Business

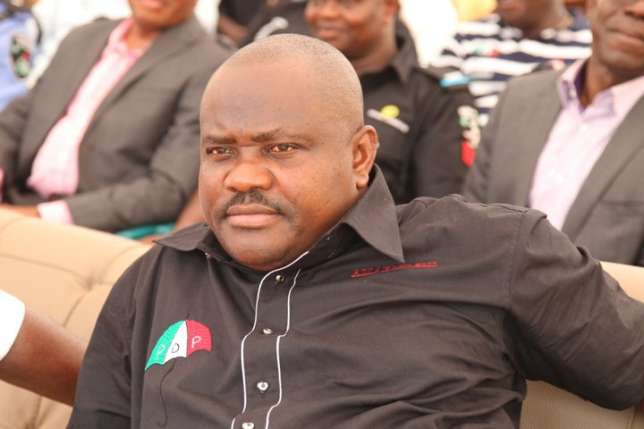

Crisis as Rivers state Governor, Nyesom Wike, NIA fight over ownership of N13bn found in Ikoyi

The controversy surrounding the ownership of the N13bn ($43.4m, N23m and £27,000) found by the Economic and Financial Crimes Commission at the Osborne Towers, Ikoyi, Lagos, took a dramatic turn on Friday evening when Governor Nyesom Wike of Rivers State and the National Intelligence Agency claimed ownership of the money.

The National Intelligence Agency on Friday said the money belonged to it.

A national daily had earlier reported that the money belonged to the NIA. Sources at the agency confirmed to one our correspondents late Friday that the money belonged to the agency and that it had written a formal letter to President Muhammadu Buhari to claim ownership of the money.

Saturday PUNCH learnt that the NIA, which is Nigeria’s foreign intelligence service, explained that the money, which was found on the seventh floor of the building, was approved by former President Goodluck Jonathan for covert operations and security projects covering a period of years.

The money was said to have been released in bits during the tenure of a former NIA director-general.

A source said that the cash was approved before the advent of the Treasury Single Account.

He stated that the Director-General of the NIA, Amb. Ayo Oke; the EFCC Chairman, Mr. Ibrahim Magu; and the National Security Adviser, Babagana Moguno, had met over the issue. A Presidency source also confirmed the meeting to one of our correspondents.

The NIA source explained that when EFCC operatives stormed the Ikoyi property on Wednesday, they were informed that the said apartment was a safe house of the NIA from which discreet operations were carried out.

The EFCC boss, however, rejected all entreaties from the NIA and entered the building, breaking the fireproof safes and taking the money.

The source, who wished to remain anonymous because he was not authorised to speak with the media, said, “The money belongs to the NIA. It is for covert operations and security projects covering a period of years.The DG has met with the President, he has explained everything to him. The President asked him to put everything into writing and he has done so.

“The entire chain of events was a big misunderstanding. That place was an NIA safe house and you have to understand that the NIA carries out discreet investigation in conjunction with many agencies across the world.

“On the day the EFCC men gathered around the house, the NIA reached out to Magu to explain to him that the money was the property of the Federal Government and the place was an NIA safe house. Unfortunately, the EFCC still went ahead to break down the doors.”

But Wike, who described the claim that the cash belonged to the NIA as balderdash, alleged that the immediate past governor of the state and the current Minister of Transportation, Mr. Rotimi Amaechi, kept the money in the apartment.

As such, the Rivers State governor gave the Federal Government a seven-day ultimatum to return the money to the state government or be ready to face legal action.

Speaking with newsmen in Port Harcourt on Friday night, Wike said the $43m was part of the proceeds from the sale of a gas turbine by the immediate past administration, adding that the gas turbine was initially built by the Peter Odili administration.

The governor further challenged the Federal Government to set up a commission of inquiry to probe the source of the huge money found in the flat, insisting that the funds belonged to Rivers people and should be returned to the owners within seven days.

He said, “All these things they are saying that the $43m belong to the Nigerian Intelligence Agency is balderdash. When did the NIA begin to keep money in houses? As I speak to you now, the Federal Government is so embarrassed.

“I want the President to set up a commission of inquiry. We don’t want to fight anybody; they should set up a commission of inquiry or return our money within seven days. If they don’t, we will take all necessary legal actions and NIA will come and prove where they got the money from.

“The $43m is the proceeds of the sale of the gas turbine sold by the immediate past administration. The gas turbine was built by the (Peter) Odili administration. It (gas turbine) was sold to Sahara Energy.

“The turbine was sold for $319m. But as of May 2015, what was in the account was $204,000. We will avail ourselves and we will be present at the commission of inquiry expected to be set up by the Federal Government. If we are invited, we will come. There is no contradiction in this at all, but I know they (FG) will not agree.”

Wike maintained that he would complete the monorail project if the Federal Government returned the $43m to Rivers State, adding that it would be “projects galore” in the state should the money be returned back to its original owner.

“Part of the money from the sale of the gas turbine was used to fund the All Progressives Congress campaign. We are telling the world that the money belongs to us. If they (FG) give us the money, I will complete the monorail project,” he said.

When contacted, the media aide to Mr. Rotimi Amaechi, Mr. David Iyofor, said he would react to Wike’s claim on Saturday (today).

The money has since been deposited into the account of the Central Bank of Nigeria following an interim forfeiture order granted by a Federal High Court in Lagos.

The court had also ruled that if the owner of the money did not show up within 30 days, it would be forfeited to the federal Government permanently.

EFCC keeps mum

All attempts to speak with the spokesperson for the EFCC, Mr. Wilson Uwujaren, on Friday proved abortive as his phone indicated that it was switched off while a text message sent to his phone was not responded to.

It’s a security issue –Presidency

When contacted, the Special Adviser to the President on Media and Publicity, Mr. Femi Adesina, directed our correspondent to the security agencies said to have been involved in the matter.

“This is not a matter for the Presidency. It is a security issue and I will advise you to get across to the agencies mentioned,” he said on the telephone.

SERAP, CD, others hit EFCC for hiding owners’ identities

But socio-political groups, including the Socio-Economic Right Accountability Project and the Campaign for Democracy, criticised the EFCC for hiding the identities of the owners of the recently recovered funds in Lagos and Kaduna.

SERAP and the CD, in separate interviews with Saturday PUNCH, said that it was anti-democratic for the EFCC to shield the identities of the owners of recovered money.

The SERAP Director, Adetokunbo Mumuni, said, “Whatever information that the EFCC has about any money abandoned or found in any place deserves to be released to the public. In a democracy, there can’t be opaqueness. This issue affects public interest and it is against the collective interest if the EFCC withholds the identities.

“The EFCC’s action will be contrary to public policy and anti-democratic if the information is not released. What will happen if the EFCC is not open is that it will give room for rumours, which is not good for democracy.”

In his own remarks, the CD President, Usman Abdul, said, “The EFCC of recent has just been playing to the gallery. The APC-led Federal Government should not take citizens for a ride. After the denial of the confirmation of the EFCC Chair, Magu, we have had several seizures in Kaduna and Lagos states, without anybody having being identified as the custodians of these monies.

“It is quite laughable that new notes of money, even hard to get in banks, were found and the EFCC cannot disclose who committed such acts.”

On his part, the National Publicity Secretary of Afenifere, Yinka Odumakin, said that it was unfortunate that Magu’s EFCC out of desperation had thrown caution to the wind in the desperate attempt to be in the news and excite the public.

He stated, “You found such volume of cash without any attempt to find the owners and you start a cinema of exhibit. A sergeant IPO who does that should be fired without benefits.

“You cannot tell me that you cannot trace the title of a property in Ikoyi at Alausa in a matter of hours .But it seems Magu is all about anti-corruption and seduction.

“If Magu fails to disclose the owners of the money, it means that the anti-corruption war has become a ‘night of a thousand laughs.’”

Also, the Executive Secretary, Anti-Corruption Network, Ebenezer Oyetakin, said, “The fight against corruption must be total, unambiguous, true in character and content, transparent in outlook and must not be cloudy in presentation to the public.”

He said that the shielding of the identity of the looters in itself was corruption and detrimental to the success of the fight against graft.

Oyetakin stated, “The fact that this is fuelling speculations that those involved are government officials of the present regime is too bad for the image of the government that is fighting corruption.

“This is why I must vehemently call on the EFCC to do the needful by releasing the names of the looters. The more reason why the names should be made known is to serve deterrence against such practices.

“However, I am more concerned that arresting and making this type of discovery once in a month is not the only way to fight corruption or regained the loots, otherwise fifty years will not be enough to regain looted funds.”

He called for the re-denomination of the naira, adding that owners of looted funds could come out and change their money.

A former chairman of the Peoples Democratic Party, Adamu Mu’azu was reported to have said that he knew nothing about funds recovered at a property reported to be his in Ikoyi, Lagos.

An online newspaper, The Cable, reported that Mu’azu, who was the Governor of Bauchi State from 1999 to 2007, said he got a bank loan to acquire the land where the house was built, adding that he sold the house to pay back the loan.

Another online newspaper, Sahara Reporters, reported that the Minister of Transportation, Amaechi, said he had no connection whatsoever with the apartment or the money.

He was reported to have said that he did not own any apartment or house in Lagos, stating that his only property in Nigeria was in Abuja.

Business

Nigeria’s Inflation Drops to 15.10% as NBS Reports Deflationary Trend

Nigeria’s headline inflation rate declined to 15.10 per cent in January 2026, marking a significant drop from 27.61 per cent recorded in January 2025, according to the latest Consumer Price Index (CPI) report released by the National Bureau of Statistics.

The report also showed that month-on-month inflation recorded a deflationary trend of –2.88 per cent, representing a 3.42 percentage-point decrease compared to December 2025. Analysts say the development signals easing price pressures across key sectors of the economy.

Food inflation stood at 8.89 per cent year-on-year, down from 29.63 per cent in January 2025. On a month-on-month basis, food prices declined by 6.02 per cent, reflecting lower costs in several staple commodities.

The data suggests a sustained downward trajectory in inflation over the past 12 months, pointing to improving macroeconomic stability.

The administration of President Bola Ahmed Tinubu has consistently attributed recent economic adjustments to ongoing fiscal and monetary reforms aimed at stabilising prices, boosting agricultural output, and strengthening domestic supply chains.

Economic analysts note that while the latest figures indicate progress, sustaining the downward trend will depend on continued policy discipline, exchange rate stability, and improvements in food production and distribution.

The January report provides one of the clearest indications yet that inflationary pressures, which surged in early 2025, may be moderating.

Bank

Alpha Morgan to Host 19th Economic Review Webinar

Alpha Morgan to Host 19th Economic Review Webinar

In an economy shaped by constant shifts, the edge often belongs to those with the right information.

On Wednesday, February 25, 2026, Alpha Morgan Bank will host the 19th edition of its Economic Review Webinar, a high-level thought leadership session designed to equip businesses, investors, and individuals with timely financial and economic insight.

The session, which will hold live on Zoom at 10:00am WAT and will feature economist Bismarck Rewane, who will examine the key signals influencing Nigeria’s economic direction in 2026, including policy trends, market movements, and global developments shaping the local landscape.

With a consistent track record of delivering clarity in uncertain times, the Alpha Morgan Economic Review continues to provide practical context for decision-making in a dynamic environment.

Registration for the 19th Alpha Morgan Economic Review is free and can be completed via https://bit.ly/registeramerseries19

It is a bi-monthly platform that is open to the public and is held virtually.

Visit www.alphamorganbank to know more.

Business

GTBank Launches Quick Airtime Loan at 2.95%

GTBank Launches Quick Airtime Loan at 2.95%

Guaranty Trust Bank Ltd (GTBank), the flagship banking franchise of GTCO Plc, Africa’s leading financial services group, today announced the launch of Quick Airtime Loan, an innovative digital solution that gives customers instant access to airtime when they run out of call credit and have limited funds in their bank accounts, ensuring customers can stay connected when it matters most.

In today’s always-on world, running out of airtime is more than a minor inconvenience. It can mean missed opportunities, disrupted plans, and lost connections, often at the very moment when funds are tight, and options are limited. Quick Airtime Loan was created to solve this problem, offering customers instant access to airtime on credit, directly from their bank. With Quick Airtime Loan, eligible GTBank customers can access from ₦100 and up to ₦10,000 by dialing *737*90#. Available across all major mobile networks in Nigeria, the service will soon expand to include data loans, further strengthening its proposition as a reliable on-demand platform.

For years, the airtime credit market has been dominated by Telcos, where charges for this service are at 15%. GTBank is now changing the narrative by offering a customer-centric, bank-led digital alternative priced at 2.95%. Built on transparency, convenience and affordability, Quick Airtime Loan has the potential to broaden access to airtime, deliver meaningful cost savings for millions of Nigerians, and redefine how financial services show up in everyday life, not just in banking moments.

Commenting on the product launch, Miriam Olusanya, Managing Director of Guaranty Trust Bank Ltd, said: “Quick Airtime Loan reflects GTBank’s continued focus on delivering digital solutions that are relevant, accessible, and built around real customer needs. The solution underscores the power of a connected financial ecosystem, combining GTBank’s digital reach and lending expertise with the capabilities of HabariPay to deliver a smooth, end-to-end experience. By leveraging unique strengths across the Group, we are able to accelerate innovation, strengthen execution, and deliver a more integrated customer experience across all our service channels.”

Importantly, Quick Airtime Loan highlights GTCO’s evolution as a fully diversified financial services group. Leveraging HabariPay’s Squad, the solution reinforces the Group’s ecosystem proposition by bringing together banking, payment technology, and digital channels to deliver intuitive, one-stop experiences for customers.

With this new product launch, Guaranty Trust Bank is extending its legacy of pioneering digital-first solutions that have redefined customer access to financial services across the industry, building on the proven strength of its widely adopted QuickCredit offering and the convenience of the Bank’s iconic *737# USSD Banking platform.

About Guaranty Trust Bank

Guaranty Trust Bank (GTBank) is the flagship banking franchise of GTCO Plc, a leading financial services group with a strong presence across Africa and the United Kingdom. The Bank is widely recognized for its leadership in digital banking, customer experience, and innovative financial solutions that deliver value to individuals, businesses, and communities.

About HabariPay

HabariPay is the payments fintech subsidiary of GTCO Plc, focused on enabling fast, secure, and accessible digital payments for individuals and businesses. By integrating payments and digital technology, HabariPay supports innovative services that make everyday financial interactions simpler and more seamless.

Enquiries:

GTCO

Group Corporate Communication

[email protected]

+234-1-2715227

www.gtcoplc.com

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING

You must be logged in to post a comment Login