Politics

Tinubu’s Presidency In 30 Days

Tinubu’s Presidency In 30 Days

-

Households, and businesses under renewed inflationary pressures

-

Naira depreciation continues

-

Energy crises fester as electricity generation declines

-

Stock market rises 13.5%, investors gain N3.9trn

-

Portfolio investors are returning

-

Credit ratings may rise, says Bank of America

-

Oil sector reform beckons, says Int’l agencies

-

Analysts see rays of hope

The Tinubu Presidency in 30 days is impacting individuals, businesses, and the economy in an inescapable way, driven by double-barreled liberalization policies.

Though Vanguard findings reveal increased hardships as the cost of living rises sharply, many analysts, yesterday indicated that the difficulties would soften in the medium term if the fall-outs are managed properly.

The policies which are the removal of subsidy through petrol pricing to market forces and removal of official controls on the foreign exchange market by floating the Naira exchange rate in the open market, were launched in the first two weeks of Tinubu’s assumption of office.

Consequently, by yesterday, petrol prices at the pump have risen by a minimum of 175 percent to the national average of N600 per litre outside Lagos, though Lagos is selling at an average of N500 per litre, about a 169 percent rise.

The Naira, as at the close of business yesterday, has depreciated by 63 percent to N768.17 per dollar in the official market.

Last week, it was also announced that new taxes are taking effect from today while a 40 percent hike in electricity tariff has been proposed to take effect from today if the President approves the recommendation of the sector regulators and operators.

These additional policies meant to take effect from today are expected to join the petrol and the forex reforms in reshaping Nigeria’s economic environment and ultimately the life of the citizens in huge proportion going forward.

Policy Pronouncements

“….Fuel subsidy is gone………..The Central Bank must work towards a unified exchange rate”, the President said at his inauguration on May 29, 2023.

Thus the President signalled major changes in policy directions in two major sectors of the economy, which was followed by a raft of implementation measures felt in every home and in every facet of the economy, as prices of most food and essential items have now come under severe inflationary pressures.

Prices of Food, essential items

For example, eight out of the 11 food and essential items monitored by Financial Derivatives Company (FDC), a leading Lagos-based economic and financial research company, recorded significant price increases in June.

These are: Beans Oloyin (50kg) rose from N30,000 to N35,000; Tomatoes (50kg) rose from N55,000 to N65,000; Pepper (bag) rose from N20,000 to N33,000; Onions (bag) rose from N28,000 to N37,000; Palm Oil (25liters) rose from N22,500 to N29,000; New Yam (medium size) rose from N2,000 to N3,500; and Sugar (50kg) rose from N35,000 to N42,000.

The prices of Semovita (10kg) and Flour (50kg) remained stable at N6,800 and N28,500 respectively. But the price of Garri (50kg) Yellow fell from N28,000 to N19,000 and Rice (50kg) short grain fell from N35,000 to N33,000.

Naira depreciation

Following the pronouncement of the President, the Central Bank of Nigeria, CBN, on Wednesday, June 14, introduced new operational measures for the foreign exchange market. These include the elimination of multiple exchange rates and the reintroduction of the willing buyer, the willing seller model in the official market, and the Investors & Exporters (I&E) window.

Consequently, the exchange rate in the I&E window rose to N768.17 per dollar on June 27th from N471.67 per dollar on May 20th. This translated to 63 percent depreciation of the naira in the official market. The depreciation in the parallel market was marginal at 0.9 per cent during the same period, rising to N775 per dollar on June 27th from N768 per dollar on May 28th.

Meanwhile, the nation’s external reserves declined by $927 million during the same period.

According to data by CBN, the reserves fell to $34.22 billion on June 26th from $35.147 billion.

Notwithstanding these developments, analysts including the World Bank commended some aspects of the foreign exchange market reform which included the elimination of multiple exchange rates and the removal of other restrictions in the I&E window.

While noting that in the short term, the measures will lead to naira depreciation and inflation, they projected that in the long term, they will enhance investors’ confidence, enhance foreign exchange inflow into the economy, and stability in the forex market, as well as increase revenue for the government.

The World Bank in the June 2023 edition of its Nigeria Development Update, said: “The comprehensive reform initiated in mid-June addresses three critical distortions in the FX market: (i) the absence of a price discovery mechanism; (ii) the existence of multiple FX windows; and (iii) institutional weaknesses, such as a lack of transparency and predictability”.

But according to analysts at FDC, led by a notable economist, Bismarck Rewane, “The foreign exchange market will remain volatile in the short term as market expectations continue to drive the demand & supply dynamics. The naira is likely to trade within the band of N656/$ – N795/$ on the I & E window in the short term to medium term.

“ In the short term, the external reserve is likely to sustain its depletion as oil prices sustain its losses on fears of weak global demand. However, in the medium term, the reduction in forex restrictions and administrative controls will increase foreign investment inflows as lower currency & convertibility risks improve foreign investor confidence. This will lead to reduced depletion of the foreign exchange reserves”

Stock market rises, investors gain N3.9trn

Against the backdrop of a seeming adverse fallout from the new policies, investors in the Nigerian stock market seem to be the immediate beneficiaries. The stock market recorded a significant positive movement in the first 30 days of President Tinubu’s government, rising by 13.5 percent, even as investors gained N3.9 trillion within the period.

The surge is coming on the back of the new administration’s decision to remove the fuel subsidy, unify exchange rates and ensure that foreign investors and businesses are able to repatriate their earnings in dividends and profits.

The market began an upsurge on May 30, 2023, barely 24 hours after the presidential inauguration, and lasted to the end of June.

Specifically, the benchmark All Share Index (ASI), which measures the performance of the market rose to 60,108.86 points at the close of transactions on June 27, 2023, from 52,973.88 points on May 26, 202, days before the inauguration. This represents a 13.5 percent increase.

Similarly, the market capitalization of all listed equities advanced by 13.5 percent or N3.9 trillion to N32.730 trillion from N28.845 trillion.

Foreign portfolio investors have also resumed participation in the equity market in response to the policy changes. Available data from the Nigerian Exchange Limited (NGX) on Domestic and Foreign Portfolio Investors’ Participation in Equity for May 2023 showed that foreign investors raised their stake by 338.72 percent, reflecting the rally that ensued in the last two days in May, following the announcement of the policy changes.

Analysis showed that the FPIs raised their stake to N37.16 billion from N8.47 billion in April, representing an 11.5 percent participation level and a 7.07 percentage point increase compared to their total transaction (4.43%) in April.

Credit rating may rise

As Nigeria undergoes reforms, the bond market has responded positively with Nigeria’s bonds outperforming peer countries, according to the Bank of America report.

The country’s current spread came in tighter than Angola, Egypt, and Kenya for 5yr, 10yr, and 30yr which made the country’s rating reflect B (implied rating), higher than the actual rating of B-.

In November 2022, Fitch downgraded the country’s credit rating to B- due to the continued deterioration of the fiscal and debt position despite the elevated oil prices.

Not quite long after, Moody followed suit by downgrading to Caa1 with a stable outlook.

The Bank of America expects a likely upgrade of the country’s rating considering the performance of the market and the key policy reforms. Analysts affirm the possible upward review of the country’s rating as the recent policy suggests a better fiscal position.

However, the debt position and debt servicing might hinder the desired upgrade as total public debt is expected to climb to around N81trillion as of June 2023 and debt servicing continues to rise.

Analysts comments

Speaking on the developments, David Adonri, Vice Chairman, of Highcap Securities, said that the capital market would receive a great boost if the monetary policy could be normalized by lowering interest rates.

His words: “If monetary policy can be normalized through lowering of interest rate, liberalization of consumer credit including margin credit, unification of exchange rate, which has commenced, and release of trapped foreign investor’s funds, the capital market will receive a great boost. If the interest rate falls to the point where the yield on equities supersedes the yield on debt, the primary market which is the essence of the capital market can start booming again.

“However, some of these are still conjectures because the necessary actions are yet to be taken. Action always speaks louder than words. It may also be premature at this point to anticipate what impact the other proposed fiscal policies will have on the capital market but they are laudable goals if the President will summon the iron determination to actualize them.”

Agreeing with him, Victor Chiazor, Head of Research, and Investment, at FSL Securities, said: “The equities market will continue to react positively to government policies that it perceives as the right and market-friendly policies. So far, the market has been excited about the recent policy statements by the new administration hence the rally being observed in the market which has lifted the market by 13.5% in 30 days.

