Business

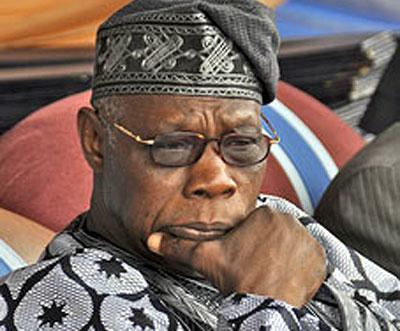

”Buying pool of cars is unnecessary” – Obasanjo writes National assembly (READ LETTER)

Former President Olusegun Obasanjo has written the National Assembly a lengthy letter accusing the lawmakers of corruption, impunity, greed and of repeatedly breaking the nation’s laws.

He addressed a lot of disturbing issues in the letter. He talked about the pool of cars they are planning to buy and told them it is of no need.

He further advised the arms of government to accept and share responsiblities due to the economic situation of the country

Below is Mr. Obasanjo’s letter:

January 13, 2016

Distinguished Senator Bukola Saraki,

President of the Senate,

Federal Republic of Nigeria,

Senate Chambers,

Abuja.

Honourable Yakubu Dogara,

Speaker, House of Representatives,

National Assembly Complex,

Abuja.

It is appropriate to begin this letter, which I am sending to all members of the Senate and the House of Representatives through both of you at this auspicious and critical time, with wishes of Happy New Year to you all.

On a few occasions in the past, both in and out of office as the President of Nigeria, I have agonised on certain issues within the arms of government at the national level and among the tiers of government as well. Not least, I have reflected and expressed, outspokenly at times, my views on the practice in the National Assembly which detracts from distinguishness and honourability because it is shrouded in opaqueness and absolute lack of transparency and could not be regarded as normal, good and decent practice in a democracy that is supposed to be exemplary. I am, of course, referring to the issue of budgets and finances of the National Assembly.

The present economic situation that the country has found itself in is the climax of the steady erosion of good financial and economic management which grew from bad to worse in the last six years or so. The executive and the legislative arms of government must accept and share responsibility in this regard. And if there will be a redress of the situation as early as possible, the two arms must also bear the responsibility proportionally. The two arms ran the affairs of the country unmindful of the rainy day. The rainy day is now here. It would not work that the two arms should stand side by side with one arm pulling and without the support of the other one for good and efficient management of the economy.

The purpose of election into the Legislative Assembly particularly at the national level is to give service to the nation and not for the personal service and interest of members at the expense of the nation which seemed to have been the mentality, psychology, mindset and practice within the National Assembly since the beginning of this present democratic dispensation. Where is patriotism? Where is commitment? Where is service?

The beginning of good governance which is the responsibility of all arms and all the tiers of government is openness and transparency. It does not matter what else we try to do, as long as one arm of government shrouds its financial administration and management in opaqueness and practices rife with corruption, only very little, if anything at all, can be achieved in putting Nigeria on the path of sustainable and enduring democratic system, development and progress. Governance without transparency will be a mockery of democracy.

Let us be more direct and specific so that action can be taken where it is urgently necessary. A situation where our national budget was predicated on $38 per barrel of oil with estimated 2 million barrels per day and before the budget was presented, the price of oil had gone down to $34 per barrel and now hovering around $30 and we have no assurance of producing 2 million barrels and if we can, we have no assurance of finding market for it, definitely calls for caution. If production and price projected in the budget stand, we would have to borrow almost one third of the 6 trillion naira budget. Now beginning with the reality of the budget, there is need for sober reflection and sacrifice with innovation at the level of executive and legislative arms of government. The soberness, the sacrifice and seriousness must be patient and apparent.

It must not be seen and said that those who, as leaders, call for sacrifice from the citizenry are living in obscene opulence. It will not only be insensitive but callously so. It would seem that it is becoming a culture that election into the legislative arm of government at the national level in particular is a licence for financial misconduct and that should not be. The National Assembly now has a unique opportunity of presenting a new image of itself. It will help to strengthen, deepen, widen and sustain our democracy.

By our Constitution, the Revenue Mobilisation, Allocation and Fiscal Commission is charged with the responsibility of fixing emoluments of the three arms of government: executive, legislature and judiciary. The Commission did its job but by different disingenuous ways and devices, the legislature had overturned the recommendation of the Commission and hiked up for themselves that which they are unwilling to spell out in detail, though they would want to defend it by force of arm if necessary. What is that?

Mr. President of the Senate and Hon. Speaker of the House, you know that your emolument which the Commission had recommended for you takes care of all your legitimate requirements: basic salary, car, housing, staff, constituency allowance. Although the constituency allowance is paid to all members of the National Assembly, many of them have no constituency offices which the allowance is partly meant to cater for. And yet other allowances and payments have been added by the National Assembly for the National Assembly members’ emoluments. Surely, strictly speaking, it is unconstitutional. There is no valid argument for this except to see it for what it is – law-breaking and impunity by lawmakers. The lawmakers can return to the path of honour, distinguishness, sensitivity and responsibility. The National Assembly should have the courage to publish its recurrent budgets for the years 2000, 2005, 2010 and 2015. That is what transparency demands. With the number of legislators not changing, comparison can be made. Comparisons in emoluments can also be made with countries like Ghana, Kenya, Senegal and even Malaysia and Indonesia who are richer and more developed than we are.

The budget is a proposal and only an estimate of income and expenditure. Where income is inadequate, expenditure will not be made. While in government, I was threatened with impeachment by the members of the National Assembly for not releasing some money they had appropriated for themselves which were odious and for which there were no incomes to support. The recent issue of cars for legislators would fall into the same category. Whatever name it is disguised as, it is unnecessary and insensitive. A pool of a few cars for each Chamber will suffice for any Committee Chairman or members for any specific duty. The waste that has gone into cars, furniture, housing renovation in the past was mind-boggling and these were veritable sources of waste and corruption. That was why they were abolished. Bringing them back is inimical to the interest of Nigeria and Nigerians.

The way of proposing budget should be for the executive to discuss every detail of the budget, in preparation, with different Committees and sub-Committees of the National Assembly and the National Assembly to discuss its budget with the Ministry of Finance. Then, the budget should be brought together as consolidated budget and formally presented to the National Assembly, to be deliberated and debated upon and passed into law. It would then be implemented as revenues are available. Where budget proposals are extremely ambitious like the current budget and revenue sources are so uncertain, more borrowing may have to be embarked upon, almost up to 50% of the budget or the budget may be grossly unimplementable and unimplemented. Neither is a choice as both are bad. Management of the economy is one of the key responsibilities of the President as prescribed in the Constitution. He cannot do so if he does not have his hands on the budget. Management of the economy is shared responsibility where the Presidency has the lion share of the responsibility. But if the National Assembly becomes a cog in the wheel, the executive efforts will not yield much reward or progress. The two have to work synchronisingly together to provide the impetus and the conducive environment for the private sector to play its active vanguard role. Management of the budget is the first step to manage the economy. It will be interesting if the National Assembly will be honourable enough and begin the process of transparency, responsibility and realism by publishing its recurrent budgets for 2016 as it should normally be done.

Hopefully, the National Assembly will take a step back and do what is right not only in making its own budget transparent but in all matters of financial administration and management including audit of its accounts by external outside auditor from 1999 to date. This, if it is done, will bring a new dawn to democracy in Nigeria and a new and better image for the National Assembly and it will surely avoid the Presidency and the National Assembly going into face-off all the time on budgets and financial matters.

While I thank you for your patience and understanding, please accept, Dear Senate President and Honourable Speaker of the House, the assurances of my highest consideration.

OLUSEGUN OBASANJO

(Premium times)

Business

Nigeria’s Inflation Drops to 15.10% as NBS Reports Deflationary Trend

Nigeria’s headline inflation rate declined to 15.10 per cent in January 2026, marking a significant drop from 27.61 per cent recorded in January 2025, according to the latest Consumer Price Index (CPI) report released by the National Bureau of Statistics.

The report also showed that month-on-month inflation recorded a deflationary trend of –2.88 per cent, representing a 3.42 percentage-point decrease compared to December 2025. Analysts say the development signals easing price pressures across key sectors of the economy.

Food inflation stood at 8.89 per cent year-on-year, down from 29.63 per cent in January 2025. On a month-on-month basis, food prices declined by 6.02 per cent, reflecting lower costs in several staple commodities.

The data suggests a sustained downward trajectory in inflation over the past 12 months, pointing to improving macroeconomic stability.

The administration of President Bola Ahmed Tinubu has consistently attributed recent economic adjustments to ongoing fiscal and monetary reforms aimed at stabilising prices, boosting agricultural output, and strengthening domestic supply chains.

Economic analysts note that while the latest figures indicate progress, sustaining the downward trend will depend on continued policy discipline, exchange rate stability, and improvements in food production and distribution.

The January report provides one of the clearest indications yet that inflationary pressures, which surged in early 2025, may be moderating.

Bank

Alpha Morgan to Host 19th Economic Review Webinar

Alpha Morgan to Host 19th Economic Review Webinar

In an economy shaped by constant shifts, the edge often belongs to those with the right information.

On Wednesday, February 25, 2026, Alpha Morgan Bank will host the 19th edition of its Economic Review Webinar, a high-level thought leadership session designed to equip businesses, investors, and individuals with timely financial and economic insight.

The session, which will hold live on Zoom at 10:00am WAT and will feature economist Bismarck Rewane, who will examine the key signals influencing Nigeria’s economic direction in 2026, including policy trends, market movements, and global developments shaping the local landscape.

With a consistent track record of delivering clarity in uncertain times, the Alpha Morgan Economic Review continues to provide practical context for decision-making in a dynamic environment.

Registration for the 19th Alpha Morgan Economic Review is free and can be completed via https://bit.ly/registeramerseries19

It is a bi-monthly platform that is open to the public and is held virtually.

Visit www.alphamorganbank to know more.

Business

GTBank Launches Quick Airtime Loan at 2.95%

GTBank Launches Quick Airtime Loan at 2.95%

Guaranty Trust Bank Ltd (GTBank), the flagship banking franchise of GTCO Plc, Africa’s leading financial services group, today announced the launch of Quick Airtime Loan, an innovative digital solution that gives customers instant access to airtime when they run out of call credit and have limited funds in their bank accounts, ensuring customers can stay connected when it matters most.

In today’s always-on world, running out of airtime is more than a minor inconvenience. It can mean missed opportunities, disrupted plans, and lost connections, often at the very moment when funds are tight, and options are limited. Quick Airtime Loan was created to solve this problem, offering customers instant access to airtime on credit, directly from their bank. With Quick Airtime Loan, eligible GTBank customers can access from ₦100 and up to ₦10,000 by dialing *737*90#. Available across all major mobile networks in Nigeria, the service will soon expand to include data loans, further strengthening its proposition as a reliable on-demand platform.

For years, the airtime credit market has been dominated by Telcos, where charges for this service are at 15%. GTBank is now changing the narrative by offering a customer-centric, bank-led digital alternative priced at 2.95%. Built on transparency, convenience and affordability, Quick Airtime Loan has the potential to broaden access to airtime, deliver meaningful cost savings for millions of Nigerians, and redefine how financial services show up in everyday life, not just in banking moments.

Commenting on the product launch, Miriam Olusanya, Managing Director of Guaranty Trust Bank Ltd, said: “Quick Airtime Loan reflects GTBank’s continued focus on delivering digital solutions that are relevant, accessible, and built around real customer needs. The solution underscores the power of a connected financial ecosystem, combining GTBank’s digital reach and lending expertise with the capabilities of HabariPay to deliver a smooth, end-to-end experience. By leveraging unique strengths across the Group, we are able to accelerate innovation, strengthen execution, and deliver a more integrated customer experience across all our service channels.”

Importantly, Quick Airtime Loan highlights GTCO’s evolution as a fully diversified financial services group. Leveraging HabariPay’s Squad, the solution reinforces the Group’s ecosystem proposition by bringing together banking, payment technology, and digital channels to deliver intuitive, one-stop experiences for customers.

With this new product launch, Guaranty Trust Bank is extending its legacy of pioneering digital-first solutions that have redefined customer access to financial services across the industry, building on the proven strength of its widely adopted QuickCredit offering and the convenience of the Bank’s iconic *737# USSD Banking platform.

About Guaranty Trust Bank

Guaranty Trust Bank (GTBank) is the flagship banking franchise of GTCO Plc, a leading financial services group with a strong presence across Africa and the United Kingdom. The Bank is widely recognized for its leadership in digital banking, customer experience, and innovative financial solutions that deliver value to individuals, businesses, and communities.

About HabariPay

HabariPay is the payments fintech subsidiary of GTCO Plc, focused on enabling fast, secure, and accessible digital payments for individuals and businesses. By integrating payments and digital technology, HabariPay supports innovative services that make everyday financial interactions simpler and more seamless.

Enquiries:

GTCO

Group Corporate Communication

[email protected]

+234-1-2715227

www.gtcoplc.com

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING

You must be logged in to post a comment Login