Business

GTBank Announces Full Year 2017 PBT of N200.24Billion

The foremost institutional Bank, Guaranty Trust Bank plc has released its audited financial results for the year ended December 31, 2017 to the Nigerian and London Stock Exchanges.

A review of the results shows positive performance across all financial indices, reaffirming the Bank’s position as one of the most profitable and well managed financial institutions in Nigeria. Gross earnings for the year grew by 1.1% to ₦419.2billion from ₦414.6billion reported in the December 2016; driven primarily by growth in interest income as well as e-payment revenues. Profit before tax stood at ₦200.2billion, representing a growth of 21.3% over ₦165.1billion recorded in the corresponding year ended December 2016. The Bank’s loan book dipped by 8.9% from ₦1.590trillion recorded as at December 2016 to ₦1.449trillion in December 2017 while customer deposits increased by 3.8% to ₦2.062trillion from ₦1.986trillion in December 2016.

The Bank’s balance sheet remained strong with a 3.9% growth in Total Assets and Contingents as the Bank closed the year ended December 2017 with Total Assets and Contingents of ₦3.845trillion and Shareholders’ Funds of ₦625.2Billion. In terms of Assets quality, NPL ratio increased to 7.7% in December 2017 from 3.7% in December 2016 largely as a result of classification of a single exposure within the Nigerian Telecommunications Industry. However, non-performing loans would moderate to 4.6%, which is below regulatory threshold, if we exclude this name from NPL ratio computation. Overall, asset quality remains stable with adequate coverage of 119.6%, while Capital remains strong with CAR of 25.7%. On the backdrop of this result, Return on Equity (ROAE) and Return on Assets (ROAA) closed at 35.4% and 6.2% respectively. The Bank is proposing a final dividend of 240k per unit of ordinary shareheld by shareholders in addition to interim dividend of 30k per unit of ordinary share bringing total dividend for 2017 financial year to ₦2.70 per unit of ordinary share.

Commenting on the financial results, the Managing Director/CEO of Guaranty Trust Bank plc, Mr. Segun Agbaje, said; “2017 was a pivotal year for the bank. We delivered a strong result in a challenging environment; achieving record growth in earnings, carefully managing cost margins and leveraging our digital-first customer-centric strategy to deliver world-class services that are simple, cheap and easily accessible.”

He further stated that “The result demonstrates the fundamental strength of our franchise as well as the progress we are making in transforming our organization into a platform on which our customers could build their businesses, connect with their consumers and access all the resources that they need to make their lives better.”

GTBank has continued to report the best financial ratios for a Financial Institution in the industry as revealed by its return on equity (ROE) of 35.4% and cost to income ratio of 38.1% evidencing the efficient management of assets and operational efficiency. Overall, the Bank has enshrined its position as a clear leader in the industry. In recognition of its innovation and hard work, the Bank received over 20 international awards in 2017.

Declares

Business

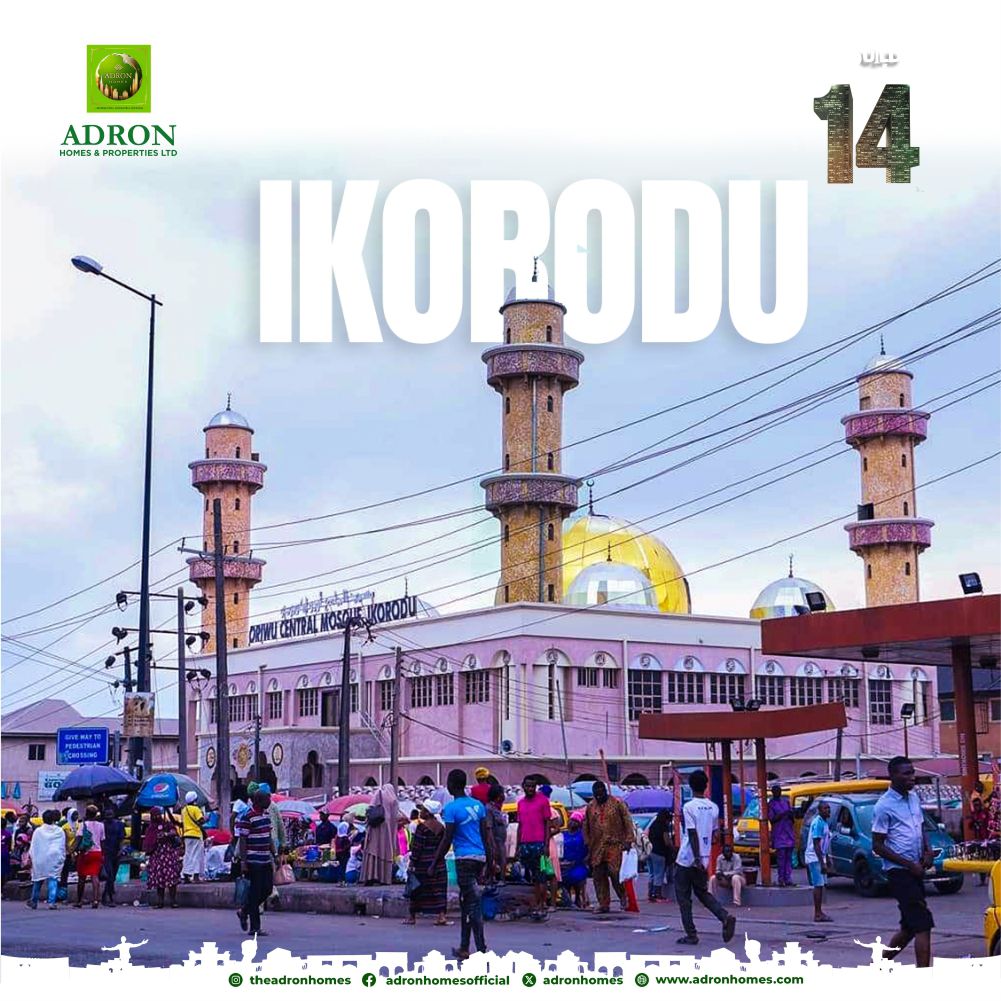

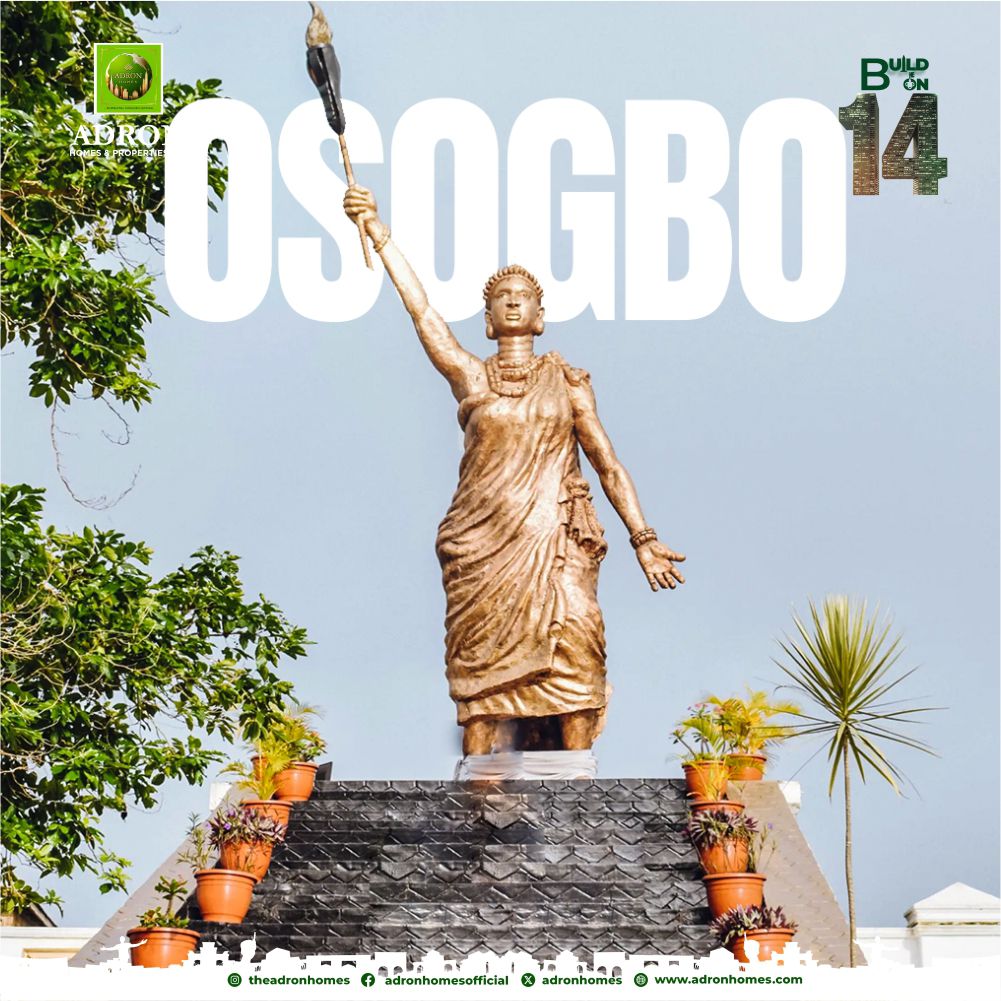

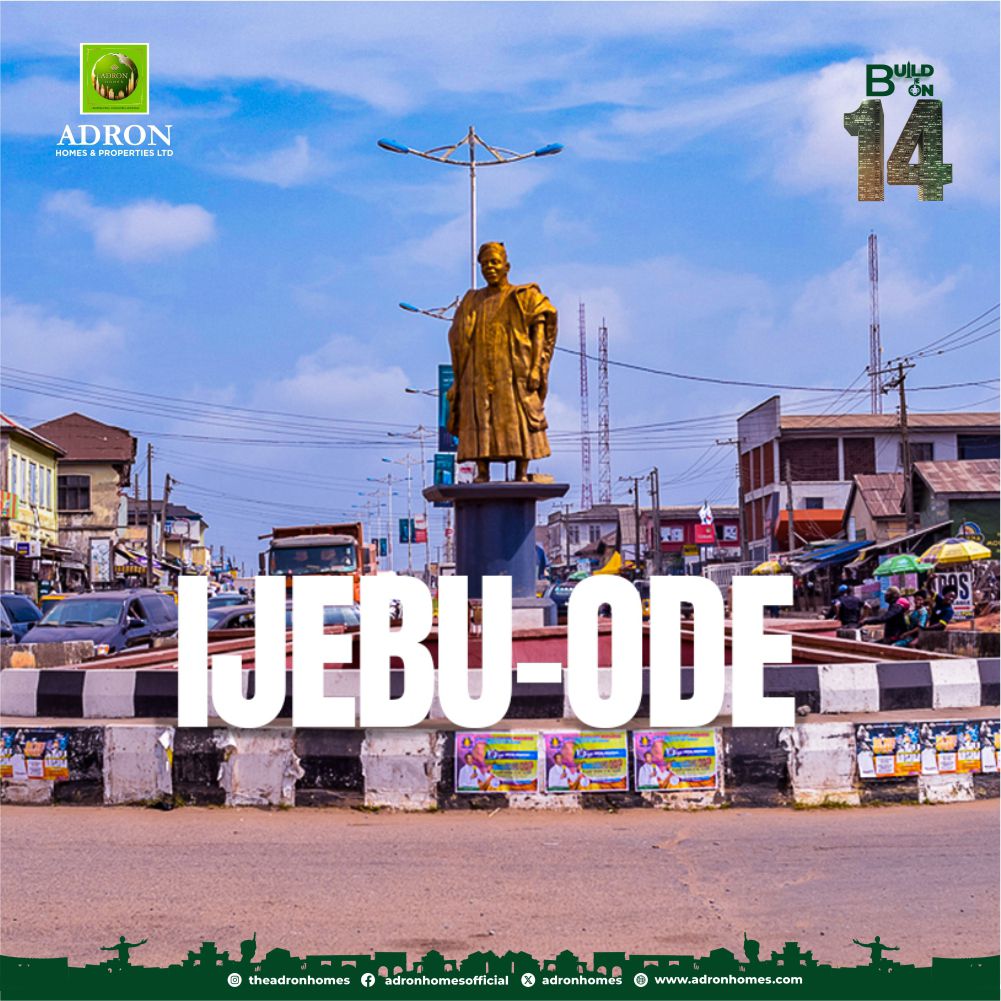

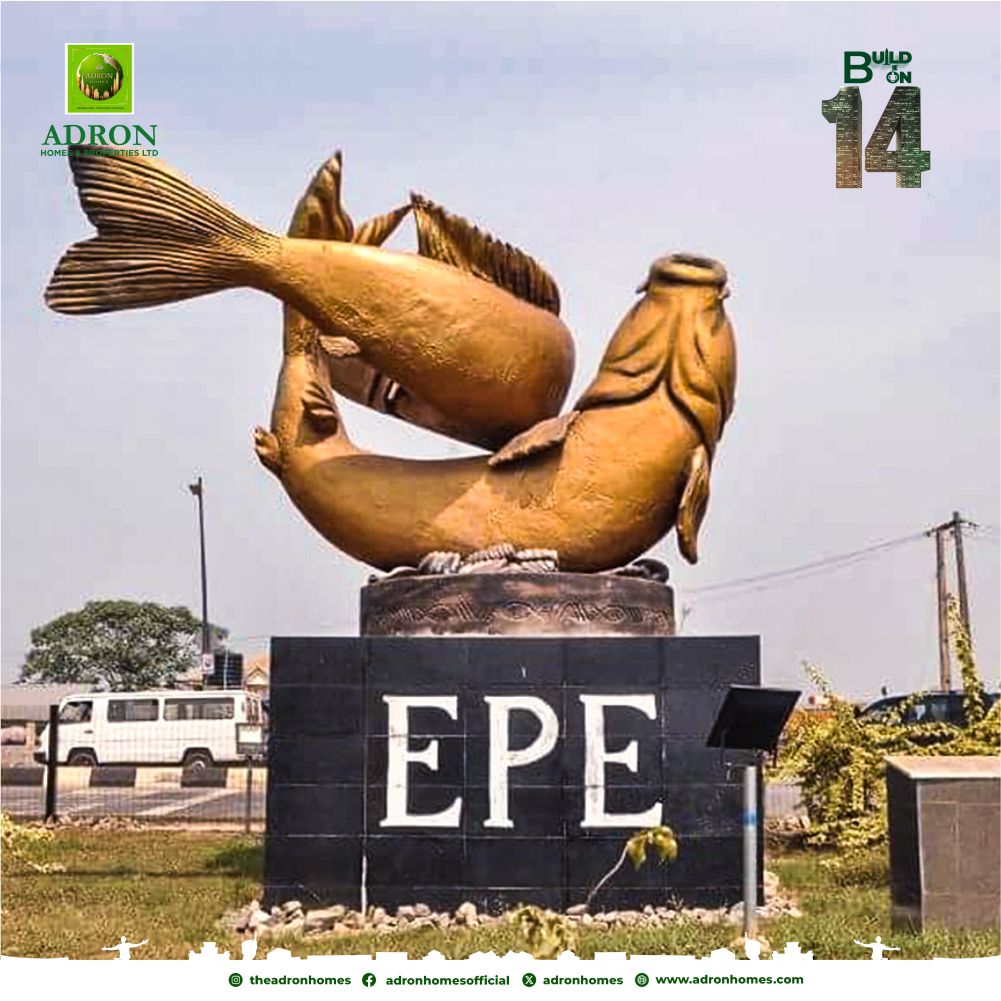

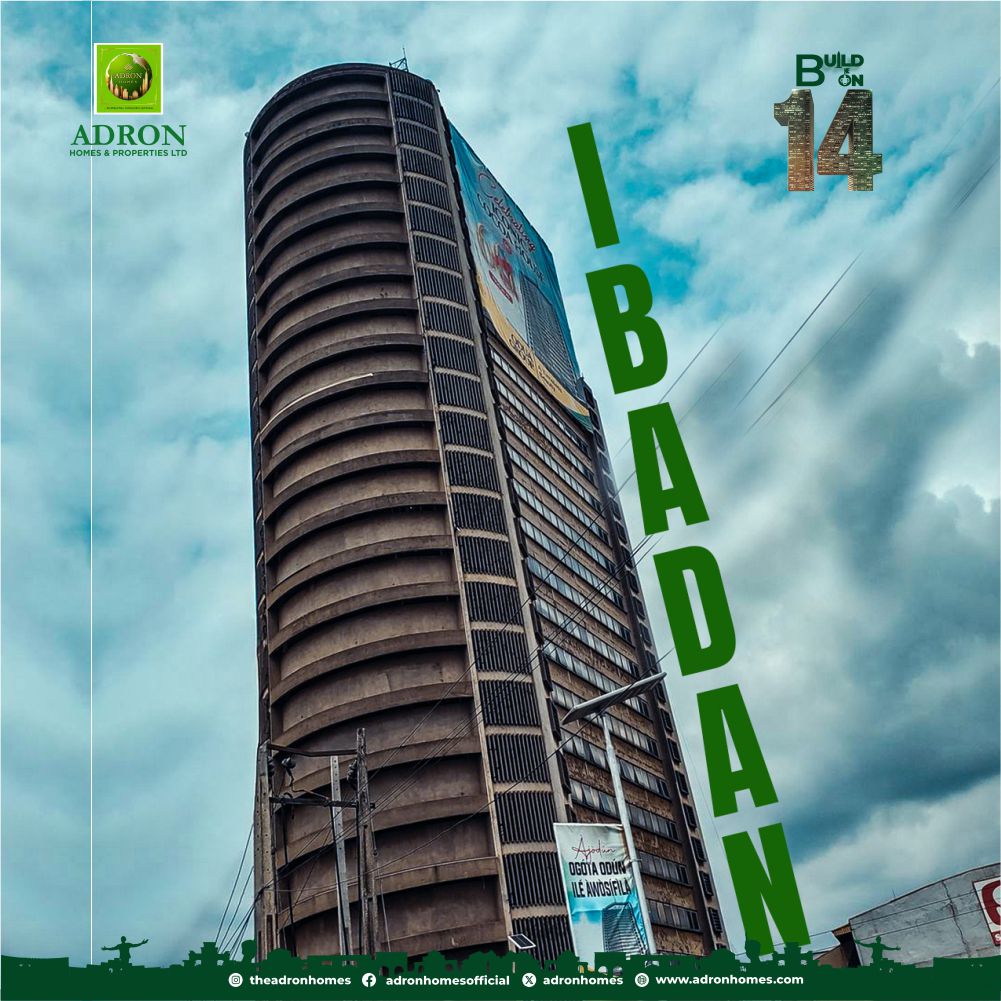

Adron Homes Celebrates 14 Years of Excellence, Reaffirms Commitment to Affordable Housing and Sustainable Communities

Adron Homes Celebrates 14 Years of Excellence, Reaffirms Commitment to Affordable Housing and Sustainable Communities

Adron Homes and Properties Limited, a leading player in Nigeria’s real estate industry, proudly celebrates its 14th Anniversary, marking over a decade of transformative impact in affordable housing delivery, sustainable community development, and structured urban growth across the country.

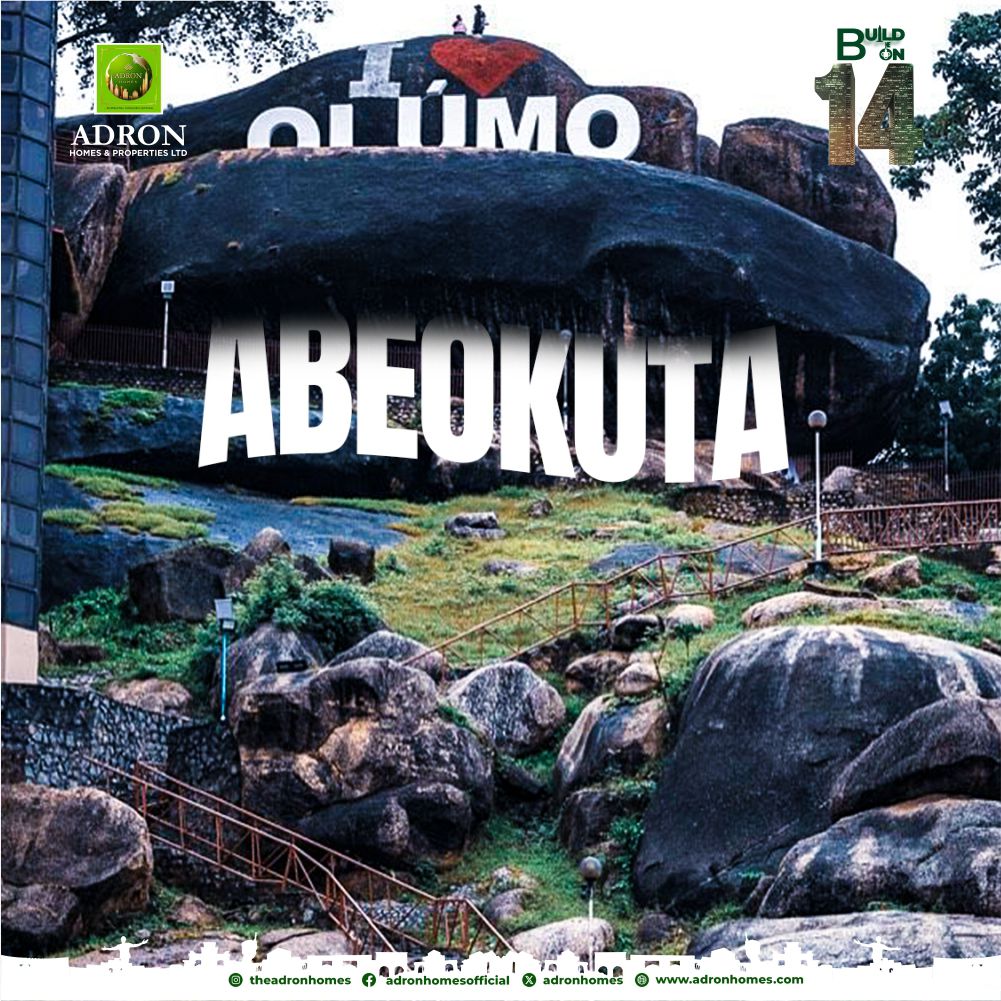

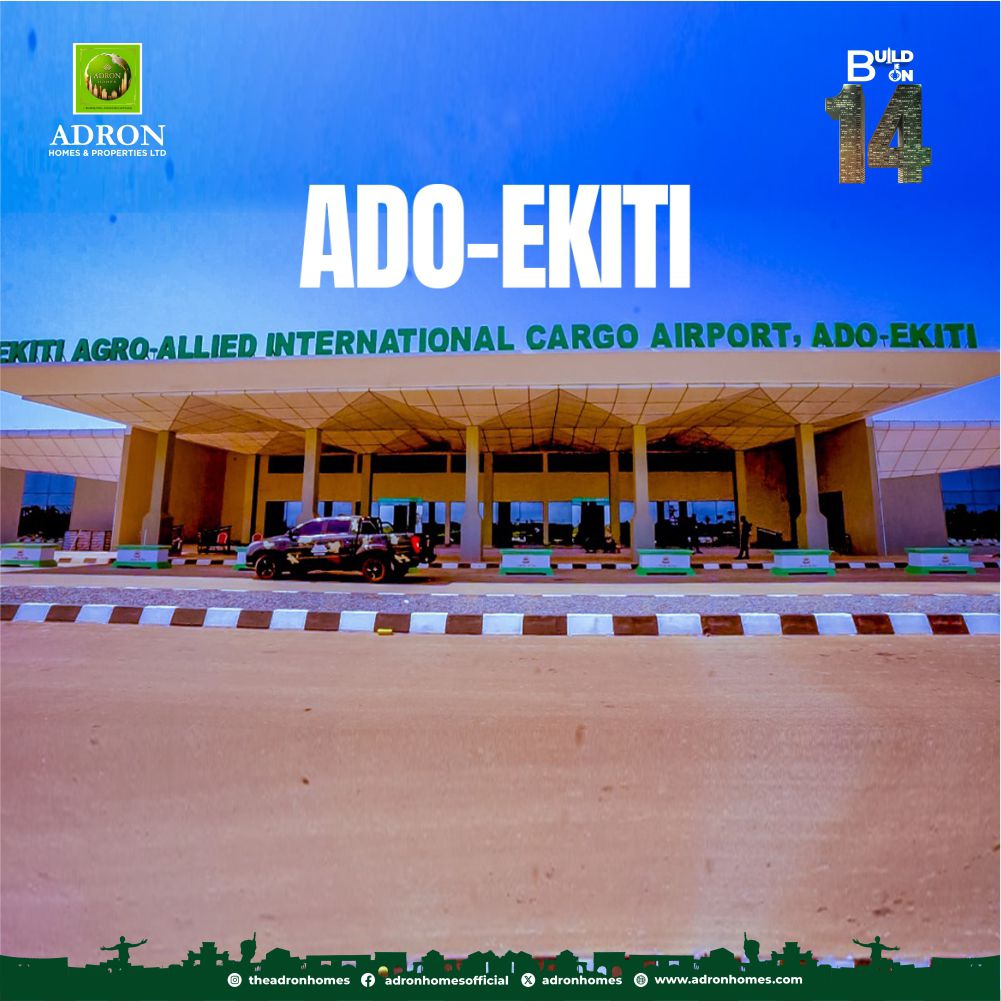

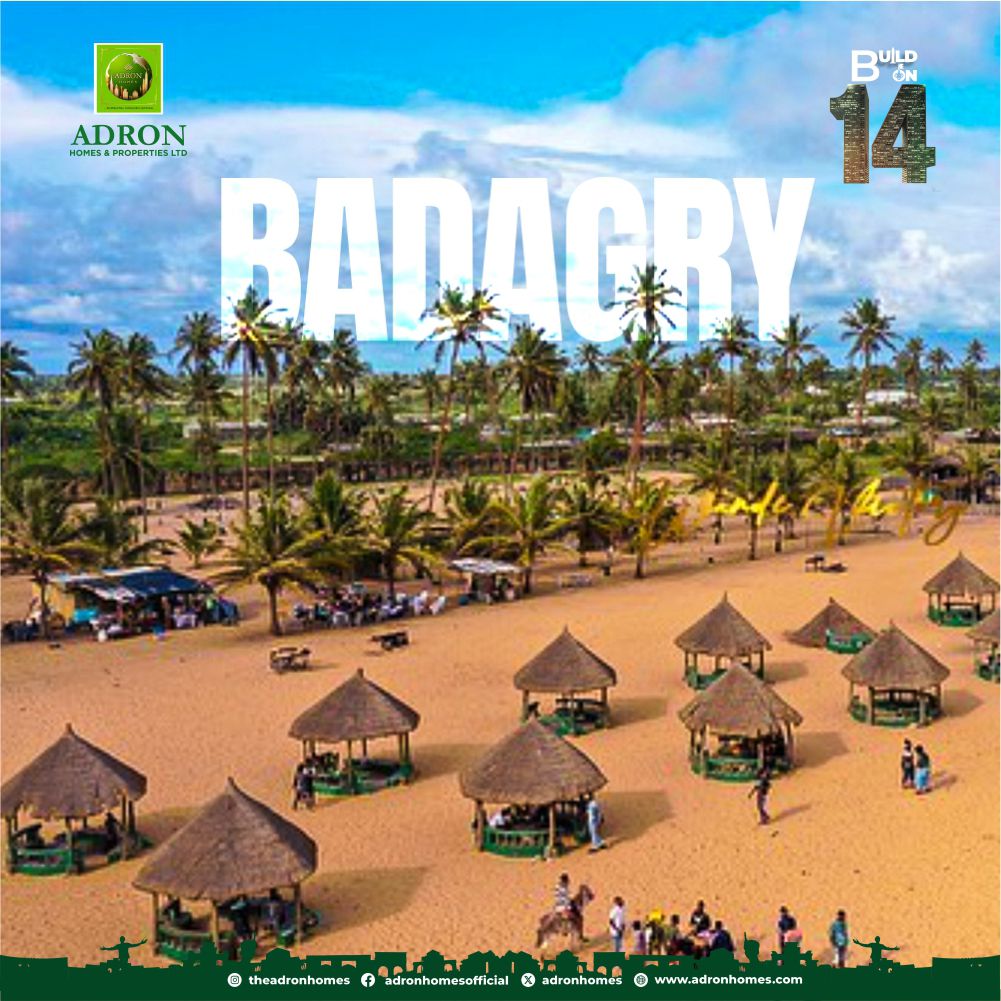

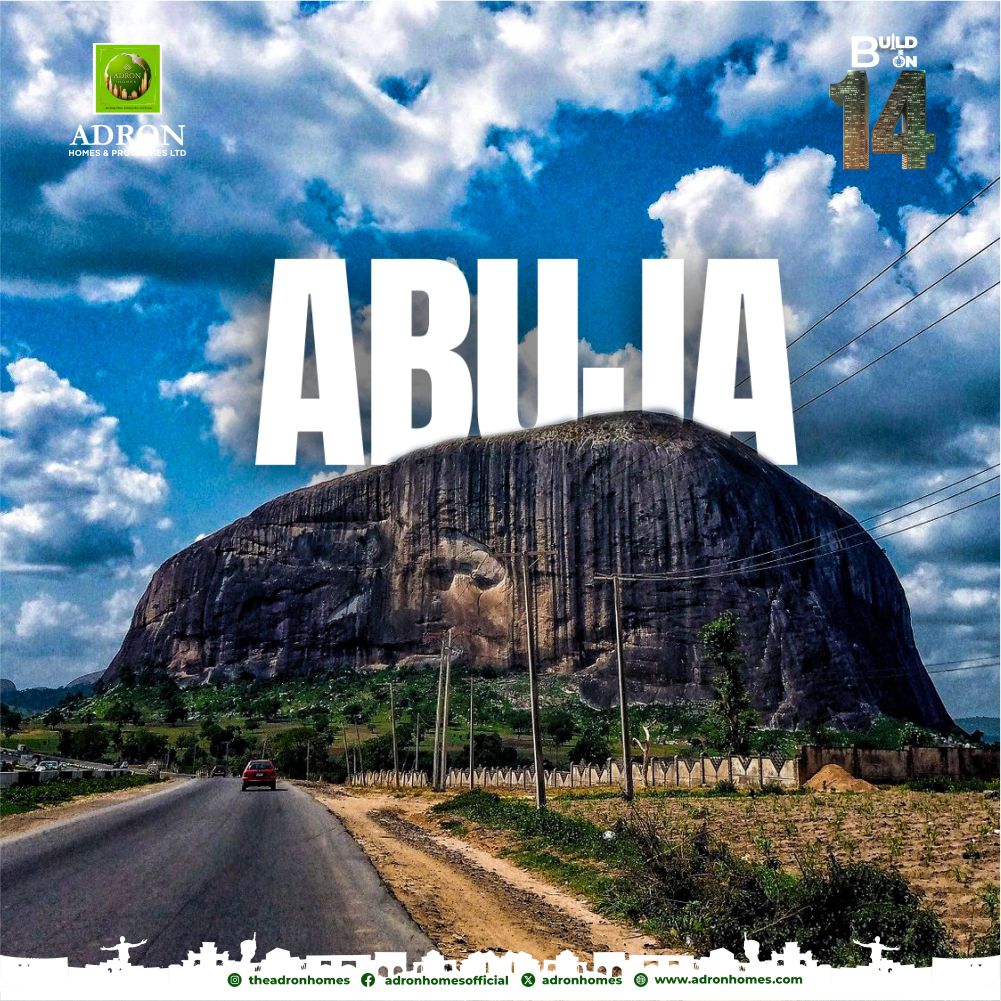

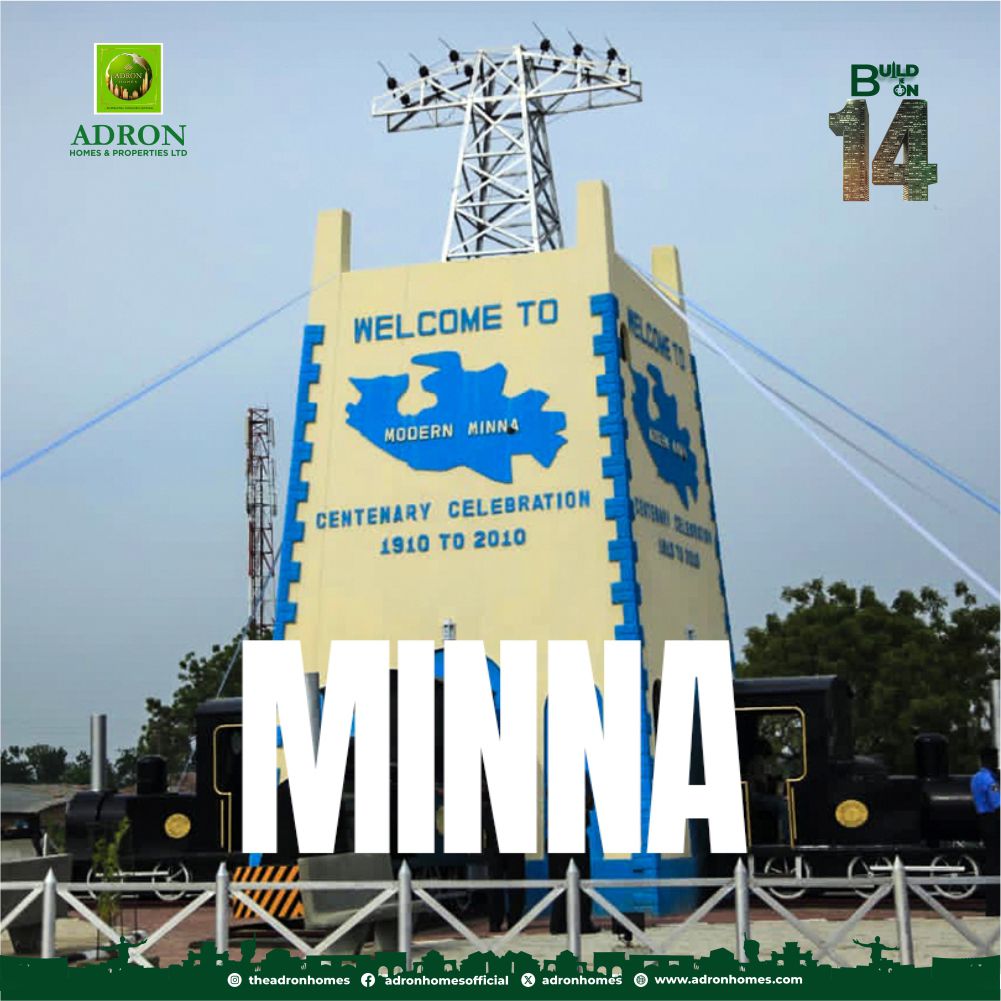

Over the last fourteen years, Adron Homes has evolved into a nationally recognised real estate powerhouse, delivering over 60 livable estates and communities across Nigeria and enabling more than 100,000 Nigerians to achieve their property ownership dreams. With strategic developments spanning Ibeju Lekki, Lekki-Epe, Badagry, Shimawa, Papalanto, Sagamu, Abeokuta, Ibadan, Osun, Ekiti, Abuja, Nasarawa, Niger State, and other emerging urban corridors, the company continues to reshape access to land and housing through affordability, innovation, and long-term planning.

Speaking on the milestone, the Chairman/CEO of Adron Group, Aare Adetola Emmanuelking, described the anniversary as a celebration of vision, resilience, and unwavering commitment to empowering Nigerians through property ownership.

“Fourteen years ago, we set out with a clear vision to make property ownership accessible and achievable for every hardworking Nigerian. Today, we celebrate not only the growth of Adron Homes but the countless families whose dreams have become reality through our communities. Our journey has always been about impact, empowerment, and building environments where people can truly thrive.”

Highlighting the company’s philosophy of developing structured environments rather than just selling land, the Chairman emphasised Adron Homes’ focus on sustainable urban planning and community building.

“At Adron Homes, we build cities, not just estates. Each development reflects thoughtful planning, infrastructure, accessibility, and a long-term vision for modern living. As Nigeria continues to urbanise rapidly, our mission is to ensure that growth is inclusive, structured, and sustainable.”

Aare Adetola Emmanuelking also acknowledged the role of customers, staff, stakeholders, and media partners in the company’s sustained growth and national relevance.

“This milestone is a testament to the trust of our customers, the dedication of our workforce, and the unwavering support of our partners and stakeholders. Together, we have demonstrated that affordable housing can be delivered with quality, innovation, and integrity.”

Looking ahead, Adron Homes reaffirmed its commitment to expanding mass housing solutions, embracing technology-driven real estate innovations, and strengthening partnerships that contribute to Nigeria’s economic development and housing accessibility.

“The future of Adron Homes is defined by innovation, expansion, and deeper community impact. We remain committed to democratizing property ownership, building sustainable communities, and shaping the future of real estate in Nigeria for generations to come.”

As Adron Homes marks 14 years of excellence and national impact, the company continues to position itself as a catalyst for structured urban development and a trusted partner in the realization of property dreams across Nigeria.

Business

Adron Homes at 14: From Shimawa to Over 60 Livable Communities, Building Cities Beyond Estates

Adron Homes at 14: From Shimawa to Over 60 Livable Communities, Building Cities Beyond Estates

Fourteen years ago, what began as a visionary real estate development effort in Shimawa, Ogun State, has evolved into one of Nigeria’s most recognizable housing success stories. Today, Adron Homes & Properties stands as a major force in structured urban development, with over 60 livable communities and estate dwellings spread across key regions of the country. Its journey reflects a deliberate mission that is not just to sell land, but to build functional cities where Nigerians can live with dignity, security, and a strong sense of community.

At a time when Nigeria faces rapid urbanization and an ever-growing housing deficit, Adron Homes has embraced an approach rooted in planning and affordability. From its earliest developments, the company adopted a city-building model that integrates structured layouts, accessible infrastructure, and community-focused design. Roads, drainage systems, green areas, and designated social spaces are incorporated into estate planning, transforming empty land into organized residential hubs.

The story of Adron’s growth mirrors Nigeria’s evolving urban landscape. Beginning in Shimawa, the company strategically expanded into major growth corridors, including Lagos, Ogun, Oyo, Osun, Ekiti, Abuja, Nasarawa, Niger, and beyond. Its estates have not only provided shelter but have also influenced the emergence of new residential districts, encouraging organized expansion and helping to reduce the challenges associated with unplanned settlements.

Central to the company’s success is its commitment to affordability. Through flexible payment structures and innovative housing initiatives, Adron Homes has opened the door to homeownership for thousands of Nigerians who previously considered property ownership out of reach. This democratization of housing has empowered families, strengthened communities, and supported economic growth through increased property investment and local business opportunities within estates.

Beyond physical structures, Adron Homes prioritizes community building. Estates are designed as living ecosystems where families interact, children grow in secure environments, and entrepreneurs find opportunities to thrive. The emphasis on social cohesion has helped transform residential spaces into vibrant neighborhoods, reinforcing the idea that housing development should nurture human connection as much as physical infrastructure.

As Nigeria continues to urbanize, Adron Homes’ model demonstrates that real estate development can be both commercially viable and socially impactful. Its projects serve as reference points for emerging residential corridors, attracting further investment and setting standards for organized development across multiple regions.

Celebrating fourteen years of growth and innovation, Adron Homes remains committed to shaping Nigeria’s urban future through sustainable planning, inclusive housing solutions, and community-driven development. From its humble beginnings in Shimawa to a nationwide network of livable communities, the company’s journey stands as a testament to the power of vision, resilience, and a steadfast belief that cities are built not just with structures, but with people at their heart.

Business

14 Years of Democratizing Landownership: How Adron Homes Is Redefining Mass Housing in Nigeria

14 Years of Democratizing Landownership: How Adron Homes Is Redefining Mass Housing in Nigeria

For decades, homeownership in Nigeria remained an elusive dream for millions, restricted by rising rents, unstable housing markets, and mortgage systems beyond the reach of the average citizen. Fourteen years ago, Adron Homes and Properties Limited set out to challenge this reality with a bold and disruptive vision: to make land and homeownership affordable, accessible, and achievable for everyday Nigerians.

Founded on the principle that housing should be a right and not a privilege, Adron Homes has steadily emerged as one of Nigeria’s most influential mass housing developers. At the heart of its success is an affordability-driven model that prioritizes inclusion without compromising quality. Through flexible payment plans, low initial deposits, and extended installment options, the company has broken long-standing financial barriers that once excluded civil servants, young professionals, artisans, traders, and Nigerians in the diaspora from owning property.

Fourteen years on, this vision has translated into tangible impact across over 60 estates nationwide, strategically located in major and emerging growth corridors including Ibeju-Lekki, Lekki–Epe, Badagry, Shimawa, Papalanto, Sagamu, Abeokuta, Ibadan, Osun, Ekiti, Abuja, Nasarawa, and Niger State. Each estate represents more than infrastructure, it reflects Adron Homes’ commitment to decentralizing development and expanding access to property ownership beyond traditional urban centers.

Through this mass housing initiative, thousands of Nigerians have successfully transitioned from tenants to landlords, many achieving property ownership for the first time. Unlike conventional real estate models that emphasize exclusivity and luxury, Adron Homes has consistently aligned its offerings with the real income realities of the Nigerian population, ensuring that housing solutions remain practical, inclusive, and sustainable.

Beyond affordability, trust has remained a defining pillar of the Adron Homes brand. The company places strong emphasis on secure land titles, transparent documentation, and regulatory compliance, protecting subscribers from land disputes and fraudulent transactions. This focus on integrity has strengthened customer confidence and positioned Adron Homes as a dependable gateway to long-term wealth creation through real estate.

As Adron Homes marks its 14th anniversary, its mass housing journey stands as more than a corporate achievement but a national intervention. By restoring dignity, promoting financial security, and transforming thousands of property ownership dreams into reality, Adron Homes continues to play a vital role in shaping Nigeria’s housing landscape and building a future where more citizens can truly call a place their own.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING

-

Business6 months ago

Business6 months agoBatsumi Travel CEO Lisa Sebogodi Wins Prestigious Africa Travel 100 Women Award

You must be logged in to post a comment Login