Business

Again, Opay Leaves 40 Million Customers Stranded Over Failed Transactions

Again, Opay Leaves 40 Million Customers Stranded Over Failed Transactions

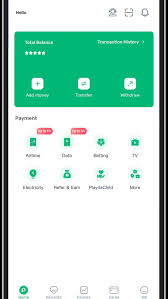

Popular financial technology company, Opay has once again rendered its over 40 Million customer base stranded due to an unexplained application glitch, barely a month after customers complained of their funds disappearing into thin air.

Several customers were embarrassed on Monday when their attempt to perform transactions failed repeatedly without any form of solution and explanation from the fintech company which prides itself as a company that gives freedom to make quick and easy payments.

Unfortunately, the company’s reputation to provide quick and easy payments proved otherwise following the inability of customers to make and receive payments. Some had to rely on other fintech apps like Moniepoint and Palmpay to execute their transactions.

‘’I went to bokku mart to purchase some goods and because I don’t have an ATM, I use my Opay always because it’s always been easy but I was embarrassed yesterday when the payment failed. I didn’t even see my transaction history but my account was debited. It was like disappearance of money’’, said a frustrated customer.

Another customer explained that his transactions were on pending for several hours when he tried to make payments after purchasing food items for his baby.

‘’My baby’s food finished and I thought of buying some at the supermarket on my way from work. I got there, picked what I wanted and proceeded to make payment but my transactions were pending. I initially thought it was network so I changed the line I was using for data. It was the same thing, I had to leave there to my house to get my ATM so that my baby will not starve.’’

It would be recalled that one month ago, customers experienced similar situation with Opay.

ead some tweets below

@OPay_NG

please explain why I say those money add up to my account and suddenly disappeared

https://x.com/psallo_tunes/status/1811851586412425220

@OPay_NG

”I made a transfer to an account, the money was debited twice but not credited to the account and I can’t even find the transaction in my Opay history. What’s going on!?”

”I don taya for Opay o I made a transaction and there was network error before I knew it my money was debited without any receipt to show for it. I’m getting tired of all this wey person dey try survive. Be like I go soon switch wallet to Palmpay”

”This is absolutely unacceptable! I transferred 10,000 to my Opay account, and to my greatest surprise, the amount has vanished without a trace. There is no receipt or transaction history available for this transfer.I demand a proper and immediate explanation for this.”

However, there has been no statement from the fintech company to explain the reason for this application glitch.

Business

Aig-Imoukhuede Foundation opens applications for 6th Cohort Programme

Aig-Imoukhuede Foundation opens applications for 6th Cohort Programme

The Aig-Imoukhuede Foundation is pleased to announce that applications are now open for the sixth cohort of its transformative AIG Public Leaders Programme (AIG PLP).

This flagship six-month executive education initiative, delivered by the University of Oxford’s Blavatnik School of Government, is designed to empower high-potential public sector leaders across Africa with the tools, networks, and strategic insight required to deliver meaningful reform across African public institutions.

Applications are now open to qualified public servants from all English-speaking African countries and will close on Sunday, April 12, 2026. The programme commences in October 2026.

Since its inception in 2021, the AIG PLP has built a formidable reputation for creating tangible impact.

Alumni from the programme have gone on to design and implement more than 230 reform projects within their ministries, departments, and agencies across Africa.

An impact survey revealed that 62% of alumni have earned promotions or assumed expanded leadership roles post-training, demonstrating the programme’s direct effect on career advancement and institutional influence.

“Across Africa, the complexity of public sector challenges demands more than good intentions. It requires reformers who understand systems, can navigate institutional realities, and are equipped to implement sustainable change.

The AIG PLP is designed to meet this need,” said Ofovwe Aig-Imoukhuede, Executive Vice-Chair of the Aig-Imoukhuede Foundation.

As part of the programme, a PLP alumna, Titilola Vivour-Adeniyi, Executive Secretary of Lagos State DSVA, launched a secure self-reporting tool that allows survivors of domestic and sexual abuse safely document incidents and preserve evidence.

Survivors are already accessing support, and the tool ensures that crucial proof is protected until justice can be sought. This is one of over 230 impactful reform projects being implemented across sectors as diverse as healthcare, finance, agriculture, and education.

We are seeing proof every day that investing in the capacity and leadership potential of people, delivers the kind of transformation that policy alone cannot achieve.”

The AIG PLP is a blended learning experience that combines online sessions with an intensive residential module.

It is offered at no cost to selected participants, with the Foundation covering all costs of the programme including accommodation and feeding during the residential weeks.

Participants gain direct access to world-class faculty from the University of Oxford, and learn to tackle core public sector challenges such as: Negotiating in the public interest. Harnessing digital technology for governance.

Strengthening public organisations.

Upholding integrity in public life.

The curriculum culminates in a capstone reform project, where participants apply their new skills to a real-world challenge within their institution.

This practical component ensures that learning translates directly into actionable solutions.

Interested candidates are encouraged to apply early. For more details on the application process and to apply, please visit the Aig-Imoukhuede Foundation website.

Business

Renewed Hope Ambassadors Inspect RHA Secretariat

Renewed Hope Ambassadors Inspect RHA Secretariat

Renewed Hope Ambassadors, led by its Director-General and the Governor of Imo State, Hope Uzodinma, alongside Zonal Coordinators (NW, NC, SE), the Media & Publicity Directorate, and other key stakeholders, inspected the RHA Secretariat two days after President Bola Tinubu unveiled the Renewed Hope Ambassadors grassroots engagement drive in Abuja.

Business

Harmony Gardens’ Ibeju-Lekki Portfolio Crosses $1bn

Harmony Gardens’ Ibeju-Lekki Portfolio Crosses $1bn

Harmony Garden & Estate Development Limited has expanded its development activities across Ibeju-Lekki, pushing the projected long-term value of its estate portfolio beyond $1 billion.

Led by Chief Executive Officer Hon. Dr. Audullahi Saheed Mosadoluwa, popularly know Saheed Ibile, the company is developing seven estates within the Lekki–Ibeju corridor. Details available on Harmony Garden & Estate Development show a portfolio spanning land assets and ongoing residential construction across key growth locations.

A major component is Lekki Aviation Town, where urban living meets neighborhood charm, located near the proposed Lekki International Airport and valued internally at over $250 million. The development forms part of the company’s broader phased expansion strategy within the axis.

Other estates in the corridor tagged as the “Citadel of Joy” (Ogba-idunnu) include Granville Estate, Majestic Bay Estate, The Parliament Phase I & II, and Harmony Casa Phase I & II.

With multiple projects active, the rollout of the Ibile Traditional Mortgage System, and structured expansion underway, Harmony Garden & Estate Development Ltd continues to deepen its presence within the fast-growing Ibeju-Lekki real estate market.

-

celebrity radar - gossips7 months ago

celebrity radar - gossips7 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

society7 months ago

society7 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

news7 months ago

news7 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING