Business

A Businessman and His Siren: Tunde Ayeni Refutes News of His Fatal Return to Gail Fajembola

A Businessman and His Siren: Tunde Ayeni Refutes News of His Fatal Return to Gail Fajembola

The allure of forbidden passion often carries a price, and for Dr. Tunde Ayeni, the once-revered businessman whose rise and fall mirrors the trajectory of a Greek tragedy, the cost has been steep.

Amid the ruins of financial embarrassment, public disgrace, and familial strain, Ayeni has frantically disassociated himself from speculations of his purported return into the arms of the arms of Gail Fajembola, a woman whose name is synonymous with scandal.

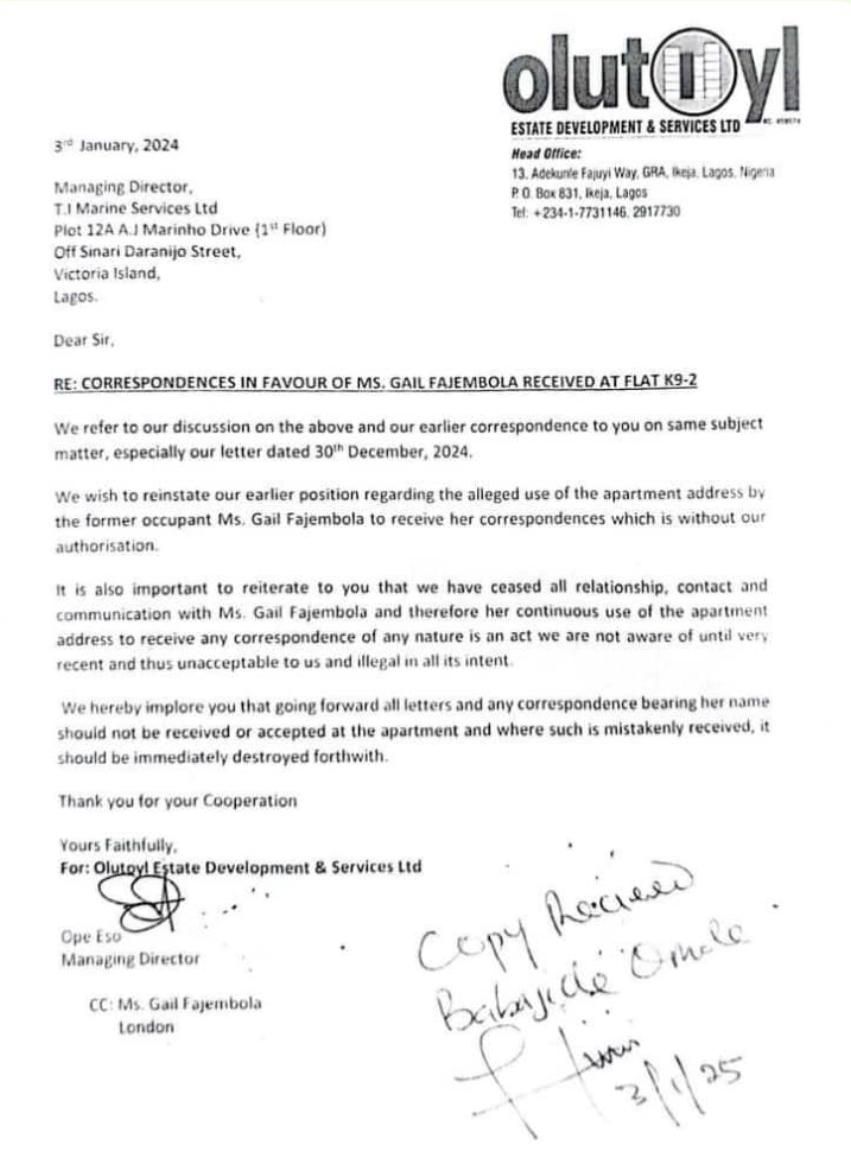

In a bid to distance himself from Gail and their controversial past together, Ayeni went as far as instructing his property firm to notify tenants of a choice Ikoyi property that Gail should no longer be allowed to use the address for correspondence. “Dr. Ayeni has nothing to do with Gail’s relocation to Nigeria,” a source close to him declared. “He is focused on growing his businesses and spending quality time with his family and true friends.” Yet, despite these denials and calculated efforts to sanitize his image, insiders whisper of a rekindled liaison between the embattled businessman and his former mistress.

This revelation comes as a shock to many who recall Ayeni’s vehement disassociation from Gail years ago. Back then, he publicly vowed to sever all ties with her, swearing on his children’s lives that he would never return to the woman whose influence nearly dismantled his business empire and marriage. The reasons for this oath were both public and damning: Gail, with her extravagant lifestyle and insatiable demands, had drawn Ayeni into a vortex of corruption and financial impropriety that nearly consumed him.

The Return of the Femme Fatale

Gail Fajembola’s return to the Nigerian social scene, after a five-year sojourn in the United Kingdom, has been met with both intrigue and suspicion. Described by some as a “femme fatale” with a penchant for seducing powerful men, her arrival in Abuja has reignited whispers of her alleged connection to Ayeni. Sources suggest that Gail’s relocation may not be as innocent as claimed, with many speculating that her return signals a calculated move to reclaim her position in Ayeni’s life.

The woman once vilified for the chaos she sowed in Ayeni’s world seems undeterred by past scandals. Gail’s critics describe her as a chameleon—a master manipulator who has left a trail of broken relationships and tarnished reputations in her wake. Despite this, Ayeni appears to remain ensnared by her charms, prompting questions about what compels him to rekindle a relationship that has cost him so dearly.

A Scandalous. History

Gail’s romantic history reads like a cautionary tale of ambition and audacity. Her past liaisons include some of Nigeria’s most prominent men, from a former Senate President to influential oil industry magnates. Yet it is her relationship with Ayeni that has proven the most enduring—and destructive.

During their initial affair, Gail’s extravagant demands reportedly drained Ayeni’s finances and drew him into a web of questionable dealings. Her influence was so pervasive that Ayeni found himself under investigation by the Economic and Financial Crimes Commission (EFCC), with allegations of embezzlement and financial misconduct dominating headlines. The fallout left Ayeni’s reputation in tatters, his businesses struggling to recover, and his family in disarray.

In the years that followed their breakup, Ayeni’s public declarations of remorse and determination to rebuild his life were seen as an attempt at redemption. He sought to distance himself from Gail, focusing on salvaging what remained of his legacy. However, recent developments suggest that Ayeni’s resolve has faltered, raising questions about his judgment and the nature of his relationship with the woman who nearly destroyed him.

Gail’s Calculated Return

Observers note that Gail’s return to Nigeria coincides with a period of significant upheaval in Ayeni’s life. Once a high-flying billionaire, Ayeni’s financial empire has reportedly been reduced to a shadow of its former self. With mounting debts and diminishing influence, Ayeni’s renewed association with Gail appears both illogical and self-destructive.

For Gail, however, the motivations seem clear. Known for her ability to manipulate powerful men, she has often been described as a “hunter”—a woman who thrives on the wealth and influence of her targets. Critics argue that her return is a calculated move to regain access to Ayeni’s resources, despite his precarious financial state.

The Anatomy of Obsession

What drives Ayeni’s apparent inability to break free from Gail’s grasp? Psychologists might label it as a classic case of compulsive attachment, a destructive bond fueled by a mix of passion, vulnerability, and dependency. Others see it as a testament to Gail’s unparalleled skill in exploiting the weaknesses of her partners, drawing them into a cycle of desire and destruction.

For Ayeni, the consequences of this renewed liaison could be dire. Already besieged by financial woes and public skepticism, his decision to re-engage with Gail risks alienating his family and further tarnishing what remains of his reputation. His critics have been unsparing in their condemnation, describing him as a “shameless man” who has returned to his vomit, defying both logic and morality.

Gail, too, has faced harsh judgment, with detractors labeling her as a woman devoid of dignity. Her willingness to endure public humiliation for another chance at affluence has only reinforced her reputation as a manipulative figure, willing to go to any lengths to achieve her goals.

The story of Tunde Ayeni and Gail Fajembola serves as an admonition about the perils of unchecked desire and the corrosive effects of scandal. Their relationship, a volatile mix of passion, ambition, and self-destruction, offers a stark reminder of the dangers of succumbing to temptation.

For Ayeni, the stakes could not be higher. His continued association with Gail risks sealing his fate as a man undone by his own desires. For Gail, the narrative is one of relentless ambition and calculated opportunism, a woman whose pursuit of power and influence knows no bounds.

As their story continues to unfold, one thing is certain: the saga of Tunde Ayeni and Gail Fajembola is far from over. Whether it ends in redemption or ruin, it will undoubtedly remain a stark reminder of the high cost of forbidden love.

Findings reveal that to ensure a clean break from this past relationship, Tunde Ayeni’s property firm recently wrote to the occupants of one of his choice properties in Victoria Island to inform them that Gail Fajembola should no longer be allowed to use the address as her mailing address and should no longer receive her mails through the office address. The correspondence was firm in its assertion that the business mogul and his company no longer have anything to do with Gail. ( letter attached).

To further lend credence to the position that the relationship has since been consigned to the backyard of history, another source disclosed that Dr Ayeni, nowadays, often makes it clear to confidants and close business associates that he was done with the past social life and that the new chapter of his life is focused on expanding and deepening his business interests.

When contacted on the Gail relocation issue and the allegation that he facilitated it, the businessman said: “When will you guys leave me alone and stop disturbing me over mundane issues. I have made it clear, and it is in the media space: I’m done with all these issues of this relationship, that relationship. I have moved on, and I’m not looking back. What you are asking is in the realms of the past, and I’m now focused on the present and the future. Spare me, please. “t and the future. Spare me, please.”

Business

Nigeria’s Inflation Drops to 15.10% as NBS Reports Deflationary Trend

Nigeria’s headline inflation rate declined to 15.10 per cent in January 2026, marking a significant drop from 27.61 per cent recorded in January 2025, according to the latest Consumer Price Index (CPI) report released by the National Bureau of Statistics.

The report also showed that month-on-month inflation recorded a deflationary trend of –2.88 per cent, representing a 3.42 percentage-point decrease compared to December 2025. Analysts say the development signals easing price pressures across key sectors of the economy.

Food inflation stood at 8.89 per cent year-on-year, down from 29.63 per cent in January 2025. On a month-on-month basis, food prices declined by 6.02 per cent, reflecting lower costs in several staple commodities.

The data suggests a sustained downward trajectory in inflation over the past 12 months, pointing to improving macroeconomic stability.

The administration of President Bola Ahmed Tinubu has consistently attributed recent economic adjustments to ongoing fiscal and monetary reforms aimed at stabilising prices, boosting agricultural output, and strengthening domestic supply chains.

Economic analysts note that while the latest figures indicate progress, sustaining the downward trend will depend on continued policy discipline, exchange rate stability, and improvements in food production and distribution.

The January report provides one of the clearest indications yet that inflationary pressures, which surged in early 2025, may be moderating.

Bank

Alpha Morgan to Host 19th Economic Review Webinar

Alpha Morgan to Host 19th Economic Review Webinar

In an economy shaped by constant shifts, the edge often belongs to those with the right information.

On Wednesday, February 25, 2026, Alpha Morgan Bank will host the 19th edition of its Economic Review Webinar, a high-level thought leadership session designed to equip businesses, investors, and individuals with timely financial and economic insight.

The session, which will hold live on Zoom at 10:00am WAT and will feature economist Bismarck Rewane, who will examine the key signals influencing Nigeria’s economic direction in 2026, including policy trends, market movements, and global developments shaping the local landscape.

With a consistent track record of delivering clarity in uncertain times, the Alpha Morgan Economic Review continues to provide practical context for decision-making in a dynamic environment.

Registration for the 19th Alpha Morgan Economic Review is free and can be completed via https://bit.ly/registeramerseries19

It is a bi-monthly platform that is open to the public and is held virtually.

Visit www.alphamorganbank to know more.

Business

GTBank Launches Quick Airtime Loan at 2.95%

GTBank Launches Quick Airtime Loan at 2.95%

Guaranty Trust Bank Ltd (GTBank), the flagship banking franchise of GTCO Plc, Africa’s leading financial services group, today announced the launch of Quick Airtime Loan, an innovative digital solution that gives customers instant access to airtime when they run out of call credit and have limited funds in their bank accounts, ensuring customers can stay connected when it matters most.

In today’s always-on world, running out of airtime is more than a minor inconvenience. It can mean missed opportunities, disrupted plans, and lost connections, often at the very moment when funds are tight, and options are limited. Quick Airtime Loan was created to solve this problem, offering customers instant access to airtime on credit, directly from their bank. With Quick Airtime Loan, eligible GTBank customers can access from ₦100 and up to ₦10,000 by dialing *737*90#. Available across all major mobile networks in Nigeria, the service will soon expand to include data loans, further strengthening its proposition as a reliable on-demand platform.

For years, the airtime credit market has been dominated by Telcos, where charges for this service are at 15%. GTBank is now changing the narrative by offering a customer-centric, bank-led digital alternative priced at 2.95%. Built on transparency, convenience and affordability, Quick Airtime Loan has the potential to broaden access to airtime, deliver meaningful cost savings for millions of Nigerians, and redefine how financial services show up in everyday life, not just in banking moments.

Commenting on the product launch, Miriam Olusanya, Managing Director of Guaranty Trust Bank Ltd, said: “Quick Airtime Loan reflects GTBank’s continued focus on delivering digital solutions that are relevant, accessible, and built around real customer needs. The solution underscores the power of a connected financial ecosystem, combining GTBank’s digital reach and lending expertise with the capabilities of HabariPay to deliver a smooth, end-to-end experience. By leveraging unique strengths across the Group, we are able to accelerate innovation, strengthen execution, and deliver a more integrated customer experience across all our service channels.”

Importantly, Quick Airtime Loan highlights GTCO’s evolution as a fully diversified financial services group. Leveraging HabariPay’s Squad, the solution reinforces the Group’s ecosystem proposition by bringing together banking, payment technology, and digital channels to deliver intuitive, one-stop experiences for customers.

With this new product launch, Guaranty Trust Bank is extending its legacy of pioneering digital-first solutions that have redefined customer access to financial services across the industry, building on the proven strength of its widely adopted QuickCredit offering and the convenience of the Bank’s iconic *737# USSD Banking platform.

About Guaranty Trust Bank

Guaranty Trust Bank (GTBank) is the flagship banking franchise of GTCO Plc, a leading financial services group with a strong presence across Africa and the United Kingdom. The Bank is widely recognized for its leadership in digital banking, customer experience, and innovative financial solutions that deliver value to individuals, businesses, and communities.

About HabariPay

HabariPay is the payments fintech subsidiary of GTCO Plc, focused on enabling fast, secure, and accessible digital payments for individuals and businesses. By integrating payments and digital technology, HabariPay supports innovative services that make everyday financial interactions simpler and more seamless.

Enquiries:

GTCO

Group Corporate Communication

[email protected]

+234-1-2715227

www.gtcoplc.com

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING