society

FrieslandCampina WAMCO beats the odds, announces 35% revenue increase

FrieslandCampina WAMCO beats the odds, announces 35% revenue increase

Dairy leader and maker of Peak, Three Crowns, Coast, Olympic and Nunu brands of milk FrieslandCampina WAMCO Nigeria PLC has announced 35% revenue growth and 1-for-1 bonus at its 49th Annual General Meeting held recently at the Sheraton Hotel, Ikeja, Lagos.

*Operating Results and Performance:*

The Company achieved strong volume and value growth compared with the previous year despite the difficult operating environment characterised by increased competition and influx of substitute propositions. As a result, Turnover increased by 35% from N199.5 billion in 2020 to N268.4 billion in 2021. Operating Profit increased by 13% from N19.4 Billion in 2020 to N22 Billion in 2021. High Finance costs due to Naira devaluation led to a decline in Profit Before Tax (PBT) by 15% from N14.9 billion in 2020 to N12.7 billion in 2021.

Ben Langat, Managing Director FrieslandCampina WAMCO Nigeria PLC and Sub-Sahara Africa Cluster, explained: “In the year under review, we made excellent progress in strengthening our business strategies. We scaled up investments in brands and optimized physical availability. The combination of solid brands, operational excellence and expanded route-to-market (RTM) distribution strategy sustained our leadership position and delivered significant top-line growth. Likewise, our sustainable Dairy Development received a boost through significant initiatives including collaboration on the Value4Dairy Consortium, investment in a new mobile yoghurt factory to scale up fresh milk processing, expansion to new states; all modelled towards delivering and accelerating backward integration of the dairy sector in Nigeria.”

In accordance with the company’s dividend policy, the Board of Directors proposed a total dividend of N5.83 per N0.50 ordinary share. An interim dividend of N1.10 was paid in 2021, and a final cash dividend of N4.23per N0.50 share was approved by the shareholders at the Annual General Meeting plus a bonus share to be issued to existing shareholders on a one-for-one basis i.e., one ordinary share with a nominal value of N0.50 for each share owned.

According to Mr. Moyo Ajekigbe, OFR, Chairman, Board of Directors, “Our achievements in 2021 were the result of concerted efforts by various stakeholders, and I would like to express my appreciation to them for their valued contributions. The Board recognises the formidable leadership, resilience and professionalism of the Management Team, which delivered the strong performance recorded in 2021; and our greatly valued employees at all levels for their hard work, dedication and continued commitment. Despite the severe headwinds in our business environment, our Company was able to sustainably grow the business across the board.”

*2022 Company Outlook*

The country’s GDP is expected to grow by 3-4%; however, the outlook remains clouded by uncertainty surrounding oil price trajectory, scarcity of FX, rising inflation, high unemployment, security challenges and social tensions across the country. Both the supply and demand sides of our business would be under immense pressure. The expected volatility and uncertainty in the business environment not withstanding, the Board and Management remain confident about the future of the Company and are committed to its success and sustainability. We are confident that the Company’s brands, which are leaders in the dairy sector, will continue to leverage our optimised route-to-market. We will continue to aggressively pursue our backward integration and product diversification strategies with vigour to ensure the long-term sustainability of our business.

society

Viral “Chat With God” Claim Targeting Kenyan Prophet David Owuor Proven False

Viral “Chat With God” Claim Targeting Kenyan Prophet David Owuor Proven False

By George Omagbemi Sylvester, SaharaWeeklyNG

“Viral screenshot sparks national controversy as the Ministry of Repentance and Holiness dismisses fabricated “divine” WhatsApp exchange, raising urgent questions about faith, digital misinformation, and religious accountability in Kenya.”

A sensational social media claim that Kenyan evangelist Prophet Dr. David Owuor displayed a WhatsApp conversation between himself and God has been definitively debunked as misinformation, sparking national debate over digital misinformation, religious authority and faith-based claims in Kenya.

On February 18–19, 2026, an image purporting to show a WhatsApp exchange between a deity and Prophet Owuor circulated widely on Twitter, Facebook, WhatsApp groups and TikTok. The screenshot, allegedly shared during one of his sermons, was interpreted by many as illustrating unprecedented direct communication with the divine delivered through a mainstream messaging platform; a claim that, if true, would have broken new ground in how religious revelation is understood in contemporary society.

However, this narrative quickly unraveled. Owuor’s Ministry of Repentance and Holiness issued an unequivocal public statement calling the image “fabricated, baseless and malicious,” emphasizing that he has never communicated with God through WhatsApp and has not displayed any such digital conversation to congregants. The ministry urged the public and believers to disregard and stop sharing the image.

Independent analysis of the screenshot further undermined its credibility: timestamps in the image were internally inconsistent and the so-called exchange contained chronological impossibilities; clear indicators of digital fabrication rather than an authentic conversation.

This hoax coincides with rising scrutiny of Owuor’s ministry. Earlier in February 2026, national broadcaster TV47 aired an investigative report titled “Divine or Deceptive”, which examined alleged “miracle healing” claims associated with Owuor’s crusades, including assertions of curing HIV and other chronic illnesses. Portions of that investigation suggested some medical documentation linked to followers’ health outcomes were fraudulent or misleading, intensifying debate over the intersection of faith and public health.

Credible faith leaders have weighed in on the broader context. Elias Otieno, chairperson of the National Council of Churches of Kenya (NCCK), recently urged that “no religious leader should replace God or undermine medicine,” affirming a widely accepted Christian understanding that divine healing does not supplant established medical practice. He warned against unverified miracle claims that may endanger lives if believers forego medical treatment.

Renowned communications scholar Professor Pippa Norris has noted that in digital societies, “religious authority is increasingly contested in the public sphere,” and misinformation (intentional or accidental) can quickly erode trust in both religious and secular institutions. Such dynamics underscore the importance of rigorous fact-checking and responsible communication, especially when claims intersect profoundly with personal belief and public well-being.

In sum, the viral WhatsApp chat narrative was not a revelation from the divine but a striking example of how misinformation can exploit reverence for religious figures. Owuor’s swift repudiation of the false claim and broader commentary from established church bodies, underline the ongoing challenge of balancing deeply personal faith experiences with the evidence-based scrutiny necessary in a digitally connected world.

society

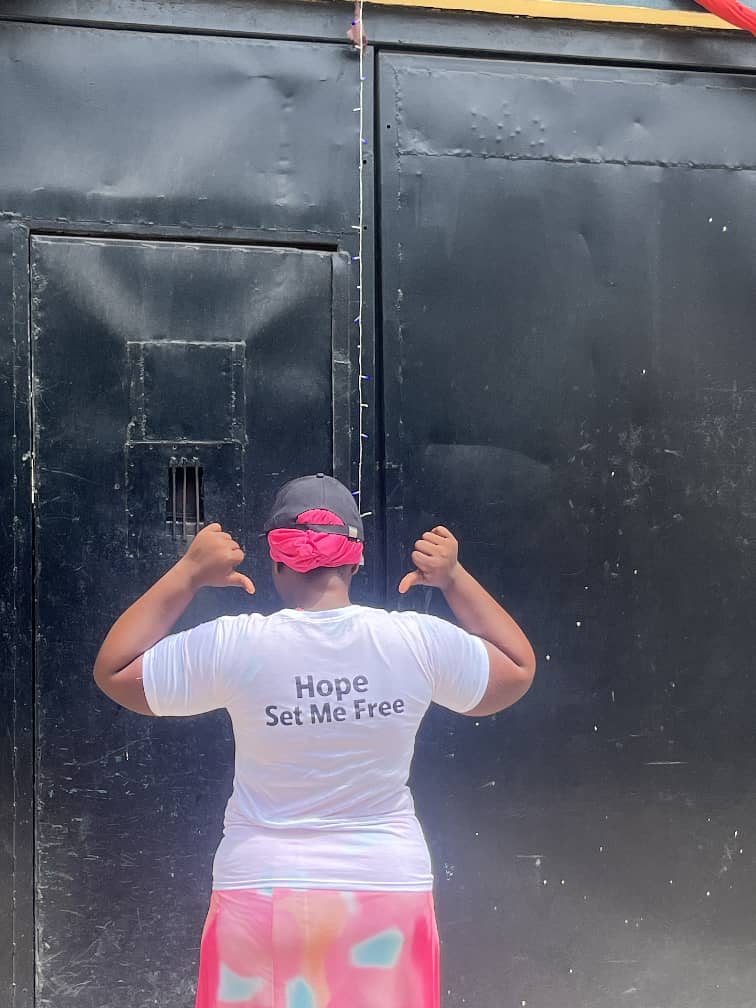

HOPE BEYOND THE WALLS 2026: ASSOCIATION OF MODELS SUCCESSFULLY SECURES RELEASE OF AN INMATE, CALLS FOR CONTINUED SUPPORT

HOPE BEYOND THE WALLS 2026: ASSOCIATION OF MODELS SUCCESSFULLY SECURES RELEASE OF AN INMATE, CALLS FOR CONTINUED SUPPORT

The Association of Models (AOMNGO) proudly announces the successful completion of the first edition of Hope Beyond the Walls 2026, a humanitarian initiative dedicated to restoring hope and freedom to deserving inmates.

Despite enormous challenges, financial pressure, emotional strain, and operational stress, the organization remained committed to its mission. Through perseverance, faith, and collective support, one inmate has successfully regained freedom a powerful reminder that hope is stronger than circumstance.

This milestone did not come easily.

Behind the scenes were weeks of coordination, advocacy, fundraising, documentation, and intense engagement. There were moments of uncertainty, but the determination to give someone a second chance kept the vision alive.

Today, the Association of Models gives heartfelt appreciation to all partners and sponsors, both locally and internationally, who stood with us mentally, financially, morally, and physically.

Special Recognition and Appreciation To:

Correctional Service Zonal Headquarters Zone A Ikoyi

Esan Dele

Ololade Bakare

Ify

Kweme

Taiwo & Kehinde Solagbade

Segun

Mr David Olayiwola

Mr David Alabi

PPF Zion International

OlasGlam International

Razor

Mr Obinna

Mr Dele Bakare (VOB International)

Tawio Bakare

Kehinde Bakare

Hannah Bakare

Mrs Doyin Adeyemi

Shade Daniel

Mr Seyi United States

Toxan Global Enterprises Prison

Adeleke Otejo

Favour

Yetty Mama

Loko Tobi Jeannette

MOSES OLUWATOSIN OKIKIADE

Moses Okikiade

(Provenience Enterprise)

We also acknowledge the numerous businesses and private supporters whose names may not be individually mentioned but whose contributions were instrumental in achieving this success.

Your generosity made freedom possible.

A CALL TO ACTION

Hope Beyond the Walls is not a one-time event. It is a movement.

There are still many deserving inmates waiting for a second chance individuals who simply need financial assistance, legal support, and advocacy to reunite with their families and rebuild their lives.

The Association of Models is therefore calling on:

Corporate organizations

Local and international sponsors

Philanthropists

Faith-based organizations

Community leaders

Individuals with a heart for impact

to partner with us.

Our vision is clear:

To secure the release of inmates regularly monthly, quarterly, or during special intervention periods through structured support and transparent collaboration.

HOW TO SUPPORT

Interested partners and supporters can reach out via

Social Media: Official Handles Hope In Motion

Donations and sponsorship inquiries are welcome.

Together, we can turn difficult stories into testimonies of restoration.

ABOUT AOMNGO

The Association of Models (AOMNGO) is a humanitarian driven organization committed to advocacy, empowerment, and social impact. Through projects like Hope Beyond the Walls, the organization works tirelessly to restore dignity and create opportunities for individuals seeking a second chance.

“When we come together, walls fall and hope rises.”

For media interviews, partnerships, and sponsorship discussions, please contact the Association of Models directly.

society

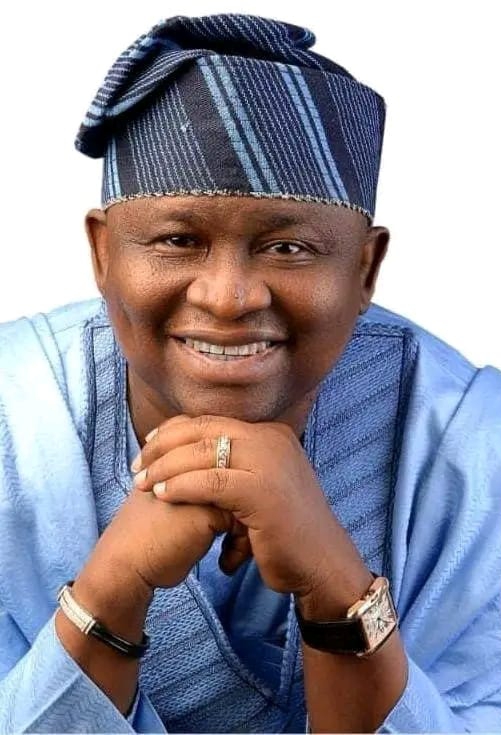

SENATOR ADEOLA YAYI REGISTERS 4000 JAMB CANDIDATES

SENATOR ADEOLA YAYI REGISTERS 4000 JAMB CANDIDATES

In continuation of his educational support initiatives and following established tradition, Senator Solomon Adeola (APC,Ogun West) has successfully paid for and enrolled 4000 indigent students for the 2026 Joint Admission Matriculation Board(JAMB) examination.

According to a release e-signed and made available to members of the League of Yewa-Awori Media Practitioners (LOYAMP) by High Chief Kayode Odunaro, Media Adviser to Senator Adeola and shared with (your mediu), the programme financed by the senator under the “SEN YAYI FREE JAMB 2026” ended on Saturday , February 21, 2026, with a total of 4000 candidates successfully enrolled with their PINs provided.

Commenting on the success of the programme, Senator Adeola said the programme is another leg of his personal educational empowerment for indigent but brilliant citizens preparatory to his scholarship and bursary facilitation for tertiary education institutions’ students.

“As far as I can help it, none of our children will miss educational opportunities arising out of adverse economic predicament of their parents or guardians”, he stated.

Successful candidates cut across all the three senatorial districts of Ogun State with 2183 coming from Ogun West, 1358 coming from Ogun Central and 418 from Ogun East.

Some of the candidates that applied and are yet to get their PINs due wrong information supplied in their profiles and being underage as discovered by JAMB and other reasons are being further assisted to see the possibility of getting their PINs.

The Free JAMB programme of the Senator that has been running for years is well received by appreciative beneficiaries and their parents.

Alhaji Suara Adeyemi from Ipokia Local Government whose daughter successfully got her PIN in the programme said the Senator’s gesture was a welcome financial relief for his family at this period after payment of numerous school fees of other siblings of the beneficiary seeking admission to higher institution.

Also posting on the social media handle of the Senator, a beneficiary Mr. Henry Olaitan, from Odeda LGA said that he would have missed doing the entry examination as his guardian cannot afford the fees for himself and two of his children.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING