Fidelity Bank Commends Air Peace’s Performance

. Celebrates Airline For The Commencement of the Lagos-London Route

LAGOS – Fidelity Bank Plc has commended Air Peace’s performance since it commenced flight operations about 10 years ago.

Dr. Nneka Onyeali-Ikpe, the Managing Director, Fidelity Bank Plc gave the commendation over the weekend in Lagos during a special event organised for the airline by the bank to celebrate Air Peace for the milestone of commencement of direct flights from Lagos to London.

According to Nneka Onyeali-Ikpe, who doubled as the host at the event, the airline has upheld the principles of financial discipline and good corporate governance since inception, while it has also been very loyal to the bank.

She expressed delight that the bank had the airline as one of its major clients since inception, stressing that the Bank was celebrating the airline’s milestone of launching direct flight service to London and other developments it would attain in the future.

The event, which held at the Civic Center, Victoria Island, Lagos, had in attendance several bank Managing Directors, stakeholders in the aviation sector, media personalities and well-wishers of both brands.

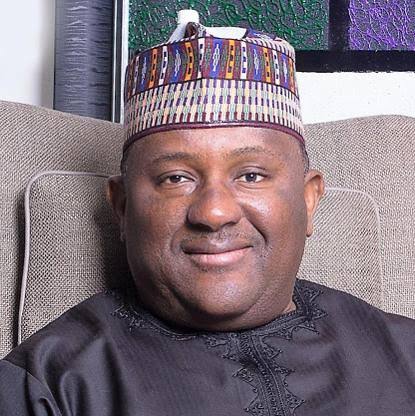

Speaking at the event, an elated Dr. Allen Onyema, the Chairman, Air Peace, observed that it was not rosy for the airline to attain its status and expressed gratitude to the flying public, the various aviation stakeholders, the media and the government for the continued support since it launched in 2014.

He specifically acknowledged the pivotal role played by Engr. Ben Adeyileka, the former Acting Director-General, Nigeria Civil Aviation Authority (NCAA), in helping the airline secure its Airline Operator Certificate (AOC).

He further commended Fidelity Bank for the consistent support and stressed that the bank had contributed to the success story of the airline.

“I call it our journey with Fidelity Bank. I did not envisage this day would come when an indigenous institution would be celebrating another indigenous institution. Fidelity supports real business. They keep removing people from the streets of poverty. Let other banks emulate Fidelity,” he said.

He reiterated that Air Peace was set up primarily to create employment, not for profitmaking, stressing that the motivation behind the business was to empower Nigerians economically.

“Air Peace was not borne out of the intent to profiteer, but to create jobs. Air Peace was not established because I wanted more money but because of the conviction that running an airline would create massive job opportunities. That was why we went into aviation”, he remarked.

He restated the airline’s belief in the Nigerian project, maintaining that supporting the airline meant supporting the growth of the Nigerian economy.

Onyema further craved for the support of all Nigerians on the Lagos-London route, which it opened on March 30, 2024.

He explained that the airline needed to sustain the route, stressing that this could only be done through support from Nigerians.

He said: “For every penny you pay to Air Peace, you pay to sustain the jobs of thousands of Nigerians and support economic growth.

“Air Peace flies you from any of our domestic routes to London. So, you can fly from Yola to London via Lagos. From the local airport, you are taken to the international airport free of charge with a seamless luggage transfer.”

He pledged that the airline would continue to fully adhere to the standard of safety and lauded the management and staff of Air Peace for their efforts in realising the London dream.

Business6 months ago

Business6 months ago

celebrity radar - gossips4 months ago

celebrity radar - gossips4 months ago

celebrity radar - gossips4 months ago

celebrity radar - gossips4 months ago

Business3 months ago

Business3 months ago