy, and long-term value—principles that real estate ownership represents.

Under the promo structure, clients who make a payment of ₦100,000 receive cake, chocolates, and a bottle of wine, while those who pay ₦200,000 are rewarded with a Love Hamper. Payments of ₦500,000 attract a Love Hamper plus cake, and clients who pay ₦1,000,000 enjoy a choice of a Samsung phone or a Love Hamper with cake.

The rewards become increasingly premium as commitment grows. Clients who pay ₦5,000,000 receive either an iPad or an all-expenses-paid romantic getaway for a couple at one of Nigeria’s finest hotels, which includes two nights’ accommodation, special treats, and a Love Hamper. A payment of ₦10,000,000 comes with a choice of a Samsung Z Fold 7, three nights at a top-tier resort in Nigeria, or a full solar power installation.

For high-value investors, the Love for Love Promo delivers exceptional lifestyle experiences. Clients who pay ₦30,000,000 on land are rewarded with a three-night couple’s trip to Doha, Qatar, or South Africa, while purchasers of any Adron Homes house valued at ₦50,000,000 receive a double-door refrigerator.

The promo covers Adron Homes’ estates located in Lagos, Shimawa, Sagamu, Atan–Ota, Papalanto, Abeokuta, Ibadan, Osun, Ekiti, Abuja, Nasarawa, and Niger States, offering clients the opportunity to invest in fast-growing, strategically positioned communities nationwide.

Adron Homes reiterated that beyond the incentives, the campaign underscores the company’s strong reputation for secure land titles, affordable pricing, strategic locations, and a proven legacy in real estate development.

As Valentine’s Day approaches, Adron Homes encourages Nigerians at home and in the diaspora to take advantage of the Love for Love Promo to enjoy exceptional value, exclusive rewards, and the opportunity to build a future rooted in love, security, and prosperity.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

Business6 months ago

Business6 months agoBatsumi Travel CEO Lisa Sebogodi Wins Prestigious Africa Travel 100 Women Award

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING

You must be logged in to post a comment Login