Business

ZENITH BANK ACTIVATES THE SPIRIT OF CHRISTMAS WITH AJOSE ADEOGUN STREET LIGHT-UP

ZENITH BANK ACTIVATES THE SPIRIT OF CHRISTMAS WITH AJOSE ADEOGUN STREET

LIGHT-UP

-

Ajose Adeogun Street, which can compare and compete with any decorations anywhere in theworld – be it in Europe, North America, or Asia.Whilst wishing everyone a Merry Christmas filled with joy, love, peace and harmony, he enjoinedall to remember that Christmas is also a time for sober reflection when we think about things thatwe couldn’t do and focus our thoughts on being better people and building a better society andcountry. He also used the opportunity to remind Nigerians and the whole world in general that thefight against COVID-19 is far from over. He, therefore, appealed to everyone that as “we celebrateChristmas, we should celebrate responsibly, maintain social distance, wear our masks and forthose of us who haven’t been vaccinated, please take your vaccine for vaccination is saving lives”.The Light-Up Ceremony is one of the many Corporate Social Responsibility and SustainabilityInitiatives of Zenith Bank, as the Bank continues to lead in corporate social responsibility (CSR)contributions and spending by Nigerian financial institutions. Indeed, Zenith Bank has clearlydistinguished itself in the Nigerian financial services industry as an institution that is committed tobuilding a more sustainable and inclusive economy and one that promotes responsible businesspractices in Nigeria through the integration of sustainability principles in its business operations.Zenith Bank’s sustainability and CSR initiatives are hinged on the belief that today’s businessperformance is not all about the financial numbers – the Bank believes that an institution’s socialinvestments, contributions to inclusive economic growth and development as well as improvementsin the condition of the physical environment, all constitute a balanced scorecard.Through its CSR initiatives, the Bank has embodied the overarching objective of the 17 SDGs,which provide a framework for addressing the major challenges confronting our society. Its socialinvestments are targeted at health, education, women and youth empowerment, sportsdevelopment and public infrastructure enhancement. Overall, Zenith Bank’s total socialinvestments in 2020 stood at NGN3.29 billion ($8.62million), representing 1.66 per cent of its ProfitAfter Tax.The Bank remains committed to furthering the economic, cultural and social development of hostcommunities, particularly through community-based initiatives and philanthropy. As a goodcorporate citizen, it continues to deliver projects that have long-term social and economic benefitsfor the communities because it believes that its business is only as strong as the communities inwhich it operates.To demonstrate its commitment to creating and expanding opportunities, the Bank regularly makesdonations towards the setting up of ultramodern ICT centres in several educational institutionsacross the country. It also supports various developmental projects, and healthcare delivery

-

causes in Nigeria and contributes to the development of sports in Nigeria through its sponsorshipof the Zenith Women Basketball League and the Zenith Bank Delta State Principals’ andHeadmasters’ Football Competitions, to mention a few.The Bank also demonstrates leadership when its host communities deal with a crisis. For example,following the unfortunate gas explosion incident of March 15, 2020, which led to the loss of livesand properties at the Abule-Ado area in Amuwo Odofin Local Government Area of Lagos State,Zenith Bank made a donation of NGN100 million to the Emergency Relief Fund set up by theLagos State Government for the victims of the explosion.Amidst the COVID-19 pandemic, Zenith Bank’s commitment to sustainability has not waned, as theBank donated NGN1 billion as part of the Coalition Against COVID-19 (CACOVID), a privatesector-led initiative to support the Nigerian Government to combat the Covid-19 crisis

Business

Deadline of Compliance: Nigeria’s Urgent Call for Tax Return Filing

Deadline of Compliance: Nigeria’s Urgent Call for Tax Return Filing

By George Omagbemi Sylvester | Published by SaharaWeeklyNG.com

“Shift or Structural Demand? A Declaration of Civic Duty in a Nation at a Fiscal Crossroads.”

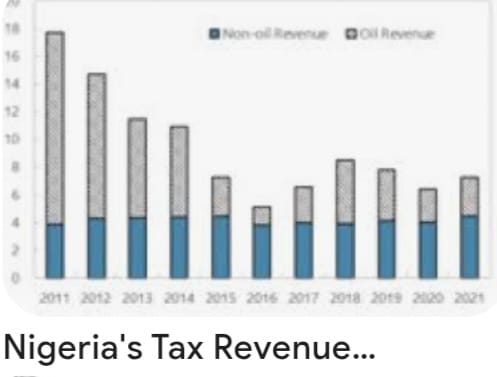

In the unfolding narrative of national development and economic reform, few instruments are as defining as tax compliance. For Nigeria, a nation perpetually grappling with revenue shortfalls, structural dependency on a single export commodity, and entrenched informal economic behaviour, the Federal Government’s recent clarification on tax return deadlines is not mere bureaucratic noise. It is a deliberate and inescapable declaration: the social contract between citizen and state must be honoured through transparent, lawful and timely tax reporting.

At its core, the government’s pronouncement is stark in its simplicity and radical in its implications. Federal authorities, speaking through the Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, have made it unequivocally clear that every Nigerian, whether employer or individual taxpayer, must file annual tax returns under the law. This encompasses self-assessment filings by individuals that too many assumed ended once employers deducted pay-as-you-earn taxes from their salaries.

This is not an optional civic suggestion, it is mandatory, backed by statute, and tied to a broader vision of national fiscal responsibility. Citizens can no longer hide behind ignorance, apathy, or false assumptions. “Many people assume that if their employer deducts tax from their salaries, their obligations end there. That is wrong,” Oyedele warned, emphasizing that the obligation to file remains with the individual under both existing and newly reformed tax laws.

The Deadlines and the Reality They Reveal.

Across the federation, state and federal revenue authorities have reaffirmed statutory deadlines in pursuit of compliance. The Lagos State Internal Revenue Service, for instance, moved to extend its filing date for employer returns by a narrow window, reflecting the reality that compliance often lags behind legal timelines. The extension was intended not as leniency, but as a pragmatic effort to allow accurate and complete submissions, underscoring that true compliance rises above mere mechanical ticking of a box.

At the federal level, Oyedele’s intervention was even more fundamental. He reminded Nigerians that annual tax returns for the preceding year must be filed in good faith, with integrity and in respect of the law. This applies regardless of income level including low-income earners who have historically believed that they are outside the tax net. “All of us must file our returns, including those earning low income,” he stated.

Herein lies one of the most challenging truths of contemporary Nigerian governance: widespread tax non-compliance is not just a technical breach of law, it is a deep cultural and structural issue that reflects decades of mistrust between citizens and the state.

The Root of the Problem: Non-Compliance as a Symptom.

Nigeria’s tax culture has long been under scrutiny. Public discourse and economic analysis consistently show that a significant majority of eligible taxpayers do not file annual returns. Oyedele highlighted that even in states widely regarded as tax administration leaders, compliance remains strikingly low, often below five percent.

This widespread non-compliance stems from multiple sources:

A long history of weak tax administration systems, where enforcement was inconsistent and penalties were rarely applied.

A perception that public services do not reflect the taxes collected, eroding the citizenry’s belief in reciprocity.

An informal economy where income often goes unrecorded, making filing seem irrelevant or impossible to many.

Lack of awareness, with many Nigerians genuinely believing that tax liability ends with employer deductions.

The government’s renewed push for compliance directly challenges these perceptions. It signals a shift from voluntary or lax compliance to structured accountability, a stance that aligns with best practices in modern public finance.

Why This Matters: Beyond Deadlines.

At its most profound level, the insistence on tax return filings is about nation-building and shared responsibility.

Scholars of public finance universally agree that a robust tax system is the backbone of sustainable development. As the eminent economist Dr. Joseph E. Stiglitz has observed, “A society that cannot mobilize its own resources through fair taxation undermines both its government’s legitimacy and its capacity to provide for its people.” Filing tax returns is not a mere administrative task, it is a declaration of participation in the collective project of national advancement.

In Nigeria’s context, this declaration carries weight. With the enactment of comprehensive tax reforms in recent years (including unified frameworks for tax administration and enforcement) authorities now possess broader statutory tools to ensure compliance and accountability. These measures, which include electronic filing platforms and stronger enforcement powers, have been framed as fair and equitable, targeting efficiency rather than arbitrariness.

Yet the success of these reforms depends heavily on citizens embracing their civic duties with sincerity. And this depends on mutual trust, the belief that paying taxes yields tangible benefits in infrastructure, education, healthcare, security and social services.

Voices From Experts: Fiscal Responsibility as a Public Ethic.

Tax law experts and economists, reflecting on the compliance push, have underscored a universal theme: taxation without transparency is inequity, but taxation with accountability is empowerment. When managed with fairness, a functional tax system can reduce dependency on volatile revenue sources, stabilise national budgets, and support long-term investment in human capital.

Professor Aisha Bello, a respected authority in fiscal policy, notes that “Tax compliance is not a burden; it is the foundation upon which social contracts are built. A citizen who honours tax obligations affirms the legitimacy of governance and demands better performance in return.”

Similarly, a leading tax scholar, Dr. Emeka Okon, argues that “The era when Nigerians could evade broader tax responsibilities simply because automatic deductions occur at source must end. For a modern economy, every eligible citizen must be part of the formal tax fold not as victims, but as stakeholders.”

These authoritative voices point to an unassailable truth: filing tax returns is both a legal requirement and a moral responsibility, an expression of citizenship in its fullest sense.

Challenges on the Ground: Compliance and Capacity.

While the rhetoric of compliance is compelling, the reality on the ground demands nuanced understanding. Many taxpayers (especially in the informal sector) lack meaningful access to digital platforms and resources for filing returns. For others, the fear of bureaucratic complexity and perceived punitive enforcement deters participation.

The government, for its part, has responded by promoting online systems and pledging greater taxpayer support. Tax authorities are increasingly engaging stakeholders to demystify filing processes, explain requirements and offer assistance. This mix of enforcement and facilitation is essential. As one seasoned revenue specialist observed: “The state cannot compel compliance through force alone; it must earn it through education, simplicity and fairness.”

The Broader Implication: A New Social Compact.

Ultimately, Nigeria’s renewed emphasis on tax return filing transcends administrative deadlines. It is an unequivocal declaration that national development is a shared responsibility, that citizens and state must engage in a transparent, accountable, and reciprocal relationship.

Tax compliance, therefore, becomes far more than a legal act; it becomes a moral claim on the nation’s future.

When citizens file their returns honestly, they affirm their stake in the nation’s destiny. When the government collects taxes transparently and deploys them effectively, it strengthens not only public services but civic trust itself.

In this sense, the deadlines proclaimed by Nigeria’s fiscal authorities mark not an end but a beginning; the beginning of a civic epoch in which accountability replaces apathy, participation replaces indifference and national purpose triumphs over fragmentation.

The road ahead will not be easy. But in demanding compliance, Nigeria is demanding more than tax returns. It is demanding commitment and that, ultimately, is the foundation on which nations are built.

Business

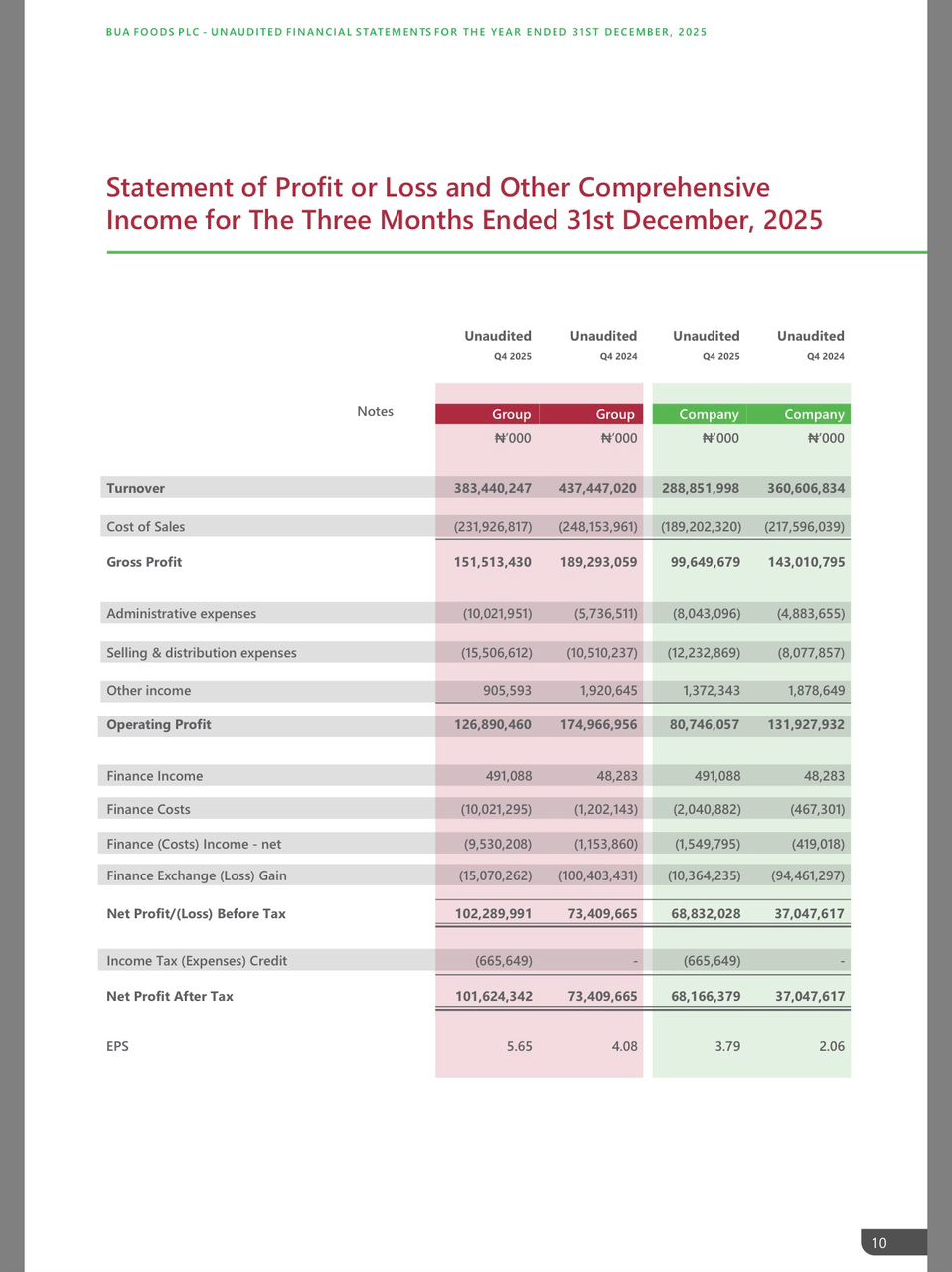

BUA Foods Records 91% Surge in Profit After Tax, Hits ₦508bn in 2025

BUA Foods Records 91% Surge in Profit After Tax, Hits ₦508bn in 2025

By femi Oyewale

Business

Adron Homes Unveils “Love for Love” Valentine Promo with Exciting Discounts, Luxury Gifts, and Travel Rewards

Adron Homes Unveils “Love for Love” Valentine Promo with Exciting Discounts, Luxury Gifts, and Travel Rewards

In celebration of the season of love, Adron Homes and Properties has announced the launch of its special Valentine campaign, “Love for Love” Promo, a customer-centric initiative designed to reward Nigerians who choose to express love through smart, lasting real estate investments.

The Love for Love Promo offers clients attractive discounts, flexible payment options, and an array of exclusive gift items, reinforcing Adron Homes’ commitment to making property ownership both rewarding and accessible. The campaign runs throughout the Valentine season and applies to the company’s wide portfolio of estates and housing projects strategically located across Nigeria.

Speaking on the promo, the company’s Managing Director, Mrs Adenike Ajobo, stated that the initiative is aimed at encouraging individuals and families to move beyond conventional Valentine gifts by investing in assets that secure their future. According to the company, love is best demonstrated through stability, legacy, and long-term value—principles that real estate ownership represents.

Under the promo structure, clients who make a payment of ₦100,000 receive cake, chocolates, and a bottle of wine, while those who pay ₦200,000 are rewarded with a Love Hamper. Payments of ₦500,000 attract a Love Hamper plus cake, and clients who pay ₦1,000,000 enjoy a choice of a Samsung phone or a Love Hamper with cake.

The rewards become increasingly premium as commitment grows. Clients who pay ₦5,000,000 receive either an iPad or an all-expenses-paid romantic getaway for a couple at one of Nigeria’s finest hotels, which includes two nights’ accommodation, special treats, and a Love Hamper. A payment of ₦10,000,000 comes with a choice of a Samsung Z Fold 7, three nights at a top-tier resort in Nigeria, or a full solar power installation.

For high-value investors, the Love for Love Promo delivers exceptional lifestyle experiences. Clients who pay ₦30,000,000 on land are rewarded with a three-night couple’s trip to Doha, Qatar, or South Africa, while purchasers of any Adron Homes house valued at ₦50,000,000 receive a double-door refrigerator.

The promo covers Adron Homes’ estates located in Lagos, Shimawa, Sagamu, Atan–Ota, Papalanto, Abeokuta, Ibadan, Osun, Ekiti, Abuja, Nasarawa, and Niger States, offering clients the opportunity to invest in fast-growing, strategically positioned communities nationwide.

Adron Homes reiterated that beyond the incentives, the campaign underscores the company’s strong reputation for secure land titles, affordable pricing, strategic locations, and a proven legacy in real estate development.

As Valentine’s Day approaches, Adron Homes encourages Nigerians at home and in the diaspora to take advantage of the Love for Love Promo to enjoy exceptional value, exclusive rewards, and the opportunity to build a future rooted in love, security, and prosperity.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

Business6 months ago

Business6 months agoBatsumi Travel CEO Lisa Sebogodi Wins Prestigious Africa Travel 100 Women Award

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING