Business

Why we moved Money out of Nigeria illegally – MTN Confesses

At the commencement of investigative hearing into the alleged illegal repatriation of $13.9 billion out of the country by MTN yesterday, the company told the Senate Committee on Banks, Insurance and Other Financial Institutions, that circumstances compelled it to move funds without observing the law.

The Senate had on September 27, 2016, alleged that MTN in connivance with the Minister of Trade and Investment, Okechukwu Enelamah, and four commercial banks exploited the porous Nigerian financial system to move the money out of the country without the required authorisation.

The upper legislative chamber according to a motion moved by Senator Dino Melaye (Kogi West) on September 27, alleged that MTN smartly beat Nigeria’s financial regulatory laws by failing to obtain a certificate of capital importation (CCI) as authorised by CBN Financial and Miscellaneous Act within 24 hours between 2006 and 2016 before moving the money out of the country.

It further alleged that the repatriation was done through four banks, viz: Standard Chartered Bank, Stanbic IBTC, Diamond Bank and Citi Bank.

However, why MTN and other stakeholders, inluding the Central Bank of Nigeria (CBN) and Financial Regulation Council of Nigeria (FRCN), summoned by the committee to testify on the allegation stated their own sides of the story, Enelamah defied the committee’s directive not to leave before testifying as he instead walked out of the meeting venue before its commencement.

This resulted in insinuations by some individuals present at the meeting that the minister might have done so because he had something to hide moreso that he had earlier given excuses for his failure to appear before the committee on October 12.

However, the Chief Executive Officer (CEO) of MTN, Fedi Moolman, admitted that the company moved funds without complying with the 24-hour order for the issuance of CCI, saying it was practically impossible to do so.

Nevertheless, he stated that the action was taken without any deliberate intention to flout Nigerian laws but was rather compelled to do so because of circumstances which he said made it impossible for it to observe the 24-hour provision in the Act for issuance of CCI.

He said: “There was no intention to flout the rule and regulation. The 24-hour rule is not in all cases practicable and it is almost impossible to comply with.”

The CEO further told the committee that MTN faced acute challenges when it got to Nigeria in 2000 as it found out that necessary facilities for business transactions were not available, a situation he said compelled it to import equipment to Nigeria.

He, however, attempted to justify his claim that MTN meant well for Nigeria through his submissions that MTN solely contributed 3.4 per cent of Nigeria’s gross domestic product (GDP) in the first quarter of 2006 and had since its advent in Nigeria employed 500,000 Nigerians directly and indirectly.

He also claimed that besides generating 80 per cent of the electricity it uses, MTN had committed N16 billion to various projects in Nigeria through its MTN Foundation and paid N1.6 trillion tax in 14 years. He further claimed that funds moved out of Nigeria were MTN’s dividends done in line with due process.

But Moolman’s submission was in contradiction to the presentation of Mr. Pascal Dozie, Chairman of Diamond Bank, who denied the allegation of illegal repatriation by MTN, arguing that MTN had invested $16 billion in Nigeria within 16 years.

He said the money imported to Nigeria was done in three tranches as he insisted that the allegation by the Senate “was completely false.”

According to him, when MTN came to Nigeria, it offered 40 per cent shares to Nigerians while it took the other 60 per cent only to find out that it was difficult to get Nigerians to invest 12 per cent of the 40 per cent offer. He added that MTN had to bring other investors before it could secure 25 per cent of the offer.

Dozie further said it was these Nigerians who constituted Celtelecom adding that a conversion of Celtelecom investment was done in 2007 through its bankers with CBN approval as he exonerated Enelamah, saying he was not a shareholder in MTN but only a director of Celtelecom and CEO of Capital Alliance which he said midwived the Celtelecom.

But Melaye countered him as he displayed a form signed by Enelamah on February 7, 2008 for repatriation of funds, with a CCI form attached the same day investment was said to have been made in Nigeria, as he queried: “Is it possible to invest in Nigeria same day and repatriate funds same day?”

Melaye also confronted Dozie and MTN CEO with evidences that whereas CCI was supposed to have been issued within 24 hours before repatriation, such CCIs were not issued until five years later as he dismissed Dozie’s claim that Nigerian laws were not flouted in the process. “The law says CCI should be issued in 24 hours but CCIs were issued five years after. Is that not a contravention?” he queried.

Melaye also said he had information that whereas CBN approved only 13 CCIs, Stanbic IBTC only had issued over 300 CCIs without containing the necessary information it ought to contain.

But CBN in its submission said it only approved CCIs beyond the 24-hour stipulation when it was obvious that banks could not issue the document within the stipulated time.

In his submission, Managing Director of Diamond Bank and son of Dozie, Uzoma, said the bank had issued some CCIs to MTN as he admitted that the bank had been involved in repatriation of funds by MTN but added that such repatriations were “carried out with appropriate documentation,” adding: “None was repatriated without genuine CCIs.”

Also speaking, the CEO of Stanbic IBTC, Olayinka Sani, who evaded questions directly put to him, said his bank was ready to co-operate with the committee in its investigation adding that it had represented MTN in various capacities since the company opened an account with the bank.

Also, the Managing Director of Citibank, Akin Daodu, said the bank had never been involved in any illegal repatriation of funds as he disclosed that Citibank had issued 46 CCIs on behalf of MTN so far.

But in view of Daodu’s claim, Melaye drew his attention to the document his bank had earlier submitted to the committee where it had stated that “MTN didn’t request for CCI’s to be issued until more than the 24 hours,” required to issue the CCIs. Against this background, he could no longer defend the claim he earlier made moreso that Melaye reminded him that he was making his submissions under oath.

In her own submission, the CEO of Standard Chartered Bank, Mrs. Yemi Owolabi, admitted that in most cases when they were contacted for issuance of CCIs by MTN, prevalent circumstances made such issuance impossible within the stipulated time frame.

According to her, such circumstances had always compelled the bank to contact the CBN to explain the difficult circumstances in which it found itself, pointing out that they only issued the documents after securing the go-ahead from the apex bank. “Until we get approval from CBN, we don’t issue CCI,” she added.

Towards the end of the meeting, Moolman reiterated that MTN had not claimed that it had complied with the 24-hour regulation for the issuance of CCI 100 per cent but explained that such developments were dictated by circumstances beyond its control.

At the end of the meeting, Chairman of the committee, Senator Rafiu Ibrahim, urged Dozie to educate Enelamah on how to behave as he warned the minister against getting on Senate’s nerves, insisting that if he thought he could dare the Senate, the parliament would be forced to invoke its power to force him to appear before the committee.

“We want you to advise him. For him to tell us that he couldn’t wait, I think he was being audacious against the Senate. We as senators expect him to engage the Senate in a more civilised way or else, we ‘ll be forced to invoke our powers,” Ibrahim threatened.

Enelamah had upon his arrival at the commencement of the event, approached the chairman and requested for his leave to attend another engagement which the chairman turned down. But the committee was shocked that Enelamah opted to dare the committee by walking away.

While senators perceived Enelamah’s action to be insolent, some of the individuals present alleged that the minister might have deliberately opted to avoid making submissions before the committee.

However, Enelamah has reiterated that he is not involved in any wrong-doing, with regard to the MTN saga.

According to a statement from the minister’s office last night and signed by the Director of Press, Greene Anosike, the minister said:

“Enelamah served as CEO of Capital Alliance Nigeria Ltd (CANL) between 1998 and 2015. CANL is a wholly owned subsidiary of African Captial Alliance (ACA), an Africa focused private equity firm with investments in carefully selected companies within and outside Nigeria, including MTN Nigeria

“A fund managed by ACA, alongside other minority shareholders, invested in MTN Nigeria through Celtelecom. Enelamah was never the ‘owner’ of Celtelecom, neither was he ever a Celtelecom shareholder. Instead, he was a director of the company representing the ACA Managed fund.

“Investors do not have responsibility for remittance of proceeds from the company they are invested in. Therefore, at no time was Enelamah in a position to transfer funds out of Nigeria on behalf of MTN Nigeria, and at no time did he transfer any funds out of Nigeria on behalf of MTN Nigeria. As it relates to Celtelecom’s investment in MTN Nigeria, it is important to note that the entire process for applying for and using Certificate of Capital Importation (CCIs) was done by MTN Nigeria.

“All the allegations against the minister therefore, are baseless and without merit.”

Business

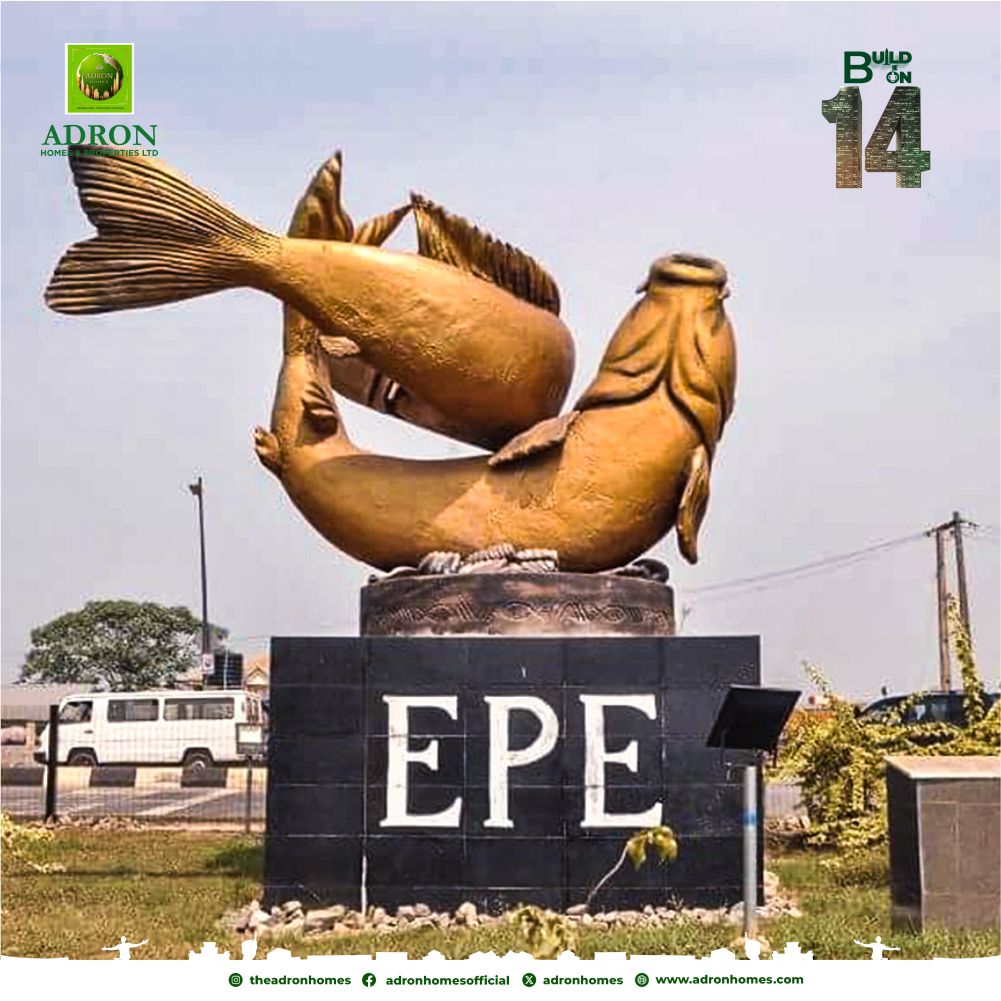

Adron Homes Celebrates 14 Years of Excellence, Reaffirms Commitment to Affordable Housing and Sustainable Communities

Adron Homes Celebrates 14 Years of Excellence, Reaffirms Commitment to Affordable Housing and Sustainable Communities

Adron Homes and Properties Limited, a leading player in Nigeria’s real estate industry, proudly celebrates its 14th Anniversary, marking over a decade of transformative impact in affordable housing delivery, sustainable community development, and structured urban growth across the country.

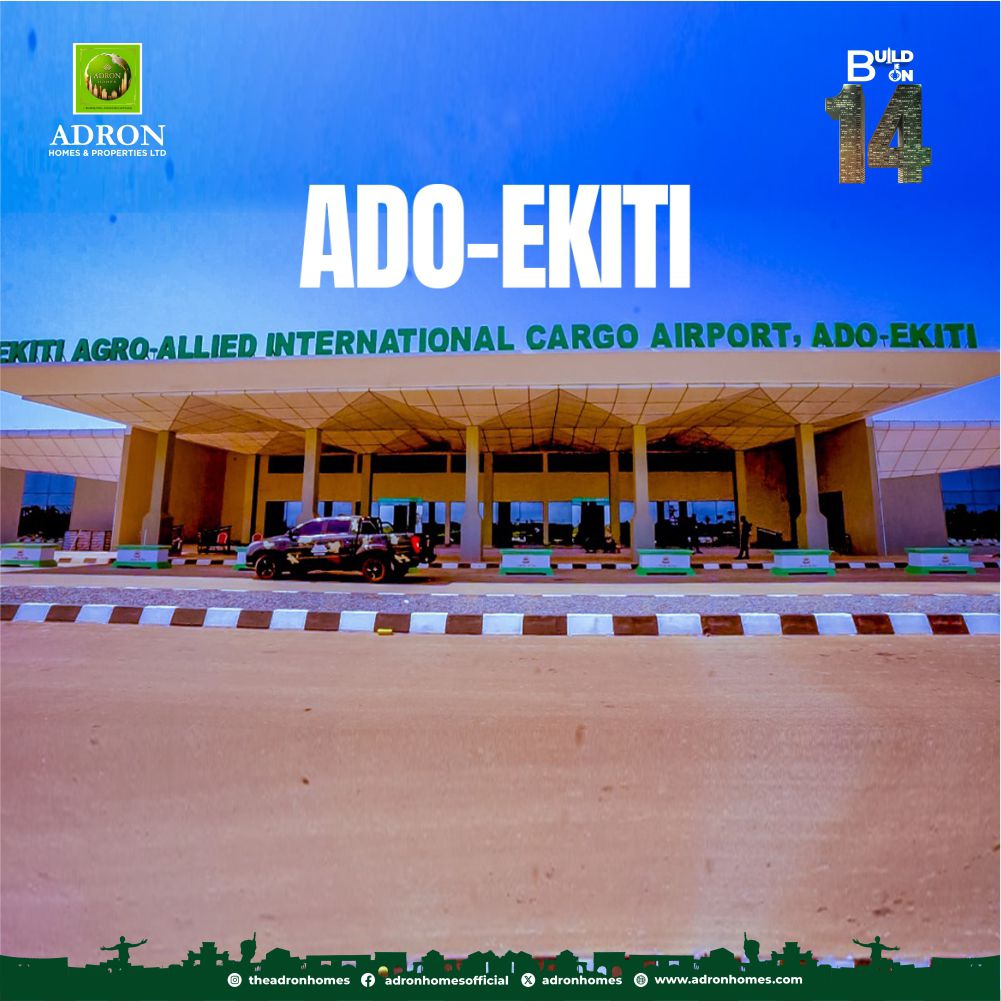

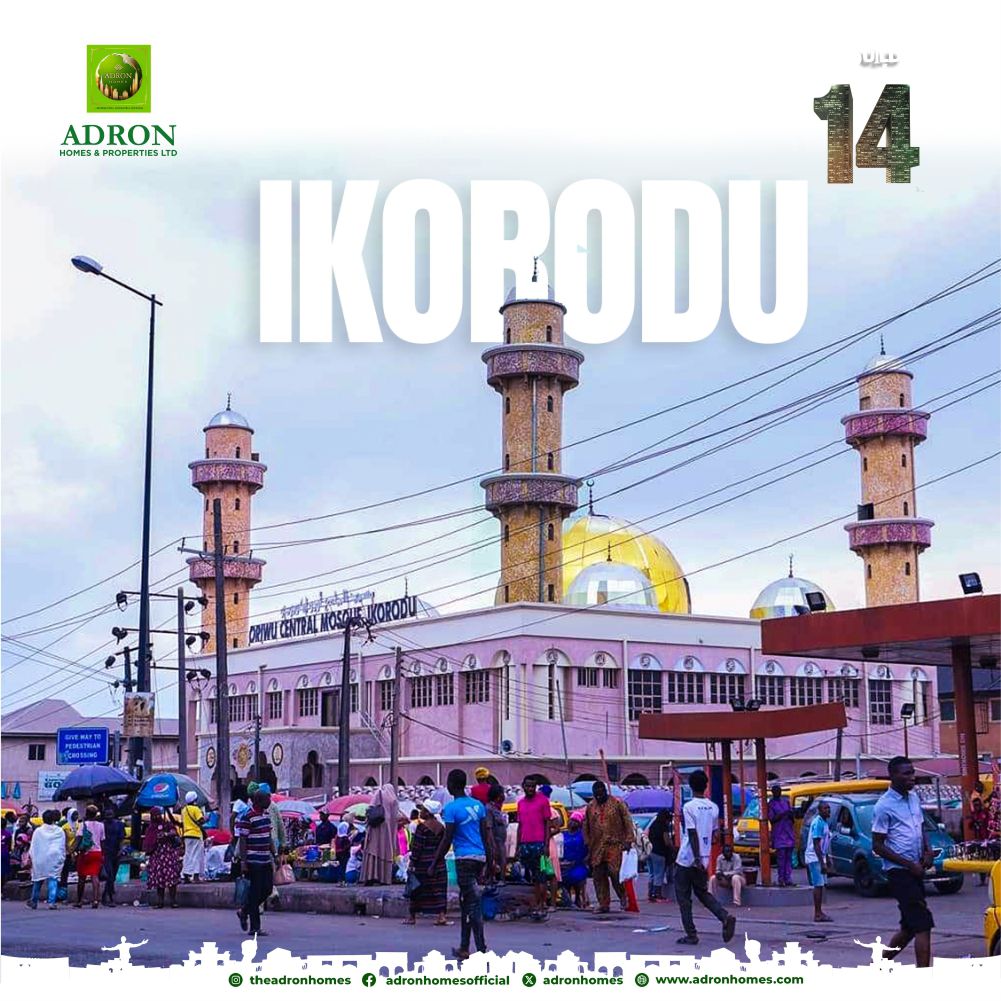

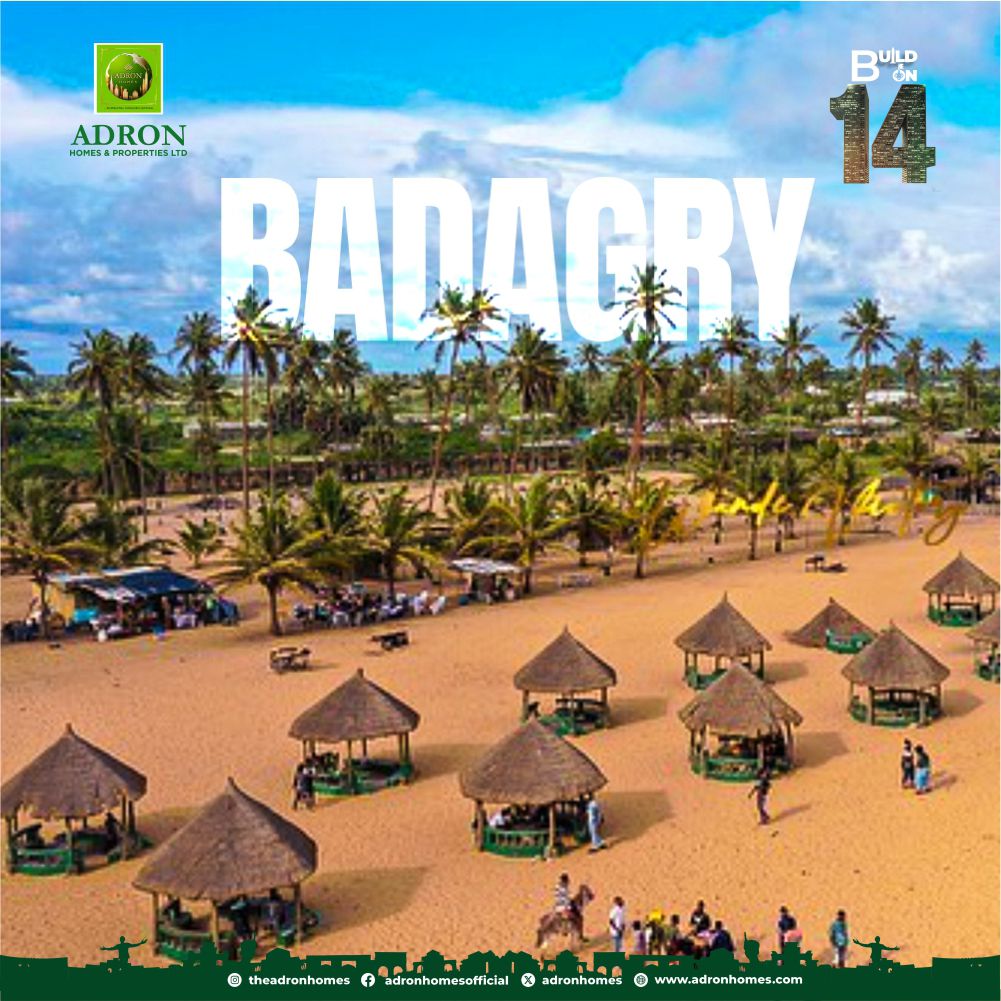

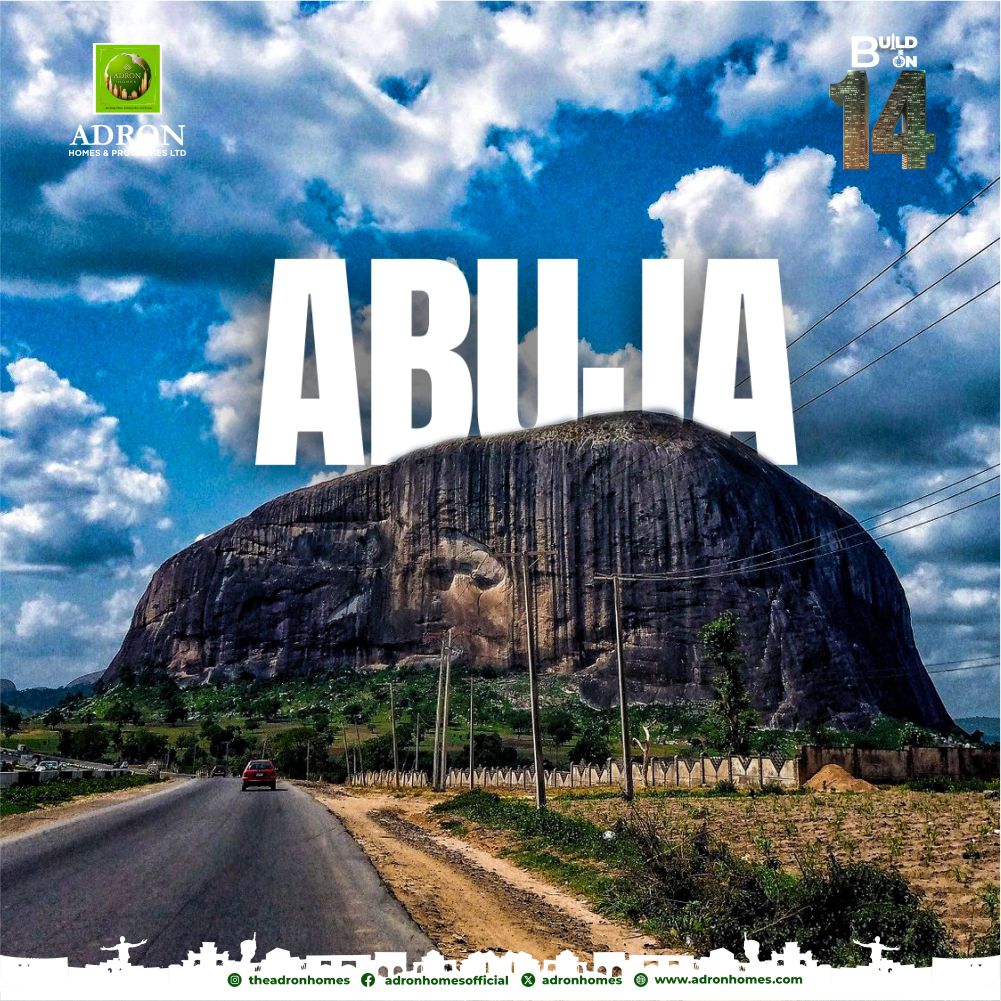

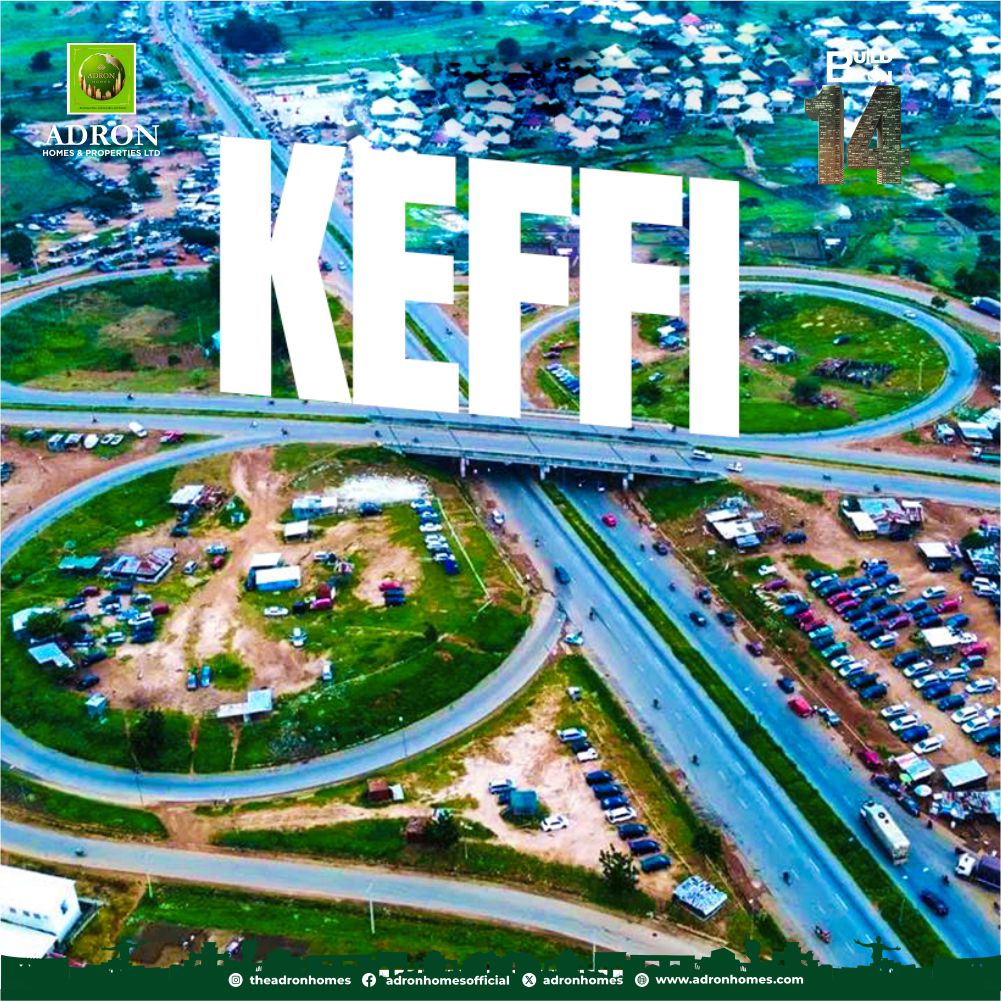

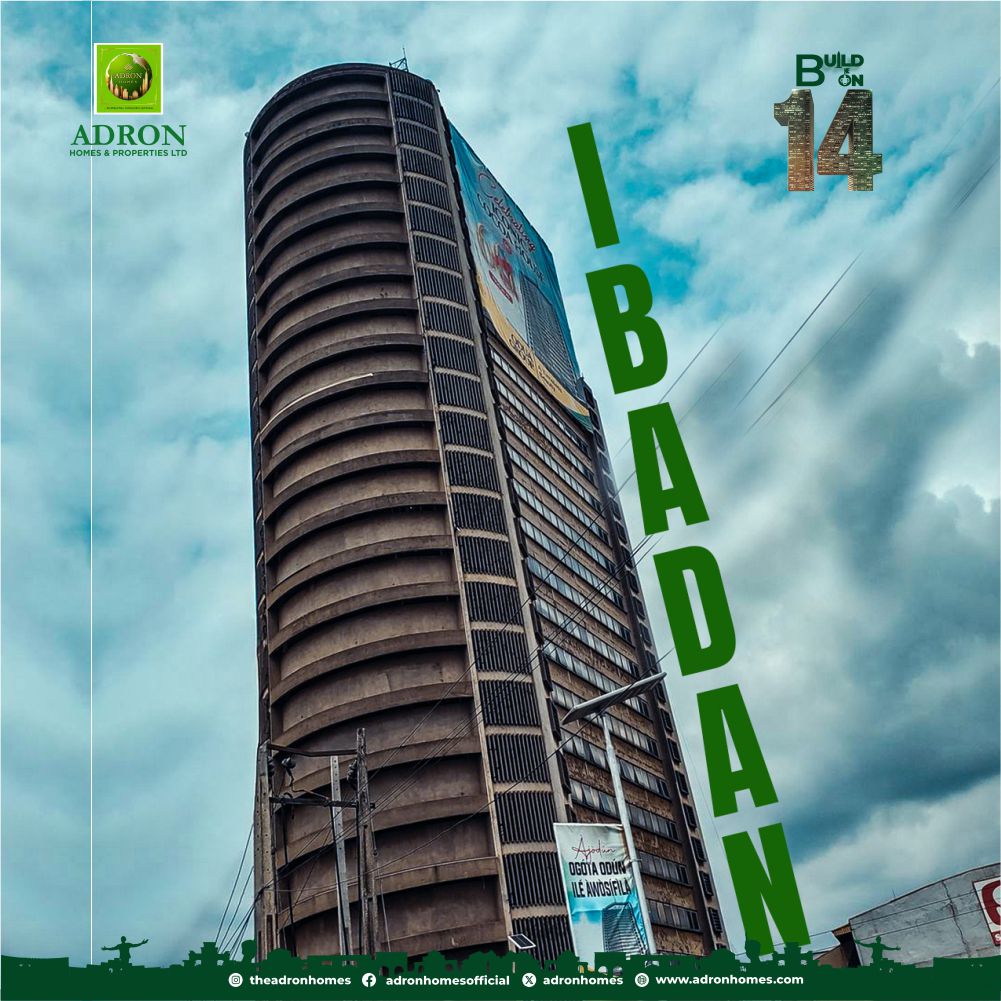

Over the last fourteen years, Adron Homes has evolved into a nationally recognised real estate powerhouse, delivering over 60 livable estates and communities across Nigeria and enabling more than 100,000 Nigerians to achieve their property ownership dreams. With strategic developments spanning Ibeju Lekki, Lekki-Epe, Badagry, Shimawa, Papalanto, Sagamu, Abeokuta, Ibadan, Osun, Ekiti, Abuja, Nasarawa, Niger State, and other emerging urban corridors, the company continues to reshape access to land and housing through affordability, innovation, and long-term planning.

Speaking on the milestone, the Chairman/CEO of Adron Group, Aare Adetola Emmanuelking, described the anniversary as a celebration of vision, resilience, and unwavering commitment to empowering Nigerians through property ownership.

“Fourteen years ago, we set out with a clear vision to make property ownership accessible and achievable for every hardworking Nigerian. Today, we celebrate not only the growth of Adron Homes but the countless families whose dreams have become reality through our communities. Our journey has always been about impact, empowerment, and building environments where people can truly thrive.”

Highlighting the company’s philosophy of developing structured environments rather than just selling land, the Chairman emphasised Adron Homes’ focus on sustainable urban planning and community building.

“At Adron Homes, we build cities, not just estates. Each development reflects thoughtful planning, infrastructure, accessibility, and a long-term vision for modern living. As Nigeria continues to urbanise rapidly, our mission is to ensure that growth is inclusive, structured, and sustainable.”

Aare Adetola Emmanuelking also acknowledged the role of customers, staff, stakeholders, and media partners in the company’s sustained growth and national relevance.

“This milestone is a testament to the trust of our customers, the dedication of our workforce, and the unwavering support of our partners and stakeholders. Together, we have demonstrated that affordable housing can be delivered with quality, innovation, and integrity.”

Looking ahead, Adron Homes reaffirmed its commitment to expanding mass housing solutions, embracing technology-driven real estate innovations, and strengthening partnerships that contribute to Nigeria’s economic development and housing accessibility.

“The future of Adron Homes is defined by innovation, expansion, and deeper community impact. We remain committed to democratizing property ownership, building sustainable communities, and shaping the future of real estate in Nigeria for generations to come.”

As Adron Homes marks 14 years of excellence and national impact, the company continues to position itself as a catalyst for structured urban development and a trusted partner in the realization of property dreams across Nigeria.

Business

Adron Homes at 14: From Shimawa to Over 60 Livable Communities, Building Cities Beyond Estates

Adron Homes at 14: From Shimawa to Over 60 Livable Communities, Building Cities Beyond Estates

Fourteen years ago, what began as a visionary real estate development effort in Shimawa, Ogun State, has evolved into one of Nigeria’s most recognizable housing success stories. Today, Adron Homes & Properties stands as a major force in structured urban development, with over 60 livable communities and estate dwellings spread across key regions of the country. Its journey reflects a deliberate mission that is not just to sell land, but to build functional cities where Nigerians can live with dignity, security, and a strong sense of community.

At a time when Nigeria faces rapid urbanization and an ever-growing housing deficit, Adron Homes has embraced an approach rooted in planning and affordability. From its earliest developments, the company adopted a city-building model that integrates structured layouts, accessible infrastructure, and community-focused design. Roads, drainage systems, green areas, and designated social spaces are incorporated into estate planning, transforming empty land into organized residential hubs.

The story of Adron’s growth mirrors Nigeria’s evolving urban landscape. Beginning in Shimawa, the company strategically expanded into major growth corridors, including Lagos, Ogun, Oyo, Osun, Ekiti, Abuja, Nasarawa, Niger, and beyond. Its estates have not only provided shelter but have also influenced the emergence of new residential districts, encouraging organized expansion and helping to reduce the challenges associated with unplanned settlements.

Central to the company’s success is its commitment to affordability. Through flexible payment structures and innovative housing initiatives, Adron Homes has opened the door to homeownership for thousands of Nigerians who previously considered property ownership out of reach. This democratization of housing has empowered families, strengthened communities, and supported economic growth through increased property investment and local business opportunities within estates.

Beyond physical structures, Adron Homes prioritizes community building. Estates are designed as living ecosystems where families interact, children grow in secure environments, and entrepreneurs find opportunities to thrive. The emphasis on social cohesion has helped transform residential spaces into vibrant neighborhoods, reinforcing the idea that housing development should nurture human connection as much as physical infrastructure.

As Nigeria continues to urbanize, Adron Homes’ model demonstrates that real estate development can be both commercially viable and socially impactful. Its projects serve as reference points for emerging residential corridors, attracting further investment and setting standards for organized development across multiple regions.

Celebrating fourteen years of growth and innovation, Adron Homes remains committed to shaping Nigeria’s urban future through sustainable planning, inclusive housing solutions, and community-driven development. From its humble beginnings in Shimawa to a nationwide network of livable communities, the company’s journey stands as a testament to the power of vision, resilience, and a steadfast belief that cities are built not just with structures, but with people at their heart.

Business

14 Years of Democratizing Landownership: How Adron Homes Is Redefining Mass Housing in Nigeria

14 Years of Democratizing Landownership: How Adron Homes Is Redefining Mass Housing in Nigeria

For decades, homeownership in Nigeria remained an elusive dream for millions, restricted by rising rents, unstable housing markets, and mortgage systems beyond the reach of the average citizen. Fourteen years ago, Adron Homes and Properties Limited set out to challenge this reality with a bold and disruptive vision: to make land and homeownership affordable, accessible, and achievable for everyday Nigerians.

Founded on the principle that housing should be a right and not a privilege, Adron Homes has steadily emerged as one of Nigeria’s most influential mass housing developers. At the heart of its success is an affordability-driven model that prioritizes inclusion without compromising quality. Through flexible payment plans, low initial deposits, and extended installment options, the company has broken long-standing financial barriers that once excluded civil servants, young professionals, artisans, traders, and Nigerians in the diaspora from owning property.

Fourteen years on, this vision has translated into tangible impact across over 60 estates nationwide, strategically located in major and emerging growth corridors including Ibeju-Lekki, Lekki–Epe, Badagry, Shimawa, Papalanto, Sagamu, Abeokuta, Ibadan, Osun, Ekiti, Abuja, Nasarawa, and Niger State. Each estate represents more than infrastructure, it reflects Adron Homes’ commitment to decentralizing development and expanding access to property ownership beyond traditional urban centers.

Through this mass housing initiative, thousands of Nigerians have successfully transitioned from tenants to landlords, many achieving property ownership for the first time. Unlike conventional real estate models that emphasize exclusivity and luxury, Adron Homes has consistently aligned its offerings with the real income realities of the Nigerian population, ensuring that housing solutions remain practical, inclusive, and sustainable.

Beyond affordability, trust has remained a defining pillar of the Adron Homes brand. The company places strong emphasis on secure land titles, transparent documentation, and regulatory compliance, protecting subscribers from land disputes and fraudulent transactions. This focus on integrity has strengthened customer confidence and positioned Adron Homes as a dependable gateway to long-term wealth creation through real estate.

As Adron Homes marks its 14th anniversary, its mass housing journey stands as more than a corporate achievement but a national intervention. By restoring dignity, promoting financial security, and transforming thousands of property ownership dreams into reality, Adron Homes continues to play a vital role in shaping Nigeria’s housing landscape and building a future where more citizens can truly call a place their own.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING

-

Business6 months ago

Business6 months agoBatsumi Travel CEO Lisa Sebogodi Wins Prestigious Africa Travel 100 Women Award

You must be logged in to post a comment Login