society

DEFENCE HEADQUARTERS ORGANISES HUMAN RIGHTS LECTURE FOR TROOPS OF OPERATION SAFE HAVEN

*DEFENCE HEADQUARTERS ORGANISES HUMAN RIGHTS LECTURE FOR TROOPS OF OPERATION SAFE HAVEN

The Defence Headquarters has organised human rights lecture for troops of Operation SAFE HAVEN (OPSH), as a mechanism to prevent the violation of the rights of innocent civilians by troops and other personnel of Operation SAFE HAVEN.

In his opening remarks at the event held at Headquarters 3 Division Maxwell Khobe Cantonment Jos, the General Officer Commanding 3 Division Nigerian Army and Commander Operation SAFE HAVEN, Major General AE Abubakar, said troops operating within OPSH Joint Operations Area have constantly undergone trainings on human management from military institutions and civil society organizations. The Commander disclosed that, these trainings have boosted the capacity of personnel during internal security operations, where troops engage civilians on regular basis.

Major General Abubakar further stated that, military personnel deployed on OPSH have been inundated on the need to continually operate within the ambit of the law, with maximum respect for the rights of innocent civilians. He also urged the participants to educate their colleagues who were not opportuned to attend the lectures in order to ensure that the knowledge gained trickles down to every personnel to guide their conduct. The commander also revealed that the lecture was in fulfillment of the Chief of Defence Staff, Gen CG Musa resolve to improve the professional capability of military personnel on internal security operations across the country which is also aptly captured in the Training Directive to all formations under the guidance of the Chief of Army Staff, Lt Gen TA Lagbaja.

Delivering a lecture on Protection of Civilians, the guest speaker, Major AA Goni, said that the human rights lecture was important to troops on OPSH owing to the people-centric nature of the operations. The guest speaker noted that, there must not be selective protection of civilians during conflict. He further stressed that no intensity of military operations would justify unlawful killing of civilians.

On her part, Barrister Lovina Abbah, a Human Rights Lawyer, who delivered the second lecture on Torture and Cruel Treatment, said by respecting human rights, military personnel are likely to gain the confidence of the civil populace, which could aid military operations for optimal success.

Barrister Abbah added, that the law does not permit the use of torture to extract information from detainees. She urged the participants to embrace forensic method of investigation to determine the facts of cases being investigated. She, therefore advocated that operational guidelines should be followed while military personnel are on operations.

The team leader and Special Adviser to the Chief of Defence Staff on Human Rights, Air Commodore OO Akisanya (Rtd), disclosed that the lecture was conducted to improve the operational effectiveness of military personnel operating in a joint environment.

Highlights of the event include Lectures on Protection of Civilians/Torture and Cruel Treatment, interactive session, presentation of souvenirs and group photographs.

society

Ajiran Youth Protest Over Deaths of Two Residents, Demand Justice

Ajiran Youth Protest Over Deaths of Two Residents, Demand Justice

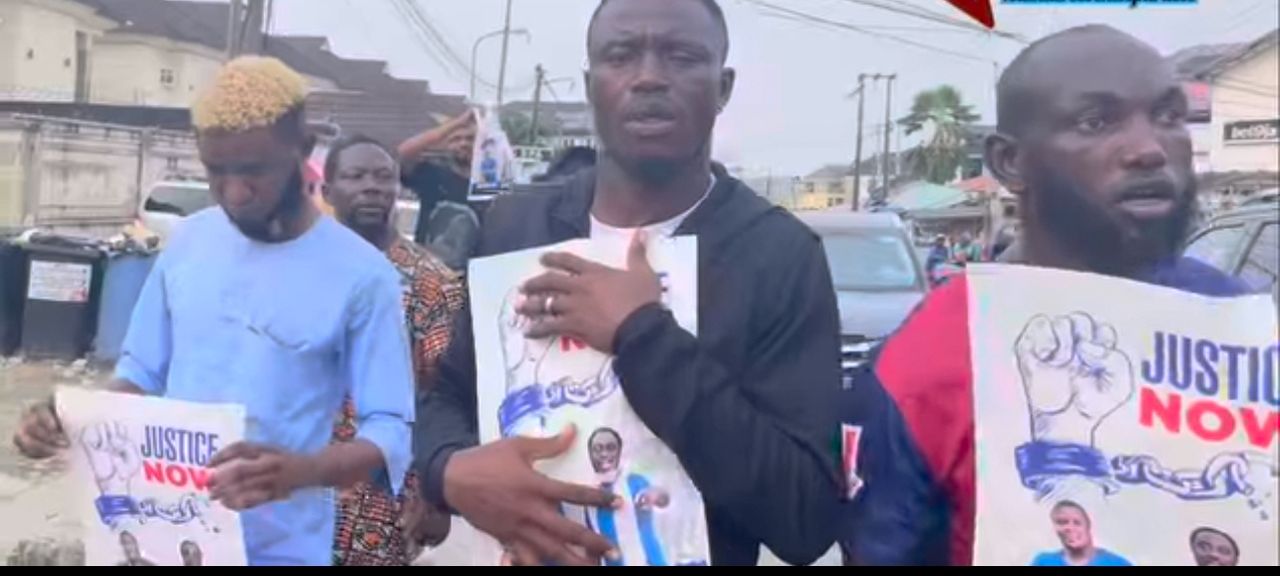

The Ajiran community of Lagos State erupted in a powerful protest on Tuesday as local youths took to the streets to express their grief and anger over the tragic murders of Prince Ademola Akintoye and Sherrif Agboworin. The demonstration follows the recent decision to reopen the murder case, an investigation that has already led to the arrest of over nine suspects in connection with the heinous crimes committed more than a year ago.

Carrying vibrant banners and poignant posters featuring the faces of the deceased, the protesters marched through the heart of their community while singing somber dirges to honor their memory. With chants of unity and justice ringing in the air, they called on both the Lagos State Government and the Lagos State Police Command to ensure that those responsible are swiftly and decisively brought to justice.

The youth leaders emphasized that peace and normalcy will remain elusive in Ajiran until all those complicit in the killings are held accountable. They articulated that true justice is the only way to restore tranquility and honor the lives of Akintoye and Agboworin, whom they described as innocent victims of a grave injustice.

Speaking on behalf of the demonstrators, youth leader Mr. Kehinde Oladele urged law enforcement to conduct a thorough and fair investigation. He asserted that every individual involved including the nine arrested suspects must face the full extent of the law. Especially Hammed Tajudeen, the principal suspect mentioned by others in custody, whom they believe should not escape scrutiny.

“The reopening of this case after more than a year is a critical first step towards achieving justice and fairness for our brothers,” Oladele said. “We urge the police to get to the root of the matter. Those mentioned during the investigation, especially Hammed Tajudeen, should not be spared.”

The atmosphere in the community grew increasingly tense last week following speculation that prominent businessman Aare Bashir Olawale Fakorede was implicated in the unrest. The speculation appeared to stem from his alleged influence on the reopening of the murder investigation. This misunderstanding escalated when a group of protesters targeted his filling station in Ikate, vandalizing his properties and disrupting business operations in the gas station based on the false assumption that Fakorede was behind the police’s renewed inquiries.

In response to the rising tensions and misinformation, Fakorede’s spokesperson, Ola Muhammed, issued a comprehensive statement denying any connection between Fakorede and the unrest. The spokesperson emphasized that rumors suggesting the businessman orchestrated the revival of the murder case were completely unfounded.

“I feel it is crucial to clarify, for the sake of transparency and historical accuracy, that this entire ordeal is in no way related to me,” Fakorede stated. “I am also very interested to see that the culprits are brought to book. I categorically affirm that I have never been involved in any business dealings with Mr. Hammed Tajudeen.”

Fakorede further elaborated that the recent protests which led to the destruction of his property were reportedly instigated by Tajudeen and others who seem determined to manipulate the narrative and cast suspicion upon him. Fakorede expressed his own strong commitment to uncovering the truth surrounding the deaths.

As the police investigation progresses, it has become increasingly apparent that all accusing fingers are pointing to Hammed Tajudeen who is currently evading capture, adding another layer of complexity and urgency to the ongoing situation. Community members have questioned why he remains at large instead of submitting himself to the police for questioning if he is truly innocent of the allegations against him.

Community leaders are now emphasizing the need for dialogue to address the root causes of the unrest and work toward restoring harmony within Ajiran, even as the demand for justice remains at the forefront of public consciousness.

society

Ramadan: Al-Yusuff International Travels and Tours Boss Greets Muslims

Ramadan: Al-Yusuff International Travels and Tours Boss Greets Muslims

As the holy month of Ramadan begins across the globe, the Chief Executive Officer of Al-Yusuff International Travels and Tours Limited, Dr. Abdulmajeed Oladele, has extended his heartfelt greetings to Muslims worldwide.

In his message, the respected business mogul expressed gratitude to Almighty Allah for the privilege of witnessing this year’s sacred month.

“We glorify Allah for granting us the grace and opportunity to witness this year’s month of blessings. Ramadan is a sacred and special month for all Muslims, a month greater than many others, filled with piety, mercy, and abundant blessings.

I congratulate all Muslims across the world. Let us faithfully observe the requirements of Ramadan. May Allah (SWT) grant our heart’s desires and make this period easy and rewarding for us all.”

Dr. Oladele urged Muslims to embrace the spiritual significance of Ramadan through devotion, charity, self-discipline, and prayers for peace and prosperity.

society

UKA UNVEILS THREE-TIER ATC PLATFORM AS MONARCH ANNOUNCES $10BN GOLD-BACKED MILESTONE

UKA UNVEILS THREE-TIER ATC PLATFORM AS MONARCH ANNOUNCES $10BN GOLD-BACKED MILESTONE

Emperor Nobilis Prof Solomon Winning declares global recognition of ATC ecosystem, urges citizens and partners to embrace unified digital, crypto and gold-backed financial structure

The Reigning Monarch of the United Kingdom of Atlantis (UKA), Emperor Nobilis Prof Solomon Winning, has formally announced what he described as a historic milestone in the financial evolution of the Atlantis nation and empire worldwide, the consolidation and global recognition of the ATC financial ecosystem backed by a $10 billion gold reserve.

In a voice message released from the Office of the Throne, the Monarch expressed gratitude to God and to citizens and partners across the globe for what he termed a “defining achievement” in the journey of the United Kingdom of Atlantis.

According to him, the ATC asset structure, supported by a $10 billion gold-backed certificate, has now been positioned among the world’s leading capitalisation financial platforms, ranking number 12 globally.

“We appreciate God for the milestone achieved of our 10 billion gold-backed certificate of ATC assets. We are delighted to inform our esteemed citizens, partners, viewers and friends all over the world that ATC has come to stay,” the Monarch declared.

Three Distinct but Interconnected ATC Platforms

Emperor Winning explained that the UKA Government and the Atlantis nation have officially released three integrated ATC platforms to the general public. He emphasised that while each platform serves a distinct purpose, they are structured to interact seamlessly for effective management, business transactions and global trading operations.

1.ATC Digital (Government Platform)

The first platform, known as ATC Digital, is the official government-backed digital transaction system. It is designed to facilitate digital financial operations within the UKA ecosystem and serve as the administrative and transactional backbone of the nation’s digital economy.

The Monarch described it as the formally recognised digital framework governed directly by the government under the Throne.

ATC Gold Version (Business and Trade Platform). The second platform, referred to as the ATC Gold Version, is primarily tailored for business trade, commercial exchange and transactional fluidity. It is structured to enhance business-to-business engagement, exchangeability and broader economic interaction.

“This version is mainly for business trade, business exchange and commercial transactions,” he clarified.

ATC Crown Coin (Crypto and Visitor Platform)

The third platform, known as the ATC Crown Coin, represents the Atlantis Crown Coin and is linked to what the monarch described as the Atlantean Bank Gold structure. This version operates as a crypto and digital hybrid, including visitor engagement capabilities and broader exchange functions.

(atlantisgoldbank.org

The Digital/Cryto currency Version

Atlantian Crown Gold (E-ATC) https://share.google/a7Jns9VtrMKCZ6Prk

The E-ATC purely for Trading and Exchang

Atlantean Crown (ATC) – The Future of Digital Currency https://share.google/1EhdkkDBFvBLLgfR1

The Digital version for Government

We also Have DEOS INTERNATIONAL Bank (DIB)

And ATCB)

The Monarch indicated that all three platforms are interconnected to ensure efficiency, transparency and global recognition.

“Please do not be confused. The United Kingdom of Atlantis has three major versions of ATC. Two are crypto-based, one is digital; one is also a hybrid of crypto and digital. All three interact together for effective management and effective business transactions.”

Global Recognition and Expansion Vision

Emperor Winning further asserted that the ATC ecosystem is already recognised internationally and positioned within the global financial framework. “Our platforms are presently recognised in the whole world,” he said, while encouraging existing holders of ATC assets to remain confident in the system.

He congratulated all ATC holders and reiterated the Throne’s commitment to strengthening the ecosystem’s credibility, usability and cross-platform functionality.

A Strategic Financial Architecture

Observers say the three-tier structure reflects an attempt by the United Kingdom of Atlantis to create a multi-layered financial architecture combining government-regulated digital systems, crypto-based trade platforms and gold-backed reserve credibility.

By integrating digital governance with cryptocurrency and gold certification, the UKA appears to be positioning ATC as both a sovereign-backed asset and a tradable global instrument.

As the UKA advances its financial ambitions, the monarch’s message signals a push for adoption, participation and global engagement with the ATC ecosystem.

“If you are a holder of ATC, congratulations to you from the Throne. God bless you,” the monarch concluded.

The development marks another significant chapter in the evolving digital and gold-backed finance narrative emerging from the United Kingdom of Atlantis.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth