Business

EXPOSED!!!The Stupendous wealth Bukola Saraki acquired as Gov. of Kwara + The Many Assets His wife and Children Possess

Akure— The President of the Nigerian Senate, Bukola Saraki, currently facing corruption charges, was worth N10 billion (by current exchange rate) at the time he assumed office as governor of Kwara State in 2003.

While his entire assets, including cash, landed properties and shares in Nigeria and abroad stood at about N8 billion, those of his wife totalled N1.8 billion and his four children N202 million.

These are contained in the asset declaration form and the affidavit Mr. Saraki deposed to before an Ilorin High Court and submitted to the Code of Conduct Bureau on September 16, 2003.

The document entitled “Form CCB 1: Asset Declaration Form for Public Officers,” was exclusively obtained by PREMIUM TIMES.

Mr. Saraki was on September 18 this year docked at the Code of Conduct Tribunal on a 13-count charge bordering on alleged corruption and false declaration of assets.

He was specifically accused of deliberately manipulating the asset declaration form he submitted prior to his assumption of his current position as senate president.

Although he pleaded not guilty to the charges, claiming his ordeal was politically motivated, the CCT adjourned the case to October 21, 22 and 23 for further hearing.

His wife had earlier been invited by the Economic and Financial Crimes Commission over alleged complicity in shady contract deals during her husband’s tenure as governor between 2003 and 2011.

The assets declaration form showed that Mr. Saraki, who was a little over 40 years at the time he assumed office, had only N2.5 million cash at hand and a total of N51 million in various Nigerian banks at the time he filed the document.

He was also worth a total of £2.9 million and $400,000 lodged in some foreign banks at the time. That was besides owning landed and movable assets running into billions of naira and pound sterling in Nigeria and London.

He also held a substantial number of shares in a number of local and foreign companies valued at millions of naira and pounds.

Mr. Saraki said while he had N11,050,000 in the defunct Societe Generale Bank, where his family had interest, he had N350,000, N3 million and N390,000 in EcoBank, Guaranty Trust Bank and the defunct Citizen Bank, respectively, all in Lagos.

Besides, one of Mr. Saraki’s companies – Better Foods Ltd – had N600,000 and N23 million in Citizen Bank, Broad Street, Lagos and Societe Generale Bank, Oke Arin Street, Lagos, respectively.

Two other companies, namely Carlisle Properties & Investment Limited and BAS Trading and Manufacturing Ltd had N10.2 million and N2.9 million in accounts domiciled in EcoBank and Guaranty Trust Bank.

The senate president, in Appendix 2 of the document, declared a total of £905 million in one of his offshore accounts domiciled in Coutts & Co. 440 Strand, London.

Tyberry Corporation, another of his companies, had £2 million in Forte Bank, Camoile Street, London.

He also opened an account for his company, Eficaz Ltd, at Northern Trust International Banking Corporation Merrill Lynch Pierce Fenner, where he had $400,000 at the time he declared the assets.

In Appendix 3 of the form, Mr. Saraki also detailed eight landed property scattered in various parts of Lagos and Abuja which he said he acquired between December 1991 and March 2000, all valued at N2.3 billion.

According to him, a plot of land in Lekki, Lagos that he acquired in February 1992 was valued at N7 million while another one in Ajah he got in November 1992 was valued at N5 million.

Yet in November 1996, he acquired a plot in the Maitama District at N160 million.

Other properties he declared are those owned by his companies – a N750 million property at 42 Gerrard Road, Ikoyi owned by Skyview Properties Ltd; a N500 million property at 19 Ruxton road, Ikoyi, Lagos by Skyview Properties Ltd; and a N100 million property at 62 Awolowo Road, Ikoyi.

He declared the rental value of the property as N110 million, N65 million and N6 million per annum, respectively.

One of his companies, Carlisle Properties Ltd owned a property worth N160 million at No 15A & 15B McDonald Road, Ikoyi while BAS Trading owned a property on Musa Yar’Adua Street, Victoria Island, also in Lagos, valued at N700 million.

The rental income of the latter was N96 million per annum. He did not disclose that of the former.

Outside Nigeria, Mr. Saraki had landed property worth $12.9 million, all of which he listed in Appendix 5.

The properties, according to the document, were all located in London, UK.

According to him, the value of the properties at 123 Ashley Gardens, Thirlebey Road, London, (acquired in April 1990), 54 Ashley Road Gardens, Ambrasden Avenue ( acquired in January 1995) and 70 Bourne Street, London SW 1 (acquired in January 2002), were valued at $750,000, $2.55 million and $4.8 million, respectively.

He also declared some properties as belonging to his companies.

The property at 56 Cheque Road, London (valued at $900,000) and another located at Ormond House, Crimond Street, London SW 1 (valued at $400,000) were owned by European & America Trading Company.

Three others located at 53, 54 and 141 Ashley Gardens, London, were owned by Tyberry Corporation. The values were $2.5 million, $2.5 million and $600,000.

In Appendix 4, Mr. Saraki listed 15 various movable assets, mainly motor vehicles which he acquired between 1997 and 2002 all at a total value of N263.4 million.

The vehicles and their prices are a Mercedes S320 valued at N16 million; Mercedes S500 (N20 million); Mercedes G500 (N18 million); Mercedes V220 (N6million); Mercedes 300 E (N2 million); Ferrari 456 GT (N25 million); Navigator (N15 million); Mercedes ML 240 (N8.5 million); Peugeot 406 (N2.9 million); Mercedes CLK 320 (N9 million).

Others are Mercedes E320 (N11 million); Mercedes 500 (Bullet Proof), N45 million; Mercedes S500 (Bullet Proof), N30 million; Lexus Jeep (Bullet Proof), N30 million; and Lincoln Navigator (Bullet Proof), N25 million.

He said he acquired the cars proceeds of “Business” and “Savings.”

Mr. Saraki also declared a number of shares he held in different companies in Nigeria and abroad.

For instance, in Nigeria, the senate president said at the time he became governor he had a total of 1,204,653 shares in four companies valued at N2.2 million.

The companies were African Petroleum, UNIPETROL, Airline Catering and Central Petroleum.

Other organisations where he held huge shares were GTB where he had 100,000 worth N425,000.

These shares in the bank were however bought in his son’s name, Seni.

Outside Nigeria, Mr. Saraki declared he had shares in five companies, namely Gensoft, All African Media Coy, Merrill BBH Fund, Mundernet Fund and Izorch Inc.

The 100,000 shares he held at Gensoft were valued at €2.6 million while the total number of shares in the remaining four companies was worth $6.1 million.

His company, HAUSSMAN, however held 160 units of shares with a total value of $1.5 million in some foreign companies. It had 25,000 shares valued at $100,000 in Mundernet Fund, 10,000 valued at $400,000 in Eaton Vanice Fund, 50,000 shares valued at $700,000 in PIMCO Fund and 75,000 shares worth $300,000 in Merrill BBH.

Wife

He stated in the assets declaration form that his wife held an account in EcoBank Broad Street, Lagos, where she had N1.5 million at the time he became governor.

She also maintained an account in Coutts & Co Strand, London where she owned £450,000 and $125,000.

She also had $3 million in Northern Trust International Banking Corporation Merrill Lynch Pierce Fenner.

Mrs. Saraki also maintained substantial shares in European and American Trading Company, Tyberry Corporation and EFICAZ Ltd.

Other property the senate president listed against his wife’s name were a plot of land at Lekki valued at N5 million which he said was a gift he received in January 1989.

She also had a property at 15 Bryanston Square, London W1 and 69 Bourne Street, London.

While the first, whose rental income he put at £48,000 with a value of £900,000, was acquired in January 1989, the second, whose value was £2m and had rental value of £150,000 was acquired for business in April 2000.

Mr. Saraki also declared that his wife held 500,000 shares, valued at £500,000, at P.C.C (U.K) Ltd.

He was silent on the number of shares the former first lady had in HAUSSMANN and TINY TEE (Nig) Ltd.

Children

In APPENDIX 1 of the form, the senate president also detailed the property owned by his four children, whose names he gave as Tosin, Seni, Teniola and Teniayo.

According to the document, Tosin had N700,000 in the family bank, Societe Generale Bank while Seni had N400,000 in the same family bank.

Outside Nigeria, Tosin and Seni jointly maintained an account in Northern Trust International Banking Corporation Merrill Lynch Pierce Fenner, where they had £400,000 while Teniola and Teniayo had £250,000 in the same bank at the time.

In Coutts & Co. 440 Strand, London, Tosin and Seni had £1000 and £500, respectively.

Saraki’s Case At Code of Conduct Bureau

In what some interpreted as political persecution, Mr. Saraki was arraigned last month before the CCT for false declaration of assets seven years after he concluded his two terms as governor.

In one of the 13-count charge, the senate president was accused of making anticipatory declaration of asset, thus breaching the Code of Conduct Bureau and Tribunal Act, Cap C15, Laws of the Federation of Nigeria, 2004.

The charge reads, “That you, Dr. Olubukola Abubakar Saraki, while being the Executive Governor of Kwara State on or about 16th September, 2003 within the jurisdiction of this Hon. Tribunal, did make a false declaration in assets declaration form for public officers on assumption of office as Governor of Kwara State by making an anticipatory asset declaration in that you claimed to have owned and acquired No. 15A and N0. 15B McDonald Ikoyi, Lagos through your company Carlisle Properties Limited in the year 2006 when the said property was in actual fact sold by the Implementation Committee on Federal Government landed property in the year 2006 to your companies Tiny Tee Limited and Vitti Oil Limited for the aggregate sum of N396, 150, 000 and you hereby committed an offence under Section 15 of the Code of Conduct Bureau and Tribunal Act, Cap C15, Laws of the Federation of Nigeria, 2004 and incorporated under Paragraph 11(1) and (2) of Part 1, 5th Schedule to the Constitution of the Federal Republic of Nigeria 1999 (as amended) and punishable under Section 23(2) of the Code of Conduct Bureau and Tribunal Act and incorporated under Paragraph 18 of part 1, 5th Schedule to the Constitution of the Federal Republic of Nigeria 1999 (as amended).”

Career History

Mr. Saraki, a medical doctor, assumed office as governor on May 29, 2003.

He served as medical officer for about one year at Rush Green Hospital, London between 1988 and 1989.

He later served as Director of SGB, owned by his late father, Olusola, between 1990 and 2000. In 2000, former President Olusegun Obasanjo named him his special assistant on budget.

He also served on the Economic Policy Coordination Committee, where he had the task of formulating and implementation key economic policies for the country.

In 2003, he ran for the office of governor of Kwara State on the platform of the Peoples Democratic Party and won.

Societie Generale Bank, the bank in which he was director, became insolvent around the same time, with several depositors losing their savings.

He was re-elected in 2007. During his second tenure, he served as chairman of the Nigerian Governors’ Forum.

Mr. Saraki later showed interest in running for president in 2011 but was excluded alongside two others from the presidential race by the Adamu Ciroma-led Northern Political Leaders Forum, which picked a former vice president, Atiku Abubakar, as its consensus candidate.

That year, he was however elected into the Senate to represent Kwara Central senatorial District on the platform of the PDP.

He was re-elected in 2015 on the platform of the APC. He had led some other PDP senators to defect to the party in early 2014.

He emerged senate president on June 9 against the wishes of his party and some of its leading chieftains.

SOURCE : PREMIUM TIMES

Business

Adron Homes at 14: From Shimawa to Over 60 Livable Communities, Building Cities Beyond Estates

Adron Homes at 14: From Shimawa to Over 60 Livable Communities, Building Cities Beyond Estates

Fourteen years ago, what began as a visionary real estate development effort in Shimawa, Ogun State, has evolved into one of Nigeria’s most recognizable housing success stories. Today, Adron Homes & Properties stands as a major force in structured urban development, with over 60 livable communities and estate dwellings spread across key regions of the country. Its journey reflects a deliberate mission that is not just to sell land, but to build functional cities where Nigerians can live with dignity, security, and a strong sense of community.

At a time when Nigeria faces rapid urbanization and an ever-growing housing deficit, Adron Homes has embraced an approach rooted in planning and affordability. From its earliest developments, the company adopted a city-building model that integrates structured layouts, accessible infrastructure, and community-focused design. Roads, drainage systems, green areas, and designated social spaces are incorporated into estate planning, transforming empty land into organized residential hubs.

The story of Adron’s growth mirrors Nigeria’s evolving urban landscape. Beginning in Shimawa, the company strategically expanded into major growth corridors, including Lagos, Ogun, Oyo, Osun, Ekiti, Abuja, Nasarawa, Niger, and beyond. Its estates have not only provided shelter but have also influenced the emergence of new residential districts, encouraging organized expansion and helping to reduce the challenges associated with unplanned settlements.

Central to the company’s success is its commitment to affordability. Through flexible payment structures and innovative housing initiatives, Adron Homes has opened the door to homeownership for thousands of Nigerians who previously considered property ownership out of reach. This democratization of housing has empowered families, strengthened communities, and supported economic growth through increased property investment and local business opportunities within estates.

Beyond physical structures, Adron Homes prioritizes community building. Estates are designed as living ecosystems where families interact, children grow in secure environments, and entrepreneurs find opportunities to thrive. The emphasis on social cohesion has helped transform residential spaces into vibrant neighborhoods, reinforcing the idea that housing development should nurture human connection as much as physical infrastructure.

As Nigeria continues to urbanize, Adron Homes’ model demonstrates that real estate development can be both commercially viable and socially impactful. Its projects serve as reference points for emerging residential corridors, attracting further investment and setting standards for organized development across multiple regions.

Celebrating fourteen years of growth and innovation, Adron Homes remains committed to shaping Nigeria’s urban future through sustainable planning, inclusive housing solutions, and community-driven development. From its humble beginnings in Shimawa to a nationwide network of livable communities, the company’s journey stands as a testament to the power of vision, resilience, and a steadfast belief that cities are built not just with structures, but with people at their heart.

Business

14 Years of Democratizing Landownership: How Adron Homes Is Redefining Mass Housing in Nigeria

14 Years of Democratizing Landownership: How Adron Homes Is Redefining Mass Housing in Nigeria

For decades, homeownership in Nigeria remained an elusive dream for millions, restricted by rising rents, unstable housing markets, and mortgage systems beyond the reach of the average citizen. Fourteen years ago, Adron Homes and Properties Limited set out to challenge this reality with a bold and disruptive vision: to make land and homeownership affordable, accessible, and achievable for everyday Nigerians.

Founded on the principle that housing should be a right and not a privilege, Adron Homes has steadily emerged as one of Nigeria’s most influential mass housing developers. At the heart of its success is an affordability-driven model that prioritizes inclusion without compromising quality. Through flexible payment plans, low initial deposits, and extended installment options, the company has broken long-standing financial barriers that once excluded civil servants, young professionals, artisans, traders, and Nigerians in the diaspora from owning property.

Fourteen years on, this vision has translated into tangible impact across over 60 estates nationwide, strategically located in major and emerging growth corridors including Ibeju-Lekki, Lekki–Epe, Badagry, Shimawa, Papalanto, Sagamu, Abeokuta, Ibadan, Osun, Ekiti, Abuja, Nasarawa, and Niger State. Each estate represents more than infrastructure, it reflects Adron Homes’ commitment to decentralizing development and expanding access to property ownership beyond traditional urban centers.

Through this mass housing initiative, thousands of Nigerians have successfully transitioned from tenants to landlords, many achieving property ownership for the first time. Unlike conventional real estate models that emphasize exclusivity and luxury, Adron Homes has consistently aligned its offerings with the real income realities of the Nigerian population, ensuring that housing solutions remain practical, inclusive, and sustainable.

Beyond affordability, trust has remained a defining pillar of the Adron Homes brand. The company places strong emphasis on secure land titles, transparent documentation, and regulatory compliance, protecting subscribers from land disputes and fraudulent transactions. This focus on integrity has strengthened customer confidence and positioned Adron Homes as a dependable gateway to long-term wealth creation through real estate.

As Adron Homes marks its 14th anniversary, its mass housing journey stands as more than a corporate achievement but a national intervention. By restoring dignity, promoting financial security, and transforming thousands of property ownership dreams into reality, Adron Homes continues to play a vital role in shaping Nigeria’s housing landscape and building a future where more citizens can truly call a place their own.

Business

Deadline of Compliance: Nigeria’s Urgent Call for Tax Return Filing

Deadline of Compliance: Nigeria’s Urgent Call for Tax Return Filing

By George Omagbemi Sylvester | Published by SaharaWeeklyNG.com

“Shift or Structural Demand? A Declaration of Civic Duty in a Nation at a Fiscal Crossroads.”

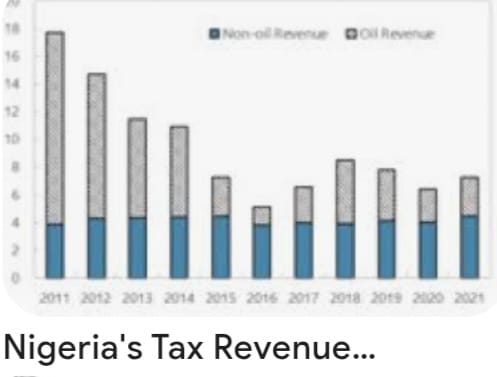

In the unfolding narrative of national development and economic reform, few instruments are as defining as tax compliance. For Nigeria, a nation perpetually grappling with revenue shortfalls, structural dependency on a single export commodity, and entrenched informal economic behaviour, the Federal Government’s recent clarification on tax return deadlines is not mere bureaucratic noise. It is a deliberate and inescapable declaration: the social contract between citizen and state must be honoured through transparent, lawful and timely tax reporting.

At its core, the government’s pronouncement is stark in its simplicity and radical in its implications. Federal authorities, speaking through the Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, have made it unequivocally clear that every Nigerian, whether employer or individual taxpayer, must file annual tax returns under the law. This encompasses self-assessment filings by individuals that too many assumed ended once employers deducted pay-as-you-earn taxes from their salaries.

This is not an optional civic suggestion, it is mandatory, backed by statute, and tied to a broader vision of national fiscal responsibility. Citizens can no longer hide behind ignorance, apathy, or false assumptions. “Many people assume that if their employer deducts tax from their salaries, their obligations end there. That is wrong,” Oyedele warned, emphasizing that the obligation to file remains with the individual under both existing and newly reformed tax laws.

The Deadlines and the Reality They Reveal.

Across the federation, state and federal revenue authorities have reaffirmed statutory deadlines in pursuit of compliance. The Lagos State Internal Revenue Service, for instance, moved to extend its filing date for employer returns by a narrow window, reflecting the reality that compliance often lags behind legal timelines. The extension was intended not as leniency, but as a pragmatic effort to allow accurate and complete submissions, underscoring that true compliance rises above mere mechanical ticking of a box.

At the federal level, Oyedele’s intervention was even more fundamental. He reminded Nigerians that annual tax returns for the preceding year must be filed in good faith, with integrity and in respect of the law. This applies regardless of income level including low-income earners who have historically believed that they are outside the tax net. “All of us must file our returns, including those earning low income,” he stated.

Herein lies one of the most challenging truths of contemporary Nigerian governance: widespread tax non-compliance is not just a technical breach of law, it is a deep cultural and structural issue that reflects decades of mistrust between citizens and the state.

The Root of the Problem: Non-Compliance as a Symptom.

Nigeria’s tax culture has long been under scrutiny. Public discourse and economic analysis consistently show that a significant majority of eligible taxpayers do not file annual returns. Oyedele highlighted that even in states widely regarded as tax administration leaders, compliance remains strikingly low, often below five percent.

This widespread non-compliance stems from multiple sources:

A long history of weak tax administration systems, where enforcement was inconsistent and penalties were rarely applied.

A perception that public services do not reflect the taxes collected, eroding the citizenry’s belief in reciprocity.

An informal economy where income often goes unrecorded, making filing seem irrelevant or impossible to many.

Lack of awareness, with many Nigerians genuinely believing that tax liability ends with employer deductions.

The government’s renewed push for compliance directly challenges these perceptions. It signals a shift from voluntary or lax compliance to structured accountability, a stance that aligns with best practices in modern public finance.

Why This Matters: Beyond Deadlines.

At its most profound level, the insistence on tax return filings is about nation-building and shared responsibility.

Scholars of public finance universally agree that a robust tax system is the backbone of sustainable development. As the eminent economist Dr. Joseph E. Stiglitz has observed, “A society that cannot mobilize its own resources through fair taxation undermines both its government’s legitimacy and its capacity to provide for its people.” Filing tax returns is not a mere administrative task, it is a declaration of participation in the collective project of national advancement.

In Nigeria’s context, this declaration carries weight. With the enactment of comprehensive tax reforms in recent years (including unified frameworks for tax administration and enforcement) authorities now possess broader statutory tools to ensure compliance and accountability. These measures, which include electronic filing platforms and stronger enforcement powers, have been framed as fair and equitable, targeting efficiency rather than arbitrariness.

Yet the success of these reforms depends heavily on citizens embracing their civic duties with sincerity. And this depends on mutual trust, the belief that paying taxes yields tangible benefits in infrastructure, education, healthcare, security and social services.

Voices From Experts: Fiscal Responsibility as a Public Ethic.

Tax law experts and economists, reflecting on the compliance push, have underscored a universal theme: taxation without transparency is inequity, but taxation with accountability is empowerment. When managed with fairness, a functional tax system can reduce dependency on volatile revenue sources, stabilise national budgets, and support long-term investment in human capital.

Professor Aisha Bello, a respected authority in fiscal policy, notes that “Tax compliance is not a burden; it is the foundation upon which social contracts are built. A citizen who honours tax obligations affirms the legitimacy of governance and demands better performance in return.”

Similarly, a leading tax scholar, Dr. Emeka Okon, argues that “The era when Nigerians could evade broader tax responsibilities simply because automatic deductions occur at source must end. For a modern economy, every eligible citizen must be part of the formal tax fold not as victims, but as stakeholders.”

These authoritative voices point to an unassailable truth: filing tax returns is both a legal requirement and a moral responsibility, an expression of citizenship in its fullest sense.

Challenges on the Ground: Compliance and Capacity.

While the rhetoric of compliance is compelling, the reality on the ground demands nuanced understanding. Many taxpayers (especially in the informal sector) lack meaningful access to digital platforms and resources for filing returns. For others, the fear of bureaucratic complexity and perceived punitive enforcement deters participation.

The government, for its part, has responded by promoting online systems and pledging greater taxpayer support. Tax authorities are increasingly engaging stakeholders to demystify filing processes, explain requirements and offer assistance. This mix of enforcement and facilitation is essential. As one seasoned revenue specialist observed: “The state cannot compel compliance through force alone; it must earn it through education, simplicity and fairness.”

The Broader Implication: A New Social Compact.

Ultimately, Nigeria’s renewed emphasis on tax return filing transcends administrative deadlines. It is an unequivocal declaration that national development is a shared responsibility, that citizens and state must engage in a transparent, accountable, and reciprocal relationship.

Tax compliance, therefore, becomes far more than a legal act; it becomes a moral claim on the nation’s future.

When citizens file their returns honestly, they affirm their stake in the nation’s destiny. When the government collects taxes transparently and deploys them effectively, it strengthens not only public services but civic trust itself.

In this sense, the deadlines proclaimed by Nigeria’s fiscal authorities mark not an end but a beginning; the beginning of a civic epoch in which accountability replaces apathy, participation replaces indifference and national purpose triumphs over fragmentation.

The road ahead will not be easy. But in demanding compliance, Nigeria is demanding more than tax returns. It is demanding commitment and that, ultimately, is the foundation on which nations are built.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

Business6 months ago

Business6 months agoBatsumi Travel CEO Lisa Sebogodi Wins Prestigious Africa Travel 100 Women Award

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING

You must be logged in to post a comment Login