Business

FirstBank Employees Making a Difference in their Immediate Environments

How FirstBank Employees are Making a Difference in their Immediate Environments Through the SPARK Initiative

Sahara Weekly Reports That FirstBank Employees are Making a Difference in their Immediate Environments Through the SPARK Initiative. Every other day, social media brings us a picture or video of a dilapidated school somewhere in Nigeria or shares images of a distraught widow, a struggling roadside trader or street hawker or some other hapless victims of the extremely harsh realities of living in Nigeria. Immediately, as if on cue or automated, viewers launch into stinging attacks of government, public officials, the privileged class, and even Nigeria itself. The attacking mob wastes no time in calling for the government’s head or the heads of public officials with responsibilities in the jurisdiction or sector where the unfortunate sights surfaced from.

The online mob seems unconcerned that while its eyes and ears, aided and locked in by the binoculars and headsets of social media, are completely focused on distressing situations it may not be able to help other than rant about, countless situations that it can help are calling for attention in its immediate neighborhood every single day. Focusing on things so far away while ignoring or pretending not to see the things in one’s immediate vicinity is a human tendency that is well recognized. Journalists even have a term for a similar or related behavior among their own. “Afghanistanism” is the tendency of the media to focus on news and happenings in remote places and other parts of the world to the exclusion or neglect of covering happenings and problems in the local environment of the media. It is like the psychological or emotional equivalent of the eye defect medical practitioners refer to as hyperopia or farsightedness. Sufferers can see objects that are far away but have difficulty focusing on objects that are up close.

By focusing on faraway objects people do not have to offer to give a helping hand but can offer their finger to point at others and their tongue to criticize and pontificate. Everyone can criticize and pontificate online or become an “e-warrior”, like Nigerians like to call it, fighting government and whoever and whatever in society they are unhappy with from the comfort and safety of their bedroom and behind their keyboard. It is the easiest of things to do but not the noblest or kindest. It is a well-trodden path but should never be confused with taking the high road in reaching out with compassion to people around whose lives and circumstances could do with some kindness.

Taking the high road rather than practicing Afghanistanism or psychological hyperopia is the approach adopted by First Bank of Nigeria Limited, the premier FirstBank in West Africa with its impact woven into the fabric of society. This approach has played an important role in sustaining FirstBank’s development-oriented services for over 127 years as the region’s foremost financial inclusion services provider. It has been a driving motivation for how the bank operates. FirstBank always considers the impact of all its operations and actions on customers and other stakeholders, including the environment, to ensure it is making a net positive difference in the end. And this orientation has attracted the bank people who share a similar outlook – whether as employees, partners, or other stakeholders. They look forward every year to an opportunity to follow in the footsteps of the bank and make a net positive difference in their immediate environments. These men and women do not pretend that they can solve or intervene in all the challenging situations confronting people in their immediate environments but they do not refrain whenever they can lend a helping hand and make a difference.

Through an Employee Giving and Volunteering program employees of FirstBank find a ready platform to fully identify with the compassionate disposition of the bank, which further has several initiatives that enable employees to give expression to this identification. The Start Performing Acts of Random Kindness (SPARK) Initiative is but one such initiative. Aimed at expanding and deepening FirstBank’s involvement within the communities of its various stakeholders, SPARK seeks to do so by integrating and institutionalizing random acts of kindness in society. Among employees, SPARK has inspired and encouraged kindness and empathy as well as consideration for others. It has also contributed to employee bonding and teamwork, which have been critical to enhancing work performance.

This year’s implementation of the SPARK Initiative has seen employees under the banner of their various departments make choices regarding the specific nature of intervention they would want to undertake and the specific group of people or institutions within their immediate communities that they would want to extend the milk of human kindness to. Employees and their departments could choose any one of the four areas that constitute FirstBank’s corporate responsibility and sustainability (CR&S) pillars: Education, entrepreneurship, health and welfare, and environment. Under education, they have had a choice to make between support for infrastructural facilities in schools, such as the renovation of dilapidated buildings, painting of school buildings, and provision of laptops and desktops; or donation of items such as classroom chairs and tables, books, and stationaries; or provision of scholarships for best students, feeding of school students per day or week, funding of a school initiative such as JETS club, Bootcamp, space club, etc. If employees and their departments were interested in supporting entrepreneurship, then they had the chance to empower through entrepreneurship programs of their choosing such as sponsoring youth and women to acquire skills like fashion designing, baking, hair styling, make-up artistry, electrical repairs, event decoration and planning, catering, etc., or enabling entrepreneurs with tools and equipment to work or supporting SMEs and start-ups.

Where the health and welfare area was their preferred area of intervention, employees and their departments could choose from: donations to orphanages (selected from an approved list of orphanages); support to a good cause, for example lending a helping hand to the Down Syndrome Foundation; support to widows; support to people with health-related issues; and off-setting medical bills. And if employees and their departments were to decide to go for the environment, then they could choose from: support to environmental issues, such as support to Nigerian Conservation Foundation (NCF) initiatives; donation of garbage cans to a community; partnership with a recycling firm to recycle waste; support to LAWMA such as donating cleaning tools (brooms, dustbin parkers), etc.

While several departments in FirstBank did things worth showcasing so the good citizens of Nigeria (individual and corporate) can emulate, this piece has just enough space to accommodate the activities of only three departments: Human Capital Management and Development (HCMD), Compliance, and Marketing and Corporate Communications (M&CC) departments. The employees in these departments seemed involved in efforts to outdo each other in acts of kindness, which made more sense and would leave a real difference on the ground as against criticizing and pontificating online on faraway issues.

The Human Capital Management and Development department decided that reaching out to one of the most vulnerable groups in Nigeria – underprivileged widows and their underfed children – was the best way they could stay true to the “Human” in their name. And employees in the department moved beyond their Marina location to the nearest environment where some of the most vulnerable widows are to be found to go show kindness. The Makoko community situated in Lagos Mainland and which CNN once described in a report as “Nigeria’s floating slum” was overwhelmed to receive the august visitors from HCMD bearing so much foodstuff to benefit their widows and children. What they did not realize was the overwhelming sense of gratitude felt by their benefactors for the opportunity to be able to give back.

Tagged “Feed a Widow Initiative”, the undertaking was HCMD employees’ way of putting a smile back on the faces of widows in impoverished communities and they got more than they could ever have imagined. Their hosts received them with the broadest of smiles and said goodbye to them with the grandest of gratitude, and they left with very broad smiles on their faces. The jury is still out on who between the hosts and their guests ended up with the broadest of smiles on the day. And given the “fierce contest” to outdo the other in smiling, one is again forced to wonder why people labeled e-warriors would choose to forfeit this kind of real joy for the joyless world they have locked themselves in by clinging on to Afghanistanism and psychological hyperopia.

Not so for employees in the Compliance department. Not to be outdone and as though going up the hierarchy of human needs, Compliance employees decided that they would focus on the education need of their beneficiary community. HCMD had done an excellent job of providing the basic “stomach infrastructure” without which it would be difficult, if not impossible, to get any of the beneficiaries interested in any talk about more sublime matters like education and mental development. So, employees of the Compliance department, to encourage pupils to continue their pursuit of education, procured Mathematics and English Language textbooks for 617 pupils who would be in senior secondary (SS) 1 and 2 classes of Gbara Community Secondary School in Jakande, Ajah in the next academic session. The visit to the school and book donation were undertaken when the pupils were in the third term preceding the new academic session.

The gesture was Compliance employees’ way of giving back in such a manner as to relieve the pupils of this public school, particularly those from indigent homes, and their parents or guardians of the financial burden involved in providing textbooks for the two core subjects. It was also, in an uncanny way, an attempt by the employees to ensure the pupils were in full compliance with the requirements for taking on the two most important subjects in the secondary school curriculum, putting the pupils at a vantage position to excel in these two essential subjects. There were other benefits of the engagement that the employees noted. They observed that their presence in the school inspired the children, giving them “hope that a better life was within reach and could be achieved.” The employees thus expressed optimism that the engagement boosted the children’s interest in succeeding in life through the pursuit of education.

For employees of the Marketing and Corporate Communications department (M&CC), entrepreneurship was the area they decided to focus on, to make a difference in their immediate environment. Every day they came to their office on Broad Street or the bank’s head office in Marina, they passed by several roadside traders around the various office buildings in the locations. They observed that some of these traders were exposed to the elements or having difficulties in their business and struggling to make ends meet, and decided that they would do something about it. And true to their word, they did something about it that made so much difference in the businesses and circumstances of the traders. They provided the traders the following: branded umbrella to offer shade from both sun and rain, improving the conditions under which they operated and their quality of life; branded chairs and tables to accommodate more customers in their corner as well as grants to boost their business capital.

Anyone who has met with employees in the corporate communications department of any major FirstBank in Nigeria would readily admit that these professionals have among them some of the most skillful digital marketers around. So, it is not for lack of skills to be e-warriors that M&CC employees chose to extend the milk of human kindness flowing in them to roadside traders around their office rather than practice Afghanistanism. They could have chosen to concentrate all their time and resources on attacking the government online and blaming public officials for all the challenges in the economy and the spate of insecurity all over the nation and whatever else would make M&CC employees true champions of Afghanistanism and psychological hyperopia. But would that make any difference to a lot of the roadside traders around them and lessen their burden? So, M&CC employees chose the road less traveled but one that could deliver the desired impact, and it did.

There are so many lessons to draw and feelings to take away from the examples demonstrated by employees of these three departments in Nigeria’s foremost lender. Besides committing their time and resources to their chosen humanitarian initiatives using the platform of the SPARK Initiative that places FirstBank at the forefront of the social impact space through employee advocacy, the employees have shown that they have the milk of human kindness flowing through their veins. They have demonstrated that they would rather consider how they could extend kindness to people around them and make a difference than pretend not to see the situations affecting those around them while playing Afghanistanism and psychological hyperopia online.

For the rest of us who are not FirstBank employees, the message could not be clearer: The next time we feel like we must share on social media distressing images to provoke government-bashing or we feel constrained to make stinging comments on such images that are shared to criticize Nigeria, we should first pause and look around us. We should look to see if we can identify situations where we, not the government of Nigeria, can make a difference. Then we should take our fingers off the keyboard and go out there or make that call that will make a difference in some other person’s life and circumstances. We should be like FirstBank and its employees. We should follow their example of trying to outdo themselves in showing kindness to others. We should start where we are with what we have, to make a difference right now – yes, this very minute and not some future time.

Business

Deadline of Compliance: Nigeria’s Urgent Call for Tax Return Filing

Deadline of Compliance: Nigeria’s Urgent Call for Tax Return Filing

By George Omagbemi Sylvester | Published by SaharaWeeklyNG.com

“Shift or Structural Demand? A Declaration of Civic Duty in a Nation at a Fiscal Crossroads.”

In the unfolding narrative of national development and economic reform, few instruments are as defining as tax compliance. For Nigeria, a nation perpetually grappling with revenue shortfalls, structural dependency on a single export commodity, and entrenched informal economic behaviour, the Federal Government’s recent clarification on tax return deadlines is not mere bureaucratic noise. It is a deliberate and inescapable declaration: the social contract between citizen and state must be honoured through transparent, lawful and timely tax reporting.

At its core, the government’s pronouncement is stark in its simplicity and radical in its implications. Federal authorities, speaking through the Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, have made it unequivocally clear that every Nigerian, whether employer or individual taxpayer, must file annual tax returns under the law. This encompasses self-assessment filings by individuals that too many assumed ended once employers deducted pay-as-you-earn taxes from their salaries.

This is not an optional civic suggestion, it is mandatory, backed by statute, and tied to a broader vision of national fiscal responsibility. Citizens can no longer hide behind ignorance, apathy, or false assumptions. “Many people assume that if their employer deducts tax from their salaries, their obligations end there. That is wrong,” Oyedele warned, emphasizing that the obligation to file remains with the individual under both existing and newly reformed tax laws.

The Deadlines and the Reality They Reveal.

Across the federation, state and federal revenue authorities have reaffirmed statutory deadlines in pursuit of compliance. The Lagos State Internal Revenue Service, for instance, moved to extend its filing date for employer returns by a narrow window, reflecting the reality that compliance often lags behind legal timelines. The extension was intended not as leniency, but as a pragmatic effort to allow accurate and complete submissions, underscoring that true compliance rises above mere mechanical ticking of a box.

At the federal level, Oyedele’s intervention was even more fundamental. He reminded Nigerians that annual tax returns for the preceding year must be filed in good faith, with integrity and in respect of the law. This applies regardless of income level including low-income earners who have historically believed that they are outside the tax net. “All of us must file our returns, including those earning low income,” he stated.

Herein lies one of the most challenging truths of contemporary Nigerian governance: widespread tax non-compliance is not just a technical breach of law, it is a deep cultural and structural issue that reflects decades of mistrust between citizens and the state.

The Root of the Problem: Non-Compliance as a Symptom.

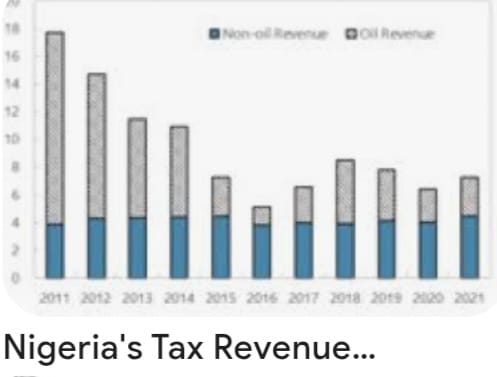

Nigeria’s tax culture has long been under scrutiny. Public discourse and economic analysis consistently show that a significant majority of eligible taxpayers do not file annual returns. Oyedele highlighted that even in states widely regarded as tax administration leaders, compliance remains strikingly low, often below five percent.

This widespread non-compliance stems from multiple sources:

A long history of weak tax administration systems, where enforcement was inconsistent and penalties were rarely applied.

A perception that public services do not reflect the taxes collected, eroding the citizenry’s belief in reciprocity.

An informal economy where income often goes unrecorded, making filing seem irrelevant or impossible to many.

Lack of awareness, with many Nigerians genuinely believing that tax liability ends with employer deductions.

The government’s renewed push for compliance directly challenges these perceptions. It signals a shift from voluntary or lax compliance to structured accountability, a stance that aligns with best practices in modern public finance.

Why This Matters: Beyond Deadlines.

At its most profound level, the insistence on tax return filings is about nation-building and shared responsibility.

Scholars of public finance universally agree that a robust tax system is the backbone of sustainable development. As the eminent economist Dr. Joseph E. Stiglitz has observed, “A society that cannot mobilize its own resources through fair taxation undermines both its government’s legitimacy and its capacity to provide for its people.” Filing tax returns is not a mere administrative task, it is a declaration of participation in the collective project of national advancement.

In Nigeria’s context, this declaration carries weight. With the enactment of comprehensive tax reforms in recent years (including unified frameworks for tax administration and enforcement) authorities now possess broader statutory tools to ensure compliance and accountability. These measures, which include electronic filing platforms and stronger enforcement powers, have been framed as fair and equitable, targeting efficiency rather than arbitrariness.

Yet the success of these reforms depends heavily on citizens embracing their civic duties with sincerity. And this depends on mutual trust, the belief that paying taxes yields tangible benefits in infrastructure, education, healthcare, security and social services.

Voices From Experts: Fiscal Responsibility as a Public Ethic.

Tax law experts and economists, reflecting on the compliance push, have underscored a universal theme: taxation without transparency is inequity, but taxation with accountability is empowerment. When managed with fairness, a functional tax system can reduce dependency on volatile revenue sources, stabilise national budgets, and support long-term investment in human capital.

Professor Aisha Bello, a respected authority in fiscal policy, notes that “Tax compliance is not a burden; it is the foundation upon which social contracts are built. A citizen who honours tax obligations affirms the legitimacy of governance and demands better performance in return.”

Similarly, a leading tax scholar, Dr. Emeka Okon, argues that “The era when Nigerians could evade broader tax responsibilities simply because automatic deductions occur at source must end. For a modern economy, every eligible citizen must be part of the formal tax fold not as victims, but as stakeholders.”

These authoritative voices point to an unassailable truth: filing tax returns is both a legal requirement and a moral responsibility, an expression of citizenship in its fullest sense.

Challenges on the Ground: Compliance and Capacity.

While the rhetoric of compliance is compelling, the reality on the ground demands nuanced understanding. Many taxpayers (especially in the informal sector) lack meaningful access to digital platforms and resources for filing returns. For others, the fear of bureaucratic complexity and perceived punitive enforcement deters participation.

The government, for its part, has responded by promoting online systems and pledging greater taxpayer support. Tax authorities are increasingly engaging stakeholders to demystify filing processes, explain requirements and offer assistance. This mix of enforcement and facilitation is essential. As one seasoned revenue specialist observed: “The state cannot compel compliance through force alone; it must earn it through education, simplicity and fairness.”

The Broader Implication: A New Social Compact.

Ultimately, Nigeria’s renewed emphasis on tax return filing transcends administrative deadlines. It is an unequivocal declaration that national development is a shared responsibility, that citizens and state must engage in a transparent, accountable, and reciprocal relationship.

Tax compliance, therefore, becomes far more than a legal act; it becomes a moral claim on the nation’s future.

When citizens file their returns honestly, they affirm their stake in the nation’s destiny. When the government collects taxes transparently and deploys them effectively, it strengthens not only public services but civic trust itself.

In this sense, the deadlines proclaimed by Nigeria’s fiscal authorities mark not an end but a beginning; the beginning of a civic epoch in which accountability replaces apathy, participation replaces indifference and national purpose triumphs over fragmentation.

The road ahead will not be easy. But in demanding compliance, Nigeria is demanding more than tax returns. It is demanding commitment and that, ultimately, is the foundation on which nations are built.

Business

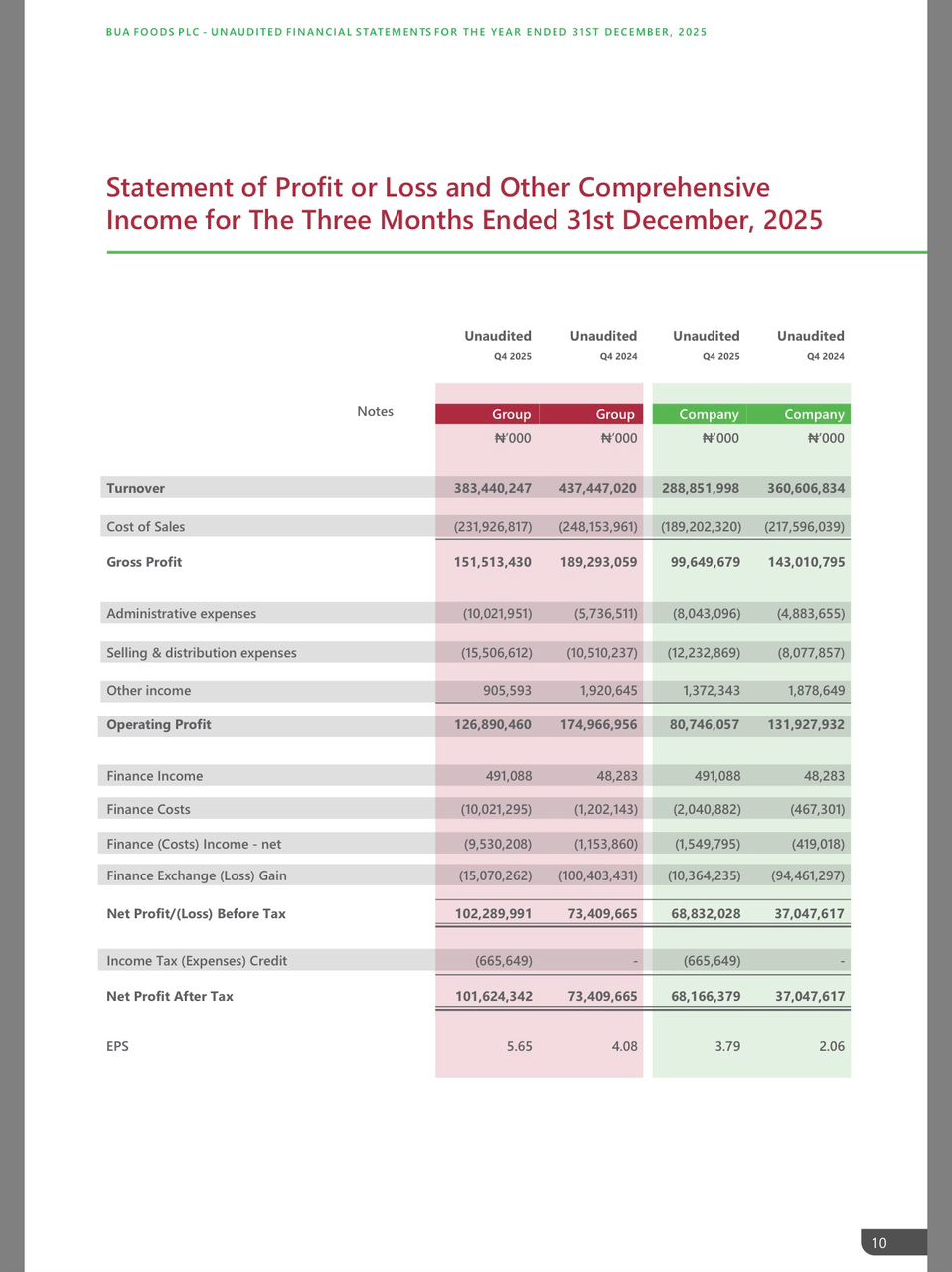

BUA Foods Records 91% Surge in Profit After Tax, Hits ₦508bn in 2025

BUA Foods Records 91% Surge in Profit After Tax, Hits ₦508bn in 2025

By femi Oyewale

Business

Adron Homes Unveils “Love for Love” Valentine Promo with Exciting Discounts, Luxury Gifts, and Travel Rewards

Adron Homes Unveils “Love for Love” Valentine Promo with Exciting Discounts, Luxury Gifts, and Travel Rewards

In celebration of the season of love, Adron Homes and Properties has announced the launch of its special Valentine campaign, “Love for Love” Promo, a customer-centric initiative designed to reward Nigerians who choose to express love through smart, lasting real estate investments.

The Love for Love Promo offers clients attractive discounts, flexible payment options, and an array of exclusive gift items, reinforcing Adron Homes’ commitment to making property ownership both rewarding and accessible. The campaign runs throughout the Valentine season and applies to the company’s wide portfolio of estates and housing projects strategically located across Nigeria.

Speaking on the promo, the company’s Managing Director, Mrs Adenike Ajobo, stated that the initiative is aimed at encouraging individuals and families to move beyond conventional Valentine gifts by investing in assets that secure their future. According to the company, love is best demonstrated through stability, legacy, and long-term value—principles that real estate ownership represents.

Under the promo structure, clients who make a payment of ₦100,000 receive cake, chocolates, and a bottle of wine, while those who pay ₦200,000 are rewarded with a Love Hamper. Payments of ₦500,000 attract a Love Hamper plus cake, and clients who pay ₦1,000,000 enjoy a choice of a Samsung phone or a Love Hamper with cake.

The rewards become increasingly premium as commitment grows. Clients who pay ₦5,000,000 receive either an iPad or an all-expenses-paid romantic getaway for a couple at one of Nigeria’s finest hotels, which includes two nights’ accommodation, special treats, and a Love Hamper. A payment of ₦10,000,000 comes with a choice of a Samsung Z Fold 7, three nights at a top-tier resort in Nigeria, or a full solar power installation.

For high-value investors, the Love for Love Promo delivers exceptional lifestyle experiences. Clients who pay ₦30,000,000 on land are rewarded with a three-night couple’s trip to Doha, Qatar, or South Africa, while purchasers of any Adron Homes house valued at ₦50,000,000 receive a double-door refrigerator.

The promo covers Adron Homes’ estates located in Lagos, Shimawa, Sagamu, Atan–Ota, Papalanto, Abeokuta, Ibadan, Osun, Ekiti, Abuja, Nasarawa, and Niger States, offering clients the opportunity to invest in fast-growing, strategically positioned communities nationwide.

Adron Homes reiterated that beyond the incentives, the campaign underscores the company’s strong reputation for secure land titles, affordable pricing, strategic locations, and a proven legacy in real estate development.

As Valentine’s Day approaches, Adron Homes encourages Nigerians at home and in the diaspora to take advantage of the Love for Love Promo to enjoy exceptional value, exclusive rewards, and the opportunity to build a future rooted in love, security, and prosperity.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

Business6 months ago

Business6 months agoBatsumi Travel CEO Lisa Sebogodi Wins Prestigious Africa Travel 100 Women Award

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING