Business

Open Letter To Ahmed Asiwaju Bola Tinubu By General Adeyinka Adebayo

My dear Asiwaju,

I am compelled to write this open letter to you because of the state of affairs of the Yoruba nation. Firstly, I wish to acknowledge that fate has put you in a prime position to determine to a large extent the direction that the Yoruba people will go. The indisputable truth is that one may quarrel with your politics but your sagacity is never in doubt. Even those who don’t see eye to eye with you agree that you are imbued with unusual native intelligence, uncommon people skills and unrivaled foresight. You, more than any other person, has been the game changer since the advent of democracy in 1999. It is for these reasons that I have chosen to direct this letter to you.

My singular purpose is to tug at the strings of your heart. I am not writing to appeal to partisan considerations but to see, if per chance, I can pour out my heart to you in a manner of speaking. God has blessed you even beyond your wildest imagination. You have installed Senators and Governors. You have removed Governors and even a President. You have also installed a President. There is nothing you have wished for or desired that you didn’t get. Fortune has smiled on you. Goodwill follows you everywhere you go. You have done very well- more than most men ever will. However, there is one area that is begging for your urgent attention. This area may well define you and all you have ever achieved. This matter, in my opinion, is the only difference between you and the late sage, Chief Obafemi Awolowo. Let me restate for the purpose of emphasis that this is the area in which the late sage and Leader of the Yorubas stand head and shoulders above you. It is the reason his name has been a constant denominator in our regional and national politics. It is the reason politicians, friends and foes invoke his name for political advantage and personal glory. It is also the reason why we can’t stop talking about him almost thirty years after his death. What will anyone say about you thirty years after you have transited?

Asiwaju Sir, you may be wondering what I’m talking about? It is the issue of legacy. According to Peter Strople, ‘Legacy is not leaving something for people, it is leaving something in people’. Legacy is building something that outlives you. Legacy is greater than currency. In the words of Leonard Sweet, ‘ What you do is your history. What you set in motion is your legacy’. You can’t live forever, Sir. No one can. But you can create something that will. Enough of speaking in parables- I shall now speak plainly.

When destiny brought you on the scene, we were enamoured because you championed the case for true federalism. It was your belief then that the Yoruba nation will fare better under a restructured arrangement than under the type of unitary government we run while pretending by calling it a federal government. Everyone knows that there is nothing federal about our government at all. If truth must be told, the Yoruba nation has fared very badly since the advent of our new democracy. And this is not about holding power at the centre.

Let me bring this home: someone passed a comment recently that he would want Biafra to become a reality because he knows the Igbo nation will survive. That comment led me to deeper introspection as I wondered if the Yorubas can truly survive. Let me cite my first example. From Oyo to Osun, Ogun to Ondo, Ekiti to Kwara and Lagos, hardly will one see any serious industry or manufacturing concern owned by a Yoruba person. I am not talking about portfolio businesses or one-man business concerns. Most industries in Oyo State are owned by the Lebanese. The native business and industry gurus who dominated the landscape- Nathaniel Idowu, Amos Adegoke, Lekan Salami, Alao Arisekola, Adeola Odutola, Jimoh Odutola, Chief Theophilus Adediran Oni and others- are all gone with no credible replacements. I’m sure you remember the tyre factory of the Odutolas and how Jimoh Odutola was even asked by the Governments of Kenya and Ghana to set up a similar factory in their countries. Chief Theophilus Adediran Oni, popularly called T.A Oni & Sons started the first indigenous construction company in Nigeria. He willed his residence- Goodwill House, to the Oyo/Western state government, to be used as a Paediatric Hospital, which is now known as T.A Oni Memorial Children Hospital at Ring Road in Ibadan. This sprawling family Estate and residence was cited on a 15acre piece of land, 65 rooms, with modern conveniences, Olympic Swimming Pool and stable for Horses, etc.

People like Chief Bode Akindele started companies like Standard Breweries and Dr Pepper Soft drink factory at Alomaja in Ibadan. Broking House built by the late Femi Johnson, an insurance magnate, still stands glittering in the mid-day sun as an epitome to a rich history that Ibadan has. The most serious and only notable Yoruba entrepreneur we have now is Michael Adenuga. I say this quite consciously because most of the other names are oil and gas barons. Most of what stood as testaments of industry in Oyo State are gone- Exide Batteries, Leyland Autos and many others. In its place are shopping malls and road side markets but no nation develops through buying and selling alone- especially when you’re not actually producing what you’re selling. Hypermarkets and supermarkets have taken over because of the need to feed our insatiable consumer-appetite and foreign tastes. In one instance, an ancient landmark in the form of a hotel was demolished to pave way for a mall. That is how low we have sunk. If our past is better than our present- if we always look back with nostalgia frequently, then there is a problem.

The case of other states is not different. Osun’s case is pathetic. Ditto for Ondo and Ekiti. Ogun State can boast of some factories at Sango-Otta and Agbara axis but most of them are not owned by the Yorubas. There is no significant pharmaceutical company owned by any Yoruba except for Bond Chemicals in Awe, Oyo State- and its wallet share is very insignificant. For Lagos State, more than 70% of the manufacturing concerns and major industries in the State are owned by the Igbos. If the Igbos were to stop paying tax in Lagos State, the IGR of Lagos State will reduce by over 60%. In contrast, Sir, go to the South East and look at the manufacturing concerns in Onitsha, Aba and Nnewi. Please don’t forget those were areas ravaged by civil war a mere forty something years ago. The Igbos have certainly made tremendous progress but the Yoruba nation has regressed. I wish to state that this letter is not meant to whip up primordial considerations or ethnic sentiments but just to put things in proper perspective.

Asiwaju, I will like to also talk about the state of education in the Yoruba nation. Our education has gone to the dogs. We have a bunch of mis-educated and ill-educated young men and women roaming the streets. Ibadan, for instance, had the first University in Nigeria and the first set of research centres in Nigeria ( The Forestry Research Institute, the Cocoa Research Institute (CRIN), The Nigerian Cereal Research Institute Moor Plantation (NCRI), the NIHORT (Nigerian Institute of Horticultural Research), the NISER (Nigerian Institute of Social and Economic Research), IAR&T (Institute of Agriculture, Research and Training), amongst several others). Ibadan was the bastion of scholarship with people like Wole Soyinka, JP Clark, D.O Fagunwa and Amos Tutuola as residents. In the May/June 2015 West African Senior Secondary Certificate Examination, Abia came tops. Anambra came 2nd while Edo was 3rd. Lagos placed 6th while Osun and Oyo was 29th and 26th. Ekiti was 11th, Ondo State was 13th and Ogun State was 19th. In 2013 WASSCE, only Lagos and Ogun States were the Yoruba States above the national average. If we do an analysis of how Lagos placed 6th in 2015, you will discover that it was substantially because of other nationalities resident in Lagos. For proof, please look no further than the winners of the Spelling Bee competition which has produced One-Day Governors in Lagos State. Since inception in 2001, other nationalities have won the competition six times (Ebuka Anisiobi in 2001, Ovuwhore Etiti in 2002, Abundance Ikechukwu in 2006, Daniel Osunbor in 2008, Akpakpan Iniodu Jones in 2011 and Lilian Ogbuefi in 2012). Sir, there is something seriously wrong about our state of education. From the vintage times of Obafemi Awolowo who initiated ‘free education’, we have regressed into a most parlous state.

Let me talk about roads, housing and infrastructure . The first dualized road in Nigeria, the Queen Elizabeth road from Mokola to Agodi in Ibadan was formally commissioned by Queen Elizabeth in 1956. The first Housing Estate in Nigeria is Bodija Housing Estate (also in Ibadan) which was built in 1958. The state of roads in the Yoruba nation has become pathetic. Our hinterland are still largely rural. Even some state capitals like Osogbo and Ado-Ekiti are big villages when you compare them to towns in the South East. How many new estates have been built over the last decade? Even Ajoda New Town lies in ruins.

We have abandoned the farm settlement strategy of the Western Region and only pay lip service to agriculture. Instead of feeding others like we once did, others now feed us. We plant no tomatoes, no pepper and the basic food that we require. The Indians have bought the large expanse of water body that we have in Onigambari village. The water body in Oke Ogun of Oyo State can provide enough fish to feed the whole of the South West. From being a major cocoa exporter many years ago, one can point to just a few vestiges of factories that still deal with Cocoa in the Yoruba nation. 80% of Cocoa processing industries in the South West have been shut down. The Chinese have taken over the cashew belt at Ogbomoso in Oyo State. They have even edged out the indigenes as brokers. They now come to the cashew belt to buy from the local farmers, sell on the spot to other Chinese exporters who now process the cashew nuts and import them back into Nigeria at a premium. Sir, there are only 7 major cashew processing plants in Nigeria and you can check out the ownership. The glory has departed from the Yoruba nation.

Apart from Asejire, Ede, Ikere Gorge and Oyan dams built ages ago, where are the new dams to cater for increased population and water capacity for the Yoruba nation? How have we improved on what our heroes past left us? Maybe apart from certain areas in Lagos State, others can’t even supply their citizens with pipe-borne water.

Our youth which we used to take pride in are largely a mass of unemployed and unemployable people. Have you noticed the abundance of street urchins, area boys, touts and ‘agberos’ that we now have all across the Yoruba nation? Have you noticed the swell in the ranks of NURTW (I mean no disrespect to an otherwise noble union)? Have you noticed the increase in the number of Yoruba beggars? There was a time that it was taboo for a Yoruba man to beg- but no more. The spirit of apprenticeship is dead. There was a time that people who learn vocational skills celebrate what we referred to as ‘freedom’. While that is largely moribund now in the Yoruba nation, the Igbos still practice it with great success.

The only thing we can boldly say the Yoruba nation controls is the information machinery- the press. We own largely the newspapers- the Nation, Punch, Nigerian Tribune, TV Continental and a few others. It is because of our control of this information machinery that we have rewritten the narrative in the country with the misguided self-belief that things are normal and we are making progress. A look beyond the surface will prove that this is so untrue.

We are largely divided. For the first time in the history of the Yoruba nation, religion is about to divide us further- and it is starting from Osun State. You are married to a Christian. My own father-in-law is an Alhaji. That is how we have peacefully do-existed but the fabrics are about to be torn to shreds because of poor management of issues. Afenifere has been reduced to a shadow of itself. OPC that once defended Yoruba interests has gone into oblivion. Yoruba elders have been vilified in the name of politics and partisanship. It is no longer news to see teenagers throwing stones at their elders because of their political indoctrination. Even under the late sage, Chief Obafemi Awolowo, the Yorubas never belonged to just a single party- yet our unity was without blemish. Now, our values have gone down the drain.

Asiwaju, I believe I have said enough. The task is Herculean but I believe Providence has brought you here for such a time like this. It is time for the Yoruba nation to clean up its acts. What do we really want? How can we quickly right the wrongs? The Yoruba nation is in a state of arrested development. The Yoruba nation is gasping for breath and crying for help. Will you rise up to the occasion? I am aware you understand that all politics is local and charity begins at home. Our fathers gave us a proverb: ‘Bi o’ode o dun, bi igbe ni’gboro ri’. I know there are no quick fixes but I also know that if there is anyone who has the capacity to do something about our current situation, that person is you. This should be thy legacy you should think of. Your legacy is our future.

Yours Very Sincerely,

Adebayo

Business

Deadline of Compliance: Nigeria’s Urgent Call for Tax Return Filing

Deadline of Compliance: Nigeria’s Urgent Call for Tax Return Filing

By George Omagbemi Sylvester | Published by SaharaWeeklyNG.com

“Shift or Structural Demand? A Declaration of Civic Duty in a Nation at a Fiscal Crossroads.”

In the unfolding narrative of national development and economic reform, few instruments are as defining as tax compliance. For Nigeria, a nation perpetually grappling with revenue shortfalls, structural dependency on a single export commodity, and entrenched informal economic behaviour, the Federal Government’s recent clarification on tax return deadlines is not mere bureaucratic noise. It is a deliberate and inescapable declaration: the social contract between citizen and state must be honoured through transparent, lawful and timely tax reporting.

At its core, the government’s pronouncement is stark in its simplicity and radical in its implications. Federal authorities, speaking through the Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, have made it unequivocally clear that every Nigerian, whether employer or individual taxpayer, must file annual tax returns under the law. This encompasses self-assessment filings by individuals that too many assumed ended once employers deducted pay-as-you-earn taxes from their salaries.

This is not an optional civic suggestion, it is mandatory, backed by statute, and tied to a broader vision of national fiscal responsibility. Citizens can no longer hide behind ignorance, apathy, or false assumptions. “Many people assume that if their employer deducts tax from their salaries, their obligations end there. That is wrong,” Oyedele warned, emphasizing that the obligation to file remains with the individual under both existing and newly reformed tax laws.

The Deadlines and the Reality They Reveal.

Across the federation, state and federal revenue authorities have reaffirmed statutory deadlines in pursuit of compliance. The Lagos State Internal Revenue Service, for instance, moved to extend its filing date for employer returns by a narrow window, reflecting the reality that compliance often lags behind legal timelines. The extension was intended not as leniency, but as a pragmatic effort to allow accurate and complete submissions, underscoring that true compliance rises above mere mechanical ticking of a box.

At the federal level, Oyedele’s intervention was even more fundamental. He reminded Nigerians that annual tax returns for the preceding year must be filed in good faith, with integrity and in respect of the law. This applies regardless of income level including low-income earners who have historically believed that they are outside the tax net. “All of us must file our returns, including those earning low income,” he stated.

Herein lies one of the most challenging truths of contemporary Nigerian governance: widespread tax non-compliance is not just a technical breach of law, it is a deep cultural and structural issue that reflects decades of mistrust between citizens and the state.

The Root of the Problem: Non-Compliance as a Symptom.

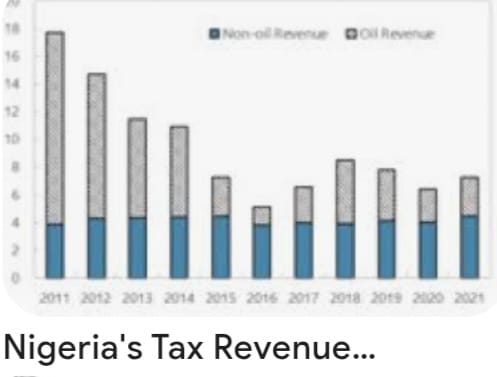

Nigeria’s tax culture has long been under scrutiny. Public discourse and economic analysis consistently show that a significant majority of eligible taxpayers do not file annual returns. Oyedele highlighted that even in states widely regarded as tax administration leaders, compliance remains strikingly low, often below five percent.

This widespread non-compliance stems from multiple sources:

A long history of weak tax administration systems, where enforcement was inconsistent and penalties were rarely applied.

A perception that public services do not reflect the taxes collected, eroding the citizenry’s belief in reciprocity.

An informal economy where income often goes unrecorded, making filing seem irrelevant or impossible to many.

Lack of awareness, with many Nigerians genuinely believing that tax liability ends with employer deductions.

The government’s renewed push for compliance directly challenges these perceptions. It signals a shift from voluntary or lax compliance to structured accountability, a stance that aligns with best practices in modern public finance.

Why This Matters: Beyond Deadlines.

At its most profound level, the insistence on tax return filings is about nation-building and shared responsibility.

Scholars of public finance universally agree that a robust tax system is the backbone of sustainable development. As the eminent economist Dr. Joseph E. Stiglitz has observed, “A society that cannot mobilize its own resources through fair taxation undermines both its government’s legitimacy and its capacity to provide for its people.” Filing tax returns is not a mere administrative task, it is a declaration of participation in the collective project of national advancement.

In Nigeria’s context, this declaration carries weight. With the enactment of comprehensive tax reforms in recent years (including unified frameworks for tax administration and enforcement) authorities now possess broader statutory tools to ensure compliance and accountability. These measures, which include electronic filing platforms and stronger enforcement powers, have been framed as fair and equitable, targeting efficiency rather than arbitrariness.

Yet the success of these reforms depends heavily on citizens embracing their civic duties with sincerity. And this depends on mutual trust, the belief that paying taxes yields tangible benefits in infrastructure, education, healthcare, security and social services.

Voices From Experts: Fiscal Responsibility as a Public Ethic.

Tax law experts and economists, reflecting on the compliance push, have underscored a universal theme: taxation without transparency is inequity, but taxation with accountability is empowerment. When managed with fairness, a functional tax system can reduce dependency on volatile revenue sources, stabilise national budgets, and support long-term investment in human capital.

Professor Aisha Bello, a respected authority in fiscal policy, notes that “Tax compliance is not a burden; it is the foundation upon which social contracts are built. A citizen who honours tax obligations affirms the legitimacy of governance and demands better performance in return.”

Similarly, a leading tax scholar, Dr. Emeka Okon, argues that “The era when Nigerians could evade broader tax responsibilities simply because automatic deductions occur at source must end. For a modern economy, every eligible citizen must be part of the formal tax fold not as victims, but as stakeholders.”

These authoritative voices point to an unassailable truth: filing tax returns is both a legal requirement and a moral responsibility, an expression of citizenship in its fullest sense.

Challenges on the Ground: Compliance and Capacity.

While the rhetoric of compliance is compelling, the reality on the ground demands nuanced understanding. Many taxpayers (especially in the informal sector) lack meaningful access to digital platforms and resources for filing returns. For others, the fear of bureaucratic complexity and perceived punitive enforcement deters participation.

The government, for its part, has responded by promoting online systems and pledging greater taxpayer support. Tax authorities are increasingly engaging stakeholders to demystify filing processes, explain requirements and offer assistance. This mix of enforcement and facilitation is essential. As one seasoned revenue specialist observed: “The state cannot compel compliance through force alone; it must earn it through education, simplicity and fairness.”

The Broader Implication: A New Social Compact.

Ultimately, Nigeria’s renewed emphasis on tax return filing transcends administrative deadlines. It is an unequivocal declaration that national development is a shared responsibility, that citizens and state must engage in a transparent, accountable, and reciprocal relationship.

Tax compliance, therefore, becomes far more than a legal act; it becomes a moral claim on the nation’s future.

When citizens file their returns honestly, they affirm their stake in the nation’s destiny. When the government collects taxes transparently and deploys them effectively, it strengthens not only public services but civic trust itself.

In this sense, the deadlines proclaimed by Nigeria’s fiscal authorities mark not an end but a beginning; the beginning of a civic epoch in which accountability replaces apathy, participation replaces indifference and national purpose triumphs over fragmentation.

The road ahead will not be easy. But in demanding compliance, Nigeria is demanding more than tax returns. It is demanding commitment and that, ultimately, is the foundation on which nations are built.

Business

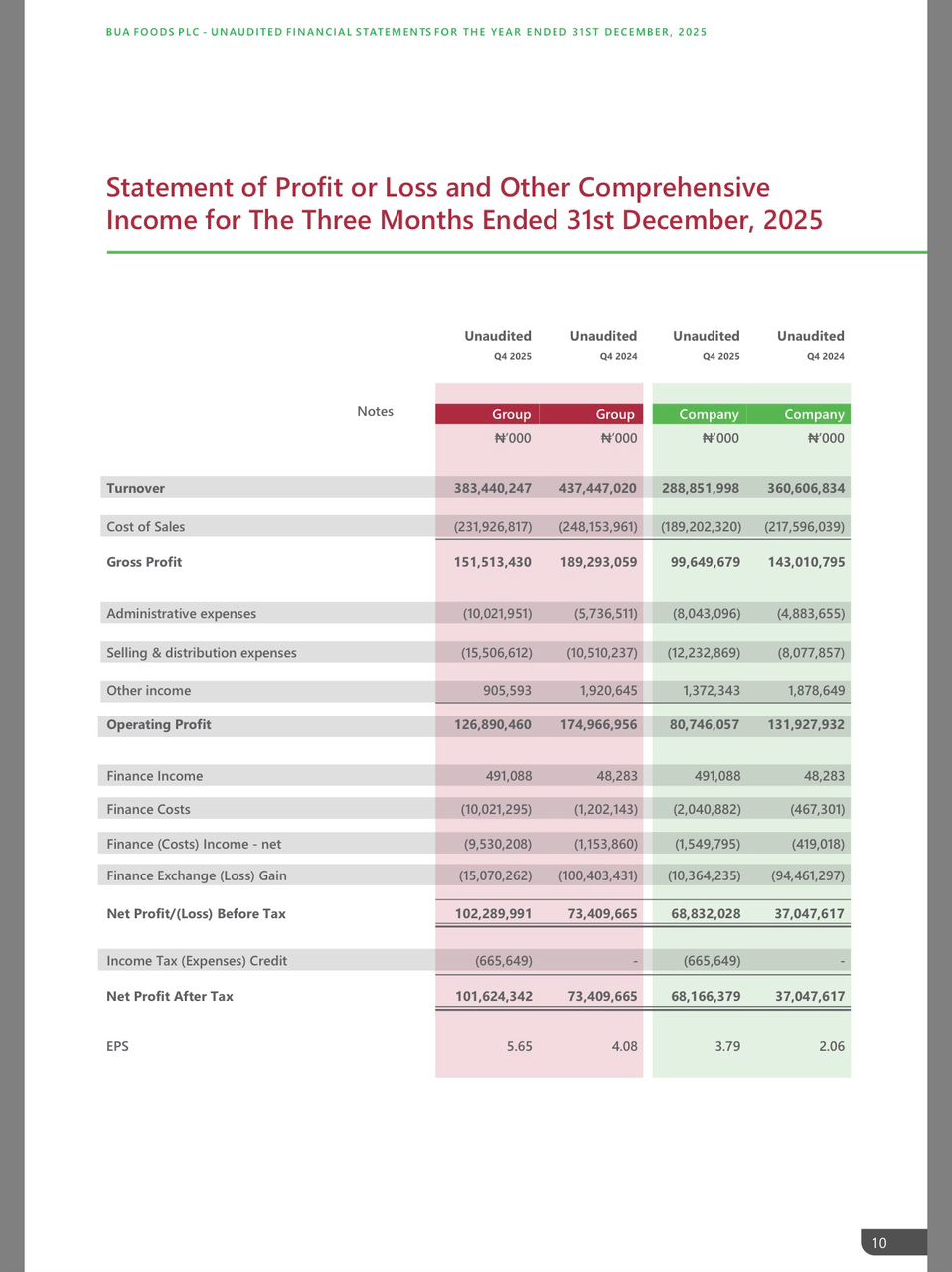

BUA Foods Records 91% Surge in Profit After Tax, Hits ₦508bn in 2025

BUA Foods Records 91% Surge in Profit After Tax, Hits ₦508bn in 2025

By femi Oyewale

Business

Adron Homes Unveils “Love for Love” Valentine Promo with Exciting Discounts, Luxury Gifts, and Travel Rewards

Adron Homes Unveils “Love for Love” Valentine Promo with Exciting Discounts, Luxury Gifts, and Travel Rewards

In celebration of the season of love, Adron Homes and Properties has announced the launch of its special Valentine campaign, “Love for Love” Promo, a customer-centric initiative designed to reward Nigerians who choose to express love through smart, lasting real estate investments.

The Love for Love Promo offers clients attractive discounts, flexible payment options, and an array of exclusive gift items, reinforcing Adron Homes’ commitment to making property ownership both rewarding and accessible. The campaign runs throughout the Valentine season and applies to the company’s wide portfolio of estates and housing projects strategically located across Nigeria.

Speaking on the promo, the company’s Managing Director, Mrs Adenike Ajobo, stated that the initiative is aimed at encouraging individuals and families to move beyond conventional Valentine gifts by investing in assets that secure their future. According to the company, love is best demonstrated through stability, legacy, and long-term value—principles that real estate ownership represents.

Under the promo structure, clients who make a payment of ₦100,000 receive cake, chocolates, and a bottle of wine, while those who pay ₦200,000 are rewarded with a Love Hamper. Payments of ₦500,000 attract a Love Hamper plus cake, and clients who pay ₦1,000,000 enjoy a choice of a Samsung phone or a Love Hamper with cake.

The rewards become increasingly premium as commitment grows. Clients who pay ₦5,000,000 receive either an iPad or an all-expenses-paid romantic getaway for a couple at one of Nigeria’s finest hotels, which includes two nights’ accommodation, special treats, and a Love Hamper. A payment of ₦10,000,000 comes with a choice of a Samsung Z Fold 7, three nights at a top-tier resort in Nigeria, or a full solar power installation.

For high-value investors, the Love for Love Promo delivers exceptional lifestyle experiences. Clients who pay ₦30,000,000 on land are rewarded with a three-night couple’s trip to Doha, Qatar, or South Africa, while purchasers of any Adron Homes house valued at ₦50,000,000 receive a double-door refrigerator.

The promo covers Adron Homes’ estates located in Lagos, Shimawa, Sagamu, Atan–Ota, Papalanto, Abeokuta, Ibadan, Osun, Ekiti, Abuja, Nasarawa, and Niger States, offering clients the opportunity to invest in fast-growing, strategically positioned communities nationwide.

Adron Homes reiterated that beyond the incentives, the campaign underscores the company’s strong reputation for secure land titles, affordable pricing, strategic locations, and a proven legacy in real estate development.

As Valentine’s Day approaches, Adron Homes encourages Nigerians at home and in the diaspora to take advantage of the Love for Love Promo to enjoy exceptional value, exclusive rewards, and the opportunity to build a future rooted in love, security, and prosperity.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

Business6 months ago

Business6 months agoBatsumi Travel CEO Lisa Sebogodi Wins Prestigious Africa Travel 100 Women Award

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING

You must be logged in to post a comment Login