Association Of Licensed Private Security Practitioners Of Nigeria (ALPSPN) Holds 3rd Annual Private Security Conference in Lagos Nigeria.

– Sanwo-Olu, Dr Solomon Arase, Dr Audi, Dr Tunji-Ojo, Others To Grace Summit

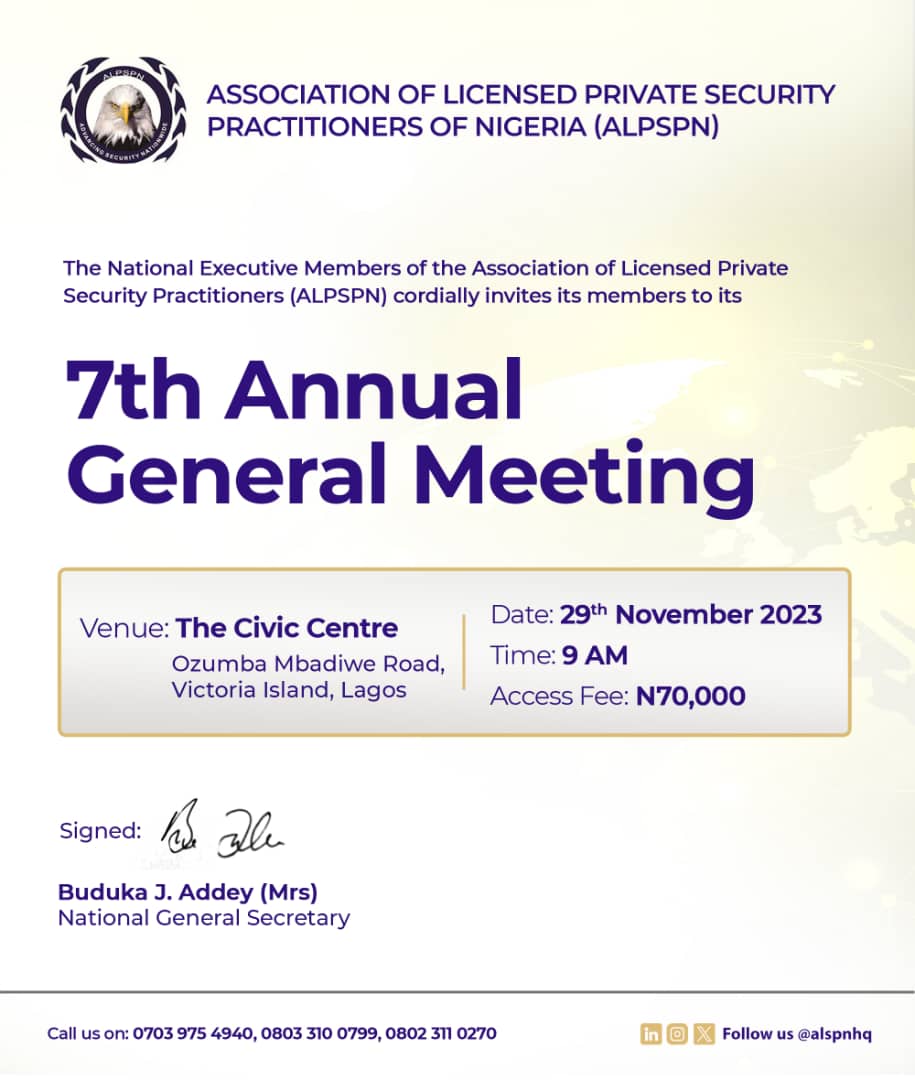

Sahara Weekly Reports That The Association of Licensed Private Security Practitioners of Nigeria (ALPSPN) – the umbrella body of all licensed private security companies in Nigeria – is hosting its 3rd Annual Private Security Conference (PSI) in Lagos Nigeria.

The summit is a convergence of over 1,450 licensed private security companies in Nigeria including government security agencies, regulating ministries, security consultants, business leaders, decision makers and other stakeholders interested in security development.

The theme of the summit, “Redefining Security – The Role of Private Security in a Changing World,” underpins the need for collaboration amongst all stakeholders to have a safe and secure home, businesses and country.

Dr. Chris Adigwu, The National President Association of Licensed Private Security Practitioners of Nigeria (ALPSPN), in his statement revealed five major reasons stakeholders should attend the Private Security Industry Summit:

1. To understand the anatomy of the private security industry.

You’ll understand the different stakeholders in the private security industry and their roles. You’ll equally understand your role in protecting your assets, your immediate environment, and Nigeria as a whole.

You’ll have a mindset shift in how you see private security companies and the industry in the 21st century. This’ll help you know how to source for and collaborate with reliable companies, improve your security, and better prevent avoidable losses.

2. You’ll understand the different ways private security can help improve your bottom line and promotion of productivity.

3. You’ll explore business opportunities with the over 2,000 stakeholders attending the conference.

4. You’ll be updated on the current security conversations, global trends, and strategies in the industry. This way, you’ll be better informed to make the right decisions in your investments in security.

5. You’ll understand how to collaborate and get the best out of your security service provider.

Interestingly, the executive Governor of Lagos State, Mr Babajide Sanwo-Olu is the Chief Guest of honour, while the host is Dr. Chris Adigwu National President ALPSPN, Dr. Ahmed A. Audi, Commandant General: Nigerian Security and Civil Defence Corps (NSCDC) as Co-host, and the Chief Host is Hon. Dr. Olubunmi Tunji-Ojo, Minister of Interior, Federal Republic of Nigeria.

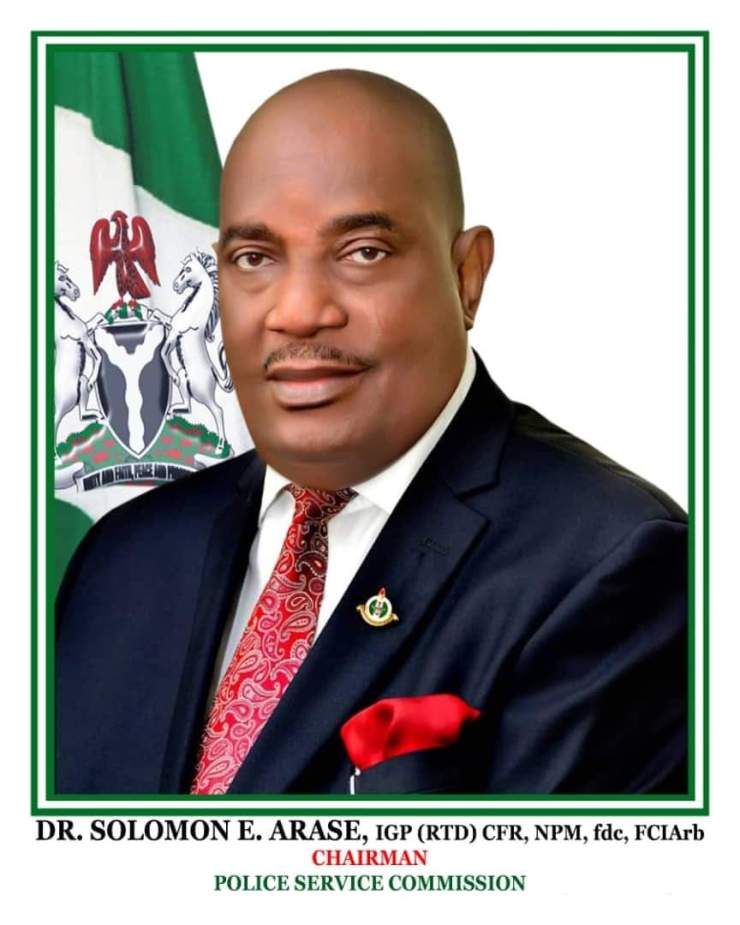

The Keynote Speakers is, Dr. Solomon E. Arase IGP (Rtd.), Chairman, Police Service Commission (PSC). The host state chairman is Mr. Babatunde Mumuni, Chairman ALPSPN Lagos State Nigeria.

Mark Otabor, anchor of the Nigeria popular TV debate show on TVC: “The Big Issue is the MC and the date is 28th November, 2023 from 9am to 4pm at the Civic Center, Victoria Island Lagos.

Access fees is N100,000 for Non- ALPSPN members While Members pay N70,000

Don’t miss this event.

Business6 months ago

Business6 months ago

celebrity radar - gossips4 months ago

celebrity radar - gossips4 months ago

celebrity radar - gossips4 months ago

celebrity radar - gossips4 months ago

Business3 months ago

Business3 months ago