Business

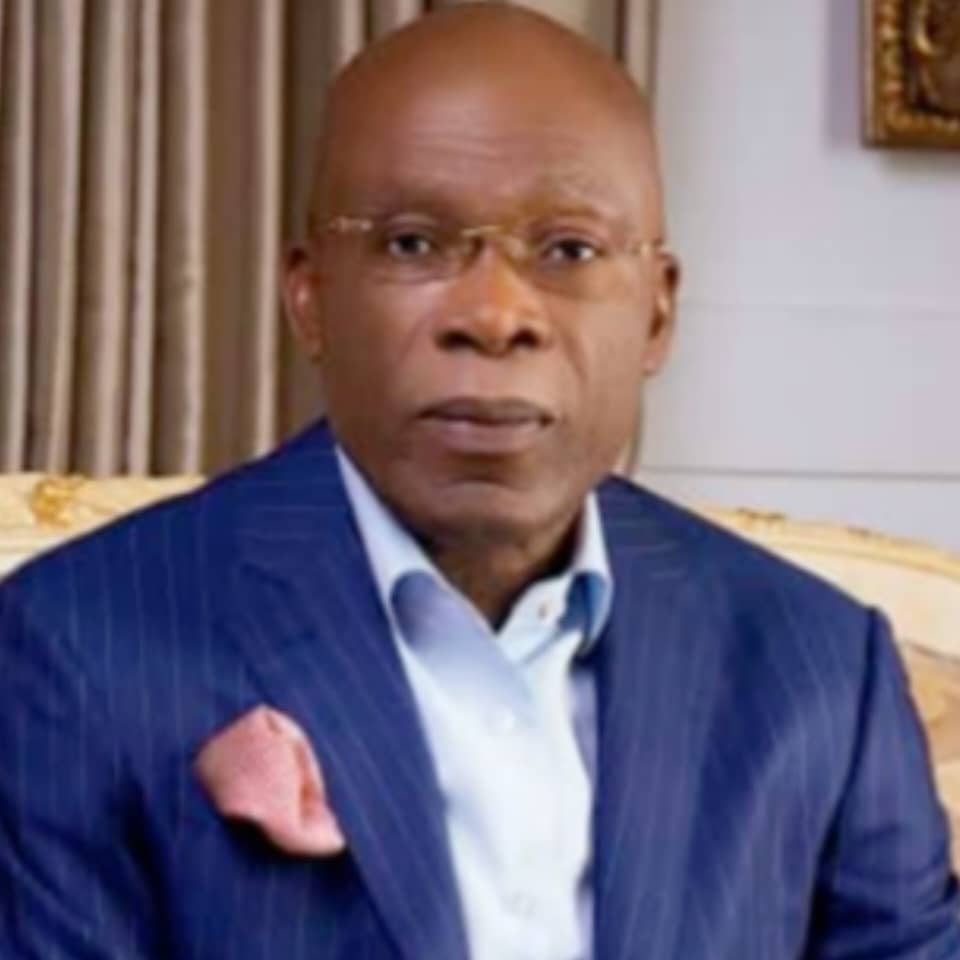

Corporate blackmail, my story as a case study, by Leo Stan Ekeh, Chairman Zinox Group”

“Corporate blackmail, my story as a case study, by Leo Stan Ekeh, Chairman Zinox Group”

In an end of year inspirational talk delivered on the 14th of December, 2024 to his select mentees of young entrepreneurs in Nigeria monitored in Lagos, Dr. Leo Stan Ekeh, advised them not to lose hope in the Nigerian economy, as he projects that the country shall start returning to a comfortable zone from the 3rd quarter of 2025, he also warned them to apply greater caution in transactions with persons and corporates of questionable character, stressing why due diligence and being local are both critical and an added advantage. Below are excerpts from the lecture.

The new fraud is Corporate and Personality blackmail which my companies and I have fallen victims of, and I am sure you read some in the newspapers where CEOs of responsible corporations in Nigeria are tagged fraudsters. This is the work of blackmailers, and they partner with a few blogs, engage some innocent respected law firms for hyping and a few government officials to achieve their set objectives to destroy your corporate and personal reputations. These negative online materials are then lifted by Google, Facebook, Instagram, and other social media platforms so that when people search your organisation or personal names, you are seen as a crook. This is with the intent to destroy your brand and affect your credit rating globally. In some cases, they sue you in multiple courts in Nigeria for the noise and to have the content to continue to upload on various social media platforms. Having set this platform against you, your competitors would leverage them to blackmail you by paying them handsomely. In some cases, they secure a Fiat from the office of the Attorney General of the Federation to give an impression that the Federal Government is suing you for fraud, which allegations they cannot prove in courts. This is to make more money from your competitors and extort you if you want such negative news taken down from social media pages.

I am a private person but for the first time in the history of my entrepreneurship I will let you people into a bit about the Group I founded over 38 years ago. In Nigeria, humility is seen as stupidity. You are free to reconcile and appreciate the noise a certain Benjamin Joseph and Femi Falana chambers are making as an insult to themselves and the nation.

My integrated technology group is the largest on the continent and it is for this reason that we have the second highest credit rating in the tech sector as far as I have been told in the whole of Africa. What this means is that, if you award us a contract of over $5billion, we don’t need to borrow to execute because we are trusted. In 38 years of tech entrepreneurship, we have done a global turnover of over $23.7billion and not borrowed a kobo from any financial institution in the world and we do not owe any. We have delivered the biggest tech projects across Africa and most of them you are aware of. I set out from day one as an orphan and an only child even though my parents were alive and I have five other siblings. So, I am my own adviser.

We built the group as corporate collateral, we are trusted by all our over 35 global partners and most of them are listed in Fortune 100. We do our best to promote a trust economy. Few weeks ago, I paid one of the leading multinationals over $31m for a debt one of the companies in the group incurred due to Naira devaluation challenges and this is one out of 31 multinationals.

So, I am like someone on steroids 24hours a day and manages to sleep 3hours a day to maintain this global reputation. As at last week, I inspected our companies’ books, the group exposure on credit extension to companies in Nigeria was over $89m. We have worked very hard to build knowledge, infrastructure and spiritual capacities for our survival and the group is not focused on money but our passion. Please research on all these before our final meet first quarter of 2025. I shall tell my full story one day.

Using what my companies TD Africa Distributions, Zinox Technologies, my colleagues in both companies, my wife, and I have suffered in the last 11 years in the hands of Benjamin Joseph of Citadel Oracle Concepts Ltd, an Enugu indigene based in Ibadan, and an alleged serial blackmailer and fraudster as a case study, you shall appreciate it.

I have never met Benjamin Joseph in my life and neither has he directly or indirectly enquired or transacted any business with Zinox Technologies Ltd in the history of our existence.

Citadel Oracle Concepts Ltd was amongst 13 companies awarded HP PC contract by Federal Inland Revenue Services (FIRS) in 2012, with instruction from the FIRS that the laptops must be sourced genuinely from HP Authorized Distributor in Nigeria, and TD Africa is the biggest HP Partner in Nigeria. This is because the FIRS wanted to guard against grey or fake products and the challenges of after-sales support. Citadel, through its authorised partner, Princess Kama (with a letter of Authority signed by Benjamin Joseph as the MD of Citadel Oracle Concepts Ltd) approached TD Africa to supply Citadel the laptops on credit as the company did not have enough funds to pay TD Africa. The agreed condition was that FIRS shall pay into a Citadel Account where two staff of TD shall be signatories to protect our pre-agreed invoice value plus additional guarantee from a responsible Nigerian. Citadel raised a Board resolution to include two TD staff, Chris Eze Ozims and Shade Oyebode, as the signatories in an account Citadel opened with Access Bank. TD Africa then supplied the systems to FIRS with serial number of each system captured. This was the same process for the other companies awarded similar contracts by the FIRS who didn’t have enough funds to pay for the laptops.

FIRS as a responsible FGN agency paid all on time and other companies immediately remitted pre-agreed amount from the dedicated account to TD Africa Account. But Benjamin Joseph the CEO of Citadel, as I was told by her partner, Princess Kama, wanted to divert the fund and possibly pay us at his own time or never. However, Princess Kama, because her Uncle Chief Igbokwe (a long-time partner of TD Africa) was an additional guarantor for the credit extended to Citadel, disagreed with the plans of Benjamin Joseph. She approached TD Africa signatories/representatives to debit the dedicated bank account the pre-agreed amount as Benjamin Joseph insisted on diverting the fund. TD representatives actioned immediately.

This is where the problem started.

One year after this transaction was closed and forgotten, we did not know both partners have been fighting over profit-sharing ratio. Benjamin Joseph engaged Afe Babalola chambers and claimed that his company was used to defraud FGN, that no laptops were supplied, and that he was not aware of both the contract and Citadel Account opened with Access Bank Plc.

According to Princess Kama, Chief Afe Babalola SAN, a distinguished lawyer of Afe Babalola Chambers, invited her to Ibadan and she obliged and when he raised the claims by Benjamin Joseph, she presented documentary evidence which was confirmed by FIRS management that Benjamin Joseph was aware of the contract and indeed submitted a copy of his International Passport, a Letter of Acceptance of the FIRS Contract and the appointment of Princess Kama as the duly authorised representative of Citadel on the FIRS contract. In fact, her position was vindicated by the FIRS in a letter dated 11th February 2014 and signed by FIRS Head of Legal, Idrissa Kogo, addressed to the same Afe Babalola and Co confirming that Mr. Benjamin Joseph was aware of the contract and even gave FIRS a letter dated 13th December, 20212 to deal with Princess Kama in relation to the contract. In the same letter, FIRS confirmed that Citadel instructed them to pay the proceed of the laptop into the Citadel Account with Access Bank. These matters would later be corroborated in the Witness Statement on Oath by Benjamin Joseph in a civil case he filed at the Lagos State High Court, accepting he was aware of the contract and gave those documents to Princess Kama. According to Princess Kama, Chief Afe Babalola advised her to increase Benjamin Joseph’s share by an additional N2m from the N10million she had initially offered. But Mr. Joseph insisted on taking all the profit from the transaction and she refused.

It was after one year that Benjamin Joseph started writing all sorts of petitions to different police stations and EFCC offices both in Lagos and Abuja and publishing interviews against me and Zinox with his hired media agents. I checked with Zinox and they never transacted any business with his company. When my staff started receiving invitations from the Police and EFCC, I had to independently investigate the transaction, and it was in order. I had no idea who both Benjamin Joseph and his partner Princess Kama were, and because a lady was involved, I had to investigate both and particularly Princess Kama to establish their partnership in case she was a member of a fraud syndicate and their true relationship. I hired foreign certified detectives who worked with local ones to establish their long-term relationship.

They once belonged in the same church, nearly got married, and been partners for years and even had previous contract bids which Princess Kama did for Citadel Oracle Concept Ltd in many offices including the Presidency. This cost me then $241,000. It was after I received a comprehensive report from the detectives that I asked my office to invite her to see me and she came and confirmed everything.

Mr. Joseph, who was properly investigated and documented including his financial status became more aggressive in publishing false claims, and probably expecting me to call him to negotiate as he was told I am a very rich man. At one point, an AIG of Police invited us to meet in his office at SFU Milverton, Ikoyi, to find a solution because he was shocked that someone was writing petition against my companies, my staff, and myself for less than N170m. But at the last minute, I apologised to the AIG, that I would not attend as Mr. Benjamin Joseph who came from Ibadan for the meeting was already blackmailing me in blogs and newspapers. He could use that meeting to a negative advantage.

Sometime in November 2013, the law firm of Afe Babalola, acting for Mr. Benjamin Joseph and his company, Citadel, wrote the first petition to the Special Fraud Unit (SFU) of the Nigerian Police at Milverton Ikoyi, that his signature was forged on the Board resolution and other documents. The SFU investigated his petitions and wrote a report that his claim of the forged signature by his partner Princess Kama and his claim that no computers were supplied to FIRS were false. He, again, petitioned the DIG of Police, then Dr. Solomon Arase, who finally became Inspector General of Police. Dr. Arase according to what I was told, sent his crack team to visit FIRS office and investigated other claims and found out that Mr. Benjamin Joseph lied absolutely.

Consequently, the IG of Police charged him to court in Charge No. CR/216/16 before Honourable Justice Peter Kekemeke of the FCT High Court, for false information. Even though the Prosecution proved and closed its case in 2018, Mr. Benjamin Joseph could not defend or substantiate his allegations after being required many times by the court to open his defence. He would change lawyers and absent himself from court giving medical reasons. Rather than opening his defence, Mr. Joseph was spending time in the Office of the Attorney General of the Federation begging for the AG to take over the case and discontinue the charges against him. However, the then Attorney General, after reviewing the case file on each of those three occasions, wrote to the Police to continue with his prosecution to a logical conclusion.

These directives were contained in three separate letters dated 10th February 2017, 7th May 2018, and 6th June 2022.

While the above case was on, Benjamin wrote the same lies to the then Vice President, Prof Yemi Osinbajo, claiming that his company was used to defraud the FGN and the VP rightly instructed the Chairman of EFCC to investigate and report back. The EFCC in their report stated that the allegation was false and absolved TD and its staff of any wrongdoing because they are entitled to payment for the laptops they supplied on credit and did not forge any documents; in fact, had no reasons to forge documents. However, the EFCC charged Princess Kama and her uncle, Chief Igbokwe to court before Honourable Justice Senchi of the FCT High Court, on the instigation of Mr. Benjamin Joseph. But, again, Mr. Benjamin Joseph, was unable to prove his allegations against them, and in a judgment delivered in February 2021, Honourable Justice Danlami Senchi in Charge No. FCT/HC/CR/244/2018, discharged and acquitted both Princess Kama and Chief Igbokwe, and imposed a damage of N20million against Mr. Benjamin Joseph for false petitioning and to serve as a deterrence against others who engage in false petitions that waste tax payers’ money.

More importantly, the judgment of Honourable Justice Senchi unequivocally stated that Technology Distributions and its staff were not liable for any fraud, that they were entitled to receive the proceeds of the laptops supplied on credit to Citadel Oracle Concept limited which were delivered to FIRS and confirmed by them. This judgment is still subsisting and Mr. Joseph has yet to pay the damage of N20million imposed on him. Before this point, Mr. Joseph and his media partners became desperate in blackmailing my wife, myself and Zinox Technologies in cheap blogs as no responsible media ever published any of their press releases except Sahara Reporters who was coopted and refuse to hear our side of the story.

All these years, none of my staff, companies or myself was invited or included in all these court processes except the EFCC court case where TD was only invited as a witness because Citadel transacted with them. But his media blackmail was on me and Zinox and he smartly avoided his partner Princess Kama. What Benjamin Joseph and his syndicate set up is a platform to work with my competitors who are willing to sponsor them to diminish my reputation by escalating in the media same case he could not defend and begged that it should be withdrawn. This is the cause of the Nigeria digital Census project delay till date and equipment worth over N300billion are wasting in warehouses because my competitors and their sponsors at the highest level used them and engaged Femi Falana SAN to secure a Fiat against my name, my wife, my companies to tag us as frauds. By their action, Zinox almost lost a digital census contract of over $250million of which it was the most qualified. However, then Attorney General of Federation, Mr. Malami SAN, when he found out that he was deceived by Femi Falana (SAN) in granting the Fiat, wrote him a letter dated 28th October 2022, withdrawing the Fiat and discontinuing the case against me and my company which they had filed, unknown to us. This is because Femi Falana SAN did not disclose fully to the Attorney General the fact that there is a subsisting judgment given by Honourable Justice Senchi that has dismissed all the allegations of Mr. Joseph and asked him to pay N20million damages. He also did not disclose the fact that his client, Mr. Joseph, was still facing a criminal trial brought by the IG of Police against him. So, a few days after, President Muhammadu Buhari, based on submissions at the Federal Executive Council meeting, approved that the contract be awarded to Zinox Technologies Ltd based on competence, capacity and experience. And it was awarded to Zinox Technologies after months of blackmail to eliminate us from the deal. We delivered the project on time per our terms of engagement, but it was too late for the previous administration to conduct the Digital Census. What it means is that these blackmailers with support of people like Femi Falana caused the lack of credible data to move the country forward as all the equipment procured for the census are lying waste in warehouses nationwide. That’s shameless Nigerians for you and they walk the street as free men till date.

The arrival of the new Attorney General, Lateef Fagbemi SAN, changed everything. As a lawyer who had worked with Afe Babalola chambers (former lawyers to Benjamin Joseph), one of his early actions in office was to discontinue the Police case (CR/216/16) against Benjamin Joseph following the petition lodged by the chambers of Afe Babalola SAN at the SFU, Milvertion Road, Ikoyi, Lagos, on behalf of Mr. Benjamin Jospeh, that was found to be false. As a distinguished lawyer that I respect, I expected him to request for source documents of the cases including one already decided against Joseph by Honourable Justice Senchi of the FCT High Court that had already found Mr. Benjamin Joseph of lying in his petition with a damage of N20million imposed on him. As the number one judicial officer of the nation, even if he wanted to save Mr. Joseph from going to jail, I expected the Honourable Attorney General to act dispassionately in the light of a subsisting case/order directed against him to refrain from discontinuing the Police Charge pending the determination of that case, and also in the light of the valid and subsisting judgment of Honourable Justice Senchi. Instead, he, against all the glaring SFU and EFFC reports and the decided case, withdrew the Police case against Mr. Joseph on reasons best known to him, thereby setting Mr. Joseph free, and he has been celebrating the withdrawal of a case he reported and could not prove/defend for years. To date, Benjamin Joseph acts as a blackmail platform for my competitors whenever we are competing on a bid, using nefarious publications in social media directed at me, my wife, and my company, Zinox.

Please, as stakeholders and future Nigerian trillionaires, learn from my experience but you must not dine with blackmailers as technologies shall soon delete them from the tech ecosystem.

Business

Renewed Hope Ambassadors Inspect RHA Secretariat

Renewed Hope Ambassadors Inspect RHA Secretariat

Renewed Hope Ambassadors, led by its Director-General and the Governor of Imo State, Hope Uzodinma, alongside Zonal Coordinators (NW, NC, SE), the Media & Publicity Directorate, and other key stakeholders, inspected the RHA Secretariat two days after President Bola Tinubu unveiled the Renewed Hope Ambassadors grassroots engagement drive in Abuja.

Business

Harmony Gardens’ Ibeju-Lekki Portfolio Crosses $1bn

Harmony Gardens’ Ibeju-Lekki Portfolio Crosses $1bn

Harmony Garden & Estate Development Limited has expanded its development activities across Ibeju-Lekki, pushing the projected long-term value of its estate portfolio beyond $1 billion.

Led by Chief Executive Officer Hon. Dr. Audullahi Saheed Mosadoluwa, popularly know Saheed Ibile, the company is developing seven estates within the Lekki–Ibeju corridor. Details available on Harmony Garden & Estate Development show a portfolio spanning land assets and ongoing residential construction across key growth locations.

A major component is Lekki Aviation Town, where urban living meets neighborhood charm, located near the proposed Lekki International Airport and valued internally at over $250 million. The development forms part of the company’s broader phased expansion strategy within the axis.

Other estates in the corridor tagged as the “Citadel of Joy” (Ogba-idunnu) include Granville Estate, Majestic Bay Estate, The Parliament Phase I & II, and Harmony Casa Phase I & II.

With multiple projects active, the rollout of the Ibile Traditional Mortgage System, and structured expansion underway, Harmony Garden & Estate Development Ltd continues to deepen its presence within the fast-growing Ibeju-Lekki real estate market.

Business

BUA Group Showcases Food Manufacturing Strength at 62nd Paris International Agricultural Show

BUA Group Showcases Food Manufacturing Strength at 62nd Paris International Agricultural Show

BUA Group, one of Africa’s leading diversified conglomerates, is maintaining a strong presence at the ongoing 62nd edition of the Paris International Agricultural Show in France, participating as a premium sponsor and supporting the Nigeria Pavilion at one of the world’s most respected agricultural gatherings.

The 62nd Paris International Agricultural Show, taking place from February 21 to March 1, 2026, at Porte de Versailles in Paris, convenes global leaders across farming, agro processing, technology, finance, and policy. The event serves as a strategic platform for industry engagement, knowledge exchange, and commercial partnerships shaping the future of global food systems.

BUA Group’s participation reflects its long term commitment to strengthening the entire food production value chain. Through sustained investments in large scale processing, value addition, and branded consumer products, the Group continues to reinforce its role in advancing food security, industrial growth, and regional trade integration.

Speaking on the Group’s participation, the Executive Chairman of BUA Group, Abdul Samad Rabiu CFR, said, “BUA’s presence at the Paris International Agricultural Show reflects our belief that Africa must be an active participant in shaping the future of global food systems. We have invested significantly in local production capacity because we understand that food security, industrial growth, and economic resilience are interconnected. Platforms like this allow us to build partnerships that strengthen Nigeria’s competitiveness and expand our reach beyond our borders.”

BUA Foods, a subsidiary of BUA Group, maintains a strong footprint in flour, pasta, spaghetti, sugar, and rice production, serving millions of consumers within Nigeria and across neighbouring African markets. The Managing Director of BUA Foods, Engr. Abioye Ayodele, representing the Executive Chairman, is attending the event at the Nigeria Pavilion, engaging industry stakeholders and showcasing the company’s manufacturing capabilities.

Also speaking at the show, Engr. Ayodele stated, “BUA Foods has built scale across key staple categories that are central to household consumption. Our participation at this Show allows us to demonstrate the quality, consistency, and operational strength behind our products. We are also engaging global stakeholders with a clear message that Nigerian manufacturing can meet international standards while serving both domestic and regional markets efficiently.”

The Show provides BUA Group with an opportunity to deepen trade relationships, explore new export pathways, and reinforce Nigeria’s growing relevance within the global agricultural and food ecosystem.

BUA Group remains focused on building enduring institutions, expanding productive capacity, and positioning African enterprise competitively within global markets.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

news7 months ago

news7 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING