society

From Boom to Burden: Nigeria’s Public Debt Skyrockets to ₦152.39 Trillion; The Fiscal Timebomb No One Can Afford to Ignore

From Boom to Burden: Nigeria’s Public Debt Skyrockets to ₦152.39 Trillion; The Fiscal Timebomb No One Can Afford to Ignore.

By George Omagbemi Sylvester, published on saharaweeklyng.com

“A deep dive into the National Bureau of Statistics’ Q2 2025 debt report, the drivers of the surge, its human and macroeconomic costs and urgent remedies the country must adopt.”

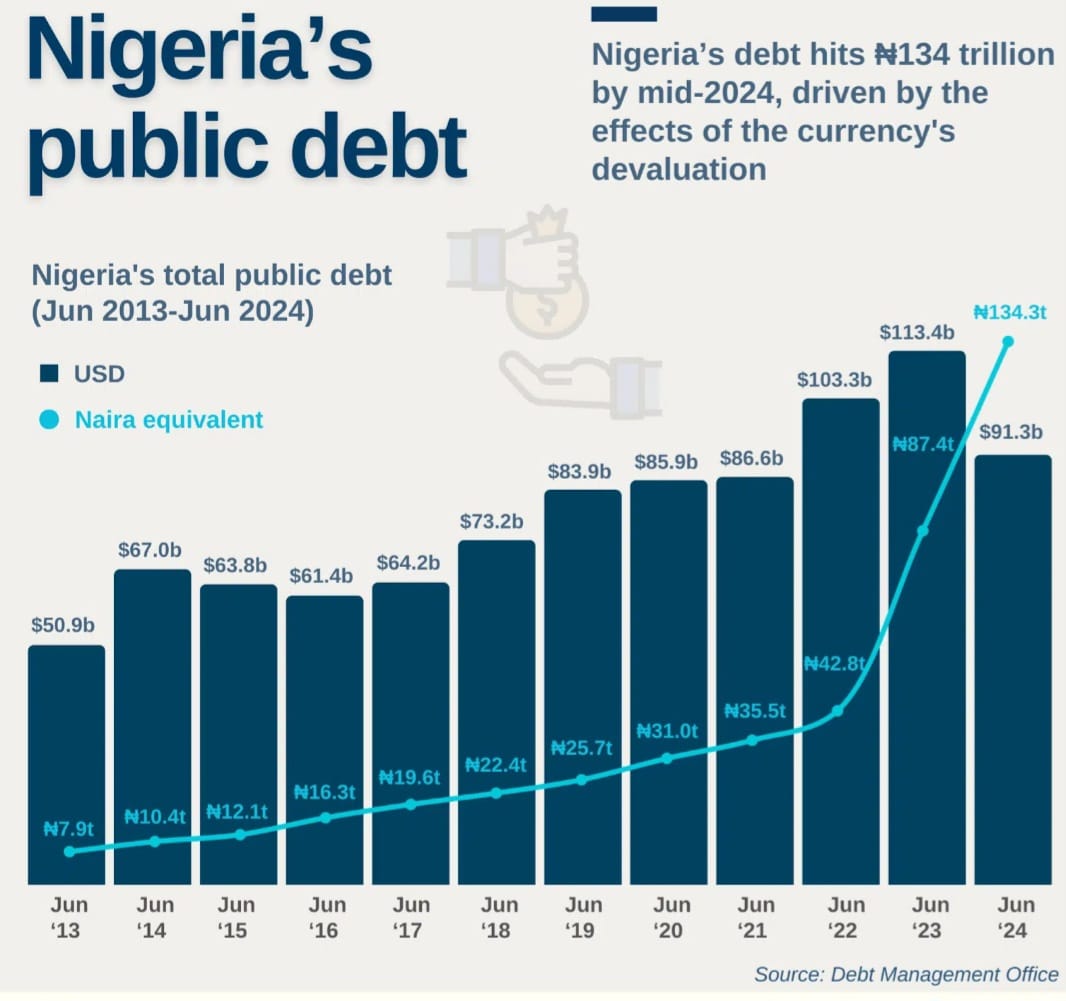

Nigeria’s public debt stock climbed to ₦152.39 trillion in the second quarter of 2025, a number so large it should break the complacency of every policymaker, investor and citizen. The National Bureau of Statistics (NBS) disclosed the figure in its Nigerian Domestic and Foreign Debt Report for Q2 2025, noting that the total represents an increase from ₦149.38 trillion in Q1 2025 and an eye-watering year-on-year rise of about ₦18.09 trillion from Q2 2024.

This is not arithmetic on a spreadsheet. It is a health check on the nation’s financial body and the diagnosis is troubling. The report shows that external debt stood at ₦71.84 trillion (about US$46.98 billion) while domestic debt reached ₦80.55 trillion (about US$52.67 billion), meaning domestic borrowing now accounts for just over half of the stock and is driving much of the recent rise.

What the numbers mean and why they are dangerous. A 2.01% quarter-on-quarter rise to ₦152.39 trillion may look modest in percentage terms, but the absolute jump and its composition carry several threats:

Debt service crowding-out. Debt servicing already consumes a growing share of government revenues. In the first quarter of 2025, public debt servicing ran into the trillions of naira monthly, a drain on funds that would otherwise finance hospitals, schools, roads and social safety nets. When more revenue goes to pay creditors, less remains for capital expenditure that lifts living standards.

Exchange rate and currency risk. A large external component exposes Nigeria to exchange rate volatility. When the naira weakens, the naira-equivalent cost of external obligations rises, inflating the debt stock in naira terms even when dollar liabilities are unchanged. This mechanism has pushed Nigeria’s debt figures higher in recent quarters.

Shift toward domestic borrowing. The tilt to domestic markets can temporarily shield Nigeria from forex swings but it is not benign: domestic borrowing competes with the private sector for savings, can raise interest rates and risks “crowding out” private investment. The NBS data show domestic debt now represents roughly 52.9% of the total stock which is a structural shift with consequences for growth.

Fiscal sustainability and bond market appetite. Investors will demand higher yields if they sense fiscal slippage or that borrowing is financing consumption rather than productive investment. Higher yields increase future debt service costs and can precipitate a vicious cycle of borrowing and servicing. International lenders and rating agencies watch these trends closely.

Voices of alarm; experts weigh in. This is not just a numbers story. Economists and fiscal watchdogs have repeatedly warned that Nigeria’s rising debt service burden risks displacing essential public investment. Muda Yusuf, CEO of the Centre for the Promotion of Private Enterprise, has stressed that the country’s growing debt-service obligations are already outpacing capital expenditure and that if left unchecked the trend will “CROWD OUT ESSENTIAL GOVERNMENT FUNCTIONS.” His warning is a sober reminder that borrowing without a credible plan for revenue growth and efficiency is a recipe for stagnation.

From the policy side, Finance Minister Olawale (Wale) Edun has defended ongoing reforms while acknowledging the fiscal pressures they aim to correct; his public commentary has emphasized the need to balance reform momentum with debt sustainability. But words must be matched with concrete measures and revenue reform, expenditure prioritization and transparent use of loan proceeds.

BudgIT and other civil-society monitors have also cautioned that fresh borrowing plans risk breaching prudential thresholds unless accompanied by aggressive fiscal consolidation and transparency. The public deserves clear accounting of what loans are for and how they translate into jobs, services and growth.

Who owes what? – sub-national contributions and the Lagos effect. The NBS report flagged that several sub-national governments (states and local councils) account for a material portion of liabilities. Lagos State, Africa’s commercial powerhouse, tops the list of state debtors, reflecting a mix of infrastructure projects and financing strategies used by its government. This raises questions about the sustainability of state borrowing and coordination with federal debt strategy.

State borrowing is not inherently wrong: cities and states need capital for roads, water and urban services. But the danger comes when short-term revenue mismatches finance long-term projects, or when guarantees and contingent liabilities are not transparently recorded in public accounts, risks that compound national exposure.

The human cost; AUSTERITY by another name. Debt is not an abstract macro variable; it is translated into policy choices that affect ordinary Nigerians. When debt servicing eats into the budget, governments face stark options: cut capital projects, raise taxes, reduce subsidies or borrow more. Each option hits households. Higher taxes and reduced services fall hardest on the poor; heavier borrowing sows the seeds of future austerity. The recent rounds of subsidy reform and tariff adjustments illustrate how fiscal tightening quickly becomes a matter of daily survival for vulnerable families.

Practical policy prescriptions; what must happen now. Nigeria needs a coherent, aggressive and transparent strategy to arrest unsustainable debt dynamics. Key policy measures should include:

Fiscal consolidation anchored on revenue growth, not just austerity. Close tax gaps, widen the tax base, modernize collection and rationalize exemptions. Without credible revenue mobilization, debt reduction will be cosmetic.

Prioritize productive borrowing. New loans must be costed against expected economic returns. Borrow for infrastructure that catalyzes private investment and jobs; avoid borrowing to fund recurrent consumption.

Strengthen debt transparency and sub-national coordination. Publish timely, disaggregated debt data (federal, state, guaranteed, contingent liabilities) and enforce borrowing rules for states. Citizens must be able to see what is owed and for what purpose.

Protect capital expenditure. Ring-fence a minimum share of spending for capital projects; prioritize those with measurable social returns. Debt that finances growth pays for itself; debt that finances consumption destroys fiscal space.

Engage creditors for smarter terms. Where appropriate, renegotiate maturities, explore concessional windows, and pursue blended finance with private partners to reduce direct government exposure.

A closing warning and a call to action. Nigeria’s rise to ₦152.39 trillion in public debt is not destiny; it is a consequence of choices. The challenge for leaders is to choose policies that restore fiscal balance, revive growth and protect the poorest. As Muda Yusuf cautioned, the country cannot allow debt servicing to outpace capital spending or to become the tail that wags the dog.

If policymakers fail to act decisively, the result will be slow growth, higher costs of living and a future generation saddled with the obligation to repay a debt that did not translate into durable prosperity. The NBS report is a clarion call and EVERY RESPONSIBLE NIGERIAN, from the PRESIDENCY to the STREET, must treat it as such.

society

Banwo Questions Omokri’s Conduct After Appointment As Ambassador

Banwo Questions Omokri’s Conduct After Appointment As Ambassador

Political commentator and founder of the Naija Lives Matter Organisation (NLM), Dr. Ope Banwo, has raised concerns about the conduct expected of diplomats following the appointment of Reno Omokri as Nigeria’s ambassador to Mexico.

In an article published on his website, www.mayoroffadeyi.com, Banwo argued that individuals appointed to represent Nigeria abroad are expected to maintain a level of neutrality and decorum that reflects the country’s diplomatic traditions.

The article titled “The Strange Case of Reno Omokri,” questions whether the tone of public political engagement associated with Omokri’s social media presence aligns with the expectations of diplomatic service.

Omokri, a former presidential aide who has built a strong online following through commentary on Nigerian politics and governance, was recently appointed as Nigeria’s envoy to Mexico.

According to Banwo’s article, the role of an ambassador requires a transition from partisan political commentary to broader national representation.

“An ambassador represents the entire nation and not a political party,” Banwo wrote, noting that diplomats are traditionally expected to avoid public political confrontations that could affect international perceptions of their countries.

He contrasted the roles of political campaigners and diplomats, arguing that the two require different communication styles and responsibilities.

“Politics is combative while diplomacy is measured,” Banwo stated in the article, emphasizing that ambassadors typically engage in dialogue, negotiation and relationship-building rather than domestic political disputes.

Banwo also pointed to the historical composition of Nigeria’s diplomatic corps, which has largely included career diplomats trained in international relations and protocol.

According to him, such professionals are accustomed to maintaining restraint in public communication because their statements can carry official implications.

The article also referenced the biblical book of Ecclesiastes to illustrate the author’s broader reflections on leadership and public office.

Banwo noted that the appointment of political figures to diplomatic positions is not unusual globally but stressed that such appointments usually come with expectations of behavioural adjustments.

He urged Nigerian public officials who hold diplomatic positions to prioritise the country’s international image and approach public commentary with caution.

“Nigeria deserves ambassadors who elevate the country’s image,” he wrote.

society

How OPay Is Turning Product Architecture Into a Customer Service Advantage

How OPay Is Turning Product Architecture Into a Customer Service Advantage

In high-volume fintech markets like Nigeria, customer service can no longer sit at the end of the business process. When a platform serves tens of millions of users and processes millions of transactions every day, the old model of customer service, call centres, long queues, and manual complaint handling quickly becomes too slow, too costly, and challenging to scale.

The future of customer service in fintech is not just about answering calls faster. It is about preventing problems before they happen. This is where product design, technology, and risk systems begin to play a bigger role. Instead of reacting to customer complaints, modern fintech platforms are now building customer protection and support directly into the app experience itself.

OPay is one of the platforms showing how this shift works in practice.

Over the past few years, OPay’s product development has followed a clear pattern. New features are not only designed to make payments easier, but also to reduce errors, prevent fraud, and lower the number of issues that customers need to complain about. In simple terms, many customer service problems are stopped before users even notice them.

One of the strongest examples of this approach is OPay’s real-time fraud and scam alerts. Traditionally, customers only contact support after money has already left their account. At that point, the damage is done, emotions are high, and recovery becomes more complex. OPay’s system works differently. When a transaction looks unusual, based on amount, timing, behaviour, or pattern, the system raises a warning before the transfer is completed. This gives users a chance to pause, review, and confirm. In many cases, this stops fraud before it happens.

For users, this feels like protection built into the app, not an emergency response after a loss. For the business, it means fewer fraud cases, fewer complaints, and less pressure on customer support teams. This proactive model aligns with global fintech best practices, which prioritise prevention over recovery.

Another important layer is step-up security for high-risk or high-value transactions. As users move more money and rely more heavily on digital wallets, security cannot be one-size-fits-all. Adding too many checks to every transaction creates frustration. Adding too few creates risk. OPay balances this by applying stronger security only when it is needed. For example, biometric verification and additional authentication steps are triggered in sensitive situations. This keeps everyday transactions smooth, while adding extra protection when the risk is higher. This approach builds trust quietly. Users may not always notice the security working in the background, but they feel the result: fewer unauthorised transfers and fewer urgent problems that require support intervention.

Beyond visible features, OPay also runs behaviour-based risk systems in the background. These systems monitor patterns such as sudden device changes, unusual login behaviour, or transaction activity that does not match a user’s normal habits. When something looks off, the system responds automatically. Most users never see these checks. But their impact shows up in fewer failed transactions, fewer reversals, and fewer cases where customers need to chase resolutions. As a result, customer service interactions shift away from crisis handling toward simple guidance and assistance.

Together, these layers form what can be called an invisible customer service system. Many issues are intercepted early, long before they become formal complaints. User sentiment on social media provides real-world signals of how this system is being experienced. On X (formerly Twitter), some users have publicly shared their experiences with OPay’s responsiveness and reliability.

One user, @ifedayo_johnson, wrote, “Opay has refunded it almost immediately. Before I even made this tweet but I didn’t notice. logged it as transfer made in error on the Opay app and they acted almost immediately. Commendable. Thank you @OPay_NG. I’m very impressed with this!”

Another user, @EgbonAduugbo, shared “The reason I love opay so much is that you hardly ever have to worry, wait or call their customer service for anything cuz everything just works!”

While social media comments are not formal performance metrics, they matter. They reflect how real users feel when systems work smoothly and issues are resolved quickly, often without friction. This product-led customer service model becomes even more important when viewed in the context of OPay’s scale. At this scale, even minor improvements in fraud prevention or transaction success rates can prevent thousands of potential complaints every day. In this context, customer service is no longer driven mainly by headcount. It is driven by engineering choices, risk models, and system design.

OPay’s journey suggests what the future of fintech in Africa may look like. The next generation of leaders will not only be those with the most users, but those whose systems are designed to protect users, resolve issues quickly, and reduce friction at scale.

society

Phillips Esther Omolara : Answering The Call To Worship And Transforming Lives Through Gospel Music

Phillips Esther Omolara : Answering The Call To Worship And Transforming Lives Through Gospel Music

Introduction : Phillips Esther Omolara (Apple Of God’s Eye) is an Inspirational and passionate Nigerian gospel music minister, singer, and songwriter dedicated to spreading the message of Christ through her songs.

Background : I was born and brought up in Lagos State. I am a devoted gospel minister and a worship leader who began her musical journey in the children choir later graduated to adult church choir at a young age, leading praises and also a vocalist in the choir.

Early Life : I was born on April 8th 1990 in Lagos, Phillips Esther Omolara is a native of Oyo state in Ogbomosho.

Family : Got married to Phillips Oluwatomisin Omobolaji from Ogun State and our union was blessed with children.

Education : I went to Duro-oyedoyin nursery and primary school Ijeshatedo, Lagos, where I laid the foundation for my academic pursuits. For my secondary education, I attended Sanya Grammer school in Ijeshatedo, Lagos.

During my high school years, I was already deeply involved in church activities. After completing my secondary education, Phillips Esther pursed higher education at Lagos State Polytechnic (LASPOTECH).

Musical Style : Known for [e.g., Inspirational songs, Contemporary Worship, Highlife, Reggae, Traditional Yoruba], and my music blends spiritual depth with creative musicality.

INSPIRATIONS AND INFLUENCES : I have no specific role model in the gospel music industry. However, I have expressed my love for songs from several Veteran gospel artists who have influenced my musical journey.

Some of the gospel artists whose music i admires include:

* Mama Bola Are

* Tope Alabi

* Omije Ojumi

* Baba Ara

* Bulky Beks

Mission : My ministry focuses on leading people to the presence of God and creating an atmosphere for miracles.

-

society6 months ago

society6 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

news3 months ago

news3 months agoWHO REALLY OWNS MONIEPOINT? The $290 Million Deal That Sold Nigeria’s Top Fintech to Foreign Interests

-

Business6 months ago

Business6 months agoGTCO increases GTBank’s Paid-Up Capital to ₦504 Billion

-

society6 months ago

society6 months ago“You Are Never Without Help” – Pastor Gebhardt Berndt Inspires Hope Through Empower Church (Video)