Business

“MTN OF FRAUD”?: How MTN allegedly smuggles billions to shell companies abroad, to evade tax in Nigeria

MTN has consistently prided itself as the foremost telephone company that is getting Nigerians talking the most. Now the South African company is about to set tongues wagging across networks with revelations that it has routinely been shipping billions of dollars overseas to avoid paying its fair share of tax in Nigeria.

An 11-month-long joint investigation by PREMIUM TIMES, Finance Uncovered and amaBhugane reveals that MTN has been running circles around Nigerian revenue authorities using a complex but noxious tax avoidance scheme called Transfer Pricing.

For any economy, it is a slow death.

The red flag was raised the moment our investigations showed that MTN Nigeria has been making payments to two overseas companies – MTN Dubai and MTN International in Mauritius – both located in tax havens.

It was discovered that in 2013 for example, MTN set aside N11.398 Billion from MTN Nigeria to pay to MTN Dubai. A similar transfer of N11.789 Billion was made by MTN Ghana to the same MTN Dubai, making it a total of N23.187 Billion that was shipped to the Dubai offshore account.

In a rare disclosure in 2013, MTN admitted it made unauthorized payments of N37.6 Billion to MTN Dubai between 2010 and 2013. The transfers were then “on-paid” to Mauritius, a shell company with zero number of staff and which physical presence in the capital Port Louis is nothing more than a post office letter box. The disclosure amounted to a confession given that MTN made the dodgy transfers without seeking approval from the National Office for Technology Acquisition and Promotion (NOTAP), the body mandated to oversight such transfers.

On the basis of an earlier management fees agreement that was technically quashed by NOTAP and on the basis of MTN’s reported revenues, it is estimated that N90.2 Billion could have been transferred out of Nigeria in management fees alone since the company was founded in 2002.

Transfer Pricing

For corporate organizations determined to escape the taxman but still cleverly staying on the right side of the law, Transfer Pricing is the new cellar door constructed by the most ingenious of accountants. It is a new global disease to which Third World economies are the most vulnerable.

Multinationals employ Transfer Pricing to move their profits offshore, leaving behind a shrinking tax base in their host countries and inexorable cuts to public services.

In Africa, tax avoidance has been named as one of the factors holding the continent back by starving governments of the revenues it needs for development.

A report jointly commissioned by the United Nations and the African Union and drafted by a high level panel led by former South African president Thabo Mbeki considered tax avoidance by multinationals to be an “illicit financial flow” and a significant drain on government resources across the continent.

In total illicit financial flows, which included corruption and the proceeds of crime, were determined to be costing the continent $50 Billion a year $50bn.

Just last year, South Africa’s deputy president Cyril Ramaphosa had harsh words for tax dodgers. He said: “Tax evasion is not only a crime against the state; it’s also a crime against the people of our country, ordinary people.”

Curiously, the same Cyril Rhamaposa was non-executive chairman of the board of MTN between 2001 and 2013 before he became South Africa’s No.2 man. In effect, the same tax practices which the deputy president strongly condemned in his country as financial crime is vigorously being promoted in Nigeria.

MTN is the largest cell phone company in Africa with 227.5 million subscribers. The company, which operates in more than 20 countries across Africa and the Middle East, has Nigeria as its biggest operation.

Until now, tax justice investigations had focused on computer giants, corporations in the extractive industry, food and beverages; in fact everywhere but the mobile phone sector despite the cell phone industry in Africa being one of the largest and most important industries for the continent.

Mobile phone has been a cheap and quick way of rolling out the vital communications infrastructure that has underpinned Africa’s growth story over the last decade. As a result the industry has seen explosive growth. With 685million mobile phone users in Africa, the success story means that cell phone companies are now the largest contributor to government revenues in many African countries. That is when they pay their fair share of taxes.

Artificial operating costs

To pay little or no tax, companies determined to cheat begin by seeking ways to create artificial operating costs in the country where they operate. For example, a company is in Nigeria but has a parent or subsidiary company in another country. It makes huge profit but decides to declare a much lower profit-before-tax. To achieve this, it pays the parent and/ or subsidiary company for services not rendered and ships cash to them. Where services are rendered, the costs are inflated. Such services may include royalty for the use of brand name, procurement services, technical services and management services.

Typically, the recipient company is located in an offshore territory under a different financial jurisdiction. MTN has a substantial network of subsidiaries in offshore tax havens, including the British Virgin Islands, Dubai and Mauritius.

Because of the growing concerns that multinationals are using intra-company trading to shift profits around the world by overcharging for services delivered or in more extreme cases by creating artificial transactions where no services was rendered at all, respective countries have a maximum percentage of profits it can allow companies to pay out as management fees.

For example, in Senegal, accounts from the company Sonatel show that the company has a ‘cooperation agreement’ with parent company France Telecom that is capped at 1.43% of revenue.

Until 2010 MTN Nigeria had an agreement with MTN Dubai to pay 1.75% of revenues to the company for management, and royalties for the use of the MTN trademark. Nigeria requires that management fees paid by multinationals are approved by the National Office for Technology Acquisition and Promotion (NOTAP). The fee payments had been reversed following a failure to come to a new agreement on management fees with Nigerian regulators.

MTN’s previous agreement with NOTAP expired in 2010.

Notwithstanding, MTN has continued to make payments overseas. When we sent questions to MTN over these unauthorized payments, the company told us that this was because they expected NOTAP to approve a new deal and backdate it to the date of the expiry of the previous deal.

MTN’s financial activities are now being questioned by more than one tax authorizes in Africa.

In Ghana the MTN subsidiary, Scancom, has been paying vast management fees to companies located offshore. Our investigations reveal that Scancom paid 758m GHS in management and technical fees to MTN Dubai between 2008 and 2013. This was 9.64% of the company’s revenue. Normally the maximum fee level allowed in Ghana is 6%.

We can reveal that the high levels of fees attracted the attention of Ghana’s intelligence services, which launched an investigation into “economic fraud” between 2012 and 2013.

MTN’s management fees need approval from the Ghana Investment Promotion Centre (GIPC). The Ghanaian “National Security Taskforce” has called for a “review of all technology transfer and management service agreements currently held by GIPC to remove sections which are inapplicable and wrongly provided for” and upgrading and training of state systems and staff.

In response to this, MTN in Ghana told us: “The technical and management services agreements between Scancom and Investcom were duly approved by the GIPC.”

The current head of the GIPC is Mrs. Mawuena Trebarh, who between 2007 and 2012 was responsible for government relations at MTN Ghana. This reporting team asked Mrs Trebarh to comment on whether her previous role could be perceived a conflict of interest. She did not respond to our requests.

In response to our enquiries MTN confirmed that the company paid 12 billion West African Francs in 2012 and 14 billion West African Francs in 2013 in management fees to MTN International. The figure for 2013 is equivalent to 5% of the revenue made by MTN in Cote d’Ivoire.

Dubai paradox

Dubai is one of the places MTN ships huge profits to. Meanwhile, MTN does not operate any mobile phones in Dubai, yet it has significant operations in the small city state.

MTN told us that it employs around 115 people in Dubai who provides services to the MTN group such as group procurement, group finance, legal services, human resources and other corporate functions.

One tool that campaigners have said will be helpful is to look at company reporting on a country by country basis. If a company is making huge revenues in a country where it has few employees but there is a low tax rate, which would suggest that there may be some profit shifting taking place.

In Uganda, a dispute between the Uganda Revenue Authority and MTN has revealed that the company is paying 3% of its turnover in management fees to MTN International.

The fees have been challenged by the Uganda Revenue Authority (URA) who issued MTN with a “notice of assessment” in 2011. This was for a number of tax issues between 2003 and 2009, but a large portion was to do with a dispute over management fees, most of which had been paid to Mauritius.

Correspondence between the URA and MTN seen by us show that the URA questioned the legitimacy of these fees, and pointed out that MTNI, the company providing “management services” to MTN Uganda had not spent any money in the years they had looked into. The URA said this could only mean two things: that management services provided to MTN Uganda had either already been paid for by MTN Uganda (and so MTN was in effect charging twice for the same thing) or they were never provided at all.

The Ugandan authority told the company: “We have repeatedly asked for evidence of specific work performed by MTN Group for MTN Uganda for each of the tax years 2003 to 2009. We have only been provided with very little information relating to 2009 and the latter years. This information is very far from justifying a payment of 3 per cent of MTN Uganda’s turnover as management fees.”

NOTAP keeps mum

Asked to confirm the amount of fees paid out to MTN Dubai and Mauritius based on the company’s reported revenue between 2002 and today, MTN told PREMIUM TIMES: “There is no disclosure obligation for this information in South Africa or Nigeria.”

Asked to explain the possible justification for MTN Nigeria to pay fees for management and technical services to a company with no employees, MTN said: “It is the contracting party’s prerogative as to how it elects to discharge its contractual obligations.”

Meaning is that MTN Mauritius can perform its task without a single staff member.

PREMIUM TIMES made sustained efforts to get NOTAP and the Federal Inland Revenue Service (FIRS) to comment on the MTN practices in Nigeria.

The Director in charge of Technology Transfer and Agreement, Ephraim Okejiri, initially pleaded that he was in a meeting, and that the reporter should wait.

But after over four hours of waiting, he sent a secretary to say he would not be able to give any information on MTN.

Similarly at Nigeria’s tax agency, the Federal Inland Revenue Service, the Director of Public Communications, Emmanuel Obeta, who had earlier promised on three occasion to make information available on the matter suddenly had a change of mind.

He said relevant officials who should provide him with the information sought were all not available.

Additional report by Bassey Udo

Business

Adron Homes at 14: From Shimawa to Over 60 Livable Communities, Building Cities Beyond Estates

Adron Homes at 14: From Shimawa to Over 60 Livable Communities, Building Cities Beyond Estates

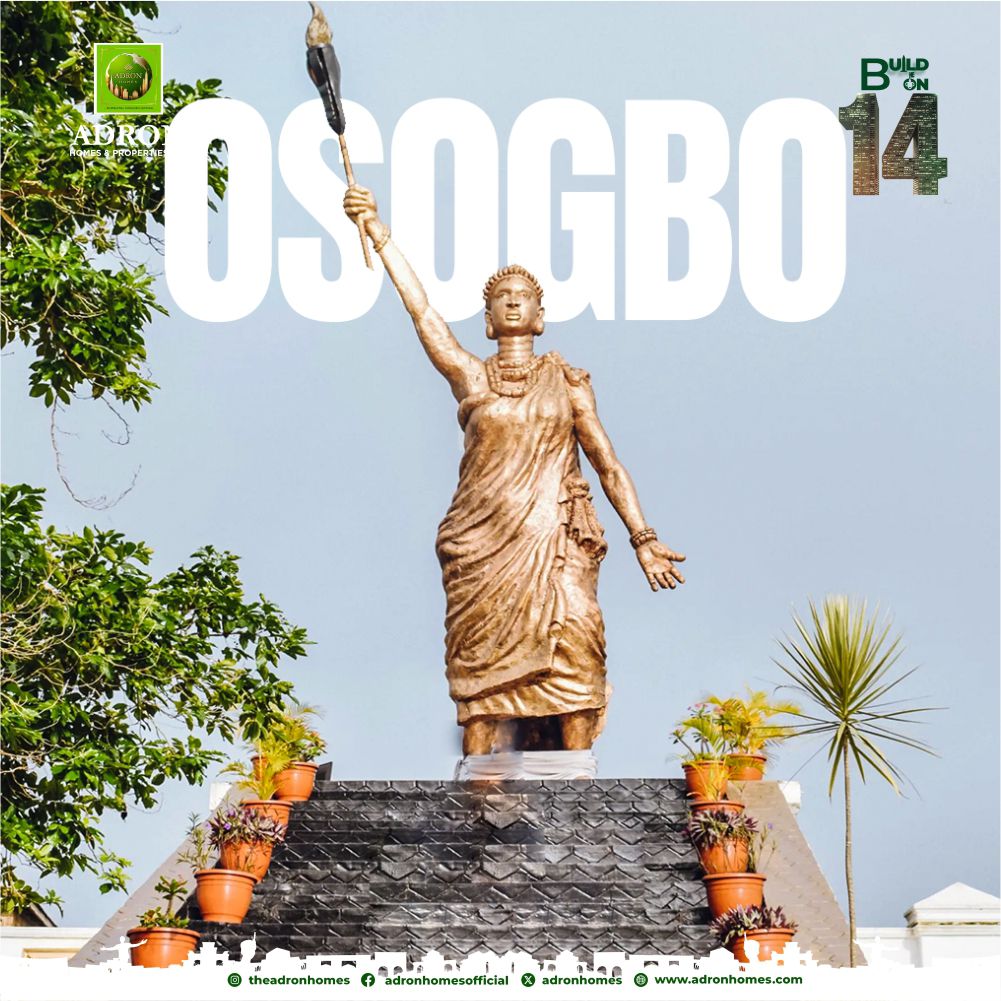

Fourteen years ago, what began as a visionary real estate development effort in Shimawa, Ogun State, has evolved into one of Nigeria’s most recognizable housing success stories. Today, Adron Homes & Properties stands as a major force in structured urban development, with over 60 livable communities and estate dwellings spread across key regions of the country. Its journey reflects a deliberate mission that is not just to sell land, but to build functional cities where Nigerians can live with dignity, security, and a strong sense of community.

At a time when Nigeria faces rapid urbanization and an ever-growing housing deficit, Adron Homes has embraced an approach rooted in planning and affordability. From its earliest developments, the company adopted a city-building model that integrates structured layouts, accessible infrastructure, and community-focused design. Roads, drainage systems, green areas, and designated social spaces are incorporated into estate planning, transforming empty land into organized residential hubs.

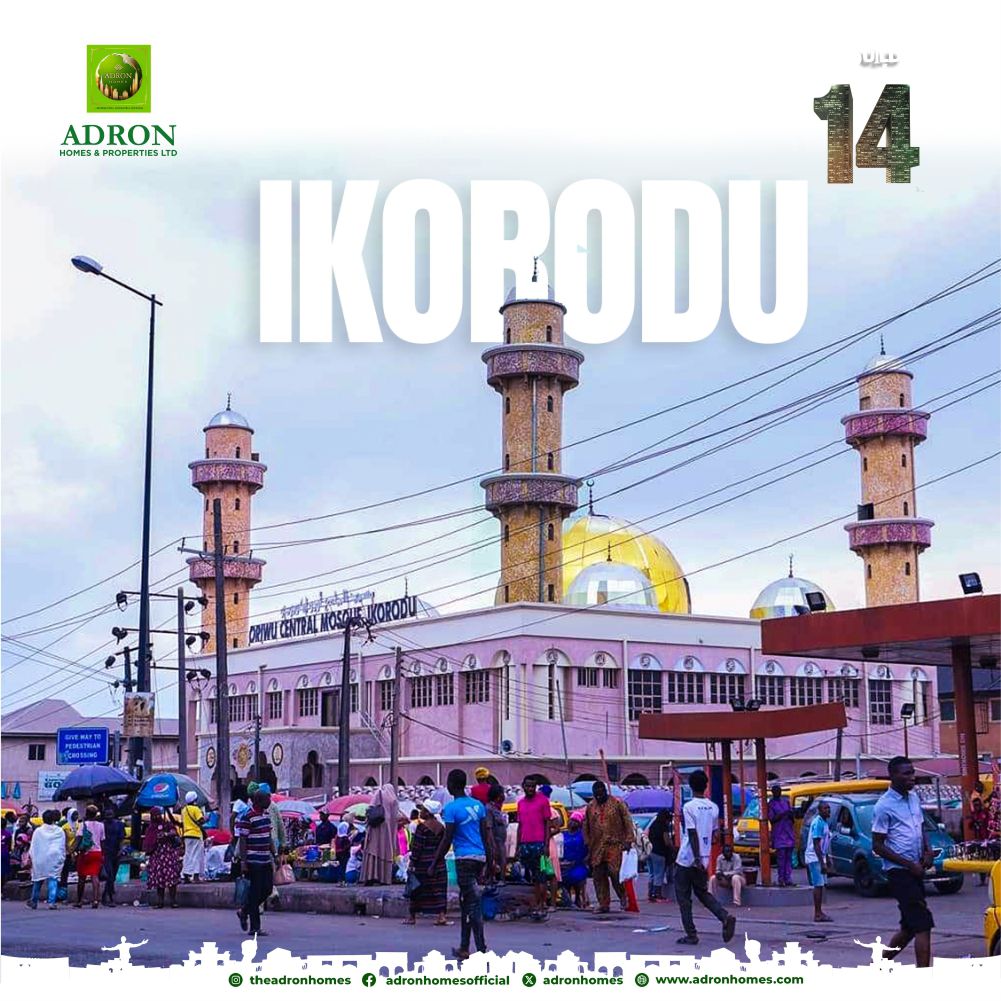

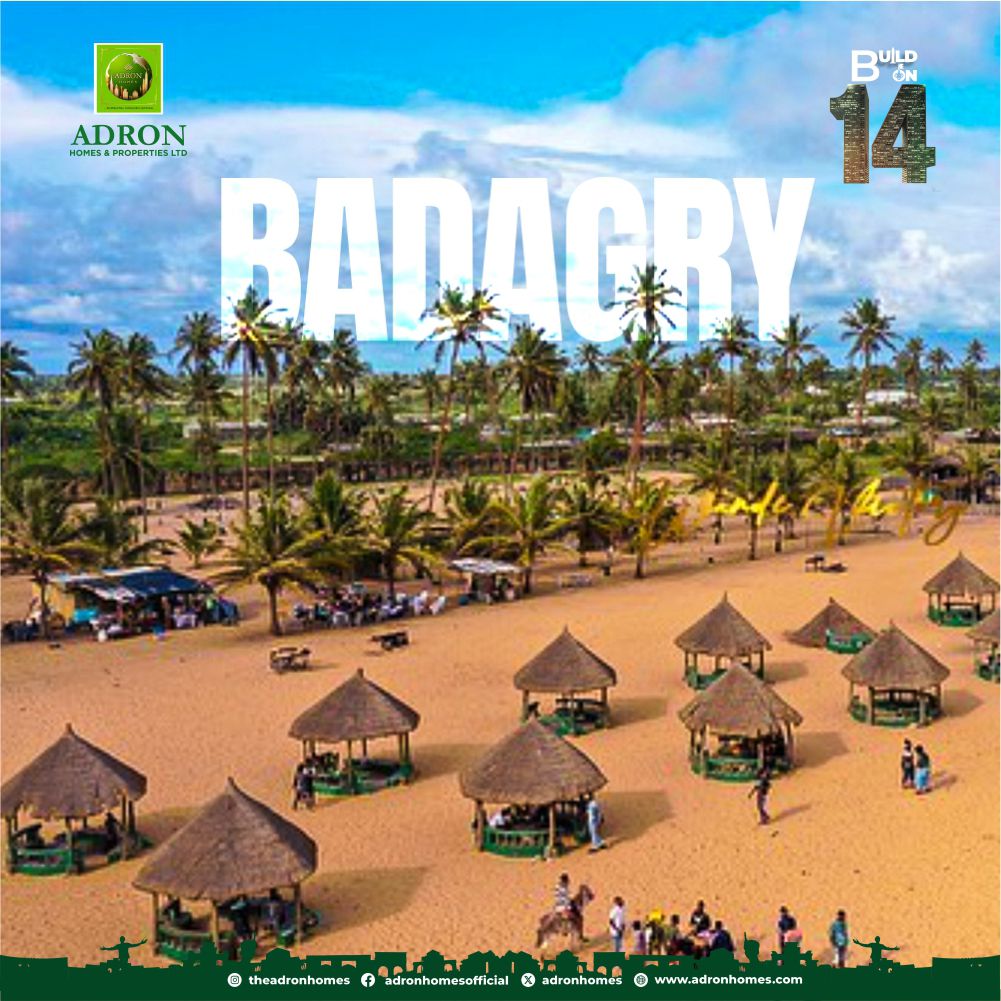

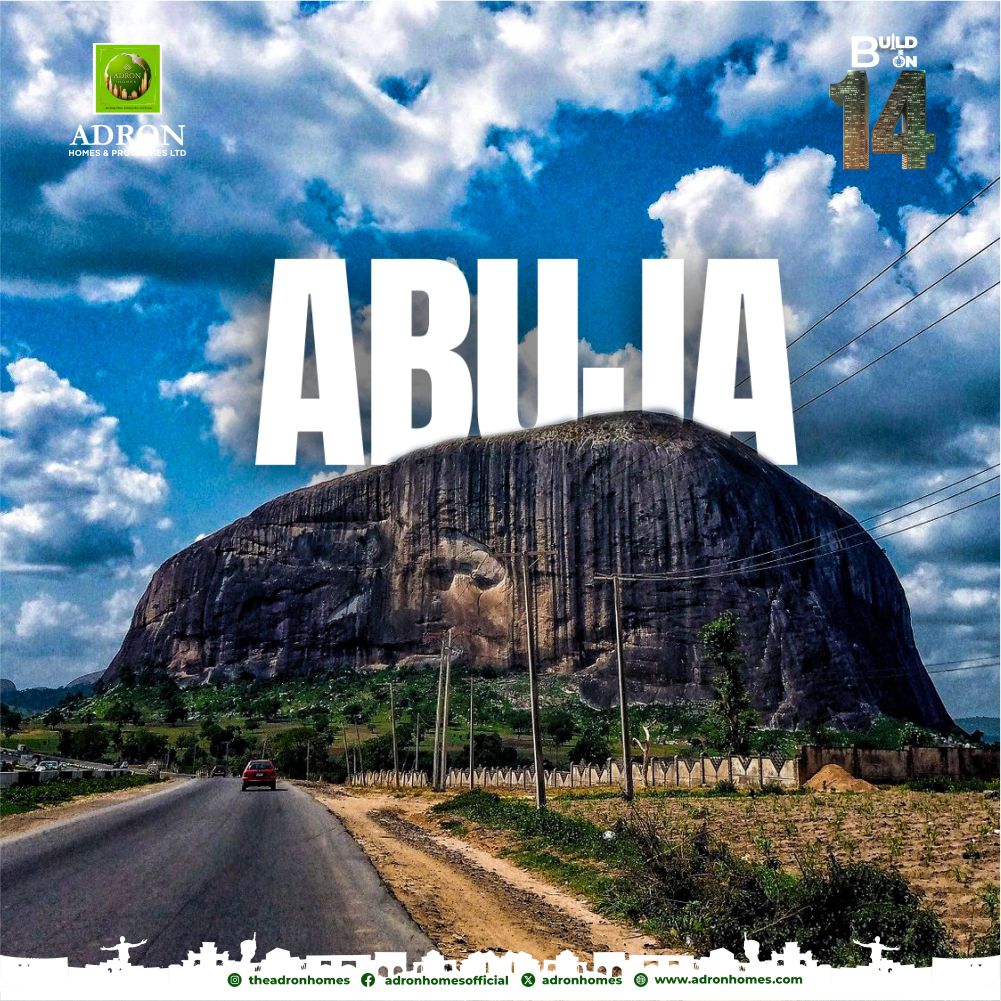

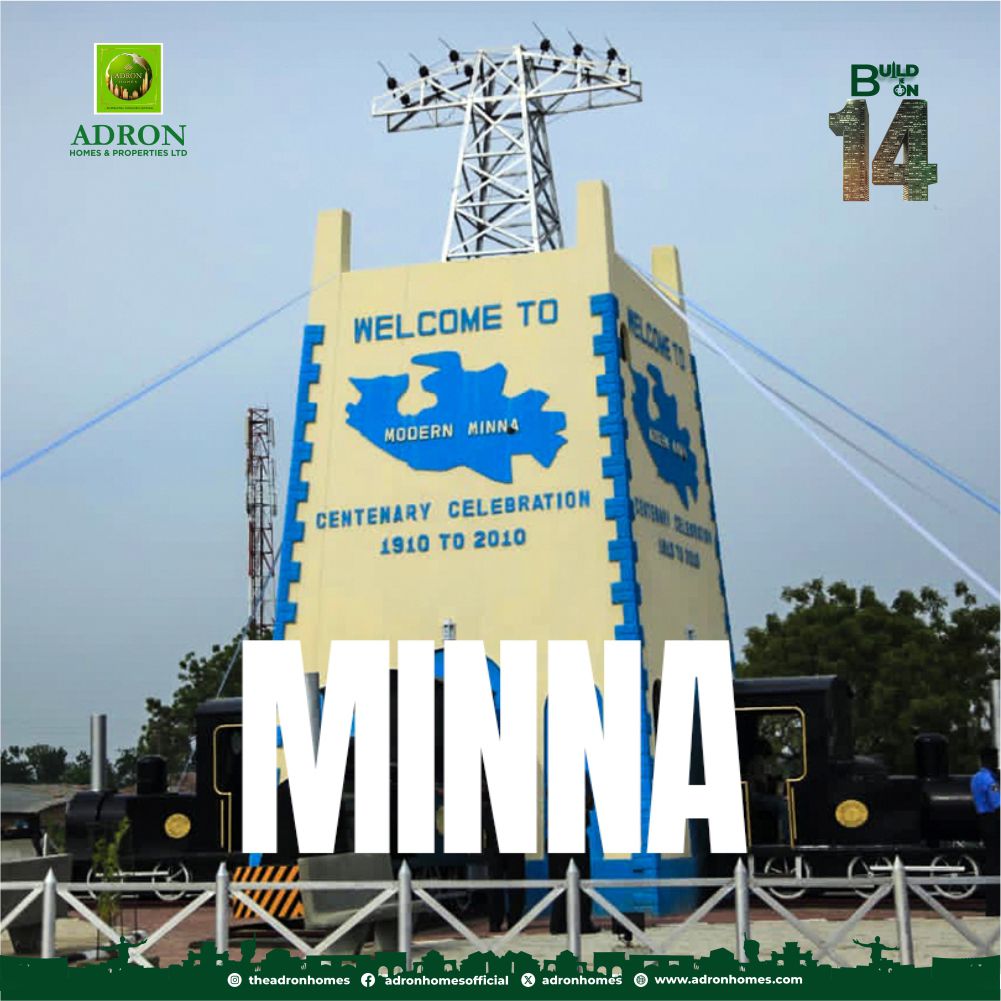

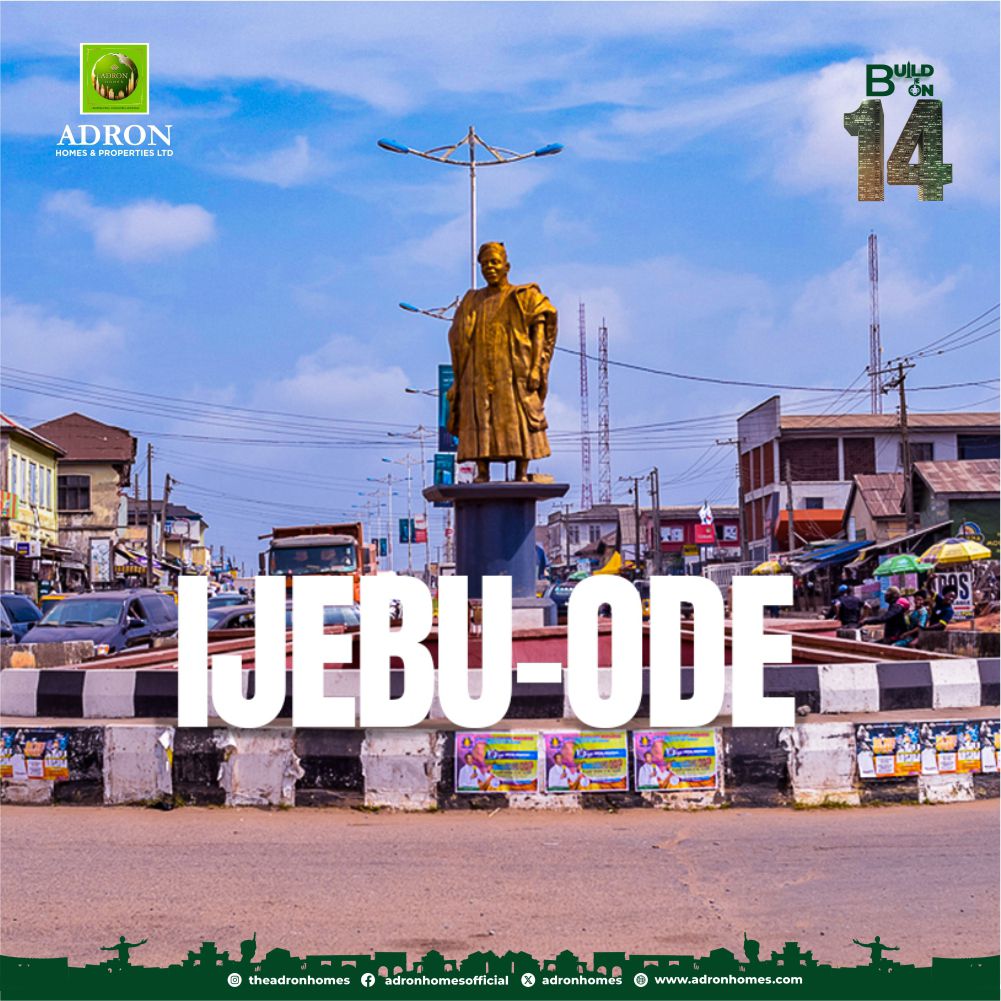

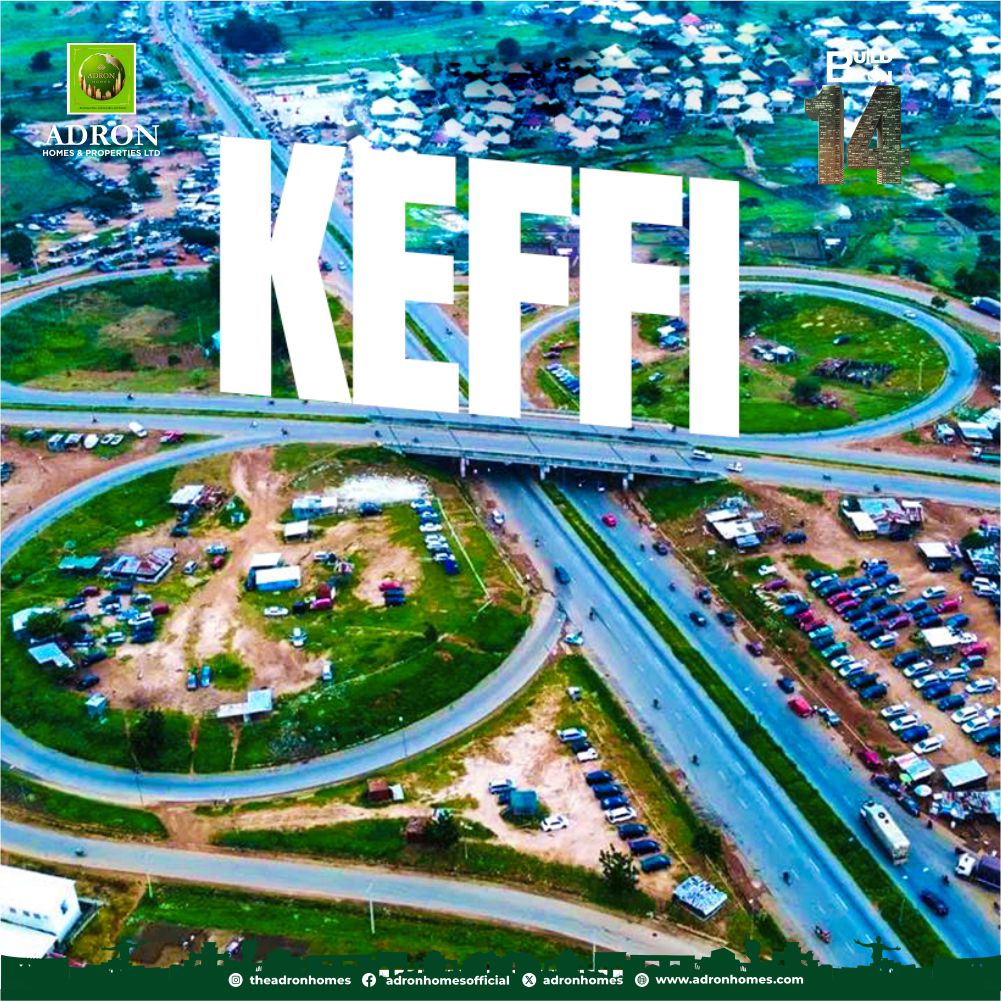

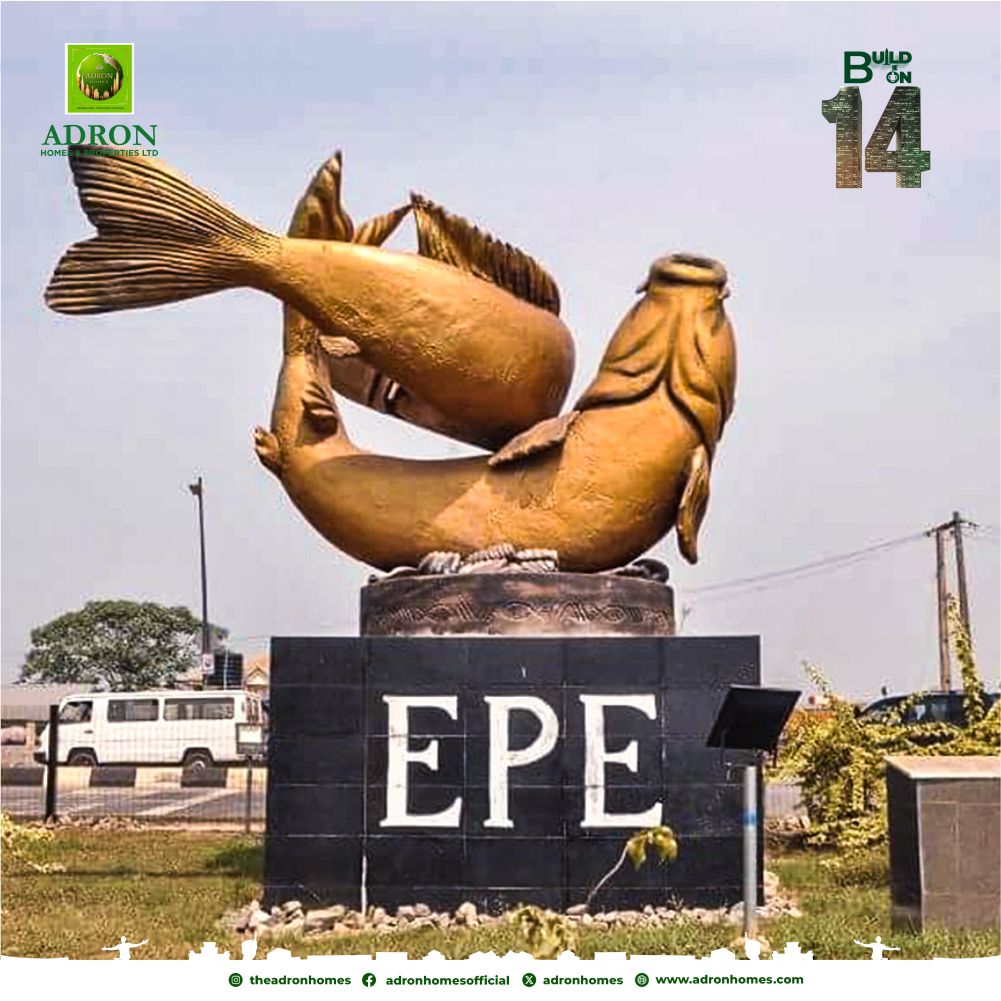

The story of Adron’s growth mirrors Nigeria’s evolving urban landscape. Beginning in Shimawa, the company strategically expanded into major growth corridors, including Lagos, Ogun, Oyo, Osun, Ekiti, Abuja, Nasarawa, Niger, and beyond. Its estates have not only provided shelter but have also influenced the emergence of new residential districts, encouraging organized expansion and helping to reduce the challenges associated with unplanned settlements.

Central to the company’s success is its commitment to affordability. Through flexible payment structures and innovative housing initiatives, Adron Homes has opened the door to homeownership for thousands of Nigerians who previously considered property ownership out of reach. This democratization of housing has empowered families, strengthened communities, and supported economic growth through increased property investment and local business opportunities within estates.

Beyond physical structures, Adron Homes prioritizes community building. Estates are designed as living ecosystems where families interact, children grow in secure environments, and entrepreneurs find opportunities to thrive. The emphasis on social cohesion has helped transform residential spaces into vibrant neighborhoods, reinforcing the idea that housing development should nurture human connection as much as physical infrastructure.

As Nigeria continues to urbanize, Adron Homes’ model demonstrates that real estate development can be both commercially viable and socially impactful. Its projects serve as reference points for emerging residential corridors, attracting further investment and setting standards for organized development across multiple regions.

Celebrating fourteen years of growth and innovation, Adron Homes remains committed to shaping Nigeria’s urban future through sustainable planning, inclusive housing solutions, and community-driven development. From its humble beginnings in Shimawa to a nationwide network of livable communities, the company’s journey stands as a testament to the power of vision, resilience, and a steadfast belief that cities are built not just with structures, but with people at their heart.

Business

14 Years of Democratizing Landownership: How Adron Homes Is Redefining Mass Housing in Nigeria

14 Years of Democratizing Landownership: How Adron Homes Is Redefining Mass Housing in Nigeria

For decades, homeownership in Nigeria remained an elusive dream for millions, restricted by rising rents, unstable housing markets, and mortgage systems beyond the reach of the average citizen. Fourteen years ago, Adron Homes and Properties Limited set out to challenge this reality with a bold and disruptive vision: to make land and homeownership affordable, accessible, and achievable for everyday Nigerians.

Founded on the principle that housing should be a right and not a privilege, Adron Homes has steadily emerged as one of Nigeria’s most influential mass housing developers. At the heart of its success is an affordability-driven model that prioritizes inclusion without compromising quality. Through flexible payment plans, low initial deposits, and extended installment options, the company has broken long-standing financial barriers that once excluded civil servants, young professionals, artisans, traders, and Nigerians in the diaspora from owning property.

Fourteen years on, this vision has translated into tangible impact across over 60 estates nationwide, strategically located in major and emerging growth corridors including Ibeju-Lekki, Lekki–Epe, Badagry, Shimawa, Papalanto, Sagamu, Abeokuta, Ibadan, Osun, Ekiti, Abuja, Nasarawa, and Niger State. Each estate represents more than infrastructure, it reflects Adron Homes’ commitment to decentralizing development and expanding access to property ownership beyond traditional urban centers.

Through this mass housing initiative, thousands of Nigerians have successfully transitioned from tenants to landlords, many achieving property ownership for the first time. Unlike conventional real estate models that emphasize exclusivity and luxury, Adron Homes has consistently aligned its offerings with the real income realities of the Nigerian population, ensuring that housing solutions remain practical, inclusive, and sustainable.

Beyond affordability, trust has remained a defining pillar of the Adron Homes brand. The company places strong emphasis on secure land titles, transparent documentation, and regulatory compliance, protecting subscribers from land disputes and fraudulent transactions. This focus on integrity has strengthened customer confidence and positioned Adron Homes as a dependable gateway to long-term wealth creation through real estate.

As Adron Homes marks its 14th anniversary, its mass housing journey stands as more than a corporate achievement but a national intervention. By restoring dignity, promoting financial security, and transforming thousands of property ownership dreams into reality, Adron Homes continues to play a vital role in shaping Nigeria’s housing landscape and building a future where more citizens can truly call a place their own.

Business

Deadline of Compliance: Nigeria’s Urgent Call for Tax Return Filing

Deadline of Compliance: Nigeria’s Urgent Call for Tax Return Filing

By George Omagbemi Sylvester | Published by SaharaWeeklyNG.com

“Shift or Structural Demand? A Declaration of Civic Duty in a Nation at a Fiscal Crossroads.”

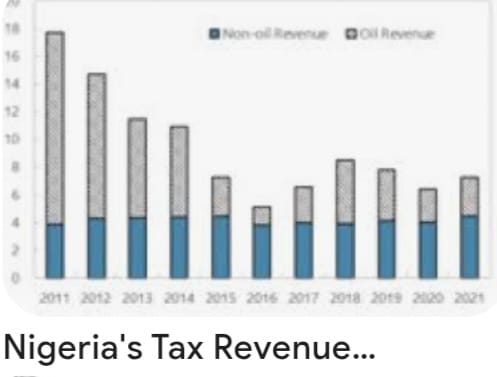

In the unfolding narrative of national development and economic reform, few instruments are as defining as tax compliance. For Nigeria, a nation perpetually grappling with revenue shortfalls, structural dependency on a single export commodity, and entrenched informal economic behaviour, the Federal Government’s recent clarification on tax return deadlines is not mere bureaucratic noise. It is a deliberate and inescapable declaration: the social contract between citizen and state must be honoured through transparent, lawful and timely tax reporting.

At its core, the government’s pronouncement is stark in its simplicity and radical in its implications. Federal authorities, speaking through the Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, have made it unequivocally clear that every Nigerian, whether employer or individual taxpayer, must file annual tax returns under the law. This encompasses self-assessment filings by individuals that too many assumed ended once employers deducted pay-as-you-earn taxes from their salaries.

This is not an optional civic suggestion, it is mandatory, backed by statute, and tied to a broader vision of national fiscal responsibility. Citizens can no longer hide behind ignorance, apathy, or false assumptions. “Many people assume that if their employer deducts tax from their salaries, their obligations end there. That is wrong,” Oyedele warned, emphasizing that the obligation to file remains with the individual under both existing and newly reformed tax laws.

The Deadlines and the Reality They Reveal.

Across the federation, state and federal revenue authorities have reaffirmed statutory deadlines in pursuit of compliance. The Lagos State Internal Revenue Service, for instance, moved to extend its filing date for employer returns by a narrow window, reflecting the reality that compliance often lags behind legal timelines. The extension was intended not as leniency, but as a pragmatic effort to allow accurate and complete submissions, underscoring that true compliance rises above mere mechanical ticking of a box.

At the federal level, Oyedele’s intervention was even more fundamental. He reminded Nigerians that annual tax returns for the preceding year must be filed in good faith, with integrity and in respect of the law. This applies regardless of income level including low-income earners who have historically believed that they are outside the tax net. “All of us must file our returns, including those earning low income,” he stated.

Herein lies one of the most challenging truths of contemporary Nigerian governance: widespread tax non-compliance is not just a technical breach of law, it is a deep cultural and structural issue that reflects decades of mistrust between citizens and the state.

The Root of the Problem: Non-Compliance as a Symptom.

Nigeria’s tax culture has long been under scrutiny. Public discourse and economic analysis consistently show that a significant majority of eligible taxpayers do not file annual returns. Oyedele highlighted that even in states widely regarded as tax administration leaders, compliance remains strikingly low, often below five percent.

This widespread non-compliance stems from multiple sources:

A long history of weak tax administration systems, where enforcement was inconsistent and penalties were rarely applied.

A perception that public services do not reflect the taxes collected, eroding the citizenry’s belief in reciprocity.

An informal economy where income often goes unrecorded, making filing seem irrelevant or impossible to many.

Lack of awareness, with many Nigerians genuinely believing that tax liability ends with employer deductions.

The government’s renewed push for compliance directly challenges these perceptions. It signals a shift from voluntary or lax compliance to structured accountability, a stance that aligns with best practices in modern public finance.

Why This Matters: Beyond Deadlines.

At its most profound level, the insistence on tax return filings is about nation-building and shared responsibility.

Scholars of public finance universally agree that a robust tax system is the backbone of sustainable development. As the eminent economist Dr. Joseph E. Stiglitz has observed, “A society that cannot mobilize its own resources through fair taxation undermines both its government’s legitimacy and its capacity to provide for its people.” Filing tax returns is not a mere administrative task, it is a declaration of participation in the collective project of national advancement.

In Nigeria’s context, this declaration carries weight. With the enactment of comprehensive tax reforms in recent years (including unified frameworks for tax administration and enforcement) authorities now possess broader statutory tools to ensure compliance and accountability. These measures, which include electronic filing platforms and stronger enforcement powers, have been framed as fair and equitable, targeting efficiency rather than arbitrariness.

Yet the success of these reforms depends heavily on citizens embracing their civic duties with sincerity. And this depends on mutual trust, the belief that paying taxes yields tangible benefits in infrastructure, education, healthcare, security and social services.

Voices From Experts: Fiscal Responsibility as a Public Ethic.

Tax law experts and economists, reflecting on the compliance push, have underscored a universal theme: taxation without transparency is inequity, but taxation with accountability is empowerment. When managed with fairness, a functional tax system can reduce dependency on volatile revenue sources, stabilise national budgets, and support long-term investment in human capital.

Professor Aisha Bello, a respected authority in fiscal policy, notes that “Tax compliance is not a burden; it is the foundation upon which social contracts are built. A citizen who honours tax obligations affirms the legitimacy of governance and demands better performance in return.”

Similarly, a leading tax scholar, Dr. Emeka Okon, argues that “The era when Nigerians could evade broader tax responsibilities simply because automatic deductions occur at source must end. For a modern economy, every eligible citizen must be part of the formal tax fold not as victims, but as stakeholders.”

These authoritative voices point to an unassailable truth: filing tax returns is both a legal requirement and a moral responsibility, an expression of citizenship in its fullest sense.

Challenges on the Ground: Compliance and Capacity.

While the rhetoric of compliance is compelling, the reality on the ground demands nuanced understanding. Many taxpayers (especially in the informal sector) lack meaningful access to digital platforms and resources for filing returns. For others, the fear of bureaucratic complexity and perceived punitive enforcement deters participation.

The government, for its part, has responded by promoting online systems and pledging greater taxpayer support. Tax authorities are increasingly engaging stakeholders to demystify filing processes, explain requirements and offer assistance. This mix of enforcement and facilitation is essential. As one seasoned revenue specialist observed: “The state cannot compel compliance through force alone; it must earn it through education, simplicity and fairness.”

The Broader Implication: A New Social Compact.

Ultimately, Nigeria’s renewed emphasis on tax return filing transcends administrative deadlines. It is an unequivocal declaration that national development is a shared responsibility, that citizens and state must engage in a transparent, accountable, and reciprocal relationship.

Tax compliance, therefore, becomes far more than a legal act; it becomes a moral claim on the nation’s future.

When citizens file their returns honestly, they affirm their stake in the nation’s destiny. When the government collects taxes transparently and deploys them effectively, it strengthens not only public services but civic trust itself.

In this sense, the deadlines proclaimed by Nigeria’s fiscal authorities mark not an end but a beginning; the beginning of a civic epoch in which accountability replaces apathy, participation replaces indifference and national purpose triumphs over fragmentation.

The road ahead will not be easy. But in demanding compliance, Nigeria is demanding more than tax returns. It is demanding commitment and that, ultimately, is the foundation on which nations are built.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

Business6 months ago

Business6 months agoBatsumi Travel CEO Lisa Sebogodi Wins Prestigious Africa Travel 100 Women Award

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING

You must be logged in to post a comment Login