“The next phase will now be to implement coordinated fiscal and monetary policies that will foster a favourable business environment and a prosperous economy and until the market sees a semblance of these things, the market rally may be short-lived.”

Also speaking, Uche Uwaleke, Professor of Capital Market and President, of Capital Market Academics of Nigeria, said: “Whether the bullish sentiment will be sustained, especially on the part of domestic investors, depends on how the impact of the reforms are managed as well as on the implementation of the policies contained in his economic blueprint aimed at boosting the capital market such as leveraging opportunities in infrastructure financing via Sukuk and promoting commodity exchanges which ought to facilitate growth in agric GDP.”

Oil sector reform beckons

During the Buhari-led administration, policy advice from international development agencies revolved around the removal of the petrol subsidy and the elimination of the multi-tiered exchange rate system.

The implementation of these reforms by the new Tinubu-led administration has been driving the wave of optimism expressed by these agencies about Nigeria’s business environment.

Bank of America’s (BoA) analysis of Nigeria demonstrates this viewpoint. The US-based bank noted that President Bola Tinubu’s political influence has successfully led to the removal of fuel subsidies and the floatation of the naira, without any societal uproar.

The bank predicts that, with the current momentum, Tinubu’s next significant move will be to eliminate oil theft by overhauling the security sector and involving host communities.

According to the bank, if this strategy proves effective, it could raise Nigeria’s crude oil production to 1.6mb/d in 12-18 months from the present 1.2mb/d, barring OPEC limits, and combining this with the operation of the Dangote refinery would indicate a potential structural enhancement in Nigeria’s economic prospects.

But some other analysts are less optimistic as BoA was about the country’s oil and gas sector reforms and prosperity. According to them, the country’s oil infrastructure is limited in capacity as many would require a complete overhaul to operate near the nameplate capacity, which would require more than the projected timeframe.

Also, Nigeria’s oil theft cartel is said to have extended beyond the security architecture and host communities. It has become an organized parallel industry that includes security personnel, oil companies, supply chain partners, and host communities, among others, with sophisticated infrastructure, which could undermine reforms targeted at certain segments.

Moreso, they said years of many challenges, such as the high cost of production and unmet export obligations, may have weakened the prospect of Nigeria’s crude oil in the international market.

Analysts believe a more holistic approach that combines regulatory actions, technology, and institutional reforms should, however, deliver short to medium success.

Meanwhile, analysts reckon that the operation of the Dangote refinery will not significantly bring down petroleum product prices but could provide price cushions as the company will also operate in the global high-cost environment.

Electricity generation drops

Notwithstanding, with the mixed fallouts from the policy statements so far, Nigeria’s electricity sector remained negative.

Average electricity generation dropped month-on-month, MoM, by 3.8 percent to 4,003.4 megawatts, MW in June 2023, from an average of 4,161MW recorded in the preceding month of May 2023.

This was based on data obtained by Vanguard from the Nigeria Electricity System Operator, the semi-autonomous arm of the Transmission Company of Nigeria, TCN.

Checks by Vanguard indicated that less than 4,000MW was transmitted and distributed daily to consumers, including households and organizations, a development that compelled many to generate their independent power at a higher cost.

The high cost of independent power generation by households and organizations was not only because of the high price of diesel currently hovering at over N600 per litre, but also the higher cost of petrol in the past one month.

Politics

Kogi’s Quiet Shift: Reviewing Governor Ododo’s First 24 Months in Office

Kogi’s Quiet Shift: Reviewing Governor Ododo’s First 24 Months in Office

By Rowland Olonishuwa

On Tuesday, Kogi State paused to mark two years since Alhaji Ahmed Usman Ododo took the oath as Executive Governor. Across government circles, community halls, and everyday conversations, the anniversary was more than a date on the calendar; it was a milestone that invites both reflection and renewed optimism. A moment to look back at how far the state has travelled in just twenty-four months, and where it is heading next.

Since assuming office in January 2024, Ododo has steered the state through a period of measured consolidation, delivering strategic interventions across security, infrastructure, human capital, and economic revitalisation that are beginning to translate into real improvements for residents.

Governor Ododo stepped into office at a time when expectations were high, and confidence in public institutions needed rebuilding.

His response to these was not loud declarations, but steady consolidation, strengthening structures, restoring order in governance, and setting a clear direction. Over time, that calm approach has become his signature: leadership that listens first, plans carefully, and moves with purpose.

Security has remained the most urgent concern for Nigerians, and Kogi residents are no exceptions; the Ododo-led administration has treated it as such. From deploying surveillance drones to support intelligence operations to recruiting and integrating local hunters and vigilante personnel into formal security frameworks, the government has built a layered safety net.

For farmers returning to their fields, travellers moving along highways, and families in rural communities, the impact is simple and deeply personal: fewer fears, quicker response, and growing confidence that the government is present and concerned about the ordinary people.

Infrastructural development has followed the same practical logic. Roads have been rehabilitated, easing movement for traders and commuters. Budget priorities have shifted toward capital projects and human development, while revived facilities like the Confluence Rice Mill now provide farmers with real economic opportunity. For many households, this means better income prospects, stronger local trade, and renewed belief that development is no longer a distant promise.

Health and education are not left out; the Ododo-led administration has expanded free healthcare services and supported students through examination funding and institutional improvements.

Parents who once struggled with medical bills and school fees have felt relief. Young people preparing for their futures now see government investment not as abstract policy but as something that touches their daily lives.

Governance reforms, from civil service strengthening to new legislative frameworks, have quietly improved how government functions. Salaries are more predictable, public offices are more responsive, and local government structures are more coordinated. These may not always make headlines, but they shape how citizens experience leadership every day.

As the second year anniversary celebrations fade into routine today and Governor Ododo enters his third year in office, the true meaning of the anniversary will continue to linger on.

Two years may not have solved every challenge in the Confluence State -no government ever does, by the way- but they have set a tone of stability, responsiveness, and direction. The next phase will demand deeper impact, broader reach, and sustained security gains.

But for many in Kogi State, the story of the past twenty-four months is already clear: steady hands on the wheel, and a journey that is firmly underway.

Olonishuwa is the Editor-in-Chief of Newshubmag.com. He writes from Ilorin

Politics

Lagos Assembly Debunks Abuja House Rumour, Warns Against Election Season Propaganda

Lagos Assembly Debunks Abuja House Rumour, Warns Against Election Season Propaganda

The Lagos State House of Assembly has described as misleading and mischievous the widespread misinformation that it budgeted for the purchase of houses in Abuja for its members in the 2026 Appropriation Law.

This rebuttal is contained in a statement jointly signed by Hon. Stephen Ogundipe, Chairman, House Committee on Information, Strategy, and Security, and Hon. Sa’ad Olumoh, Chairman, House Committee on Economic Planning and Budget.

Describing the report as a deliberate and disturbing falsehood being peddled by patently ignorant people, the statement reads, “There is no provision whatsoever in the 2026 Budget for the purchase of houses in Abuja or anywhere else for members of the Lagos State House of Assembly. The report is a complete fabrication and a product of political mischief intended to misinform the public.

“The Lagos State House of Assembly does not operate in Abuja. Our constitutional responsibilities, constituencies, and legislative duties are entirely within Lagos State. It is, therefore, illogical, irrational, and irresponsible for anyone to suggest that legislators would appropriate public funds for personal housing outside their jurisdiction.”

The statement emphasised that the budget is already in the public domain and accessible for scrutiny by discerning Lagosians and Nigerians alike. It reiterated that the Lagos State Government operates a transparent budget that speaks to the needs of the people and the demands of a megalopolis.

“We view this rumour as part of a wider attempt at election-season propaganda, designed to erode public trust, sow discord, and malign democratic institutions.”

The chairmen further clarified that the 2026 capital expenditure of the House of Assembly is less than 0.04% of the total CAPEX of the state, which clearly demonstrates the culture of prudence, accountability, and fiscal responsibility that guides the legislature. However, they noted, “Historically, the House does not even access up to its approved budget in many fiscal years.”

They stressed that the Assembly remains fully committed to excellence, transparency, good governance, and the collective welfare of the people of Lagos State, in line with the objectives of the 2026 Budget of Shared Prosperity.

“We therefore challenge those behind this harebrained allegation to produce credible evidence or retract their statements forthwith. Failure to do so may attract appropriate legal actions.

“We urge Lagosians and the general public to disregard this baseless rumour and always verify information from official and credible sources.”

Politics

Democracy in the Crosshairs: How Nigeria’s Ruling APC Weaponises Power and Silences Dissent

Democracy in the Crosshairs: How Nigeria’s Ruling APC Weaponises Power and Silences Dissent.

By George Omagbemi Sylvester | Published by saharaweeklyng.com

“Tinubu’s Government, the EFCC and the Strategic Undermining of Opposition Governors”.

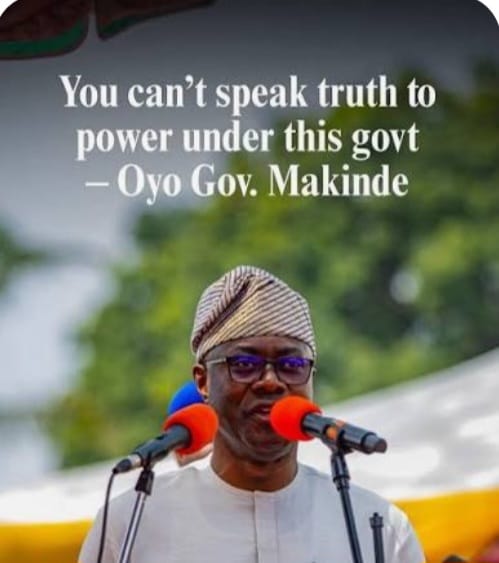

In a striking indictment of Nigeria’s current political reality, Governor Seyi Makinde of Oyo State declared that “you cannot speak truth to power in this dispensation”, directly accusing the administration of President Bola Ahmed Tinubu of intolerance for dissent and an erosion of democratic norms.

Makinde’s remarks (made during a public event in Ibadan on January 25, 2026) were more than a local governor’s lament. They crystallised a mounting national frustration: that Nigeria’s political landscape has tilted dangerously toward executive overreach, institutional capture and political engineering.

This narrative is not isolated. Across Nigeria, governors from opposition parties have defected to the ruling All Progressives Congress (APC) in numbers unprecedented in the nation’s democratic history. Critics argue that these defections are not merely voluntary political choices, but part of a strategic pressure campaign leveraging federal power and institutions to fracture opposition influence.

At its centre lies Nigeria’s principal anti-graft agency – the Economic and Financial Crimes Commission (EFCC).

The EFCC: Anti-Graft Agency or Political Instrument? Founded to combat corruption, the EFCC’s constitutional mandate is to investigate and prosecute financial and economic crimes across public and private sectors. Its legal independence is enshrined in statute and it has historically pursued high-profile cases, including recovery of nearly $500 million in illicit assets in a single year, demonstrating its capacity for tackling corruption.

However, critics now claim that under the Tinubu administration, the EFCC’s prosecutorial power is being perceived (if not deployed) as a political instrument.

Opposition leaders, including former Vice President Atiku Abubakar and coalition parties such as the African Democratic Congress (ADC), have publicly accused the federal government of using anti-corruption agencies to intimidate opposition figures and governors, effectively pressuring them into aligning with the APC.

In a statement released in December 2025, opposition figures alleged that institutions such as the EFCC, the Nigerian Police and the Independent Corrupt Practices and Other Related Offences Commission were being selectively wielded to weaken political competitors rather than combat financial crime impartially.

This is not merely rhetorical noise. The opposition’s grievances centre on several observable patterns:

Reopened or New Investigations Against Opposition Figures: The ADC pointed to recent abnormal reactivation of long-dormant cases or new inquiries into financial activities involving senior opposition politicians. These, they argue, often arise shortly before critical elections or political realignments.

Alleged Differential Treatment: According to opponents of the current administration, individuals who have defected to the APC appear less likely to face sustained legal scrutiny or prosecution in EFCC proceedings, even in cases of credible allegations of mismanagement.

Timing of Actions: The timing of certain high-profile investigations, emerging ahead of the 2027 general elections, reinforces perceptions that anti-graft measures are tailored to political cycles rather than legal merit.

The EFCC and Presidency have publicly denied these allegations, insisting that the commission operates independently and pursues corruption irrespective of political affiliation and that Nigeria’s democratic freedoms (including party choice and mobility) remain intact.

Yet the perception of bias, once systemic, is hard to erase, especially when political actors deploy powerful state machinery with strategic timing and selective intensity.

Defections and Power Realignment: A Democracy at Risk? Since 2023 and particularly through 2025, a remarkable number of state governors and senior political leaders have crossed over from opposition parties (notably the Peoples Democratic Party – PDP) to the APC. Though defections are normal in Nigeria’s fluid political system, the scale and speed in recent years are historically noteworthy, raising critical questions about underlying incentives.

The SaharaWeeklyNG reported Makinde’s comments within the broader context of a political climate where dissenting voices face greater obstacles than at any time in recent democratic memory.

Governors who remain in opposition find themselves squeezed between growing federal assertiveness and dwindling political capital. Some analysts argue that the combination of federal resource control, political appointments and influence over public agencies exerts tangible pressure on subnational leaders to align with the ruling party for political survival. This dynamic, they contend, undermines competitive party politics and weakens Nigeria’s multiparty democracy.

Speaking Truth to Power: What Makinde’s Critique Exposes. Governor Makinde’s core grievance (that it is increasingly difficult, perhaps perilous, to speak truth to power) resonates widely among civil society actors, political analysts and democratic advocates:

“YOU CANNOT SPEAK TRUTH TO POWER IN THIS DISPENSATION,” Makinde declared, specifically citing the government’s handling of contentious tax reform bills as an example where dissent was neither welcomed nor transparently debated.

Makinde’s critique reflects deeper structural concerns:

Exclusion of Key Stakeholders: Opposition leaders and state executives report being marginalised from meaningful consultation on national policies affecting federal-state relations, revenue sharing and fiscal reforms.

Institutional Intimidation: The perception that state politicians become targets of federal legal scrutiny after taking firm oppositional stances (real or perceived) discourages robust democratic debate.

Erosion of Opposition Space: A symbiotic effect of party defections and institutional pressure is a shrinking viable space for genuine political opposition, weakening checks and balances essential to democratic governance.

A respected political scientist, Dr. Aisha Bello of the University of Lagos, recently argued that “when opposition becomes fraught with state leverage instead of ideological competition, the very foundation of democratic contestation collapses,” adding that “a government that shies away from criticism risks inversion into autocracy.”

Another expert, Prof. Chinedu Eze, former dean of political studies at Ahmadu Bello University, warned that “selective use of anti-corruption agencies as political tools corrodes public trust and ultimately delegates justice into the hands of incumbents rather than independent courts.” These observations echo growing public skepticism.

The Way Forward: Strengthening Democracy and Institutions. Nigeria’s path forward depends on restoring confidence in democratic norms and institutional independence.

Transparent EFCC Processes: Civil society groups and legal scholars are advocating for enhanced transparency in anti-graft investigations, including clear prosecutorial thresholds and independent audits of case initiation and closures.

Judicial Oversight: Strengthening the judiciary’s capacity and independence is critical to ensuring that allegations of political weaponisation do not go unchecked. Courts must remain the ultimate arbiters of evidence and guilt.

Political Reforms: Advocates demand reforms to party financing, federal-state fiscal relations, and consultation mechanisms to reduce incentives for defections driven by federal resource leverage.

Public Engagement: A more informed and engaged civil society, anchored by independent media and civic education, must hold both government and opposition accountable for adherence to democratic principles.

Beyond The Present Moment.

Governor Makinde’s assertion that it is no longer tenable to “speak truth to power” under the current administration reflects unsettling trends in Nigeria’s evolving democratic landscape. While the EFCC and the Presidency maintain that anti-corruption efforts are independent and constitutionally grounded, opposition leaders (backed by political data and patterns of defections) argue that state power is being used to consolidate one-party dominance and undermine political pluralism.

At this critical juncture, Nigeria must choose between entrenching competitive democracy or sliding toward a political monopoly where dissent is subdued, institutions compromised, and power concentrated.

For Nigeria’s democratic ideals to survive (and thrive) its leaders and citizens must ensure that speaking truth to power remains not a perilous act of defiance but an honoured pillar of national life.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

Business6 months ago

Business6 months agoBatsumi Travel CEO Lisa Sebogodi Wins Prestigious Africa Travel 100 Women Award

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING