Bank

FBNBANK UK STANDS TALL AT 40, APPRECIATES ITS CUSTOMERS AND REGULATORS

FBNBANK UK STANDS TALL AT 40, APPRECIATES ITS CUSTOMERS AND REGULATORS

FBNBank UK, a member of First Bank of Nigeria Limited and Subsidiaries had London, the United Kingdom painted blue as it celebrated its 40th anniversary, themed Partnership Beyond Borders, on Friday, 11 November 2022.

The event which had customers, members of government functionaries and the diplomatic community, regulators, captains of industries in attendance, was convened to appreciate the patronage and support the Bank had received since it opened its doors in the United Kingdom 40 years ago. As key stakeholders, they were instrumental to establishing the Bank as an important gateway to connect international markets in Africa, Europe and the rest of the world to the finest financial services solutions that the UK has to offer.

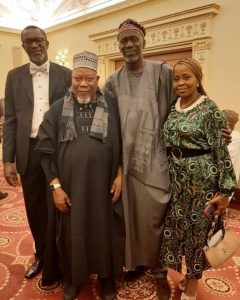

Guests at the event include Hon. Justice Olukayode Ariwoola GCON, Chief Justice of Nigeria; Oba Sen. Dr. Moshood Olalekan Ishola Balogun, Alliiwo II, Olubadan of Ibadan land; Ambassador Sarafa Tunji Isola, High Commissioner, Nigerian High Commission, UK; His Highness, Muhammadu Sanusi II, former Governor, Central Bank of Nigeria.

Other dignitaries that graced the occasion include Alhaji Umaru Abdul Mutallab, Nigerian businessman and former Chairman of FirstBank; Mohammed Indimi OFR, Chairman, Oriental Energy Resources.

Delivering his welcome address to the dignitaries and guests present, Sam Aiyere, Chief Executive Officer, FBN Bank UK Ltd said “since its establishment, our Bank has demonstrated an unmatched dexterity, serving as a gateway connecting international markets in Africa, Europe and the rest of the world to the finest financial services solution that the UK has to offer. Through its office in the UK and the Paris Branch, our Bank has continued to facilitate international trade between Africa and Europe while offering top-notch, world-class corporate, institutional, and private banking solutions to our esteemed customers.

We have recorded laudable achievement only because you stand solidly with us. Therefore, I dedicate the success of the past 40 years to all our stakeholders. Thank you for being the lever beneath our thrust”, he also added.

Appreciating the patronage and support extended to FBNBank UK, Dr. Adesola Adeduntan, CEO, FirstBank said “today we celebrate 40 years of unbroken business operations in the United Kingdom; 40 years of supporting and enabling dreams; 40 years of resilience and relevance; 40 years of trust, safety and security; 40 years of long-term value to all stakeholders; and 40 years of partnerships beyond borders. I believe the future is bright for FBN Bank UK. With our beautiful outing tonight, our Group stands out, once again, as one big and happy family of many parts.

In his speech, Godwin Emefiele, Governor, Central Bank of Nigeria highlighted that “FBNBank UK’s established presence in a leading global financial centre such as London ensures that FirstBank Group is well positioned to play an active role in the promotion of Africa as an investment destination, attract much needed capital to the continent and facilitate trade with other parts of the world. The presence of FirstBank in other countries outside Nigeria shows that the span of its impact is continent-wide. As you are headquartered in the largest economy on the continent, you have a unique role in also facilitating capital flows into other African countries and assisting their economic growth and development.

In addition, in his goodwill message, President Muhammedu Buhari, GCFR, President and Commander-in-chief, Federal Republic of Nigeria said “FirstBank has profoundly demonstrated a high level of nationalism by keeping the Nigerian dream at the heart of its business through constant evolution to birth agile financial services solution to suit the demands of its customers both home and abroad. Also, perhaps more than any other institution in its class, FirstBank has supported the Government by providing human resources at various times to booster much required professional expertise in various sectors of our economy.”

Established in the United Kingdom in 1982 as the London Branch of the First Bank of Nigeria Limited., FBNBank UK was initially established to service the UK banking requirements of Nigerian companies and FirstBank.

Later in November 2002, the Bank was incorporated in the UK as a registered and a wholly-owned subsidiary of First Bank of Nigeria Limited with offices in the City of London and has then developed into a much broader business in the gateway to Europe and beyond for African banks, companies and high net worth individuals.

Bank

Separating Fact from Confusion: What Nigerians Need to Know About the 7.5% VAT on Banking Service Fees

In recent weeks, digital-banking customers and social media, especially on Twitter have raised concerns about deductions labelled as “VAT” on transfers and other charges.

Some dangerously false narratives, which when you take a critical look, you’ll clearly see that they have been orchestrated and sponsored by malicious elements, have given the impression that the 7.5% Value Added Tax (VAT) is a new or arbitrary charge introduced by fintechs, or that it applies to the amounts customers send. These claims are misleading and deserve careful clarification which is the purpose of this piece.

First, it’s important to understand how VAT works in Nigeria’s financial sector today. VAT on fees and charges for financial services has long been part of Nigeria’s tax system. The then Federal Inland Revenue Service (FIRS) had issued information circulars on March 31, 2021 where it stated that VAT on Financial Services (Circular No. 2021/04) that most fees, commissions, and charges by financial institutions (banks, insurance companies, brokers) are subject to 7.5% VAT.

This justifies a recent advertorial the Nigeria Revenue Service (NRS) which stated unequivocally that VAT was not newly introduced on banking service charges by recent tax reforms, and that it did not impose a new tax obligation on customers in that regard.

However what was left unsaid in that publication was that on the 12th of December, the tax agency had written to all financial institutions and payment gateways based on past meetings with operators that following from the new Tax Act, they were reminded of their mandatory obligations to collect, deduct and remit VAT at the prescribed rate.

The Agency then gave an 18- day grace period to all players to configure and align their systems while directing full compliance with the directive with effect from January 19, 2026. And so, some fintechs sent messages to their customers in the spirit of clarity and transparency.

It must be said that what has changed is that in a bid to widen the tax net, microfinance banks and fintechs who were not obligated to deduct and remit said VAT before now, have now become compelled to do so. The enforcement and standardised collection of VAT across banks and fintech platforms including mobile transfers, USSD transaction fees, and card issuance fees with compliance deadlines issued by tax authorities. So why anyone would vilify any financial institution obeying the laws of the land beats my imagination.

For those who have raised questions around transparency and wrongly suggesting that fintechs are suddenly imposing new, unexplained costs on users – as it has been explained above, this is a matter of regulatory compliance, not a lack of transparency or customer exploitation. These VAT deductions are not new fees created by the companies themselves, and providers are not arbitrarily raising their prices.

In closing, two things that everyone must bear in mind as we move forward in this new tax climate – all stakeholders including fintech platforms and regulators must communicate better and clearly. Nigerians must refrain from peddling unsubstantiated claims and malicious narratives, it has no benefits for anyone and erodes trust in systems.

Bank

FirstBank Introduces Exclusive 500-Seater Bleacher at Carnival Calabar & Festival 2025

FirstBank Introduces Exclusive 500-Seater Bleacher at Carnival Calabar & Festival 2025

Lagos, 26 December 2025 – FirstBank, West Africa’s premier financial institution and financial inclusion services provider, has officially announced its sponsorship of the Carnival Calabar & Festival 2025, unveiling a landmark addition set to redefine the carnival experience — the first-ever private premium seating area at the event.

The highlight of FirstBank’s participation is the construction of a 500-seater premium bleacher, designed to provide comfort, safety, and an elevated viewing experience for carnival enthusiasts.

Speaking on the sponsorship, the Acting Group Head Marketing and Corporate Communications, FirstBank, Olayinka Ijabiyi, noted that the carnival aligns with the Bank’s First@Arts initiative, a platform dedicated to supporting the creative arts value chain across Nigeria. He said, “We recognise the transformative power of the arts, including carnivals, in inspiring people and strengthening national unity. For more than 131 years, we have supported platforms that promote self-expression, social reflection and cultural exchange. Our investment in the Carnival Calabar & Festival demonstrates our commitment to preserving the nation’s rich cultural heritage through First@Arts.”

“As part of our sponsorship this year, we are introducing the first-ever private 500-seater premium bleacher to further elevate the carnival experience. This exclusive seating is designed to provide exceptional comfort and an unforgettable viewing experience for attendees,” Ijabiyi added.

The Chairman of the Cross River State Carnival Calabar Commission, Gabe Onah, also commented on FirstBank’s sponsorship. “FirstBank’s involvement is a strong demonstration of private-sector support for culture and tourism. This partnership not only enhances the overall quality of the carnival but also strengthens its global appeal,” he said.

The Carnival Calabar & Festival 2025 is officially marketed by Okhma Global Limited, the appointed Official Marketer responsible for brand partnerships, promotional engagements, and ticket sales. Okhma Global Limited has partnered with the Cross River State government in delivering Carnival Calabar & Festival for over ten years, playing a key role in strengthening the carnival’s commercial growth and global visibility.

Bank

Alpha Morgan Bank Backs Cultural Preservation at the 2025 Iganmode Festival

Alpha Morgan Bank Backs Cultural Preservation at the 2025 Iganmode Festival

Alpha Morgan Bank has reaffirmed its commitment to cultural preservation and community development as one of the major sponsors of the recently concluded Iganmode Cultural Festival (Odun Omo Iganmode) held in Sango-Ota, Ogun State.

The annual festival, a landmark cultural celebration in the ancient town of Ota, showcased the rich heritage, history, and identity of the Awori people. The event came alive with vibrant displays of traditional music, dance, colourful regalia, and performances that reflected the deep-rooted customs and values of the community.

Alpha Morgan Bank’s sponsorship followed closely on the heels of the recent launch of its Sango-Ota branch, further underscoring the Bank’s dedication to supporting local initiatives, promoting indigenous culture, and fostering sustainable community development in Ota and its environs.

The ceremony attracted an impressive array of dignitaries, including former President of Nigeria, His Excellency Chief Olusegun Obasanjo; Deputy Governor of Ogun State, Engr. (Mrs.) Noimot Salako-Oyedele; and the Olota of Ota, His Majesty, Prof. Adeyemi Obalanlege, alongside several other traditional rulers and members of royal households from across the state. Their presence highlighted the cultural and historical significance of the festival to Ogun State and the wider Yoruba nation.

Alpha Morgan Bank’s participation as a major sponsor reflects its broader corporate vision of strengthening community values and supporting initiatives that promote Nigeria’s rich cultural heritage. The Bank joined thousands of attendees in celebrating a festival that continues to serve as a symbol of unity, pride, and cultural continuity for the people of Ota.

The 2025 edition of the Iganmode Festival was widely acclaimed as a success, leaving guests and participants with lasting impressions of a colourful, well-coordinated celebration that honoured tradition while fostering communal harmony.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

Business6 months ago

Business6 months agoBatsumi Travel CEO Lisa Sebogodi Wins Prestigious Africa Travel 100 Women Award

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING