news

How God warned the Arab nations of tragedies and disasters -prophet Ikuru

By Collins Nkwocha

The death of the president of Iran Ebrahim Raisi came as a huge shock to everyone as nobody was expecting the huge lose,the helicopter carrying him and other officials crashed in a mountainous and forested area of the country in poor weather.

It’s very explicit that Iran lost their president due to climatic problems and this reminds me of the prophetic hall of fame, prophet Godwin Ikuru of Jehovah Eye Salvation Ministry who warned the Arab nations,last year,when he was dishing out his prophecies for the year 2024.

He specifically warned the Arab nations of impending calamities disasters and tragedies that will be prompted by climatic problems and this was exactly what caused the death of the president of Iran.

Just few weeks ago, heavy and thunderous rain caused the death of about 17 people in Oman, just the way it caused serious disaster in UAE and crippled business activities in the nation for days.

news

Buratai Pays Tribute to Ihejirika at 70, Hails Mentorship and Legacy of Leadership

Buratai Pays Tribute to Ihejirika at 70, Hails Mentorship and Legacy of Leadership

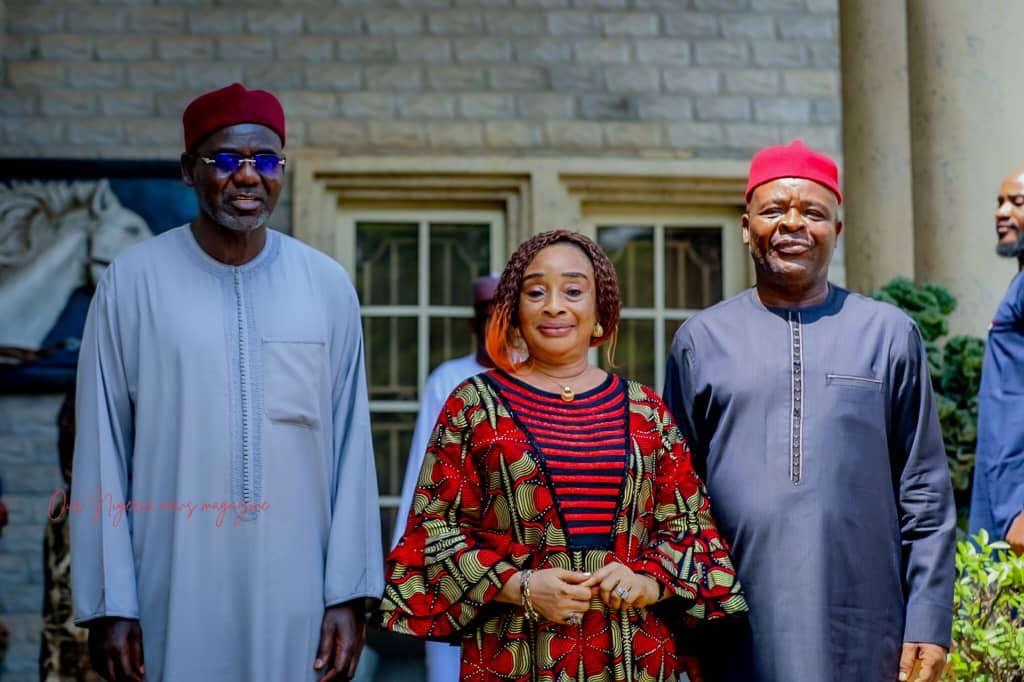

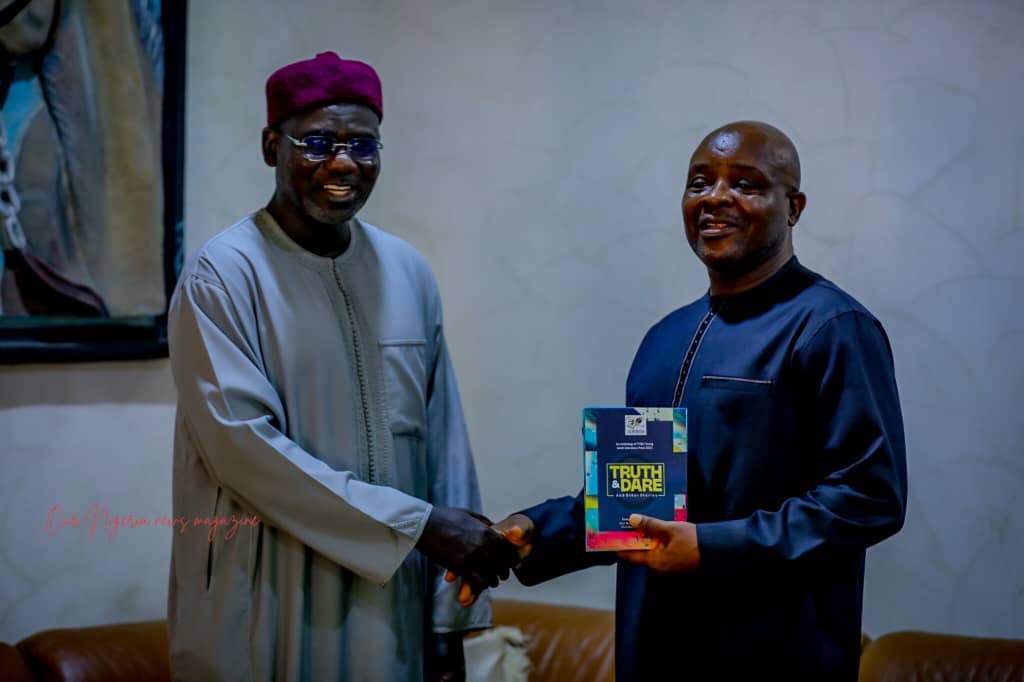

Former Chief of Army Staff and Nigeria’s immediate past Ambassador to the Republic of Benin, Lt. Gen. (Rtd) Tukur Yusuf Buratai, has paid a glowing tribute to his predecessor, Lt. Gen. OA Ihejirika, as the retired General marks his 70th birthday.

In a heartfelt message released in Abuja on Friday, Buratai described Ihejirika as not only a distinguished soldier and statesman, but also a commander, mentor, and “architect of leadership” whose influence shaped a generation of senior military officers.

Buratai recalled that his professional rise within the Nigerian Army was significantly moulded under Ihejirika’s command, citing key appointments that defined his career trajectory.

According to him, the trust reposed in him through early command responsibilities, including his first command posting at Headquarters 2 Brigade and later as Commandant of the Nigerian Army School of Infantry, laid a solid foundation for his future leadership roles.

“These opportunities were not mere appointments; they were strategic investments in leadership,” Buratai noted, adding that such exposure prepared him for higher national responsibilities.

He further acknowledged that the mentorship and professional grounding he received under Ihejirika’s leadership were instrumental in his eventual appointment as Chief of Army Staff and later as Nigeria’s Ambassador to the Republic of Benin.

Buratai praised Ihejirika’s command philosophy, describing it as professional, pragmatic, and mission-driven. He said the former Army Chief led by example, combining firm strategic direction with a clear blueprint for excellence that continues to influence military leadership practices.

“At seventy, General Ihejirika has earned the right to reflect on a legacy secured,” Buratai stated, praying for good health, peace, and enduring joy for the retired General as he enters a new decade.

He concluded by expressing profound gratitude for the leadership, mentorship, and lasting example provided by Ihejirika over the years.

The tribute was signed by Lt. Gen. Tukur Yusuf Buratai, who described himself as a grateful mentee and successor, underscoring the enduring bonds of mentorship within the Nigerian Army’s top leadership.

news

Sagamu Plantation Row: Igimisoje-Anoko Family Challenges LG Claim

news

Sagamu Communities Exonerate Sir Kay Oluwo, Accuse Teriba of Land Invasions, Violence

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING

-

Business6 months ago

Business6 months agoBatsumi Travel CEO Lisa Sebogodi Wins Prestigious Africa Travel 100 Women Award