Business

KPMG SME REPORT: FIRSTBANK NAMED BIGGEST MOVER IN 2019

Written by Collins Nweze

Capital is crucial in driving sustainable Small and Medium Enterprises’(SMEs’) growth and uplifting the economy. First Bank of Nigeria Limited, as part of the launch of its specialised SMEs’ propositions, has continually supported SMEs through diverse initiatives. The bank says its support for SMEs is in line with the Central Bank of Nigeria’s directive on improved funding for SMEs to ensure economic growth and development.

The economies of great nations thrive on the strength and performance of Small and Medium Enterprises (SMEs) seen as engine of growth.

For Nigeria, the Central Bank (CBN) defines SMEs as enterprises with asset base (excluding land) of between N5 million and N500 million and labour force of 11 and 300 people.

The benefits of funding SMEs have attracted many banks with eye on the future to invest and support SMEs in the interest of the economy.

For SMEs to achieve these goals, operators’ easy access to credit must be promoted.

First Bank of Nigeria Limited is one of the banks that is investing and supporting SMEs. Following research by the bank over the years, it identified these seven strategic pillars that are essential to the sustainability and growth of the SMEs.

These include access to infrastructure, access to talent, capacity building, policy and regulation, access to resources, access to market as well as access to finance.

The bank has also held its SMEs’ Week in Lagos, Abuja, Port Harcourt, Ibadan, Kano and Owerri. The week-long event was rounded off with a live webinar, facilitated by Gbenga Shobo, the bank’s Deputy Managing Director.

According to Shobo, “FirstBank has, over the years, been at the forefront of supporting businesses, especially the SMEs, as we recognise that the SMEs are the engine of the economy.

We are committed to ensuring that we leave no stone unturned as we connect with them in their continued contribution to national development in terms of the employment opportunities they create as well as their contribution to the nation’s GDP amongst many economic values.

“The FirstBank SME Week is driven to promote the Bank’s SME proposition, thereby having SMEs across the country optimally enlightened on how to plug in. We believe this will help SMEs bolster their contribution to the growth and development of the economy.”

The 2019 Nigeria banking industry customer experience survey report recently published by KPMG Nigeria showed that in the retail segment, the top two performers have remained the same for the fourth consecutive year.

GTBank, Zenith Bank are top-rated bank in the 2019 ranking. Sterling Bank, FirstBank and UBA are the biggest movers in 2019, coming in third, fifth and seventh places.

Commitment to fashion and entrepreneurship

FirstBank sponsored the Sixth Africa Fashion Week, which held last December in Lagos.

The event themed ‘’Africa Unites’’ was a convergence of fashion entrepreneurs and the public to promote the creativity and innovation of Nigerian and African brands through worldwide visibility, distribution and manufacturing.

Dignitaries at the event include wives of the Ekiti, Ogun and Kwara state governors, Mrs Bisi Adeleye-Fayemi, Mrs Bamidele Abiodun and Mrs Folake Abdulrazaq. The Ooni of Ife, Oba Adeyeye Enitan Ogunwusi; former Director-General of Nigerian Tourism Development Corporation,Mrs Omotayo Omotosho; television presenter and model, Idia Aisen; model and beauty influencer, Whitney Madueke were also there. FirstBank was represented by Helen Ogboh, Business Manager, Corporate Banking.

Speaking on FirstBank’s sponsorship of the event, the Bank’s Group Head, Marketing & Corporate Communications, Folake Ani-Mumuney, said: “We are pleased to identify with Africa Fashion Week Nigeria as it showcases creativity by African fashion designers to the teeming public, leading players and enthusiasts of African fashion while promoting their contribution to the growth of the fashion industry.

“We will continue to drive advocacy for this as it can create jobs that will deepen opportunities for the revival of our textile industry resulting in SMEs’growth along the value chains especially, with the growing demand in the fashion industry.”

Recently, the bank promoted the use of local fabrics with a ‘What If’ campaign to commemorate the country’s Independence. It ran across the social media channels, Twitter, Instagram and Facebook, focusing on the creativity of sewing local fabrics as a national symbol vis-a-vis our outfits, clothing accessories, household furniture, in line with the bank’s celebratory 125th Anniversary, themed, “Woven into the Fabric of Society”.

Ani-Mumuney said the bank would continue to empower the society, including the support for small businesses and promotion of the growth of the entertainment industry.

Also, on the list of fashion sponsorship credentials of the Bank is the Fashion Souk, as well as Street Souk organized in partnership with Eventful Limited. Ani-Mumuney said “Street Souk was designed to encourage the youth to channel their talents to genres as music, arts and fashion. It’s a platform that identifies opportunities, which promote the innovative spirit in youngsters.

She noted that Street Souk was tied to the FirstBank’s initiative to empower the society, including small business owners. According to her, the initiative is also tied to the promotion of the entertainment industry.

Manager XIIG Glover, a merchant at the Street Souk, Mr Obembe Abiola, said he was happy to be part of last year’s (2019) street trading.

“We are here to showcase what we also have as a brand which is African made and to reach out to people to know about the brand. Last year (in 2018), we were also here and it was a great time out to meet up with new clients, customers and to meet up with other brands and this year is a lot more better than last year. We are large in number, new faces and everything is going on fine,” Abiola said. He commended FirstBank for organising the event aimed at encouraging entrepreneurship.

Also, Creative Director, Dmf Designs & Shopwith5k, Adebayo Bankole, a participant, said she was glad to showcase her brand to people. “I have finally found my target audience here, people that are interested in street Souk culture in Nigeria. They are my target audience,” Bankole said.

She stated that sales had been very amazing and that it was worth-while being part of this year’s Street Souk.

“I really appreciate the fact that FirstBank is doing this because most banks go for ankara or made- in-Nigeria but this is promoting a different culture in Nigeria. Street trading is not common in Nigeria, the fact that FirstBank is able to support the promotion of street Souk in Nigeria is amazing,” Bankole added.

The bank also said it would remain committed to the Federal Government’s diversification drive with the development of agricultural value chain to boost employment.

FirstBank’s Chairman, Mrs Ibukun Awosika, stated this at last year’s edition of ‘Food Souk’, an event the Bank convened in partnership with Eventful Limited, an events management firm.

Mrs Awosika said the bank would continue to support the agricultural value chain from production to consumption to create opportunities for SMEs in the food sector to create job opportunities. “As you have noticed, we have been doing a chain of Souks with Eventful. It is critical for the economy of the nation that we encourage the SMEs sector across different industries,” she said.

According to her, the Food Souk was introduced to diversify the economy through agricultural development. “When we have 200 million people, food is big business because everybody will eat. So, what we are trying to do is in support of the nation’s building. We are seeking to encourage small, medium and big enterprises in different sectors of the economy.

“One is to help create jobs because if we think that 65 per cent of our population is made up of people under 40 years and the highest unemployment rate is within the segment that is between 20 and 35, so you need to create jobs.

“But you will only create jobs when you create entrepreneurs, as we create more businesses you are creating job opportunities,” Mrs Awosika said.

She added that the bank’s focused on the growth of the economy with the hope it would benefit from it as a provider of financial services. “As we grow the economy, as we build lives of Nigerians, as we support the government’s investment in the diversification of the economy and help to create jobs through the enterprises we will ultimately benefit,” Mrs Awosika stated.

The Chairman said FirstBank, the largest retail bank in the country, would continue to support growth and development of SMEs. “A lot of big businesses of today that grew in Nigeria are businesses we supported from scratch. “We are starting with different generations of new businesses and events like this help you to see the trends. It helps you to see the companies that need nurturing.

“It helps you to see the companies that you can support. It also gives you information about how you can best support them and engage them in their terrain to see businesses and understand their feelings to create the kind of product that will support their businesses,” Mrs Awosika said.

A food vendor, Ms Ijeoma Ebeneme, the Chief Executive Officer, JEM N Iris, commended FirstBank for putting the event together. Ebeneme said she was at the fair to make profit, meet new clients as well as create the needed publicity for her brand. Food Souk, formerly known as Fiesta of Flavours, is a food and wine fair, that holds yearly at Harbour Point in Victoria Island, Lagos, since its premier edition in 2015.

The fun food and beverage fair hosted by Eventful and sponsored by FirstBank provides an avenue for attendees to experience the entertainment, art and business of food. It showcases the best in local and international cuisine, cutting-edge food technology and cooking techniques, and the best beverages, wines and spirits the world offers. It provides management and training seminars, food demonstrations and performances.

Business

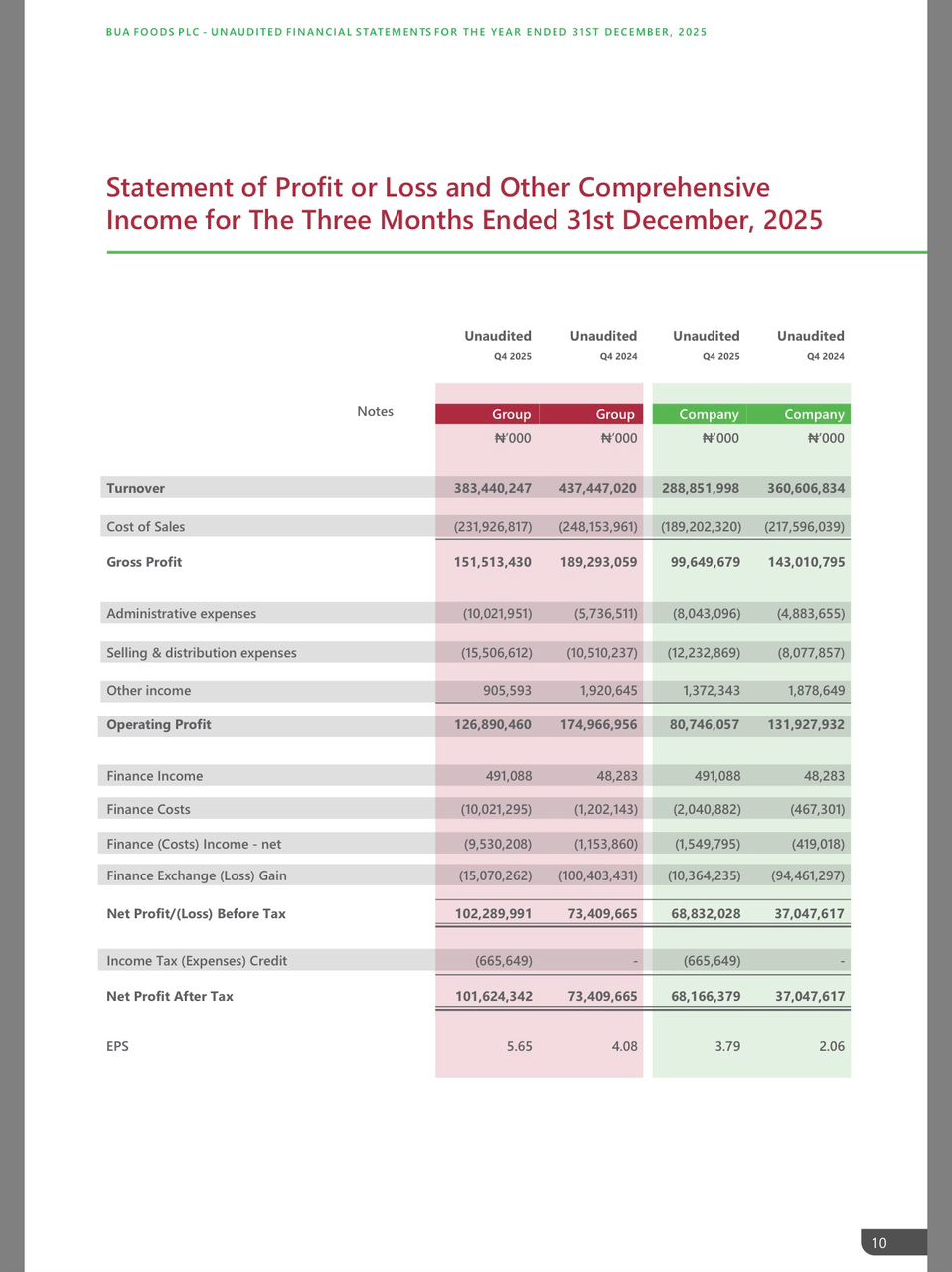

BUA Foods Records 91% Surge in Profit After Tax, Hits ₦508bn in 2025

BUA Foods Records 91% Surge in Profit After Tax, Hits ₦508bn in 2025

By femi Oyewale

Business

Adron Homes Unveils “Love for Love” Valentine Promo with Exciting Discounts, Luxury Gifts, and Travel Rewards

Adron Homes Unveils “Love for Love” Valentine Promo with Exciting Discounts, Luxury Gifts, and Travel Rewards

In celebration of the season of love, Adron Homes and Properties has announced the launch of its special Valentine campaign, “Love for Love” Promo, a customer-centric initiative designed to reward Nigerians who choose to express love through smart, lasting real estate investments.

The Love for Love Promo offers clients attractive discounts, flexible payment options, and an array of exclusive gift items, reinforcing Adron Homes’ commitment to making property ownership both rewarding and accessible. The campaign runs throughout the Valentine season and applies to the company’s wide portfolio of estates and housing projects strategically located across Nigeria.

Speaking on the promo, the company’s Managing Director, Mrs Adenike Ajobo, stated that the initiative is aimed at encouraging individuals and families to move beyond conventional Valentine gifts by investing in assets that secure their future. According to the company, love is best demonstrated through stability, legacy, and long-term value—principles that real estate ownership represents.

Under the promo structure, clients who make a payment of ₦100,000 receive cake, chocolates, and a bottle of wine, while those who pay ₦200,000 are rewarded with a Love Hamper. Payments of ₦500,000 attract a Love Hamper plus cake, and clients who pay ₦1,000,000 enjoy a choice of a Samsung phone or a Love Hamper with cake.

The rewards become increasingly premium as commitment grows. Clients who pay ₦5,000,000 receive either an iPad or an all-expenses-paid romantic getaway for a couple at one of Nigeria’s finest hotels, which includes two nights’ accommodation, special treats, and a Love Hamper. A payment of ₦10,000,000 comes with a choice of a Samsung Z Fold 7, three nights at a top-tier resort in Nigeria, or a full solar power installation.

For high-value investors, the Love for Love Promo delivers exceptional lifestyle experiences. Clients who pay ₦30,000,000 on land are rewarded with a three-night couple’s trip to Doha, Qatar, or South Africa, while purchasers of any Adron Homes house valued at ₦50,000,000 receive a double-door refrigerator.

The promo covers Adron Homes’ estates located in Lagos, Shimawa, Sagamu, Atan–Ota, Papalanto, Abeokuta, Ibadan, Osun, Ekiti, Abuja, Nasarawa, and Niger States, offering clients the opportunity to invest in fast-growing, strategically positioned communities nationwide.

Adron Homes reiterated that beyond the incentives, the campaign underscores the company’s strong reputation for secure land titles, affordable pricing, strategic locations, and a proven legacy in real estate development.

As Valentine’s Day approaches, Adron Homes encourages Nigerians at home and in the diaspora to take advantage of the Love for Love Promo to enjoy exceptional value, exclusive rewards, and the opportunity to build a future rooted in love, security, and prosperity.

Business

Why Nigeria’s Banks Still on Shaky Ground with Big Profits, Weak Capital

*Why Nigeria’s Banks Still on Shaky Ground with Big Profits, Weak Capital*

*BY BLAISE UDUNZE*

Despite the fragile 2024 economy grappling with inflation, currency volatility, and weak growth, Nigeria’s banking industry was widely portrayed as successful and strong amid triumphal headlines. The figures appeared to signal strength, resilience, and superior management as the Tier-1 banks such as Access Bank, Zenith Bank, GTBank, UBA, and First Bank of Nigeria, collectively reported profits approaching, and in some cases exceeding, N1 trillion. Surprisingly, a year later, these same banks touted as sound and solid are locked in a frenetic race to the capital markets, issuing rights offers and public placements back-to-back to meet the Central Bank of Nigeria’s N500 billion recapitalisation thresholds.

The contradiction is glaring. If Nigeria’s biggest banks are so profitable, why are they unable to internally fund their new capital requirements? Why have no fewer than 27 banks tapped the capital market in quick succession despite repeated assurances of balance-sheet robustness? And more fundamentally, what do these record profits actually say about the real health of the banking system?

The recapitalisation directive announced by the CBN in 2024 was ambitious by design. Banks with international licences were required to raise minimum capital to N500 billion by March 2026, while national and regional banks faced lower but still substantial thresholds ranging from N200 billion to N50 billion, respectively. Looking at the policy, it was sold as a modern reform meant to make banks stronger, more resilient in tough times, and better able to support major long-term economic development. In theory, strong banks should welcome such reforms. In practice, the scramble that followed has exposed uncomfortable truths about the structure of bank profitability in Nigeria.

At the heart of the inconsistency is a fundamental misunderstanding often encouraged by the banks themselves between profits and capital. Unknown to many, profitability, no matter how impressive, does not automatically translate into regulatory capital. Primarily, the CBN’s recapitalisation framework actually focuses on money paid in by shareholders when buying shares, fresh equity injected by investors over retained earnings or profits that exist mainly on paper.

This distinction matters because much of the profit surge recorded in 2024 and early 2025 was neither cash-generative nor sustainably repeatable. A significant portion of those headline banks’ profits reported actually came from foreign exchange revaluation gains following the sharp fall of the naira after exchange-rate unification. The industry witnessed that banks’ holding dollar-denominated assets their books showed bigger numbers as their balance sheets swell in naira terms, creating enormous paper profits without a corresponding improvement in underlying operational strength. These gains inflated income statements but did little to strengthen core capital, especially after the CBN barred banks from using FX revaluation gains for dividends or routine operations. In effect, banks looked richer without becoming stronger.

Beyond FX effects, Nigerian banks have increasingly relied on non-interest income fees, charges, and transaction levies to drive profitability. While this model is lucrative, it does not necessarily deepen financial intermediation or expand productive lending. High profits built on customer charges rather than loan growth offer limited support for long-term balance-sheet expansion. They also leave banks vulnerable when macroeconomic conditions shift, as is now happening.

Indeed, the recapitalisation exercise coincides with a turning point in the monetary cycle. The extraordinary conditions that supported bank earnings in 2024 and 2025 are beginning to unwind. Analysts now warn that Nigerian banks are approaching earnings reset, as net interest margins the backbone of traditional banking profitability, come under sustained pressure.

Renaissance Capital, in a January note, projects that major banks including Zenith, GTCO, Access Holdings, and UBA will struggle to deliver earnings growth in 2026 comparable to recent performance.

In a real sense, the CBN is expected to lower interest rates by 400 to 500 basis points because inflation is slowing down, and this means that banks will earn less on loans and government bonds, but they may not be able to quickly lower the interest they pay on deposits or other debts. The cash reserve requirements are still elevated, which does not earn interest; banks can’t easily increase or expand lending investments to make up for lower returns. The implications are significant. Net interest margin, the difference between what banks earn on loans and investments and what they pay on deposits, is poised to contract. Deposit competition is intensifying as lenders fight to shore up liquidity ahead of recapitalisation deadlines, pushing up funding costs. At the same time, yields on treasury bills and bonds, long a safe and lucrative haven for banks are expected to soften in a lower-rate environment. The result is a narrowing profit cushion just as banks are being asked to carry far larger equity bases.

Compounding this challenge is the fading of FX revaluation windfalls. With the naira relatively more stable in early 2026, the non-cash gains that once flattered bank earnings have largely evaporated. What remains is the less glamorous reality of core banking operations: credit risk management, cost efficiency, and genuine loan growth in a sluggish economy. In this new environment, maintaining headline profits will be far harder, even before accounting for the dilutive impact of recapitalisation.

That dilution is another underappreciated consequence of the capital rush. Massive share issuances mean that even if banks manage to sustain absolute profit levels, earnings per share and return on equity are likely to decline. Zenith, Access, UBA, and others are dramatically increasing their share counts. The same earnings pie is now being divided among many more shareholders, making individual returns leaner than during the pre-recapitalisation boom. For investors, the optics of strong profits may soon give way to the reality of weaker per-share performance.

Yet banks have pressed ahead, not only out of regulatory necessity but also strategic calculation.

During this period of recapitalization, investors are interested in the stock market with optimism, especially about bank shares, as banks are raising fresh capital, and this makes it easier to attract investments. This has become a season for the management teams to seize the moment to raise funds at relatively attractive valuations, strengthen ownership positions, and position themselves for post-recapitalisation dominance. In several cases, major shareholders and insiders have increased their stakes, as projected in the media, signalling confidence in long-term prospects even as near-term returns face pressure.

There is also a broader structural ambition at play. Well-capitalised banks can take on larger single obligor exposures, finance infrastructure projects, expand regionally, and compete more credibly with pan-African and global peers. From this perspective, recapitalisation is not merely about compliance but about reshaping the competitive hierarchy of Nigerian banking. What will be witnessed in the industry is that those who succeed will emerge larger, fewer, and more powerful. Those that fail will be forced into consolidation, retreat, or irrelevance.

For the wider economy, the outcome is ambiguous. Stronger banks with deeper capital buffers could improve systemic stability and enhance Nigeria’s ability to fund long-term development. The point is that while merging or consolidating banks may make them safer, it can also harm the market and the economy because it will reduce competition, let a few banks dominate, and encourage them to earn easy money from bonds and fees instead of funding real businesses. The truth be told, injecting more capital into the banks without complementary reforms in credit infrastructure, risk-sharing mechanisms, and fiscal discipline, isn’t enough as the aforementioned reforms are also needed.

The rush as exposed in this period, is that the moment Nigerian banks started raising new capital, the glaring reality behind their reported profits became clearer, that profits weren’t purely from good management, while the financial industry is not as sound and strong as its headline figures. The fact that trillion-naira profit banks must return repeatedly to shareholders for fresh capital is not a sign of excess strength, but of structural imbalance.

With the deadline for banks to raise new capital coming soon, by 31 March 2026, the focus has shifted from just raising N500 billion. N200 billion or N50 billion to think about the future shape and quality of Nigeria’s financial industry, or what it will actually look like afterward. Will recapitalisation mark a turning point toward deeper intermediation, lower dependence on speculative gains, and stronger support for economic growth? Or will it simply reset the numbers while leaving underlying incentives unchanged?

The answer will define the next chapter of Nigerian banking long after the capital market roadshows have ended and the profit headlines have faded.

Blaise, a journalist and PR professional, writes from Lagos and can be reached via: [email protected]

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

Business6 months ago

Business6 months agoBatsumi Travel CEO Lisa Sebogodi Wins Prestigious Africa Travel 100 Women Award

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING