Business

Crisis on Multiple Fronts: Reuters & World Bank Expose Nigeria’s Humanitarian and Economic Collapse.

Crisis on Multiple Fronts: Reuters & World Bank Expose Nigeria’s Humanitarian and Economic Collapse.

By George Omagbemi Sylvester | SaharaWeeklyNG.com

“Record hunger. Surging inflation. A nation on the edge.”

In Nigeria today, the line between economic distress and humanitarian catastrophe is vanishing. Reports from Reuters and the World Bank paint a dire Tableau which millions are teetering on the brink, besieged by food insecurity, inflation, fiscal strain and systemic fragility. This is not a distant crisis; but the lived reality for many Nigerians.

Humanitarian Alarm Bells: Hunger, Displacement and Aid Droughts.

The United Nations now warns that nearly 31 million Nigerians are experiencing acute food insecurity, an ominous figure equivalent to the population of a MEDIUM-SIZED COUNTRY. This is not due to lack of need; but to a catastrophic shortfall in humanitarian funding. The World Food Programme (WFP) has sounded the alarm that cuts in aid will force over 1.3 million Nigerians to lose essential food support.

In northeastern Nigeria (a conflict-scarred zone already battered by insurgency) over 150 nutrition clinics are at risk of closure, placing 300,000 children at danger of severe malnutrition, while 700,000 displaced persons could be left without vital support. These are not abstractions; they are children whose next meal is uncertain, mothers watching their infants fade, families torn from their lands. The humanitarian safety net has holes wide enough to swallow entire communities.

Memory of past disasters haunts the present. In 2024, raging floods displaced millions, destroyed crops and worsened nutrition deficits; especially among subsistence farmers. In conflict zones, the devastation multiplies: fields lie fallow, trade routes shut and supply chains collapse.

One recent empirical study in Benue State confirms a grim truth, insecurity reduces agricultural output directly. The researchers found that even a modest rise in insecurity correlates with a 0.211% drop in crop yields and 0.311% drop in livestock output. In other words, violence is not a side effect but a contributor.

Amid this dearth of aid, the USAID decision to slash support in northeastern Nigeria amounts to a lifeline being yanked away. Over 90% of key foreign aid contracts were terminated, pushing relief operations to the brink. In Dikwa and other displaced persons sites, malnutrition and mortality climb while humanitarian actors pull back.

Economic Realities: Growth with Broken Bones.

In the economic realm, the World Bank and Reuters both register a paradox whereby Nigeria’s GDP is showing signs of recovery, yet the masses are sinking further.

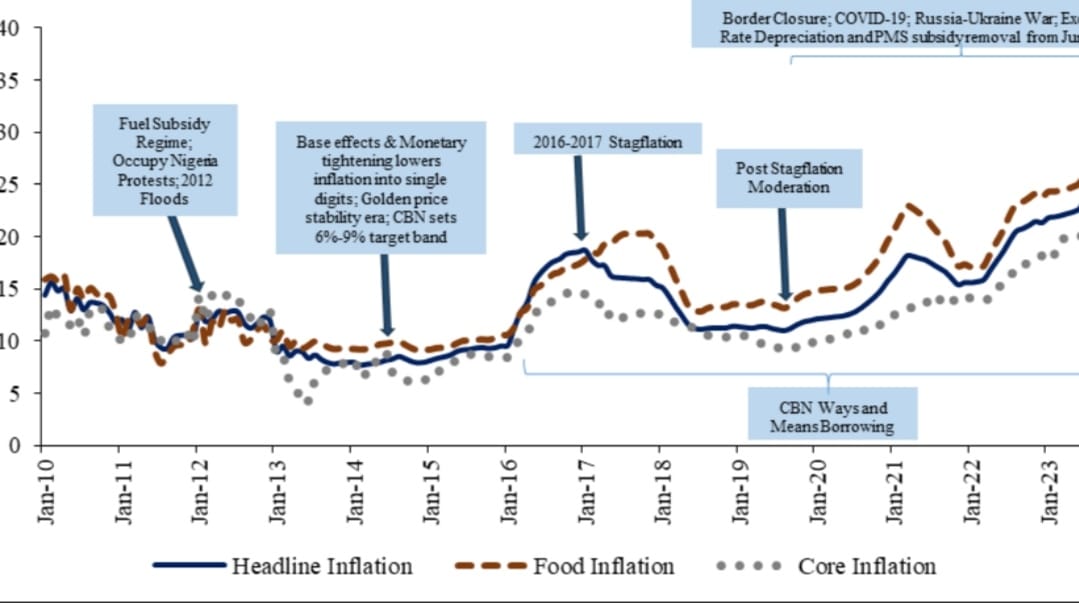

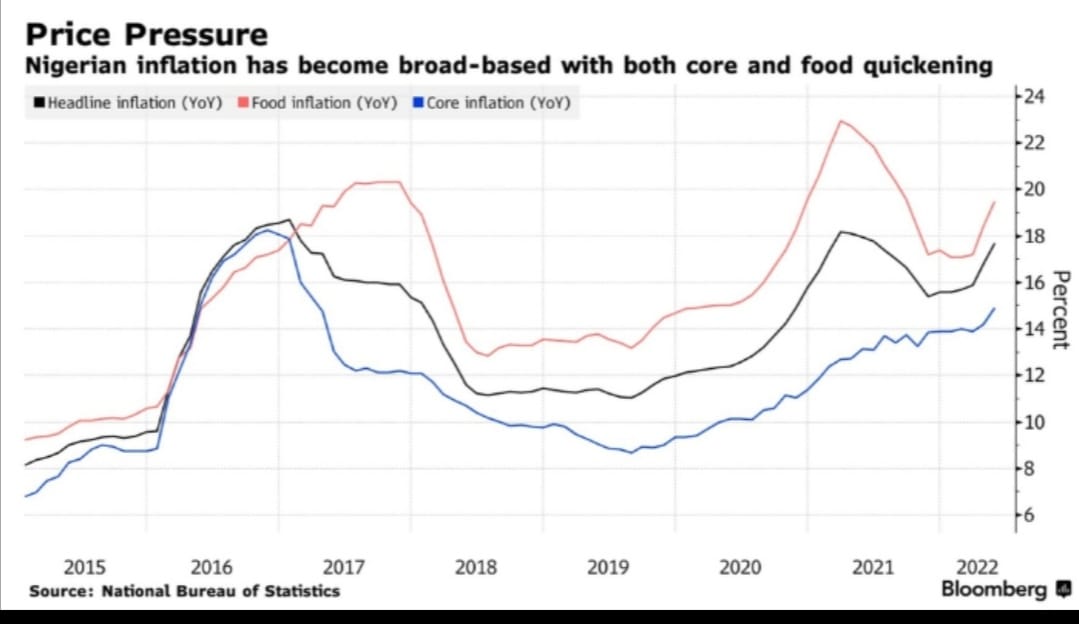

According to Reuters, the Nigerian economy posted its fastest growth in a decade during 2024, with a 4.6% expansion in the final quarter. The Bank projects a more tempered 3.6% growth in 2025. Yet this growth is brittle. Inflation remains entrenched (especially in food prices) and the purchasing power of ordinary Nigerians continues to erode. The World Bank describes inflation as a “BURDEN,” warning that lower oil prices are offset by rising costs of imports.

The Nigerian fiscal deficit is projected at 2.6% of GDP in 2025, nearly unchanged from 2024, while public debt (once a pressing risk) may decline slightly from 42.9% to 39.8% of GDP. Mathew Verghis, World Bank Country Director for Nigeria, said that while government steps to stabilize the economy are beginning to pay dividends, the relief has yet to reach the most vulnerable.

Still, the structural contradictions are stark. Economic gains are tilted toward sectors like finance, ICT and transport, with limited spin-off into jobs and livelihoods. As the World Bank notes, employment alone is not enough, what matters are productive jobs.

Reuters furthermore reports that Nigeria’s Finance Minister, Wale Edun, has publicly admitted that the country must double its growth rate in the next year or two to plausibly reduce poverty. That is no small ask, yet the stakes could not be higher.

The Human Cost Behind the Numbers.

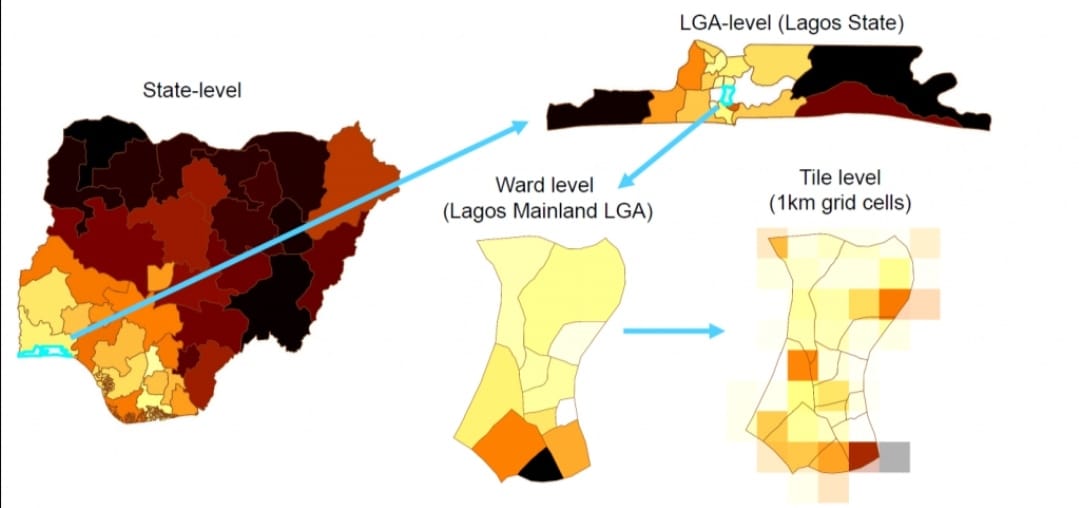

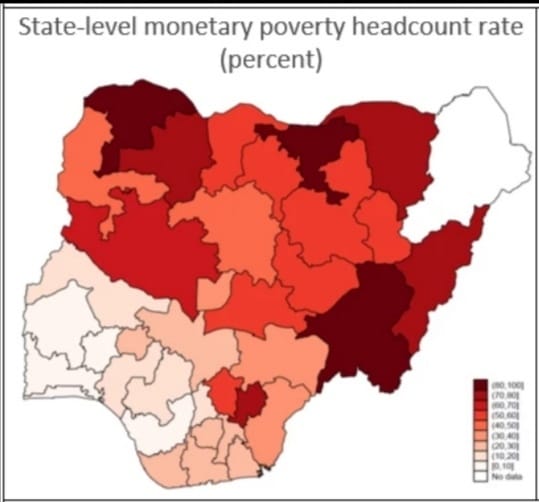

Between 2018/19 and 2024, an estimated 45 million additional Nigerians slipped into poverty, bringing the share of Nigerians below the poverty line to roughly 47%. In rural areas, poverty is pervasive; over three in four rural dwellers now live in poverty, while in urban centers more than two in five do so. Meanwhile, food inflation continues to ravage the poor. Poor households (whose limited budgets allocate up to 70% toward food) bear the brunt. The Jollof Index, a clever food-price tracker in Nigeria, spotlights how basic meals have become prohibitively expensive such as rice, tomatoes, onions, protein and oil prices have all surged in ways that outpace general inflation.

As Reuters captured, even with improving macroeconomic indicators, high food prices remain a heavy burden on vulnerable Nigerians. Now add to that regional inequality, insecurity and dysfunctional social programs and what you have is a perfect storm.

Structural Fault Lines: Why Growth Failed the Poor.

1. Weak revenue mobilization & fiscal misalignment.

Nigeria’s tax-to-GDP ratio hovers near 10.9%, placing it far behind peer African economies like South Africa or Rwanda. While new tax reforms (e.g. higher VAT) are floating in policy circles, they face resistance and especially from states wary of federal revenue allocations.

Government spending is misaligned, sectors most essential to human development (Education, Health, Agriculture) are underfunded. Security claims a large slice of the budget, while agriculture and social infrastructure receive paltry allocations.

2. Ineffective social protection.

The World Bank repeatedly calls attention to the need to protect the poor and economically insecure by strengthening social protection frameworks. Yet implementation is weak-poor targeting, late payments, leakages and insufficient scale mean many fall through the cracks.

3. Insecurity & climate risk.

Insurgency, banditry, farmer-herder conflict and environmental degradation strike hardest in Nigeria’s least resilient states. The loss in agricultural output, displacement of farming households and fracturing of supply chains all deepen humanitarian hardships.

4. Uneven growth.

Growth has failed to be inclusive. Gains cluster in urban, capital-intensive sectors. Rural areas, especially in the North and Northeast, see scant trickle-down. The divide between those benefiting and those excluded grows wider each year.

5. Dependence on oil & external shocks.

Despite being oil-rich, Nigeria’s overdependence on hydrocarbon exports makes it vulnerable to swings in global prices. When oil dips, the budget suffers; when oil rises, windfalls often misallocated. External shocks (like global inflation, currency swings or climate events) transmit pain to ordinary Nigerians.

Voices of Wake-Up Calls.

Economist Justin Yifu Lin has long argued that “inclusive growth is the key to poverty reduction.” Growth that excludes the common citizen is hollow growth. Meanwhile, Amartya Sen’s theory of capability expansion echoes here: for citizens to rise, policy must invest in education, health and social infrastructure; not just GDP.

In Nigeria’s context, former Finance Minister Ngozi Okonjo-Iweala has repeatedly warned that currency stability, inflation control and domestic production are pillars without which reforms collapse.

And as George Omagbemi Sylvester has said: “You cannot borrow your way out of poverty. You must produce your way to prosperity.”

That maxim must guide Nigeria now more than ever. Borrowing to placate deficits is SELF-DELUSION if it does not seed productive industries or jobs.

The Bottom Line.

Nigeria now faces a dual calamity: its humanitarian fabric is fraying while its economic underpinnings wobble. Reports from Reuters and the World Bank confirm that despite apparent growth, millions suffer hunger, malnutrition and deprivation.

To salvage the future, Nigeria must bridge the gap between macro gains and human gains:

Scale up social protection for the most vulnerable with precision and integrity.

Mobilize domestic revenue, reduce leakages and reallocate spending toward education, health, agriculture and infrastructure.

Promote agricultural resiliency, support farmers in conflict zones, and shore up climate adaptation.

Incentivize productive investments and industries that create jobs, rather than depending on imports or debt.

Restore security and governance in fragile regions so development can take root.

The alternative is bleak, a nation producing numbers of growth on paper, but producing despair in the hearts of millions.

Let the reports from Reuters and the World Bank serve not as ominous forecasts but as urgent clarion calls. Nigeria’s moment is now; or the suffering deepens.

Business

Harmony Gardens’ Ibeju-Lekki Portfolio Crosses $1bn

Harmony Gardens’ Ibeju-Lekki Portfolio Crosses $1bn

Harmony Garden & Estate Development Limited has expanded its development activities across Ibeju-Lekki, pushing the projected long-term value of its estate portfolio beyond $1 billion.

Led by Chief Executive Officer Hon. Dr. Audullahi Saheed Mosadoluwa, popularly know Saheed Ibile, the company is developing seven estates within the Lekki–Ibeju corridor. Details available on Harmony Garden & Estate Development show a portfolio spanning land assets and ongoing residential construction across key growth locations.

A major component is Lekki Aviation Town, where urban living meets neighborhood charm, located near the proposed Lekki International Airport and valued internally at over $250 million. The development forms part of the company’s broader phased expansion strategy within the axis.

Other estates in the corridor tagged as the “Citadel of Joy” (Ogba-idunnu) include Granville Estate, Majestic Bay Estate, The Parliament Phase I & II, and Harmony Casa Phase I & II.

With multiple projects active, the rollout of the Ibile Traditional Mortgage System, and structured expansion underway, Harmony Garden & Estate Development Ltd continues to deepen its presence within the fast-growing Ibeju-Lekki real estate market.

Business

BUA Group Showcases Food Manufacturing Strength at 62nd Paris International Agricultural Show

BUA Group Showcases Food Manufacturing Strength at 62nd Paris International Agricultural Show

BUA Group, one of Africa’s leading diversified conglomerates, is maintaining a strong presence at the ongoing 62nd edition of the Paris International Agricultural Show in France, participating as a premium sponsor and supporting the Nigeria Pavilion at one of the world’s most respected agricultural gatherings.

The 62nd Paris International Agricultural Show, taking place from February 21 to March 1, 2026, at Porte de Versailles in Paris, convenes global leaders across farming, agro processing, technology, finance, and policy. The event serves as a strategic platform for industry engagement, knowledge exchange, and commercial partnerships shaping the future of global food systems.

BUA Group’s participation reflects its long term commitment to strengthening the entire food production value chain. Through sustained investments in large scale processing, value addition, and branded consumer products, the Group continues to reinforce its role in advancing food security, industrial growth, and regional trade integration.

Speaking on the Group’s participation, the Executive Chairman of BUA Group, Abdul Samad Rabiu CFR, said, “BUA’s presence at the Paris International Agricultural Show reflects our belief that Africa must be an active participant in shaping the future of global food systems. We have invested significantly in local production capacity because we understand that food security, industrial growth, and economic resilience are interconnected. Platforms like this allow us to build partnerships that strengthen Nigeria’s competitiveness and expand our reach beyond our borders.”

BUA Foods, a subsidiary of BUA Group, maintains a strong footprint in flour, pasta, spaghetti, sugar, and rice production, serving millions of consumers within Nigeria and across neighbouring African markets. The Managing Director of BUA Foods, Engr. Abioye Ayodele, representing the Executive Chairman, is attending the event at the Nigeria Pavilion, engaging industry stakeholders and showcasing the company’s manufacturing capabilities.

Also speaking at the show, Engr. Ayodele stated, “BUA Foods has built scale across key staple categories that are central to household consumption. Our participation at this Show allows us to demonstrate the quality, consistency, and operational strength behind our products. We are also engaging global stakeholders with a clear message that Nigerian manufacturing can meet international standards while serving both domestic and regional markets efficiently.”

The Show provides BUA Group with an opportunity to deepen trade relationships, explore new export pathways, and reinforce Nigeria’s growing relevance within the global agricultural and food ecosystem.

BUA Group remains focused on building enduring institutions, expanding productive capacity, and positioning African enterprise competitively within global markets.

Business

Nigeria’s Inflation Drops to 15.10% as NBS Reports Deflationary Trend

Nigeria’s headline inflation rate declined to 15.10 per cent in January 2026, marking a significant drop from 27.61 per cent recorded in January 2025, according to the latest Consumer Price Index (CPI) report released by the National Bureau of Statistics.

The report also showed that month-on-month inflation recorded a deflationary trend of –2.88 per cent, representing a 3.42 percentage-point decrease compared to December 2025. Analysts say the development signals easing price pressures across key sectors of the economy.

Food inflation stood at 8.89 per cent year-on-year, down from 29.63 per cent in January 2025. On a month-on-month basis, food prices declined by 6.02 per cent, reflecting lower costs in several staple commodities.

The data suggests a sustained downward trajectory in inflation over the past 12 months, pointing to improving macroeconomic stability.

The administration of President Bola Ahmed Tinubu has consistently attributed recent economic adjustments to ongoing fiscal and monetary reforms aimed at stabilising prices, boosting agricultural output, and strengthening domestic supply chains.

Economic analysts note that while the latest figures indicate progress, sustaining the downward trend will depend on continued policy discipline, exchange rate stability, and improvements in food production and distribution.

The January report provides one of the clearest indications yet that inflationary pressures, which surged in early 2025, may be moderating.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

news7 months ago

news7 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING