society

BenKalu Network Joins Campaign to Avert Protests in Nigeria, Sensitizes Youths on Patriotism

BenKalu Network Joins Campaign to Avert Protests in Nigeria, Sensitizes Youths on Patriotism

The BenKalu Intellectuals Network (BIN), a think tank of young intellectuals, has launched a nationwide campaign to de-escalate the growing feeling of disunity, hatred, and animosity in the country.

In a statement signed by its intellectual leader, Comrade Benedict Aguele, the group expressed commitment to building honest and patriotic leaders based on the philosophy of its mentor, the Deputy Speaker of the House of Representatives, Rt. Hon. Benjamin Kalu.

While admitting that frustrations are high, and emotions are running deep due to the economic hardship, Aguele added that protests and violence are not the solution.

The group, therefore, said it is committed to supporting the laudable reforms of President Bola Ahmed Tinubu’s administration which are geared towards building a more prosperous and equitable society.

The BenKalu Network said it has met with over 1,000 groups in the last one week and all have assured that it will not protest against the administration.

Aguele said rather, the groups will work closely with leaders of thoughts across board to see to the implementation of laudable reforms.

“As a network of young thinkers, we recognize the importance of peace and progress in achieving our collective goals,” Aguele said.

“We have embarked on a mission to sensitize young Nigerians on the need to prioritize patriotism and national unity above personal interests.

“Our methods include social media campaigns, workshops, seminars, and community outreach programs.

“In light of the current economic challenges facing our nation, we understand that frustrations are high, and emotions are running deep.

“However, we strongly believe that protests and violence are not the solutions to our problems. Instead, we should channel our energies towards constructive engagement, dialogue, and collaboration with the government.”

The group, therefore, urged all Nigerians, especially the youth, to support the government and refrain from participating in any form of protest.

Aguele added: “Let us work together to build a more prosperous and peaceful Nigeria.

“Patriotism is the foundation of our campaign, as we believe that love for our country should be the guiding principle of our actions.

“This means that every decision we make and every step we take should be motivated by a desire to promote the welfare and prosperity of Nigeria and its people.

“Unity is the backbone of our campaign, as we recognize that our diversity is our strength and that together, we can achieve greatness.

“We believe that our differences are what make us unique and strong and that by embracing and celebrating our diversity, we can build a more inclusive and equitable society.

“Dialogue is the engine of our campaign, as we advocate for constructive engagement and dialogue as the best means of resolving conflicts.

“We believe that by talking to each other, listening to each other’s perspectives, and working together, we can find solutions to even the most seemingly intractable problems.

“Progress is the goal of our campaign, as we are committed to building a better future for ourselves and generations to come.

“The BenKalu Intellectuals Network is committed to supporting the laudable reforms of President Asiwaju Bola Ahmed Tinubu’s administration, which are geared towards building a more prosperous and equitable society.

“We believe that the President’s vision for a better Nigeria aligns with our own values of patriotism, unity, dialogue, and progress.

“We are particularly impressed by the administration’s efforts to address the country’s economic challenges, improve infrastructure, and enhance the quality of life for all Nigerians.

“As a think tank, we are convinced that the President’s reforms will have a positive impact on the country and its people.

“We are therefore committed to supporting and promoting these reforms through our various platforms and activities.

“We will continue to engage with stakeholders, conduct research, and provide policy recommendations that will help to ensure the success of the President’s agenda.

“We believe that by working together and supporting one another, we can create a brighter, more prosperous future for all Nigerians.

“Join us in this noble cause. Let us work together to build a Nigeria where peace, progress, and prosperity reign supreme.”

society

TICP Customs Launches Paperless Regime, Warns Against False Declarations

TICP Customs Launches Paperless Regime, Warns Against False Declarations

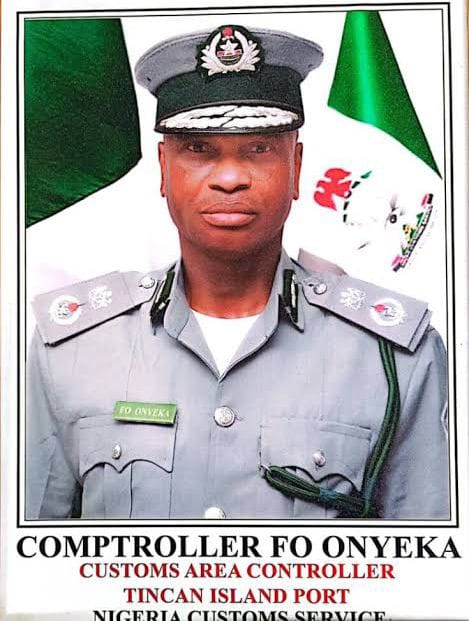

The Customs Area Controller of Tin Can Island Port Command of the Nigeria Customs Service (NCS), Comptroller Frank Onyeka, has launched a roadmap for the full implementation of a paperless regime at the command.

Onyeka disclosed this during a press briefing in Lagos, stating that the command was fully prepared for seamless digital operations ahead of the nationwide rollout scheduled for the second quarter of the year.

He described the engagement as the first in a series of consultations aimed at sensitising stakeholders on the strategies, operational framework and expectations under the new regime.

The controller commended the media for its constructive reportage since his assumption of office and sought continued collaboration to ensure the success of the initiative.

Presenting the command’s performance report, Onyeka said the Tin Can Island Command generated ₦609 billion in revenue in 2025, describing it as the highest in the history of the command.

He added that revenue collection rose from ₦116 billion recorded in January of the previous year to ₦145 billion in the corresponding period last month, representing an increase of over ₦29.9 billion.

Onyeka stated that his vision was to make the command known for trade efficiency, explaining that under the paperless regime, containers would be released without physical contact between Customs officers and clearing agents, provided declarations were accurate.

He credited the Comptroller-General of Customs, Bashir Adewale Adeniyi, for providing the leadership and strategic direction driving modernisation efforts across Customs formations nationwide.

The controller urged stakeholders to avoid false declarations and engage directly with the command to resolve concerns, emphasising that transparency and dialogue were essential to achieving efficient port operations.

He assured that consignments with clear scanning results and proper documentation would be released promptly, while those flagged by the risk management system would undergo physical examination, adding that the command would continue to collaborate with other agencies to reduce cargo dwell time and enhance port efficiency.

society

Love on Display: Katie Price and Lee Put On a Public Show of Affection

Love on Display: Katie Price and Lee Put On a Public Show of Affection

By George Omagbemi Sylvester | Published by SaharaWeeklyNG

British media personality Katie Price is once again at the center of tabloid and public attention after being photographed poolside with her new husband, Lee, in a display of affection that quickly circulated across entertainment platforms. The images, reportedly taken during a recent leisure outing at a private resort location in the United Kingdom, show the couple embracing and kissing beside a swimming pool, with Lee prominently displaying a tattoo tribute dedicated to Price.

The photographs, which surfaced in mid-February 2026 through British tabloid outlets, depict the couple appearing relaxed and affectionate. Lee, whose full name has been reported in sections of the UK press but who largely maintains a lower public profile compared to his wife, lifted his arm to reveal a visible tattoo said to be in honor of Price and a gesture widely interpreted as a public affirmation of their relationship.

What happened was straightforward but symbolically charged: a public display of affection between newlyweds, amplified by Price’s longstanding celebrity status. Where it happened (poolside at what sources describe as a private holiday setting) underscores the blending of personal life and public spectacle that has long defined Price’s media journey. During a recent February getaway placed it squarely within ongoing tabloid interest surrounding her latest marriage. Price, 47 and her new husband Lee, whose visible tribute tattoo became the focal point of the moment.

Celebrity culture scholars argue that public figures such as Price operate within a media ecosystem where visibility sustains relevance. “Modern celebrity is performative intimacy,” explains Professor Graeme Turner, a media and cultural studies scholar known for his work on celebrity culture. “Public displays of affection are not merely private acts; they are communicative gestures that reinforce brand identity and narrative continuity.” In Price’s case, her romantic relationships have long been interwoven with her public persona.

Price first rose to prominence in the late 1990s under the glamour model moniker “Jordan,” before transitioning into reality television, publishing and business ventures. Her personal life (including previous marriages and high-profile relationships) has frequently generated headlines in the British press. This latest marriage continues that pattern of intense scrutiny.

The tattoo tribute displayed by Lee is particularly significant in celebrity symbolism. Body art dedicated to a partner is often perceived as a declaration of permanence. Dr. Chris Rojek, emeritus professor of sociology and an authority on fame and public identity, has observed that “celebrity relationships are sustained as much through symbolic reinforcement as through private commitment. Visible tokens (rings, tattoos, coordinated appearances) function as public assurances.” In this case, the tattoo serves not merely as personal expression but as a visual narrative device in an already highly mediated relationship.

How the moment unfolded (casually but conspicuously) reflects the dynamics of contemporary celebrity coverage. Photographs were reportedly captured either by paparazzi stationed nearby or shared through controlled media access, a common practice in the British entertainment industry. Within hours, the images were republished by multiple outlets, accompanied by commentary on Price’s relationship history and ongoing legal and financial challenges, issues that have previously placed her under intense public scrutiny.

Despite recurring controversy throughout her career, Price remains a resilient media figure. Communications analyst Mark Borkowski has previously remarked in interviews that “Katie Price understands publicity better than most. Whether by design or instinct, she maintains a feedback loop with the press that keeps her culturally visible.” The poolside photographs appear to fit squarely within that established pattern of managed exposure and reactive media amplification.

Critically, there is no indication of misconduct, public disturbance or controversy tied directly to the poolside display itself. It was, by all verified accounts, a consensual and celebratory expression of affection between married adults. The wider attention it has generated speaks less to the act and more to the individuals involved; particularly Price’s enduring position within British popular culture.

For global audiences, the episode illustrates a broader truth about contemporary fame: private milestones often become public commodities. The marriage of Katie Price and Lee (and the symbolic tattoo that now marks it) has become another chapter in a life lived persistently under the camera’s gaze.

As celebrity culture continues to blur boundaries between intimacy and publicity, moments like this poolside embrace are no longer trivial snapshots. They are narrative events, reinforcing identity, commitment and brand continuity in equal measure.

society

Tinubu Signs Electoral Bill into Law — A Defining Moment for Nigeria’s Democracy

Tinubu Signs Electoral Bill into Law — A Defining Moment for Nigeria’s Democracy

By George Omagbemi Sylvester | Published by SaharaWeeklyNG

“New Electoral Act 2026 Enters the Statute Books Amid Intense Debate Over Nigeria’s Democratic Future.”

In a watershed development for Nigeria’s political trajectory, President Bola Ahmed Tinubu has signed the Electoral Act, 2026 (a fundamental overhaul of the nation’s electoral legal framework) into law. The signing took place on 18 February 2026 at the Presidential Villa in Abuja, following the passage of the Electoral Act (Repeal and Re‑Enactment) Bill, 2026 by the National Assembly.

This move marks a critical legislative milestone ahead of the 2027 general elections. The amended Electoral Act replaces the 2022 law and introduces key changes to Nigeria’s electoral processes, procedures and timelines; a package that has ignited both approval and fierce criticism from political stakeholders, civil society and democracy advocates.

At the centre of the amendments are revisions to election timetables, the scope of result transmission procedures, and administrative adjustments intended to align the law with the logistical realities of upcoming polls. The Senate, during its legislative consideration, moved to shorten the notice period for general elections from 360 days to 300 days, a shift argued to be necessary to avoid a clash with the Ramadan fasting period, which could complicate nationwide mobilisation and voter participation.

Among the most contested provisions in the new law is the treatment of electronic transmission of election results. Initial versions of the bill sought to mandate the real‑time upload of polling unit results directly to the Independent National Electoral Commission’s (INEC) result platform — a reform widely regarded by experts as crucial for transparency and public confidence. However, the Senate’s final version retained a fallback to manual transmission in cases of network failure, a compromise that has been sharply criticised.

This compromise has drawn pointed warnings from seasoned electoral experts. Mike Igini, a former Resident Electoral Commissioner with the Independent National Electoral Commission (INEC), unequivocally described the bill as potentially harmful to Nigeria’s democratic progress. In a televised appeal on Arise Television, Igini urged President Tinubu not to sign the bill, calling it “a recipe for chaos” and a betrayal of the struggles that brought Nigeria to a competitive democratic space. He warned that weakening electronic transmission safeguards could leave room for manipulation, undercutting confidence in election outcomes.

Such dissent underscores the larger debate now gripping the nation, especially among civil society and opposition figures. Critics argue that the amendments fall short of international best practices for electoral transparency and accountability. Natasha Akpoti‑Uduaghan, a lawmaker and vocal proponent of stronger electoral reforms, has publicly condemned the removal of mandatory real‑time result transmission, calling it a “lethal assault on Nigeria’s democracy”. She urged for stronger safeguards that align with technological advancements and global trends toward transparent elections.

Proponents of the new law, including some in the ruling All Progressives Congress (APC) and supportive legislators, insist that the provisions strike a necessary balance between ambition and practicality. They argue that preserving manual processes as a contingency recognises the realities of Nigeria’s digital infrastructure challenges, especially in rural and underserved regions where reliable internet connectivity cannot be guaranteed.

Notably, the new law also preserves the Independent National Electoral Commission’s discretionary authority over certain key administrative functions, including the manner and timing of result transmission, which INEC is now expected to align with fresh guidelines consistent with the new statutory framework.

Analysts note that this legislative stride comes at a moment of heightened political activity as parties gear up for the 2027 elections. INEC’s recently released timetable for the next general polls signals a compressed campaign and preparation cycle, heightening the stakes for political actors and voters alike.

For many Nigerians, the day’s events resonate beyond legislative procedure and enter the realm of democratic symbolism. According to Dr Akin Olukayode, a governance expert at the Centre for Democratic Development, “How electoral laws are crafted and implemented defines the essence of representation. Elections are not merely contests for power; they are expressions of popular will. Any framework that weakens transparency undermines the social contract between citizens and state.”

As Nigeria enters its next general election cycle under this new legal regime, the country faces profound questions about reform, credibility and political inclusiveness. The path ahead (from INEC’s operationalisation of the law, through legal interpretations in the courts, to the lived experience of voters in 2027) will ultimately determine whether this legislative overhaul strengthens or weakens Nigeria’s democratic foundation.

What remains clear is that in signing the Electoral Act 2026 into law, President Tinubu has set into motion a defining chapter in Nigeria’s electoral history; one that will be intensely scrutinised by scholars, policymakers and citizens at home and abroad.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth