Business

Shareholders Commend FCMB’s performance in 2014; Approve N25 kobo Dividend

Shareholders of FCMB Group Plc have unanimously approved the payment of a cash dividend of 25 kobo per ordinary share, for the year ended December 31, 2014. The approval came at the 2nd Annual General Meeting (AGM) of FCMB Group Plc held in Lagos on Thursday, April 23, 2015.

Commenting on the development and the financial statements of the Group, the Coordinator of Independent Shareholders Association of Nigeria (ISAN), Sir Sunny Nwosu, commended the Board and Management of FCMB Group Plc for the performance and dividend payment, despite the particularly challenging operating environment for banks in 2014. He added that, ‘’the increase in the Group’s profit from N16b in 2013 to N22b in 2014 is commendable. It is a clear signal that things are looking up. We are also happy that FCMB has emerged as a strong player in retail banking and from what we have seen so far, we are optimistic that the Bank will continue to wax stronger’’.

On his part, the National Chairman of Shareholders’ Trustees Association of Nigeria, Alhaji Mukhtar Mukhtar, said, ‘’theresult is very wonderful, despite the very harsh economic environment. The FCMB has been able to give us a wonderful result. We are very satisfied. The 22k dividend is very encouraging. Profit after tax has gone up, total assets has increased. We are very impressed with the result. I congratulate the current executive management of the Bank for a job well done’’. On the refreshed corporate identity of FCMB, Alhaji Mukhtar described the move as welcome development that will help the Bank become more visible and connect better with customers.

Speaking at the AGM, the Chairman of FCMB Group, Dr. Jonathan Long, stated that the Group, which comprises First City Monument Bank Limited, FCMB Capital Markets Limited and CSL Stockbrokers Limited, ‘’has achieved a strong and sustained growth over the past three years’’, adding that during the past year, the Group continued the profitable development of its core banking, capital markets and stock-broking businesses’’. Mr. Long assured that with the implementation of the Group’s supervisory structure, ‘’we are confident that this will help us to consolidate the gains made over the past years and face the economic challenges which we are confronted in 2015’’.

The Managing Director of FCMB Group Plc, Mr. Peter Obaseki, noted that, “the Group is on track to deliver on its promise to its various shareholders’’. He continued by explaining that the Financial Holding Company structure adopted by FCMB in 2013 has given, ‘’opportunity for us to diversify our revenue sources and minimise our exposure to the risks inherent in some of the businesses in our portfolio of investments’’. Mr. Obaseki stated that despite regulatory and macro-economic challenges, ‘’our future outlook is bright, our capital base remain strong, the bank’s strategies are yielding results and we will focus more improving contribution to revenue from the non-banking businesses, especially in the wealth management space’’.

Also speaking, the Group Managing Director/Chief Executive of First City Monument Bank Limited, Mr. Ladi Balogun, pointed out that the Bank made considerable progress on the priorities it set out last year, including accelerating market share in retail banking, primarily through consumer finance; enhanced investment in customer experience as a means of growing customer base and containment of operating expense. ‘’Our capital positioned strengthened over the year. We successfully raised N26 billion tier 2 capital which helped us maintain a reasonable capital adequacy ratio, at 19 percent. We remain well placed to meet expected future growth requirements’’, he said.

Mr. Balogun disclosed that following the Bank’s renewed focus on retail banking, ‘’we acquired 500,000 customers in 2014. We also supported 278,518 borrowing customers during the year with loan disbursements which demonstrates the broad impact we are having on the economy’’. According to him, the Bank also provided greater convenience for its retail customers by rolling out 245 new ATMs, just as it migrated more customers to alternate channels.

On the future outlook, he said that among other priorities, ‘’our e-banking and cards business will be a key focus area for non-interest income growth to replace COT, bring greater convenience and consistency of experience to our customers. We will continue to moderate our operating expenses and cost of risk by consolidating our risk acceptance criteria in an increasingly high-risk environment, while focusing increasingly on deposit growth’’. The GMD/CEO of First City Monument Bank told the shareholders that, ‘’we are very much on course to build a dominant retail banking business well diversified across lending, savings deposits, bancassurance and payments. Overall, we are confident this progress and momentum will be sustained, as we continue to grow our market share through service excellence and improve our efficiency ratios’’.

The audited accounts of FCMB Group Plc for the year ended December 31, 2014 showed a stellar performance. The Group’s total assets grew by 17 per cent to N1.2trillion, deposits rose by 6% to N755billion. All the Group’s subsidiaries achieved progress during 2014 with FCMB Capital Markets Limited recording a profit before tax of N1 billion, an increase of 145% compared to that of 2013, while CSL Stockbrokers Limited witnessed a 127 per cent surge in profit before tax to N377million.

First City Monument Bank Limited, the banking subsidiary of the Group, also sustained the soundness of its balance sheet and credit standing. Going by the 2014 financial statements, the recorded a 26% improvement in profit before tax from N17.8 billion in 2013 to N22.5billion in 2014. Net revenue was up by 16.7% to N96.1 billion in 2014. This was driven mainly by a stronger growth of 13 percent in interest income as against the 2 percent reduction in the corresponding interest expense. Overall, the Bank’s balance sheet grew by 15 percent from N998.71 billion in 2013 to N1.15trillion in 2014. The banks earnings per share (EPS) increased by 38 percent to 112k in 2014 from 81k in 2013. Return on average equity (ROAE) increased to 14.58 percent in 2014 from 11.61 percent in 2013, while the return on average assets (ROAA) jumped to 2.05 percent in 2014 from 1.67 in 2013.

Recently, the Bank opened another chapter in its evolution as it unveiled a refreshed corporate identity. Its colours of black and gold which spoke to an exclusive audience have been replaced by a vibrant combination of purple and yellow, speaking to a broader audience. The logo has also been modified to be slightly less formal and more contemporary, yet retaining a distinctly FCMB feel. At the unveiling of the refreshed corporate identity, Mr. Balogun said that, ‘we have reached a tipping point in our evolution, and we feel we are now ready to wear a new look that is reflective of not only where we are, but also where we are going. In doing this, we have set ourselves a long term vision to be the premier financial services group of African origin. The diversity of our business is bringing greater resilience and strength. Steadily this strength is revealing itself in our financial performance’’.

He further explained that, ‘’at FCMB we believe that our future is intertwined with the collective future of our customers. We do not believe that we can succeed if you do not. Hence, we will reinforce our position of being an inclusive lender. We will support sectors that will drive the prosperity of the markets in which we operate. We will bring greater accessibility to a broad range of financial services. We are optimistic about the future and determined, whatever the challenges, to make this happen for the benefit of all stakeholders’’

Business

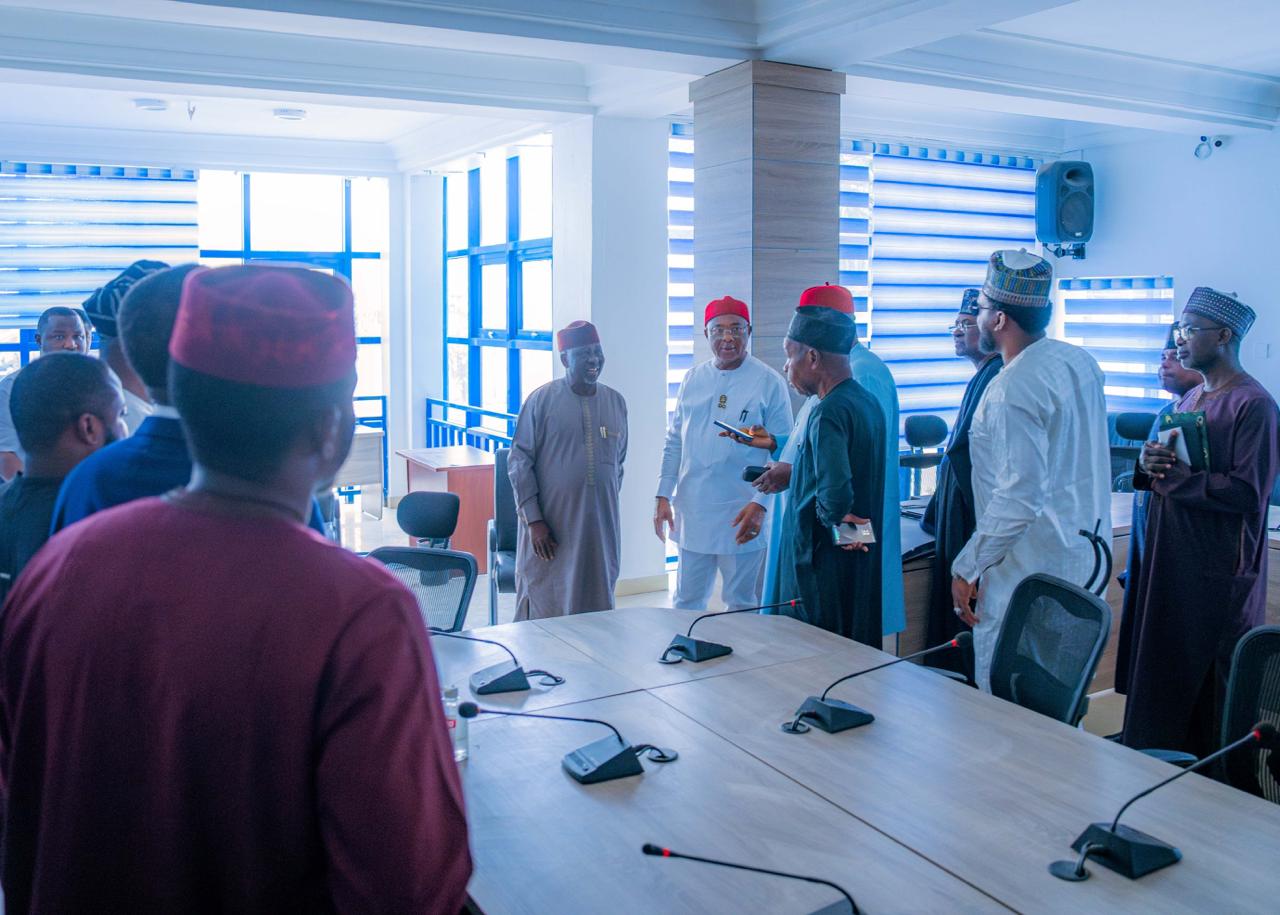

Renewed Hope Ambassadors Inspect RHA Secretariat

Renewed Hope Ambassadors Inspect RHA Secretariat

Renewed Hope Ambassadors, led by its Director-General and the Governor of Imo State, Hope Uzodinma, alongside Zonal Coordinators (NW, NC, SE), the Media & Publicity Directorate, and other key stakeholders, inspected the RHA Secretariat two days after President Bola Tinubu unveiled the Renewed Hope Ambassadors grassroots engagement drive in Abuja.

Business

Harmony Gardens’ Ibeju-Lekki Portfolio Crosses $1bn

Harmony Gardens’ Ibeju-Lekki Portfolio Crosses $1bn

Harmony Garden & Estate Development Limited has expanded its development activities across Ibeju-Lekki, pushing the projected long-term value of its estate portfolio beyond $1 billion.

Led by Chief Executive Officer Hon. Dr. Audullahi Saheed Mosadoluwa, popularly know Saheed Ibile, the company is developing seven estates within the Lekki–Ibeju corridor. Details available on Harmony Garden & Estate Development show a portfolio spanning land assets and ongoing residential construction across key growth locations.

A major component is Lekki Aviation Town, where urban living meets neighborhood charm, located near the proposed Lekki International Airport and valued internally at over $250 million. The development forms part of the company’s broader phased expansion strategy within the axis.

Other estates in the corridor tagged as the “Citadel of Joy” (Ogba-idunnu) include Granville Estate, Majestic Bay Estate, The Parliament Phase I & II, and Harmony Casa Phase I & II.

With multiple projects active, the rollout of the Ibile Traditional Mortgage System, and structured expansion underway, Harmony Garden & Estate Development Ltd continues to deepen its presence within the fast-growing Ibeju-Lekki real estate market.

Business

BUA Group Showcases Food Manufacturing Strength at 62nd Paris International Agricultural Show

BUA Group Showcases Food Manufacturing Strength at 62nd Paris International Agricultural Show

BUA Group, one of Africa’s leading diversified conglomerates, is maintaining a strong presence at the ongoing 62nd edition of the Paris International Agricultural Show in France, participating as a premium sponsor and supporting the Nigeria Pavilion at one of the world’s most respected agricultural gatherings.

The 62nd Paris International Agricultural Show, taking place from February 21 to March 1, 2026, at Porte de Versailles in Paris, convenes global leaders across farming, agro processing, technology, finance, and policy. The event serves as a strategic platform for industry engagement, knowledge exchange, and commercial partnerships shaping the future of global food systems.

BUA Group’s participation reflects its long term commitment to strengthening the entire food production value chain. Through sustained investments in large scale processing, value addition, and branded consumer products, the Group continues to reinforce its role in advancing food security, industrial growth, and regional trade integration.

Speaking on the Group’s participation, the Executive Chairman of BUA Group, Abdul Samad Rabiu CFR, said, “BUA’s presence at the Paris International Agricultural Show reflects our belief that Africa must be an active participant in shaping the future of global food systems. We have invested significantly in local production capacity because we understand that food security, industrial growth, and economic resilience are interconnected. Platforms like this allow us to build partnerships that strengthen Nigeria’s competitiveness and expand our reach beyond our borders.”

BUA Foods, a subsidiary of BUA Group, maintains a strong footprint in flour, pasta, spaghetti, sugar, and rice production, serving millions of consumers within Nigeria and across neighbouring African markets. The Managing Director of BUA Foods, Engr. Abioye Ayodele, representing the Executive Chairman, is attending the event at the Nigeria Pavilion, engaging industry stakeholders and showcasing the company’s manufacturing capabilities.

Also speaking at the show, Engr. Ayodele stated, “BUA Foods has built scale across key staple categories that are central to household consumption. Our participation at this Show allows us to demonstrate the quality, consistency, and operational strength behind our products. We are also engaging global stakeholders with a clear message that Nigerian manufacturing can meet international standards while serving both domestic and regional markets efficiently.”

The Show provides BUA Group with an opportunity to deepen trade relationships, explore new export pathways, and reinforce Nigeria’s growing relevance within the global agricultural and food ecosystem.

BUA Group remains focused on building enduring institutions, expanding productive capacity, and positioning African enterprise competitively within global markets.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

news7 months ago

news7 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING

You must be logged in to post a comment Login