Business

Catch Hollywood’s biggest awards ceremony, the Oscars® on DStv

Hosted by Jimmy Kimmel, the 89th Academy Awards will be broadcast live on DStv this Monday, 27 February on M-Net Movies Premiere, DStv channel 104 at 2:30am and during Prime Time on M-Net, DStv channel 101/102, from 6:30pm.

The Oscars also will be televised in more than 225 countries and territories worldwide. Viewers can look forward to seeing perfomances by Oscar®-nominees Lin-Manuel Miranda, Sting, Justin Timberlake and 2014 Oscar-winner John Legend. Movies currently distributed by M-Net (highlighted in yellow): Hacksaw Ridge, Florence Foster Jenkins and La La Land are also competing for the most coveted award in their categories.

For more information, visit mnet.tv. Follow M-Net on Twitter @MNet (#Oscars #MMPremiere #MNet101) and Facebook https://www.facebook.com/MNet/

Attached is an image of Jimmy Kimmel. More images available on request.

Please see below the list of nominees:

Performance by an actor in a leading role

Casey Affleck in Manchester by the Sea

Andrew Garfield in Hacksaw Ridge

Ryan Gosling in La La Land

Viggo Mortensen in Captain Fantastic

Denzel Washington in Fences

Performance by an actor in a supporting role

Mahershala Ali in Moonlight

Jeff Bridges in Hell or High Water

Lucas Hedges in Manchester by the Sea

Dev Patel in Lion

Michael Shannon in Nocturnal Animals

Performance by an actress in a leading role

Isabelle Huppert in Elle

Ruth Negga in Loving

Natalie Portman in Jackie

Emma Stone in La La Land

Meryl Streep in Florence Foster Jenkins

Performance by an actress in a supporting role

Viola Davis in Fences

Naomie Harris in Moonlight

Nicole Kidman in Lion

Octavia Spencer in Hidden Figures

Michelle Williams in Manchester by the Sea

Best animated feature film of the year

“Kubo and the Two Strings” Travis Knight and Arianne Sutner

“Moana” John Musker, Ron Clements and Osnat Shurer

“My Life as a Zucchini” Claude Barras and Max Karli

“The Red Turtle” Michael Dudok de Wit and Toshio Suzuki

“Zootopia” Byron Howard, Rich Moore and Clark Spencer (Catch it on M-Net Movies Premiere at 104 on Sunday 26 February at 18:40)

Achievement in cinematography

“Arrival” Bradford Young

“La La Land” Linus Sandgren

“Lion” Greig Fraser

“Moonlight” James Laxton

“Silence” Rodrigo Prieto

Achievement in costume design

“Allied” Joanna Johnston

“Fantastic Beasts and Where to Find Them” Colleen Atwood

“Florence Foster Jenkins” Consolata Boyle

“Jackie” Madeline Fontaine

“La La Land” Mary Zophres

Achievement in directing

“Arrival” Denis Villeneuve

“Hacksaw Ridge” Mel Gibson

“La La Land” Damien Chazelle

“Manchester by the Sea” Kenneth Lonergan

“Moonlight” Barry Jenkins

Best documentary feature

“Fire at Sea”

A Stemal Entertainment Production

Gianfranco Rosi and Donatella Palermo

“I Am Not Your Negro”

A Velvet Film Production

Raoul Peck, Rémi Grellety and Hébert Peck

“Life, Animated”

A Motto Pictures and A&E IndieFilms Production

Roger Ross Williams and Julie Goldman

“O.J.: Made in America”

A Laylow Films and ESPN Films Production

Ezra Edelman and Caroline Waterlow

“13th”

A Forward Movement Production

Ava DuVernay, Spencer Averick and Howard

Barish

Best documentary short subject

“Extremis”

An f/8 Filmworks in association with Motto Pictures

Production

Dan Krauss

“4.1 Miles”

A University of California, Berkeley Production

Daphne Matziaraki

“Joe’s Violin”

A Lucky Two Production

Kahane Cooperman and Raphaela Neihausen

“Watani: My Homeland”

An ITN Production

Marcel Mettelsiefen and Stephen Ellis

“The White Helmets” (Netflix)

A Grain Media and Violet Films Production

Orlando von Einsiedel and Joanna Natasegara

Achievement in film editing

“Arrival” Joe Walker

“Hacksaw Ridge” John Gilbert

“Hell or High Water” Jake Roberts

“La La Land” Tom Cross

“Moonlight” Nat Sanders and Joi McMillon

Best foreign language film of the year

“Land of Mine”

A Nordisk Film Production

Denmark

“A Man Called Ove”

A Tre Vänner Production

Sweden

“The Salesman”

An Asghar Farhadi/Memento Films Production

Iran

“Tanna”

A Contact Films Production

Australia

“Toni Erdmann”

A Komplizen Film Production

Germany

Achievement in makeup and hairstyling

“A Man Called Ove” Eva von Bahr and Love Larson

“Star Trek Beyond” Joel Harlow and Richard Alonzo

“Suicide Squad” Alessandro Bertolazzi, Giorgio Gregorini and

Christopher Nelson

Achievement in music written for motion pictures (Original score)

“Jackie” Mica Levi

“La La Land” Justin Hurwitz

“Lion” Dustin O’Halloran and Hauschka

“Moonlight” Nicholas Britell

“Passengers” Thomas Newman

Achievement in music written for motion pictures (Original song)

“Audition (The Fools Who Dream)” from “La La Land”

Music by Justin Hurwitz

Lyric by Benj Pasek and Justin Paul

“Can’t Stop The Feeling” from “Trolls”

Music and Lyric by Justin Timberlake, Max Martin

and Karl Johan Schuster

“City Of Stars” from “La La Land”

Music by Justin Hurwitz

Lyric by Benj Pasek and Justin Paul

“The Empty Chair” from “Jim: The James Foley Story”

Music and Lyric by J. Ralph and Sting

“How Far I’ll Go” from “Moana”

Music and Lyric by Lin-Manuel Miranda

Best motion picture of the year

“Arrival”

A Paramount Pictures Production

Shawn Levy, Dan Levine, Aaron Ryder and David

Linde, Producers

“Fences”

A Paramount Pictures Production

Scott Rudin, Denzel Washington and Todd Black,

Producers

“Hacksaw Ridge”

A Pandemonium Films/Permut Presentations

Production

Bill Mechanic and David Permut, Producers

“Hell or High Water”

A Sidney Kimmel Entertainment/Film 44/LBI

Entertainment/OddLot Entertainment Production

Carla Hacken and Julie Yorn, Producers

“Hidden Figures”

A Fox 2000 Pictures Production

Donna Gigliotti, Peter Chernin, Jenno Topping,

Pharrell Williams and Theodore Melfi, Producers

“La La Land”

An Impostor Pictures/Gilbert Films/Marc Platt

Production

Fred Berger, Jordan Horowitz and Marc Platt,

Producers

“Lion”

A See-Saw Films Production

Emile Sherman, Iain Canning and Angie Fielder,

Producers

“Manchester by the Sea”

A Pearl Street Films/The Media Farm/K Period

Media/The A | Middleton Project/B Story Production

Matt Damon, Kimberly Steward, Chris Moore,

Lauren Beck and Kevin J. Walsh, Producers

“Moonlight”

A Dos Hermanas Production

Adele Romanski, Dede Gardner and Jeremy

Kleiner, Producers

Achievement in production design

“Arrival” Production Design:

Set Decoration:

Patrice Vermette

Paul Hotte

“Fantastic Beasts and Where to Find Them” (Warner Bros.) Production Design:

Set Decoration:

Stuart Craig

Anna Pinnock

“Hail, Caesar!” Production Design:

Set Decoration:

Jess Gonchor

Nancy Haigh

“La La Land” Production Design:

Set Decoration:

David Wasco

Sandy Reynolds-Wasco

“Passengers” Production Design:

Set Decoration:

Guy Hendrix Dyas

Gene Serdena

Best animated short film

“Blind Vaysha”

A National Film Board of Canada Production

Theodore Ushev

“Borrowed Time”

A Quorum Films Production

Andrew Coats and Lou Hamou-Lhadj

“Pear Cider and Cigarettes”

A Massive Swerve Studios and Passion Pictures

Animation Production

Robert Valley and Cara Speller

“Pearl”

A Google Spotlight Stories and Evil Eye Pictures

Production

Patrick Osborne

“Piper”

A Pixar Animation Studios Production

Alan Barillaro and Marc Sondheimer

Best live action short film

“Ennemis Intérieurs”

A Qualia Films Production

Sélim Azzazi

“La Femme et le TGV”

An arbel Production

Timo von Gunten and Giacun Caduff

“Silent Nights”

A M & M Production

Aske Bang and Kim Magnusson

“Sing”

A Meteor Filmstudio Production

Kristof Deák and Anna Udvardy

“Timecode”

A Nadir Films Production

Juanjo Giménez

Achievement in sound editing

“Arrival” Sylvain Bellemare

“Deepwater Horizon” Wylie Stateman and Renée Tondelli

“Hacksaw Ridge” Robert Mackenzie and Andy Wright

“La La Land” Ai-Ling Lee and Mildred Iatrou Morgan

“Sully” Alan Robert Murray and Bub Asman

Achievement in sound mixing

“Arrival” Bernard Gariépy Strobl and Claude La Haye

“Hacksaw Ridge” Kevin O’Connell, Andy Wright, Robert Mackenzie

and Peter Grace

“La La Land” Andy Nelson, Ai-Ling Lee and Steve A. Morrow

“Rogue One: A Star Wars Story” David Parker, Christopher Scarabosio and Stuart

Wilson

“13 Hours: The Secret Soldiers of Benghazi” Greg P. Russell, Gary Summers, Jeffrey J. Haboush and Mac Ruth

Achievement in visual effects

“Deepwater Horizon” Craig Hammack, Jason Snell, Jason Billington

and Burt Dalton

“Doctor Strange” Stephane Ceretti, Richard Bluff, Vincent Cirelli

and Paul Corbould

“The Jungle Book” Robert Legato, Adam Valdez, Andrew R. Jones

and Dan Lemmon

“Kubo and the Two Strings” Steve Emerson, Oliver Jones, Brian McLean and

Brad Schiff

“Rogue One: A Star Wars Story” John Knoll, Mohen Leo, Hal Hickel and Neil

Corbould

Adapted screenplay

“Arrival” Screenplay by Eric Heisserer

“Fences” Screenplay by August Wilson

“Hidden Figures” Screenplay by Allison Schroeder and Theodore

Melfi

“Lion” Screenplay by Luke Davies

“Moonlight” Screenplay by Barry Jenkins;

Story by Tarell Alvin McCraney

Original screenplay

“Hell or High Water” Written by Taylor Sheridan

“La La Land” Written by Damien Chazelle

“The Lobster” Written by Yorgos Lanthimos, Efthimis Filippou

“Manchester by the Sea” Written by Kenneth Lonergan

“20th Century Women” Written by Mike Mills

MOTION PICTURE NOMINATIONS – 89TH AWARDS

NOMINATIONS BY PICTURE

(This list does not include Short Films or Documentary Short Subjects.)

“Allied,” a Paramount Pictures Production

Costume design

(1 nomination)

“Arrival,” a Paramount Pictures Production

Cinematography

Directing

Film editing

Best picture

Production design

Sound editing

Sound mixing

Adapted screenplay

(8 nominations)

“Captain Fantastic,” an Electric City Entertainment/ShivHans Pictures Production (BleeckerStreet) Viggo Mortensen – Performance by an actor in a leading role

(1 nomination)

“Deepwater Horizon,” a di Bonaventura Pictures/Closest to the Hole/Leverage Entertainment

Production

Sound editing

Visual effects

(2 nominations)

“Doctor Strange,” a Marvel Studios Production (

Visual effects

(1 nomination)

“Elle,” an SBS Production

Isabelle Huppert – Performance by an actress in a leading role

(1 nomination)

“Fantastic Beasts and Where to Find Them,” a Boswell Street Production Costume design

Production design

(2 nominations)

“Fences,” a Paramount Pictures Production

Denzel Washington – Performance by an actor in a leading role

Viola Davis – Performance by an actress in a supporting role

Best picture

Adapted screenplay

(4 nominations)

“Fire at Sea,” a Stemal Entertainment Production

Documentary feature

(1 nomination)

“Florence Foster Jenkins,” a Paramount Pictures Production

Meryl Streep – Performance by an actress in a leading role

Costume design

(2 nominations)

“Hacksaw Ridge,” a Pandemonium Films/Permut Presentations Production

Andrew Garfield – Performance by an actor in a leading role

Directing

Film editing

Best picture

Sound editing

Sound mixing

(6 nominations)

“Hail, Caesar!,” a Working Title Films Production (Universal)

Production design

(1 nomination)

“Hell or High Water,” a Sidney Kimmel Entertainment/Film 44/LBI Entertainment/OddLot

Entertainment Production

Jeff Bridges – Performance by an actor in a supporting role

Film editing

Best picture

Original screenplay

(4 nominations)

“Hidden Figures,” a Fox 2000 Pictures Production

Octavia Spencer – Performance by an actress in a supporting role

Best picture

Adapted screenplay

(3 nominations)

“I Am Not Your Negro,” a Velvet Film Production

Documentary feature

(1 nomination)

“Jackie,”

Business

Deadline of Compliance: Nigeria’s Urgent Call for Tax Return Filing

Deadline of Compliance: Nigeria’s Urgent Call for Tax Return Filing

By George Omagbemi Sylvester | Published by SaharaWeeklyNG.com

“Shift or Structural Demand? A Declaration of Civic Duty in a Nation at a Fiscal Crossroads.”

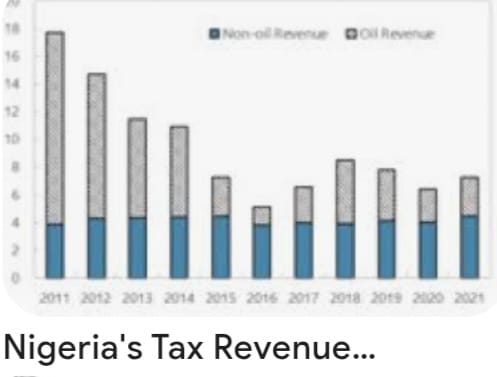

In the unfolding narrative of national development and economic reform, few instruments are as defining as tax compliance. For Nigeria, a nation perpetually grappling with revenue shortfalls, structural dependency on a single export commodity, and entrenched informal economic behaviour, the Federal Government’s recent clarification on tax return deadlines is not mere bureaucratic noise. It is a deliberate and inescapable declaration: the social contract between citizen and state must be honoured through transparent, lawful and timely tax reporting.

At its core, the government’s pronouncement is stark in its simplicity and radical in its implications. Federal authorities, speaking through the Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, have made it unequivocally clear that every Nigerian, whether employer or individual taxpayer, must file annual tax returns under the law. This encompasses self-assessment filings by individuals that too many assumed ended once employers deducted pay-as-you-earn taxes from their salaries.

This is not an optional civic suggestion, it is mandatory, backed by statute, and tied to a broader vision of national fiscal responsibility. Citizens can no longer hide behind ignorance, apathy, or false assumptions. “Many people assume that if their employer deducts tax from their salaries, their obligations end there. That is wrong,” Oyedele warned, emphasizing that the obligation to file remains with the individual under both existing and newly reformed tax laws.

The Deadlines and the Reality They Reveal.

Across the federation, state and federal revenue authorities have reaffirmed statutory deadlines in pursuit of compliance. The Lagos State Internal Revenue Service, for instance, moved to extend its filing date for employer returns by a narrow window, reflecting the reality that compliance often lags behind legal timelines. The extension was intended not as leniency, but as a pragmatic effort to allow accurate and complete submissions, underscoring that true compliance rises above mere mechanical ticking of a box.

At the federal level, Oyedele’s intervention was even more fundamental. He reminded Nigerians that annual tax returns for the preceding year must be filed in good faith, with integrity and in respect of the law. This applies regardless of income level including low-income earners who have historically believed that they are outside the tax net. “All of us must file our returns, including those earning low income,” he stated.

Herein lies one of the most challenging truths of contemporary Nigerian governance: widespread tax non-compliance is not just a technical breach of law, it is a deep cultural and structural issue that reflects decades of mistrust between citizens and the state.

The Root of the Problem: Non-Compliance as a Symptom.

Nigeria’s tax culture has long been under scrutiny. Public discourse and economic analysis consistently show that a significant majority of eligible taxpayers do not file annual returns. Oyedele highlighted that even in states widely regarded as tax administration leaders, compliance remains strikingly low, often below five percent.

This widespread non-compliance stems from multiple sources:

A long history of weak tax administration systems, where enforcement was inconsistent and penalties were rarely applied.

A perception that public services do not reflect the taxes collected, eroding the citizenry’s belief in reciprocity.

An informal economy where income often goes unrecorded, making filing seem irrelevant or impossible to many.

Lack of awareness, with many Nigerians genuinely believing that tax liability ends with employer deductions.

The government’s renewed push for compliance directly challenges these perceptions. It signals a shift from voluntary or lax compliance to structured accountability, a stance that aligns with best practices in modern public finance.

Why This Matters: Beyond Deadlines.

At its most profound level, the insistence on tax return filings is about nation-building and shared responsibility.

Scholars of public finance universally agree that a robust tax system is the backbone of sustainable development. As the eminent economist Dr. Joseph E. Stiglitz has observed, “A society that cannot mobilize its own resources through fair taxation undermines both its government’s legitimacy and its capacity to provide for its people.” Filing tax returns is not a mere administrative task, it is a declaration of participation in the collective project of national advancement.

In Nigeria’s context, this declaration carries weight. With the enactment of comprehensive tax reforms in recent years (including unified frameworks for tax administration and enforcement) authorities now possess broader statutory tools to ensure compliance and accountability. These measures, which include electronic filing platforms and stronger enforcement powers, have been framed as fair and equitable, targeting efficiency rather than arbitrariness.

Yet the success of these reforms depends heavily on citizens embracing their civic duties with sincerity. And this depends on mutual trust, the belief that paying taxes yields tangible benefits in infrastructure, education, healthcare, security and social services.

Voices From Experts: Fiscal Responsibility as a Public Ethic.

Tax law experts and economists, reflecting on the compliance push, have underscored a universal theme: taxation without transparency is inequity, but taxation with accountability is empowerment. When managed with fairness, a functional tax system can reduce dependency on volatile revenue sources, stabilise national budgets, and support long-term investment in human capital.

Professor Aisha Bello, a respected authority in fiscal policy, notes that “Tax compliance is not a burden; it is the foundation upon which social contracts are built. A citizen who honours tax obligations affirms the legitimacy of governance and demands better performance in return.”

Similarly, a leading tax scholar, Dr. Emeka Okon, argues that “The era when Nigerians could evade broader tax responsibilities simply because automatic deductions occur at source must end. For a modern economy, every eligible citizen must be part of the formal tax fold not as victims, but as stakeholders.”

These authoritative voices point to an unassailable truth: filing tax returns is both a legal requirement and a moral responsibility, an expression of citizenship in its fullest sense.

Challenges on the Ground: Compliance and Capacity.

While the rhetoric of compliance is compelling, the reality on the ground demands nuanced understanding. Many taxpayers (especially in the informal sector) lack meaningful access to digital platforms and resources for filing returns. For others, the fear of bureaucratic complexity and perceived punitive enforcement deters participation.

The government, for its part, has responded by promoting online systems and pledging greater taxpayer support. Tax authorities are increasingly engaging stakeholders to demystify filing processes, explain requirements and offer assistance. This mix of enforcement and facilitation is essential. As one seasoned revenue specialist observed: “The state cannot compel compliance through force alone; it must earn it through education, simplicity and fairness.”

The Broader Implication: A New Social Compact.

Ultimately, Nigeria’s renewed emphasis on tax return filing transcends administrative deadlines. It is an unequivocal declaration that national development is a shared responsibility, that citizens and state must engage in a transparent, accountable, and reciprocal relationship.

Tax compliance, therefore, becomes far more than a legal act; it becomes a moral claim on the nation’s future.

When citizens file their returns honestly, they affirm their stake in the nation’s destiny. When the government collects taxes transparently and deploys them effectively, it strengthens not only public services but civic trust itself.

In this sense, the deadlines proclaimed by Nigeria’s fiscal authorities mark not an end but a beginning; the beginning of a civic epoch in which accountability replaces apathy, participation replaces indifference and national purpose triumphs over fragmentation.

The road ahead will not be easy. But in demanding compliance, Nigeria is demanding more than tax returns. It is demanding commitment and that, ultimately, is the foundation on which nations are built.

Business

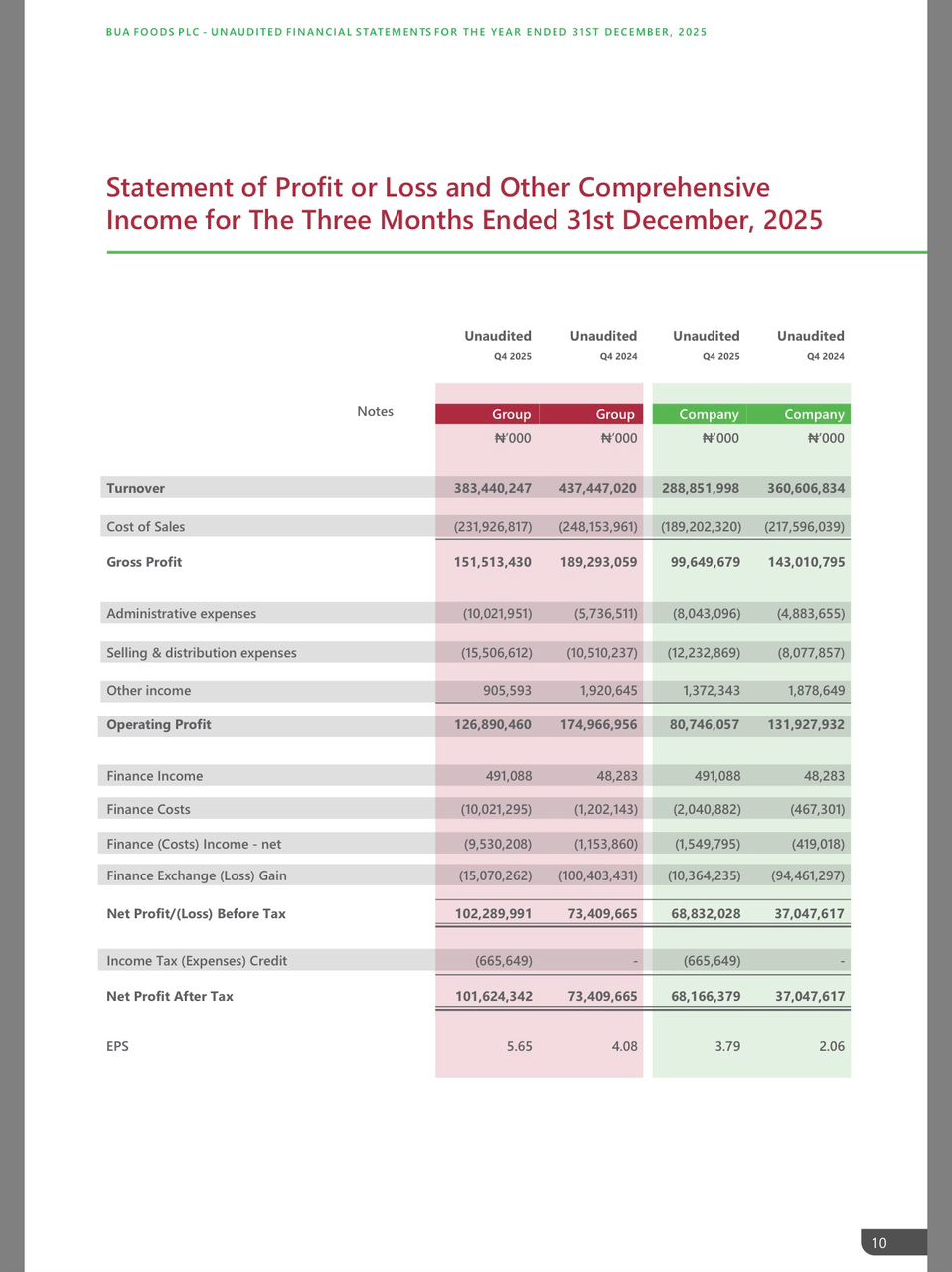

BUA Foods Records 91% Surge in Profit After Tax, Hits ₦508bn in 2025

BUA Foods Records 91% Surge in Profit After Tax, Hits ₦508bn in 2025

By femi Oyewale

Business

Adron Homes Unveils “Love for Love” Valentine Promo with Exciting Discounts, Luxury Gifts, and Travel Rewards

Adron Homes Unveils “Love for Love” Valentine Promo with Exciting Discounts, Luxury Gifts, and Travel Rewards

In celebration of the season of love, Adron Homes and Properties has announced the launch of its special Valentine campaign, “Love for Love” Promo, a customer-centric initiative designed to reward Nigerians who choose to express love through smart, lasting real estate investments.

The Love for Love Promo offers clients attractive discounts, flexible payment options, and an array of exclusive gift items, reinforcing Adron Homes’ commitment to making property ownership both rewarding and accessible. The campaign runs throughout the Valentine season and applies to the company’s wide portfolio of estates and housing projects strategically located across Nigeria.

Speaking on the promo, the company’s Managing Director, Mrs Adenike Ajobo, stated that the initiative is aimed at encouraging individuals and families to move beyond conventional Valentine gifts by investing in assets that secure their future. According to the company, love is best demonstrated through stability, legacy, and long-term value—principles that real estate ownership represents.

Under the promo structure, clients who make a payment of ₦100,000 receive cake, chocolates, and a bottle of wine, while those who pay ₦200,000 are rewarded with a Love Hamper. Payments of ₦500,000 attract a Love Hamper plus cake, and clients who pay ₦1,000,000 enjoy a choice of a Samsung phone or a Love Hamper with cake.

The rewards become increasingly premium as commitment grows. Clients who pay ₦5,000,000 receive either an iPad or an all-expenses-paid romantic getaway for a couple at one of Nigeria’s finest hotels, which includes two nights’ accommodation, special treats, and a Love Hamper. A payment of ₦10,000,000 comes with a choice of a Samsung Z Fold 7, three nights at a top-tier resort in Nigeria, or a full solar power installation.

For high-value investors, the Love for Love Promo delivers exceptional lifestyle experiences. Clients who pay ₦30,000,000 on land are rewarded with a three-night couple’s trip to Doha, Qatar, or South Africa, while purchasers of any Adron Homes house valued at ₦50,000,000 receive a double-door refrigerator.

The promo covers Adron Homes’ estates located in Lagos, Shimawa, Sagamu, Atan–Ota, Papalanto, Abeokuta, Ibadan, Osun, Ekiti, Abuja, Nasarawa, and Niger States, offering clients the opportunity to invest in fast-growing, strategically positioned communities nationwide.

Adron Homes reiterated that beyond the incentives, the campaign underscores the company’s strong reputation for secure land titles, affordable pricing, strategic locations, and a proven legacy in real estate development.

As Valentine’s Day approaches, Adron Homes encourages Nigerians at home and in the diaspora to take advantage of the Love for Love Promo to enjoy exceptional value, exclusive rewards, and the opportunity to build a future rooted in love, security, and prosperity.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

Business6 months ago

Business6 months agoBatsumi Travel CEO Lisa Sebogodi Wins Prestigious Africa Travel 100 Women Award

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING

You must be logged in to post a comment Login