Business

Crisis as Rivers state Governor, Nyesom Wike, NIA fight over ownership of N13bn found in Ikoyi

The controversy surrounding the ownership of the N13bn ($43.4m, N23m and £27,000) found by the Economic and Financial Crimes Commission at the Osborne Towers, Ikoyi, Lagos, took a dramatic turn on Friday evening when Governor Nyesom Wike of Rivers State and the National Intelligence Agency claimed ownership of the money.

The National Intelligence Agency on Friday said the money belonged to it.

A national daily had earlier reported that the money belonged to the NIA. Sources at the agency confirmed to one our correspondents late Friday that the money belonged to the agency and that it had written a formal letter to President Muhammadu Buhari to claim ownership of the money.

Saturday PUNCH learnt that the NIA, which is Nigeria’s foreign intelligence service, explained that the money, which was found on the seventh floor of the building, was approved by former President Goodluck Jonathan for covert operations and security projects covering a period of years.

The money was said to have been released in bits during the tenure of a former NIA director-general.

A source said that the cash was approved before the advent of the Treasury Single Account.

He stated that the Director-General of the NIA, Amb. Ayo Oke; the EFCC Chairman, Mr. Ibrahim Magu; and the National Security Adviser, Babagana Moguno, had met over the issue. A Presidency source also confirmed the meeting to one of our correspondents.

The NIA source explained that when EFCC operatives stormed the Ikoyi property on Wednesday, they were informed that the said apartment was a safe house of the NIA from which discreet operations were carried out.

The EFCC boss, however, rejected all entreaties from the NIA and entered the building, breaking the fireproof safes and taking the money.

The source, who wished to remain anonymous because he was not authorised to speak with the media, said, “The money belongs to the NIA. It is for covert operations and security projects covering a period of years.The DG has met with the President, he has explained everything to him. The President asked him to put everything into writing and he has done so.

“The entire chain of events was a big misunderstanding. That place was an NIA safe house and you have to understand that the NIA carries out discreet investigation in conjunction with many agencies across the world.

“On the day the EFCC men gathered around the house, the NIA reached out to Magu to explain to him that the money was the property of the Federal Government and the place was an NIA safe house. Unfortunately, the EFCC still went ahead to break down the doors.”

But Wike, who described the claim that the cash belonged to the NIA as balderdash, alleged that the immediate past governor of the state and the current Minister of Transportation, Mr. Rotimi Amaechi, kept the money in the apartment.

As such, the Rivers State governor gave the Federal Government a seven-day ultimatum to return the money to the state government or be ready to face legal action.

Speaking with newsmen in Port Harcourt on Friday night, Wike said the $43m was part of the proceeds from the sale of a gas turbine by the immediate past administration, adding that the gas turbine was initially built by the Peter Odili administration.

The governor further challenged the Federal Government to set up a commission of inquiry to probe the source of the huge money found in the flat, insisting that the funds belonged to Rivers people and should be returned to the owners within seven days.

He said, “All these things they are saying that the $43m belong to the Nigerian Intelligence Agency is balderdash. When did the NIA begin to keep money in houses? As I speak to you now, the Federal Government is so embarrassed.

“I want the President to set up a commission of inquiry. We don’t want to fight anybody; they should set up a commission of inquiry or return our money within seven days. If they don’t, we will take all necessary legal actions and NIA will come and prove where they got the money from.

“The $43m is the proceeds of the sale of the gas turbine sold by the immediate past administration. The gas turbine was built by the (Peter) Odili administration. It (gas turbine) was sold to Sahara Energy.

“The turbine was sold for $319m. But as of May 2015, what was in the account was $204,000. We will avail ourselves and we will be present at the commission of inquiry expected to be set up by the Federal Government. If we are invited, we will come. There is no contradiction in this at all, but I know they (FG) will not agree.”

Wike maintained that he would complete the monorail project if the Federal Government returned the $43m to Rivers State, adding that it would be “projects galore” in the state should the money be returned back to its original owner.

“Part of the money from the sale of the gas turbine was used to fund the All Progressives Congress campaign. We are telling the world that the money belongs to us. If they (FG) give us the money, I will complete the monorail project,” he said.

When contacted, the media aide to Mr. Rotimi Amaechi, Mr. David Iyofor, said he would react to Wike’s claim on Saturday (today).

The money has since been deposited into the account of the Central Bank of Nigeria following an interim forfeiture order granted by a Federal High Court in Lagos.

The court had also ruled that if the owner of the money did not show up within 30 days, it would be forfeited to the federal Government permanently.

EFCC keeps mum

All attempts to speak with the spokesperson for the EFCC, Mr. Wilson Uwujaren, on Friday proved abortive as his phone indicated that it was switched off while a text message sent to his phone was not responded to.

It’s a security issue –Presidency

When contacted, the Special Adviser to the President on Media and Publicity, Mr. Femi Adesina, directed our correspondent to the security agencies said to have been involved in the matter.

“This is not a matter for the Presidency. It is a security issue and I will advise you to get across to the agencies mentioned,” he said on the telephone.

SERAP, CD, others hit EFCC for hiding owners’ identities

But socio-political groups, including the Socio-Economic Right Accountability Project and the Campaign for Democracy, criticised the EFCC for hiding the identities of the owners of the recently recovered funds in Lagos and Kaduna.

SERAP and the CD, in separate interviews with Saturday PUNCH, said that it was anti-democratic for the EFCC to shield the identities of the owners of recovered money.

The SERAP Director, Adetokunbo Mumuni, said, “Whatever information that the EFCC has about any money abandoned or found in any place deserves to be released to the public. In a democracy, there can’t be opaqueness. This issue affects public interest and it is against the collective interest if the EFCC withholds the identities.

“The EFCC’s action will be contrary to public policy and anti-democratic if the information is not released. What will happen if the EFCC is not open is that it will give room for rumours, which is not good for democracy.”

In his own remarks, the CD President, Usman Abdul, said, “The EFCC of recent has just been playing to the gallery. The APC-led Federal Government should not take citizens for a ride. After the denial of the confirmation of the EFCC Chair, Magu, we have had several seizures in Kaduna and Lagos states, without anybody having being identified as the custodians of these monies.

“It is quite laughable that new notes of money, even hard to get in banks, were found and the EFCC cannot disclose who committed such acts.”

On his part, the National Publicity Secretary of Afenifere, Yinka Odumakin, said that it was unfortunate that Magu’s EFCC out of desperation had thrown caution to the wind in the desperate attempt to be in the news and excite the public.

He stated, “You found such volume of cash without any attempt to find the owners and you start a cinema of exhibit. A sergeant IPO who does that should be fired without benefits.

“You cannot tell me that you cannot trace the title of a property in Ikoyi at Alausa in a matter of hours .But it seems Magu is all about anti-corruption and seduction.

“If Magu fails to disclose the owners of the money, it means that the anti-corruption war has become a ‘night of a thousand laughs.’”

Also, the Executive Secretary, Anti-Corruption Network, Ebenezer Oyetakin, said, “The fight against corruption must be total, unambiguous, true in character and content, transparent in outlook and must not be cloudy in presentation to the public.”

He said that the shielding of the identity of the looters in itself was corruption and detrimental to the success of the fight against graft.

Oyetakin stated, “The fact that this is fuelling speculations that those involved are government officials of the present regime is too bad for the image of the government that is fighting corruption.

“This is why I must vehemently call on the EFCC to do the needful by releasing the names of the looters. The more reason why the names should be made known is to serve deterrence against such practices.

“However, I am more concerned that arresting and making this type of discovery once in a month is not the only way to fight corruption or regained the loots, otherwise fifty years will not be enough to regain looted funds.”

He called for the re-denomination of the naira, adding that owners of looted funds could come out and change their money.

A former chairman of the Peoples Democratic Party, Adamu Mu’azu was reported to have said that he knew nothing about funds recovered at a property reported to be his in Ikoyi, Lagos.

An online newspaper, The Cable, reported that Mu’azu, who was the Governor of Bauchi State from 1999 to 2007, said he got a bank loan to acquire the land where the house was built, adding that he sold the house to pay back the loan.

Another online newspaper, Sahara Reporters, reported that the Minister of Transportation, Amaechi, said he had no connection whatsoever with the apartment or the money.

He was reported to have said that he did not own any apartment or house in Lagos, stating that his only property in Nigeria was in Abuja.

Business

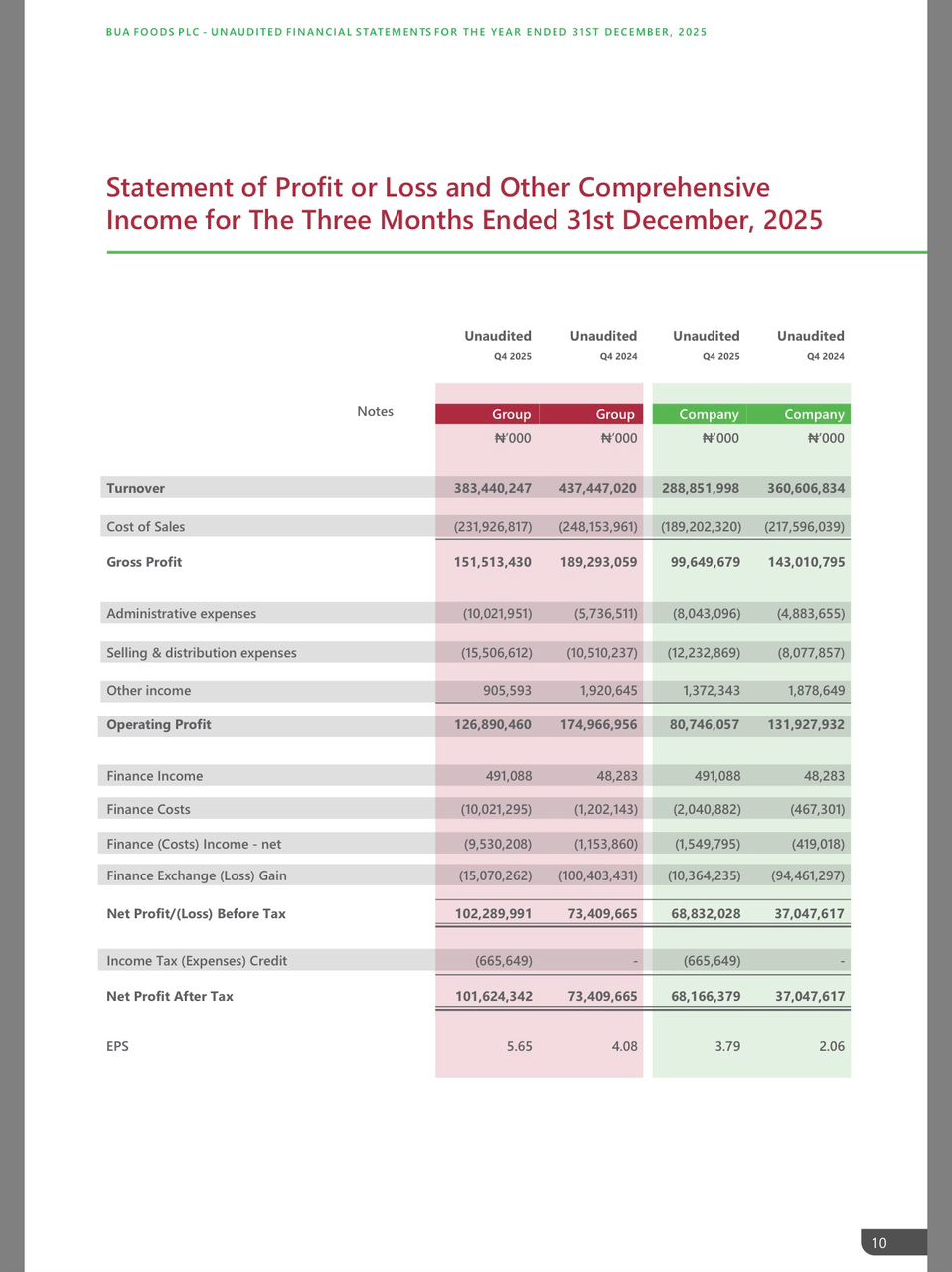

BUA Foods Records 91% Surge in Profit After Tax, Hits ₦508bn in 2025

BUA Foods Records 91% Surge in Profit After Tax, Hits ₦508bn in 2025

By femi Oyewale

Business

Adron Homes Unveils “Love for Love” Valentine Promo with Exciting Discounts, Luxury Gifts, and Travel Rewards

Adron Homes Unveils “Love for Love” Valentine Promo with Exciting Discounts, Luxury Gifts, and Travel Rewards

In celebration of the season of love, Adron Homes and Properties has announced the launch of its special Valentine campaign, “Love for Love” Promo, a customer-centric initiative designed to reward Nigerians who choose to express love through smart, lasting real estate investments.

The Love for Love Promo offers clients attractive discounts, flexible payment options, and an array of exclusive gift items, reinforcing Adron Homes’ commitment to making property ownership both rewarding and accessible. The campaign runs throughout the Valentine season and applies to the company’s wide portfolio of estates and housing projects strategically located across Nigeria.

Speaking on the promo, the company’s Managing Director, Mrs Adenike Ajobo, stated that the initiative is aimed at encouraging individuals and families to move beyond conventional Valentine gifts by investing in assets that secure their future. According to the company, love is best demonstrated through stability, legacy, and long-term value—principles that real estate ownership represents.

Under the promo structure, clients who make a payment of ₦100,000 receive cake, chocolates, and a bottle of wine, while those who pay ₦200,000 are rewarded with a Love Hamper. Payments of ₦500,000 attract a Love Hamper plus cake, and clients who pay ₦1,000,000 enjoy a choice of a Samsung phone or a Love Hamper with cake.

The rewards become increasingly premium as commitment grows. Clients who pay ₦5,000,000 receive either an iPad or an all-expenses-paid romantic getaway for a couple at one of Nigeria’s finest hotels, which includes two nights’ accommodation, special treats, and a Love Hamper. A payment of ₦10,000,000 comes with a choice of a Samsung Z Fold 7, three nights at a top-tier resort in Nigeria, or a full solar power installation.

For high-value investors, the Love for Love Promo delivers exceptional lifestyle experiences. Clients who pay ₦30,000,000 on land are rewarded with a three-night couple’s trip to Doha, Qatar, or South Africa, while purchasers of any Adron Homes house valued at ₦50,000,000 receive a double-door refrigerator.

The promo covers Adron Homes’ estates located in Lagos, Shimawa, Sagamu, Atan–Ota, Papalanto, Abeokuta, Ibadan, Osun, Ekiti, Abuja, Nasarawa, and Niger States, offering clients the opportunity to invest in fast-growing, strategically positioned communities nationwide.

Adron Homes reiterated that beyond the incentives, the campaign underscores the company’s strong reputation for secure land titles, affordable pricing, strategic locations, and a proven legacy in real estate development.

As Valentine’s Day approaches, Adron Homes encourages Nigerians at home and in the diaspora to take advantage of the Love for Love Promo to enjoy exceptional value, exclusive rewards, and the opportunity to build a future rooted in love, security, and prosperity.

Business

Why Nigeria’s Banks Still on Shaky Ground with Big Profits, Weak Capital

*Why Nigeria’s Banks Still on Shaky Ground with Big Profits, Weak Capital*

*BY BLAISE UDUNZE*

Despite the fragile 2024 economy grappling with inflation, currency volatility, and weak growth, Nigeria’s banking industry was widely portrayed as successful and strong amid triumphal headlines. The figures appeared to signal strength, resilience, and superior management as the Tier-1 banks such as Access Bank, Zenith Bank, GTBank, UBA, and First Bank of Nigeria, collectively reported profits approaching, and in some cases exceeding, N1 trillion. Surprisingly, a year later, these same banks touted as sound and solid are locked in a frenetic race to the capital markets, issuing rights offers and public placements back-to-back to meet the Central Bank of Nigeria’s N500 billion recapitalisation thresholds.

The contradiction is glaring. If Nigeria’s biggest banks are so profitable, why are they unable to internally fund their new capital requirements? Why have no fewer than 27 banks tapped the capital market in quick succession despite repeated assurances of balance-sheet robustness? And more fundamentally, what do these record profits actually say about the real health of the banking system?

The recapitalisation directive announced by the CBN in 2024 was ambitious by design. Banks with international licences were required to raise minimum capital to N500 billion by March 2026, while national and regional banks faced lower but still substantial thresholds ranging from N200 billion to N50 billion, respectively. Looking at the policy, it was sold as a modern reform meant to make banks stronger, more resilient in tough times, and better able to support major long-term economic development. In theory, strong banks should welcome such reforms. In practice, the scramble that followed has exposed uncomfortable truths about the structure of bank profitability in Nigeria.

At the heart of the inconsistency is a fundamental misunderstanding often encouraged by the banks themselves between profits and capital. Unknown to many, profitability, no matter how impressive, does not automatically translate into regulatory capital. Primarily, the CBN’s recapitalisation framework actually focuses on money paid in by shareholders when buying shares, fresh equity injected by investors over retained earnings or profits that exist mainly on paper.

This distinction matters because much of the profit surge recorded in 2024 and early 2025 was neither cash-generative nor sustainably repeatable. A significant portion of those headline banks’ profits reported actually came from foreign exchange revaluation gains following the sharp fall of the naira after exchange-rate unification. The industry witnessed that banks’ holding dollar-denominated assets their books showed bigger numbers as their balance sheets swell in naira terms, creating enormous paper profits without a corresponding improvement in underlying operational strength. These gains inflated income statements but did little to strengthen core capital, especially after the CBN barred banks from using FX revaluation gains for dividends or routine operations. In effect, banks looked richer without becoming stronger.

Beyond FX effects, Nigerian banks have increasingly relied on non-interest income fees, charges, and transaction levies to drive profitability. While this model is lucrative, it does not necessarily deepen financial intermediation or expand productive lending. High profits built on customer charges rather than loan growth offer limited support for long-term balance-sheet expansion. They also leave banks vulnerable when macroeconomic conditions shift, as is now happening.

Indeed, the recapitalisation exercise coincides with a turning point in the monetary cycle. The extraordinary conditions that supported bank earnings in 2024 and 2025 are beginning to unwind. Analysts now warn that Nigerian banks are approaching earnings reset, as net interest margins the backbone of traditional banking profitability, come under sustained pressure.

Renaissance Capital, in a January note, projects that major banks including Zenith, GTCO, Access Holdings, and UBA will struggle to deliver earnings growth in 2026 comparable to recent performance.

In a real sense, the CBN is expected to lower interest rates by 400 to 500 basis points because inflation is slowing down, and this means that banks will earn less on loans and government bonds, but they may not be able to quickly lower the interest they pay on deposits or other debts. The cash reserve requirements are still elevated, which does not earn interest; banks can’t easily increase or expand lending investments to make up for lower returns. The implications are significant. Net interest margin, the difference between what banks earn on loans and investments and what they pay on deposits, is poised to contract. Deposit competition is intensifying as lenders fight to shore up liquidity ahead of recapitalisation deadlines, pushing up funding costs. At the same time, yields on treasury bills and bonds, long a safe and lucrative haven for banks are expected to soften in a lower-rate environment. The result is a narrowing profit cushion just as banks are being asked to carry far larger equity bases.

Compounding this challenge is the fading of FX revaluation windfalls. With the naira relatively more stable in early 2026, the non-cash gains that once flattered bank earnings have largely evaporated. What remains is the less glamorous reality of core banking operations: credit risk management, cost efficiency, and genuine loan growth in a sluggish economy. In this new environment, maintaining headline profits will be far harder, even before accounting for the dilutive impact of recapitalisation.

That dilution is another underappreciated consequence of the capital rush. Massive share issuances mean that even if banks manage to sustain absolute profit levels, earnings per share and return on equity are likely to decline. Zenith, Access, UBA, and others are dramatically increasing their share counts. The same earnings pie is now being divided among many more shareholders, making individual returns leaner than during the pre-recapitalisation boom. For investors, the optics of strong profits may soon give way to the reality of weaker per-share performance.

Yet banks have pressed ahead, not only out of regulatory necessity but also strategic calculation.

During this period of recapitalization, investors are interested in the stock market with optimism, especially about bank shares, as banks are raising fresh capital, and this makes it easier to attract investments. This has become a season for the management teams to seize the moment to raise funds at relatively attractive valuations, strengthen ownership positions, and position themselves for post-recapitalisation dominance. In several cases, major shareholders and insiders have increased their stakes, as projected in the media, signalling confidence in long-term prospects even as near-term returns face pressure.

There is also a broader structural ambition at play. Well-capitalised banks can take on larger single obligor exposures, finance infrastructure projects, expand regionally, and compete more credibly with pan-African and global peers. From this perspective, recapitalisation is not merely about compliance but about reshaping the competitive hierarchy of Nigerian banking. What will be witnessed in the industry is that those who succeed will emerge larger, fewer, and more powerful. Those that fail will be forced into consolidation, retreat, or irrelevance.

For the wider economy, the outcome is ambiguous. Stronger banks with deeper capital buffers could improve systemic stability and enhance Nigeria’s ability to fund long-term development. The point is that while merging or consolidating banks may make them safer, it can also harm the market and the economy because it will reduce competition, let a few banks dominate, and encourage them to earn easy money from bonds and fees instead of funding real businesses. The truth be told, injecting more capital into the banks without complementary reforms in credit infrastructure, risk-sharing mechanisms, and fiscal discipline, isn’t enough as the aforementioned reforms are also needed.

The rush as exposed in this period, is that the moment Nigerian banks started raising new capital, the glaring reality behind their reported profits became clearer, that profits weren’t purely from good management, while the financial industry is not as sound and strong as its headline figures. The fact that trillion-naira profit banks must return repeatedly to shareholders for fresh capital is not a sign of excess strength, but of structural imbalance.

With the deadline for banks to raise new capital coming soon, by 31 March 2026, the focus has shifted from just raising N500 billion. N200 billion or N50 billion to think about the future shape and quality of Nigeria’s financial industry, or what it will actually look like afterward. Will recapitalisation mark a turning point toward deeper intermediation, lower dependence on speculative gains, and stronger support for economic growth? Or will it simply reset the numbers while leaving underlying incentives unchanged?

The answer will define the next chapter of Nigerian banking long after the capital market roadshows have ended and the profit headlines have faded.

Blaise, a journalist and PR professional, writes from Lagos and can be reached via: [email protected]

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

Business6 months ago

Business6 months agoBatsumi Travel CEO Lisa Sebogodi Wins Prestigious Africa Travel 100 Women Award

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING

You must be logged in to post a comment Login