society

Industrialists begs Tinubu over destruction of his company by Banks,other to intervene By Ifeoma Ikem

Industrialists begs Tinubu over destruction of his company by Banks,other to intervene

By Ifeoma Ikem

An industrialist, Chief Executive Officer of Algrain Foods Limited, Chief Anthony Obidulu has called on President Bola Tinubu, the Senate President, Lagos State Governor Babajide Sanwu-Olu and other well meaning Nigerians to save indigenous entrepreneurs and industrialists from what he described as the “crookedness with which some commercial banks manipulate accounting books relating to loans in a manner that cripple businesses in the country to the great advantage of banks.”

Addressing journalists in Lagos during a press briefing, Obidulu said he had been running the food company with about 300 direct employees and over 2800 indirect personnel who were deriving their means of livelihood from the company before the company got involved in a criminally orchestrated seizure by the First City Monument Bank and its collaborators with a view to destroying it.

Taking journalists round the multibillion naira production complex located in Canal Estate in Okota area of Lagos, he disclosed that all the assets of the company worth not less than N20billion had been criminally carted away by agents of the FCMB in the guise of carrying out a court judgment that was dubiously procured.

According to him,“Our company is one of the beneficiaries of the Federal Government’s intervention loans tagged Small and Medium Enterprises Credit Guarantee Scheme (SMECGS) in 2011.

We got a N100 million of the intervention fund through the bank (FCMB) because one of the conditions for getting the fund was that one must go through a commercial bank to access it. So we opened an account with the bank,from where the fund was accessed. But unfortunately,as the CEO what I personally thought would boost our business and increase the company’s economic base, turned out to be one of our worst economic decisions as a businessman.

“The N100 million was guaranteed by the Federal Government of Nigeria to the tune of 80% (Principal and interest) and tenure of 60 months with12months moratorium. Final date of repayment ought to be November, 2016 in respect of which the Central Bank of Nigeria issued a Guarantee Certificate to First City Monument Bank Plc.dated 15th March,2012 containing the afore-mentioned terms which the Bank concealed from the Federal High Court in securing the judgment they are peddling around.”

Pointing that “the action of the bank became a nightmare which has crippled our business since 2017 and continuing. The bank, cooked up some fictitious figures, and alleged that we owed about N350 million.They went to court behind us,procured an order to take over the company and eventually sealed the company.

As at the time they went to court, we had only touched the Federal Government’s money, not the bank’s money.The offer letter that has not been drawn down is what they relied on to convince the court that our company owed them. The judge did not look at the drawdown, while looking at the offer letter, and he gave the judgment without telling them how much money they can recover from Algrain Foods Limited, thereby giving them an open ticket that has led to the looting that has taken place in the factory as moveable assets worth over N20billion (Twenty Billion Naira) have been stolen from the factory with the aid of Mobile Policemen illegally procured from Mopol 20, Ikeja, Lagos.

“Drawdown means you have touched the money. For example, they gave you N100 million, you withdrew N80 million, and then, N20 million remains with the bank and attracts no interest. So,they used the offer letter and other manipulations to go to court. They had no right in the first place to enforce the loan which was not even due for repayment as at the time they appointed the Receiver/Manager because it has a tenure of 60 months,with 12 months moratorium.

“Final payment was to be due in November, 2016 (5th year anniversary of the facility). In fact the SMECGS guidelines issued by the Central Bank of Nigeria talks of 8 years tenure; it was an intervention fund for Small and medium enterprises engaged in the Agriculture value chain.We did not take any loan from the FCMB because there was no drawdown even on their own N205million (Two Hundred and Five Million Naira, they encouraged us to take in case of financial emergency. Neither was any such money utilized by our company If they claim otherwise, let the bank show any application to utilize this sum of money by Algrain Foods Limited,” he stated.

“Having played a fast one on our company by the bank (due to my absence from the country as I was overseas attending a conference) which has now taken over the company, we did not know what to do and where to start. In this desperation, after three months, we initially offered to give the bank N150 million so that the company could be re-opened temporarily.They said we should put it in writing and we did but they did not accept it. We wanted to use that period to study the documents they presented to the court to really understand what actually happened, but the bank demanded N450 million. It was at this point we assembled a team of experts in accounting, auditing and banking, as well as legal experts to assist us fight the legal battle that was imminent.

“Regrettably, the first thing the bank did was to overwhelm our team in a manner that created some ambiguity. The team reported that the bank was wrong to have said we owed them N350 million but rather said what we owed was N280 million. As the CEO of the company, I personally began to suspect that something was wrong and I used my contact to find out exactly what was happening. I got answers that confirmed my suspicion. So, we disbanded that team and set up a new team of lawyers, accountants, auditors and ex-bankers. We set up four accounting around the world, one in Toronto, Canada, one in Holland, another one in Enugu, and the fourth one was in Lagos. After two weeks of painstakingly looking into the books, the account was negative indicating that we were not owning the commercial bank.”

According to Obidulu, it is quite unimaginable how FCMB and its collaborators could get a court judgment that purportedly gave out a company with assets worth over N20billion to a receiver/manager Mr. Emmanuel Adeyeye Oyebanji (Senior Advocate of Nigeria) for an alleged debt of N350million. Shockingly and surprisingly, the assets had been sold to a foreign company which was in competition. “It is disheartening to say that a Senior Advocate of Nigeria, Emmanuel Oyebanji, was appointed as Receiver/Manager by CSL Trustees Limited on behalf of First City Monument Bank (FCMB) when issues revolving around the disputed N350million loan had not been resolved. The Receiver Manager has converted, and sold assets worth about N20 billion belonging to our company Algrain Foods Limited- located at 15/17, Canal Avenue, Canal Estate, Okota, Lagos.”

Further, he asked “how can a judge give order that they should go and sell our company without ascertaining how much we owed. It was wrong to do so. That kind of judgment is what has killed many Nigerian businessmen. However, the Appeal Court ruling of 5th December, 2023 proved that the Judiciary can live up to expectation if the will is there as they permitted us to present the concealed document before the Court to determine the pending appeals. The document they concealed was what the judges relied on. The statement in the judgment said, ‘If the judge in the lower court had seen that document, he would not have given them that judgment meaning the judgment that empowered them to seal off my company was wrong. One of the ongoing appeals now in the court by Algrain Foods Limited is for the Court to give limitation order on what can be sold from the company, assuming the alleged N350million indebtedness is proved beyond any doubt.

Speaking on First Bank’s involvement, the Algrains boss said “the FCMB having seen that we were fighting back, involved First Bank of Nigeria which our company had a business dealing with, in the past to join forces to fight us. The two banks collaborated to put pressure on me that that our company owed them. The official from the First Bank was in my place several times looking for something to rope our company in. He had brought one programme and said they would give us N50 million in Dangote Flour line, to be repaid at every 60 days interval without interest. And we will put that money towards a flour project.

”We accepted and decided to patronise them. They disbursed N40million worth of flour and before they took our company, we had paid N27 million, remaining N13million out of which we had placed order for N4million worth of flour not supplied before the closure of the company. But the First Bank of Nigeria joined FCMB to take over the company. They came under N13 million to seal the place but when they wrote us, they said we owed them N155 million. When the books were dissected, we found out that we had overpaid them. So, we are in court with them on accusation of fraud.

The industrialist is therefore appealing to the Inspector General of Police to also intervene in the matter as some mobile policemen suspected to have been wrongly engaged in the carting away and sales of the machinery and other movable assets of Algrain Foods Limited (which is located on hectares of land) to a foreign company and other buyers. On tour of the premises by journalists, it was discovered that apart from the expansive warehouses and spaces that used to house production materials, machines and finished goods, not a single machine, forklift or vehicle was seen. Over forty trucks and other vehicles belonging to Algrains Food Limited had reportedly been sold by the receiver/manager based on the purported court judgment which has been challenged on appeal.

society

HIGH CHIEF CHETACHI NWOGA-ECTON HONOURED BY IMO STATE HAUSA, IGBO AND YORUBA COMMUNITIES, EMPOWERS THE UNDERPRIVILEGED WITH CASH GIFTS AND TOOLS

*HIGH CHIEF CHETACHI NWOGA-ECTON HONOURED BY IMO STATE HAUSA, IGBO AND YORUBA COMMUNITIES, EMPOWERS THE UNDERPRIVILEGED WITH CASH GIFTS AND TOOLS

An atmosphere of joy and celebration filled Owerri Municipal as High Chief Chetachi NWOGA-ECTON — Adaure, Ada Imo and Uwar Marayu of the Northern Community in Imo State — led her team from Abuja to Owerri for a humanitarian outreach empowerment programme tagged Mission of Mercy.

The outreach, organized under the auspices of the When In Need Foundation and the All Life Matters Humanitarian Foundation, saw the distribution of cash gifts and skill acquisition equipment worth millions of naira to underprivileged and vulnerable members of the Igbo, Hausa and Yoruba communities in Owerri Municipal.

The event was hosted by HRH Alhaji Baba Suleiman, Sarkin Hausawa of the Northern Community in Imo State. He was joined by the Chairman of the Imo State Council of Traditional Rulers and Chairman of the South East Council of Traditional Rulers, HRM Eze Dr. E. C. Okeke, CFR, who was represented by HRH Eze Engr. Fredrick Nwachukwu, Deputy Chairman of the Owerri Zone Council of Traditional Rulers. Also present was the host traditional ruler, HRH Eze Austine Possible Uche of Owerri Municipal.

Other royal fathers in attendance included HRH Eze Dr. Clinton Uboegbulam of Umuororonjo, HRH Eze Peter Njemanze of Amawom, HRH Eze Kelvin Tochukwu Ihebom of Umuihugba-Umuodu Communities, and HRH Alhaji Oba Musibau Aladeji, the Oba of the Yoruba Community in Imo State. The Chief Imam of Owerri Central Mosque, Alhaji Barr. Suleiman Njoku, was also present.

Dignitaries at the occasion included Alhaji Ibrahim Saley, former Secretary of the Imo State Muslim Pilgrimage Board; Alhaji Hassan Babidi, former Special Adviser on Northern Affairs under Governor Emeka Ihedioha; Alhaji Ibrahim Suleiman Ibrahim, Special Adviser to Governor Hope Uzodimma on Northern Affairs; and Hajiya Fatima Hamza, Special Adviser on Northern Women Affairs, Gender and the Vulnerable, among others.

A special appearance was made by Yahaya Moh’d Kyabo Fagge, FCIML (USA), Dan Darman Jiwa Wakilin Sarkin of Jiwa Ward in the Federal Capital Territory, Abuja. He offered prayers and words of encouragement to High Chief Chetachi NWOGA-ECTON, praising her extensive humanitarian services which, he noted, have impacted many communities across Northern Nigeria and beyond. He further described her as an adopted daughter of his emirate, acknowledging her significant contributions to the Jiwa community.

Speaking through his representative, HRM Eze Dr. E. C. Okeke, CFR commended the philanthropist’s numerous good works, noting that they justified the traditional recognition conferred upon her by the Imo State Council of Traditional Rulers.

In his goodwill message, Alhaji Ibrahim Saley cited verses from the Qur’an, highlighting examples of individuals who used their wealth to uplift the poor and were rewarded by Allah. He encouraged her to remain steadfast in her humanitarian service.

While distributing the items and cash gifts, High Chief Chetachi NWOGA-ECTON expressed deep appreciation to the Hausa, Igbo and Yoruba communities for honouring her with the traditional title “Uwar Marayu,” meaning “Mother of Orphans.”

She thanked HRM Eze Dr. E. C. Okeke, CFR, whom she described as a father figure, as well as other traditional rulers who graced the occasion.

She reflected on her humble beginnings, recalling a personal vow she made to God while struggling to survive as a street hawker — that if blessed with wealth, she would dedicate her resources to serving humanity. She expressed gratitude to God that the vision has become a reality through programmes such as the Mission of Mercy.

In his closing remarks, the host, HRH Alhaji Baba Suleiman, appreciated High Chief Chetachi NWOGA-ECTON for her generosity towards the less privileged in his community. He recounted how, after consultations with his cabinet, the council resolved to honour her with the title “Uwar Marayu” in recognition of her selfless service.

According to him, in appreciation of the honour bestowed upon her, the philanthropist provided financial support running into millions of naira, which was used to procure skill acquisition equipment and grants for traders and vulnerable individuals.

Items distributed included sewing machines, barbing kits, salon tools, and wheelbarrows. Beneficiaries also received food items such as 50 kg bags of rice and garri, cartons of noodles, loaves of bread, and other essential supplies.

The Mission of Mercy outreach not only strengthened unity among the Hausa, Igbo and Yoruba communities in Imo State but also reaffirmed High Chief Chetachi NWOGA-ECTON’s commitment to humanitarian service and community development.

society

Only Fools Assume They Can Fight the State Like El-Rufai Did

Only Fools Assume They Can Fight the State Like El-Rufai Did — Ope Banwo

Public affairs commentator Ope Banwo has described as “strategic folly” the assumption that a former political office holder can openly confront the Nigerian state without consequences.

Banwo made the remarks while analysing the recent detention of former Kaduna State governor Nasir El-Rufai, which he said underscores the imbalance between individual ambition and institutional power.

“Only fools believe they can challenge the state the way El-Rufai did and continue life as usual,” Banwo stated. “The Nigerian state is not a debating club.”

He noted that El-Rufai repeatedly made grave allegations against government institutions on national platforms, including claims of conspiracies and surveillance, without publicly providing evidence. According to Banwo, such statements, whether true or not, inevitably provoke a response from authorities determined to maintain control.

Banwo explained that when a former official challenges state authority, it is often interpreted not as dissent but as defiance. “The state reacts to defiance, not arguments,” he said.

He further argued that El-Rufai appeared to overestimate his political backing, assuming that his past influence would shield him from institutional action. “That assumption collapsed the moment power called his bluff,” Banwo added.

According to him, the involvement of agencies such as the Economic and Financial Crimes Commission and the Department of State Services illustrates how swiftly the machinery of state can move once a decision is made.

Banwo also highlighted the public’s muted reaction as a crucial lesson. “There were no mass protests. That silence shows the difference between perceived influence and real leverage,” he said.

He stressed that political power in Nigeria is sustained by active control of institutions, not by reputation. “Once you lose the levers, your bravado becomes a liability,” Banwo noted.

He concluded that El-Rufai’s experience should caution other former power brokers against mistaking visibility for authority. “Fighting the state without power is not courage; it is miscalculation,” he said.

society

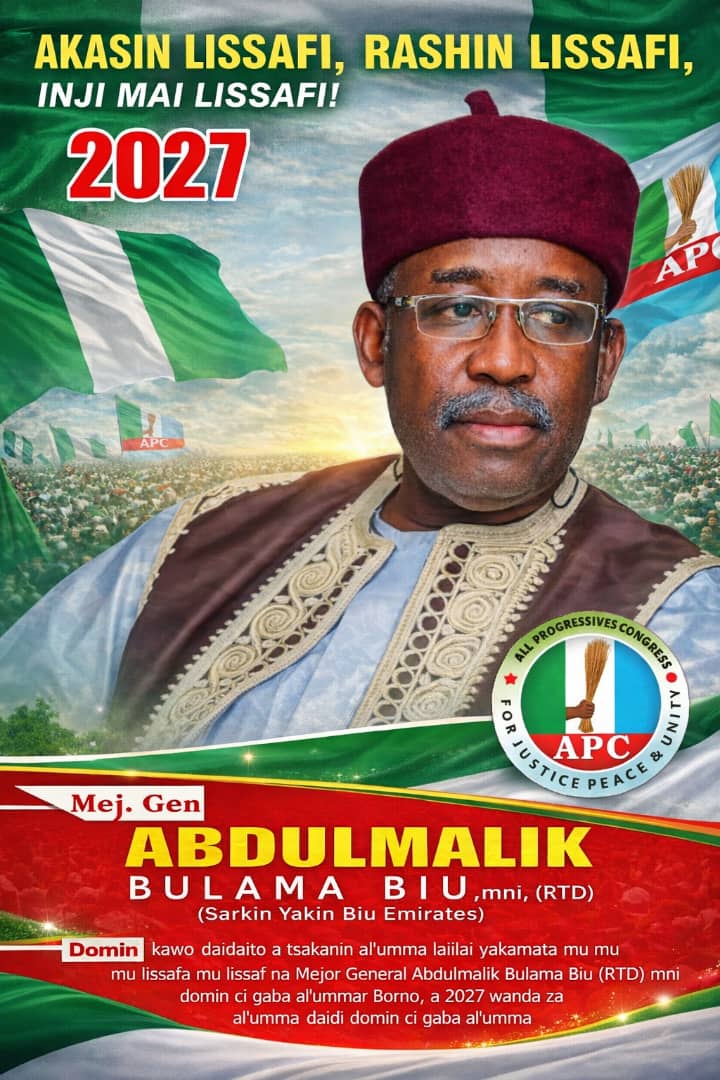

GENERAL BULAMA BIU APPLAUDS SUCCESSFUL APC CONGRESSES, URGES NEW EXECUTIVES TO FOCUS ON GOOD GOVERNANCE

GENERAL BULAMA BIU APPLAUDS SUCCESSFUL APC CONGRESSES, URGES NEW EXECUTIVES TO FOCUS ON GOOD GOVERNANCE

Major General Abdulmalik Bulama Biu (Rtd), mni, Sarkin Yakin Biu, has extended his heartfelt congratulations to the newly elected Ward and Local Government Executives of the All Progressives Congress (APC) following the successful conduct of the party congresses across Borno State.

In a statement he personally issued to mark this significant milestone, General Biu commended the peaceful and well-organized nature of the congresses, highlighting them as a testament to the unity, maturity, and democratic spirit that characterize the APC. He praised the leadership, stakeholders, and dedicated members of the party for their commitment and discipline, which contributed to the smooth and credible outcome of the elections.

Addressing the newly elected executives, Biu emphasized that their victory is not just an honor, but a mandate for greater service, responsibility, and sacrifice. “Our party faithful look up to you to help shape leadership choices that are credible, experienced, and deeply committed to delivering the dividends of democracy to our people,” he stated, urging them to work sincerely and fairly to strengthen the party at the grassroots level.

He called upon the new leaders to promote unity among members and support good governance to ensure the continued progress of Borno State and the nation as a whole.

In closing, Major General Biu assured the new executives of his unwavering support and extended his best wishes for their tenure, wishing everyone a prosperous and blessed Ramadan.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING