news

ALHAJI MUNIRUDEEN BOLA OYEBAMIJI A.M.B.O.: THE MAKING OF THE NEXT OSUN GOVERNOR

A Life of Discipline, Public Trust, and Institutional Leadership

By Prince Adeyemi Shonibare

Alhaji Munirudeen Bola Oyebamiji AMBO stands as one of the most prepared public figures in Osun State’s contemporary history. His journey is neither accidental nor theatrical. It is the product of deliberate growth across education, finance, agriculture, governance, and national service. In a time when Osun seeks stability, productivity, and long-term direction, AMBO represents the making of the next Osun Governor through preparation rather than proclamation.

Born on 17 November 1965 in Osun State, Alhaji Munirudeen Bola Oyebamiji’s life reflects the values of diligence, discipline, and service that define the Yoruba ethos. His early years were shaped by community, faith, and a strong respect for education.

He began his formal education at ADC Primary School, Oke-Ada, from 1971 to 1977, where foundational discipline and leadership instincts were nurtured. He proceeded to Ayedaade Grammar School, Ikire, between 1978 and 1982, developing a strong interest in economics, governance, and social organization. These formative years anchored him firmly in the lived realities of Osun people.

His academic pursuit of finance and administration led him to The Polytechnic, Ibadan, where he earned a Higher National Diploma in Banking and Finance between 1985 and 1988. Recognizing the importance of advanced knowledge for public leadership, he obtained a Master’s degree in Public Administration from Lagos State University, Ojo, and a Master’s degree in Business Administration from the University of Ado-Ekiti. This combination of public policy and executive management training remains a defining strength of his leadership profile.

Professionally, AMBO holds respected credentials across finance, economics, and risk governance. He became a member of the Chartered Institute of Bankers of Nigeria in 2009. In 2011, he was admitted as a Fellow of the Institute of Chartered Economists of Nigeria, and in 2016, he became a Fellow of the Association of Enterprise Risk Management Professionals. These qualifications reinforce his expertise in financial systems, economic planning, and institutional stability.

His career in the corporate world began in 1989 at Wema Bank Plc, where he served as Assistant Manager. In 1998, he joined Trans International Bank as Senior Manager and rose to Principal Manager, also serving as Head of the Lagos Region before leaving in 2003. He later worked at Spring Bank Plc from 2005 to 2009 as Head of Business Development and subsequently joined Enterprise Bank in 2009 as Head of the Retail Business Unit. Across these institutions, he built a reputation for strategic growth, disciplined management, and performance accountability.

AMBO’s transition into Osun State public service marked a critical turning point. In 2012, he was appointed Managing Director of Osun State Investment Company Limited. At the time, the company faced operational inefficiencies and limited returns. Applying private-sector discipline to public enterprise, he restructured operations, improved asset utilization, and enforced financial controls. Under his leadership, the company reportedly achieved over 700 percent growth in turnover within a short period, earning him recognition as a results-driven technocrat.

This performance led to higher responsibilities within Osun State Government. He was appointed Commissioner for Finance, Budget, and Economic Planning, where he became the chief custodian of Osun’s fiscal system. His tenure coincided with periods of economic pressure and declining federal revenues. Through prudent budgeting, expenditure discipline, revenue optimization, and careful debt management, he helped stabilize the state’s finances and ensure continuity in salaries, pensions, and core public services.

A senior Osun political leader once observed,

“He understands money the way a doctor understands the human body. He knows where it hurts, what to treat, and what not to touch.”

Beyond executive roles, AMBO served on the boards of key financial institutions linked to Osun’s development, including Omoluabi Mortgage Bank and Brent Mortgage Bank. These positions expanded his influence in housing finance, SME support, and long-term capital formation.

Alongside public service, AMBO has remained deeply connected to agriculture. Since 1997, he has served as Chairman of White Green Farm in Onireke Village, Ikire. The farm produces plantain, plantain flour, yam flour, palm oil, palm kernel oil, maize, and other grains in commercial quantities. It supports local employment and supplies raw materials to manufacturers. For AMBO, agriculture is not nostalgia but economics.

As a market woman in Ikire once said,

“He is not someone who talks farming. He farms. That is why we trust him.”

His leadership journey expanded to the national stage with his appointment as Managing Director and Chief Executive Officer of the National Inland Waterways Authority. At NIWA, he oversees a strategic national asset critical to transport efficiency, trade expansion, and regional development. His mandate includes improving safety, navigation, infrastructure, and economic utilization of Nigeria’s inland waterways.

President Bola Ahmed Tinubu, in a congratulatory message following his appointment, described him as

“A disciplined administrator with proven capacity for institutional reform and national service.”

What distinguishes Alhaji Munirudeen Bola Oyebamiji AMBO is not ambition but readiness. He is a technocrat who understands politics, not a politician learning governance. He believes Osun must unlock its dormant wealth through structured development of its mineral resources, including gold, limestone, kaolin, granite, quartz, marble, clay, phosphate, and gemstones, converting natural endowments into shared prosperity.

Equally central to his vision is youth inclusion through education, skills, sports, creative industries, and enterprise development. To him, governance is measured not by announcements, but by outcomes.

A trader at Oja-Oba, Osogbo, summarized public sentiment simply,

“He is calm, but he works. That is the kind of governor we need now.”

Osun stands at a defining moment. It requires a leader who understands systems, respectss not slogans. A steward of resources, not a seeker of applause. In Alhaji Munirudeen Bola Oyebamiji AMBO, Osun sees not just a contender, but the making of its next governor.

news

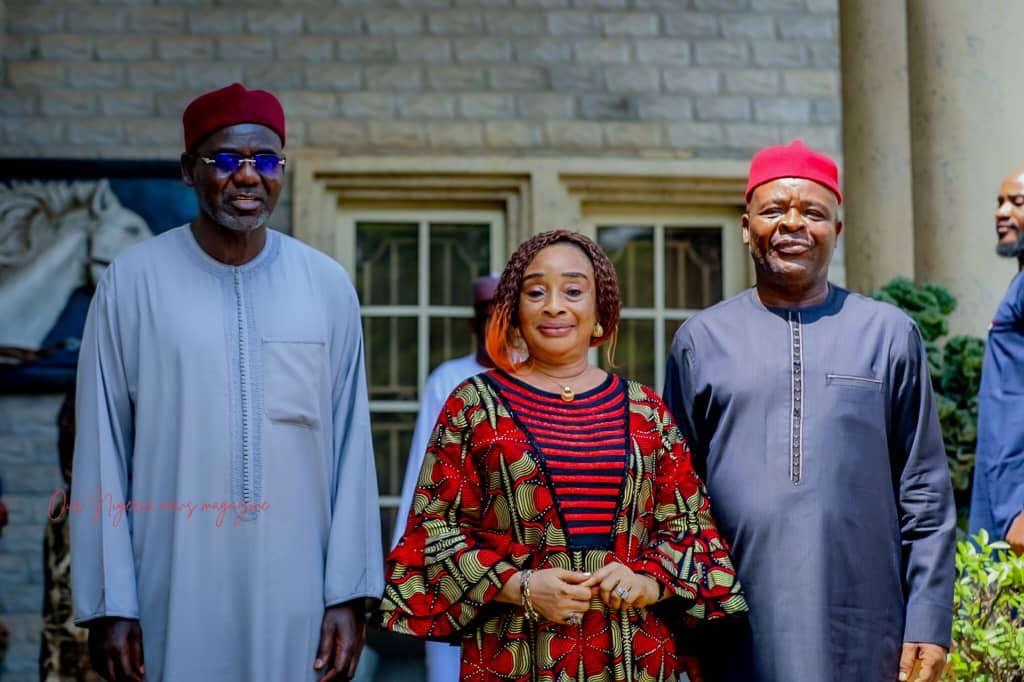

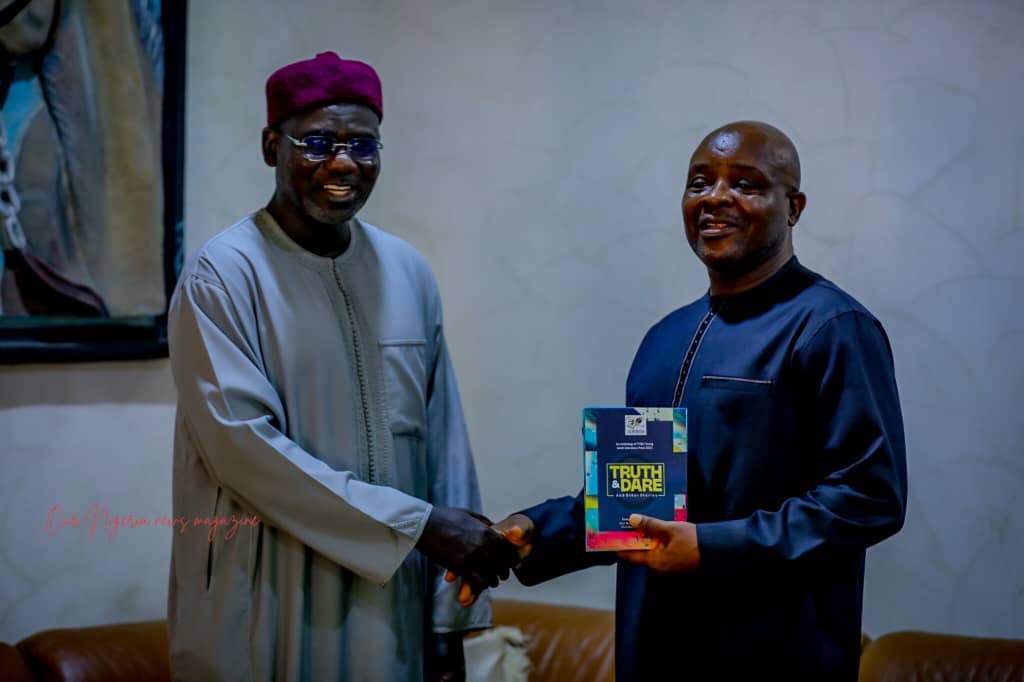

Buratai Pays Tribute to Ihejirika at 70, Hails Mentorship and Legacy of Leadership

Buratai Pays Tribute to Ihejirika at 70, Hails Mentorship and Legacy of Leadership

Former Chief of Army Staff and Nigeria’s immediate past Ambassador to the Republic of Benin, Lt. Gen. (Rtd) Tukur Yusuf Buratai, has paid a glowing tribute to his predecessor, Lt. Gen. OA Ihejirika, as the retired General marks his 70th birthday.

In a heartfelt message released in Abuja on Friday, Buratai described Ihejirika as not only a distinguished soldier and statesman, but also a commander, mentor, and “architect of leadership” whose influence shaped a generation of senior military officers.

Buratai recalled that his professional rise within the Nigerian Army was significantly moulded under Ihejirika’s command, citing key appointments that defined his career trajectory.

According to him, the trust reposed in him through early command responsibilities, including his first command posting at Headquarters 2 Brigade and later as Commandant of the Nigerian Army School of Infantry, laid a solid foundation for his future leadership roles.

“These opportunities were not mere appointments; they were strategic investments in leadership,” Buratai noted, adding that such exposure prepared him for higher national responsibilities.

He further acknowledged that the mentorship and professional grounding he received under Ihejirika’s leadership were instrumental in his eventual appointment as Chief of Army Staff and later as Nigeria’s Ambassador to the Republic of Benin.

Buratai praised Ihejirika’s command philosophy, describing it as professional, pragmatic, and mission-driven. He said the former Army Chief led by example, combining firm strategic direction with a clear blueprint for excellence that continues to influence military leadership practices.

“At seventy, General Ihejirika has earned the right to reflect on a legacy secured,” Buratai stated, praying for good health, peace, and enduring joy for the retired General as he enters a new decade.

He concluded by expressing profound gratitude for the leadership, mentorship, and lasting example provided by Ihejirika over the years.

The tribute was signed by Lt. Gen. Tukur Yusuf Buratai, who described himself as a grateful mentee and successor, underscoring the enduring bonds of mentorship within the Nigerian Army’s top leadership.

news

Sagamu Plantation Row: Igimisoje-Anoko Family Challenges LG Claim

news

Sagamu Communities Exonerate Sir Kay Oluwo, Accuse Teriba of Land Invasions, Violence

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING

-

Business6 months ago

Business6 months agoBatsumi Travel CEO Lisa Sebogodi Wins Prestigious Africa Travel 100 Women Award