Business

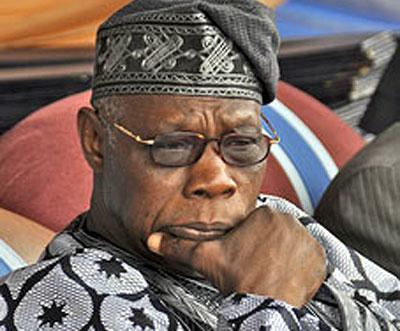

”Buying pool of cars is unnecessary” – Obasanjo writes National assembly (READ LETTER)

Published

8 years agoon

Former President Olusegun Obasanjo has written the National Assembly a lengthy letter accusing the lawmakers of corruption, impunity, greed and of repeatedly breaking the nation’s laws.

He addressed a lot of disturbing issues in the letter. He talked about the pool of cars they are planning to buy and told them it is of no need.

He further advised the arms of government to accept and share responsiblities due to the economic situation of the country

Below is Mr. Obasanjo’s letter:

January 13, 2016

Distinguished Senator Bukola Saraki,

President of the Senate,

Federal Republic of Nigeria,

Senate Chambers,

Abuja.

Honourable Yakubu Dogara,

Speaker, House of Representatives,

National Assembly Complex,

Abuja.

It is appropriate to begin this letter, which I am sending to all members of the Senate and the House of Representatives through both of you at this auspicious and critical time, with wishes of Happy New Year to you all.

On a few occasions in the past, both in and out of office as the President of Nigeria, I have agonised on certain issues within the arms of government at the national level and among the tiers of government as well. Not least, I have reflected and expressed, outspokenly at times, my views on the practice in the National Assembly which detracts from distinguishness and honourability because it is shrouded in opaqueness and absolute lack of transparency and could not be regarded as normal, good and decent practice in a democracy that is supposed to be exemplary. I am, of course, referring to the issue of budgets and finances of the National Assembly.

The present economic situation that the country has found itself in is the climax of the steady erosion of good financial and economic management which grew from bad to worse in the last six years or so. The executive and the legislative arms of government must accept and share responsibility in this regard. And if there will be a redress of the situation as early as possible, the two arms must also bear the responsibility proportionally. The two arms ran the affairs of the country unmindful of the rainy day. The rainy day is now here. It would not work that the two arms should stand side by side with one arm pulling and without the support of the other one for good and efficient management of the economy.

The purpose of election into the Legislative Assembly particularly at the national level is to give service to the nation and not for the personal service and interest of members at the expense of the nation which seemed to have been the mentality, psychology, mindset and practice within the National Assembly since the beginning of this present democratic dispensation. Where is patriotism? Where is commitment? Where is service?

The beginning of good governance which is the responsibility of all arms and all the tiers of government is openness and transparency. It does not matter what else we try to do, as long as one arm of government shrouds its financial administration and management in opaqueness and practices rife with corruption, only very little, if anything at all, can be achieved in putting Nigeria on the path of sustainable and enduring democratic system, development and progress. Governance without transparency will be a mockery of democracy.

Let us be more direct and specific so that action can be taken where it is urgently necessary. A situation where our national budget was predicated on $38 per barrel of oil with estimated 2 million barrels per day and before the budget was presented, the price of oil had gone down to $34 per barrel and now hovering around $30 and we have no assurance of producing 2 million barrels and if we can, we have no assurance of finding market for it, definitely calls for caution. If production and price projected in the budget stand, we would have to borrow almost one third of the 6 trillion naira budget. Now beginning with the reality of the budget, there is need for sober reflection and sacrifice with innovation at the level of executive and legislative arms of government. The soberness, the sacrifice and seriousness must be patient and apparent.

It must not be seen and said that those who, as leaders, call for sacrifice from the citizenry are living in obscene opulence. It will not only be insensitive but callously so. It would seem that it is becoming a culture that election into the legislative arm of government at the national level in particular is a licence for financial misconduct and that should not be. The National Assembly now has a unique opportunity of presenting a new image of itself. It will help to strengthen, deepen, widen and sustain our democracy.

By our Constitution, the Revenue Mobilisation, Allocation and Fiscal Commission is charged with the responsibility of fixing emoluments of the three arms of government: executive, legislature and judiciary. The Commission did its job but by different disingenuous ways and devices, the legislature had overturned the recommendation of the Commission and hiked up for themselves that which they are unwilling to spell out in detail, though they would want to defend it by force of arm if necessary. What is that?

Mr. President of the Senate and Hon. Speaker of the House, you know that your emolument which the Commission had recommended for you takes care of all your legitimate requirements: basic salary, car, housing, staff, constituency allowance. Although the constituency allowance is paid to all members of the National Assembly, many of them have no constituency offices which the allowance is partly meant to cater for. And yet other allowances and payments have been added by the National Assembly for the National Assembly members’ emoluments. Surely, strictly speaking, it is unconstitutional. There is no valid argument for this except to see it for what it is – law-breaking and impunity by lawmakers. The lawmakers can return to the path of honour, distinguishness, sensitivity and responsibility. The National Assembly should have the courage to publish its recurrent budgets for the years 2000, 2005, 2010 and 2015. That is what transparency demands. With the number of legislators not changing, comparison can be made. Comparisons in emoluments can also be made with countries like Ghana, Kenya, Senegal and even Malaysia and Indonesia who are richer and more developed than we are.

The budget is a proposal and only an estimate of income and expenditure. Where income is inadequate, expenditure will not be made. While in government, I was threatened with impeachment by the members of the National Assembly for not releasing some money they had appropriated for themselves which were odious and for which there were no incomes to support. The recent issue of cars for legislators would fall into the same category. Whatever name it is disguised as, it is unnecessary and insensitive. A pool of a few cars for each Chamber will suffice for any Committee Chairman or members for any specific duty. The waste that has gone into cars, furniture, housing renovation in the past was mind-boggling and these were veritable sources of waste and corruption. That was why they were abolished. Bringing them back is inimical to the interest of Nigeria and Nigerians.

The way of proposing budget should be for the executive to discuss every detail of the budget, in preparation, with different Committees and sub-Committees of the National Assembly and the National Assembly to discuss its budget with the Ministry of Finance. Then, the budget should be brought together as consolidated budget and formally presented to the National Assembly, to be deliberated and debated upon and passed into law. It would then be implemented as revenues are available. Where budget proposals are extremely ambitious like the current budget and revenue sources are so uncertain, more borrowing may have to be embarked upon, almost up to 50% of the budget or the budget may be grossly unimplementable and unimplemented. Neither is a choice as both are bad. Management of the economy is one of the key responsibilities of the President as prescribed in the Constitution. He cannot do so if he does not have his hands on the budget. Management of the economy is shared responsibility where the Presidency has the lion share of the responsibility. But if the National Assembly becomes a cog in the wheel, the executive efforts will not yield much reward or progress. The two have to work synchronisingly together to provide the impetus and the conducive environment for the private sector to play its active vanguard role. Management of the budget is the first step to manage the economy. It will be interesting if the National Assembly will be honourable enough and begin the process of transparency, responsibility and realism by publishing its recurrent budgets for 2016 as it should normally be done.

Hopefully, the National Assembly will take a step back and do what is right not only in making its own budget transparent but in all matters of financial administration and management including audit of its accounts by external outside auditor from 1999 to date. This, if it is done, will bring a new dawn to democracy in Nigeria and a new and better image for the National Assembly and it will surely avoid the Presidency and the National Assembly going into face-off all the time on budgets and financial matters.

While I thank you for your patience and understanding, please accept, Dear Senate President and Honourable Speaker of the House, the assurances of my highest consideration.

OLUSEGUN OBASANJO

(Premium times)

Related

Sahara weekly online is published by First Sahara weekly international. contact saharaweekly@yahoo.com

You may like

brands/telecom

Investors Across The Globe Testify To Genuineness Of Afriq Arbiritage System, Say Jesam Micheal Changed Their Lives

Published

22 hours agoon

April 27, 2024

Investors Across The Globe Testify To Genuineness Of Afriq Arbiritage System, Say Jesam Micheal Changed Their Lives

Abayomi Segun Oluwasesan, who was employed by his boss on the 15th of June, 2022 to work as a web developer, literally tampered with the platform at a time when his boss, Jesam Micheal went for a liver transplant and entrusted the codes to him.

Overwhelmed by greed, Abayomi who was entrusted with the sensitive data for the smooth operations of the company, engaged the services of his cohorts, disrupting the smooth operations of the platform and stealing hard-earned investors’ money running into several billions.

Watch Video:

https://youtu.be/uhxAL81FPp4?si=psRtceBuHSQmUHHB

Related

Fidelity Bank: Improved Share Price as Growth Indicator

When the management of the Nigerian Exchange Limited (NGX) in July 2023 announced that it was reclassifying Fidelity Bank Plc from small-price stock to medium-price stock, financial analysts concluded that the road to attaining Tier1 status by the bank is closer than ever imagined.

In full year 2022. Fidelity Bank briefly fell into the Tier 1 category and saw the highest gross earnings of N337.10 billion and profit before tax of N53.68 billion. The bank’s higher interest income relative to interest expense led to a net interest margin of 7.70 per cent, ahead of other similar banks.

Regarding its financial position, the bank had the highest total assets at N3.99 trillion in 2022. The bank’s relatively low-risk asset exposure kept non-performing loans (NPLs) at 2.90 per cent, the second lowest in the Tier 2 category ahead of Wema Bank.

Although the group has struggled with curtailing operating costs with CIR above 50 per cent, Fidelity earned the second lowest CIR among Tier 2 banks at 59.00 per cent, slightly behind FCMB at 53.90 per cent in FY 2022.

In 9M 2023, Fidelity Bank, according to Proshare analysts will rise to full Tier 1 status in its next Tier 1 Banking Sector Report review based on Proshare’s Banking Strength Index (PBSI)) led second-tier banks in gross earnings, profitability, total assets, customer deposits, and loans and advances.

However, its non-performing loan ratio (NPLR) rose to 3.54 per cent after Wema Bank’s 2.50 per cent, while its cost-to-income ratio (CIR) settled at 49.86 per cent, which was an improvement from the previous year’s ratio.

Significantly, in its full-year 2023 results, the bank’s total assets as of December 31, 2023 has risen to N6.2 trillion.

The bank closed 2023 as the fifth best banking stock on the floor of the NGX with a share price of N10.85 and a market capitalization of N347.3 billion, depicting an annual gain of 149.4 per cent, Fidelity Bank also showcased a commendable financial performance.

Notably, it achieved a net income of N91.8 billion in the nine months ending September 2023, reflecting a substantial 162.46% year-on-year growth from the corresponding period in 2022.

Furthermore, the bank registered an impressive return on equity of 28.48 per cent during the first nine months of 2023.

The 2023 performance of the bank was similar to that of 2022 as it was one of the three banks that led the list of the best-performing banks on the NGX. The other banks are FCMB and FBN Holdings.

The research pours into the performance of thirteen of Nigeria’s largest commercial banks analyzing improvement year on year over two quarters.

The analysis revealed that the thirteen banks raked in a sum of N298.84 billion as post-tax profit between July and September 2022, representing an increase of 29.9 per cent compared to N228.54 billion recorded in the corresponding period of 2021.

The commercial banks remained resilient despite economic headwinds, which saw the nation’s aggregate GDP growth slowed to 2.25 per cent in Q3 2022 from 3.54 per cent recorded in the previous quarter and 4.03 per cent in the corresponding period of 2021.

Also, banks’ loans to customers grew by 5.5 per cent between June and September 2022 to stand at N23.76 trillion, representing a net new loan of N1.23 trillion in three months. However, this showed a slightly slower growth than the 6.81 per cent increase recorded in the comparable period of 2021.

NGX reclassification

The NGX said the reclassification became necessary because Fidelity Bank shares have been trading above the N5.00 mark since February 2023.

According to the NGX, rule 15.29 of the Rulebook of the Exchange, 2015 (Dealing Members’ Rules) notes that equities priced above N5 per share for at least four of the most recent six months of trading, or new security listings priced above N5 per share at the time of listing on NGX are classified as medium price stock.

“Fidelity Bank traded above the N5.00 mark on February 20, 2023 and has remained above the N5 mark up until close of business on 30 June 2023.

“This indicates that Fidelity Bank has been trading above N5 for at least four months in the last six months. Therefore, it should be reclassified from small price stock to medium price stock,” it pointed out.

The bank has continued to post commendable financial performance every quarter as it cements its position amongst tier-one banks in the country.

In the half-year 2023 results and for the second year running, the bank emerged as the company with the highest earnings per share on the Nigerian Exchange Limited (NGX).

According to a report, Fidelity Bank, Seplat Energy, Total Energies, Okomu Oil, Presco, Dangote Cement, MTN Nigeria, BUA Foods, First City Monument Bank (FCMB) and Geregu Power emerged as the companies with the highest earnings per share within that review period.

Earnings per share (EPS) is a company’s net profit divided by the number of common shares it has outstanding.

It also indicates how much money a company makes for each share of its stock and is a widely used metric for estimating corporate value.

A higher EPS indicates greater value because investors will pay more for a company’s shares if they think the company has higher profits relative to its share price.

Fidelity Bank recorded an earnings per share of N184 in the first half of 2023 from N79 in the first half of 2022.

The share price of the bank as of Thursday, April 25, 2024, stood at N9.00 per share as the bank traded 12.642 million shares valued at N112.071 billion in 246 deals.

Fidelity Bank’s share price movement has shown intense volatility in an upward direction over the past years. The stock price has risen from N2.52 on January 04, 2010, to N10.00 on March 15, 2023, generating a YTD return of 297 per cent.

The bank’s market capitalization as of Thursday, April 25, 2024, stood at N288.11 billion. Average volume stood at 11.76 million, share outstanding was 32.01 billion while free float was 31.72 billion

Stakeholders speak

Analysts believe the bank’s share price underlines its earnings growth and financial performance as higher dividend yields and future earnings forecasts have triggered demand in the money lender’s shares.

Over the last ten years, the bank’s share price has risen to a resistance (highest price) of N14.20 on March 05, 2024, and a support price (lowest price) of N0.76 on November 16, 2016.

According to a Lagos-based stockbroker, ‘Fidelity Bank demonstrates the classical admonition to prospective investors of entering low and selling high. Over the last eight years, Fidelity’s stock price has risen by 44.19 per cent on a compound annual basis; very few stocks could prove a better inflation hedge”.

Ambrose Omordion, Chief Research Officer at Investdata Consulting Limited, believes that this is the best time for Fidelity as the bank’s share price is doing well among its peers.

He said, “Fidelity is doing well and its share price is one of the best among its peers. This is so because the bank has recorded impressive results in its 2023 financial year. In June 2023, the bank shares rose by 32 per cent making it the nation’s best-performing bank share as of half year (June 30).

“I can only see a better bank now and in the future. The bank is a potential Tier 1 bank and the performance of the bank is a pointer to the fact that the bank will scale the recapitalisation hurdle of the Central Bank of Nigeria (CBN)”.

Prince Anthony Omojola, National Coordinator, Independent Shareholders Association of Nigeria (ISAN), asserted that “Fidelity Bank is moving up in terms of performance. They have joined those paying interim dividends and they have also dipped their hand into big money tills for huge investment. They have borrowed big to be able to handle bigger contracts and be able to reap big. The reclassification is welcomed and I hope they will not disappoint us. If they can meet expectations, the benefit will be for Nigeria”.

On his part, Sam Ndata, Doyen of Nigerian Stockbrokers and non-executive director at UIDC Securities Limited commented, “This is a good development. If a company performs well, it will surely be rewarded to earn investors’ confidence”.

Mr Boniface Okezie, the National Coordinator, Progressive Shareholders Association of Nigeria, commented, “Fidelity Bank has paid its dues in the financial services sector. It has contributed immensely to the development of the small and medium enterprises (SME) sector yet pays dividends to the shareholders. Last year, it took the market by surprise by declaring a dividend of 50k per share which had not happened in previous years. The massive investment in ICT and effective branch network shows it is ready to serve the customers in a better way and make the shareholders happy.”

Related

Business

Revealed! How Detained Binance executive planned prison escape

Published

2 days agoon

April 26, 2024Revealed! How Detained Binance executive planned prison escape

The detained Binance Holdings Limited executive, Tigran Gambaryan, has attempted to escape from Kuje Correctional Facility accordign to a report by the PUNCH.

Investigations by their correspondent revealed how Mr Gambaryan who is currently remanded in Kuje Correctional Facility, applied for a new United States of America passport, under the pretence that his seized passport was missing.

The Armenian-born Binance executive, Gambaryan who has both American and Armenian passports, told the US Embassy in Abuja that he lost his passport which is currently being held by the EFCC, impeccable anti-graft sources privy to the development but not authorised to speak, told The PUNCH on Wednesday.

Following the development, the EFCC has urged the Federal High Court sitting in Abuja to disregard Gambaryan’s bail application, while noting that the Armenian-American could flee from Nigeria like his Kenyan-British colleague, Nadeem Anjarwalla who fled to Kenya.

A source, who is privy to the investigations, revealed that “The second Binance executive, Tigran Gambaryan, who is currently remanded in Kuje prison, has planned to escape from the facility. He applied to the US embassy in Abuja to issue him a new Visa while lying that he lost his passport which was seized by the EFCC.”

Another source, who insisted on anonymity, noted that “Gambaryan could have escaped from Kuje if not for the fact that the US embassy flagged his request for a new passport. Fortunately, the US embassy immediately reached out to the EFFC, and the embassy was informed that he’s a criminal suspect whose case is currently in court for alleged money laundering – concealing the source of the $35,400, 000 generated as revenue by Binance in Nigeria knowing that the funds constituted proceeds of unlawful activity.”

Meanwhile, the EFCC had on Tuesday, urged Justice Emeka Nwite of the Federal High Court Abuja to deny Gambaryan’s bail application.

The anti-graft agency said it was too risky to admit the foreigner to bail, noting the escape of his co-defendant, Nadeem Anjarwalla, from the custody of the National Security Adviser and his escape to Kenya.

Besides, the prosecuting counsel for the EFCC, Ekele Iheanacho, told the court that the anti-graft agency uncovered an alleged plot by Gambaryan to obtain a new passport to facilitate his escape from Nigeria after the EFCC had seized his passport.

Gambaryan, his fleeing colleague, Anjarwalla, and Binance Holdings Limited are being prosecuted by the EFCC on money laundering charges.

The anti-graft agency accused them of concealing the source of the $35,400, 000 generated as revenue by Binance in Nigeria knowing that the funds constituted proceeds of unlawful activity.

Opposing Gambaryan’s bail application on Tuesday, the EFCC prosecutor said, “There was an attempt by this defendant to procure another travelling document even when he was aware that his passport was in the custody of the state. He pretended as if the said passport was stolen.”

Iheanacho told the court that within the same period that Anjarwalla fled the custody, Gambaryan also allegedly made moves to escape from custody and flee the country but was intercepted by the operatives of the commission.

“This court will be taking a grave risk to grant the defendant bail. This is also because he has no attachment to any community in Nigeria.

“The experience we have had with the man who escaped to Kenya while his United Kingdom passport is in Nigeria will certainly repeat itself if this defendant is granted bail.

“The 1st defendant (Binance) is operating virtually. The only thing we have to hold on to is this defendant. So, we pray My Lord to refuse bail to the defendant.”

Iheanacho said with the intelligence information at the EFCC’s disposal it was not safe to release the foreigner on bail.

Related

Cover Of The Week

- Zimbabwe Backs Raila's African Union (AU) Commission Bid April 27, 2024

- President Ruto: Agricultural Innovation Key to Poverty Reduction April 27, 2024

- Egypt: President El-Sisi Meets Speakers of Arab Parliaments Attending Arab Parliament Conference April 27, 2024

- Eritrean Delegation Participates at Euro-Asia Economic Forum April 27, 2024

- Seychelles: Presentation of Credentials by Ambassador Racombo to His Royal Highness of Luxembourg April 27, 2024

- United Nations Economic Commission for Africa's (ECA) Claver Gatete urges youth to raise their voice in shaping Africa’s development April 27, 2024

- Africa’s youth urged to advocate for multilateralism to secure a better future April 27, 2024

- Administrator Samantha Power Concludes Her Visit to Angola April 26, 2024

- Philippines Ambassador to Kenya discusses Blue Economy, Potential Investments, People-to-People Exchanges with Mombasa Officials April 26, 2024

- Boosting efforts to transform care for severe chronic diseases in Africa April 26, 2024

- Zimbabwe Backs Raila's African Union (AU) Commission Bid April 27, 2024

- President Ruto: Agricultural Innovation Key to Poverty Reduction April 27, 2024

- Egypt: President El-Sisi Meets Speakers of Arab Parliaments Attending Arab Parliament Conference April 27, 2024

- Eritrean Delegation Participates at Euro-Asia Economic Forum April 27, 2024

- Seychelles: Presentation of Credentials by Ambassador Racombo to His Royal Highness of Luxembourg April 27, 2024

- United Nations Economic Commission for Africa's (ECA) Claver Gatete urges youth to raise their voice in shaping Africa’s development April 27, 2024

- Africa’s youth urged to advocate for multilateralism to secure a better future April 27, 2024

Trending

-

Business6 months ago

Business6 months agoLeading Financial Platform, AAS Bounces Back Stronger, Better With Global Coin

-

celebrity radar - gossips4 months ago

celebrity radar - gossips4 months agoTripple Celebration, As AAS CEO, Jesam Micheal Emerges Fintech Expert of The Year, Launches Lounge

-

celebrity radar - gossips4 months ago

celebrity radar - gossips4 months agoJesam Micheal the philanthropist, Clears the Hospital Bills of UGEP Patients, Put Smiles On Faces Of Orphanages, Police (video)

-

Business3 months ago

Business3 months agoFintech Guru, Jesam Micheal Opens Biggest Apple Store In Africa, Reveals Why

You must be logged in to post a comment Login