Business

ARIK AIR OF THIEVES “How Arik Air ‘steals’ from us” — passengers

The Aviation Minister, Osita Chidoka, on Monday said the ministry has arrested three Arik Air staff for stealing fuel from an aircraft.

Making the announcement on his official Facebook page, Chidoka said “the trio of Blessing Dugbe, Samuel Asuquo and Isaac Ajakaiye were arrested at the Murtala Mohammed International Airport, Lagos, during a security patrol operation on Sunday at about around 3 a.m. The trios were stealing Jet A1 fuel from Arik Air plane, with registration number: 5N-MID into six jerry cans for sale at a cheaper price to other unsuspecting airline operators. It’s a development that has the capacity to threaten safety and security of airplanes. Meanwhile, the three (3) suspects were handed over to the Crime Investigation Bureau (CIB), AVSEC MMIA for further action,” Mr. Chidoka said.

He said considering the magnitude of the crime to the security and safety of airplanes, the chief security officer of the Lagos airport has been asked to ensure that the suspects are handed over to the airport police for adequate prosecution.

This is not the first time that Arik staffers are accused of theft. Passengers have often lamented the loss of one item or the other, ranging from iPad, jewelleries, money, clothes to perfumes aboard the airline’s flights.

“Arik Air inflight theft (Flight no. W3 151 @ 0700hr, 24th April, 2014.

“I boarded this Arik Air flight from Abuja to Lagos 16th June, 2012 to connect an international flight. The flight scheduled to depart at 14:25 eventually left just around 15:00, which is a relatively good time considering the fact that delays of over 6 hours are the norm these days.

First off, we couldn’t find where to sit as the cabin crew informed us that it was ‘free sitting.’ I wondered why the order guaranteed with seat allocation was discarded for the chaos of “free sitting.” Most of the passengers were not pleased. During the flight, I read a book and discussed an article I was working on with my friend Azeenarh. She encouraged me to get started with the article already.

At this point I picked up my ipad to write, trying to imagine what happened in the last minutes of the Dana Crash. I had done some 500 words when the pilot announced that we were almost landing and all the routine of sitting upright, putting out electronic equipment meant that I had to stop using the ipad. I put the ipad in the seat pocket right in front of me.

On arrival in Lagos, I helped Azeenarh with her bag which was under the seat in front of her, while others in the usual style rushed to go out. We took our time and eventually alighted from the aircraft. When we got to Allen Avenue, I realised I had left my Ipad in the aircraft. We quickly dashed to the airport and we were fortunate to find out that the aircraft that brought us was still on ground.

We finally met one Lanre who was in charge of complaints as mine – “Lost and Found” is what they call it. “Lost and Gone” would be more apt based on my experience. His friend asked him in Yoruba if he had seen anything and he mumbled something which I didn’t hear. I didn’t like the fact that they were even speaking Yoruba in mumbled voices at this time and I told Azeenarh the comportment of the staff best compares with that of Lagos motor parks.

Lanre went and came back and said “they saw the ipad and put it inside your bag.” Of course that could not have happened. How could you have put an Ipad in my bag when the ipad was not tagged? How did you know which bag to put it in? While we were arguing about this, he left to attend to other passengers who had even more interesting complaints.

Mary Chen as stated earlier had travelled from Lagos to Abuja (Flight W3 155, 11:45 June 12, 2012) to lodge a complaint. She found out that her jewelleries (gold trinkets INCLUDING her wedding ring) inside her jewelry box had been stolen. She had checked this box in and it was obvious someone had found a way to open the bag, steal her jewelleries and left the bag as if nothing had happened. There were other people with complaints of theft as Mary noted when she made her complaint the first time.

Asked about making a report, the Arik Air staff with phone number 08077791490 (the official number for complaints such as mine and Mary’s) said there was no form to fill, there was no superior to talk to, and that just verbally telling him was enough. Essentially there was nothing to document the complaints.

Why should someone who made a report a week after he had lost something just as valuable as my ipad, have his lost good returned to him within minutes of asking and I who made my report within 90 minutes of forgetting my ipad has to force Arik Air to do the needful? Lanre said they found the ipad and put it in my bag; that established the fact that the ipad was at least found. Emirates found the camera and kept it in place for the owner who claimed it on his return journey a week after.

Arik Air found my ipad and claimed they had put it in my bag. The difference is why you can check in your luggage on Emirates airline and connect flights around the world and be sure they can be trusted to take care of even your lost good. With the other, your luggage is in danger on even a flight as short as Lagos – Abuja, even in a locked box like Mary’s.

I will be posting more reports on thefts such as this for now and would give special preference to Arik Air stolen goods reports.

The hashtag on twitter is #ArikAirWhereIsMyIpad”

somehow i forgot i had a pair of scissors in my hand luggage which was spotted during scan.

The attendant requested i drop it before i can board. This wasn’t a big deal but I first had to almost empty my bag just to locate the scissors during which process i place certain items including my samsung camera on the desk. I foolishly let the dude assist me in getting my items back in my bag. That was the last time i saw the camera. It took me till last year to resume flying with Arik as i was seriously pissed.- anonymous

Funny enough while typing this reply, my boss narrated his own experience on how his pouch containing valuables and ID cards was lost when he flew Arik from Port Harcourt to Abuja and all efforts to locate the items proved a abortive”.- anonymous

Business

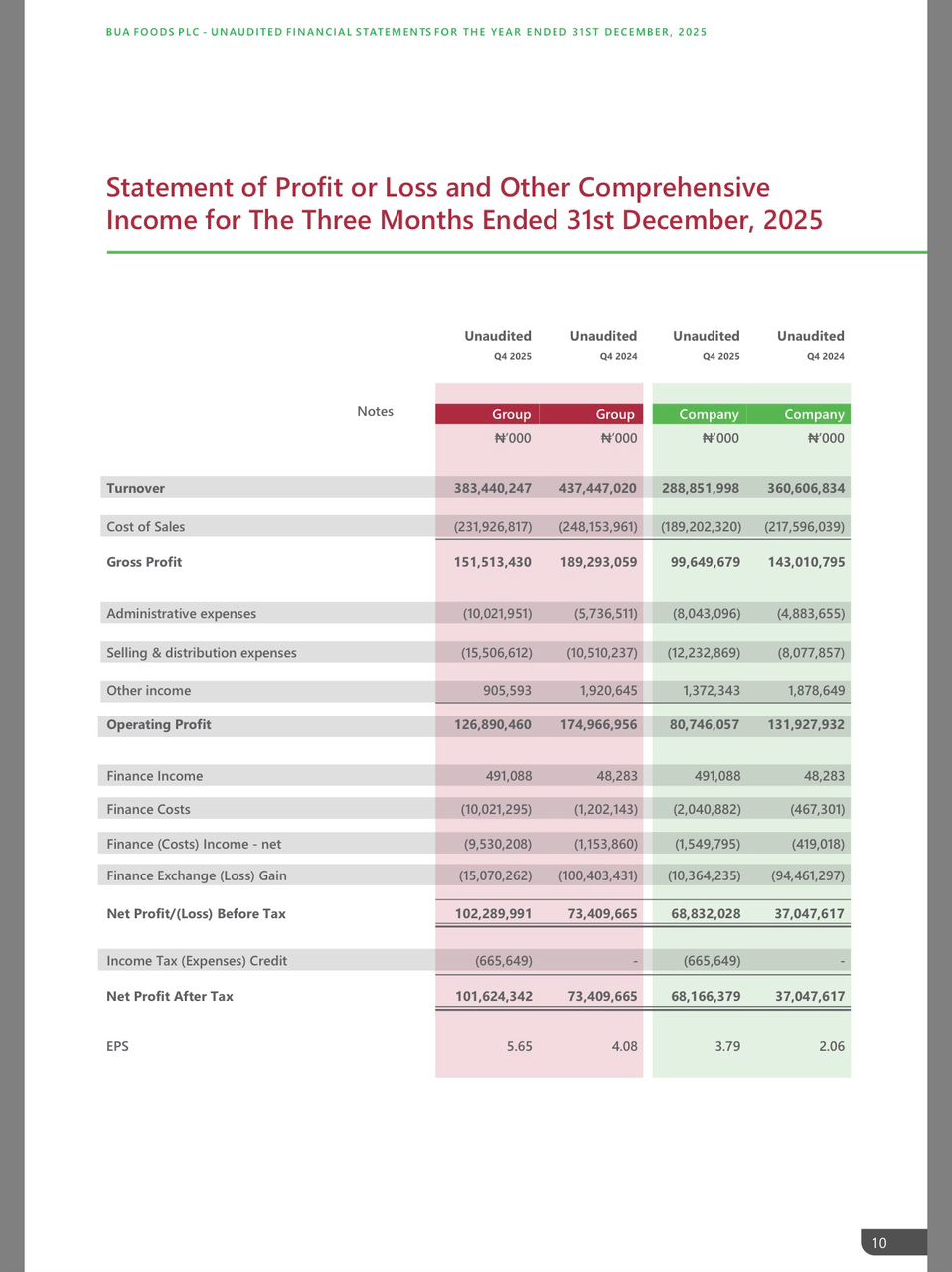

BUA Foods Records 91% Surge in Profit After Tax, Hits ₦508bn in 2025

BUA Foods Records 91% Surge in Profit After Tax, Hits ₦508bn in 2025

By femi Oyewale

Business

Adron Homes Unveils “Love for Love” Valentine Promo with Exciting Discounts, Luxury Gifts, and Travel Rewards

Adron Homes Unveils “Love for Love” Valentine Promo with Exciting Discounts, Luxury Gifts, and Travel Rewards

In celebration of the season of love, Adron Homes and Properties has announced the launch of its special Valentine campaign, “Love for Love” Promo, a customer-centric initiative designed to reward Nigerians who choose to express love through smart, lasting real estate investments.

The Love for Love Promo offers clients attractive discounts, flexible payment options, and an array of exclusive gift items, reinforcing Adron Homes’ commitment to making property ownership both rewarding and accessible. The campaign runs throughout the Valentine season and applies to the company’s wide portfolio of estates and housing projects strategically located across Nigeria.

Speaking on the promo, the company’s Managing Director, Mrs Adenike Ajobo, stated that the initiative is aimed at encouraging individuals and families to move beyond conventional Valentine gifts by investing in assets that secure their future. According to the company, love is best demonstrated through stability, legacy, and long-term value—principles that real estate ownership represents.

Under the promo structure, clients who make a payment of ₦100,000 receive cake, chocolates, and a bottle of wine, while those who pay ₦200,000 are rewarded with a Love Hamper. Payments of ₦500,000 attract a Love Hamper plus cake, and clients who pay ₦1,000,000 enjoy a choice of a Samsung phone or a Love Hamper with cake.

The rewards become increasingly premium as commitment grows. Clients who pay ₦5,000,000 receive either an iPad or an all-expenses-paid romantic getaway for a couple at one of Nigeria’s finest hotels, which includes two nights’ accommodation, special treats, and a Love Hamper. A payment of ₦10,000,000 comes with a choice of a Samsung Z Fold 7, three nights at a top-tier resort in Nigeria, or a full solar power installation.

For high-value investors, the Love for Love Promo delivers exceptional lifestyle experiences. Clients who pay ₦30,000,000 on land are rewarded with a three-night couple’s trip to Doha, Qatar, or South Africa, while purchasers of any Adron Homes house valued at ₦50,000,000 receive a double-door refrigerator.

The promo covers Adron Homes’ estates located in Lagos, Shimawa, Sagamu, Atan–Ota, Papalanto, Abeokuta, Ibadan, Osun, Ekiti, Abuja, Nasarawa, and Niger States, offering clients the opportunity to invest in fast-growing, strategically positioned communities nationwide.

Adron Homes reiterated that beyond the incentives, the campaign underscores the company’s strong reputation for secure land titles, affordable pricing, strategic locations, and a proven legacy in real estate development.

As Valentine’s Day approaches, Adron Homes encourages Nigerians at home and in the diaspora to take advantage of the Love for Love Promo to enjoy exceptional value, exclusive rewards, and the opportunity to build a future rooted in love, security, and prosperity.

Business

Why Nigeria’s Banks Still on Shaky Ground with Big Profits, Weak Capital

*Why Nigeria’s Banks Still on Shaky Ground with Big Profits, Weak Capital*

*BY BLAISE UDUNZE*

Despite the fragile 2024 economy grappling with inflation, currency volatility, and weak growth, Nigeria’s banking industry was widely portrayed as successful and strong amid triumphal headlines. The figures appeared to signal strength, resilience, and superior management as the Tier-1 banks such as Access Bank, Zenith Bank, GTBank, UBA, and First Bank of Nigeria, collectively reported profits approaching, and in some cases exceeding, N1 trillion. Surprisingly, a year later, these same banks touted as sound and solid are locked in a frenetic race to the capital markets, issuing rights offers and public placements back-to-back to meet the Central Bank of Nigeria’s N500 billion recapitalisation thresholds.

The contradiction is glaring. If Nigeria’s biggest banks are so profitable, why are they unable to internally fund their new capital requirements? Why have no fewer than 27 banks tapped the capital market in quick succession despite repeated assurances of balance-sheet robustness? And more fundamentally, what do these record profits actually say about the real health of the banking system?

The recapitalisation directive announced by the CBN in 2024 was ambitious by design. Banks with international licences were required to raise minimum capital to N500 billion by March 2026, while national and regional banks faced lower but still substantial thresholds ranging from N200 billion to N50 billion, respectively. Looking at the policy, it was sold as a modern reform meant to make banks stronger, more resilient in tough times, and better able to support major long-term economic development. In theory, strong banks should welcome such reforms. In practice, the scramble that followed has exposed uncomfortable truths about the structure of bank profitability in Nigeria.

At the heart of the inconsistency is a fundamental misunderstanding often encouraged by the banks themselves between profits and capital. Unknown to many, profitability, no matter how impressive, does not automatically translate into regulatory capital. Primarily, the CBN’s recapitalisation framework actually focuses on money paid in by shareholders when buying shares, fresh equity injected by investors over retained earnings or profits that exist mainly on paper.

This distinction matters because much of the profit surge recorded in 2024 and early 2025 was neither cash-generative nor sustainably repeatable. A significant portion of those headline banks’ profits reported actually came from foreign exchange revaluation gains following the sharp fall of the naira after exchange-rate unification. The industry witnessed that banks’ holding dollar-denominated assets their books showed bigger numbers as their balance sheets swell in naira terms, creating enormous paper profits without a corresponding improvement in underlying operational strength. These gains inflated income statements but did little to strengthen core capital, especially after the CBN barred banks from using FX revaluation gains for dividends or routine operations. In effect, banks looked richer without becoming stronger.

Beyond FX effects, Nigerian banks have increasingly relied on non-interest income fees, charges, and transaction levies to drive profitability. While this model is lucrative, it does not necessarily deepen financial intermediation or expand productive lending. High profits built on customer charges rather than loan growth offer limited support for long-term balance-sheet expansion. They also leave banks vulnerable when macroeconomic conditions shift, as is now happening.

Indeed, the recapitalisation exercise coincides with a turning point in the monetary cycle. The extraordinary conditions that supported bank earnings in 2024 and 2025 are beginning to unwind. Analysts now warn that Nigerian banks are approaching earnings reset, as net interest margins the backbone of traditional banking profitability, come under sustained pressure.

Renaissance Capital, in a January note, projects that major banks including Zenith, GTCO, Access Holdings, and UBA will struggle to deliver earnings growth in 2026 comparable to recent performance.

In a real sense, the CBN is expected to lower interest rates by 400 to 500 basis points because inflation is slowing down, and this means that banks will earn less on loans and government bonds, but they may not be able to quickly lower the interest they pay on deposits or other debts. The cash reserve requirements are still elevated, which does not earn interest; banks can’t easily increase or expand lending investments to make up for lower returns. The implications are significant. Net interest margin, the difference between what banks earn on loans and investments and what they pay on deposits, is poised to contract. Deposit competition is intensifying as lenders fight to shore up liquidity ahead of recapitalisation deadlines, pushing up funding costs. At the same time, yields on treasury bills and bonds, long a safe and lucrative haven for banks are expected to soften in a lower-rate environment. The result is a narrowing profit cushion just as banks are being asked to carry far larger equity bases.

Compounding this challenge is the fading of FX revaluation windfalls. With the naira relatively more stable in early 2026, the non-cash gains that once flattered bank earnings have largely evaporated. What remains is the less glamorous reality of core banking operations: credit risk management, cost efficiency, and genuine loan growth in a sluggish economy. In this new environment, maintaining headline profits will be far harder, even before accounting for the dilutive impact of recapitalisation.

That dilution is another underappreciated consequence of the capital rush. Massive share issuances mean that even if banks manage to sustain absolute profit levels, earnings per share and return on equity are likely to decline. Zenith, Access, UBA, and others are dramatically increasing their share counts. The same earnings pie is now being divided among many more shareholders, making individual returns leaner than during the pre-recapitalisation boom. For investors, the optics of strong profits may soon give way to the reality of weaker per-share performance.

Yet banks have pressed ahead, not only out of regulatory necessity but also strategic calculation.

During this period of recapitalization, investors are interested in the stock market with optimism, especially about bank shares, as banks are raising fresh capital, and this makes it easier to attract investments. This has become a season for the management teams to seize the moment to raise funds at relatively attractive valuations, strengthen ownership positions, and position themselves for post-recapitalisation dominance. In several cases, major shareholders and insiders have increased their stakes, as projected in the media, signalling confidence in long-term prospects even as near-term returns face pressure.

There is also a broader structural ambition at play. Well-capitalised banks can take on larger single obligor exposures, finance infrastructure projects, expand regionally, and compete more credibly with pan-African and global peers. From this perspective, recapitalisation is not merely about compliance but about reshaping the competitive hierarchy of Nigerian banking. What will be witnessed in the industry is that those who succeed will emerge larger, fewer, and more powerful. Those that fail will be forced into consolidation, retreat, or irrelevance.

For the wider economy, the outcome is ambiguous. Stronger banks with deeper capital buffers could improve systemic stability and enhance Nigeria’s ability to fund long-term development. The point is that while merging or consolidating banks may make them safer, it can also harm the market and the economy because it will reduce competition, let a few banks dominate, and encourage them to earn easy money from bonds and fees instead of funding real businesses. The truth be told, injecting more capital into the banks without complementary reforms in credit infrastructure, risk-sharing mechanisms, and fiscal discipline, isn’t enough as the aforementioned reforms are also needed.

The rush as exposed in this period, is that the moment Nigerian banks started raising new capital, the glaring reality behind their reported profits became clearer, that profits weren’t purely from good management, while the financial industry is not as sound and strong as its headline figures. The fact that trillion-naira profit banks must return repeatedly to shareholders for fresh capital is not a sign of excess strength, but of structural imbalance.

With the deadline for banks to raise new capital coming soon, by 31 March 2026, the focus has shifted from just raising N500 billion. N200 billion or N50 billion to think about the future shape and quality of Nigeria’s financial industry, or what it will actually look like afterward. Will recapitalisation mark a turning point toward deeper intermediation, lower dependence on speculative gains, and stronger support for economic growth? Or will it simply reset the numbers while leaving underlying incentives unchanged?

The answer will define the next chapter of Nigerian banking long after the capital market roadshows have ended and the profit headlines have faded.

Blaise, a journalist and PR professional, writes from Lagos and can be reached via: [email protected]

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society5 months ago

society5 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

Business6 months ago

Business6 months agoBatsumi Travel CEO Lisa Sebogodi Wins Prestigious Africa Travel 100 Women Award

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING

You must be logged in to post a comment Login