Business

APC sweeps Lagos LG polls

Early returns from yesterday’s local government elections showed that the All Progressives Congress (APC) was having an easy ride in all parts of the state.

At press time, the party’s candidates had won the chairman position in Lagos Island LG, Badagry West LCDA, Epe LG, Eredo LCDA, Onigbongbo LCDA; Lagos Island East LCDA; Ikorodu LG, Ikorodu West LCDA; Badagry LG; and Ejigbo LCDA

Below are details of the results:

Lagos Island

Adetoyese Olusi (APC) 14,692

Yisa Ismail (PDP) 925

Kasumu Olanrewaju (LP) 1211

Ikoyi-Obalende LCDA

Atanda Lawal (APC) 7120

Samuel Akinwole (PDP) 756

Mohammed Jubril (LP) 542

Eredo LCDA

Rasal Saliu (APC) 10910

Kunle Ayantuga 737

Epe LG

Dayo Adesanya (APC) 21441

Omobibi (LP) 948

Lagos Island East

Kamal Olawale (APC) 9060

Adebayo Temitope (PDP) 1128

Onigbongbo LCDA

Hakeem Olayemi (Accord Party ) 842

Oke Babatunde (APC) 1631

Badagry West LCDA

Bello Joseph (APC) 5332

Setonji Ojugbele (PDP) 935

Ejigbo LCDA

Bello Oloyede (APC)4876

Akinlude (PDP) 179

Ikeja LG

Alabi Balogun (APC) 6191

Olowolagba Omolara (PDP) 990

Badagry LG

APC 3990

PDP1281

Accord 1597

Ojokoro

Ward-A

Chairman

APC: 1,351

PDP: 156

Councillor

APC: 1,351

PDP: 156

Ojokoro Ward-B

Chairman

APC: 912

PDP: 169

ACCORD: 103

Councillor

APC: 880

PDP: 172

ACCORD: 150

Ojokoro Ward-C

Chairman

APC: 1,786

PDP: 178

LP: 085

ACCORD: 11

Councillor

APC: 1,757

PDP: 196

LP: 070

ACCORD: 13

Ojokoro Ward-D

Chairman

APC: 1,380

PDP: 133

Councillor

APC: 1,432

PDP: 151

Ojokoro Ward-E

Chairman

APC: 2,080

PDP: 333

Councillor

APC: 2,060

PDP: 040

Ojokoro Ward-F

Chairman

APC: 1,233

PDP: 119

Councillor

APC: 1,205

PDP: 129

Ojokoro Ward-G

Chairman

APC: 978

PDP: 152

LP: 082

AA: 04

Councillor

APC: 981

PDP: 130

LP: 088

AA: 05

An early morning downpour and voter’s apathy yesterday had hampered the commencement of the election at 8am as proposed in the 20 local governments and 37 Local Council Developments Areas (LCDAs).

It was an anti climax to months of painstaking preparation by the Justice Ayotunde Phillips (retired)-led State Independent Electoral Commission (LASIEC).

The rain and the attendant flood in parts of the state prevented electoral officials from reaching their duty posts on time.

Thus, accreditation and voting which were supposed to commence at 8am began much beyond the scheduled time and only when the rain subsided.

Besides, many registered voters chose to stay indoors.

Only a few bothered to go out and vote except in areas where opposition parties tried to have a foothold.

They include Mushin, Odi-Olowo/Ojuwoye, Ajeromi-Ifelodun, Ojo, Coker Aguda, Itire-Ikate, Agboyi-Ketu, and some parts of Ikorodu.

Youths turned the roads to temporary football ‘pitches’.

Some party officials attributed the low turnout to inadequate electoral awareness by the LASIEC.

But Justice Philips dismissed any such suggestion, saying adequate publicity was carried out.

She admitted that these was delay in the commencement of the elections in some areas, which said was caused by rain.

She told reporters at Old Yaba Road while monitoring some polling units the area that the rain affected the movement of electoral materials.

She said all eligible voters would be allowed to exercise their right as there were enough materials.

“We are addressing the situation and we are assuring that everybody in the affected areas will vote once people have been accredited and are on the queue, they will be allowed to vote even after 3pm,” she said.

She expressed satisfaction with the peaceful conduct in most areas.

Phillips said there were a few cases of violence but said security agents had quelled the situation.

Lagos State Peoples Democratic Party (PDP) chieftain Segun Adewale blamed LASIEC for ‘disappointing’ Lagosians.

He said the late arrival of voting materials discouraged some people from voting after waiting for hours at the polling station for voting materials to come.

He also accused supporters of the ruling APC of harassing people.

“People were harassed by members of the ruling APC, my own sister was beaten up and people could not vote before the end of the exercise,” he claimed.

Kebbi State House of Assembly Deputy Speaker Buhari Ailero, who led Election Observers from other states, hailed the peaceful conduct of the poll.

Ailero confirmed that the election materials were distributed on time to the polling units.

He urged political parties to do more in mobilizing voters in subsequent elections.

Twelve parties – Accord Party (AP); Action Alliance (AA); Alliance for Democracy ( AD ); All Progressives Congress ( APC ); Peoples Democratic Party ( PDP ); Labour Party ( LP ); All Progressives Grand Alliance ( APGA ); United Democratic Party (UDP); United Progressive Party (UPP); Kowa Party ( KP ); National Action Council ( NAC ); and Peoples Democratic Movement (PDM).

Business

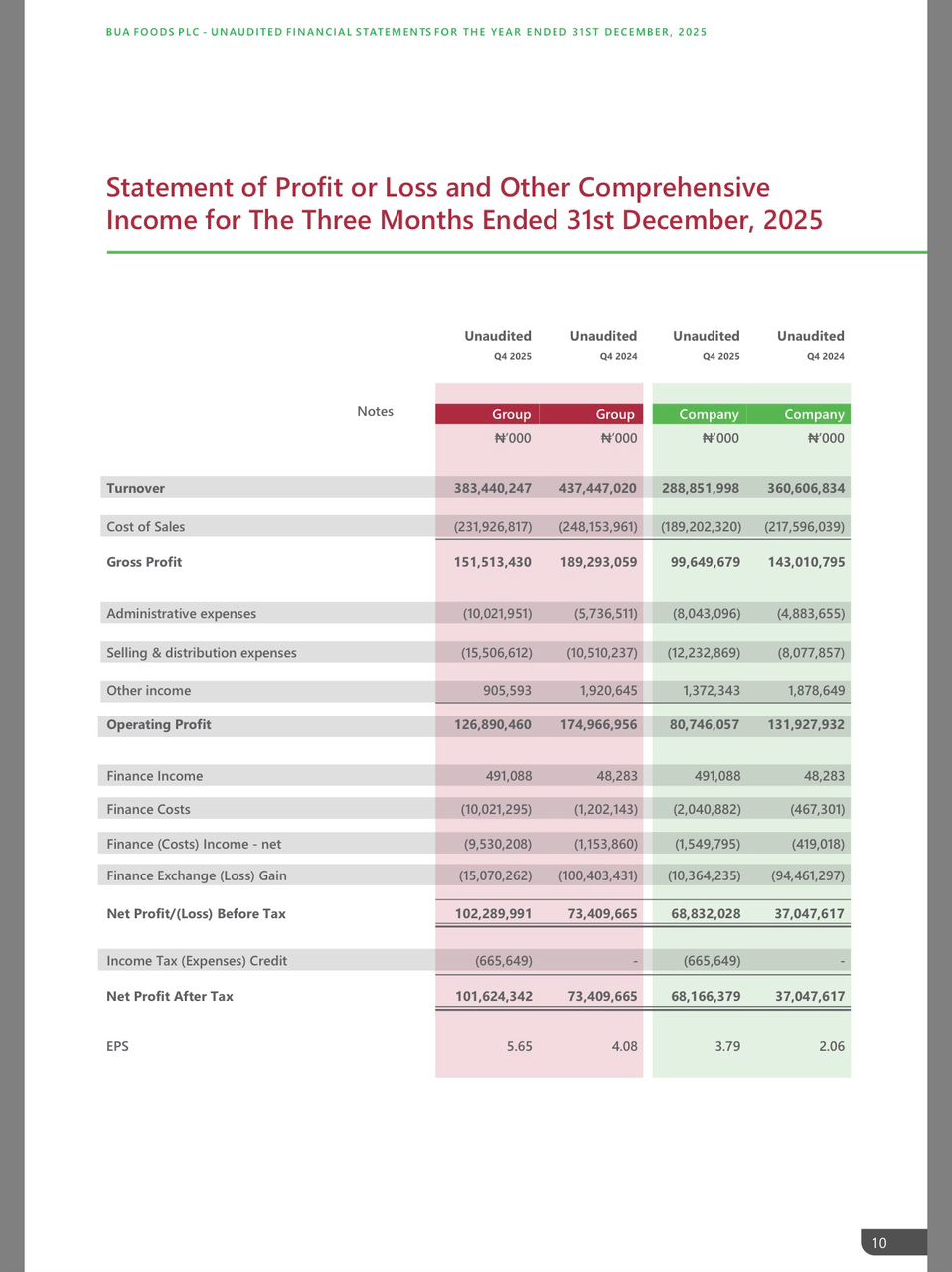

BUA Foods Records 91% Surge in Profit After Tax, Hits ₦508bn in 2025

BUA Foods Records 91% Surge in Profit After Tax, Hits ₦508bn in 2025

By femi Oyewale

Business

Adron Homes Unveils “Love for Love” Valentine Promo with Exciting Discounts, Luxury Gifts, and Travel Rewards

Adron Homes Unveils “Love for Love” Valentine Promo with Exciting Discounts, Luxury Gifts, and Travel Rewards

In celebration of the season of love, Adron Homes and Properties has announced the launch of its special Valentine campaign, “Love for Love” Promo, a customer-centric initiative designed to reward Nigerians who choose to express love through smart, lasting real estate investments.

The Love for Love Promo offers clients attractive discounts, flexible payment options, and an array of exclusive gift items, reinforcing Adron Homes’ commitment to making property ownership both rewarding and accessible. The campaign runs throughout the Valentine season and applies to the company’s wide portfolio of estates and housing projects strategically located across Nigeria.

Speaking on the promo, the company’s Managing Director, Mrs Adenike Ajobo, stated that the initiative is aimed at encouraging individuals and families to move beyond conventional Valentine gifts by investing in assets that secure their future. According to the company, love is best demonstrated through stability, legacy, and long-term value—principles that real estate ownership represents.

Under the promo structure, clients who make a payment of ₦100,000 receive cake, chocolates, and a bottle of wine, while those who pay ₦200,000 are rewarded with a Love Hamper. Payments of ₦500,000 attract a Love Hamper plus cake, and clients who pay ₦1,000,000 enjoy a choice of a Samsung phone or a Love Hamper with cake.

The rewards become increasingly premium as commitment grows. Clients who pay ₦5,000,000 receive either an iPad or an all-expenses-paid romantic getaway for a couple at one of Nigeria’s finest hotels, which includes two nights’ accommodation, special treats, and a Love Hamper. A payment of ₦10,000,000 comes with a choice of a Samsung Z Fold 7, three nights at a top-tier resort in Nigeria, or a full solar power installation.

For high-value investors, the Love for Love Promo delivers exceptional lifestyle experiences. Clients who pay ₦30,000,000 on land are rewarded with a three-night couple’s trip to Doha, Qatar, or South Africa, while purchasers of any Adron Homes house valued at ₦50,000,000 receive a double-door refrigerator.

The promo covers Adron Homes’ estates located in Lagos, Shimawa, Sagamu, Atan–Ota, Papalanto, Abeokuta, Ibadan, Osun, Ekiti, Abuja, Nasarawa, and Niger States, offering clients the opportunity to invest in fast-growing, strategically positioned communities nationwide.

Adron Homes reiterated that beyond the incentives, the campaign underscores the company’s strong reputation for secure land titles, affordable pricing, strategic locations, and a proven legacy in real estate development.

As Valentine’s Day approaches, Adron Homes encourages Nigerians at home and in the diaspora to take advantage of the Love for Love Promo to enjoy exceptional value, exclusive rewards, and the opportunity to build a future rooted in love, security, and prosperity.

Business

Why Nigeria’s Banks Still on Shaky Ground with Big Profits, Weak Capital

*Why Nigeria’s Banks Still on Shaky Ground with Big Profits, Weak Capital*

*BY BLAISE UDUNZE*

Despite the fragile 2024 economy grappling with inflation, currency volatility, and weak growth, Nigeria’s banking industry was widely portrayed as successful and strong amid triumphal headlines. The figures appeared to signal strength, resilience, and superior management as the Tier-1 banks such as Access Bank, Zenith Bank, GTBank, UBA, and First Bank of Nigeria, collectively reported profits approaching, and in some cases exceeding, N1 trillion. Surprisingly, a year later, these same banks touted as sound and solid are locked in a frenetic race to the capital markets, issuing rights offers and public placements back-to-back to meet the Central Bank of Nigeria’s N500 billion recapitalisation thresholds.

The contradiction is glaring. If Nigeria’s biggest banks are so profitable, why are they unable to internally fund their new capital requirements? Why have no fewer than 27 banks tapped the capital market in quick succession despite repeated assurances of balance-sheet robustness? And more fundamentally, what do these record profits actually say about the real health of the banking system?

The recapitalisation directive announced by the CBN in 2024 was ambitious by design. Banks with international licences were required to raise minimum capital to N500 billion by March 2026, while national and regional banks faced lower but still substantial thresholds ranging from N200 billion to N50 billion, respectively. Looking at the policy, it was sold as a modern reform meant to make banks stronger, more resilient in tough times, and better able to support major long-term economic development. In theory, strong banks should welcome such reforms. In practice, the scramble that followed has exposed uncomfortable truths about the structure of bank profitability in Nigeria.

At the heart of the inconsistency is a fundamental misunderstanding often encouraged by the banks themselves between profits and capital. Unknown to many, profitability, no matter how impressive, does not automatically translate into regulatory capital. Primarily, the CBN’s recapitalisation framework actually focuses on money paid in by shareholders when buying shares, fresh equity injected by investors over retained earnings or profits that exist mainly on paper.

This distinction matters because much of the profit surge recorded in 2024 and early 2025 was neither cash-generative nor sustainably repeatable. A significant portion of those headline banks’ profits reported actually came from foreign exchange revaluation gains following the sharp fall of the naira after exchange-rate unification. The industry witnessed that banks’ holding dollar-denominated assets their books showed bigger numbers as their balance sheets swell in naira terms, creating enormous paper profits without a corresponding improvement in underlying operational strength. These gains inflated income statements but did little to strengthen core capital, especially after the CBN barred banks from using FX revaluation gains for dividends or routine operations. In effect, banks looked richer without becoming stronger.

Beyond FX effects, Nigerian banks have increasingly relied on non-interest income fees, charges, and transaction levies to drive profitability. While this model is lucrative, it does not necessarily deepen financial intermediation or expand productive lending. High profits built on customer charges rather than loan growth offer limited support for long-term balance-sheet expansion. They also leave banks vulnerable when macroeconomic conditions shift, as is now happening.

Indeed, the recapitalisation exercise coincides with a turning point in the monetary cycle. The extraordinary conditions that supported bank earnings in 2024 and 2025 are beginning to unwind. Analysts now warn that Nigerian banks are approaching earnings reset, as net interest margins the backbone of traditional banking profitability, come under sustained pressure.

Renaissance Capital, in a January note, projects that major banks including Zenith, GTCO, Access Holdings, and UBA will struggle to deliver earnings growth in 2026 comparable to recent performance.

In a real sense, the CBN is expected to lower interest rates by 400 to 500 basis points because inflation is slowing down, and this means that banks will earn less on loans and government bonds, but they may not be able to quickly lower the interest they pay on deposits or other debts. The cash reserve requirements are still elevated, which does not earn interest; banks can’t easily increase or expand lending investments to make up for lower returns. The implications are significant. Net interest margin, the difference between what banks earn on loans and investments and what they pay on deposits, is poised to contract. Deposit competition is intensifying as lenders fight to shore up liquidity ahead of recapitalisation deadlines, pushing up funding costs. At the same time, yields on treasury bills and bonds, long a safe and lucrative haven for banks are expected to soften in a lower-rate environment. The result is a narrowing profit cushion just as banks are being asked to carry far larger equity bases.

Compounding this challenge is the fading of FX revaluation windfalls. With the naira relatively more stable in early 2026, the non-cash gains that once flattered bank earnings have largely evaporated. What remains is the less glamorous reality of core banking operations: credit risk management, cost efficiency, and genuine loan growth in a sluggish economy. In this new environment, maintaining headline profits will be far harder, even before accounting for the dilutive impact of recapitalisation.

That dilution is another underappreciated consequence of the capital rush. Massive share issuances mean that even if banks manage to sustain absolute profit levels, earnings per share and return on equity are likely to decline. Zenith, Access, UBA, and others are dramatically increasing their share counts. The same earnings pie is now being divided among many more shareholders, making individual returns leaner than during the pre-recapitalisation boom. For investors, the optics of strong profits may soon give way to the reality of weaker per-share performance.

Yet banks have pressed ahead, not only out of regulatory necessity but also strategic calculation.

During this period of recapitalization, investors are interested in the stock market with optimism, especially about bank shares, as banks are raising fresh capital, and this makes it easier to attract investments. This has become a season for the management teams to seize the moment to raise funds at relatively attractive valuations, strengthen ownership positions, and position themselves for post-recapitalisation dominance. In several cases, major shareholders and insiders have increased their stakes, as projected in the media, signalling confidence in long-term prospects even as near-term returns face pressure.

There is also a broader structural ambition at play. Well-capitalised banks can take on larger single obligor exposures, finance infrastructure projects, expand regionally, and compete more credibly with pan-African and global peers. From this perspective, recapitalisation is not merely about compliance but about reshaping the competitive hierarchy of Nigerian banking. What will be witnessed in the industry is that those who succeed will emerge larger, fewer, and more powerful. Those that fail will be forced into consolidation, retreat, or irrelevance.

For the wider economy, the outcome is ambiguous. Stronger banks with deeper capital buffers could improve systemic stability and enhance Nigeria’s ability to fund long-term development. The point is that while merging or consolidating banks may make them safer, it can also harm the market and the economy because it will reduce competition, let a few banks dominate, and encourage them to earn easy money from bonds and fees instead of funding real businesses. The truth be told, injecting more capital into the banks without complementary reforms in credit infrastructure, risk-sharing mechanisms, and fiscal discipline, isn’t enough as the aforementioned reforms are also needed.

The rush as exposed in this period, is that the moment Nigerian banks started raising new capital, the glaring reality behind their reported profits became clearer, that profits weren’t purely from good management, while the financial industry is not as sound and strong as its headline figures. The fact that trillion-naira profit banks must return repeatedly to shareholders for fresh capital is not a sign of excess strength, but of structural imbalance.

With the deadline for banks to raise new capital coming soon, by 31 March 2026, the focus has shifted from just raising N500 billion. N200 billion or N50 billion to think about the future shape and quality of Nigeria’s financial industry, or what it will actually look like afterward. Will recapitalisation mark a turning point toward deeper intermediation, lower dependence on speculative gains, and stronger support for economic growth? Or will it simply reset the numbers while leaving underlying incentives unchanged?

The answer will define the next chapter of Nigerian banking long after the capital market roadshows have ended and the profit headlines have faded.

Blaise, a journalist and PR professional, writes from Lagos and can be reached via: [email protected]

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

Business6 months ago

Business6 months agoBatsumi Travel CEO Lisa Sebogodi Wins Prestigious Africa Travel 100 Women Award

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING

You must be logged in to post a comment Login