Business

Heritage Bank: 9years of driving food sufficiency via bridging Agric value-chain finance gaps

Heritage Bank: 9years of driving food sufficiency via bridging Agric value-chain finance gaps

HERITAGE BANK– Nigeria’s agriculture sector over the years has experienced myriad of challenges ranging from sub-optimal yields, shrinking resources, post-harvest losses, fluctuating commodity prices and poor adaptation to changing climate systems, among others.

There are also problems at different stages of the value chain: scarcities in quality of inputs and varieties, inadequate funding, slow adoption of mechanisation, and a high reliance on subsistence production techniques which have hindered scaling, limited processing opportunities with direct impacts on output and value generation.

As the world population is projected to increase to 9.5billion by the year 2050, there is critical need to rev up food production and enhance value addition across the value chain segment of key agriculture food products, especially as the development of Agriculture continues to remain a critical issue for Nigeria’s economic growth, poverty reduction and in ensuring food security of the country, as over 70 percent of rural households depend on agriculture as their principal means of livelihood.

All of these have contributed to an underdeveloped commodity marketing system. The outbreak of COVID-19 added extra layers of challenges to the above-mentioned issues.

Measures put in place to manage the spread of the virus led to restrictions in the movement of people and goods, which in turn made access to critical inputs unavailable and increased costs in the few places where they were found.

These developments impacted smallholder farmers who make up the bulk of players in the industry across the country.

Given this development, many Nigerian financial institutions started investing in the agricultural sector. Heritage Bank is one of the banks that has taken pride in the past nine (9) years of its operations to bridge the agriculture value chain financing gaps.

Today marks its worthy milestone in the banking landscape, as Heritage Bank celebrates nine years of entrenching seamless service delivery in the business of banking, it has also remained resilient in hastening the transition of agriculture from traditional, low-productivity models toward a modern, high-productivity agricultural sector.

This has been made possible through its strategic collaboration with key stakeholders like the Central Bank of Nigeria (CBN) and Federal Government to prioritise the agricultural sector to attract sizable investments that has continued to help drive expansion and achieve competitiveness as well as increase financing to key parts of the value chain, particularly small-holder farmers in a bid to modernize their practices and increase outputs. Under the various intervention agricultural schemes: Anchor Borrowers Programme (ABP), the Nigeria Incentive-Based Risk Sharing System for Agricultural Lending (NIRSAL),

Commercial Agriculture Credit Scheme amongst others, Heritage Bank has made huge success of the schemes by making funding available to both small holder farmers and SMEs (Prime Anchors) in their efforts to increase agricultural output especially rice and wheat production.

Heritage Bank’s Exemplary Intervention

Heritage Bank Plc, by every instrument of measurement has distinctly and evidently made funds available to both individuals and corporate organisations in their efforts to increase agricultural output in line with governments policy and CBN intervention strategies.

The bank has palpably financed critical agricultural projects in the country and, in the process, supported many farmers.

Since the nine (9) eventful years, the bank has opened its doors to its teeming customers, the showpiece of its operations is a full gamut of completed, on-going and nascent people-oriented programmes designed to create, preserve and transfer wealth across generations in the country.

This line of operation is steadily yielding great results as the nation continues to move its economic base towards the direction of the future, with a robust emphasis on thoughts about diversification of the county’s economic base.

For some period of operation, Heritage Bank is being positioned into a bigger and stronger financial institution that is placed to play a significant role in the much-envisaged transformation of the nation’s financial sector in line with the country’s stature as one of Africa’s largest economies.

With the increasing recognition of agriculture as the ‘beautiful bride’ of Nigeria’s economy, Heritage Bank’s unfaltering energy and commitment in agricultural financing which is fast gaining new interests and more attention within the business circles is helping to rebalance the sector such that Nigeria would soon become the food basket of the African continent.

As agriculture continues to be business, financing provides tremendous opportunities for lenders and borrowers, either at small or large scale.

Heritage Bank has not only encouraged governments, corporate and individual (including young people to embrace optimal productivity and greatness in this sector), it has taken the front seat in the drive to support them in the attainment of noble agricultural virtues by funding various agricultural projects in several states in the country

Promoting Agriculture Value Chain

The Bank is also not relenting in its efforts at boosting the agricultural base of the nation by make farming profitable to stakeholders and attractive to the youth.

It has continued to create market linkages between smallholder farmers and Anchors/Processors, creating an ecosystem that drives value chain financing, improve access to credit by the smallholder farmers by developing credit history through the scheme and much more.

MD/CEO of Heritage Bank, Ifie Sekibo affirmed that the institution is committed to promoting development of agriculture and ensuring that all levels of its value chain can be financed profitably.

According to him, the bank’s involvement in the sector dated back to many years ago and it has always been at the forefront of ensuring overall growth and development of commodities products in Nigeria. For these feats, the CBN’s Governor, recently announced the apex bank’s N41billion intervention in wheat production in Nigeria for commodity associations and anchor companies. Heritage Bank has continued to work with CBN and other stakeholders such as wheat farmers association of Nigeria, wheat farmers, processors and marketers’ association of Nigeria, Lake Chad Research Institute and other development partners, flour mills of Nigeria and several seed companies and others to support over 100,000 farmers in wheat production. Also, Heritage Bank further factored consideration of value addition of financial services and products flowing to and/or through value chain participants to address and alleviate constraints to growth that have distorted product financing, receivables financing, physical-asset collateralization, risk mitigation products and financial enhancements.

According to sekibo, with its assigned position Heritage Bank would play a pivotal role in ensuring that there would be an effective and readily available platform for market linkages among players in the agribusiness value chain, involving FMCGs, warehouse operators, collateral managers, processors, farmers’ cooperatives to transact in a seamless way that guarantees quality, quantity, payment and delivery.

Partnerships As Growth Strategy

The Bank believes in teamwork and that is why partnership with various critical stakeholders and institutions remain a major pillar in its strategy to realise these objectives.

These partnership over the period brought about the support of small holders’ farmers and Anchors in Oyo, Ogun, Niger, kebbi, in various communities in Kaduna and Zamfara State in food crop cultivation, cash crop/horticulture, and food processing (in rice, maize, palm oil, casava etc) under NIRSAL and Prime ABP.

Meanwhile, in line with its collaborative initiative Heritage Bank Plc entered a partnership agreement with the Nigeria Incentive Based Risk Sharing System for Agricultural Lending in a bid to improve the agriculture value chain by increasing financing to the sector.

The partnership aims at identifying and securing financing of impactful agribusinesses within all the segments of the agricultural value chain.

The financing was designed to cover segments from primary production of raw materials and sustaining the processing industries to exportation of the produce.

Ifie Sekibo, the Managing Director of Heritage Bank, offered a wonderful explanation as to the reason for the partnership.

To him, the partnership will avail credits at very low interest rates to commercially viable agricultural projects that have been packaged and fully de-risked.

Before then arrangements have been concluded by the bank to revolutionise the agricultural sector by widening and deepening the participation of digital generation in agribusiness.

Sekibo was convinced that support of NIRSAL would help the bank develop a digital agribusiness platform that will strengthen distribution of human capital that meet parameters of agribusiness.

NIRSAL, agreed to serve as a catalyst for national agricultural revolution by boosting commercial agricultural productivity, competitiveness, value addition, market access and enhancing food security and will deploy a mechanism of de-risking the agricultural value chain in order to encourage investment by banks and the entire financial sector.

Divisional Head, Agribusiness, Natural Resources & Project Development, Heritage Bank, Olugbenga Awe said that the bank has strategically put in place measures to ensure fidelity to contract agreements and adherence to fair trade in making sure that farmers earned decent profit for their efforts, which is critical to the sustainability of the programmes.

According to him, “the bank’s participation in the programme has paid off as we currently have a rich pool of farmers’ data to support grains production. “The registered farmers in our database can easily be identified and trained with the support of extension services to plant any grains as the season demands. This flexibility provides continuous cash flows to the famers and ensures that more farmers are enlisted to join the programme,” he said.

The Divisional Head, further disclosed, “In our quest to participate in the rice value-chain through the ABP, we supported hundreds of small holder farmers in various communities in Kaduna and Zamfara State.”

“The sector is driving the next set of entrepreneurs and we are committed to the development of the sector using appropriate technology and modern farm practices. We walk the talk in Heritage Bank as demonstrated in our portfolio allocation to agribusiness,” he said. He noted that the large-scale operators are enabled to expand existing capacities and industrialise for local consumption and export.

This scheme, however, informed Heritage Bank partnership with the Oyo State government in a multi-billion-naira project to give agriculture a boost in the state.

Under the initiative, the bank is supporting the Oyo State Agricultural Initiative, OYSAI, a programme designed to revive agriculture, boost agro-allied businesses and create a massive empowerment programme for both youths and women across the state through the creation of thousands of jobs in the sector.

This huge and laudable project that is spread across 3,000 hectares of land in 28 of the 33 Local Government Areas of Oyo State, is in three stages: food crop cultivation, cash crop/horticulture, and food processing.

Poultry farming in Oyo State – N29million received from NIRSAL and disbursed to farmers Maize cultivation in Ogun State – N157million received from NIRSAL and disbursed to farmers for cassava cultivation in Kebbi State – Transaction size is about N500million approved by CBN.

Heritage Bank Plc signed a N232 million pilot phase of the out-growers agreement with Biase Plantations Limited (BPL), and its joint venture partner, PZ Wilmar Limited to produce best-in-class palm oil, using the ABP model.

Heritage Bank is supporting agro investors involved in this initiative with funds and advisory services and indications are that the programme has already led to more than 50 per cent increase in food production in the state.

Partnering the CBN

Heritage Bank’s partnership with CBN over the years has revolutionised the agricultural value-chain with consideration to value addition, marketing and other backward and forward linkages. Recently, the Bank in partnership with CBN set up plans in disbursing a whopping sum of N41billion to farmers from 14 states for the expansion of the wheat production project.

As part of bridging the Agric Value chain financing gap, the Bank, however, registered the wheat farmers with the Lagos Commodities and Futures Exchange (LCFE) for successful disbursement, as the farmers are expected to cover about 111, 025 Hectares of land to attain huge milestones in wheat production.

Meanwhile, being the pioneer Bank to finance the first-ever large scale rain-fed wheat production in Nigeria and also a participating financial institution (PFI) under CBN’s Anchor Borrowers’ Programme scheme, Heritage Bank has taken adequate steps to create an enabling environment for sustainable growth in wheat production; thereby partnering with LCFE for all value-chain stakeholders to interact and trade ownership titles to specific quantities of wheat by registering members for their clients on the commodity exchange platform. Speaking at the media briefing engagement with the pressmen, the MD/CEO of Heritage Bank, Ifie Sekibo stated that the partnership is basically to consummate Wheat Seed Multiplication Project under the CBN’s Brown Revolution Initiative, in order to ensure due diligence on loan administration, monitoring and recovery, which would bring about increase in the domestic production of wheat and close the wide supply gap in the Nigerian agricultural space.

Also, Awe explained that via the strategic partnerships Heritage Bank has achieved vast footprints in agribusiness.

“For example, through our partnership with Triton Aqua Africa Limited and on-lending support from CBN, Heritage Bank has provided N2 billion for aquaculture to reduce our heavy reliance on fish import.

“Nigeria’s current annual demand for fish is estimated at 2.7 million metric tonnes and we currently produce about 800,000 metric tonnes.

“With support from CBN through Commercial Agriculture Credit Scheme CACS, Triton is now producing about 27,000 metric tonnes and their projection is to reach 100,000 metric tonnes in five years.

“From recent forecast, they will meet that projection easily. The bank is also supporting rice farmers under the ABP in Bakolori, Zamfara, Sanga in Kaduna and Soyabeans farmers in Rijana, Kaduna. Heritage Bank also has ongoing projects across the country,” he said.

On Heritage Bank’s involvement in ABP, the Bank provides on-lending funding to aggregated farmers to grow various products that will serve as raw materials to the processors, thereby ensuring market linkages and access to the market as well as reduce importation and conserve Nigeria’s external reserves.

In 2016, the sums of N54,892,728.00 and N248,413,350.00 were sourced from CBN and disbursed as loans to 185 rice farmers and 414 soya bean farmers respectively in Kaduna State.

In 2016, N37, 995,300.00 was disbursed to 259 rice farmers via 11 cooperatives in Zamfara State.

This line of action has readily compelled young and vibrant minds into getting involved in providing affordable financial solutions that can help agribusiness investors in various aspects of agriculture.

Presently, the bank is practically involved in preparing a good future for the youth, which is imperative, while recognizing the need to expand the horizon of young people, broaden their options and increase their choices.

The institution realized that the youth are needed as solution providers, incubators of ideas, promoters of innovations and implementers of positive change through agriculture and entrepreneurship.

Recognitions

No doubt Heritage Bank’s unswerving lending to the agricultural sector has earned it a deluge of accolades.

To its portfolio Heritage Bank Plc, earned the Nigeria’s Most Innovative Banking Service Provider in 2017 that was bestowed at the inaugural Nigeria Sustainable Banking Award convened by the CBN “For Sustainable Transaction of The Year in Agriculture.”

The Nigeria Agriculture Awards (NAA), at its annual event convened by AgroNigeria (The Voice of Nigeria’s Agriculture), to appreciate immense efforts of those who have contributed to the success of the agriculture sector in the country, announced Heritage Bank as the Agric Bank of the Year.

According to NAA, Heritage Bank was selected in recognition of its footprints in the Agric space, especially the Triton Aquaculture Project. Heritage was adjudged best SME Bank for 2018 by Capital Finance International and Agriculture Bank of the Year 2018 by Nigeria Agriculture Awards, MAA.

The Bank also won “For Sustainable Transaction of The Year in Agriculture,” in the inaugural Nigeria Sustainable Banking Award convened by the Central Bank of Nigeria (CBN).

The financial institution was adjudged Banker of the Year 2021 under SMEs and Agric category, which was awarded to the MD/CEO of the Bank, Ifie Sekibo during the prestigious award at the New Telegraph 2021 Awards in recognition of its leadership position in delivering sterling development and growth of the agricultural sector and the Small and Medium Enterprises.

Also, Heritage Bank Plc which has been adjudged the lead settlement bank for Gezawa Commodity Market (GCMX), has collaborated with key stakeholders to revolutionise the agricultural value-chain.

The collaboration was aimed at providing a fully integrated ecosystem for commodity Exchange.

Heritage Bank was appointed the Lead Settlement Bank and Transaction Adviser to GCMX and a memorandum of understanding (MoU) was signed between the two firms, whilst over 10, 000 farmers in 3000 cooperatives in the 44 local governments of Kano States were hosted.

The partnership between Heritage Bank and the Exchange has continued to facilitate the ease of agro commodity trading in a more structured way, especially with the closeness to the Dawanu, the largest grain market in Africa.

Sekibo, who was a panelist at the second GCMX Farmers’ Cooperative Forum in Kano said the partnership was to de-risk the sector and bring about structured and enhanced agro-business and attain food security that leads to economic development.

Sekibo explained that the partnership which would help bridge the huge gap associated with risk, would fast track effective price discovery mechanisms and traceability and enhanced trade settlement services.

Specifically, he stated that under the Central Bank of Nigeria’s Anchor Borrowers Programme (ABP) and the Nigeria Incentive-Based Risk Sharing System for Agricultural Lending (NIRSAL), Heritage Bank would provide on-lending funding to aggregated farmers in the farming season to grow various products that will serve as raw materials to the processors, thereby ensuring market linkages and access to the market as well as reduce importation and conserve Nigeria’s external reserves.

Because the challenges are daunting, Heritage Bank Plc is also calling on governments at all levels and deposit money banks to increase support to agriculture, as it is the most resilient and important sector of the Nigerian economy, despite underwhelming investment in the sector.

The Bank believes that increased focus on the agricultural sector would contribute to the job creation objectives of the Economic Recovery and Growth Plan (ERGP), as its labour intensive process across the value chain has the potential of creating multiple jobs, create wealth, and increase the sector’s contribution to GDP and foreign exchange earnings

Heritage Bank observes that the under-performance of the sector is closely tied, amongst other factors, to poor credit access from banks.

The Bank also observes underfunding of Nigeria’s Agricultural research institutes that are established to drive the sector’s business.

It is in the Bank’s opinion that successful implementation of the Government’s Recovery Plan provides significant opportunities for entrepreneurs, investors and financiers particularly in the Agro-allied Sector.

Also, investments in infrastructure (energy and transportation) are supportive of the Agric-led growth and to explore options for de-risking and unlocking bank lending to the Agric sector so as to develop and position the sector for increased contribution to the Nigeria’s GDP and revenues, there is need to continue regulatory driven intervention funds to increase access to credit at single digit rates and long tenors, Improve knowledge of Banks and Bankers on Agric finance and Agricultural Risk Management through focused capacity building and many others, said the Bank in its submission for a better agriculture driven economy.

Business

Deadline of Compliance: Nigeria’s Urgent Call for Tax Return Filing

Deadline of Compliance: Nigeria’s Urgent Call for Tax Return Filing

By George Omagbemi Sylvester | Published by SaharaWeeklyNG.com

“Shift or Structural Demand? A Declaration of Civic Duty in a Nation at a Fiscal Crossroads.”

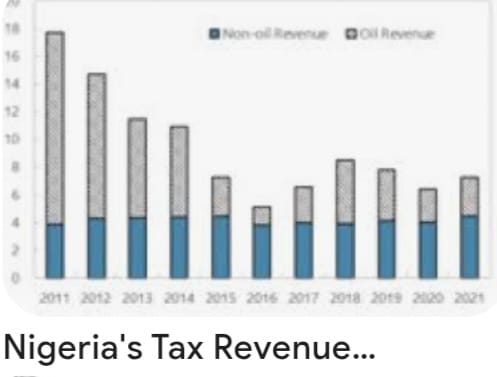

In the unfolding narrative of national development and economic reform, few instruments are as defining as tax compliance. For Nigeria, a nation perpetually grappling with revenue shortfalls, structural dependency on a single export commodity, and entrenched informal economic behaviour, the Federal Government’s recent clarification on tax return deadlines is not mere bureaucratic noise. It is a deliberate and inescapable declaration: the social contract between citizen and state must be honoured through transparent, lawful and timely tax reporting.

At its core, the government’s pronouncement is stark in its simplicity and radical in its implications. Federal authorities, speaking through the Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, have made it unequivocally clear that every Nigerian, whether employer or individual taxpayer, must file annual tax returns under the law. This encompasses self-assessment filings by individuals that too many assumed ended once employers deducted pay-as-you-earn taxes from their salaries.

This is not an optional civic suggestion, it is mandatory, backed by statute, and tied to a broader vision of national fiscal responsibility. Citizens can no longer hide behind ignorance, apathy, or false assumptions. “Many people assume that if their employer deducts tax from their salaries, their obligations end there. That is wrong,” Oyedele warned, emphasizing that the obligation to file remains with the individual under both existing and newly reformed tax laws.

The Deadlines and the Reality They Reveal.

Across the federation, state and federal revenue authorities have reaffirmed statutory deadlines in pursuit of compliance. The Lagos State Internal Revenue Service, for instance, moved to extend its filing date for employer returns by a narrow window, reflecting the reality that compliance often lags behind legal timelines. The extension was intended not as leniency, but as a pragmatic effort to allow accurate and complete submissions, underscoring that true compliance rises above mere mechanical ticking of a box.

At the federal level, Oyedele’s intervention was even more fundamental. He reminded Nigerians that annual tax returns for the preceding year must be filed in good faith, with integrity and in respect of the law. This applies regardless of income level including low-income earners who have historically believed that they are outside the tax net. “All of us must file our returns, including those earning low income,” he stated.

Herein lies one of the most challenging truths of contemporary Nigerian governance: widespread tax non-compliance is not just a technical breach of law, it is a deep cultural and structural issue that reflects decades of mistrust between citizens and the state.

The Root of the Problem: Non-Compliance as a Symptom.

Nigeria’s tax culture has long been under scrutiny. Public discourse and economic analysis consistently show that a significant majority of eligible taxpayers do not file annual returns. Oyedele highlighted that even in states widely regarded as tax administration leaders, compliance remains strikingly low, often below five percent.

This widespread non-compliance stems from multiple sources:

A long history of weak tax administration systems, where enforcement was inconsistent and penalties were rarely applied.

A perception that public services do not reflect the taxes collected, eroding the citizenry’s belief in reciprocity.

An informal economy where income often goes unrecorded, making filing seem irrelevant or impossible to many.

Lack of awareness, with many Nigerians genuinely believing that tax liability ends with employer deductions.

The government’s renewed push for compliance directly challenges these perceptions. It signals a shift from voluntary or lax compliance to structured accountability, a stance that aligns with best practices in modern public finance.

Why This Matters: Beyond Deadlines.

At its most profound level, the insistence on tax return filings is about nation-building and shared responsibility.

Scholars of public finance universally agree that a robust tax system is the backbone of sustainable development. As the eminent economist Dr. Joseph E. Stiglitz has observed, “A society that cannot mobilize its own resources through fair taxation undermines both its government’s legitimacy and its capacity to provide for its people.” Filing tax returns is not a mere administrative task, it is a declaration of participation in the collective project of national advancement.

In Nigeria’s context, this declaration carries weight. With the enactment of comprehensive tax reforms in recent years (including unified frameworks for tax administration and enforcement) authorities now possess broader statutory tools to ensure compliance and accountability. These measures, which include electronic filing platforms and stronger enforcement powers, have been framed as fair and equitable, targeting efficiency rather than arbitrariness.

Yet the success of these reforms depends heavily on citizens embracing their civic duties with sincerity. And this depends on mutual trust, the belief that paying taxes yields tangible benefits in infrastructure, education, healthcare, security and social services.

Voices From Experts: Fiscal Responsibility as a Public Ethic.

Tax law experts and economists, reflecting on the compliance push, have underscored a universal theme: taxation without transparency is inequity, but taxation with accountability is empowerment. When managed with fairness, a functional tax system can reduce dependency on volatile revenue sources, stabilise national budgets, and support long-term investment in human capital.

Professor Aisha Bello, a respected authority in fiscal policy, notes that “Tax compliance is not a burden; it is the foundation upon which social contracts are built. A citizen who honours tax obligations affirms the legitimacy of governance and demands better performance in return.”

Similarly, a leading tax scholar, Dr. Emeka Okon, argues that “The era when Nigerians could evade broader tax responsibilities simply because automatic deductions occur at source must end. For a modern economy, every eligible citizen must be part of the formal tax fold not as victims, but as stakeholders.”

These authoritative voices point to an unassailable truth: filing tax returns is both a legal requirement and a moral responsibility, an expression of citizenship in its fullest sense.

Challenges on the Ground: Compliance and Capacity.

While the rhetoric of compliance is compelling, the reality on the ground demands nuanced understanding. Many taxpayers (especially in the informal sector) lack meaningful access to digital platforms and resources for filing returns. For others, the fear of bureaucratic complexity and perceived punitive enforcement deters participation.

The government, for its part, has responded by promoting online systems and pledging greater taxpayer support. Tax authorities are increasingly engaging stakeholders to demystify filing processes, explain requirements and offer assistance. This mix of enforcement and facilitation is essential. As one seasoned revenue specialist observed: “The state cannot compel compliance through force alone; it must earn it through education, simplicity and fairness.”

The Broader Implication: A New Social Compact.

Ultimately, Nigeria’s renewed emphasis on tax return filing transcends administrative deadlines. It is an unequivocal declaration that national development is a shared responsibility, that citizens and state must engage in a transparent, accountable, and reciprocal relationship.

Tax compliance, therefore, becomes far more than a legal act; it becomes a moral claim on the nation’s future.

When citizens file their returns honestly, they affirm their stake in the nation’s destiny. When the government collects taxes transparently and deploys them effectively, it strengthens not only public services but civic trust itself.

In this sense, the deadlines proclaimed by Nigeria’s fiscal authorities mark not an end but a beginning; the beginning of a civic epoch in which accountability replaces apathy, participation replaces indifference and national purpose triumphs over fragmentation.

The road ahead will not be easy. But in demanding compliance, Nigeria is demanding more than tax returns. It is demanding commitment and that, ultimately, is the foundation on which nations are built.

Business

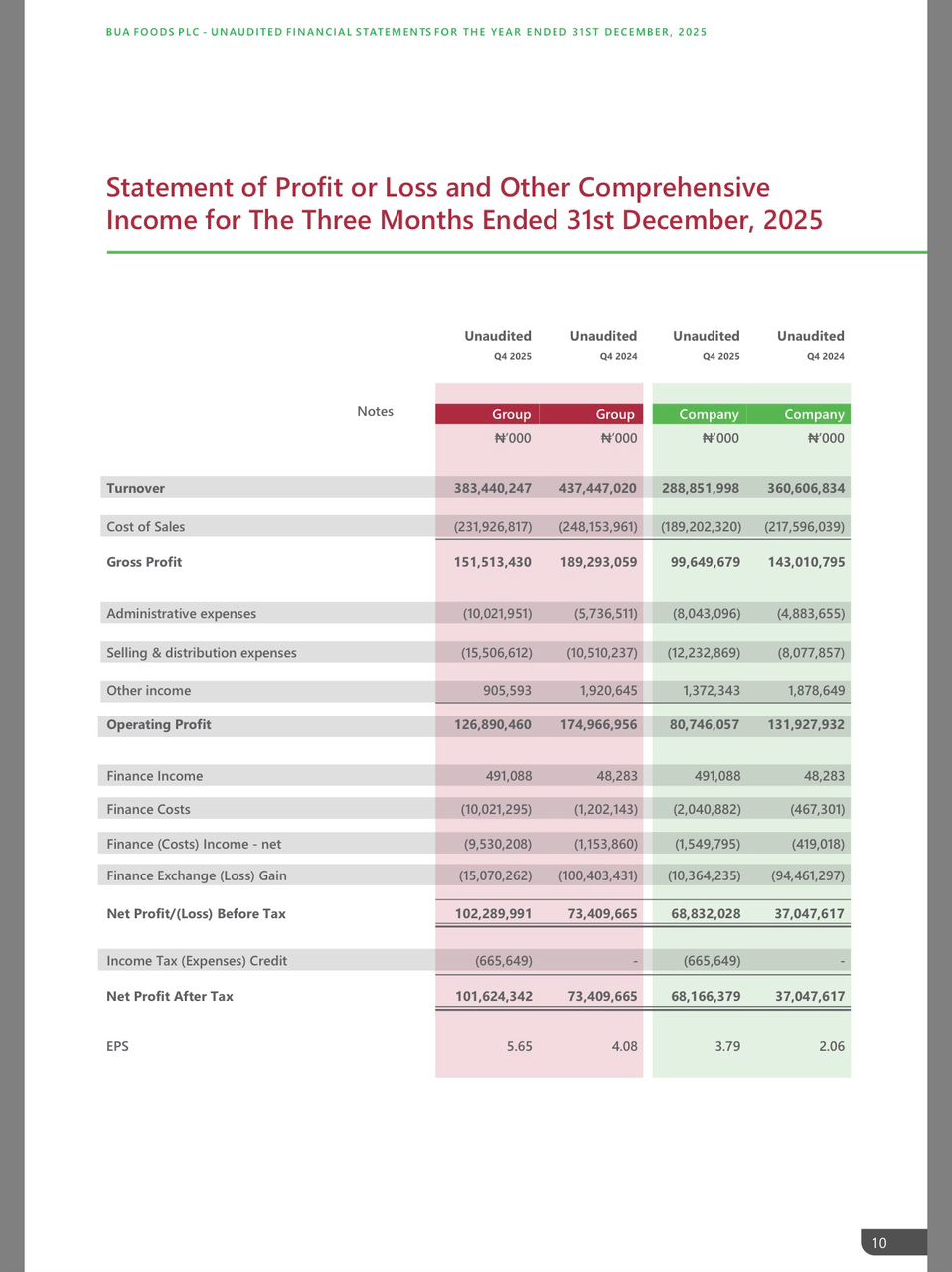

BUA Foods Records 91% Surge in Profit After Tax, Hits ₦508bn in 2025

BUA Foods Records 91% Surge in Profit After Tax, Hits ₦508bn in 2025

By femi Oyewale

Business

Adron Homes Unveils “Love for Love” Valentine Promo with Exciting Discounts, Luxury Gifts, and Travel Rewards

Adron Homes Unveils “Love for Love” Valentine Promo with Exciting Discounts, Luxury Gifts, and Travel Rewards

In celebration of the season of love, Adron Homes and Properties has announced the launch of its special Valentine campaign, “Love for Love” Promo, a customer-centric initiative designed to reward Nigerians who choose to express love through smart, lasting real estate investments.

The Love for Love Promo offers clients attractive discounts, flexible payment options, and an array of exclusive gift items, reinforcing Adron Homes’ commitment to making property ownership both rewarding and accessible. The campaign runs throughout the Valentine season and applies to the company’s wide portfolio of estates and housing projects strategically located across Nigeria.

Speaking on the promo, the company’s Managing Director, Mrs Adenike Ajobo, stated that the initiative is aimed at encouraging individuals and families to move beyond conventional Valentine gifts by investing in assets that secure their future. According to the company, love is best demonstrated through stability, legacy, and long-term value—principles that real estate ownership represents.

Under the promo structure, clients who make a payment of ₦100,000 receive cake, chocolates, and a bottle of wine, while those who pay ₦200,000 are rewarded with a Love Hamper. Payments of ₦500,000 attract a Love Hamper plus cake, and clients who pay ₦1,000,000 enjoy a choice of a Samsung phone or a Love Hamper with cake.

The rewards become increasingly premium as commitment grows. Clients who pay ₦5,000,000 receive either an iPad or an all-expenses-paid romantic getaway for a couple at one of Nigeria’s finest hotels, which includes two nights’ accommodation, special treats, and a Love Hamper. A payment of ₦10,000,000 comes with a choice of a Samsung Z Fold 7, three nights at a top-tier resort in Nigeria, or a full solar power installation.

For high-value investors, the Love for Love Promo delivers exceptional lifestyle experiences. Clients who pay ₦30,000,000 on land are rewarded with a three-night couple’s trip to Doha, Qatar, or South Africa, while purchasers of any Adron Homes house valued at ₦50,000,000 receive a double-door refrigerator.

The promo covers Adron Homes’ estates located in Lagos, Shimawa, Sagamu, Atan–Ota, Papalanto, Abeokuta, Ibadan, Osun, Ekiti, Abuja, Nasarawa, and Niger States, offering clients the opportunity to invest in fast-growing, strategically positioned communities nationwide.

Adron Homes reiterated that beyond the incentives, the campaign underscores the company’s strong reputation for secure land titles, affordable pricing, strategic locations, and a proven legacy in real estate development.

As Valentine’s Day approaches, Adron Homes encourages Nigerians at home and in the diaspora to take advantage of the Love for Love Promo to enjoy exceptional value, exclusive rewards, and the opportunity to build a future rooted in love, security, and prosperity.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

Business6 months ago

Business6 months agoBatsumi Travel CEO Lisa Sebogodi Wins Prestigious Africa Travel 100 Women Award

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING