Business

Land Grabbing: Community Head writes SOS To Police, Ogun State Government Setting the record straight…….

Land Grabbing: Community Head writes SOS To Police, Ogun State Government

Setting the record straight…….

SAVE OUR SOULS FROM THE HANDS OF IMPOSTORS, LAND GRABBERS TERRORISING EREBE IJEBU

A rejoinder to the crocodile tears of one Segun Abayomi Lawal,a political jobber, impostor and hypocritical human being

Erebe an ancient town in Odogbolu Local Government Area of Ogun State had being a peaceful society under the exclusive control of the eight (8) branches of the founding family of Erebe town, the OLOJA ADEKOYA (OFIRIGIDI) ANIKINAIYA FAMILY until recently when the Ogun State Government during the tenure of Otunba Gbenga Daniel (OGD) relocated the Sikiru Adetona College of Education, Science & Technology to Odo-Jobore directly beside Erebe. Mindful that Omu had no more vacant land in Ogun State as acknowledged in Omu’s Community’s submission before the Boundary Adjustment Commission of the Federal Government in 1976 and enviously motivated by the prime value of Erebeland due to it’s proximity to the said tertiary institution, one Oba Oludaisi Mosuro of Omu, Oba Segun Awokoya of Irete and one Obateru Akeem of Egbin near Ikorodu conspired amongst themselves with one Banjoko alias THREECO a popular land agent in the Lekki areas of Lagos State, one Jamiu Ojetete alias Jamani, Abayomi Adelaja alias Ogunyalu, Segun Lawal alias Eraser, Moshood Osinowo and others to create one ALADE OGBE ADELAJA SOKEFUN as their FAMILY name in Erebe in a bid to claim Erebeland. Our parent ruling House, the ANIKILAYA RULING HOUSE of the Awujale of Ijebuland, Ijebu Ode vide it’s letter dated 24/01/2007 warned the last Baale of Erebe, late Chief Moshood Osinowo to refrain from collaborating with the aforementioned land grabbers in their attempt to encroach on Oloja Adekoya Ofirigidi Anikinaiya’s Erebeland and advised them to tender their case before the ruling house if they have an iota of legitimacy in their claim to Erebeland.

The conspirators in issue rather than explore the opportunity offered by the Anikilaya Ruling House replied the Ruling House vide a letter dated July 21st, 2008 that they have no connection whatsoever with HRM Awujale Anikilaya’s family that HRM Anikilaya’s son Oloja Adekoya Ofirigidi was a refugee at Erebe.

These land grabbers in their aforementioned ALADE OGBE SOKEFUN ADELAJA name took the OLOJA ADEKOYA OFIRIGIDI ANIKINAIYA FAMILY, Erebe to court vide suit: HCJ/82/2009. Not wanting to beat a retreat after been overwhelmed by the traditional history of the Oloja Adekoya (Ofirigidi) Anikinaiya family with several documentary evidences affirming same from the Anikilaya Ruling House, Ijebu Ode as well as from Imota via Ikorodu, a town founded by same our ancestor, Oloja Adekoya (Ofirigidi) and records from independent sources such as the National Archives, Wikipedia and certain authored records of over 70years, the land grabbing conspirators in their fraudulent nature sometimes in November, 2015 went in the direction of abandoning their former name ALADE OGBE, created and adopted one SANGOKOYA OFIRIGIDI, a similar name to our family name; OLOJA ADEKOYA OFIRIGIDI, gave false information to the Ogun State Government and presented one of themselves Segun Lawal as Baale over our town, Erebe.

As a pretext to keep us away from our legitimate heritage these land grabbers took the Oloja elect to court that a letter addressed thus;

The Olori Ebi,

OLOJA ADEKOYA OFIRIGIDI ROYAL FAMILY, EREBE IJEBU signed by one of the land grabbers named ABAYOMI ADELAJA dated 5th February, 2016 was forged. Senior Magistrate Idowu Olayinka of the Odogbolu Magistrate court declared that the letter in issue subject of Charge No: MOD/46C/2018 is authentic and signed by the conspirators who were dubiously trying to deny reality as the said letter alone is an incontrovertible evidence invalidating impostors’ use of a similar name to our family name at the Ijebu Ode High Court to claim land at Erebe.

We had written several petitions to the Ogun State Government in this regard but the conspirators boasts of being backed by their Otunba Gbenga Daniel (OGD) who they claimed has the Nigerian Police, Ogun state Government and the judiciary in his pocket cannot be further from the truth as the land grabbers tendered forged documents, lied on oath and committed perjury to acquire 20.981 acres of the same land subject of suit: HCJ/82/2009 in another suit: HCJ/121/2015 with their new name SANGOKOYA. Contrary to the land grabbers misleading information to the public that they have a judgment covering entire Erebe land, the judgment is strictly on 20.981 acres of land and had been appealed based on the fact that it was fraudulently obtained as amongst other obvious reasons the judge rather than treating the facts of the case opted for technicality that the letter U as it appeared in EREBE IJEBU in the survey tendered by our family was traced in ink and not signed whereas we defined the location of the land as required in law.

The public are hereby informed that SANGOKOYA as son of Awujale Anikilaya WAS NOT part of the prayers sought and granted by the said court. While we have taken further steps to protect our heritage from the impostors latest (sangokoya) of Omu, the aforementioned land agents have recently being partitioning our lands, using the instrumentality of complicit police formations to take over the remaining Erebeland including 880 acres of land outside the 20.981 acres subject of appeal court litigation. To achieve their fraudulent objective the impostors have created several other aegis, such as a parallel Erebe Community Development Association and others which receipts they issue for Erebe lands illegally being sold. As at the time of making this public notice our lives are in danger as these illegal money crazy conspirators have engaged cultists and hired assassins to kill the Oloja elect of Erebe, Omoba Olawunmi Samuel, myself and other members of our family.

The parties sometimes in the year 2009 went to the Association of Osugbo Ijebuland which gave judgment in 2009 that Erebe is the exclusive business of the Oloja of Erebe, Oba Adekoya Ofirigidi descendants.

The conspirators are not only forgers of documents and history to grab land but men whose love for cheap land money has been made slaves to their stomachs.

For the records, Omu town became a landmark for Erebe area being the place where a market for sales of mat “Eni” a general trade of Erebe and environs was first established and as such visitors from Ibadan, Oyo, Ikorodu and other places usually refer to the area as Omu Eleni which earned the town her undisputed popularity this day. However, the fact remains that Erebe granted its fern farmland “Oko Imu” corrupted to Omu this day as a settlement in 1849 to refugees of the Owu war and some Igbehin-Egba migrants as approved by our ancestor, HRM Awujale Anikilaya after the Owu Ipole war of 1822 – 1829.

Sometimes in May, 2023 the conspirators ganged up with others at large with their thugs unleashed terror on Erebe community, burnt Oloja’s ancestral palace, demolished same, forcefully entered the community’s farmland – destroying our cash crops, removed traditional totems causing mayhem and using Police to harass innocent people and still went to report to the police that our people perpetrated those crimes in a bid to implicate us over very straight land matters. Our family members were unjustly charged to court over false information raised to the police by Segun Lawal that we burnt his fathers house at Omu till the Ogun State Directorate of Pubic Prosecution’s legal advise to the court exonerated our people and exposed the fact that there is no extent which these land grabbers could not go in the pursuit of cheap land money.

These land grabbers and their client one Banjoko alias THREECO whose thugs and complicit police formations have continued to find means to kills my humble, other members of our family while parading the fraudulently acquired 20.981 acres of land judgement to be selling part of the remaining 880.981 acres of Erebe land to unsuspecting members of the public. The general public, Odogbolu Local Government, the Senator-Representing Ogun East Senatorial District, Ijebu Traditional Council, the Awujale Place and the Ogun State Government are hereby alerted of these developments and should note that;

1. Erebe towns’ founding family, OLOJA ADEKOYA OFIRIGIDI ANIKILAYA FAMILY is neither the same nor connected to Owu Omu’s SANGOKOYA’s recently created to expand and annex Erebe land.

2. No Baale or any chieftaincy whatsoever in history has ever being made over any section of Erebeland outside the consent, approval and supervision of the OLOJA ADEKOYA (OFIRIGIDI) ANIKINAIYA FAMILY who are the legitimate owners of Erebe land.

3.Baale as erroneously been recently misrepresented by the land grabbers is relevant only in communities whose founders are not royals, it is a taboo for a Prince of credible background to be appointed a Baale.

4. Oloja which is the ancestral title of the Oloja Adekoya Ofirigidi descendants is not in the category of Baale or Rarun in Ijebuland.

2. SEGUN LAWAL and anyone else made Baale by the Olomu on Erebe territory against the interest and consent of the OLOJA ADEKOYA (OFIRIGIDI) FAMILY is an impostor who has neither authority nor connection with Erebeland.

3. It is a generally acknowledged fact that our ancestor OLOJA ADEKOYA OFIRIGIDI son of AWUJALE ANIKILAYA founded Imota town via Ikorodu, anyone trying to change the name to SANGOKOYA as is being attempted by these landgrabbers are fraudsterds and undoubtedly men with questionable character.

4. The ANIKILAYA RULING HOUSE, Ijebu Ode where late Prince Adebola Sanya was General Secretary and the incumbent Treasurer, Prince Onabanjo Segun both from our branch, OLOJA ADEKOYA OFIRIGIDI is not for sale and as such the impostors should be mindful that their days to answer for all acts of impersonation is numbered.

5. Government should sanction Obas who on the guise of chieftaincy privileges create Baales over traditionally superior territories as it is the case with Omu, Irete in relation to Erebe in a bid to grab, incite violence to benefit land for personal gains and as fronts for politicians on which behalf they deal in lands.

6. Any Obaship candidate whose business is land related should sign undertaking not to involve in land in his area as it it is the case with Onirete who has not turn a new leaf from the plethora of land grabbing accusations against him in Lekki area of Lagos and has now found Erebe town and villages as his next line of business, in company of his friend THREECO signing agreements with several Omu families to claim Erebe villages.

8. If these impostors could come out and be making false claims which we hereby disclaim, one could understand the kind of information they used to persuade His Excellncy, Otunba Gbenga Daniel (OGD) whose influence and name they claim to usually employ to circumvent the police and the judicial processes in their bid to grab our land and even claim certain acres of our land is allotted to OGD which we are anxiously waiting for him to come and take possession and tell us if one has money, influence and position, getting other people’s properties and ancestry is the next line of business as his allies are claiming he does in this case.

Though, the undersigned has done all along several petitions at various times to the following governmental offices for help, which are to no avail before now

1. Ogun State, Governor’s office

2. Ogun State ministry of Justice

3. Commissioner of Police, Ogun State command

4.The State Director

Ogun State security services ( SSS)

And it was discovered that same impostors went extra miles to misinform the general public and government agencies that they have a judgment declaring SANGOKOYA as a son of AWUJALE ANIKILAYA as well as covering the entire EREBE landmass. IT WAS ALL LIES FROM THE FIGMENT OF THE NARRATORS IMAGINATION. WE CHALLENGE THEM TO TENDER SAME TO THE PUBLIC

We wish to inform the public that the latest false information from these land grabbers through Segun Lawal is a ploy to defend to change the narrative for evading police service of invitation letter, evading arrest, damaging of police vehicles, shooting at police and using cultists to prevent police in exercise of their lawful duty which caused pandemonium at Erebe on the 31st of January, 2024 in which cultists engaged police in shoot out to pave the way for the shedder of crocodile tears (Segun Lawal).

He who commits no crime needs not to run away from police invitation, we as a responsible family have always honored every invitation even arrest including the unlawful arrest and detention of our over 80 years old head of family, Omoba Titilola Olawunmi at the behest of frivolous charges orchestrated by Segun Lawal. Hence if the police are investigating a claim of raising false information to the police occasioning malicious prosecution of opponents and other issues perpetrated by the land grabbers why running away and manufacturing lies to the public in search of sympathy.

The baseless narrative being pushed by these land grabbers mischievously branding our family, who are the legitimate owners of Erebeland as land grabbers is a reflection of the debased level which our society has found itself in terms of morals and integrity.

Please, I am using this medium to get to all well meaning people to come to our aid. Save us from the grab of these Owu war refugee Ajagungbales paying the good intentions of our ancestors with evil such that this expansionist campaign of the present Omu leadership won’t be a repeat of what transpired in 1862 when the quarrelsome attitude of their ancestors as reported by the Europeans visitors to Ijebuland culminated in the avoidable loss of human life at Omu. We pause here.

E-Signed

Omoba Yisa Akintunde Mumuni

For and on behalf of the

OLOJA elect of Erebe Ijebu and the OLOJA ADEKOYA (OFIRIGIDI) ANIKINAIYA DESCENDANTS’ UNION

Erebe Ijebu Town, Ogun State.

Business

Deadline of Compliance: Nigeria’s Urgent Call for Tax Return Filing

Deadline of Compliance: Nigeria’s Urgent Call for Tax Return Filing

By George Omagbemi Sylvester | Published by SaharaWeeklyNG.com

“Shift or Structural Demand? A Declaration of Civic Duty in a Nation at a Fiscal Crossroads.”

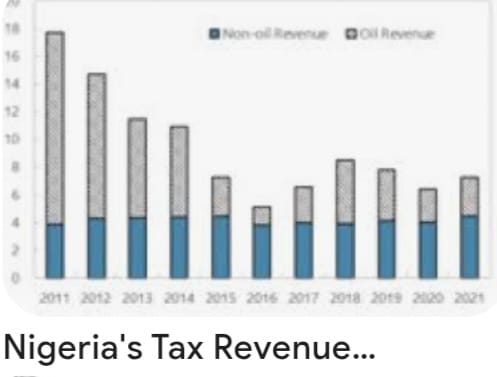

In the unfolding narrative of national development and economic reform, few instruments are as defining as tax compliance. For Nigeria, a nation perpetually grappling with revenue shortfalls, structural dependency on a single export commodity, and entrenched informal economic behaviour, the Federal Government’s recent clarification on tax return deadlines is not mere bureaucratic noise. It is a deliberate and inescapable declaration: the social contract between citizen and state must be honoured through transparent, lawful and timely tax reporting.

At its core, the government’s pronouncement is stark in its simplicity and radical in its implications. Federal authorities, speaking through the Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, have made it unequivocally clear that every Nigerian, whether employer or individual taxpayer, must file annual tax returns under the law. This encompasses self-assessment filings by individuals that too many assumed ended once employers deducted pay-as-you-earn taxes from their salaries.

This is not an optional civic suggestion, it is mandatory, backed by statute, and tied to a broader vision of national fiscal responsibility. Citizens can no longer hide behind ignorance, apathy, or false assumptions. “Many people assume that if their employer deducts tax from their salaries, their obligations end there. That is wrong,” Oyedele warned, emphasizing that the obligation to file remains with the individual under both existing and newly reformed tax laws.

The Deadlines and the Reality They Reveal.

Across the federation, state and federal revenue authorities have reaffirmed statutory deadlines in pursuit of compliance. The Lagos State Internal Revenue Service, for instance, moved to extend its filing date for employer returns by a narrow window, reflecting the reality that compliance often lags behind legal timelines. The extension was intended not as leniency, but as a pragmatic effort to allow accurate and complete submissions, underscoring that true compliance rises above mere mechanical ticking of a box.

At the federal level, Oyedele’s intervention was even more fundamental. He reminded Nigerians that annual tax returns for the preceding year must be filed in good faith, with integrity and in respect of the law. This applies regardless of income level including low-income earners who have historically believed that they are outside the tax net. “All of us must file our returns, including those earning low income,” he stated.

Herein lies one of the most challenging truths of contemporary Nigerian governance: widespread tax non-compliance is not just a technical breach of law, it is a deep cultural and structural issue that reflects decades of mistrust between citizens and the state.

The Root of the Problem: Non-Compliance as a Symptom.

Nigeria’s tax culture has long been under scrutiny. Public discourse and economic analysis consistently show that a significant majority of eligible taxpayers do not file annual returns. Oyedele highlighted that even in states widely regarded as tax administration leaders, compliance remains strikingly low, often below five percent.

This widespread non-compliance stems from multiple sources:

A long history of weak tax administration systems, where enforcement was inconsistent and penalties were rarely applied.

A perception that public services do not reflect the taxes collected, eroding the citizenry’s belief in reciprocity.

An informal economy where income often goes unrecorded, making filing seem irrelevant or impossible to many.

Lack of awareness, with many Nigerians genuinely believing that tax liability ends with employer deductions.

The government’s renewed push for compliance directly challenges these perceptions. It signals a shift from voluntary or lax compliance to structured accountability, a stance that aligns with best practices in modern public finance.

Why This Matters: Beyond Deadlines.

At its most profound level, the insistence on tax return filings is about nation-building and shared responsibility.

Scholars of public finance universally agree that a robust tax system is the backbone of sustainable development. As the eminent economist Dr. Joseph E. Stiglitz has observed, “A society that cannot mobilize its own resources through fair taxation undermines both its government’s legitimacy and its capacity to provide for its people.” Filing tax returns is not a mere administrative task, it is a declaration of participation in the collective project of national advancement.

In Nigeria’s context, this declaration carries weight. With the enactment of comprehensive tax reforms in recent years (including unified frameworks for tax administration and enforcement) authorities now possess broader statutory tools to ensure compliance and accountability. These measures, which include electronic filing platforms and stronger enforcement powers, have been framed as fair and equitable, targeting efficiency rather than arbitrariness.

Yet the success of these reforms depends heavily on citizens embracing their civic duties with sincerity. And this depends on mutual trust, the belief that paying taxes yields tangible benefits in infrastructure, education, healthcare, security and social services.

Voices From Experts: Fiscal Responsibility as a Public Ethic.

Tax law experts and economists, reflecting on the compliance push, have underscored a universal theme: taxation without transparency is inequity, but taxation with accountability is empowerment. When managed with fairness, a functional tax system can reduce dependency on volatile revenue sources, stabilise national budgets, and support long-term investment in human capital.

Professor Aisha Bello, a respected authority in fiscal policy, notes that “Tax compliance is not a burden; it is the foundation upon which social contracts are built. A citizen who honours tax obligations affirms the legitimacy of governance and demands better performance in return.”

Similarly, a leading tax scholar, Dr. Emeka Okon, argues that “The era when Nigerians could evade broader tax responsibilities simply because automatic deductions occur at source must end. For a modern economy, every eligible citizen must be part of the formal tax fold not as victims, but as stakeholders.”

These authoritative voices point to an unassailable truth: filing tax returns is both a legal requirement and a moral responsibility, an expression of citizenship in its fullest sense.

Challenges on the Ground: Compliance and Capacity.

While the rhetoric of compliance is compelling, the reality on the ground demands nuanced understanding. Many taxpayers (especially in the informal sector) lack meaningful access to digital platforms and resources for filing returns. For others, the fear of bureaucratic complexity and perceived punitive enforcement deters participation.

The government, for its part, has responded by promoting online systems and pledging greater taxpayer support. Tax authorities are increasingly engaging stakeholders to demystify filing processes, explain requirements and offer assistance. This mix of enforcement and facilitation is essential. As one seasoned revenue specialist observed: “The state cannot compel compliance through force alone; it must earn it through education, simplicity and fairness.”

The Broader Implication: A New Social Compact.

Ultimately, Nigeria’s renewed emphasis on tax return filing transcends administrative deadlines. It is an unequivocal declaration that national development is a shared responsibility, that citizens and state must engage in a transparent, accountable, and reciprocal relationship.

Tax compliance, therefore, becomes far more than a legal act; it becomes a moral claim on the nation’s future.

When citizens file their returns honestly, they affirm their stake in the nation’s destiny. When the government collects taxes transparently and deploys them effectively, it strengthens not only public services but civic trust itself.

In this sense, the deadlines proclaimed by Nigeria’s fiscal authorities mark not an end but a beginning; the beginning of a civic epoch in which accountability replaces apathy, participation replaces indifference and national purpose triumphs over fragmentation.

The road ahead will not be easy. But in demanding compliance, Nigeria is demanding more than tax returns. It is demanding commitment and that, ultimately, is the foundation on which nations are built.

Business

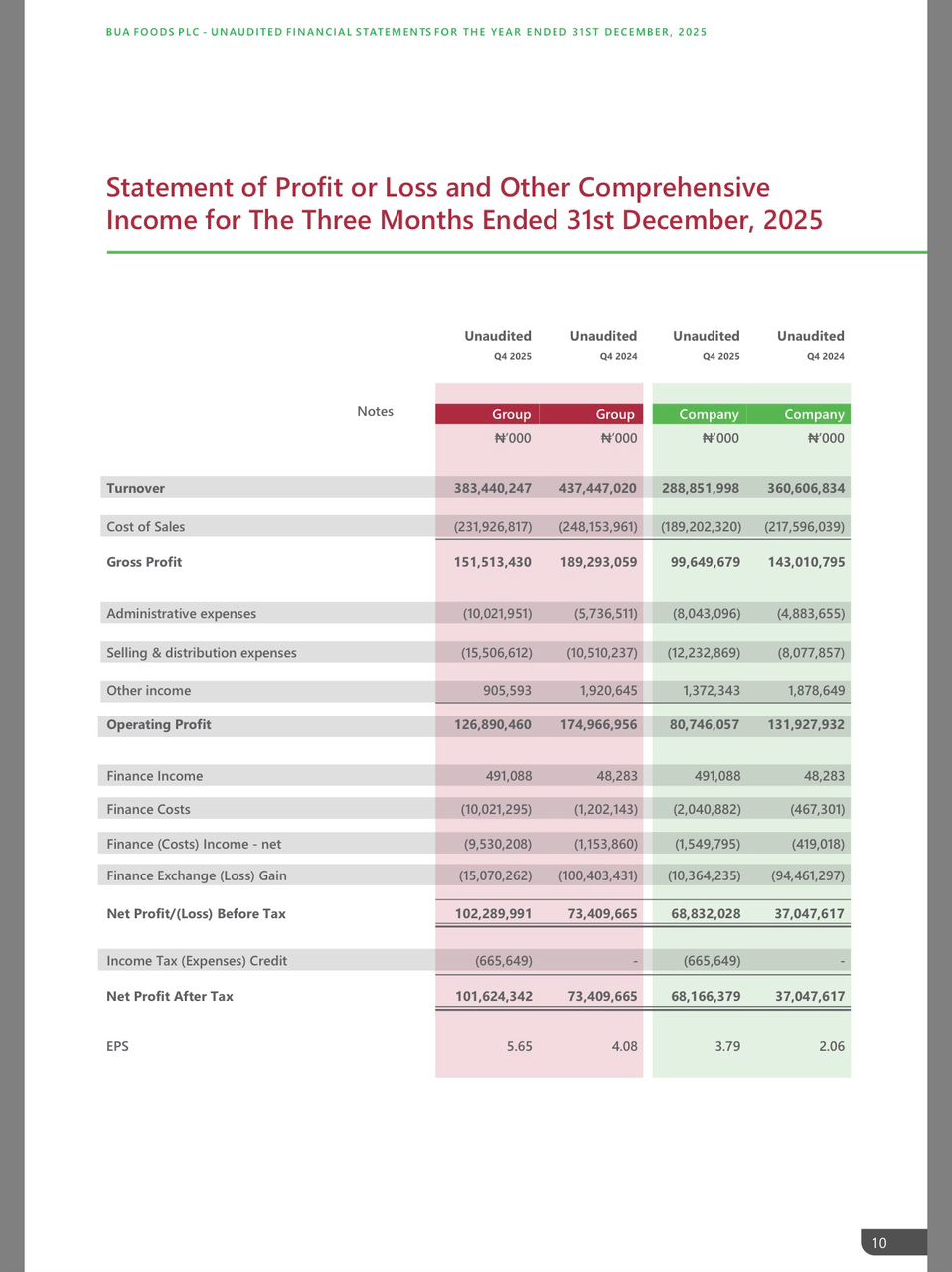

BUA Foods Records 91% Surge in Profit After Tax, Hits ₦508bn in 2025

BUA Foods Records 91% Surge in Profit After Tax, Hits ₦508bn in 2025

By femi Oyewale

Business

Adron Homes Unveils “Love for Love” Valentine Promo with Exciting Discounts, Luxury Gifts, and Travel Rewards

Adron Homes Unveils “Love for Love” Valentine Promo with Exciting Discounts, Luxury Gifts, and Travel Rewards

In celebration of the season of love, Adron Homes and Properties has announced the launch of its special Valentine campaign, “Love for Love” Promo, a customer-centric initiative designed to reward Nigerians who choose to express love through smart, lasting real estate investments.

The Love for Love Promo offers clients attractive discounts, flexible payment options, and an array of exclusive gift items, reinforcing Adron Homes’ commitment to making property ownership both rewarding and accessible. The campaign runs throughout the Valentine season and applies to the company’s wide portfolio of estates and housing projects strategically located across Nigeria.

Speaking on the promo, the company’s Managing Director, Mrs Adenike Ajobo, stated that the initiative is aimed at encouraging individuals and families to move beyond conventional Valentine gifts by investing in assets that secure their future. According to the company, love is best demonstrated through stability, legacy, and long-term value—principles that real estate ownership represents.

Under the promo structure, clients who make a payment of ₦100,000 receive cake, chocolates, and a bottle of wine, while those who pay ₦200,000 are rewarded with a Love Hamper. Payments of ₦500,000 attract a Love Hamper plus cake, and clients who pay ₦1,000,000 enjoy a choice of a Samsung phone or a Love Hamper with cake.

The rewards become increasingly premium as commitment grows. Clients who pay ₦5,000,000 receive either an iPad or an all-expenses-paid romantic getaway for a couple at one of Nigeria’s finest hotels, which includes two nights’ accommodation, special treats, and a Love Hamper. A payment of ₦10,000,000 comes with a choice of a Samsung Z Fold 7, three nights at a top-tier resort in Nigeria, or a full solar power installation.

For high-value investors, the Love for Love Promo delivers exceptional lifestyle experiences. Clients who pay ₦30,000,000 on land are rewarded with a three-night couple’s trip to Doha, Qatar, or South Africa, while purchasers of any Adron Homes house valued at ₦50,000,000 receive a double-door refrigerator.

The promo covers Adron Homes’ estates located in Lagos, Shimawa, Sagamu, Atan–Ota, Papalanto, Abeokuta, Ibadan, Osun, Ekiti, Abuja, Nasarawa, and Niger States, offering clients the opportunity to invest in fast-growing, strategically positioned communities nationwide.

Adron Homes reiterated that beyond the incentives, the campaign underscores the company’s strong reputation for secure land titles, affordable pricing, strategic locations, and a proven legacy in real estate development.

As Valentine’s Day approaches, Adron Homes encourages Nigerians at home and in the diaspora to take advantage of the Love for Love Promo to enjoy exceptional value, exclusive rewards, and the opportunity to build a future rooted in love, security, and prosperity.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

Business6 months ago

Business6 months agoBatsumi Travel CEO Lisa Sebogodi Wins Prestigious Africa Travel 100 Women Award

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING