society

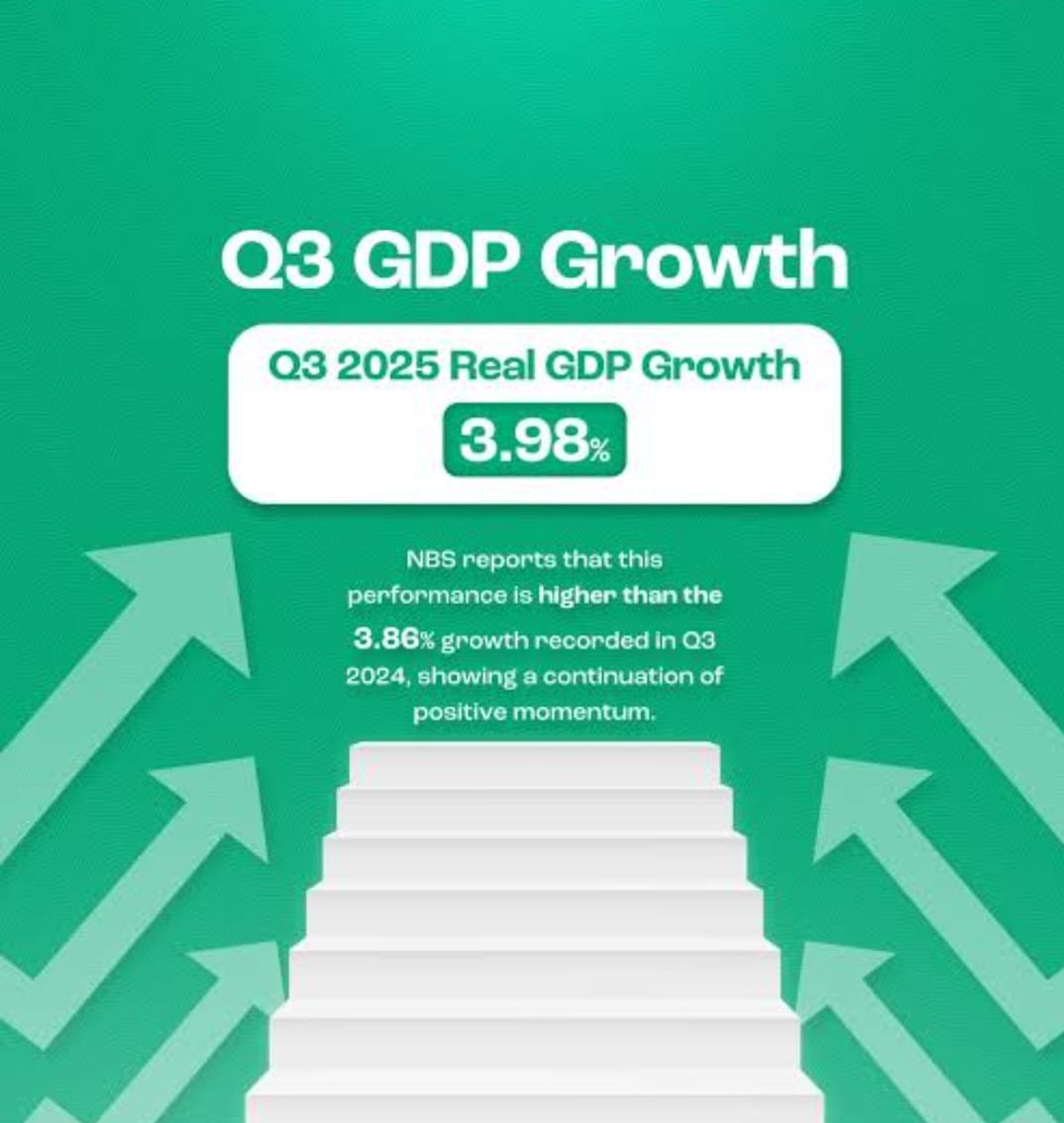

A Tentative Recovery — OR WINDOW DRESSING? Nigeria’s GDP Grows 3.98% in Q3 2025: What the Number Hides and What Must Be Done

A Tentative Recovery — OR WINDOW DRESSING?

Nigeria’s GDP Grows 3.98% in Q3 2025: What the Number Hides and What Must Be Done.

By George Omagbemi Sylvester | Published by saharaweeklyng.com

“Separating Statistical Progress from Everyday Reality in Africa’s Most Complex Economy.”

Nigeria’s economy grew by 3.98% year-on-year in real terms in the third quarter of 2025, according to the National Bureau of Statistics (NBS). At first glance the figure looks like PROGRESS and it is PROGRESS of a kind. But beneath the tidy percentage lie a tangle of uneven sectoral performance, fragile price stability, fiscal strain and a persistent failure to translate macroeconomic numbers into better daily lives for ordinary Nigerians. This piece pulls apart the headline, explains what drove the expansion, flags the risks and offers an unvarnished judgment about what policymakers must do next.

What drove the 3.98% growth? The NBS report shows that the expansion in Q3 was BROAD-BASED but led by the non-oil economy (notably services and agriculture) even as the oil sector staged a modest recovery. Services accounted for the largest share of output and recorded one of the stronger growth rates, while agriculture returned to positive territory after weaker stretches in 2024. In aggregate, the non-oil sector contributed roughly 96% of GDP, underscoring how far Nigeria’s output composition has shifted away from hydrocarbons. Those structural shifts matter because they change the policy levers that actually move the economy.

The oil sector did record positive growth (helped by higher crude production) but its share of aggregate GDP remains small, a signal that oil is less of a direct growth engine than it used to be. In other words: while higher production matters for foreign exchange and government revenues, the day-to-day purchasing power and job creation that lift millions of households are overwhelmingly determined by non-oil activity.

Why the number is both WELCOME and WORRYING.

A WELCOME sign: sustained quarterly growth after a weak patch signals momentum. The World Bank has itself noted “POSITIVE ECONOMIC MOMENTUM” in 2025 and cautioned that reforms are beginning to yield results, while urging that gains be translated into tangible welfare improvements for the poor. As Mathew Verghis, World Bank Country Director for Nigeria, put it: “The Nigerian government has taken bold steps to stabilize the economy, and these efforts are beginning to yield results.” But the World Bank’s central caveat is crucial: macro stabilization is necessary but not sufficient; the poor still face high food inflation and widespread vulnerability.

The WORRYING side is immediate and stark. Inflation remains painfully high (double-digit and food inflation especially elevated) and borrowing costs are still punitive despite modest easing from earlier peaks to conditions that throttle business expansion and household welfare. Financial market and monetary policy improvements will not help families who spend the bulk of their income on food if the price of the basic food basket keeps rising. In short: GROWTH WITHOUT DISINFLATION AND REDISTRIBUTION IS A HOLLOW VICTORY. Sahara and other analysts reported inflation pressures and pointed to a still-high policy rate as part of the context for Q3 figures.

Central Bank Governor Olayemi Cardoso has repeatedly insisted that credible, predictable policy will attract investment: “Stability is at the core of advancing Nigeria’s policy framework through inflation targeting. You do not need to beg anyone to invest.” That prescription is true, but only if the rest of the policy apparatus (fiscal discipline, supply-side fixes for food and energy, social protection) follows through. Stability without structural reform will not deliver jobs or lower the cost of living.

The fiscal and external backdrop. Growth does not occur in isolation. The Federal Government’s fiscal plans for 2026 (including a draft budget and medium-term fiscal framework) point to continued pressure on public finances, a SIZEABLE DEFICIT and RISING DEBT SERVICE OBLIGATIONS. The cabinet’s fiscal framework projects large budgetary needs, indicting the reality that public investment will be constrained unless revenue mobilization improves. In short: the state needs fiscal headroom to invest in the power, transport and logistics that convert growth into livable livelihoods.

On the external side, stronger oil production and higher non-oil exports have improved foreign exchange reserves and the external position compared with the crisis years. Those improvements matter: reserves and a more functional FX market reduce panic, allow imports of critical inputs and lower premium pressures. Yet, the gains remain delicate and reversible if confidence weakens or global commodity prices swing.

Where the gains must land: three urgent priorities

Tame inflation, especially food inflation. The World Bank and Nigerian policymakers agree: the single biggest tax on the poor is food price inflation. Targeted supply-side fixes (agricultural inputs, storage, logistics and trade measures) combined with a credible monetary framework, are indispensable. Without this, headline GDP growth will keep feeling distant from household reality.

Restore fiscal space and spend smarter. The 2026 fiscal framework highlights a difficult trade-off: service large debt obligations or invest in growth-enhancing infrastructure. Nigeria must tighten revenue collection, eliminate leakages, and prioritize public spending that directly boosts productivity (power, roads, ports, irrigation). Otherwise, growth will be cyclical and shallow.

Translate macro stability into real investment and jobs. As CBN Governor Cardoso has argued, predictable, transparent policy attracts investors. But to convert investment into jobs, governments must fix regulatory uncertainty, unblock transport bottlenecks, and support SMEs with affordable credit and market access. A solid monetary stance alone will not produce mass employment.

A candid verdict. A 3.98% growth rate is not a tragedy, it is evidence the economy is moving in the right direction after years of dislocations. But it is also a warning: growth that does not reduce costs for ordinary citizens, create stable jobs, and expand social protection is a fragile and politically toxic victory. The leadership in Abuja must stop treating statistics as an end in themselves and embrace a people-centered economic strategy that combines stabilization with direct interventions for food security, job creation and fiscal transparency.

If policymakers act with urgency (tightening the link between macro stability and social outcomes, spending smartly, and fixing supply bottlenecks) Nigeria can convert this modest momentum into sustained, inclusive growth. If they do not, the headline percentages will become yet another number that comforts elites while ordinary Nigerians continue to pay the price.

My Final note. Numbers matter and the NBS’s Q3 figure is worth acknowledging. But the measure of success is whether mothers can afford food, whether small businesses can borrow without choking on interest, and whether young people can find dignified work. Until those metrics improve, a 3.98% GDP print remains a TENTATIVE step and NOT a TRIUMPH.

society

GENERAL BULAMA BIU MOURNS BOKO HARAM VICTIMS, CALLS FOR UNITY AND RENEWED EFFORTS FOR PEACE

GENERAL BULAMA BIU MOURNS BOKO HARAM VICTIMS, CALLS FOR UNITY AND RENEWED EFFORTS FOR PEACE

In a solemn message of condolence and resolve, Major General Abdulmalik Bulama Biu mni (Rtd), the Sarkin Yakin of Biu Emirate, has expressed profound grief over a recent deadly attack by Boko Haram insurgents on citizens at a work site. The attack, which resulted in the loss of innocent lives, has been condemned as a senseless and barbaric act of inhumanity.

The revered traditional and military leader extended his heartfelt sympathies to the bereaved families, the entire people of Biu Emirate, Borno State, and all patriotic Nigerians affected by the tragedy. He described the victims as “innocent, peaceful, hardworking and committed citizens,” whose lives were tragically cut short.

General Biu lamented that the assault represents “one too many” such ruthless attacks, occurring at a time when communities are already engaged in immense personal and collective sacrifices to support government efforts in rebuilding devastated infrastructure and restoring hope.

In his statement, he offered prayers for the departed, saying, “May Almighty Allah forgive their souls and grant them Aljannan Firdaus.” He further urged the living to be encouraged by and uphold the spirit of sacrifice demonstrated by the victims.

Emphasizing the need for collective action, the retired Major General called on all citizens to redouble their efforts in building a virile community that future generations can be proud of. He specifically commended the “silent efforts” of some patriotic leaders working behind the scenes to end the security menace and encouraged all well-meaning Nigerians to join the cause for a better society.

“Together we can surmount the troubles,” he asserted, concluding with a prayer for divine intervention: “May Allah guide and protect us, free us from this terrible situation and restore an enduring peace, security, unity and prosperity. Amin.”

The statement serves as both a poignant tribute to the fallen and a clarion call for national solidarity in the face of persistent security challenges.

society

When a Nation Outgrows Its Care

When a Nation Outgrows Its Care.

By George Omagbemi Sylvester | Published by SaharaWeeklyNG.com

“Population Pressure, Poverty and the Politics of Responsibility.”

Nigeria is not merely growing. It is swelling and faster than its institutions, faster than its conscience and far faster than its capacity to care for those it produces. In a world already straining under inequality, climate stress and fragile governance, Nigeria has become a living paradox: immense human potential multiplied without the social, economic or political scaffolding required to sustain it.

This is not a demographic miracle. It is a governance failure colliding with cultural denial.

Across the globe, societies facing economic hardship typically respond by slowing population growth through education, access to healthcare and deliberate family planning. Nigeria, by contrast, expands relentlessly, even as schools decay, hospitals collapse, power grids fail and public trust erodes. The contradiction is jarring: a country that struggles to FEED, EDUCATE and EMPLOY its people continues to produce more lives than it can dignify.

And when the inevitable consequences arrive (unemployment, crime, desperation, migration) the blame is conveniently outsourced to government alone, as though citizens bear no agency, no RESPONSIBILITY, no ROLE in shaping their collective destiny.

This evasion is at the heart of Nigeria’s crisis.

The political economist Amartya Sen has long said that development is not merely about economic growth but about expanding human capabilities. Nigeria does the opposite. It multiplies human beings while shrinking the space in which they can thrive. The result is a society where life is abundant but opportunity is scarce, where children are born into structural neglect rather than possibility.

Governments matter. Bad governments destroy nations. Though no government, however competent, can sustainably provide for a population expanding without restraint in an environment devoid of planning, infrastructure and accountability.

This is where the conversation becomes uncomfortable and therefore necessary.

For decades, Nigerian leaders have failed spectacularly. Public education has been HOLLOWED out. Healthcare has become a LUXURY. Electricity remains UNRELIABLE. Social safety nets are virtually NONEXISTENT. Public funds vanish into PRIVATE POCKETS with brazen regularity. These are not disputed facts; they are lived realities acknowledged by development agencies, scholars and ordinary citizens alike.

Yet amid this collapse, REPRODUCTION continues unchecked, often CELEBRATED rather than QUESTIONED. Large families persist not as a strategy of hope but as a cultural reflex, untouched by economic logic or future consequence. Children are brought into circumstances where hunger is normalized, schooling is uncertain and survival is a daily contest.

The philosopher Hannah Arendt warned that irresponsibility flourishes where accountability is diffused. In Nigeria, responsibility has become a political orphan. The state blames history, colonialism or global systems. Citizens blame the state. Meanwhile, children inherit the cost of this mutual abdication.

International development scholars consistently emphasize that education (especially of girls) correlates strongly with smaller, healthier families and better economic outcomes. Nigeria has ignored this lesson at scale. Where education is weak, fertility remains high. Where healthcare is absent, birth becomes both risk and ritual. Where women lack autonomy, choice disappears.

This is not destiny. It is policy failure reinforced by social silence.

Religious and cultural institutions, which wield enormous influence, have largely avoided confronting the economic implications of unchecked population growth. Instead, they often frame reproduction as a moral absolute divorced from material reality. The result is a dangerous romanticism that sanctifies birth while neglecting life after birth.

The Kenyan scholar Ali Mazrui once observed that Africa’s tragedy is not lack of resources but lack of responsibility in managing abundance. Nigeria exemplifies this truth painfully. Rich in land, talent and natural wealth, the country behaves as though human life is an infinite resource requiring no investment beyond conception.

This mindset is unsustainable.

Around the world, nations that escaped mass poverty did so by aligning population growth with state capacity. They invested in people before multiplying them. They built systems before expanding demand. They treated citizens not as numbers but as future contributors whose welfare was essential to national survival.

Nigeria has inverted this logic. It produces demand without supply, citizens without systems, lives without ladders.

To say this is not to absolve government. It is to indict both leadership and followership in equal measure. Governance is not a one-way transaction. A society that demands accountability must also practice responsibility. Family planning is not a foreign conspiracy. It is a survival strategy. Reproductive choice is not moral decay. It is economic realism.

The Nigerian sociologist Adebayo Olukoshi has argued that development fails where political elites and social norms reinforce each other’s worst tendencies. In Nigeria, elite corruption meets popular denial, and the outcome is demographic pressure without developmental intent.

This pressure manifests everywhere: overcrowded classrooms, collapsing cities, rising youth unemployment and a mass exodus of talent seeking dignity elsewhere. Migration is not a dream; it is an indictment. People leave not because they hate their country, but because their country has failed to imagine a future with them in it.

And still, the cycle continues.

At some point, honesty must replace sentiment. A nation cannot endlessly reproduce its way out of poverty. Children are not economic policy. Birth is not development. Hope without planning is cruelty.

True patriotism requires difficult conversations. It demands confronting cultural habits that no longer serve collective survival. It insists on shared responsibility between state and citizen. It recognizes that bringing life into the world carries obligations that extend far beyond celebration.

Nigeria does not lack people. It lacks care, coordination and courage. The courage to align birth with dignity, growth with governance and culture with reality.

Until that reckoning occurs, complaints will continue, governments will rotate and generations will be born into a system that apologizes for its failures while reproducing them.

A nation that refuses to plan its future cannot complain when the future overwhelms it.

society

Diplomacy Under Fire: South Africa’s Anti-Apartheid Vanguard Challenges U.S. Ambassador Nomination

Diplomacy Under Fire: South Africa’s Anti-Apartheid Vanguard Challenges U.S. Ambassador Nomination

By George Omagbemi Sylvester

Published by saharaweeklyng.com

“How history, sovereignty and global justice are colliding in Pretoria’s political theatre.”

South Africa stands at the intersection of memory, morality and contemporary geopolitics. In a dramatic and deeply symbolic challenge to international diplomatic norms, the South African chapter of the Anti-Apartheid Movement (AAM) has publicly urged President Cyril Ramaphosa to exercise his constitutional right to reject the credentials of Leo Brent Bozell III, the United States’ ambassador-designate to South Africa. This demand is not merely about one diplomat’s qualifications but it represents a broader contest over historical interpretation, national sovereignty, human rights and the ethical responsibilities of global partnerships.

The statement issued by the AAM, drawing on its legacy rooted in the nation’s hard-won liberation from racial oppression, argues that Bozell’s track record and ideological orientation raise “serious questions” about his fitness to serve in South Africa. The movement insists that his appointment threatens to undermine the country’s independent foreign policy, particularly in the context of Pretoria’s pursuit of justice at the International Court of Justice (ICJ) in The Hague, where South Africa has taken the rare step of challenging alleged atrocities in Gaza.

The Roots of the Dispute.

At the heart of the controversy is the claim by activists that Bozell’s public remarks over time have been disparaging toward the African National Congress (ANC) and the broader anti-apartheid struggle that shaped modern South Africa’s democratic identity. These statements, which critics describe as reflective of a worldview at odds with the principles of liberation and equity, have animated calls for his credentials to be rejected.

South Africa’s constitution empowers the head of state to accept or refuse the credentials of foreign envoys, a power rarely exercised in recent diplomatic practice but one that acquires urgency in moments of intense bilateral tension. As the AAM’s leadership frames it, this is not about personal animus but about safeguarding the nation’s right to determine its own moral and geopolitical compass.

Historical Memory Meets Contemporary Politics.

South Africa’s anti-apartheid legacy holds deep cultural, political and moral resonance across the globe. The nation’s liberation struggle (led by giants such as Nelson Mandela, Desmond Tutu and Oliver Tambo) was rooted in the universal principles of human dignity, equality and resistance to systemic oppression. It transformed South Africa from a pariah state into a moral beacon in global affairs.

As the AAM statement put it, “We know too well that our freedom is incomplete without the freedom of others.” This invocation of history is not ceremonial. It frames South Africa’s foreign policy not just as a function of national interest but as a commitment to a universal ethos born of struggle.

Renowned scholars of post-colonial studies, including the late Mahmood Mamdani, have argued that anti-colonial movements inherently shape post-independence foreign policy through moral imperatives rooted in historical experience. In this view, South African diplomacy often reflects an ethical dimension absent in purely strategic calculations.

The Broader Diplomatic Context.

The dispute over ambassadorial credentials cannot be separated from broader tensions in South African foreign policy. Pretoria’s decision to take Israel before the ICJ on allegations of violating the Genocide Convention has triggered significant diplomatic friction with the United States. Official U.S. channels have expressed concern over South Africa’s stance, particularly amid the conflict in the Middle East. This has coincided with sharp rhetoric from certain U.S. political figures questioning South Africa’s approach.

For instance, critics in the United States have at times framed South Africa’s foreign policy as both confrontational and inconsistent with traditional Western alliances, especially on issues relating to the Middle East. These tensions have underscored how global power dynamics interact (and sometimes collide) with post-apartheid South Africa’s conception of justice.

Within South Africa, political parties have responded in kind. The Economic Freedom Fighters (EFF) have condemned Bozell’s nomination as reflective of an agenda hostile to South Africa’s principles, even labelling his ideological lineage as fundamentally at odds with emancipation and equality. Whether or not one agrees with such characterisations, the intensity of these critiques reveals the deep anxiety amongst some sectors of South African civil society about external interference in the nation’s policymaking.

Sovereignty, International Law and National Identity.

Scholars of international law emphasise that the acceptance of diplomatic credentials is not merely ceremonial; it signals a nation’s readiness to engage with a foreign representative as a legitimate interlocutor. Legal theorist Martti Koskenniemi has written that diplomatic practice functions at the intersection of law, power and morality, shaping how states perceive each other and interact on the world stage.

In this light, the AAM’s appeal to Ramaphosa reflects a profound anxiety: that South Africa’s sovereignty (and its moral authority on the world stage) is being tested. To refuse credentials would be to affirm the nation’s agency; to accept them without scrutiny could be interpreted, in some quarters, as a concession to external pressure.

President Ramaphosa himself has, in recent speeches, stressed the importance of upholding constitutional integrity and South Africa’s role as a constructive actor in global affairs. His leadership, shaped by decades as a negotiator and statesman, walks a fine line between defending national interests and maintaining diplomatic engagement.

Moral Certainties and Strategic Ambiguities.

What makes this situation especially complex is the blending of moral conviction with strategic diplomacy. South Africa, like any sovereign state, depends on a web of international relationships (economic, security, political) that require engagement with powers whose policies and values do not always align with its own.

Yet for many South Africans, drawing a line on diplomatic appointments is not just about personalities but about reaffirming the values fought for during decades of struggle. As anti-apartheid veteran and academic Professor Pumla Gobodo-Madikezela once observed, “Our history is not a relic; it is the compass by which we navigate present injustices.” This idea captures why historical memory acquires such force in debates over current foreign policy.

Towards a Resolution.

Whether President Ramaphosa will act on the AAM’s call remains uncertain. Diplomatic norms usually favour acceptance of appointed envoys to maintain continuity in bilateral relations. However, exceptional moments call for exceptional scrutiny. This situation compels a national debate on what it means to balance sovereignty with engagement, history with pragmatism, values with realpolitik.

Experts on international relations stress the need for South Africa to carefully assess not just the semantics of credential acceptance but the broader implications for its foreign policy goals and relationships. Former diplomat Dr. Naledi Pandor has argued that “diplomacy is not merely about representation, but about conveying what a nation stands for and will not compromise.” Whether this moment will redefine South Africa’s diplomatic posture or be absorbed into the standard rhythms of international practice remains to be seen.

Summation: History and the Future.

The AAM’s call to reject a U.S. ambassadorial nominee is more than an isolated political manoeuvre, it is a reflection of South Africa’s evolving self-understanding as a nation shaped by legacy, committed to justice and unwilling to dilute its moral voice in global affairs. The controversy casts a spotlight on the tensions facing post-colonial states that strive to be both sovereign and globally engaged.

At its core, this debate is about who writes the rules of international engagement when history has taught a nation never to forget what it fought to achieve. It is a reminder that in a world of shifting alliances and competing narratives, moral clarity, historical awareness and strategic foresight are indispensable.

South Africa’s decision in this matter will not only shape its diplomatic engagement with the United States but will reverberate across continents where questions of justice, human rights and national dignity remain at the forefront of global discourse.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society5 months ago

society5 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

Business6 months ago

Business6 months agoBatsumi Travel CEO Lisa Sebogodi Wins Prestigious Africa Travel 100 Women Award

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING