Business

How David Mark illegally acquired official residence of the Senate President – FG Reveals

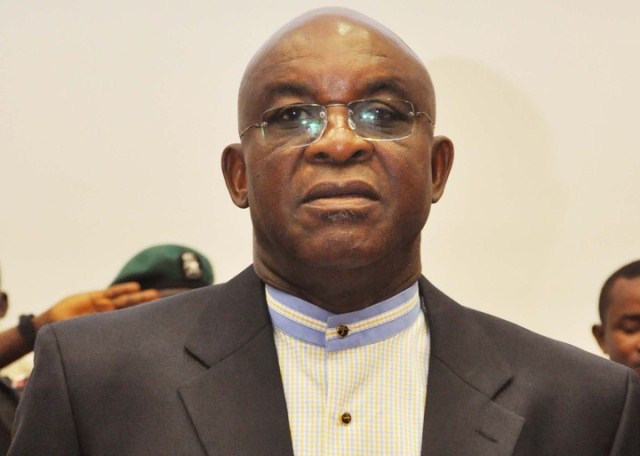

The Federal Government has accused a former Senate President, David Mark, of illegally acquiring his then official residence as his private property.

In September this year, the government, through the Special Presidential Investigation Panel for the Recovery of Public Property, which is chaired by Chief Okoi Obono-Obla, gave the former Senate President a 21-day notice to quit the mansion.

The notice to quit, however, asked Mark to “show cause” why the Federal Government should not “enforce the recovery of the property for public good.”

But Mark had quickly filed a suit before the Federal High Court in Abuja to quash all steps taken by the panel to evict him and recover the house from him.

The case has not been heard.

The PUNCH, on Monday, obtained from court sources, copies of documents, including exhibits, filed by the former Senate President in his suit challenging the recovery process.

The Senate President’s official residence is sited on 1.6 hectares of land at 1 Musa Usman Street, (also known as No. 1 Chuba Okadigbo Street), Apo Legislative Quarters, Gudu, Abuja.

According to title documents, the property comprises eight structures, made up of the main house, ADC/chief security detail’s house, guest chalet, security/generator house, boys quarters, security post, driver/servants’ quarters and chapel.

The eight structures are said to be properly spaced and linked with well-paved drive and walkways and further done with lawns.

Mark, the senator, currently representing Benue South in the National Assembly, is accused of illegally acquiring the property with the approval of former President Goodluck Jonathan despite that such property was excluded from the monetisation policy of the Federal Government.

Copies of correspondences and other documents, leading to the purchase and eventual handover of the property to Mark in April, 2011, showed that the serving senator purchased the property at a “reserved price” of N673,200,000.

Meanwhile, in his letter, dated October 28, 2010, seeking the then President Jonathan’s approval for the sale of the property, the then Minister of the Federal Capital Territory, Mr. Bala Mohammed, had indicated that the open market value of the property was N748,000,000.

In addition, the then minister specifically stated that the Federal Executive Council had, in 2004, mandated the Federal Capital Territory Administration to sell all Federal Government’s “non-essential housing units in Abuja under specific rules and guidelines.”

Exempted from this arrangement are the official residences of the Senate President, the Deputy Senate President, the Speaker of the House of Representatives and the Deputy Speaker.

He stated that the exemption was “expressly contained in the Federal Government of Nigeria’s Official Gazette No. 82, Vol. 92 of August 15, 2005.”

In justifying the request for the then President’s approval for the sale, the former minister noted that all the houses in Apo Legislative Quarters, with the exception of the official residences of the four principal officers of the National Assembly, had been sold to the legislators occupying them at the time or the general public, under the Federal Government’s monetisation arrangement.

The former minister however stated that sale of other houses in the Apo Legislative Quarters had “altered the general security provision for the area and extension, the security of the leading principal officers of the National Assembly.”

The letter added, “This lapse in the general security provision of the area led the National Assembly to unofficially rent residential accommodation for its leading principal officers in more secure areas within the city.”

It also stated that due to the security concerns, the four houses of the leading principal officers “will no longer have the status of ‘essential properties’,” hence the FCTA “has made provision in the budget to construct residential accommodation for the leading principal officers of the National Assembly where the general security is befitting the status of the officers.”

The then minister had stated that the Senate President’s residence had an open market value of N748,000,000; the Speaker’s N670,000,000; the Deputy Senate President’s N458,000,000; and the Deputy Speaker’s N348,500,000.

What appeared on the then minister’s letter as Jonathan’s hand-written approval of the request dated November 15, 2010, read, “Para 6 and 8 approved. Also see if this could be gazetted.

“N/B: Ensure that the new residences are ready early next year.”

By a letter, with reference number PRES/83/FCTA/18 and dated November 18, 2010, Jonathan conveyed his approval to the then minister’s request for the sale of the Senate President’s official residence.

The letter, addressed to the FCT minister and titled, ‘Re: Sale of Residential Houses Occupied by Leading Principal Officers of the National Assembly’, was signed by the then President’s Senior Special Assistant (Admin), Matt Aikhionbare.

The letter read in part, “I am directed to forward Reference A to you and to convey to you, Mr. President’s approval of paragraphs 6 and 8 and further directive on page 2 in line with the earlier approval of 27/06/2010.”

But by a letter with reference number SPIP/INV/2017/VOL.1/17 and dated September 5, 2017, the Obono-Obla-led Special Presidential Investigation Panel for the Recovery of Public Property insisted that Mark acquired the “national monument” in clear breach of the monetisation policy of the Federal Government.

The letter, signed by Obono-Obla and titled ‘Investigation activities: Notice to recover public property in your care’, and addressed to Mark, stated in part, “The extant Monetisation Policy of the Federal Government, as enunciated and still being implemented, excludes all Principal Officers of the National Assembly and hence places the responsibility on the Federal Government to provide accommodation for them, same which you allegedly illegally appropriated.”

The letter asked Mark “to take steps within the next 21 days to vacate the said property or show cause why the government of the Federal Republic of Nigeria should not enforce the recovery of the said property for public good.”

It added, “You are further being notified pursuant to the Recovery Property (Special Provisions) Act, 1983, to complete and return within 30 days the attached Form B (Declaration of Assets Form) to the office of the undersigned.”

But Mark, through his lawyer, Ken Ikonne, filed the suit marked FHC/ABJ/CS/1037/2017 before the Federal High Court in Abuja, insisting that he legally acquired the property through a “walk-in bid” at the behest of the FCTA.

He also contended that the recovery process initiated by the Federal Government was unconstitutional.

The Attorney General of the Federation and Obono-Obla are joined as respondents to the suit.

Among his prayers, Mark sought “a declaration that the unilateral declaration by the defendants that the plaintiff’s acquisition” of the property “is illegal and the order compelling the plaintiff to vacate the aforesaid property” without affording him “a hearing,” amounted to a denial of his “fundamental rights to fair hearing and property, and are therefore unconstitutional and void.”

He also sought a declaration that “the service by the defendants on the plaintiff of the Notice to Declare His Assets (Form A) and the Assets Declaration Form B is unconstitutional and thus void.”

He sought “an order quashing” the defendants’ declaration of his acquisition of the aforesaid property as illegal, and another order “quashing the order of the defendants” compelling him to vacate the aforesaid property.”

He also applied for an order of the court “quashing the Notice to Declare Assets Form A and the Assets Declaration Form B” served on him and “a perpetual injunction restraining the defendants, jointly and severally” or through any agent “from evicting the plaintiff from the said property, or recovering same from him.”

Mark said he was occupying the said property in 2010 when the FCTA, “citing security concerns”, decided to construct new official residences for the leadership of the National Assembly, including the President of the Senate, in a more secure and conducive environment.”

According to the former Senate President, the FCTA had insisted that the reserve price of N673,200,000.00 reflected the open market value of the property.

He added that the valuers of the FCT that inspected and carried out a valuation of the property had put the “replacement cost” of the property at N492,700,000.

He said he duly accepted the offer on April 21, 2011 and paid the “agreed purchase price to the Ad hoc Committee on Sale of FGN Houses” on April 27, 2011.

He said the house now served as his family home in Abuja.

But he said surprisingly he was on October 9, 2017 served a letter of investigation activities dated September 5, 2017, by the Okono-Obla-led panel.

He stated in his suit that, “the defendants (AGF and Obono-Obla) unilaterally, and without affording me any hearing at all, and without any order of any court, declared my acquisition of the said property illegal, and ordered me to vacate the said property failing which the defendants would enforce the recovery of the property against me.”

EFCC grills Benue senator for seven hours, seizes passport

Meanwhile, the Economic and Financial Crimes Commission, on Monday, interrogated the immediate past Senate President, David Mark, for seven hours, The PUNCH has learnt.

Impeccable sources within the EFCC told one of our correspondents that Mark’s passport was also seized before he was allowed to go on an administrative bail.

The PUNCH learnt that Mark, who served as Senate President from 2007 to 2015, arrived at the Abuja office of the EFCC around 12noon and was released at 7pm.

The source added, “The former Senate President arrived around 12pm and spent seven hours responding to several questions from detectives.

“He was released at 7pm on the condition that he must submit his passport to the commission which he did.

“Senator Mark is expected to return soon to answer more questions”

The former Senate President is expected to account for over N5.4bn slush cash and campaign funds allegedly traced to him.

He was alleged to have received over N500m from the government of former President Goodluck Jonathan during the build-up to the 2015 presidential election.

The money is alleged to have been part of the $2.1bn meant for arms procurement.

The Senator, who has been representing Benue-South Senatorial District since 1999, is also accused of sharing N2.9bn to his colleagues while presiding over the upper legislative chamber.

The former Senate President has, however, denied all the allegations levelled against him.

In a statement on Sunday, Mark said, “To set the records straight, Senator Mark was invited by the EFCC via a letter addressed to the National Assembly to answer questions on the 2015 presidential election campaign funds as it concerned Benue State.

“As a law-abiding citizen, Senator Mark honoured the invitation.

“Curiously, they also alleged that the PDP paid over N2bn into the National Assembly’s account which he, as then President of the Senate, allegedly shared among the 109 senators, including PDP, Action Congress of Nigeria and All Nigerian Peoples Party (members) in 2010.

“Again, to the best of his knowledge, Senator Mark is not aware of such transactions. This simply did not make sense to any right thinking member of society.

“Senator Mark wondered why anybody would think that PDP will pay money into National Assembly account. He, however, clarified all the issues raised before returning home.”

Business

Nigeria’s Inflation Drops to 15.10% as NBS Reports Deflationary Trend

Nigeria’s headline inflation rate declined to 15.10 per cent in January 2026, marking a significant drop from 27.61 per cent recorded in January 2025, according to the latest Consumer Price Index (CPI) report released by the National Bureau of Statistics.

The report also showed that month-on-month inflation recorded a deflationary trend of –2.88 per cent, representing a 3.42 percentage-point decrease compared to December 2025. Analysts say the development signals easing price pressures across key sectors of the economy.

Food inflation stood at 8.89 per cent year-on-year, down from 29.63 per cent in January 2025. On a month-on-month basis, food prices declined by 6.02 per cent, reflecting lower costs in several staple commodities.

The data suggests a sustained downward trajectory in inflation over the past 12 months, pointing to improving macroeconomic stability.

The administration of President Bola Ahmed Tinubu has consistently attributed recent economic adjustments to ongoing fiscal and monetary reforms aimed at stabilising prices, boosting agricultural output, and strengthening domestic supply chains.

Economic analysts note that while the latest figures indicate progress, sustaining the downward trend will depend on continued policy discipline, exchange rate stability, and improvements in food production and distribution.

The January report provides one of the clearest indications yet that inflationary pressures, which surged in early 2025, may be moderating.

Bank

Alpha Morgan to Host 19th Economic Review Webinar

Alpha Morgan to Host 19th Economic Review Webinar

In an economy shaped by constant shifts, the edge often belongs to those with the right information.

On Wednesday, February 25, 2026, Alpha Morgan Bank will host the 19th edition of its Economic Review Webinar, a high-level thought leadership session designed to equip businesses, investors, and individuals with timely financial and economic insight.

The session, which will hold live on Zoom at 10:00am WAT and will feature economist Bismarck Rewane, who will examine the key signals influencing Nigeria’s economic direction in 2026, including policy trends, market movements, and global developments shaping the local landscape.

With a consistent track record of delivering clarity in uncertain times, the Alpha Morgan Economic Review continues to provide practical context for decision-making in a dynamic environment.

Registration for the 19th Alpha Morgan Economic Review is free and can be completed via https://bit.ly/registeramerseries19

It is a bi-monthly platform that is open to the public and is held virtually.

Visit www.alphamorganbank to know more.

Business

GTBank Launches Quick Airtime Loan at 2.95%

GTBank Launches Quick Airtime Loan at 2.95%

Guaranty Trust Bank Ltd (GTBank), the flagship banking franchise of GTCO Plc, Africa’s leading financial services group, today announced the launch of Quick Airtime Loan, an innovative digital solution that gives customers instant access to airtime when they run out of call credit and have limited funds in their bank accounts, ensuring customers can stay connected when it matters most.

In today’s always-on world, running out of airtime is more than a minor inconvenience. It can mean missed opportunities, disrupted plans, and lost connections, often at the very moment when funds are tight, and options are limited. Quick Airtime Loan was created to solve this problem, offering customers instant access to airtime on credit, directly from their bank. With Quick Airtime Loan, eligible GTBank customers can access from ₦100 and up to ₦10,000 by dialing *737*90#. Available across all major mobile networks in Nigeria, the service will soon expand to include data loans, further strengthening its proposition as a reliable on-demand platform.

For years, the airtime credit market has been dominated by Telcos, where charges for this service are at 15%. GTBank is now changing the narrative by offering a customer-centric, bank-led digital alternative priced at 2.95%. Built on transparency, convenience and affordability, Quick Airtime Loan has the potential to broaden access to airtime, deliver meaningful cost savings for millions of Nigerians, and redefine how financial services show up in everyday life, not just in banking moments.

Commenting on the product launch, Miriam Olusanya, Managing Director of Guaranty Trust Bank Ltd, said: “Quick Airtime Loan reflects GTBank’s continued focus on delivering digital solutions that are relevant, accessible, and built around real customer needs. The solution underscores the power of a connected financial ecosystem, combining GTBank’s digital reach and lending expertise with the capabilities of HabariPay to deliver a smooth, end-to-end experience. By leveraging unique strengths across the Group, we are able to accelerate innovation, strengthen execution, and deliver a more integrated customer experience across all our service channels.”

Importantly, Quick Airtime Loan highlights GTCO’s evolution as a fully diversified financial services group. Leveraging HabariPay’s Squad, the solution reinforces the Group’s ecosystem proposition by bringing together banking, payment technology, and digital channels to deliver intuitive, one-stop experiences for customers.

With this new product launch, Guaranty Trust Bank is extending its legacy of pioneering digital-first solutions that have redefined customer access to financial services across the industry, building on the proven strength of its widely adopted QuickCredit offering and the convenience of the Bank’s iconic *737# USSD Banking platform.

About Guaranty Trust Bank

Guaranty Trust Bank (GTBank) is the flagship banking franchise of GTCO Plc, a leading financial services group with a strong presence across Africa and the United Kingdom. The Bank is widely recognized for its leadership in digital banking, customer experience, and innovative financial solutions that deliver value to individuals, businesses, and communities.

About HabariPay

HabariPay is the payments fintech subsidiary of GTCO Plc, focused on enabling fast, secure, and accessible digital payments for individuals and businesses. By integrating payments and digital technology, HabariPay supports innovative services that make everyday financial interactions simpler and more seamless.

Enquiries:

GTCO

Group Corporate Communication

[email protected]

+234-1-2715227

www.gtcoplc.com

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING

You must be logged in to post a comment Login